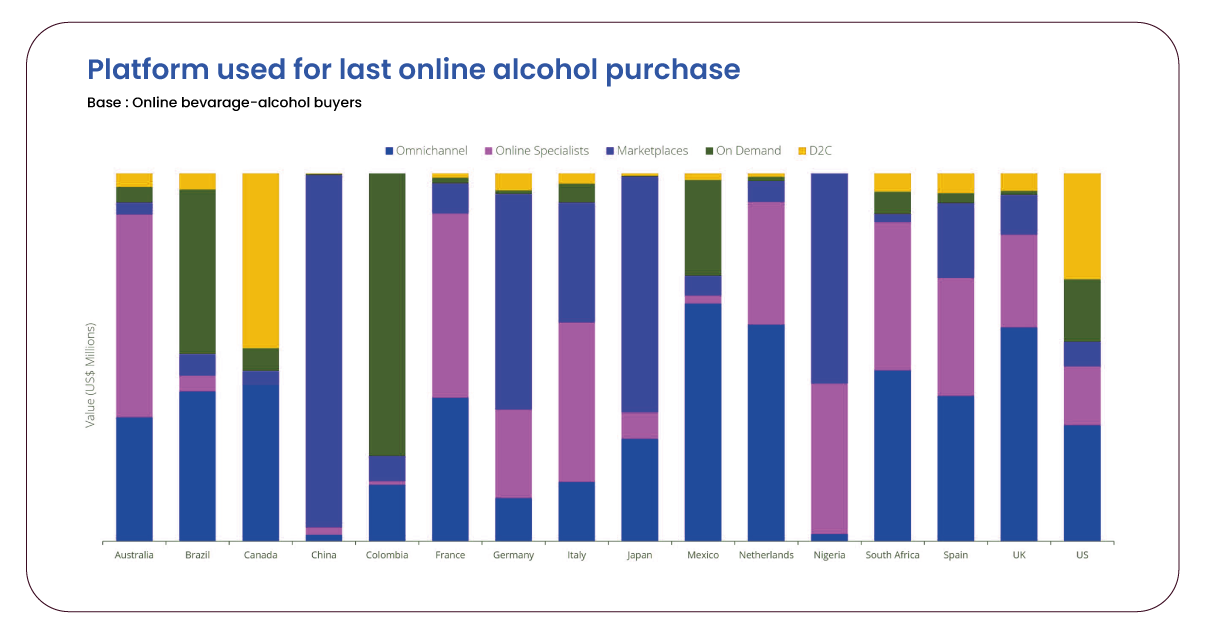

The Alcohol eCommerce sector has experienced rapid expansion, a trend

accentuated by the pandemic. Post-pandemic, factors like convenience, safety, and home delivery

gained prominence, propelling alcohol sales through eCommerce. In the UK, Kantar noted a £261

million surge in rising sales, with online and convenience stores emerging as the key

