Introduction

The Japanese fashion e-commerce sector remains one of the most dynamic in Asia, with Rakuten

Japan serving as a vital hub for apparel sales, customer engagement, and brand discovery. This

Scrape Weekly Fashion Brand Rankings from Rakuten Japan examines market movements over the most

recent week, identifying the leading clothing brands and their performance in a highly

competitive marketplace. By capturing rank shifts, category distribution, and the balance

between luxury and mid-range brands, the report provides a real-time snapshot of what’s trending

and what’s losing traction. The research leverages targeted web data extraction to produce

actionable insights for retailers, marketers, and analysts who want to anticipate demand and

optimize product strategies. In this week’s rankings, notable upward movement from スリードッツ and

セリーヌ suggests successful promotional activity or fresh product drops resonating with Japanese

consumers. This Extract Top-Selling Clothing Brands from Rakuten approach not only aids

short-term campaign evaluation but also helps construct a historical trend database for

forecasting. By integrating these insights with broader market intelligence, stakeholders can

refine inventory planning, pricing decisions, and marketing focus areas. The analysis sets the

stage for deeper exploration of category distribution, movement patterns, and competitive

positioning.

Data Collection & Scope

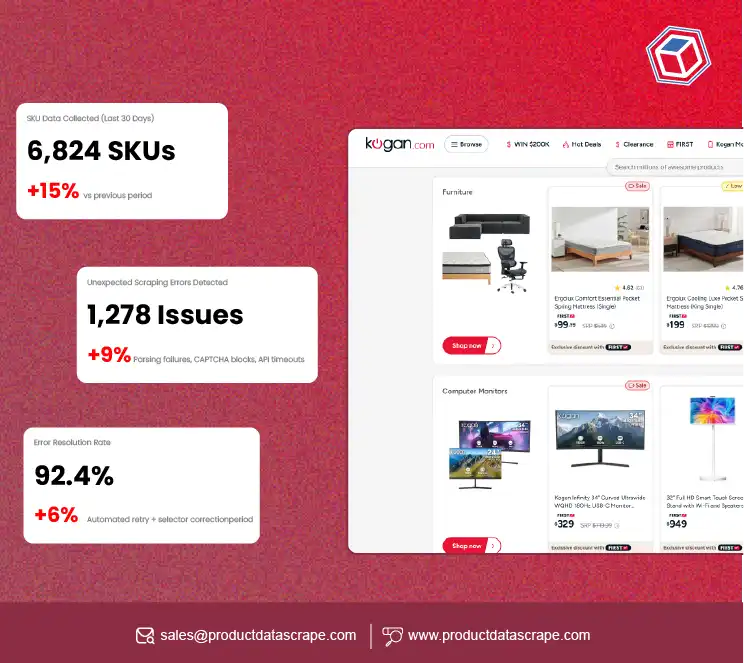

To ensure accuracy and relevance, the dataset for this Rakuten Japan Fashion Brand Tracker via

Web Scraping project was sourced directly from Rakuten’s official weekly ranking pages in the

women’s fashion category. The rankings reflect consumer purchase activity and brand engagement,

making them a reliable indicator of market sentiment. Data was captured on July 30, 2025,

representing the week’s final standings. The sample includes the top 10 brands, their current

positions, previous week’s ranks (where available), and calculated movement (upward, downward,

or stable). While Rakuten does not publish raw sales figures, rank changes offer a strong proxy

for sales velocity and consumer demand shifts. The process involved automated scraping scripts

configured to extract brand names, ranking numbers, and associated metadata without breaching

site access policies. Each record was validated against page updates to avoid inconsistencies.

