Introduction

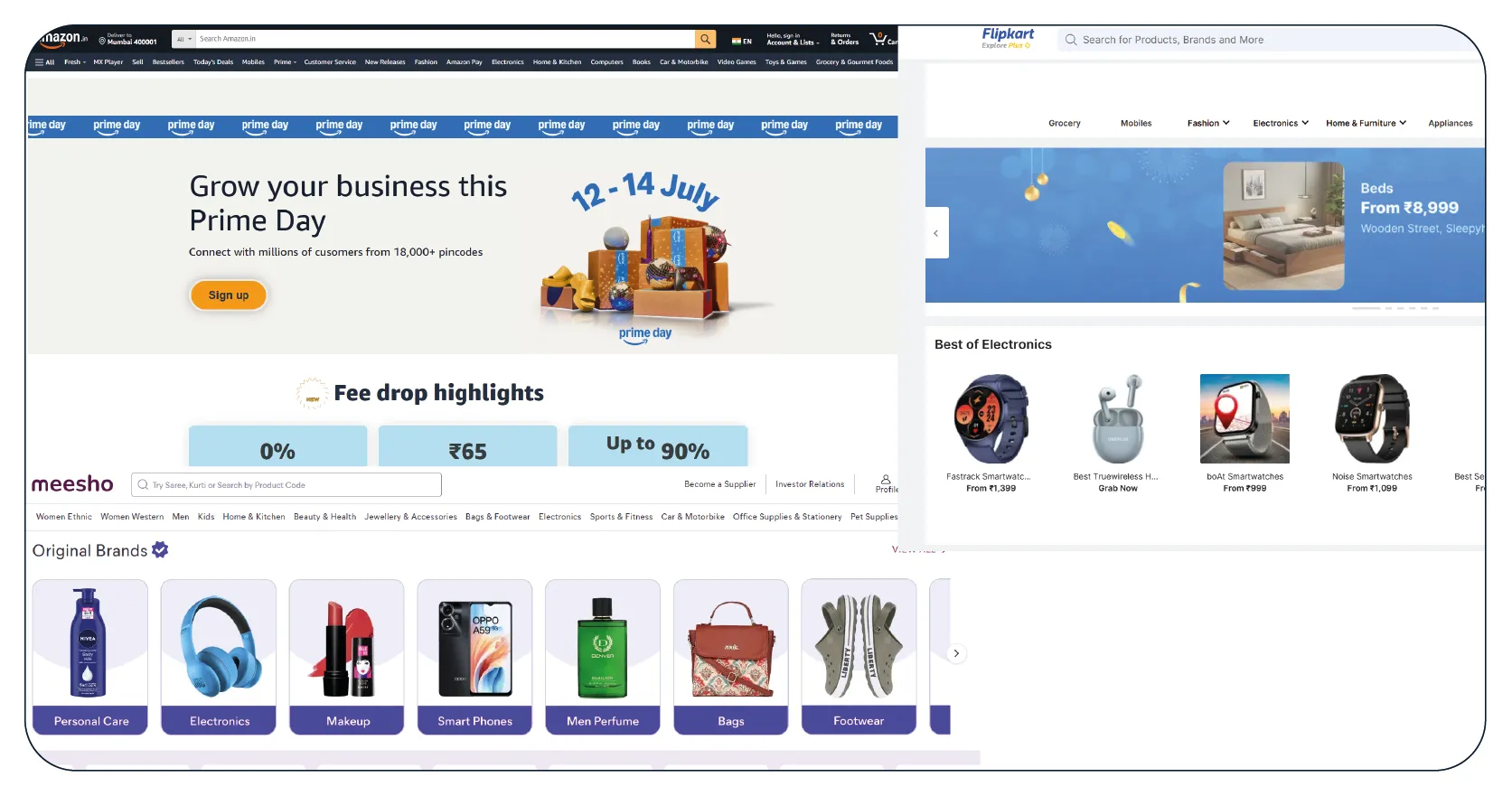

In India’s highly competitive online retail market, real-time eCommerce pricing intelligence has

become vital for consumer brands, D2C sellers, and even third-party marketplaces. Popular

platforms like Amazon India, Flipkart, and Meesho constantly adjust product prices based on

demand, inventory, promotions, and competition.

