Introduction

In the fast-changing grocery retail market, the ability to Scrape Grocery Store Product

Listings with Address & Price is a game-changer. Retailers, brands, and analysts can unlock

hidden insights, optimize pricing, and improve supply chain efficiency with clean,

structured grocery store datasets like Walmart, Aldi, and Amazon Grocery. Below, let’s break

down how this works, why it matters, and how Product Data Scrape can help you get reliable

data at scale.

The Value of Supermarket Product Price & Location Dataset

A robust Supermarket Product Price & Location Dataset is more than just a

table of prices. It is a dynamic, actionable resource that combines product-level detail

with physical store addresses and geographic regions. This means you can analyze pricing at

hyperlocal levels — down to the neighborhood, district, or even postal code — which is

critical for retailers looking to localize promotions and manage inventory efficiently.

Let’s say you are a grocery brand managing listings in Walmart and Aldi

stores across multiple states. By using a Supermarket Product Price & Location Dataset, you

can check if your products are consistently priced across regions or spot unusual price gaps

that need to be addressed with local store managers. You can compare the data with your own

suggested retail prices to enforce MAP (Minimum Advertised Price) policies.

For ecommerce grocery players, this dataset is equally useful. Online

grocery services need to match or beat local store prices to stay competitive. Tapping into

location-tagged product listings helps optimize delivery areas and pricing offers in

real-time.

| Year |

Avg. Price Difference Across ZIPs |

Price Update Frequency |

Regional Promotions Tracked |

| 2020 |

5% |

Monthly |

45% |

| 2021 |

7% |

Bi-Weekly |

52% |

| 2022 |

9% |

Weekly |

60% |

| 2023 |

11% |

3 Days |

68% |

| 2024 |

13% |

Daily |

75% |

| 2025 |

15% (est.) |

Real-Time (est.) |

82% (est.) |

Analysis: With price differences growing between regions,

businesses that adopt location-specific pricing strategies gain a distinct advantage.

Reliable datasets make this possible at scale.

Powering Decisions with Grocery Data API with Store Address & Department Info

Accessing real-time product and store data is no longer a luxury — it’s a

strategic necessity for any modern grocery brand or retailer aiming to stay competitive. A

Grocery Data API with Store Address & Department Info provides precisely this advantage,

acting as a direct pipeline between grocery chains and your internal systems.

With this API, you’re not just pulling static lists of products — you’re

tapping into a living data stream that ties each product listing to its exact store address

and department location. This means you know which store carries which product, where it’s

located within the store, and how its price shifts in real time.

For example, a regional grocery brand can use this API to analyze which

SKUs move faster in urban flagship stores versus suburban outlets. A national grocery chain

can track how promotions in the fresh produce department affect nearby categories like

bakery or deli. Suppliers gain similar visibility, ensuring their products are correctly

priced and placed where they perform best.