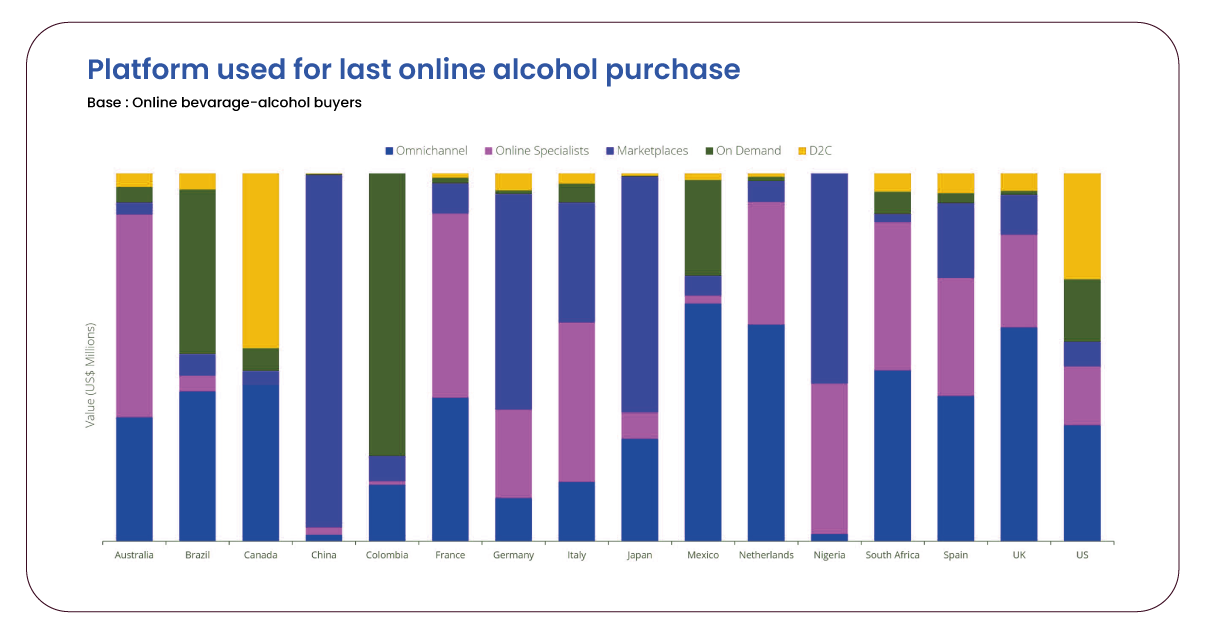

beneficiaries. Intriguingly, the IWSR Drinks Market Analysis Report 2022 highlighted a global

preference for websites over apps when purchasing alcohol online, except in China and Brazil.

Notably, in the UK, major online alcohol purchases occur via retailer websites, not apps.

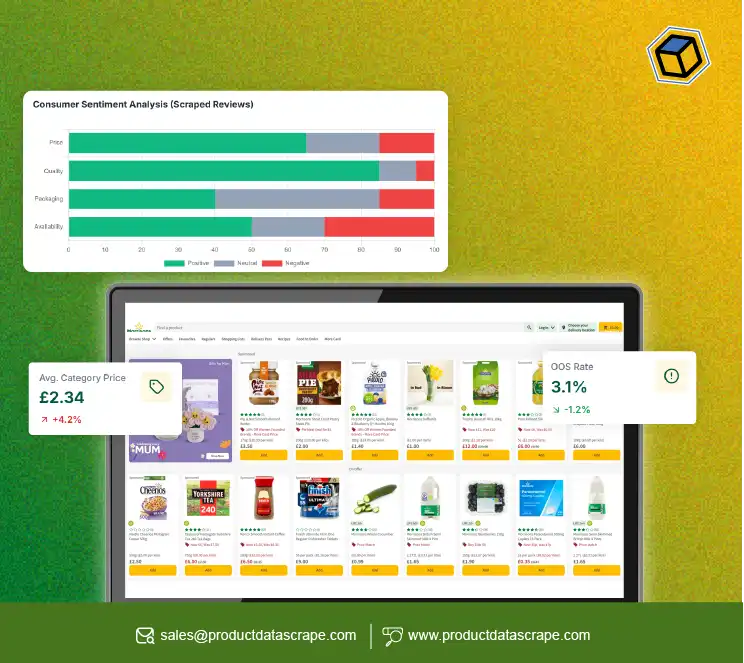

Web Scraping Retail Websites Data helps gain comprehensive insights into alcohol sales, pricing, and trends. So, we closely tracked two grocery retailers and three grocery Q-Commerce apps in the UK.

Research Approach

Our research was conducted through liqour data scraping, spanning February 2022 to June 2022. The focus of our study encompassed two prominent grocery retailers, namely Tesco and Ocado, along with three noteworthy grocery apps, namely Gorillas, Weezy, and Getir. The specific category under scrutiny throughout our analysis was alcohol.

Identifying the Alcohol Price Leader

In the alcohol category, the focus centered on identifying the top-priced

retailer. Pre-pandemic, Tesco notably expanded its alcohol market share among the Big 4

retailers, while Waitrose faced a decline from 5.4% to 4.7% in sales. The significance of

maintaining price leadership cannot surge overstated, as it profoundly influences sales and

market share growth. Naturally, consumers gravitate towards competitively priced products. Our

objective was to employ web scraping liquor data to monitor and determine the Price Leader

within the alcohol category—specifically, the retailer offering the highest number of

lower-priced items. Furthermore, we sought to scrutinize Tesco's post-pandemic position

evolution.

