Introduction

The alcohol industry in the United States has seen rapid digital transformation, and businesses

now rely heavily on data-backed decision-making. To stay competitive, brands, wholesalers, and

marketplaces must understand pricing, product availability, customer preferences, and evolving

consumption patterns. Using modern scraping technologies, companies can now extract liquor

product details USA from leading online retailers, distributors, and delivery platforms. This

helps them create real-time insights into pricing trends, ranking performance, assortment

variations, regional availability, and competitor launches. As more consumers shift to online

alcohol purchases, businesses increasingly depend on structured datasets to run pricing

intelligence, optimize their catalog, and forecast market demand. This blog explores how

organizations collect and use alcohol-related data, complete with U.S. industry statistics from

2020–2025, and how Product Data Scrape empowers brands with accurate, compliant, and

high-quality datasets.

Alcohol Pricing & Market Behavior

Businesses looking to gain a competitive edge in the liquor market turn to advanced methods of

collecting pricing behavior across states, cities, and retail platforms. Leveraging Alcohol

pricing intelligence USA, companies can monitor price fluctuations, identify discount

strategies, and understand how retailers position each product category—from craft spirits to

premium wines. Automated systems that extract liquor product details USA also capture SKU-level

variations such as bottle sizes, brand hierarchies, alcohol percentage, and promotional changes.

| Year |

Avg. Retail Price Variation (%) |

Online Alcohol Retailers (Number) |

Promo Frequency (%) |

| 2020 |

3.5% |

820 |

11% |

| 2021 |

4.1% |

910 |

13% |

| 2022 |

5.2% |

1040 |

16% |

| 2023 |

6.7% |

1185 |

20% |

| 2024 |

7.1% |

1340 |

24% |

| 2025 |

8.4% |

1510 |

28% |

This data shows a consistent rise in dynamic pricing, making automated scraping essential.