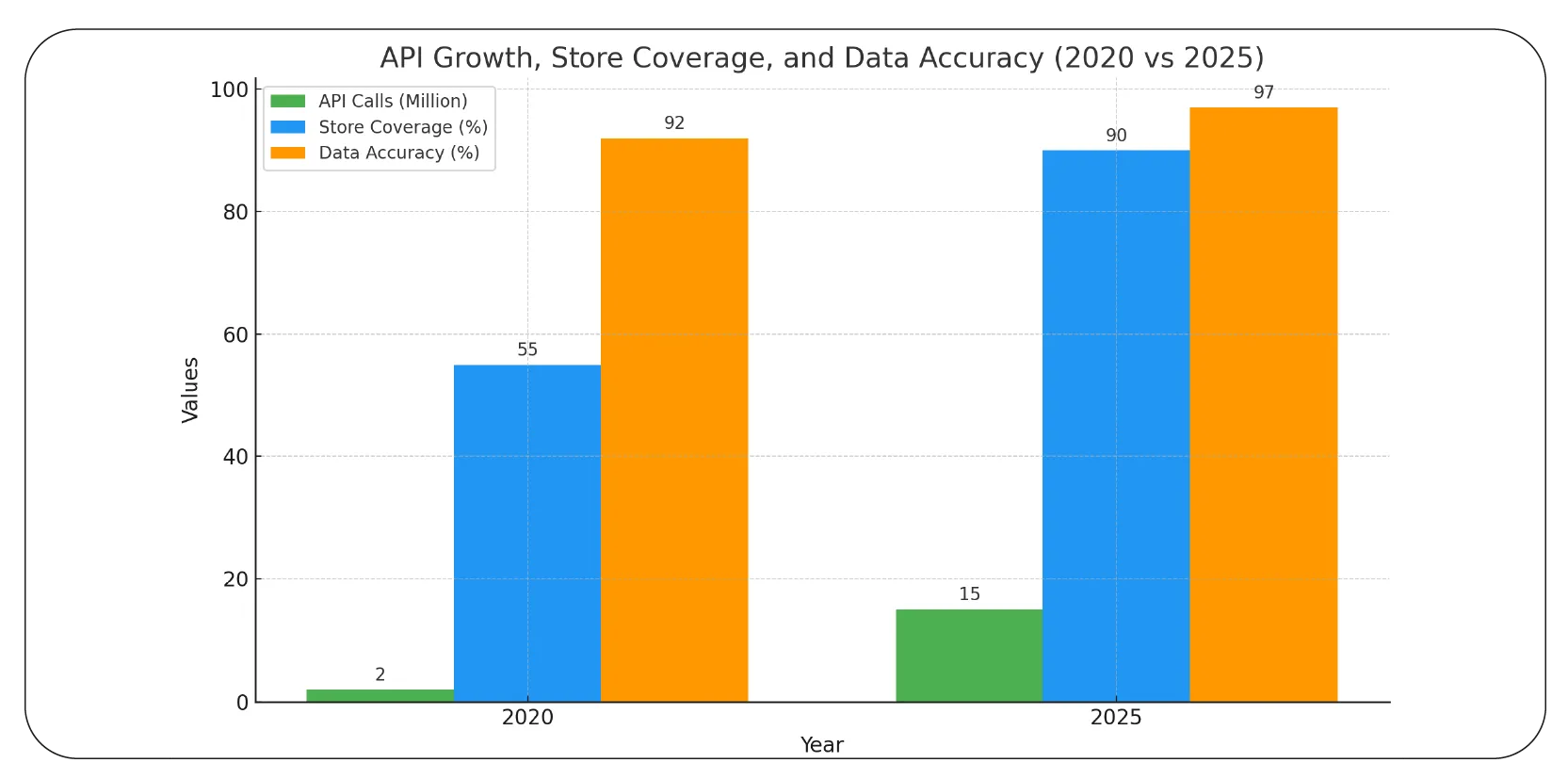

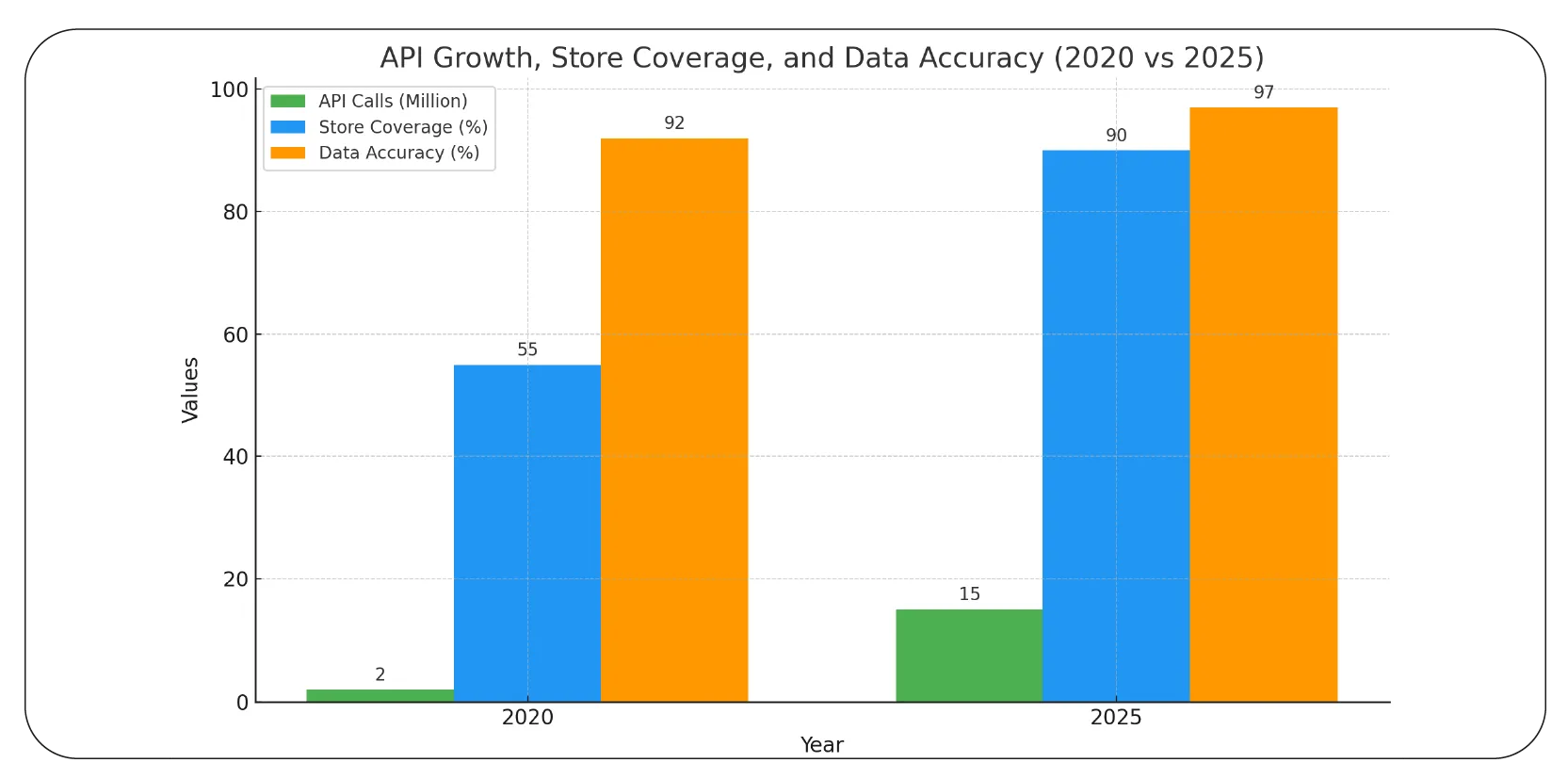

The growth in demand is clear. In 2020, the average number of API calls

per month was around 2 million, covering roughly 55% of stores with department-level data at

92% accuracy. By 2025, this is expected to reach an estimated 15 million calls monthly, with

coverage expanding to 90% of stores — and data accuracy climbing to 97%.

| Year |

No. of API Calls per Month |

% Stores with Department-Level Data |

Data Accuracy (%) |

| 2020 |

2M |

55% |

92% |

| 2021 |

4M |

62% |

93% |

| 2022 |

6M |

70% |

94% |

| 2023 |

9M |

78% |

95% |

| 2024 |

12M |

85% |

96% |

| 2025 |

15M (est.) |

90% (est.) |

97% (est.) |

Analysis:This surge proves that retailers and suppliers

increasingly rely on real-time store-level and department-level feeds to plan smarter

assortments, pricing, and localized promotions. The businesses leveraging this data have the

edge in delivering exactly what customers want, exactly where they want it.

Unlock real-time grocery insights today — get

started with our Grocery Data API with Store Address & Department

Info now!

Contact Us Today!

Grocery Retail Data Extraction API with Product & Store Info

Today’s grocery market moves at lightning speed — and so must your data

strategy. A Grocery Retail Data Extraction API with Product & Store Info is the backbone of

this real-time advantage, giving businesses the power to pull accurate product, pricing,

availability, and store location details together in one streamlined feed.

Unlike static spreadsheets or slow manual audits, this API automatically

