- According to Adobe

Analytics, Black Friday online sales achieved a record of more than $9.12 billion.

- Brick-and-mortar traffic

reports declined with vacant stores and parking lots across the country.

- Mobile shopping accounted

for 55% of digital sales, a rise of 8.5% compared to the previous year.

- Retailers showered

customers with maximum discounts. Heavily discounted items were Apple Air Pods.

- With the tough competition

among retailers, Amazon occupied the fourth position.

According to Adobe Analytics data, the Black Friday shoppers’ online sales records have

reached $9.12 billion, which is a 231% rise as compared to 2021. This has resulted in

declining in brick-and-mortar traffic sales with empty parking lots and store aisles of the

most popular ones like Target and Walmart.

The Adobe finding reports also depicted that shoppers highly drove the growth in e-

commerce with the flexibility of buy-now-pay-later options. Especially during the week of

Nov. 19-25, the flexible paying option increased by 78% as compared to the same period the

previous year.

According to Vivek Pandya, lead analyst at Adobe Digital Insights, "As Black Friday trigger

record spending online, we're also seeing more significant signs of a budget-conscious

consumer this year," He further stated, Shoppers are using the Buy Now Pay Later payment

method more this year to be able to buy desired gifts for family and friends."

Let’s understand more deeply who were the key players in this Black Friday sales.

Who: Brands and Retailers making Strong Presence

The Black Friday Record sales have impacted a lot of how people shop. On that, mobile

devices played a more significant role. A record of nearly 48% of the majority of e-

commerce sales on Black Friday was made on smartphones, compared to only 44% in 2021.

The use of buy now, pay later has also impacted a lot. The BNPL orders spiked by 78% of

orders shot and 81% in terms of sales. This is an incredibly big spike. Whereas, on

Thanksgiving, there was only a 1.3% spike in sales and 0.7% in order.

Data recorded as per Captify states that Walmart was the most searched result for Black

Friday deals. This was followed by Target, Kohl’s, and Amazon in the same order. However,

Amazon recorded to become the sole retailer to witness the highest sales of $1 billion on

Thanksgiving sales.

As per the Adobe data, electronics were the highest sales driver showing 221% higher sales

than in October. The most demanding items were smart home products and audio

equipment, which witnesses 271% and 230% higher sales. On the other hand, exercise

equipment also registered considerable growth of 285% and 218%. Other high-selling items

were Apple MacBooks, gaming consoles, Dyson products, and drones.