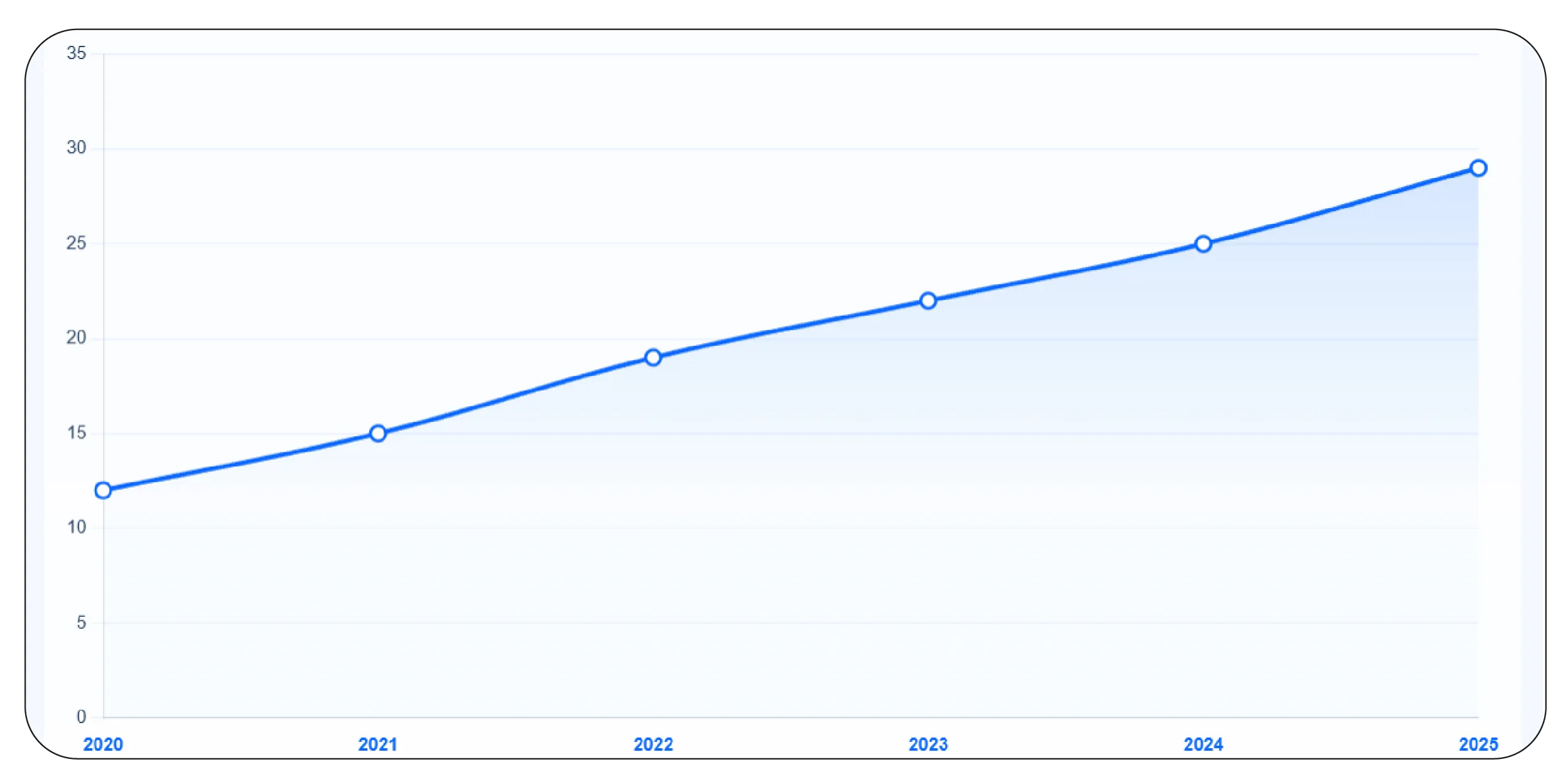

Changing Consumption Patterns

Understanding consumer behavior is crucial for forecasting seasonal demand and adjusting

inventory levels. Using Data scraping for alcohol consumption statistics, businesses now

consolidate consumption behavior from online searches, marketplace listings, user trends, and

ordering patterns. This enables predictive modeling—essential for wholesalers and delivery

platforms.