extracts fresh product listings and store-level information across an expanding network of

grocery chains. Whether you’re tracking Walmart’s extensive inventory, Aldi’s

region-specific offers, or Amazon Grocery’s online-only assortments, this unified feed

ensures your team always works with the latest information.

Retailers use this data to design hyperlocal promotions, tweak prices

store by store, and quickly respond to competitor moves. For example, if a nearby rival

slashes milk prices in a specific ZIP code, your pricing team can react instantly,

minimizing lost foot traffic. Brands use the same feed to check how their products are

priced and stocked in different regions, ensuring consistency and compliance with retail

partners.

The numbers prove just how fast the market is scaling. In 2020, businesses

extracted an average of 50 million product SKUs through these APIs. By 2025, that number is

projected to reach 120 million SKUs — more than doubling in five years. At the same time,

the number of retailers covered is expanding too: from just 25 in 2020 to an estimated 100

by 2025.

| Year |

Avg. Product SKUs Extracted |

New Retailers Added |

% Using Geo Data |

| 2020 |

50M |

25 |

68% |

| 2021 |

60M |

40 |

71% |

| 2022 |

75M |

55 |

75% |

| 2023 |

90M |

70 |

79% |

| 2024 |

105M |

85 |

82% |

| 2025 |

120M (est.) |

100 (est.) |

85% (est.) |

Analysis:This upward trend shows how essential geographic

data and broader retailer coverage have become for brands and stores aiming to localize

strategies, outsmart competitors, and meet consumer expectations in every neighborhood.