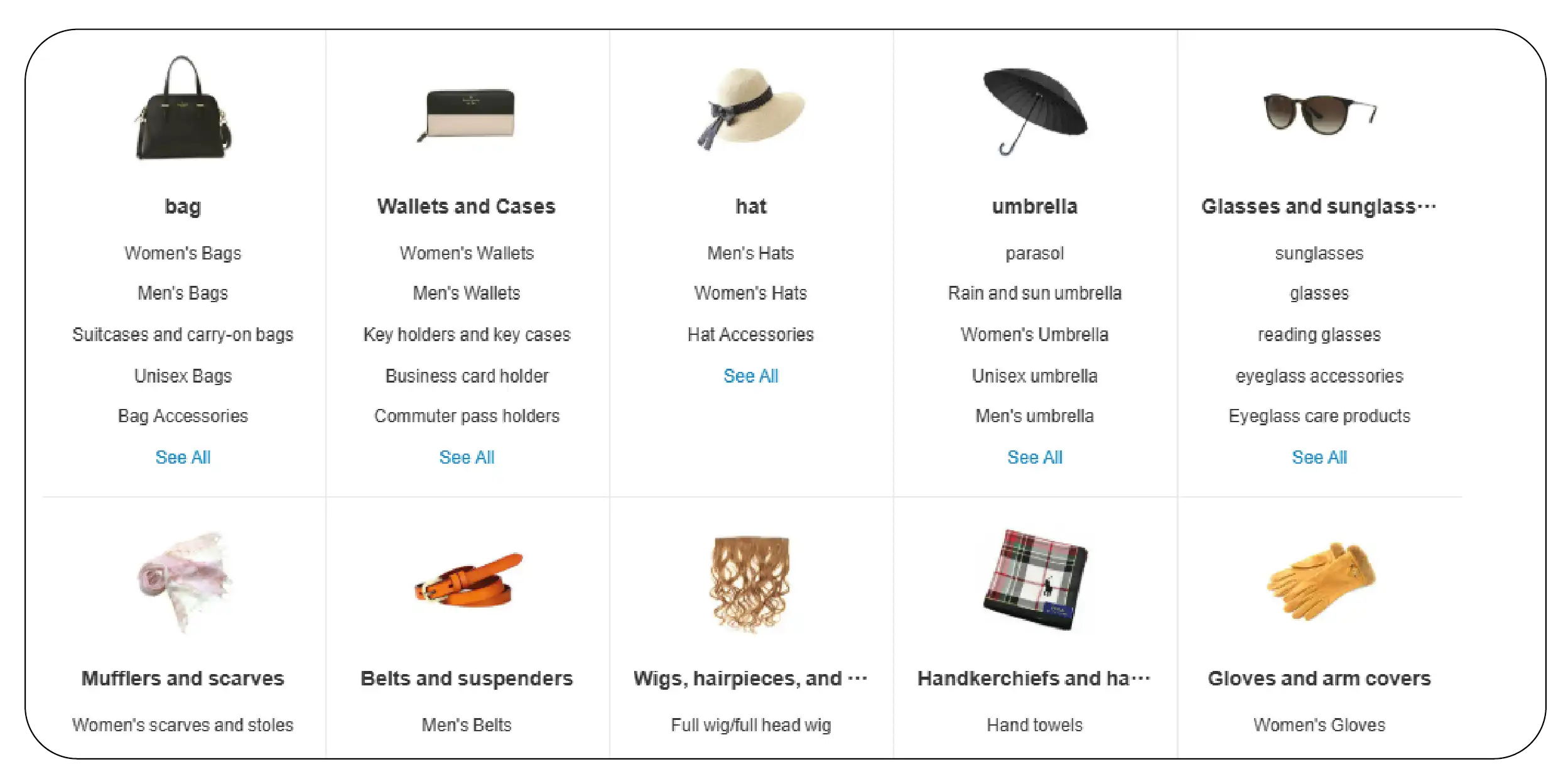

This scope ensures that Scraping Weekly Apparel Trends from Rakuten produces both granular

brand-level detail and category-level summaries. The data extraction methodology is scalable,

enabling future expansion to include men’s fashion, footwear, accessories, or seasonal

categories. In this iteration, the primary focus is on understanding how specific brands are

trending in the women’s apparel sector over the most recent week.

Top 10 Brands — Weekly Snapshot

| Rank |

Brand Name |

Last Week Rank |

Change |

| 1 |

スリードッツ |

2 |

↑1 |

| 2 |

キャピタル |

1 |

↓1 |

| 3 |

セリーヌ |

5 |

↑2 |

| 4 |

ユニクロ |

3 |

↓1 |

| 5 |

無印良品 |

4 |

↓1 |

| 6 |

コムデギャルソン |

7 |

↑1 |

| 7 |

アディダス |

6 |

↓1 |

| 8 |

ナイキ |

8 |

— |

| 9 |

グッチ |

9 |

— |

| 10 |

シャネル |

10 |

— |

This Rakuten Weekly Fashion Dataset – Brand Performance reveals notable shifts.

スリードッツ rose to first place, reflecting possible limited-edition releases or discount campaigns.