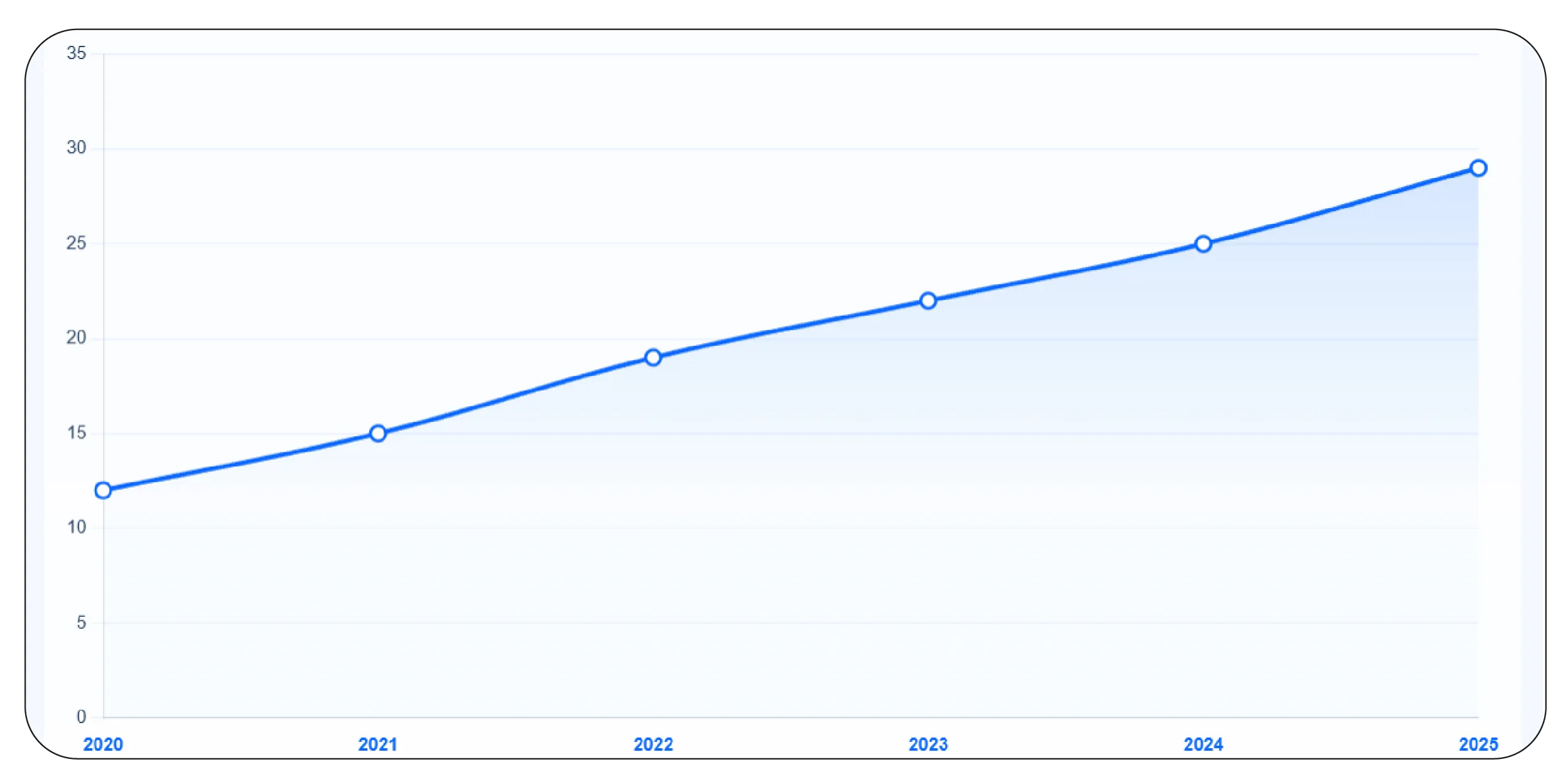

Stats from 2020–2025 illustrate how U.S. alcohol consumption shifted toward online channels:

| Year |

Online Purchasing Share (%) |

Avg. Monthly Searches (Millions) |

Top Growth Category |

| 2020 |

12% |

4.1 |

Hard Seltzers |

| 2021 |

15% |

4.9 |

Craft Beer |

| 2022 |

19% |

5.4 |

Premium Tequila |

| 2023 |

22% |

6.1 |

Wine |

| 2024 |

25% |

7.3 |

Whisky |

| 2025 |

29% |

8.1 |

RTD Cocktails |

These trends confirm that alcohol consumption aligns closely with online availability and

visibility, increasing demand for structured datasets.

Enterprise-Grade Solutions

Manufacturers and distributors require highly tailored datasets that capture pricing,

availability, and product attributes from multiple online stores. This is why many enterprises

use Custom alcohol scraper solutions USA, which allow full customization across parameters such

as brand hierarchy, bottle variants, category mapping, and regional filters.

2020–2025 adoption metrics:

| Year |

Businesses Using Custom Scrapers |

Data Volume Per Month (GB) |

Accuracy Rate (%) |

| 2020 |

560 |

140 |

93% |

| 2021 |

690 |

190 |

94% |

| 2022 |

830 |

250 |

96% |

| 2023 |

980 |

310 |

97% |

| 2024 |

1120 |

420 |

97.5% |

| 2025 |

1300 |

540 |

98% |

As alcohol regulations and retailer catalogs vary across states, tailored scraping solutions

reduce compliance risks and ensure high-quality data.