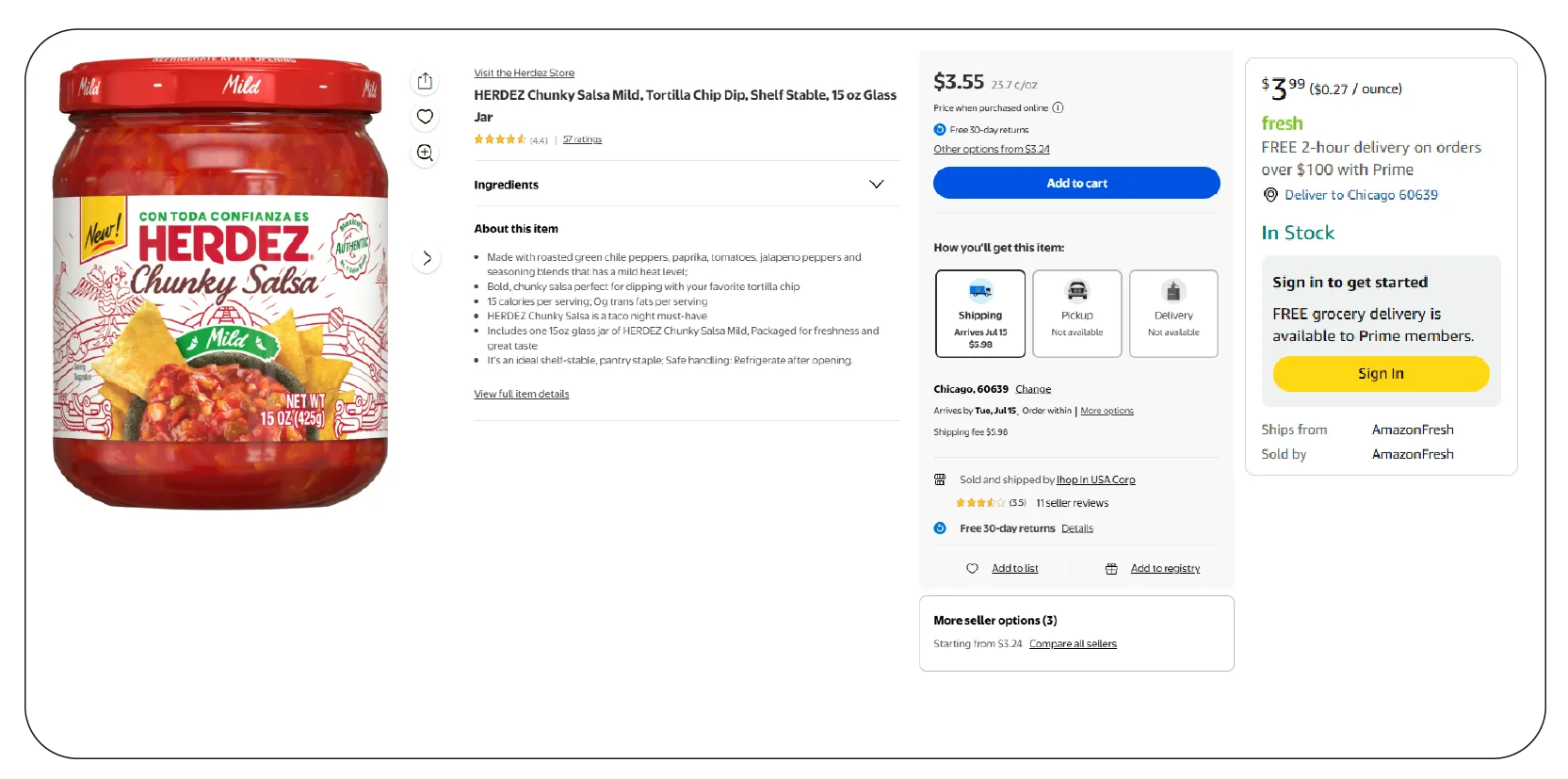

Why Scrape Grocery Product Listings from Multiple Retailers?

In an increasingly price-sensitive grocery market, shoppers have more

choices than ever. This means that staying blind to how your competitors price and stock

similar products can quickly erode your market share. When you

Scrape Grocery Product

Listings from Multiple Retailers , you gain a clear, side-by-side view of how your

pricing

stacks up against the competition in different neighborhoods and regions.

For example, a basic pantry item like organic milk or a national cereal

brand may be listed at one price at Walmart, a slightly lower price at Aldi, and yet another

price on Amazon Grocery’s platform — all within the same ZIP code. If your store is priced

even a few percentage points too high, customers will notice and may switch their loyalty,

especially when online grocery and same-day delivery make it so easy to compare and shop

around.

With reliable multi-retailer scraping, grocery chains and brands can track

not just listed prices but also live stock status. Are your competitors running a temporary

promotion? Are they out of stock while you have inventory? These details help you adjust

your pricing or highlight stock availability in your ads and online listings, capitalizing

on gaps to win customers.

The need for this capability is growing. In 2020, the average price

difference for the same SKU across major grocery chains was about 8%. By 2025, this gap is

expected to grow to 15% — meaning more consumers will hunt for deals. This directly fuels

switching behavior: 12% of shoppers switched stores in 2020 to get a better price, but by

2025, one in four shoppers will do so regularly.

| Year |

Avg. Price Difference (Same SKU) |

% Consumers Switching Retailers |

| 2020 |

8% |

12% |

| 2021 |

10% |

15% |

| 2022 |

11% |

17% |

| 2023 |

12% |

20% |

| 2024 |

13% |

23% |

| 2025 |

15% (est.) |

25% (est.) |

Analysis:The message is clear — competitive grocery

pricing is not just about setting the right price, but constantly benchmarking it against

other players. Scraping listings from multiple retailers puts you back in control.