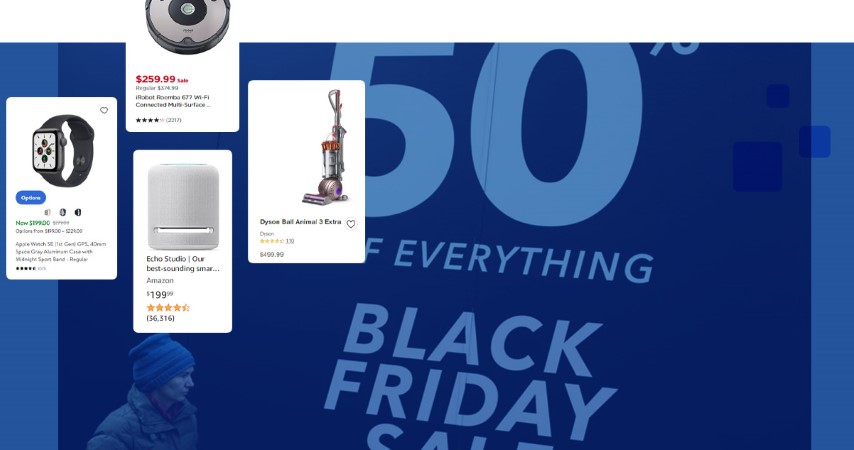

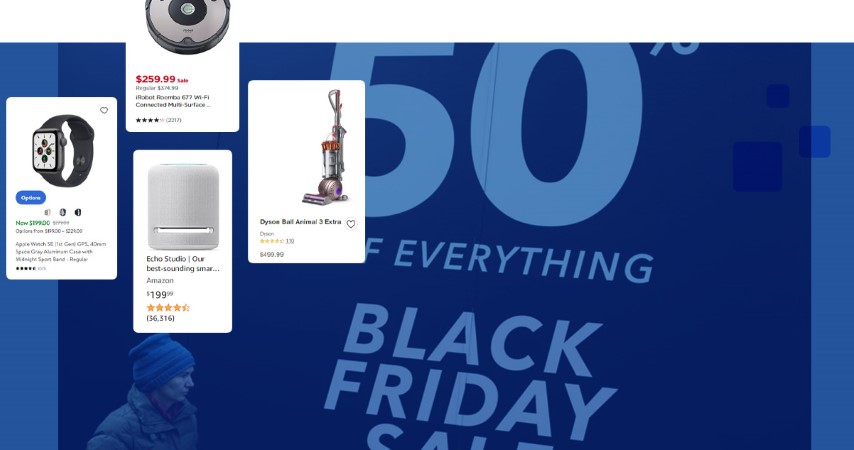

What: Top Selling Product Categories

This year during Black Friday, apart from electronics, home appliances,

exercise equipment,

toys, etc., also made a great way. To offer early sales, several attractive discounts were

offered by Walmart, Amazon, Kohl, Best Buy, and HomeDepot.

- The echo smart speaker

by Amazon was at a 50% early discount

- The Dyson vacuum

cleaner by Target was at a 30% off

- Apple iPads and

watches by Walmart were 25-35% off

- iRobot Roomba by Kohls

was at 51% off

Amazon’s popular categories on Black Friday were beauty & health, home, fashion, toys,

and Amazon devices. While, the top-ten best-selling products were Echo Show, Fire TV

sticks, Echo Dot speakers, Burt’s Bees Lotions, Nintendo Switches, Apple Air Pods, Champion

Apparel, and New Balance sneakers.

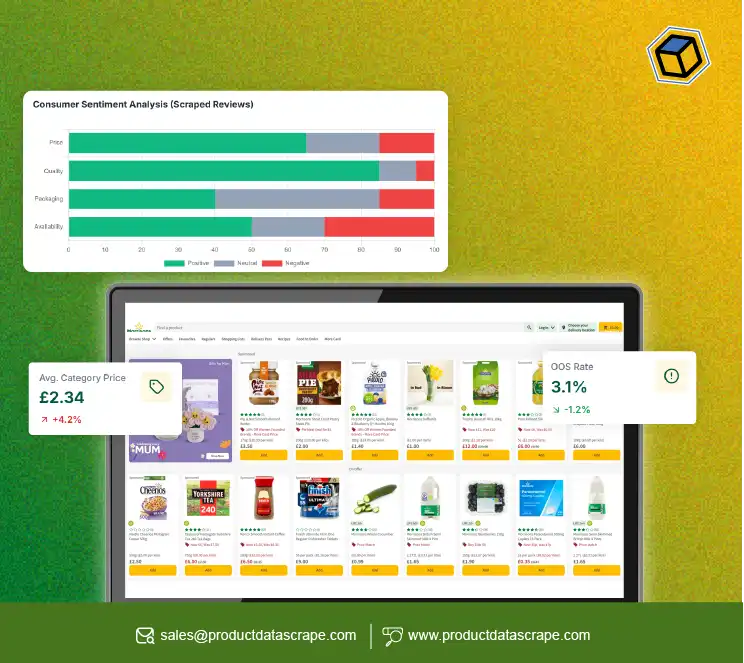

How: Evaluating Key Performance Indicators with Digital Shelf Analytics

We have already gone through the Black Friday 2022 summary in terms of top-selling

products, key players, product categories, and finally, the recorded sales. With

Product Data Scrape e-commerce analytics, we tracked the variations across retailers

before Nov 10 – Nov 21 and after Thanksgiving Nov 21 – Nov 25 and evaluated the sales in

digital shelf KPIs.