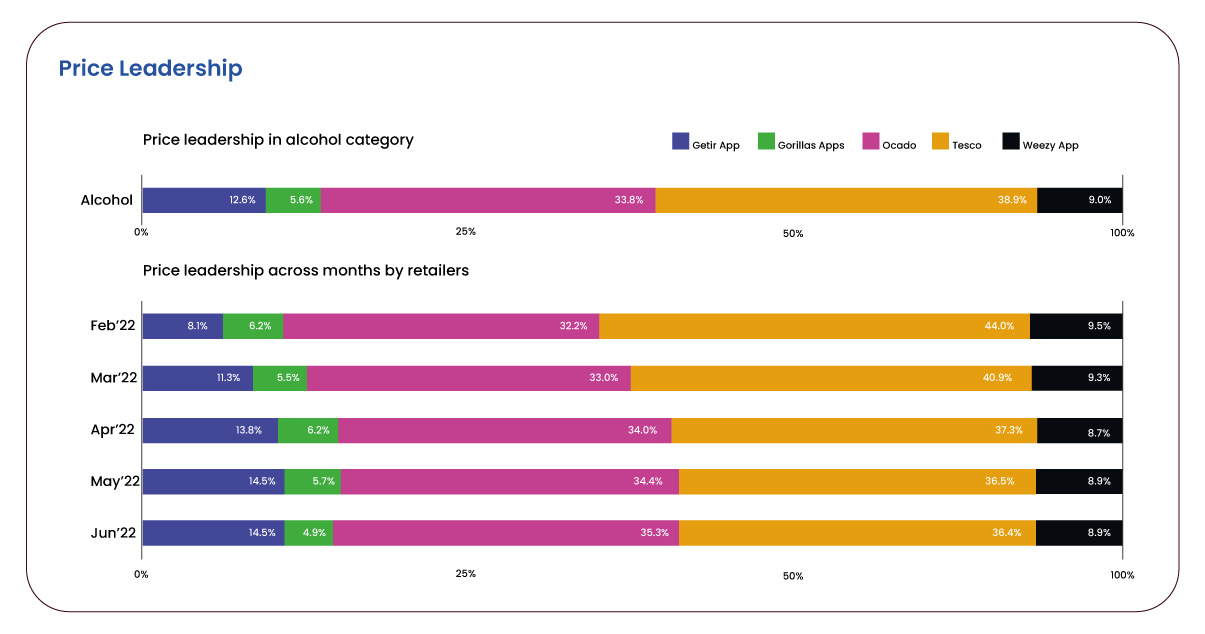

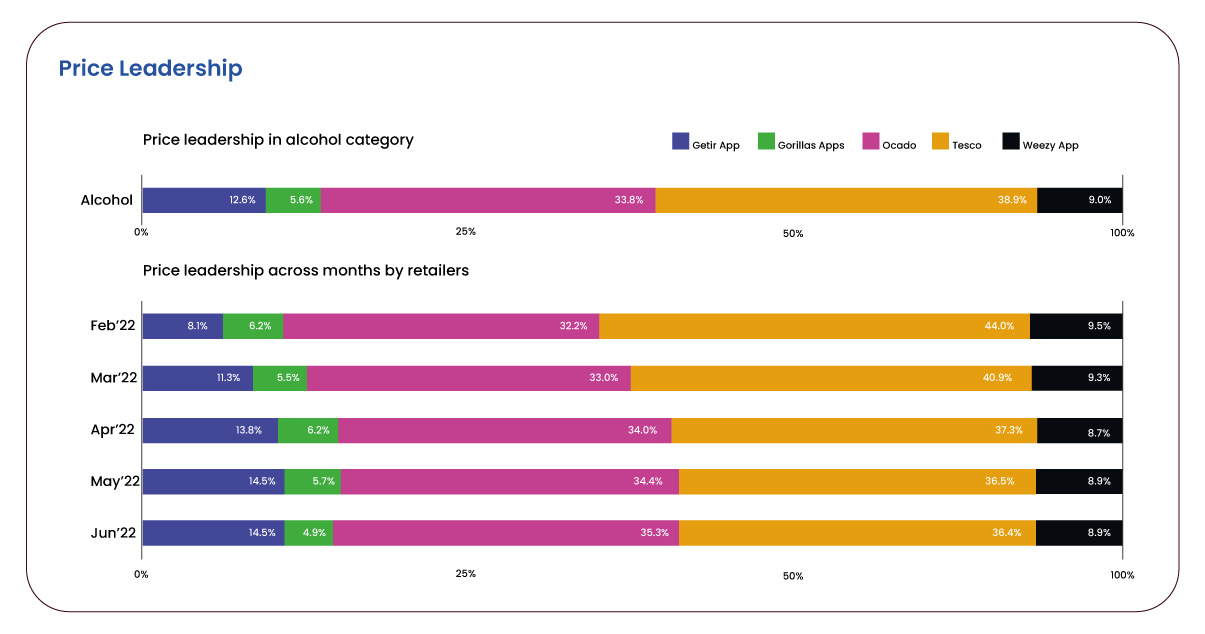

Tesco's Leadership in Alcohol Pricing

Throughout February to June 2022, Tesco consistently established itself as the

front-runner in price leadership within the Alcohol category. Leveraging e-commerce data

scraping, Tesco secured the lowest prices for 38.9% of its products. Ocado followed closely with

33.8%, while Gorillas exhibited the most minor dominance, leading in price for only 5.6% of its

alcohol offerings.

Nonetheless, Tesco's grip on price leadership experienced a gradual erosion

over the months. Commencing in February,e-commerce data scraping revealed Tesco's hold on the

lowest price for 44% of its products, which tapered to just over 36% by June. Conversely, Ocado

depicted an inverse trajectory—starting at a 32% price leadership in February, climbing to 35.3%

by June.

An intriguing contender, illuminated through e-commerce data scraping, was

Getir. Commencing with a modest 8.2% price leadership for its products in February, Getir's

proportion progressively expanded, culminating at 14.5% in June.

Retailers Employing Discounts to Bolster Alcohol Sales

Leveraging discounts using liquor product data collection proves to be an effective strategy to attract consumers impacted by inflation. Through loyalty card discounts, reward vouchers, and various promotional tactics, retailers enhance the allure of their products, rendering them more competitive and appealing to customers. Maintaining competitiveness necessitates retailers' awareness of their rivals' discount offerings. Moreover, price monitoring helps comprehend the potential ramifications of substantial discounting and its influence on profit margins.

In pursuit of insights into alcohol-related discounts in the UK, we delved into our dataset. Here's an overview of our findings.

A wave of European and UK startups, including Jiffy, Dija, Weezy, Zapp, Getir, and Gorillas, entered the scene with a shared commitment: to provide the swiftest and most cost-effective grocery delivery services.

Our dataset uncovered intriguing discounting dynamics among these players. Gorillas maintained a discounting strategy in line with its competitors. Conversely, Getir appeared to adopt a more aggressive approach, veering towards deep discounting. Notably, Getir consistently offered the highest discounts throughout the observed period. In April, their discounts surged to nearly 9% more than those of Ocado—the runner-up in discounting.

As previously discussed, the period from February to June saw Getir securing price leadership. It's plausible that their strategy of deep discounting contributed to this accomplishment. In contrast, Gorillas opted for a different route, showcasing the lowest and almost negligible discounting practices.