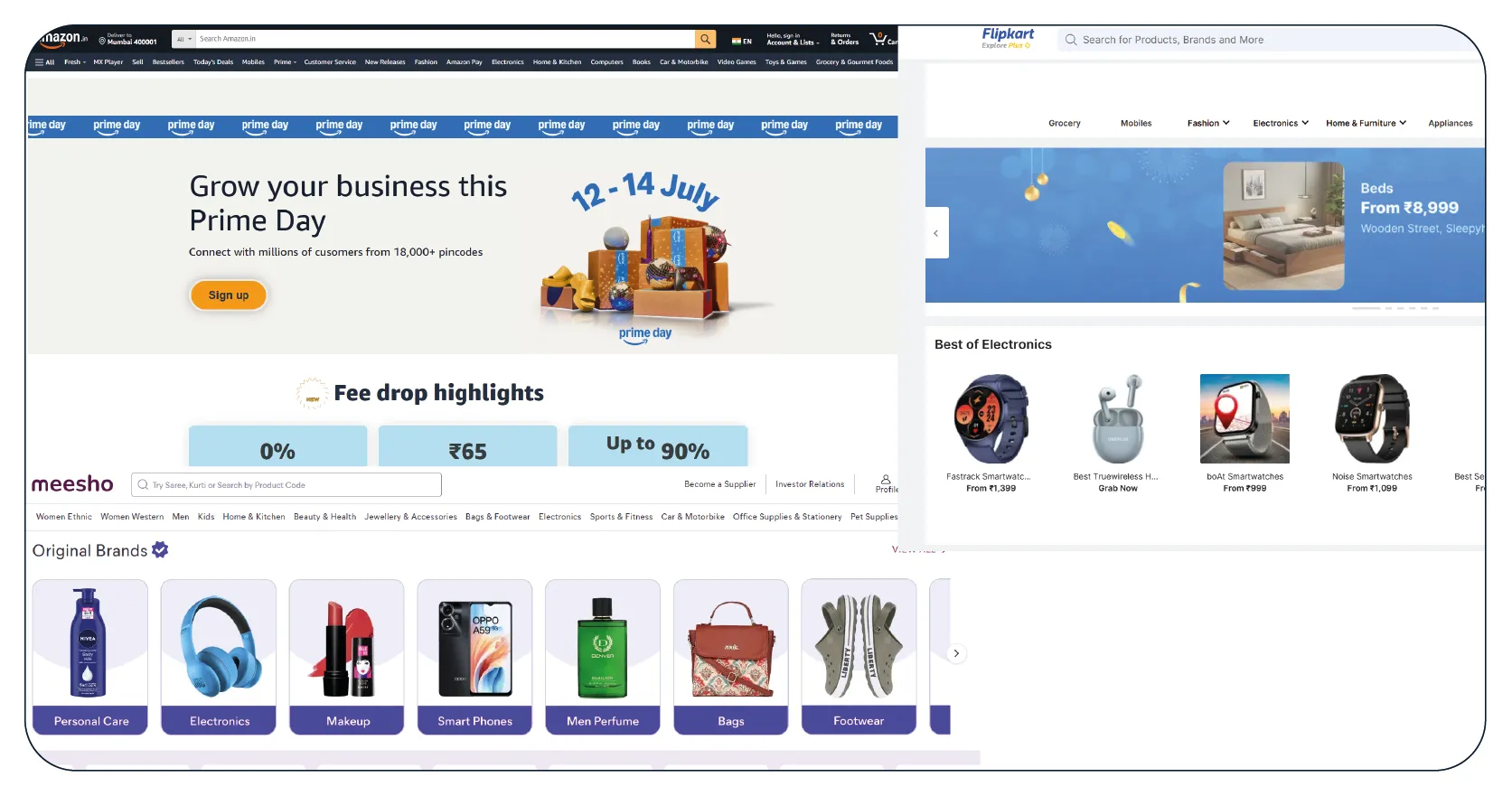

This case study explores how Product Data Scrape empowered an Indian electronics retailer to

monitor price fluctuations in real time across these three platforms. Leveraging India eCommerce

data scraping , the company gained critical pricing visibility that led to optimized

listing

strategies and a measurable increase in revenue by 17%.

Challenge

The client — a Mumbai-based consumer electronics brand selling across Amazon,

Flipkart, and Meesho — faced several problems:

- Inconsistent Pricing Visibility: They couldn’t track how their own

products or competitors’ SKUs were priced across platforms on a real-time basis.

- Lack of Dynamic Pricing Strategy: Price changes on Meesho and Flipkart

weren’t reflected on their Amazon listings, leading to lost sales and higher return rates.

