We have traveled a long from medical herbs and face paint to billion-dollar industries reforming around beauty and health. Consumers are getting progressively bombarded with different products promising something for everybody. As per the recent product data scrape study, health and Beauty are the most popular categories among CPG in the United States in terms of brand concentration and strength of assortment. With most other categories, pricing around these two categories comes into the limelight when Black Friday comes around.

As part of our pricing research series for the top retailers across categories of Black Friday, the Product Data Scrape team analyzed the sample of over 15k products from Walmart, Nordstrom, Amazon, Target, JCPenney, and Macy's. We covered 10 types of products across hair care, Makeup, Ayurveda, Fragrance, etc., and our analysis focused on the top 400 products of each product type.

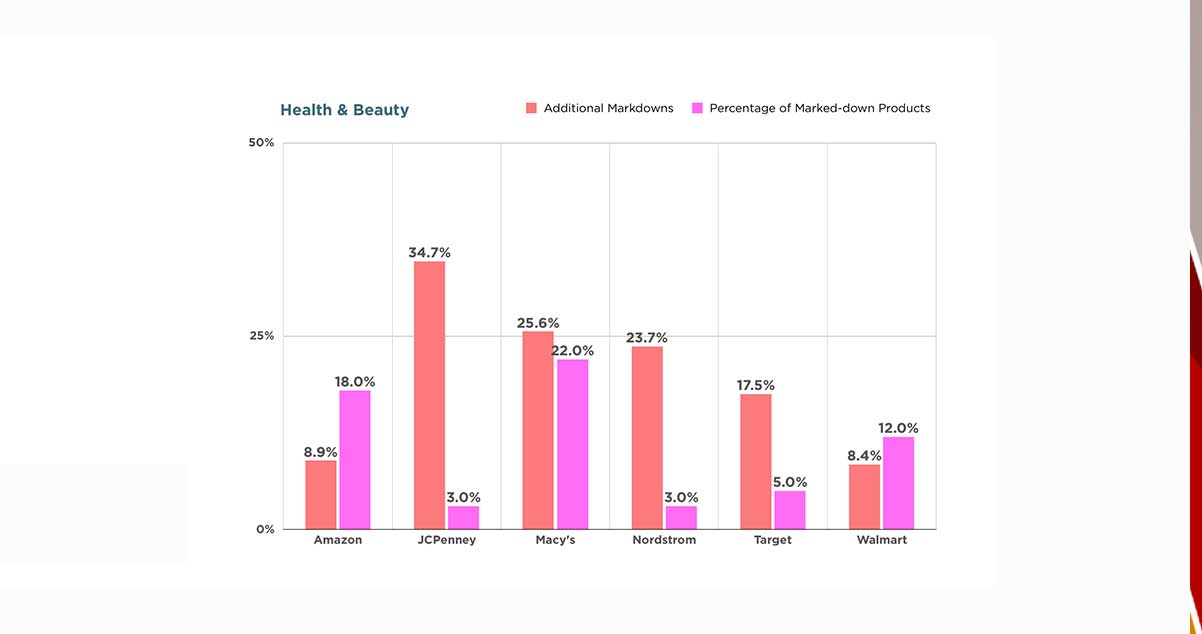

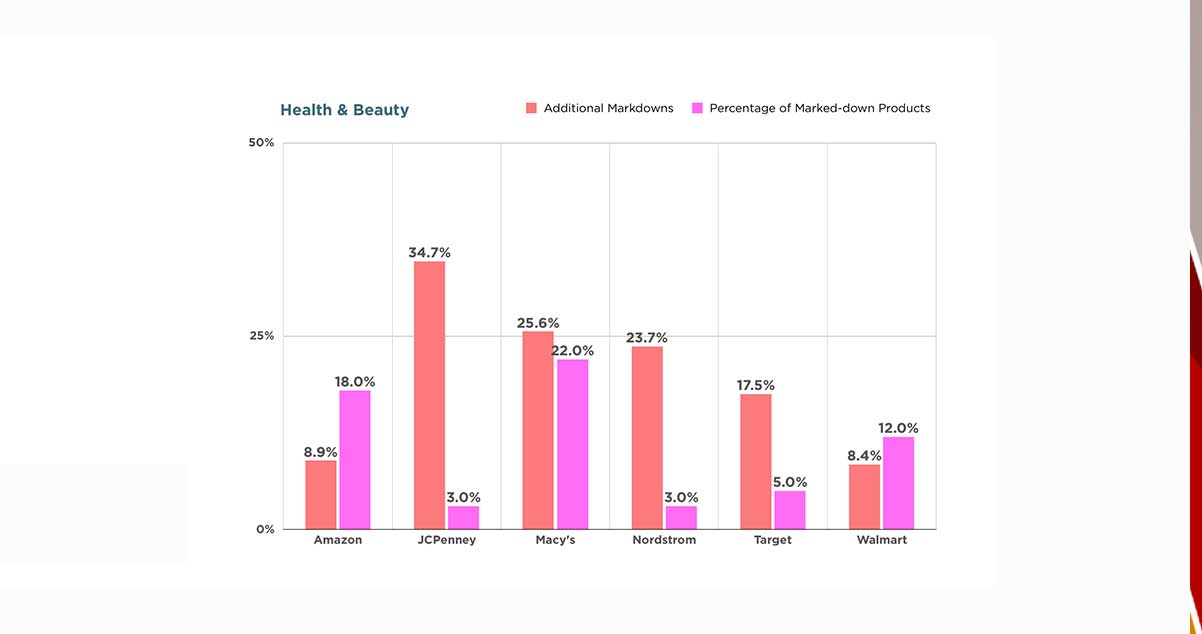

Added Markdowns

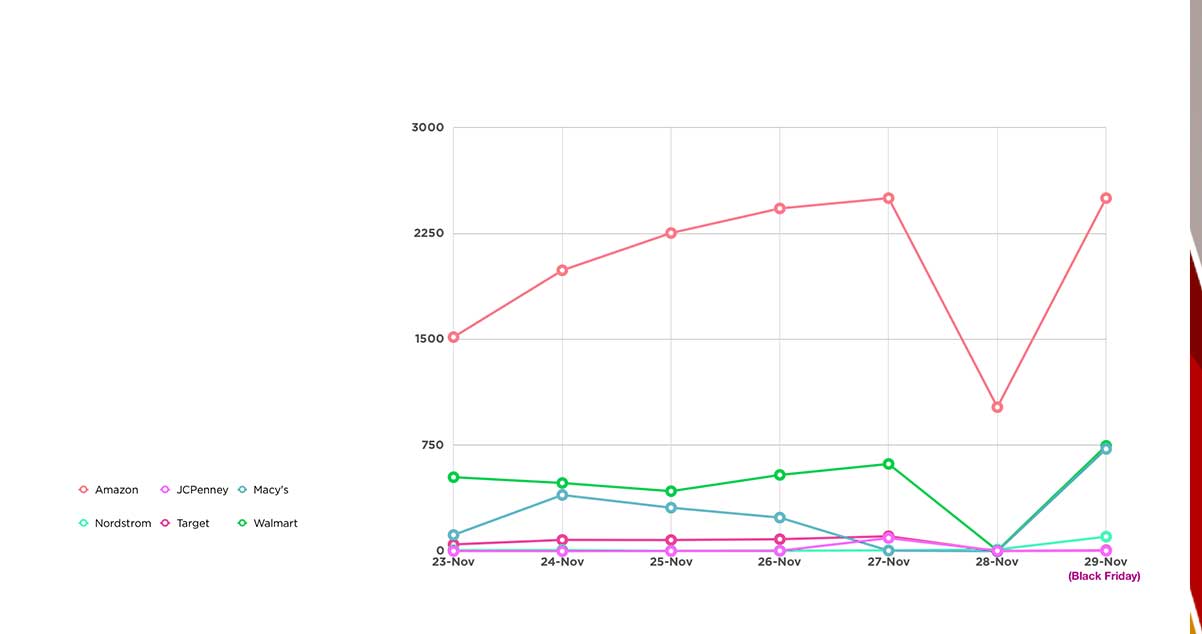

For this study, our team compared the previous week's prices with those during the sale. You can see the painted pic of the added markdowns for the duration of the sales.