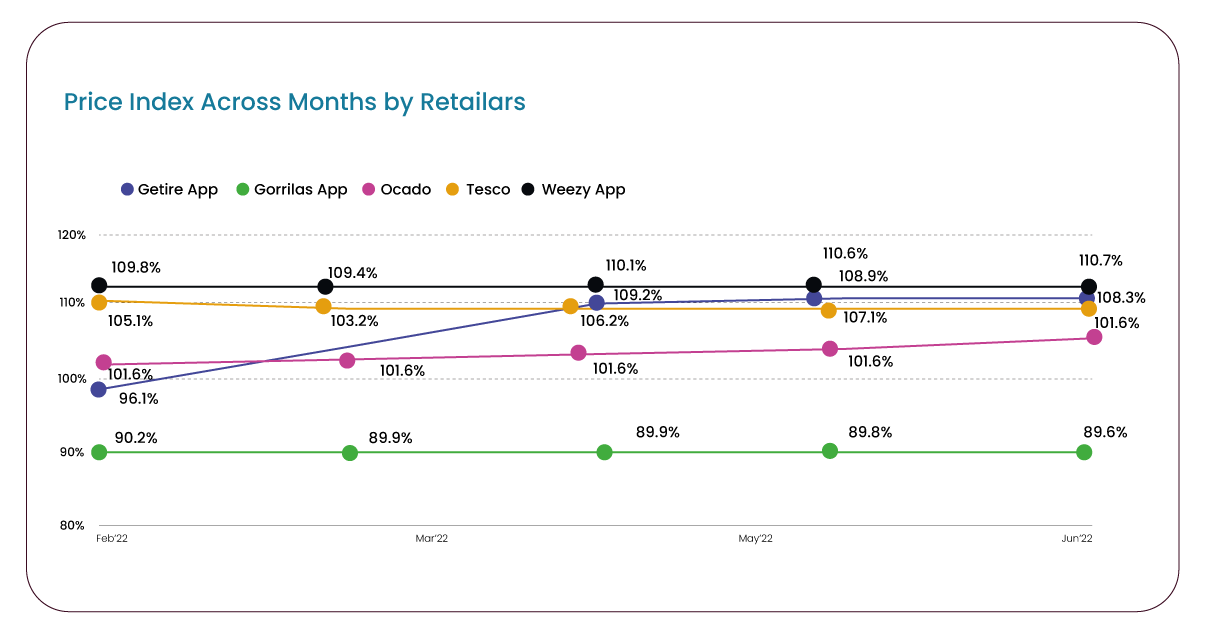

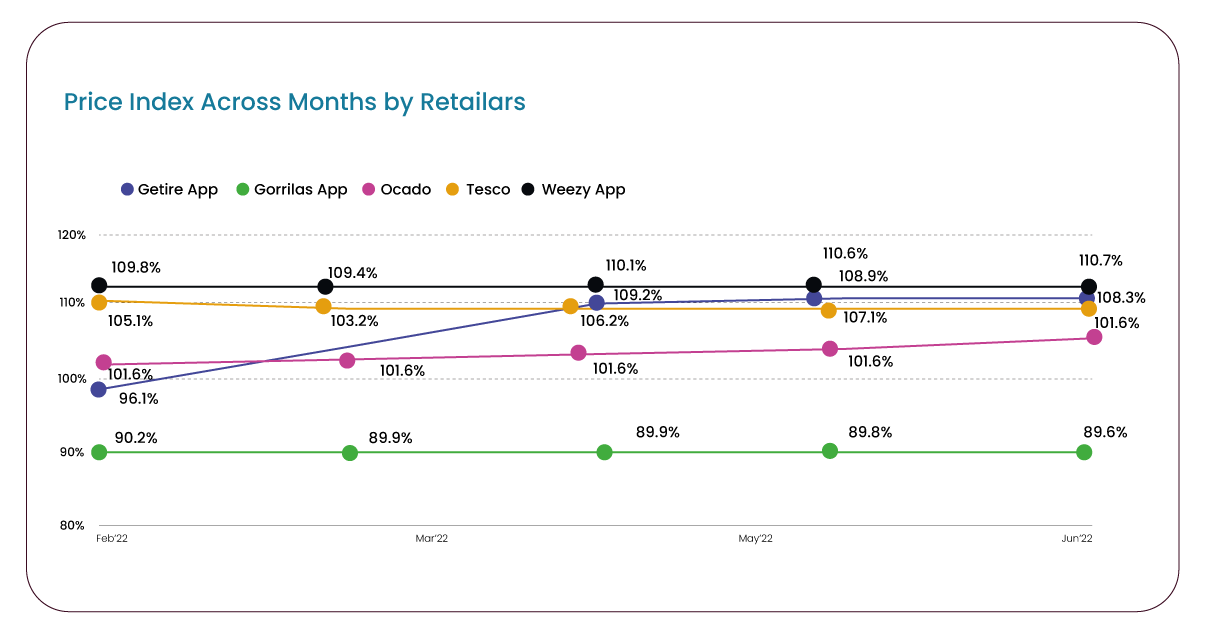

Observing Price Index Trends Over Five Monthss

Our focus shifted towards analyzing Price Index (PI) trends among these five retailers, encompassing February to June 2022. It enabled us to gauge the fluctuations in alcohol prices over this period.

Please note: Retailers operating at the 100% mark indicated they were selling at an optimal price, refraining from undercutting the market. The pricing sweet spot rested between 95% and 105%. Deviating lower would potentially jeopardize profit margins while exceeding this range indicated that the retailer needed to position more competitively.

Price Index Insights: Retailers' Strategic Positioning

Among the retailers, Weezy displayed the most optimal Price Index, residing within the 100% to 102% range.