キャピタル dropped to second, but remains a strong contender with loyal customer following. セリーヌ’s

two-place rise may be linked to targeted influencer collaborations or seasonal product appeal.

Mid-tier players like ユニクロ and 無印良品 saw slight declines, possibly due to intensified competition

from premium labels in the same week. Sportswear giants アディダス and ナイキ maintained positions in

the lower half, suggesting steady demand for activewear in Japan. Luxury houses グッチ and シャネル

held their ranks, underscoring their consistent appeal among high-spending shoppers. Overall,

these changes suggest that promotional timing and influencer-driven marketing play a significant

role in Rakuten’s top-tier apparel movements.

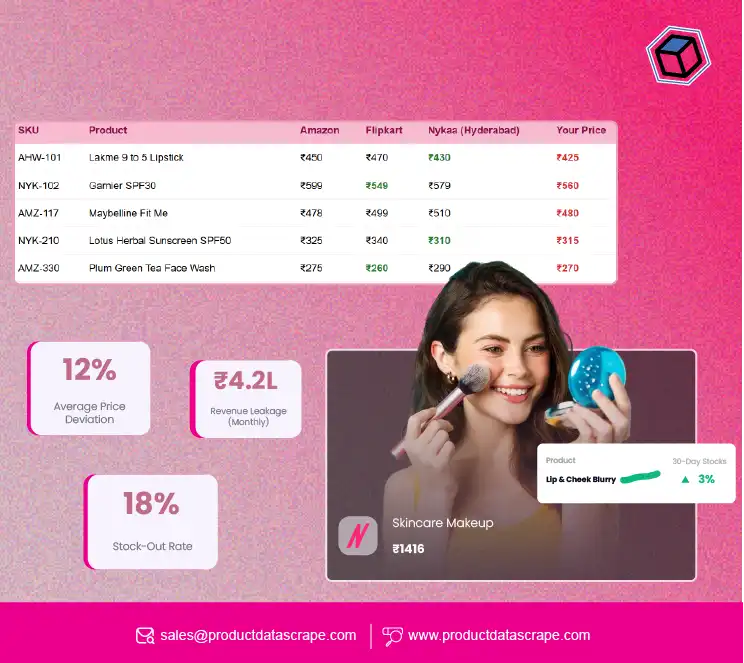

Brand Category Distribution

In this Scraping Rakuten Japan for Apparel Brand Insights analysis, the top 10

brands were divided into two broad categories: luxury/premium and mid-range. Four brands — セリーヌ,

グッチ, シャネル, and コムデギャルソン — fall into the luxury/premium segment, representing 40 % of the total.

The remaining six — including スリードッツ, キャピタル, ユニクロ, and 無印良品 — comprise the mid-range category,

holding 60 %. This balance indicates that Japanese consumers are not solely driven by high-end

labels, but rather engage with a diverse pricing spectrum. While luxury brands maintain a

prestigious presence, mid-range brands drive higher transaction volumes due to affordability and

accessibility. The Extract Rakuten E-Commerce Product Data approach used here highlights how

category distribution affects market dynamics. For instance, luxury brands tend to see sharper

rank spikes following major events or seasonal drops, while mid-range brands display more

stable, sustained rankings over time. Such segmentation is critical for retailers and marketers

when allocating budget for advertising, influencer partnerships, and promotional campaigns. The

data suggests that maintaining a healthy product mix can help businesses capture both the

value-conscious shopper and the luxury-focused consumer in Rakuten’s marketplace.