Likewise, in our preferred coverage of the fashion category on the Black Friday sales, Macy's led in marked-down product reach by around 26 percent. The average markdown percentage was 22 percent, and JCPenney eclipsed it by approximately 35 percent. On the other hand, Walmart had the lowest markdowns under 10 percent. But they could cover the top 3 products with 18 and 12 percent. The other companies, Target and Nordstrom, offered average markdowns with their conservative approach to selecting the products of 5 and 3 percent products, respectively.

Additional Product Markdowns

When we dived deep into the product types, we observed that most retailers marked down shampoo, conditioners, makeup, and hair care products for men heavily. The below table shows the first three discounted product categories for all the retailers.

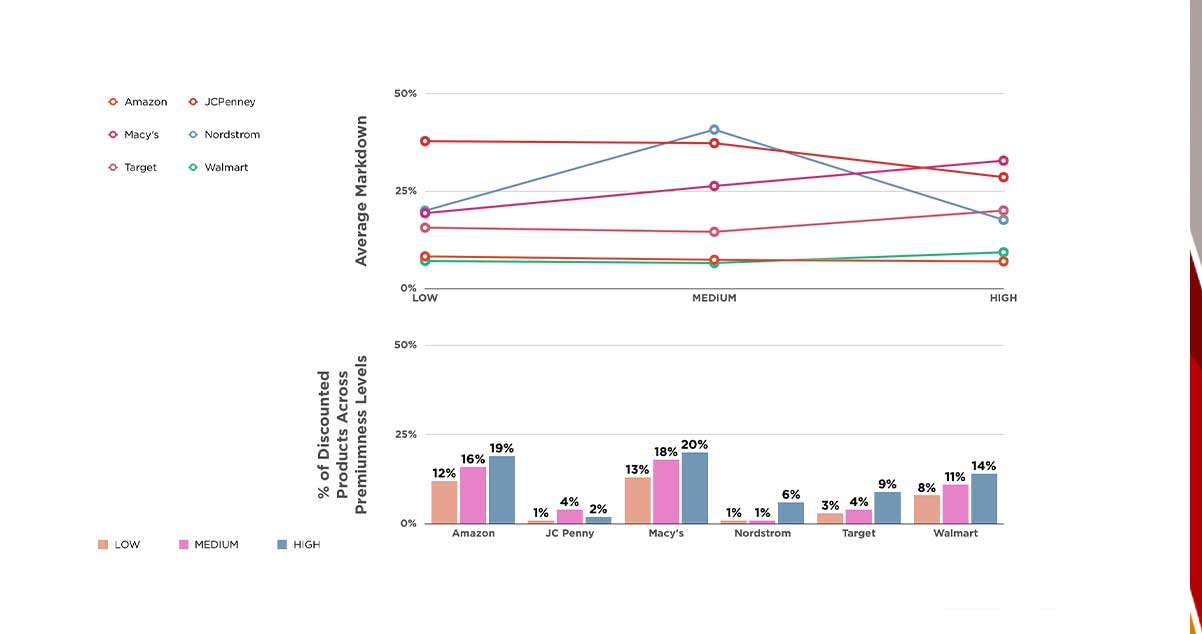

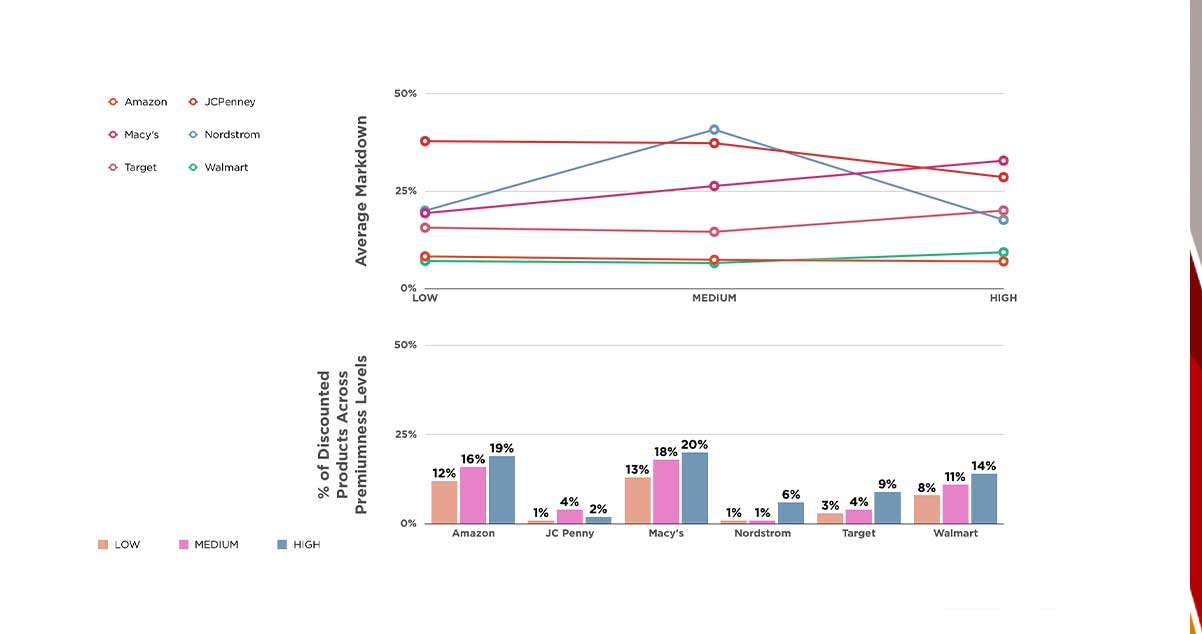

Product Premiumness

We filtered the products across retailers into cheap and expensive categories and compared them with the rest of the products which retailers had listed. For a few products, the MRP was not shown. We considered the highest price of the product during the holiday period before the Black Friday event to categorize them. Later, we tagged products as low, medium, and high in terms of the premiumness of products, with low referring to the cheapest product.

In line with past trends, Macy's led the markdown on products of high level at 33 percent. It also covered a wide range of categories at 20 percent. Further, Amazon, Target, Macy's, and Walmart followed the expected approach of offering higher markdowns on the more expensive products, with a higher share of these products.

Apart from these, JCPenney and Nordstrom had different approaches here, where JCPenney offered markdowns on the least premium products, and Nordstrom offered markdowns on a medium range of products. It was encouraging to reiterate that both retailers' share of products with markdowns was small.