Conversely, Gorillas held the lowest Price Index, from 89% to 91%.

Getir, initially boasting a lower Price Index of 96.1% in February, progressively climbed to surpass 110% in April, May, and June.

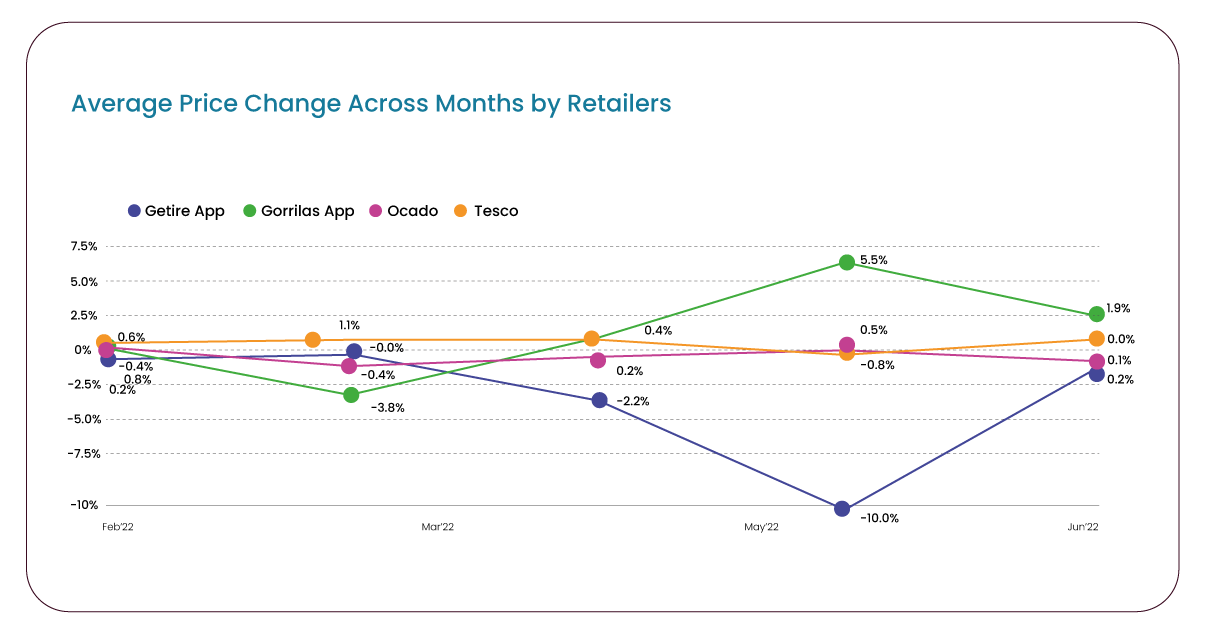

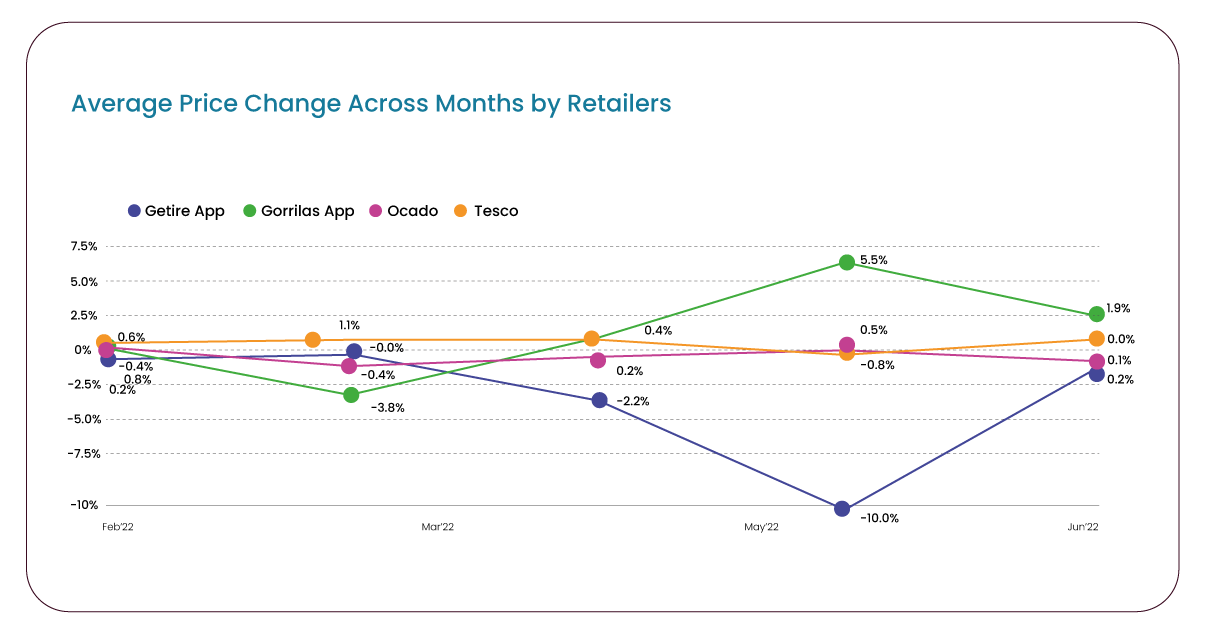

Agility in Price Adjustments: Identifying Leaders

Competitive pricing constitutes a pivotal facet of eCommerce triumph. It entails meticulously monitoring competitors' pricing and judiciously refining one's prices without compromising profit margins. To ascertain the swiftness with which retailers adapted their prices, we diligently tracked the average monthly Price change across all five retailers from February to June. It allowed us to discern which retailer exhibited the most excellent responsiveness in price adjustments and the frequency of such adaptations.

Stability in Pricing Trends Among Retailers