Quick Commerce Grocery & FMCG Data Scraping

The grocery industry is experiencing a revolution driven by speed — and

quick commerce is at the heart of it.

Quick Commerce Grocery & FMCG Data Scraping has become

indispensable for delivery platforms promising ultra-fast drop-offs within 10–30 minutes.

For these services, having accurate, real-time product data is the difference between

meeting a delivery promise or losing a customer to a faster competitor.

Quick commerce relies on small, hyperlocal warehouses known as “dark

stores.” These are strategically placed within urban neighborhoods to ensure products can be

delivered within minutes of an order being placed. But operating these dark stores

profitably means having precise data on what’s in stock, where it’s located, and at what

price it’s being offered — down to the neighborhood level.

This is where robust grocery and FMCG data scraping comes in. By

continuously scraping store listings, prices, and local stock levels, quick commerce

platforms like Instacart, DoorDash, or local grocery startups can synchronize online menus

with real-world availability in real time. This avoids costly cancellations or substitutions

that frustrate shoppers and damage brand trust.

The growth numbers tell the story. In 2020, quick commerce accounted for

just 2% of the grocery market, with the average local dark store carrying about 1,200 SKUs

and price accuracy hovering around 87%. By 2025, quick commerce is projected to capture 20%

of the grocery sector, with dark stores stocking 4,200 SKUs on average and data accuracy

reaching 97%.

| Year |

% Market Share of Quick Commerce |

Avg. SKU Count per Local Dark Store |

Price Accuracy (%) |

| 2020 |

2% |

1,200 |

87% |

| 2021 |

5% |

1,800 |

90% |

| 2022 |

9% |

2,200 |

92% |

| 2023 |

12% |

2,800 |

94% |

| 2024 |

16% |

3,500 |

96% |

| 2025 |

20% (est.) |

4,200 (est.) |

97% (est.) |

Analysis:As more shoppers expect groceries on their

doorstep in under 30 minutes, only retailers and delivery apps with reliable scraped

listings and up-to-the-minute price and stock data will be able to deliver consistently —

and profitably.

Stay ahead in fast delivery — power your business

with Quick Commerce Grocery & FMCG Data Scraping for real-time local

insights!

Contact Us Today!

Scrape Grocery & Gourmet Food Data for Better Assortment

Today’s shoppers want more than just pantry staples — they’re spending

extra on premium, organic, and gourmet foods that match changing lifestyles. That’s why

smart retailers and brands now

Scrape Grocery & Gourmet Food Data to understand which

specialty trends are emerging and which premium SKUs deserve more shelf space, both online

and in physical stores.

By scraping grocery and gourmet product listings, you gain visibility into

new brands entering the market, price points for niche items, and how promotions or seasonal

spikes drive sales. For example, a grocery chain might spot a rising demand for organic

snacks or imported cheeses in urban ZIP codes, then expand their local assortment to match.

Online retailers benefit too. E-commerce grocery stores often use gourmet

food insights to upsell — adding premium products that lift average basket value and

encourage repeat purchases. With precise scraping, you can see what your competitors are

listing in the gourmet category, how they price bundles, and which SKUs they feature in

promotions or meal kits.

The data shows clear momentum. In 2020, premium products made up around

12% of grocery assortments, raising average basket values by 8%. By 2025, premium SKUs are

expected to hit 25% of total offerings, with an average basket value increase of 20% and

more gourmet brands tracked than ever.

| Year |

Premium SKU % |

Avg. Basket Value Increase |

New Gourmet Brands Tracked |

| 2020 |

12% |

+8% |

150 |

| 2021 |

15% |

+10% |

200 |

| 2022 |

17% |

+12% |

250 |

| 2023 |

20% |

+14% |

300 |

| 2024 |

22% |

+17% |

350 |

| 2025 |

25% (est.) |

+20% (est.) |

400 (est.) |

Analysis:Consumers are spending more on gourmet and

premium grocery items. Retailers who scrape this data consistently can stock the right SKUs,

target higher-value customers, and grow profits without guesswork.

Web Scraping Grocery Price Data to Optimize Dynamic Pricing

Dynamic pricing is transforming the grocery industry. Unlike static

pricing models, which might update only a few times a season, dynamic pricing adjusts in

real time based on market conditions, local competition, and consumer behavior. But to make

it work, you need reliable Web Scraping Grocery Price Data as fuel.

When a retailer scrapes competitor prices daily — or even hourly — it can

automatically adjust its own pricing to stay competitive while protecting margins. If a

nearby supermarket drops the price of fresh produce ahead of a holiday, a smart dynamic

pricing engine can match or beat it. If stock runs low in one region, prices can rise to

reflect scarcity while discounts move to areas with surplus inventory.