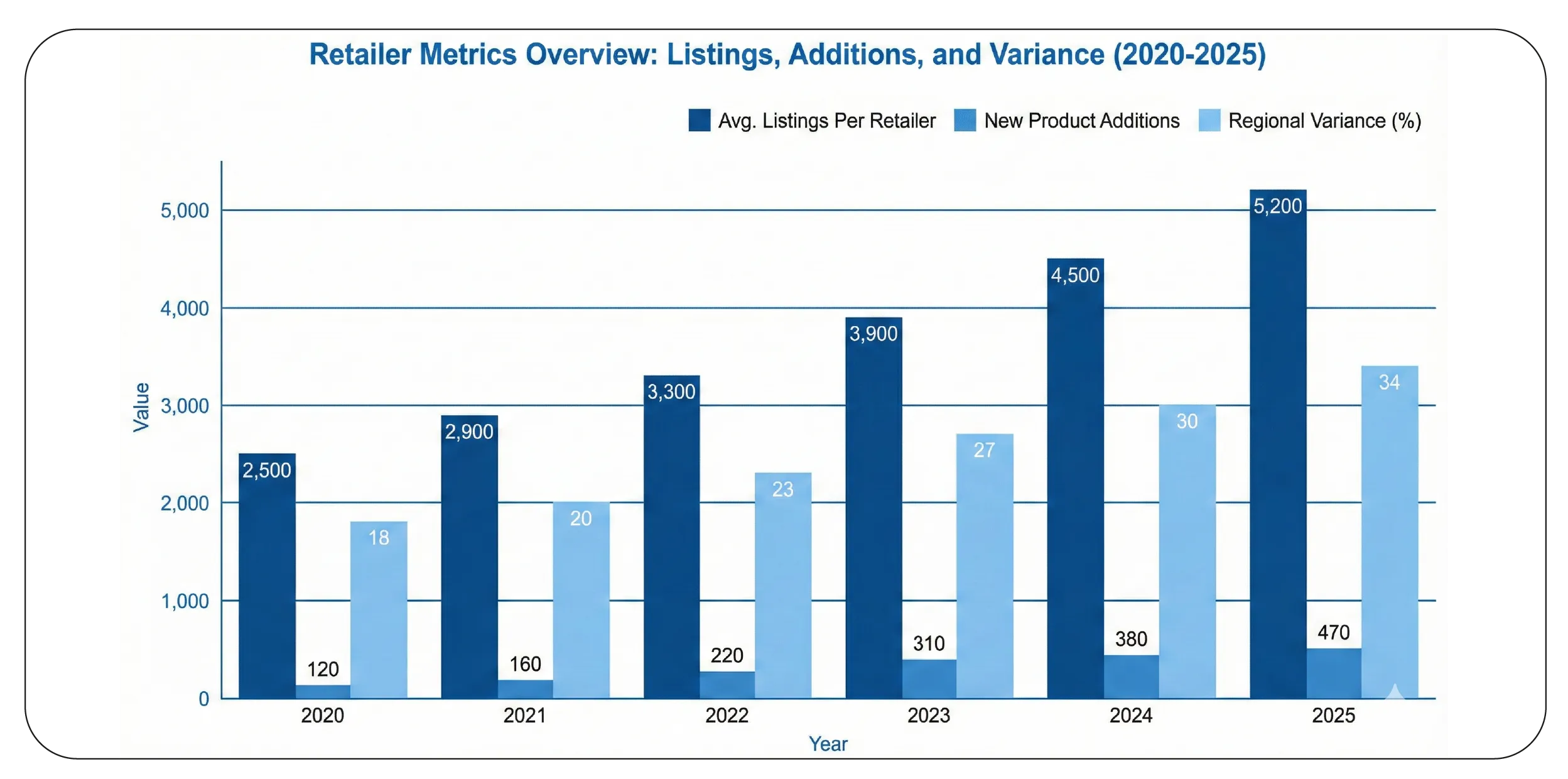

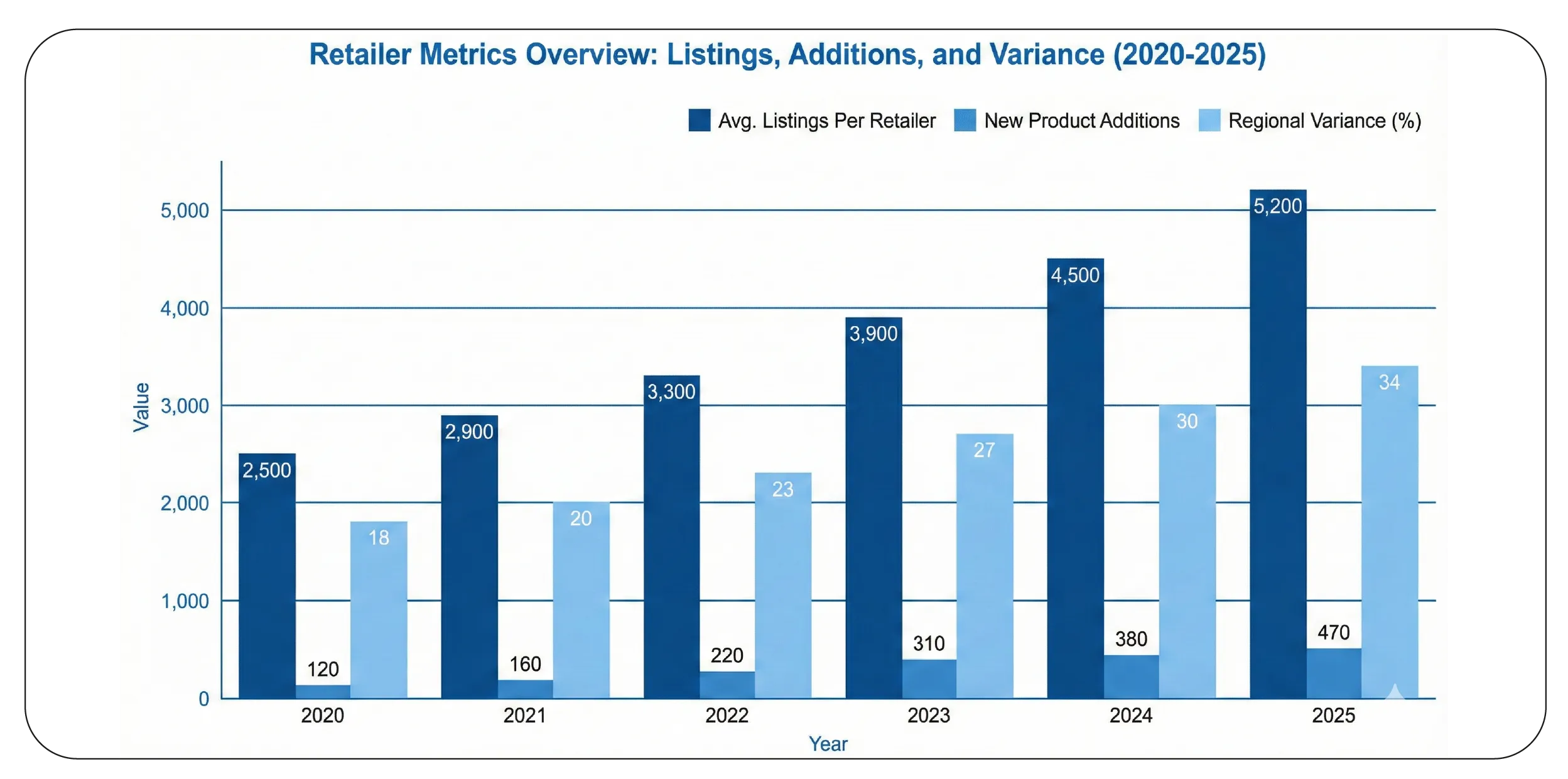

Collecting Data From Retail Websites

Retailers and marketplaces list thousands of alcohol products across multiple categories.

Businesses need a reliable method to scrape database from website platforms such as Drizly,

Total Wine, Instacart, BevMo, and others. Scraping at scale allows companies to compile product

identifiers, pricing variations, stock changes, delivery fees, and regional listings.

2020–2025 data on alcohol listing expansions:

| Year |

Avg. Listings Per Retailer |

New Product Additions |

Regional Variance (%) |

| 2020 |

2,500 |

120 |

18% |

| 2021 |

2,900 |

160 |

20% |

| 2022 |

3,300 |

220 |

23% |

| 2023 |

3,900 |

310 |

27% |

| 2024 |

4,500 |

380 |

30% |

| 2025 |

5,200 |

470 |

34% |

Rapid SKU expansion shows why automated scraping is essential to maintain updated datasets.