- Manual Monitoring Limitations: Their internal team tracked prices manually

once every 48 hours. Promotions, flash sales, and hourly discounts were missed.

They needed a system to scrape product data across all three platforms with real-time frequency, aggregate it, and trigger alerts when a competitor dropped prices. By leveraging Web Scraping for Amazon E-Commerce Product Data and integrating tools to Extract Flipkart E-Commerce Product Data , we helped the client gain real-time pricing visibility and implement an automated, dynamic pricing strategy.

Objectives

Product Data Scrape was brought in to:

1. Enable Real-Time Scraping of Amazon, Flipkart & Meesho Prices.

2. Compare SKU-level Pricing (own & competitor listings).

3. Track Seller Names, Delivery Charges, and Discount Tags.

4. Provide Daily Reports + API Access for automated dashboards.

5. Offer Pin Code–Specific Pricing Data for targeted strategies.

Product Data Scrape’s Approach

1. Custom Scraper Setup

Developed 3 custom web scraping pipelines:

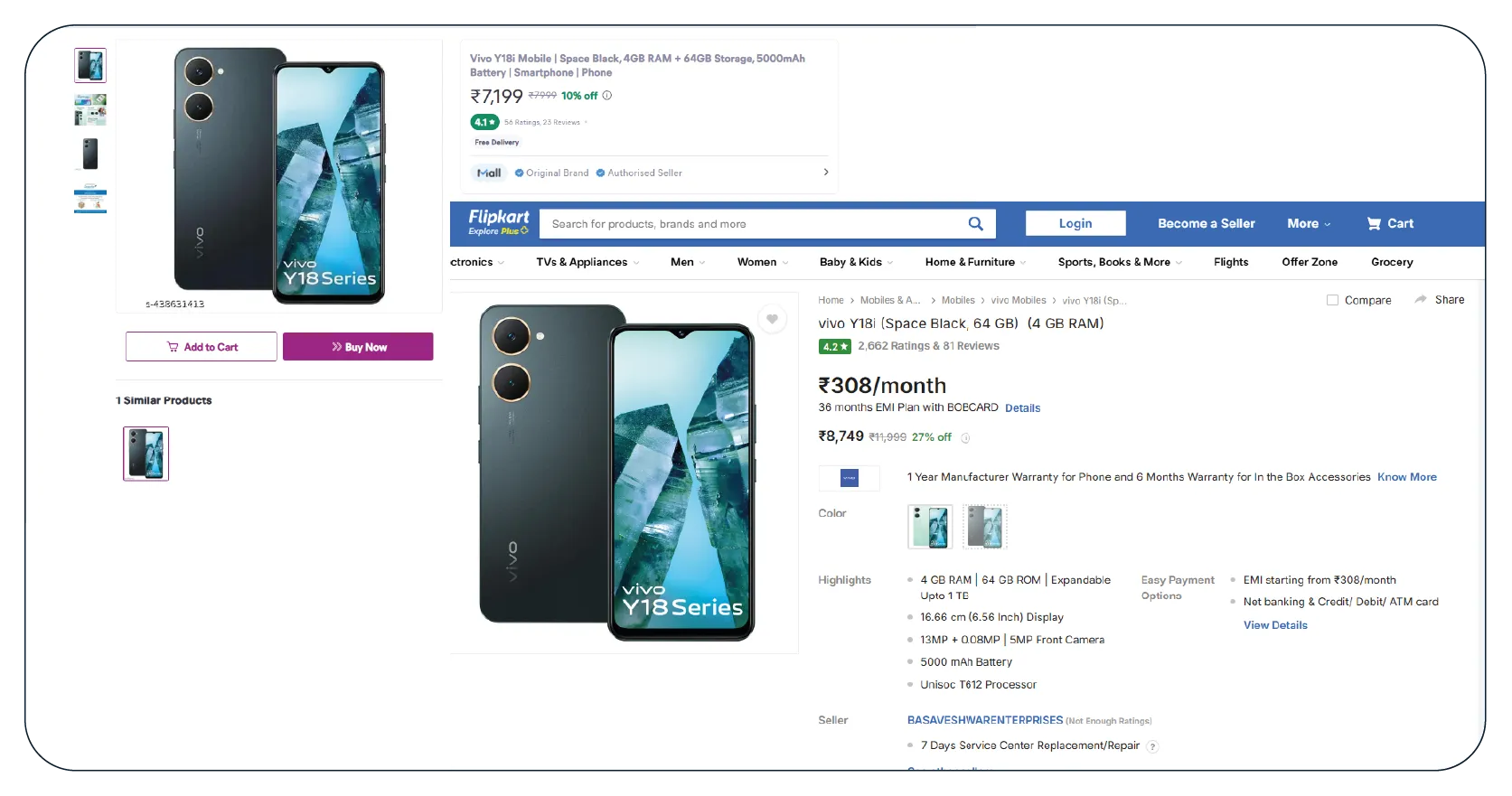

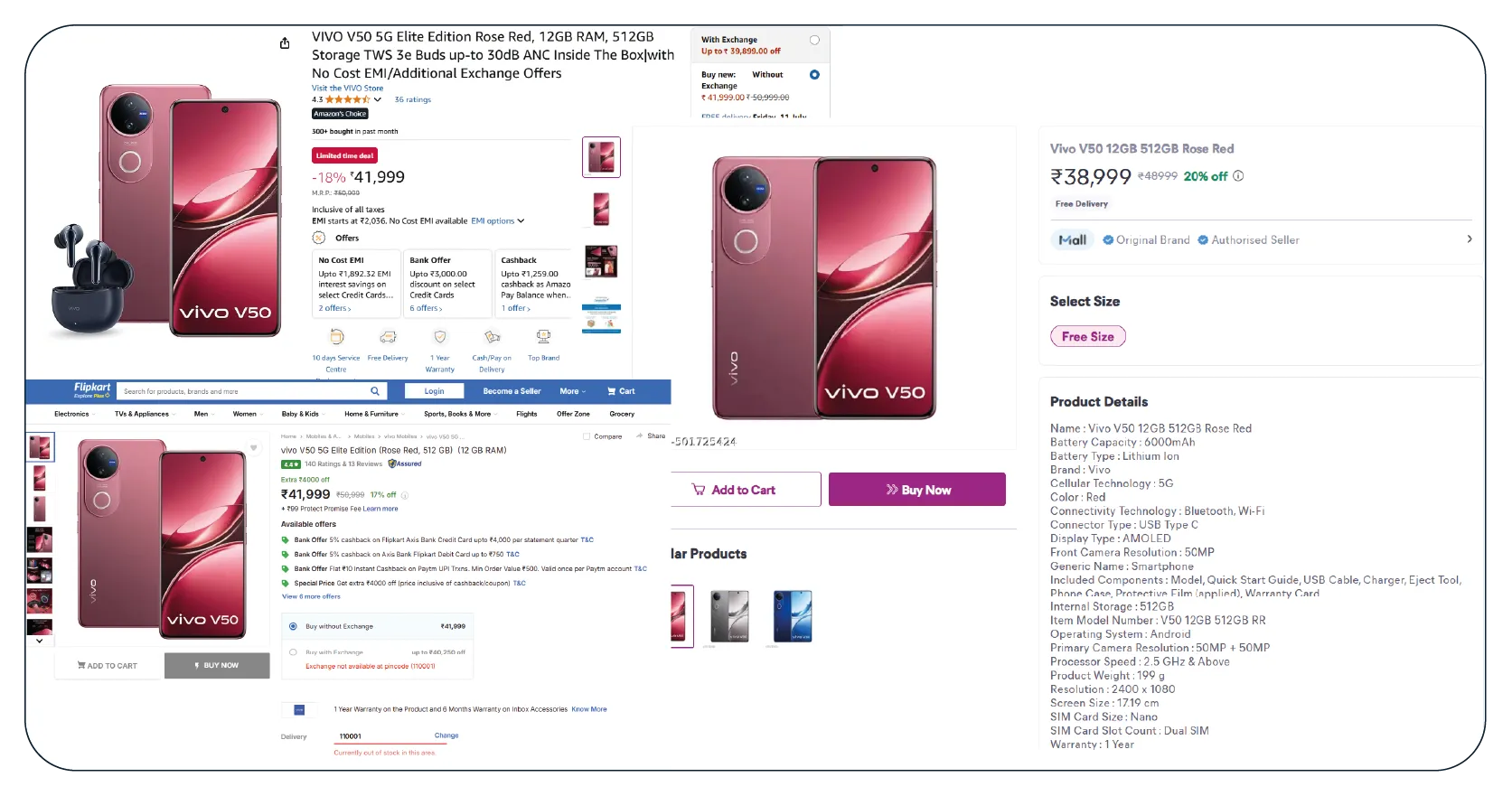

- Amazon.in scraper (buy box, MRP, seller name, Prime eligibility)