This is especially valuable for big retailers like Walmart and regional

grocery chains looking to match online pricing with local store conditions. Data scraping

feeds these models with fresh, real-world insights so they stay aligned with what customers

see when they compare on apps or visit physical shelves.

The adoption curve speaks for itself. In 2020, about 28% of grocery

retailers used dynamic pricing, adjusting prices roughly 250 times per month. By 2025, an

estimated 70% will rely on it, with top chains running up to 1,500 price adjustments each

month — all powered by high-quality scraped pricing data.

| Year |

% Retailers Using Dynamic Pricing |

Price Adjustments per Month |

| 2020 |

28% |

250 |

| 2021 |

35% |

400 |

| 2022 |

44% |

650 |

| 2023 |

52% |

900 |

| 2024 |

61% |

1,200 |

| 2025 |

70% (est.) |

1,500 (est.) |

Analysis:Dynamic pricing has moved from a nice-to-have to

a retail standard. Accurate web scraping keeps it precise, fair, and hyperlocal.

Grocery & Supermarket Data Scraping Services for Full Market Coverage

When businesses look to gather grocery data, they quickly discover how

fragmented the market is. National chains, regional players, independent stores — each has

its own online listings, local prices, promotions, and inventory. That’s why comprehensive

Grocery & Supermarket Data Scraping Services are critical.

By partnering with a trusted data scraping provider, you ensure full

market coverage that spans big names like Walmart, discount leaders like Aldi, and regional

favorites that drive local shopping habits. Unlike basic scraping tools, professional

services deliver clean, normalized datasets ready for analytics, rather than messy raw data

that wastes hours of your team’s time.

This broad data feeds pricing intelligence tools, market share tracking,

ad planning, and competitor benchmarking. It also fuels assortment optimization — so you

know which products to promote in which regions, which SKUs to drop, and which categories

are growing faster than expected.

The trend toward more automated data feeds shows how essential this has

become. In 2020, about 40 grocery chains were typically covered by scraping services, with

45% offering some automated feed. By 2025, more than 120 chains are expected to be included

— and nearly 90% will support automated updates.

| Year |

No. of Chains Covered |

% with Automated Data Feeds |

| 2020 |

40 |

45% |

| 2021 |

55 |

55% |

| 2022 |

70 |

65% |

| 2023 |

85 |

72% |

| 2024 |

100 |

80% |

| 2025 |

120 (est.) |

87% (est.) |

Analysis:As more chains automate their feeds, the

opportunity to stay ahead grows. High-quality scraping services ensure your data stays

current and competitive.

Expand your reach — use Grocery & Supermarket Data

Scraping Services for Full Market Coverage and gain unbeatable

competitive insights today!

Contact Us Today!