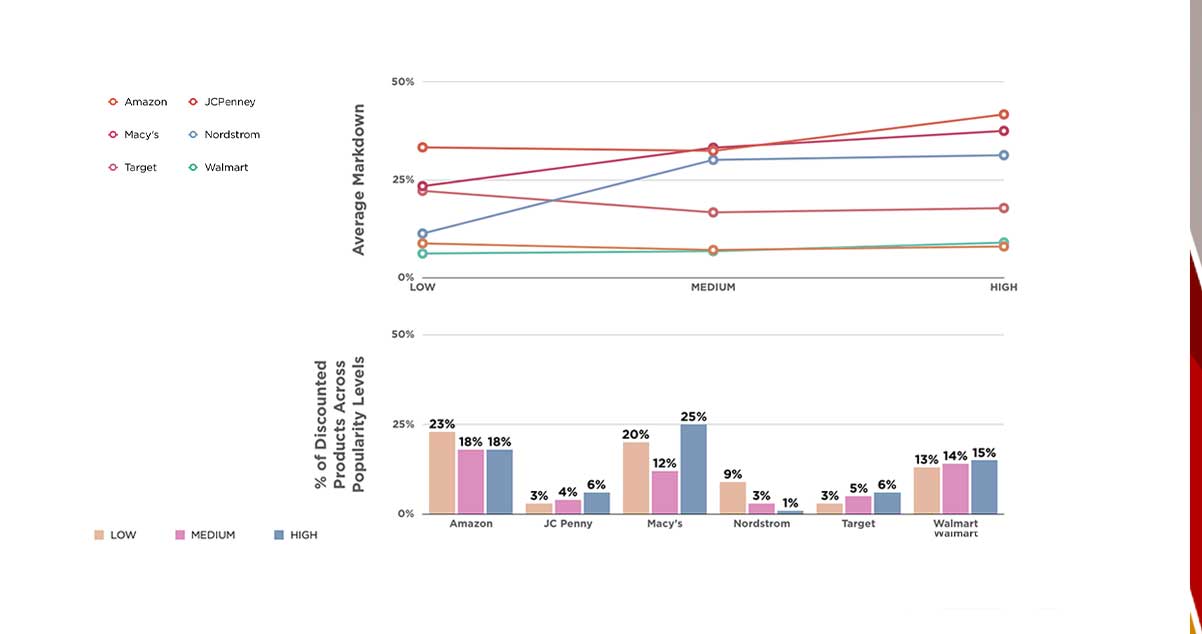

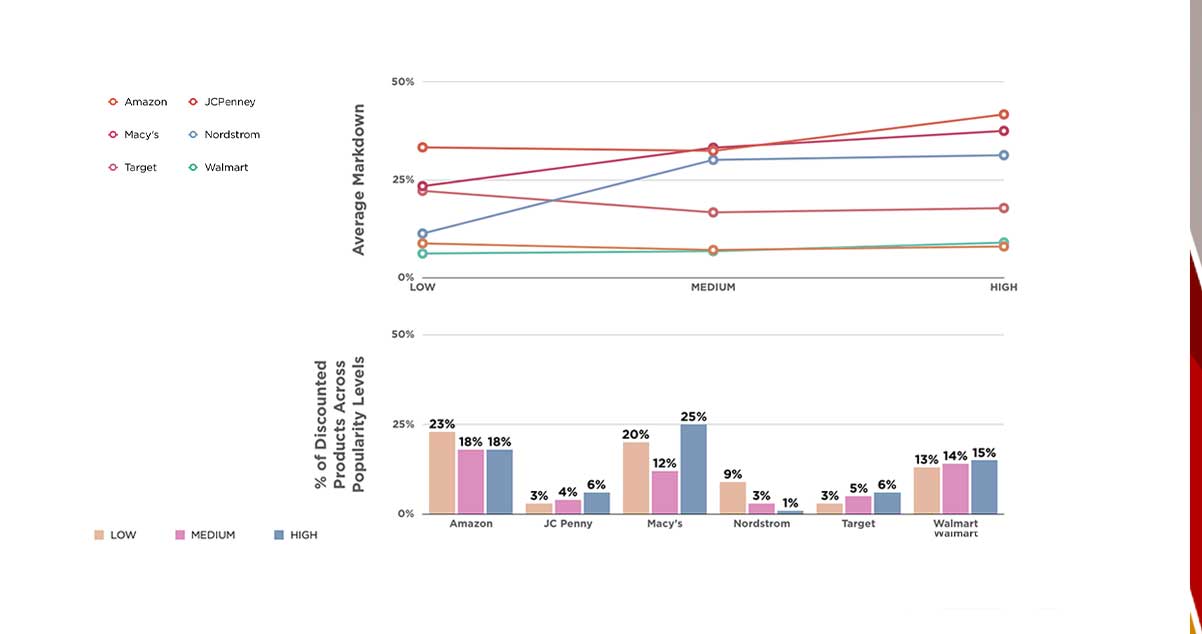

Product Popularity

Similar to filtering the products for product premiumness, we also screened them in popularity levels. To define popularity, we used a combination of the number of reviews received for each product and the average review rating.

Here, we couldn't see a consistent pattern that indicated a strategic focus on product popularity factor in the pricing strategy of retailers on Black Friday.

JCPenney and Macy's decided to mark down more portions of top-rated products. Nordstrom, JCPenney, and Macy's preferred providing higher markdowns on favorite products. Some retailers, including Amazon, came with a different approach, marking down the prices of the least popular products. The reason is to liquidate the excessive stock of these less popular products to increase the cash flow during the sales.