Predominantly, most retailers adhered to a consistent pricing trajectory using liquor product data scraping, maintaining a degree of competitive alignment. Their pricing approaches were relatively well-matched.

Yet, Gorillas stood out for implementing significant price adjustments in specific months. Notably, they enacted a notable reduction of 3.8% in prices in March. Subsequently, in May, Gorillas increased 5.5% in their pricing.

In that same eventful May, Weezy embarked on a distinctive strategy, considerably slashing prices by 10%. This move widened the gap between Gorillas and Weezy.

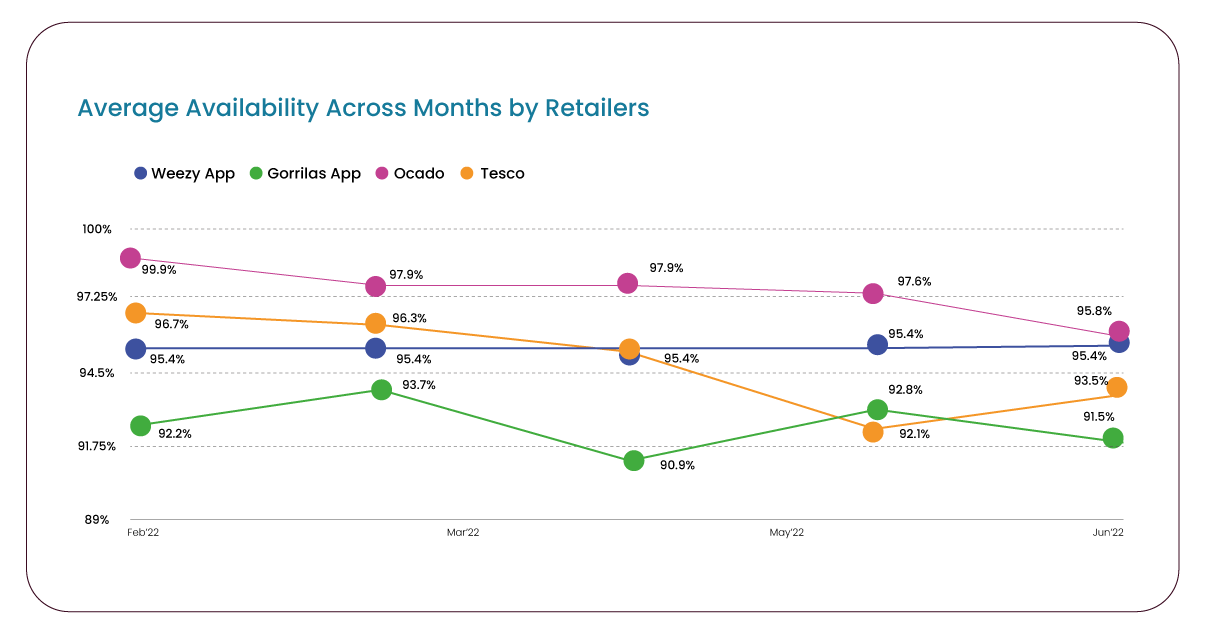

Preserving Sales through Stock Availability Management

Product Data Scrape is committed to upholding the utmost standards of ethical conduct across our Competitor Price Monitoring Services and Mobile App Data Scraping operations. With a global presence across multiple offices, we meet our customers' diverse needs with excellence and integrity.