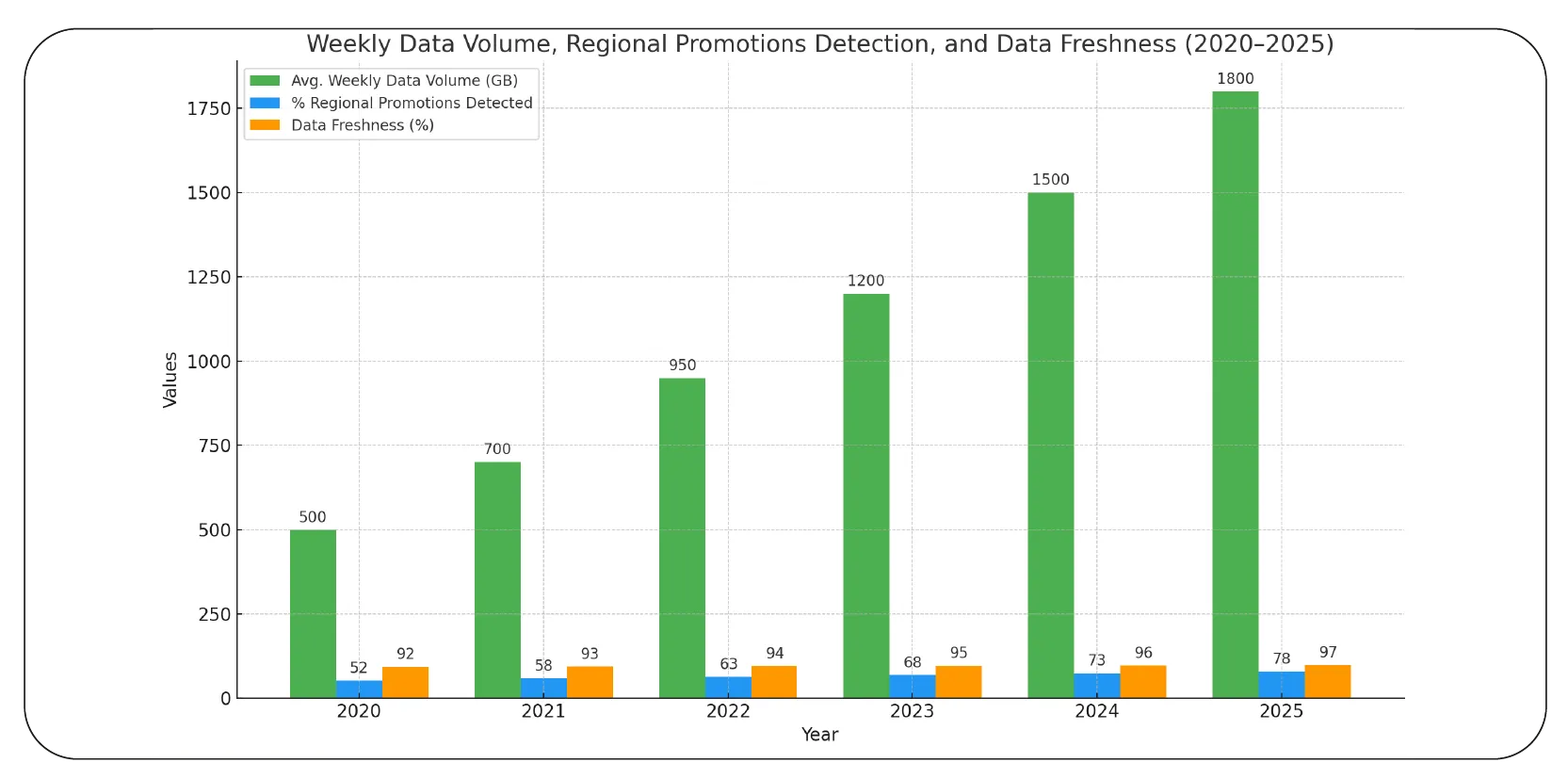

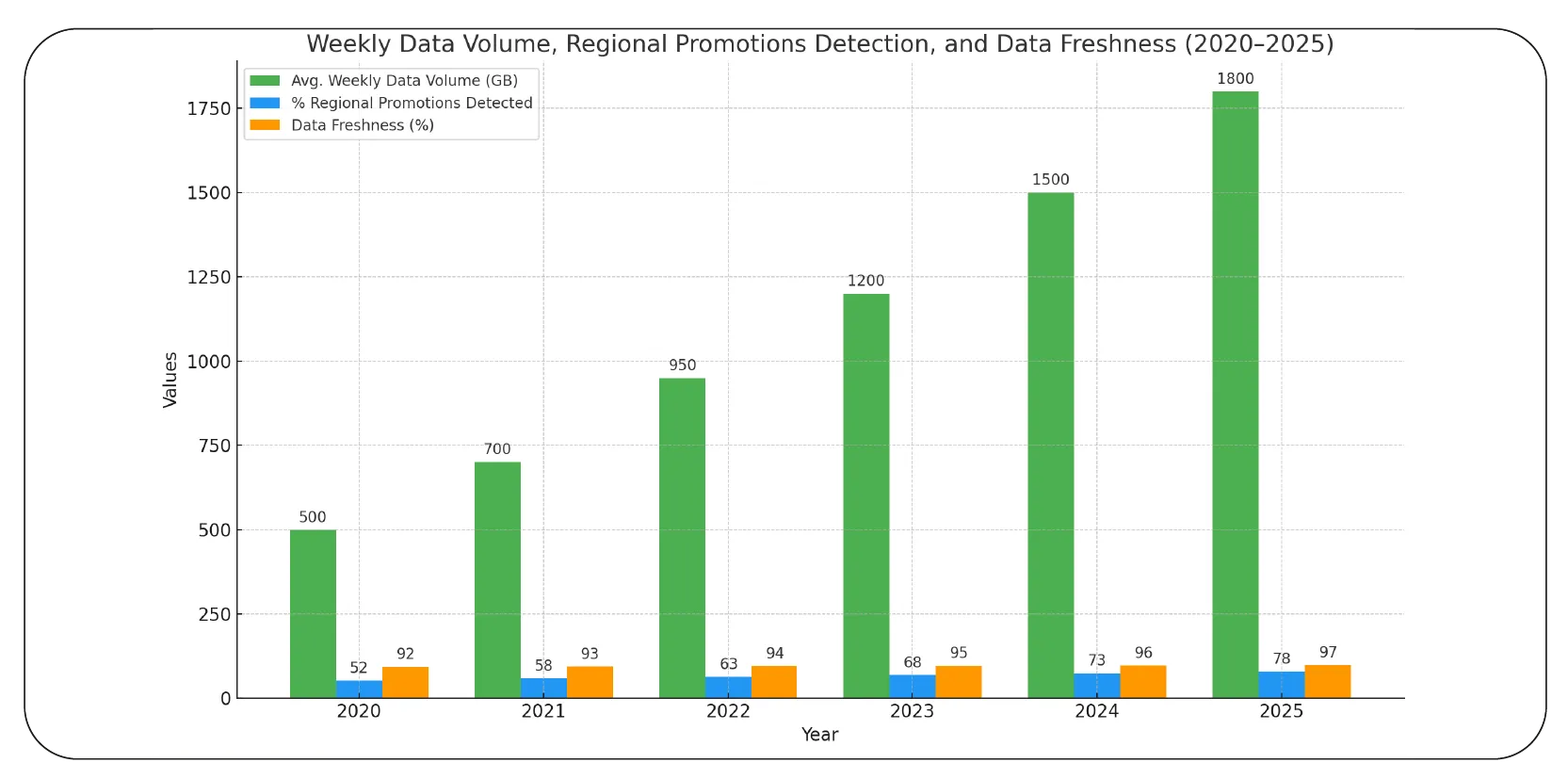

Grocery Data Scraping Services to Track Regional Trends

Consumer preferences are local. What sells out in one city might gather

dust in another. That’s why modern retailers rely on Grocery Data Scraping Services to see

not just national trends but local nuances — store by store, region by region.

This level of granularity shows which promotions are resonating, which

products fly off the shelves, and which stock needs to be rebalanced. It’s especially

critical for national grocery chains and brands selling through multiple retailers. With

fresh, geo-tagged scraped data, they can adjust store assortments, time regional promotions

perfectly, and avoid overstock or spoilage.

The scale of this insight is massive — and growing fast. In 2020, the

average weekly data volume scraped for regional trend tracking was about 500 GB. By 2025,

it’s forecasted to triple to 1,800 GB per week. And the freshness of this data is increasing

too: from 92% accuracy in 2020 to a projected 97% by 2025.

| Year |

Avg. Weekly Data Volume |

% Regional Promotions Detected |

Data Freshness (%) |

| 2020 |

500 GB |

52% |

92% |

| 2021 |

700 GB |

58% |

93% |

| 2022 |

950 GB |

63% |

94% |

| 2023 |

1,200 GB |

68% |

95% |

| 2024 |

1,500 GB |

73% |

96% |

| 2025 |

1,800 GB (est.) |

78% (est.) |

97% (est.) |

Analysis:Regional trend tracking makes the difference

between generic promotions and personalized offers that win local shoppers. Clean scraping

keeps this data fresh, relevant, and ready for action.

Getting Started with a Grocery Store Dataset

Your entire pricing, promotions, and inventory strategy depends on the

quality of your core data. A trusted Grocery Store Dataset gives you the historical and

real-time product listings you need to make smart decisions every day.

Instead of working with outdated pricing spreadsheets or relying on

quarterly retail reports, a live

grocery store dataset pulls listings straight from

retailers like Walmart, Aldi, and Amazon Grocery. This means you can run instant competitive