Methodology

- Retailers tracked:

Amazon, Best Buy, Target, Ulta, Sephora, Walmart

- Product Categories

tracked: Electronics, Beauty, Home Improvement, Furniture

- Digital Shelf KPIs

tracked: Availability, Discount rates, Share of Search

- Location: USA

Amazon leads with the highest product availabilities across all categories.

Beauty ranked the

highest!

Salient Insights

- Amazon witnessed an

enhancement of 3% over Prime Day.

- Beauty showed the

highest availability with 95%, Lotions and brushes with 97% and

95%, while shampoo reported the lowest at 92%. Home improvements with 87%,

dishwashers 68%, and dryers with the availability of 78%.

- Furniture availability

increased by 4%, while a decrease in home improvement was

seen by 4%.

- Electronics has the

highest availability of more than 90%, except television which

showed the lowest of 70%.

- Under the furniture

category, tables and chairs accounted for 99%

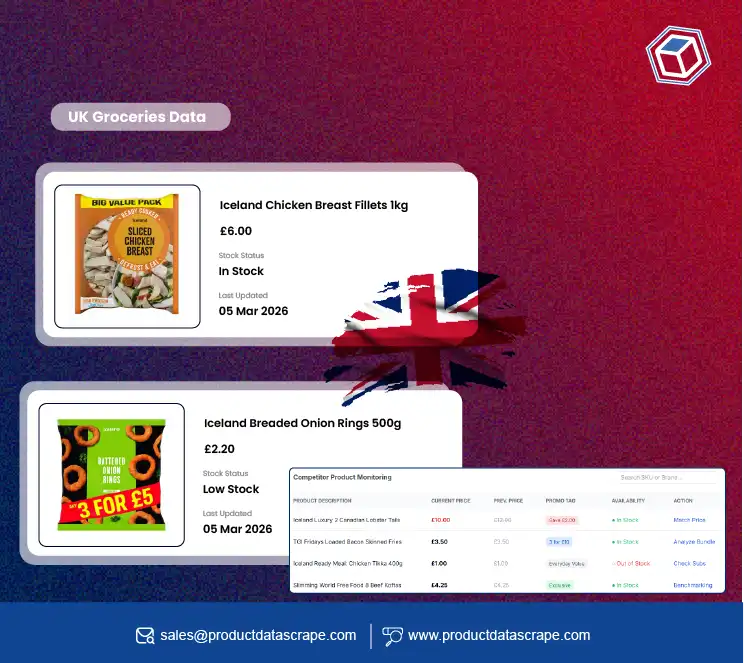

Discount Sales - Best Buy offers the Highest Discounts

Salient Insights

- Best Buy offers the

highest discount of 30% with an additional 9% discount on Black

Friday. Walmart offered 21% early discounts with an additional 4.5% discount.

Amazon with 17% and an additional 5%

- Amazon, Best Buy, and

Target offered a massive discount on Electronics at 21%. The

lowest was offered by Walmart with only 12%.

- On beauty products,

Amazon offered the highest discounts with 18%; next is Ulta

with 10%, Walmart with 8%, and Sephra and Target minimum of 3%

- On Home improvements,

the maximum discount was offered by Best Buy at 16% and

Amazon at 14%. Walmart gave the lowest of 7%.

- Both Walmart and

Amazon gave 12-13% discounts on Furniture.

Conclusion

Black Friday 2022 was an excellent surprise both for Brands and Retailers.

They reported

larger sales than predicted. This blog highlights the data recorded as per the retailers,

brand,

and their product categories that witnessed maximum sales on this day.

CTA: For more information, contact Product Data Scrape now! You can also reach us for

all your web and mobile data scraping service requirements.

.webp)