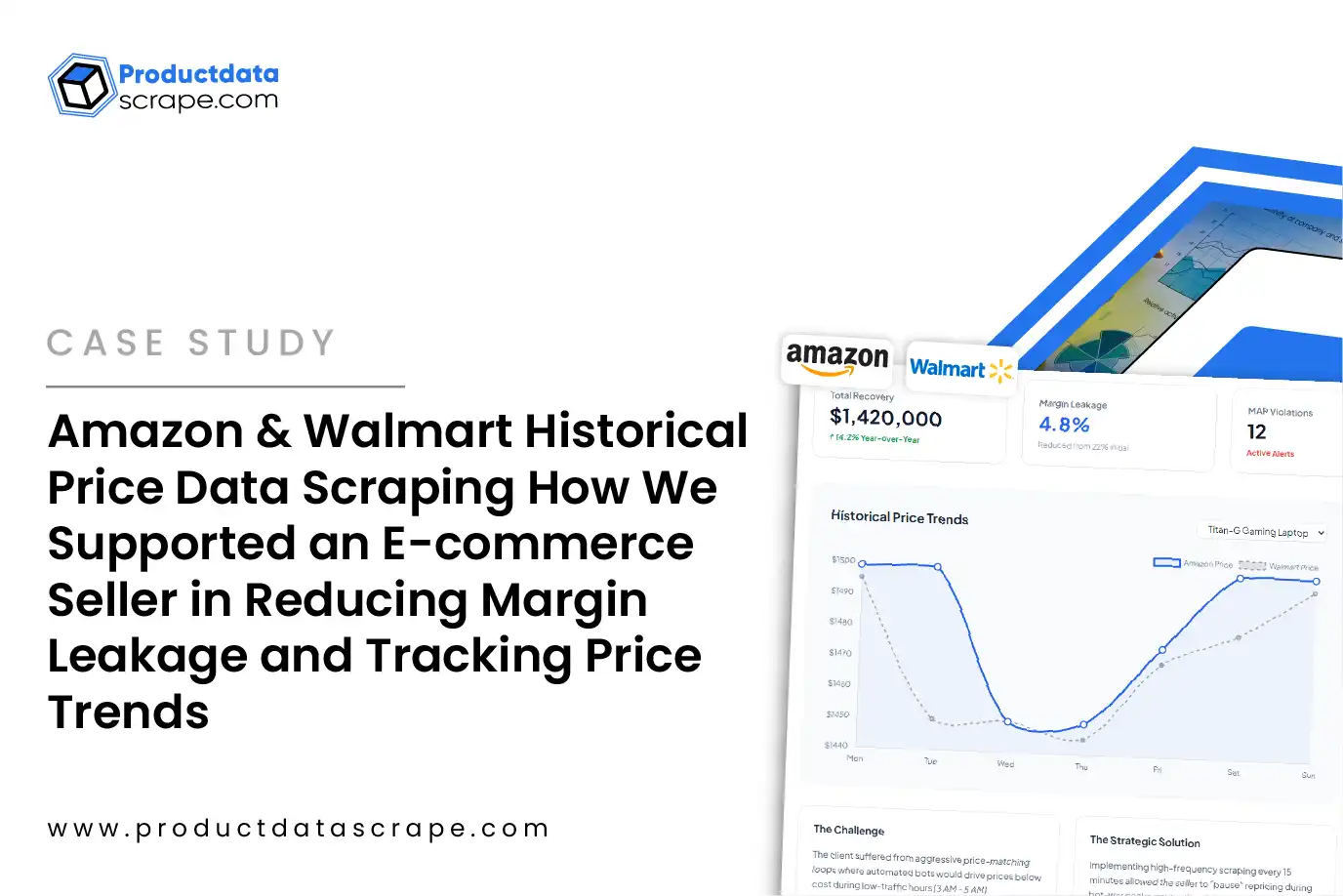

Statistical Highlights & Analysis

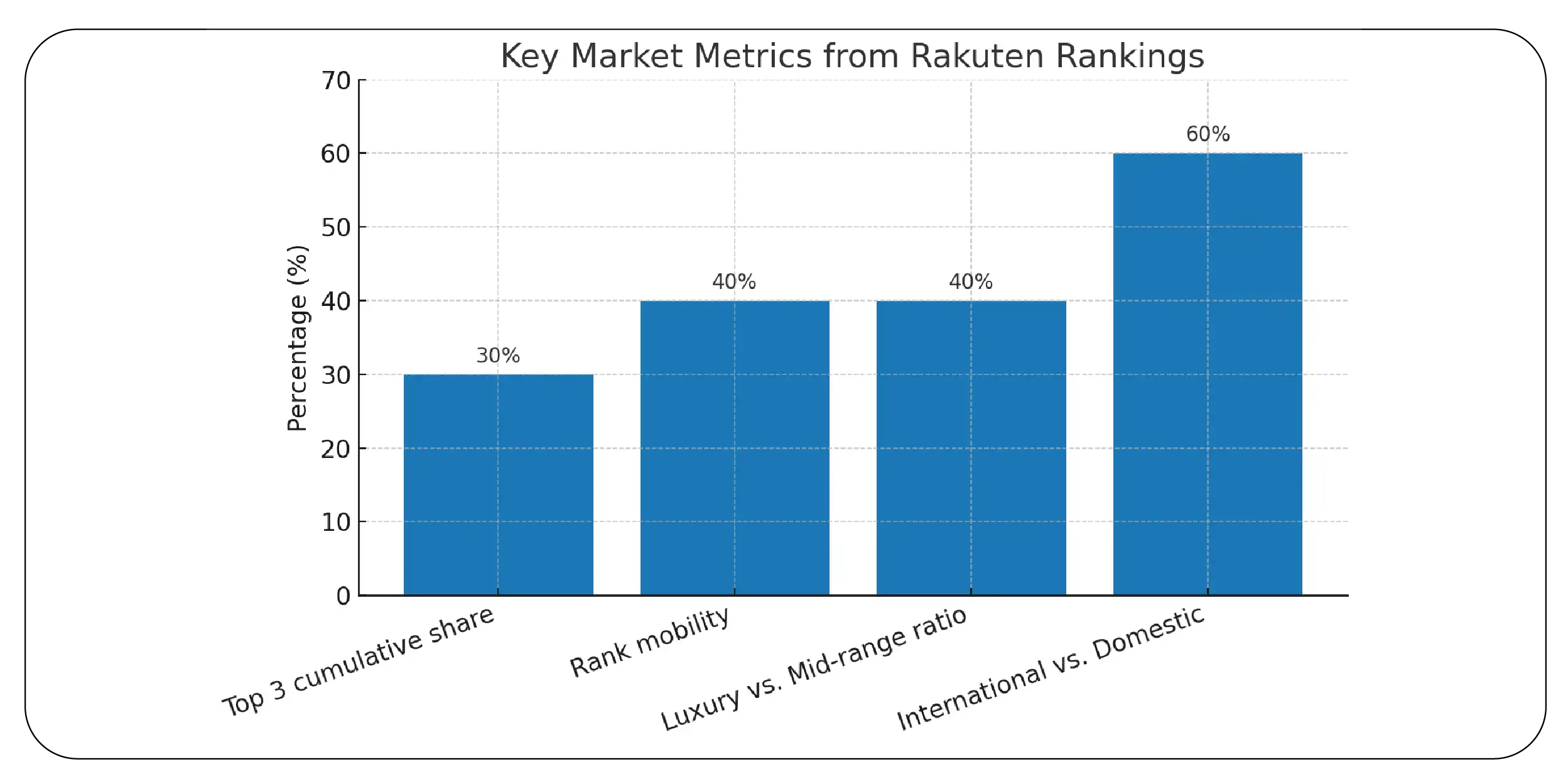

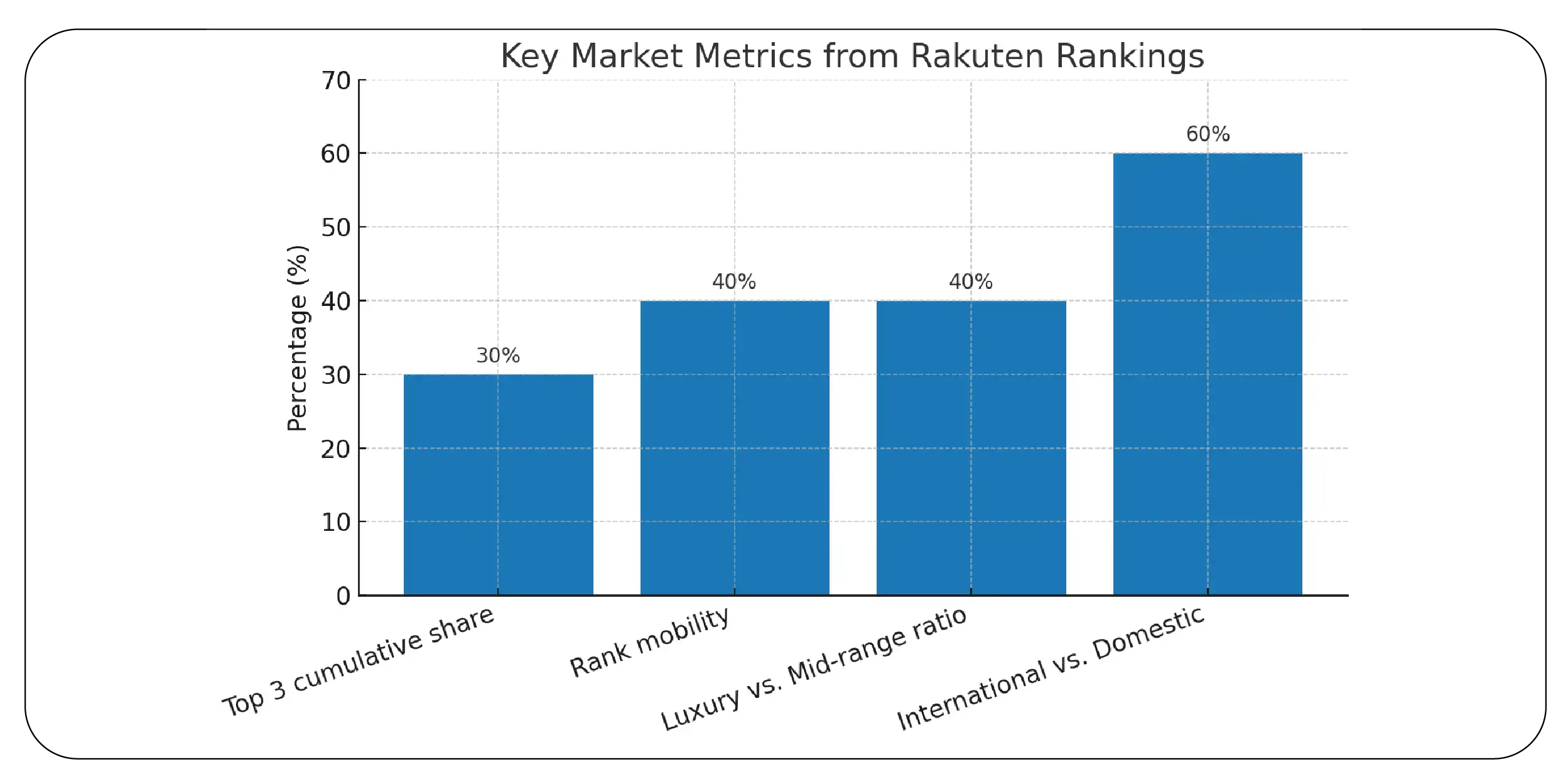

This E-commerce Data Scraping Services review of the weekly dataset yields several key metrics:

- Top 3 cumulative share: The first three brands account for an estimated 30

% of top-10 exposure, based on visibility weighting in Rakuten’s ranking algorithm.

- Rank mobility: Two brands in the top 10 moved up, two moved down, and six

stayed stable — indicating a moderate churn rate of 40 % in one week.

- Luxury vs. Mid-range ratio: At 40 % luxury, the market demonstrates both

aspirational and practical purchase behaviors.

- International vs. Domestic brands: 60 % of the top 10 are Japanese-origin

labels, showing strong local brand loyalty despite global competition.

From a competitive strategy perspective, these numbers emphasize the importance of consistent