- Flipkart scraper (price, offers, seller rating, fulfillment)

- Meesho scraper (price, margins, minimum order qty)

- Scraping frequency: Every 30 minutes

- Target: 500+ SKUs across 3 platforms

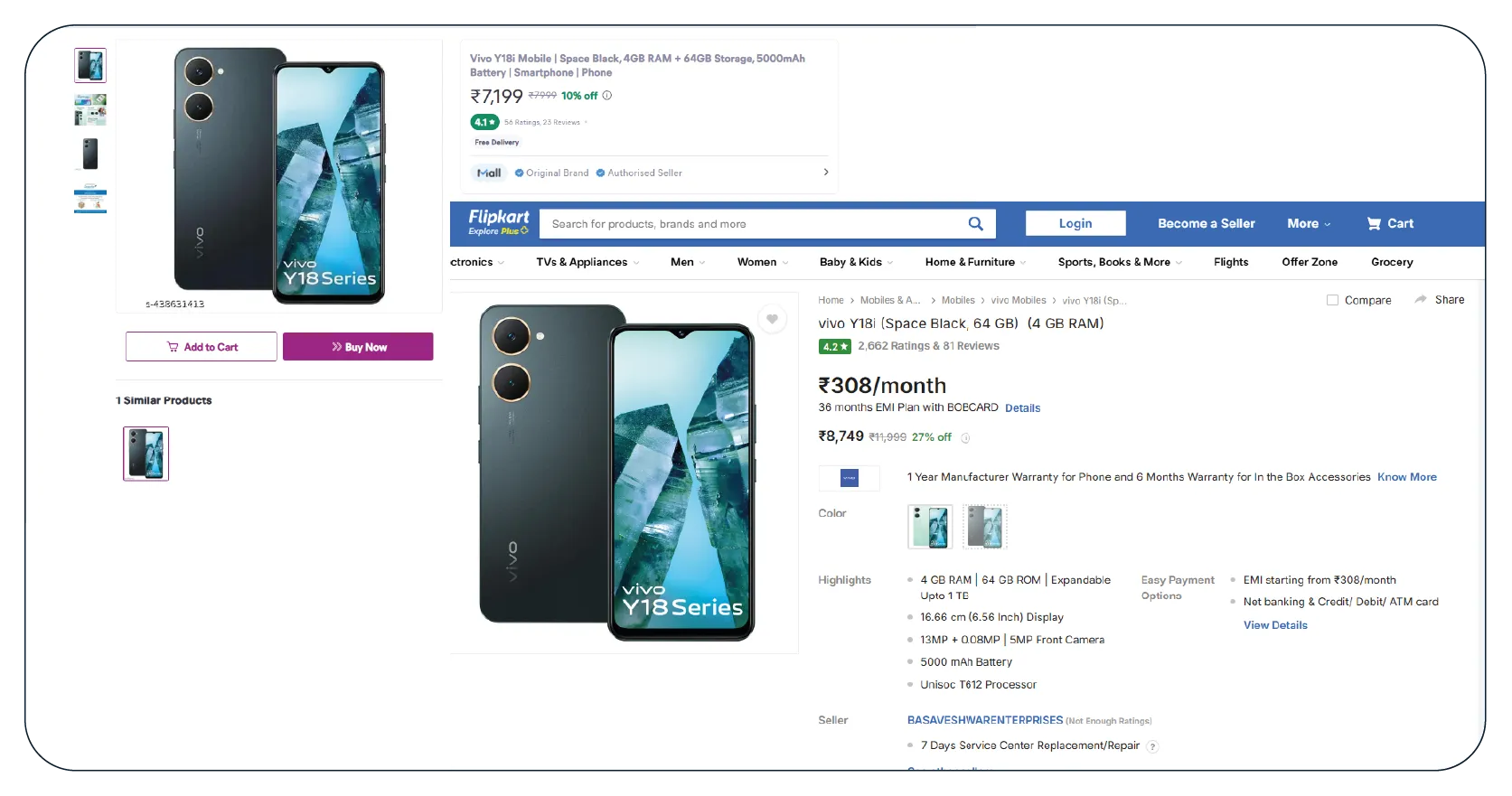

2. Pin Code-Based Tracking

To reflect regional discounts or delivery-specific charges:

- Integrated pin code-specific scraping logic

- Example: Bengaluru vs Delhi pricing variations on Amazon for the same

mobile cover

3. Normalization Layer

- Unified product titles across platforms using fuzzy logic

- Mapped variants (color, size, seller) under a master product

4. Dashboard & API Access

- Client received data in 3 ways:

- Real-time alerts via Slack/email for sudden price drops

- API feed for integration with their price automation system

- Google Looker Studio dashboard for visualization

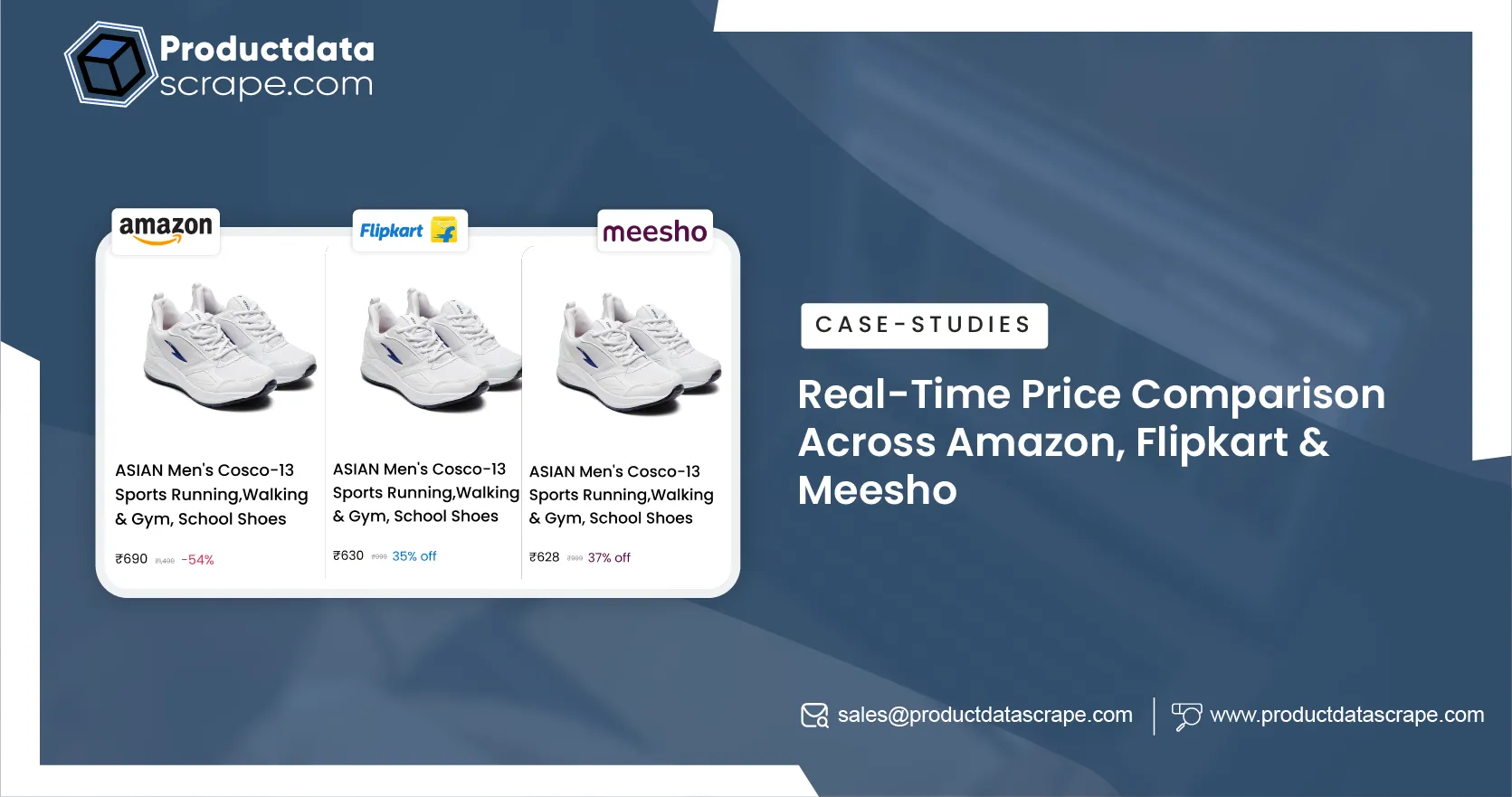

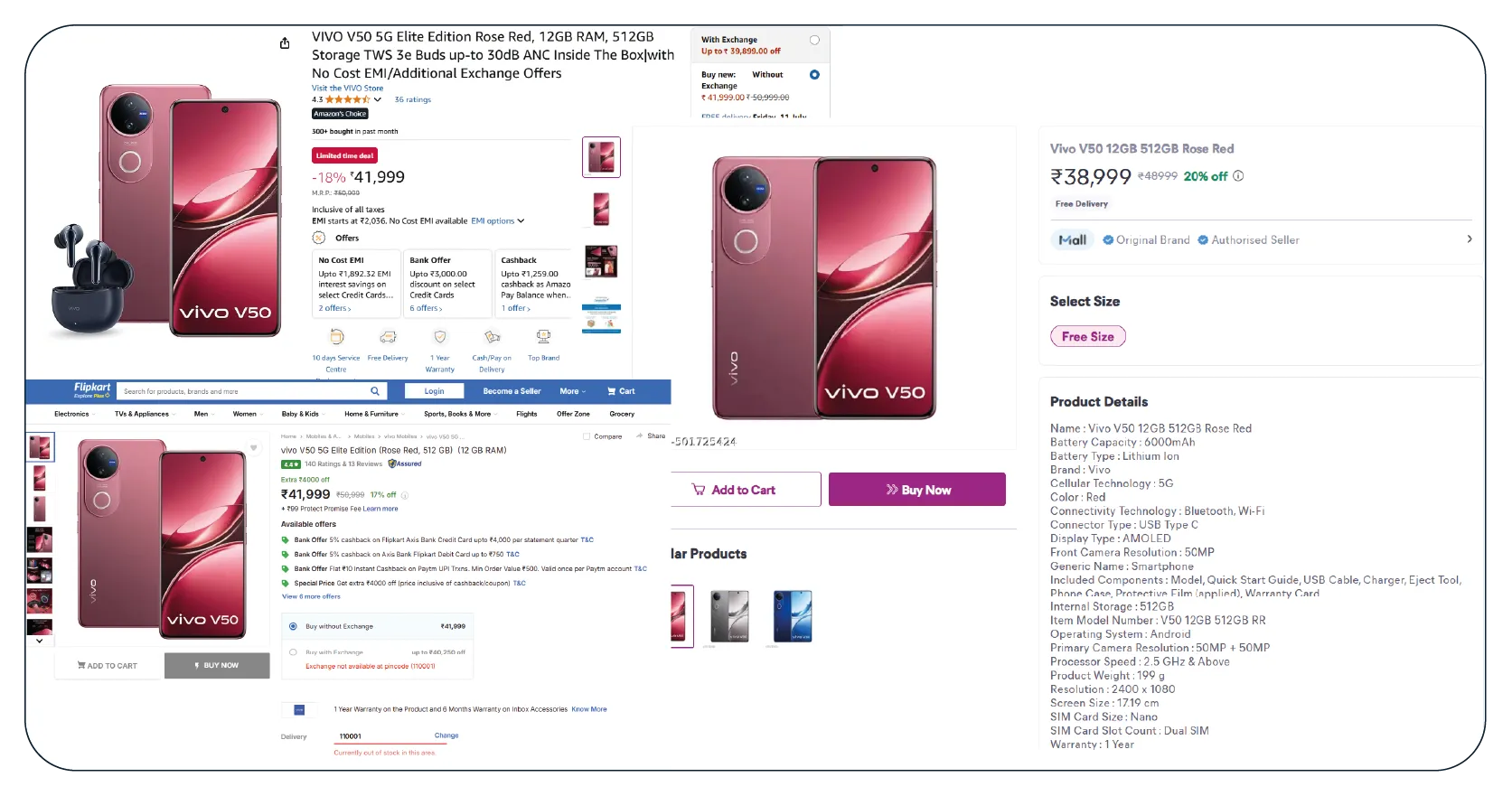

Sample Data Snapshot

| Platform |

Product Name |

Price (₹) |

MRP (₹) |

Seller |

Delivery |

Discount (%) |

| Amazon.in |

Wireless Mouse X200 |

₹499 |

₹899 |

RetailHub |

Free |

44% |

| Flipkart |

Wireless Mouse X200 |

₹469 |

₹899 |

TechZone |

₹40 |

48% |

| Meesho |

Wireless Mouse X200 |

₹389 |

₹899 |

RK Distributors |

₹60 |

57% |

Note: Price difference of ₹110 across platforms on the same day (2025-07-08).