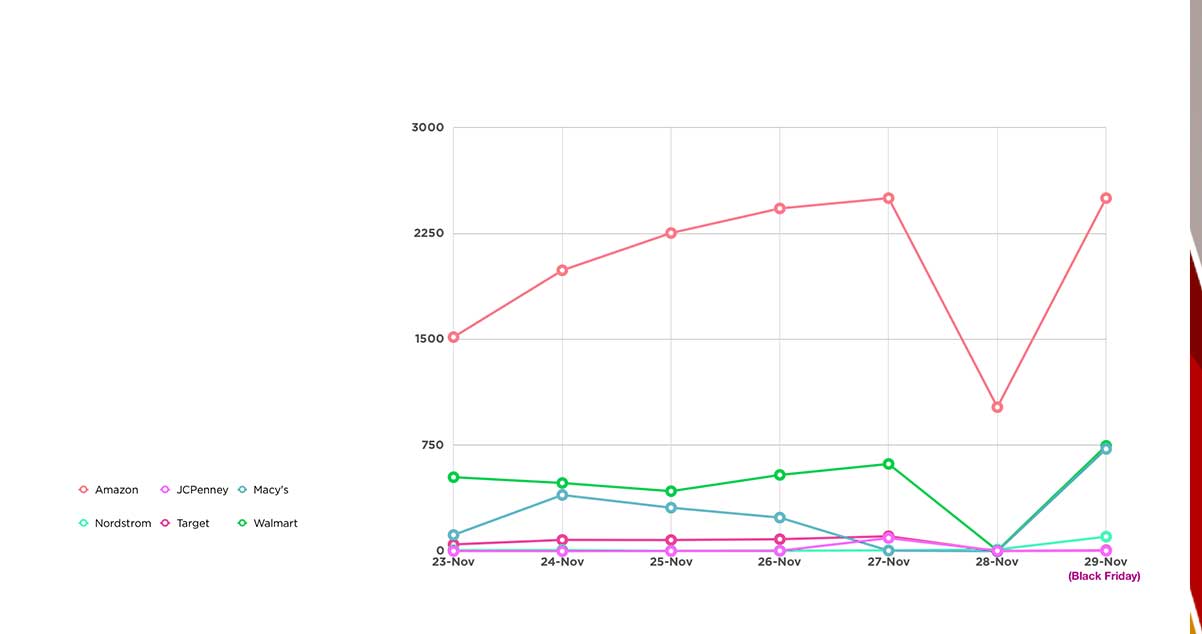

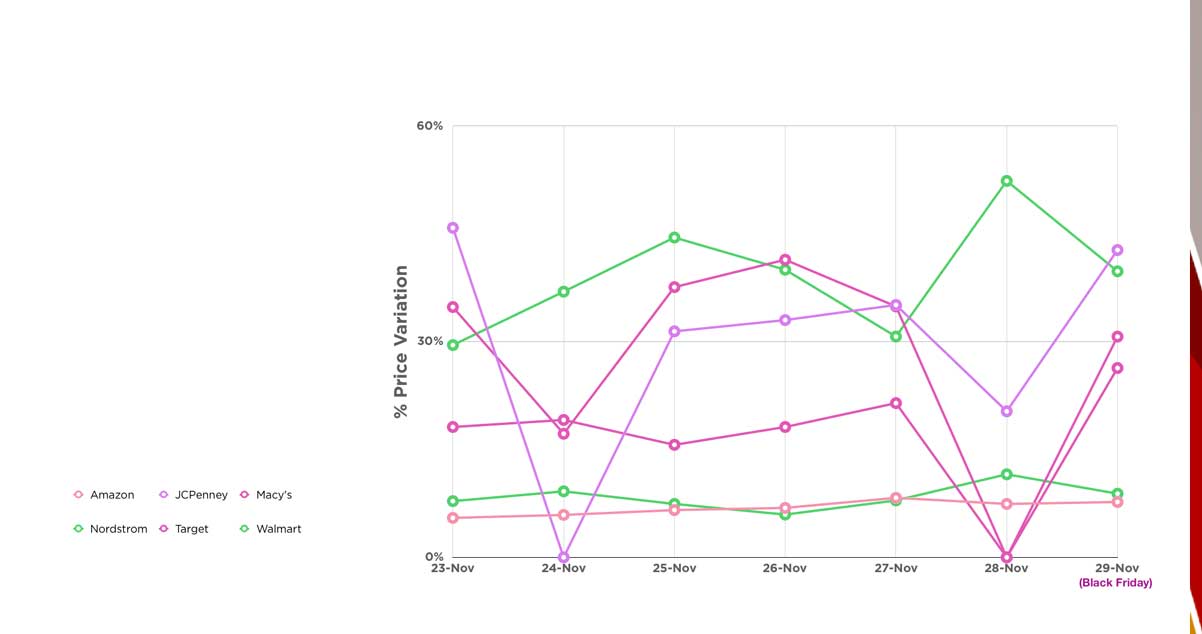

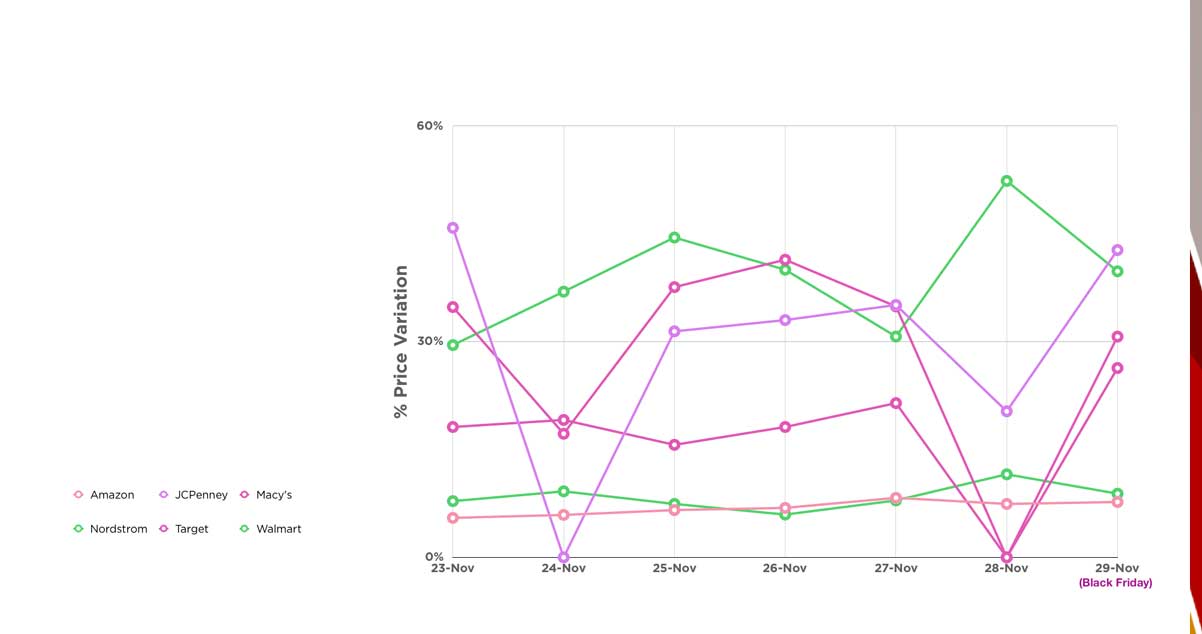

Price Change Activities

As observed quite frequently in recent times, the black Friday sale is not limited to a single-day event. But attractive offers are named Black Friday sales, often broadcast throughout November, particularly the last week of the month. We monitored the pricing activity level across all the retailers for the last week of November to check the number of price changes and the average price variation of every eCommerce retailer.

Typically, we saw that Amazon had the most significant number of price changes by a considerable margin, peaking at a margin of 2500 for the set of tracked products. The following in line was Walmart which made 618 variations on the 27th. Even changing multiple times, their average price variation remained at the bottom end of the scale without touching 10 percent.

The remaining retailers experimented with fewer price variations, except for the leading Macy's in the event of Black Friday. However, the variations almost reverted from the day prior, only to rise back on the 29th.

Every e-commerce retailer tended to follow a predictable pattern of decreasing changes on the 28th and sharply hiking it the following day. However, Walmart and Nordstrom did the opposite when they offered discounts during the event.

Wrapping Up

To conclude the analysis, we deduced that Macy's marked down relatively more products than the remaining eCommerce retailers. JCPenney, Target, and Nordstrom offered markdowns but only on some of the products. However, there was no surprise that Amazon and Walmart followed their past strategies and stayed conservative in their added markdowns during the Black Friday deals season to be on the top to attract more customers.

Look at Product Data Scrape to extract Health and Beauty related retail product data. Stay tuned for our observations and analysis of the other product categories in the coming days

.webp)