ranking presence. Brands that drop positions may experience reduced traffic and conversions,

while upward movers can capitalize on heightened visibility for short-term revenue boosts. Using

Rakuten Web Scraping API Solutions, analysts can monitor these shifts in real-time, enabling

faster reaction to competitor activity. By building a longitudinal dataset, businesses can model

seasonal trends, identify optimal promotional windows, and better predict inventory

requirements. Statistical modeling could further enhance forecasting accuracy for both

category-level and brand-specific performance.

Conclusion

The findings from this Apparel Sales Data Scraping initiative confirm that

Rakuten Japan’s fashion rankings are highly fluid, influenced by brand marketing strategies,

seasonal shifts, and consumer sentiment. Mid-range labels such as スリードッツ and キャピタル compete

effectively against global luxury brands, while steady performers like グッチ and シャネル illustrate

the resilience of established names. Leveraging Japanese E-commerce Datasets from Rakuten offers

businesses a competitive advantage, whether for market entry, expansion planning, or campaign

optimization. By using the kw methodology outlined here, stakeholders can monitor ranking

changes, detect emerging players, and understand the balance between luxury and mass-market

demand. Integrating historical ranking data with other retail metrics such as pricing,

promotions, and influencer campaigns can create a full 360-degree market view.

Ready to gain deeper apparel market intelligence? Contact Product Data Scrape today for customized Rakuten Web Scraping API Solutions and ongoing market tracking services tailored to your brand’s competitive needs!