analysis, check price changes by ZIP code, track out-of-stock patterns, and test different

promotion ideas with real numbers.

It’s especially valuable for forecasting. Brands can pair historical price

data with promotional timelines to see what works — and what doesn’t. Retailers can monitor

how well new product launches perform in specific regions before expanding them nationwide.

The depth of this dataset is increasing every year. In 2020, the average

retailer’s dataset contained about 25 million historical records. By 2025, this number is

projected to hit 100 million per retailer — and more of this data than ever before will be

fed into AI-driven forecasting models.

| Year |

Avg. Historical Records per Retailer |

% Data Used for Forecasting |

| 2020 |

25M |

55% |

| 2021 |

35M |

60% |

| 2022 |

50M |

68% |

| 2023 |

65M |

75% |

| 2024 |

80M |

82% |

| 2025 |

100M (est.) |

90% (est.) |

Analysis:The bigger and cleaner your grocery store

dataset, the more accurate your predictions — giving you an unbeatable edge in a fast-moving

market.

Why Choose Product Data Scrape?

Product Data Scrape specializes in custom Grocery & Supermarket Data

Scraping Services, covering Walmart, Aldi, Amazon, and more. We deliver clean, structured

datasets and robust Grocery Data API with Store Address & Department Info, tailored for

dynamic pricing, assortment planning, and competitive benchmarking.

Key Benefits:

- Accurate multi-retailer coverage

- Real-time and historical data

- Flexible APIs

- Support for global markets

- 24/7 monitoring and updates

Conclusion

In today’s competitive grocery market, the ability to Scrape Grocery Store

Product Listings with Address & Price is essential. With Product Data Scrape, you get

powerful Grocery Retail Data Extraction API with Product & Store Info to keep your pricing

smart and your shelves stocked efficiently. Ready to unlock grocery data that works for you?

Contact Product Data Scrape today for the most reliable Grocery Data Scraping Services!

.webp)

.webp)

.webp)