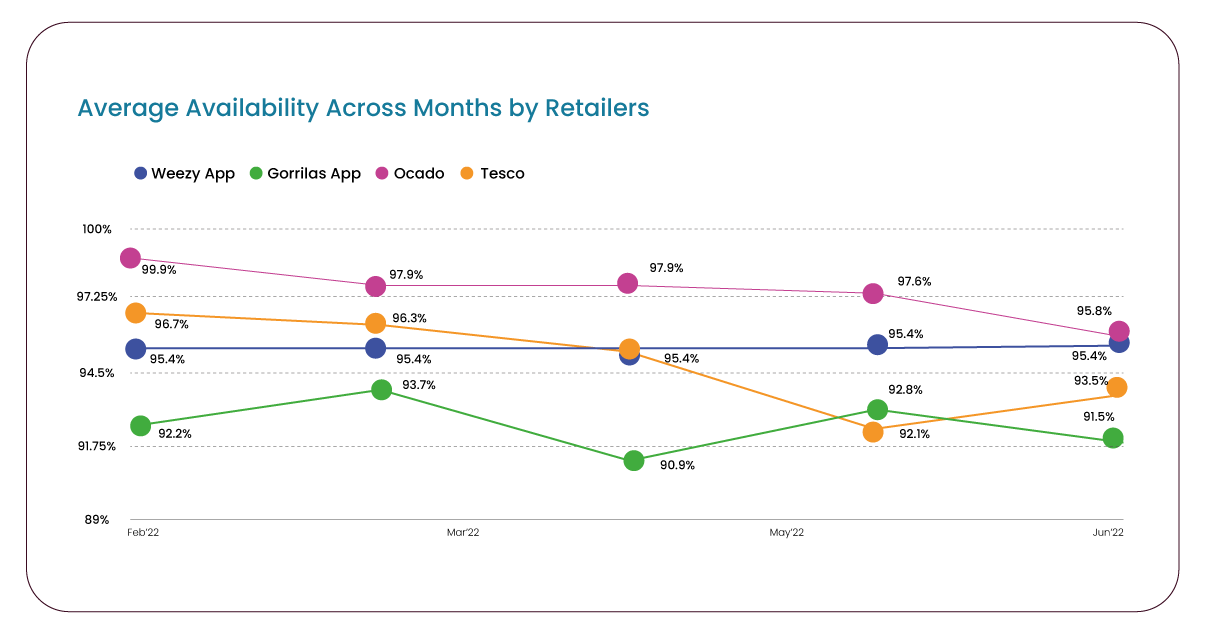

Diverse Stock Availability among Retailers

Our data analysis unveiled distinct levels of stock availability across the retailers. Ocado, in particular, maintained the highest availability throughout the observed five months. At a robust 100%, their stock levels gradually receded, concluding at 95.8% by June.

Tesco, on the other hand, encountered a pronounced decline in availability during May and June. At 97%, availability dwindled to 92-93%.

Gorillas consistently exhibited the lowest stock availability, fluctuating between 90% and 94% across the months.

Weezy demonstrated steadfast consistency, upholding a consistent 95% availability throughout five months.

Concluding Insights

In the UK market, a favorable inclination towards online alcohol purchases is evident, predominantly catalyzed by shifts in consumer behavior prompted by the pandemic. According to the IWSR Drinks Market Analysis Report 2022, markets primarily driven by websites, like the UK, prioritize a wide product range and competitive pricing. Both these factors wield significant influence in purchase decisions. Conversely, consumers in app-centric markets hold distinct preferences. While price remains a consideration, it is less vital than convenience and speed.

Product Data Scrape is committed to upholding the utmost standards of ethical

conduct across our Competitor Price Monitoring

Services and Mobile App Data Scraping operations. With a global presence across multiple

offices, we meet our customers' diverse needs with excellence and integrity.

.webp)