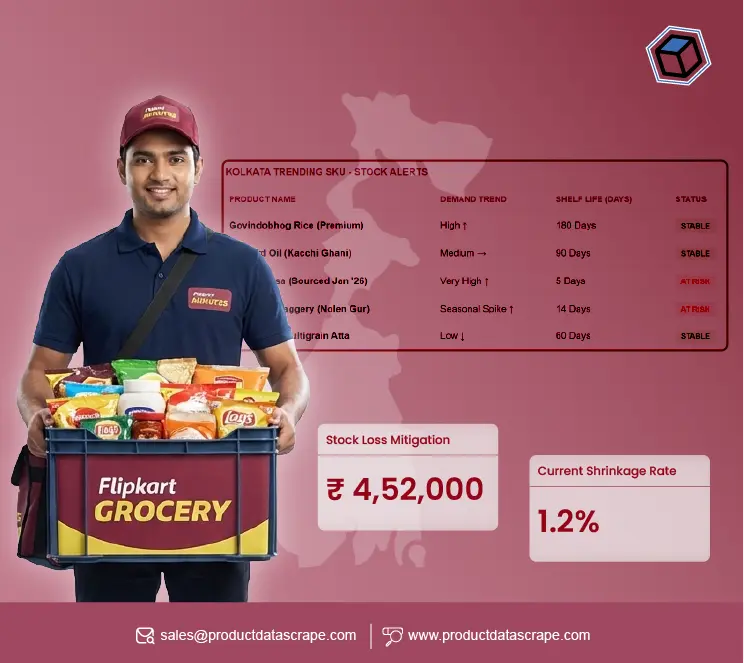

Use Cases Enabled

Competitor Price Monitoring

Through Web Scraping Meesho E-Commerce Product Data , along with Amazon and Flipkart, the client could track:

- When rival sellers dropped prices below MAP (Minimum Advertised Price)

- If a seller was undercutting on Meesho but not on Amazon

- Who won the Buy Box on Amazon and what price triggered that

Inventory Strategy

When price dropped below a set margin on one platform:

- They stopped pushing inventory ads there

- Prioritized stock for the platform with higher profitability

Automated Promotions Matching

When Flipkart ran a "10% off" electronics sale, the scraper triggered a

response workflow:

- Adjust price on Amazon using their repricing engine

- Send promotional notifications via SMS/email to loyal customers

Results Achieved

Quantifiable Gains (3-Month Period)

| Metric |

Before Product Data Scrape |

After Integration |

| Price Visibility Latency |

48 hours |

Real-time (30-min lag) |

| Missed Flash Sales (Monthly Avg.) |

12 |

2 |

| Revenue from Amazon & Flipkart |

₹28.2 lakhs |

₹33.0 lakhs |

| Meesho Conversion Rate |

2.3% |

3.9% |

| Return Rate (all platforms) |

9.1% |

6.5% |

Strategic Wins

+

- Became Buy Box winner on Amazon for 30+ products by adjusting prices

faster than competitors.

- Detected Meesho-based dumping strategies by unauthorized sellers.

- Improved ROI on paid ads by aligning pricing in real-time with platform

offers.

Why Amazon, Flipkart & Meesho?

- Amazon India: Dominant in Tier-1 cities with fast

delivery and heavy price-based competition.

- Flipkart: Popular for flash sales and regional

promotions.

- Meesho: Gaining traction in Tier-2 and Tier-3 cities;

unique seller base often disrupts pricing consistency.

Monitoring all three ensures complete India eCommerce pricing intelligence.

Client’s Testimonial

“Before Product Data Scrape, we were always reacting late to price drops. Now, we make the

first move. We’ve aligned our pricing strategy with live competition, and that’s translated

directly into sales.”

— Head of E-Commerce Strategy, Client Brand (Confidential)

Conclusion

For modern brands competing in India’s multi-platform eCommerce ecosystem,

staying ahead of pricing shifts is no longer optional—it’s survival. Product Data Scrape’s

real-time scraping and price monitoring solution helped the client align listings, cut losses,

and boost conversions by empowering dynamic pricing at scale.

Whether you're managing thousands of SKUs across Amazon, Flipkart, and

Meesho—or just starting your D2C journey—web scraping for price intelligence

can be your

strongest strategic weapon.

.webp)

.webp)

.webp)