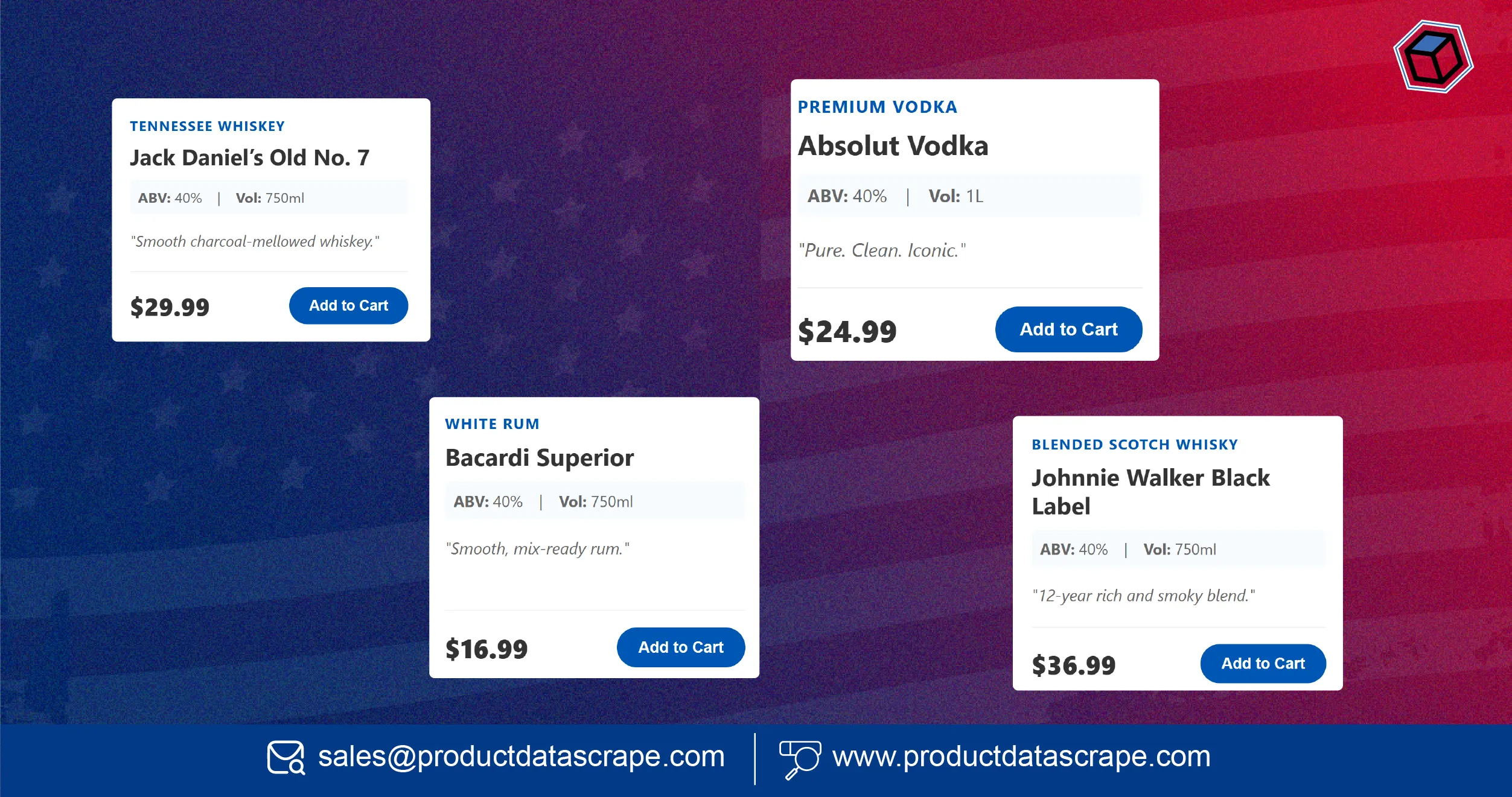

Structured Category Datasets

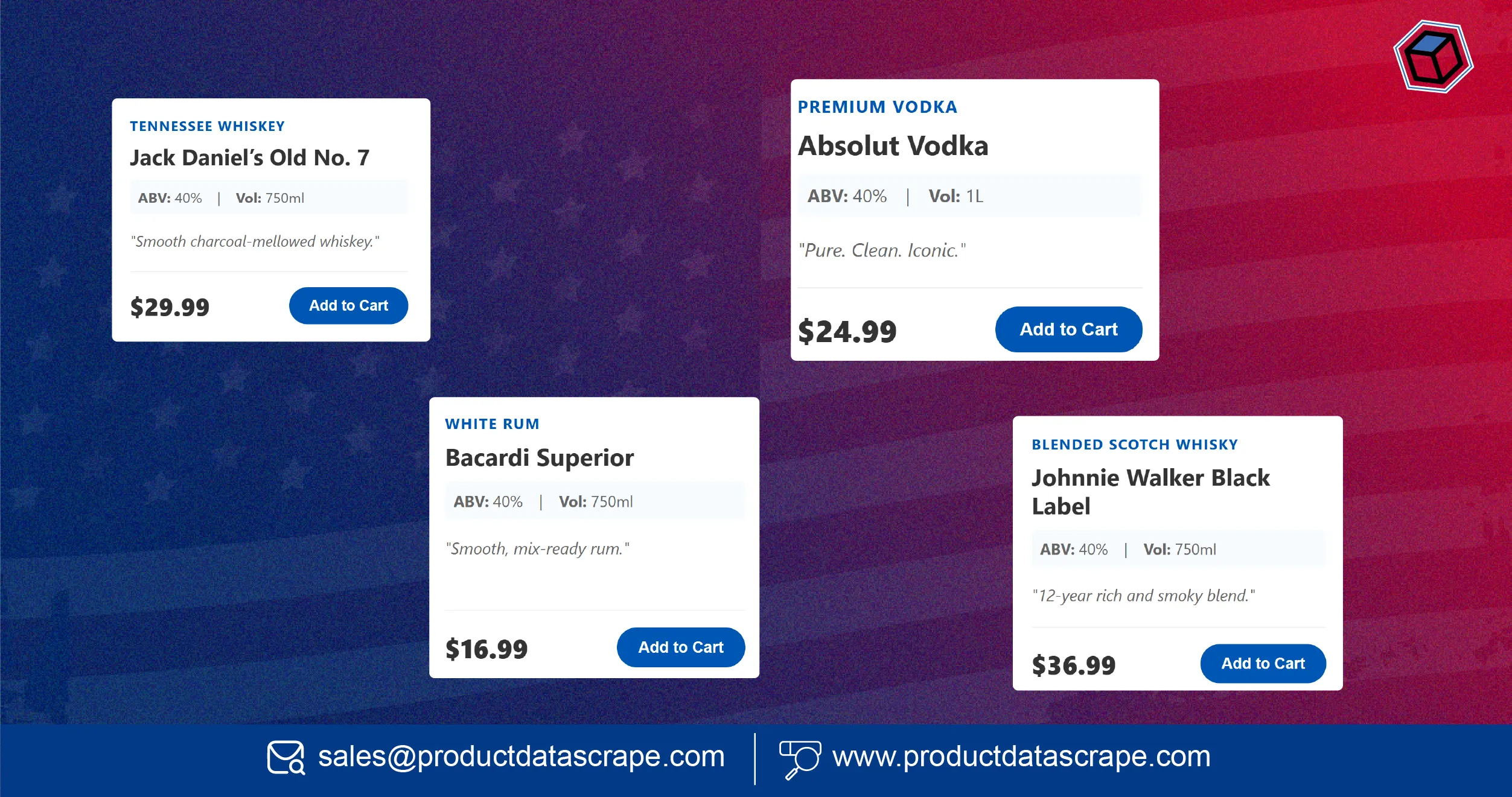

Modern retailers rely heavily on an Alcohol and Liquor Dataset enriched with attributes like

brand lineage, ABV %, product ratings, bottle size variations, and compliance markers.

Categorized datasets help in running analytics that support pricing optimization and market

positioning.

2020–2025 trend analysis:

| Year |

Avg. Data Points Per SKU |

Data Requests (Monthly) |

Classification Accuracy |

| 2020 |

19 |

32,000 |

89% |

| 2021 |

22 |

41,000 |

91% |

| 2022 |

26 |

52,000 |

94% |

| 2023 |

30 |

64,000 |

95% |

| 2024 |

34 |

78,000 |

96% |

| 2025 |

39 |

92,000 |

97% |

Businesses now use machine learning to enrich product identifiers, which boosts precision across

all alcohol categories.

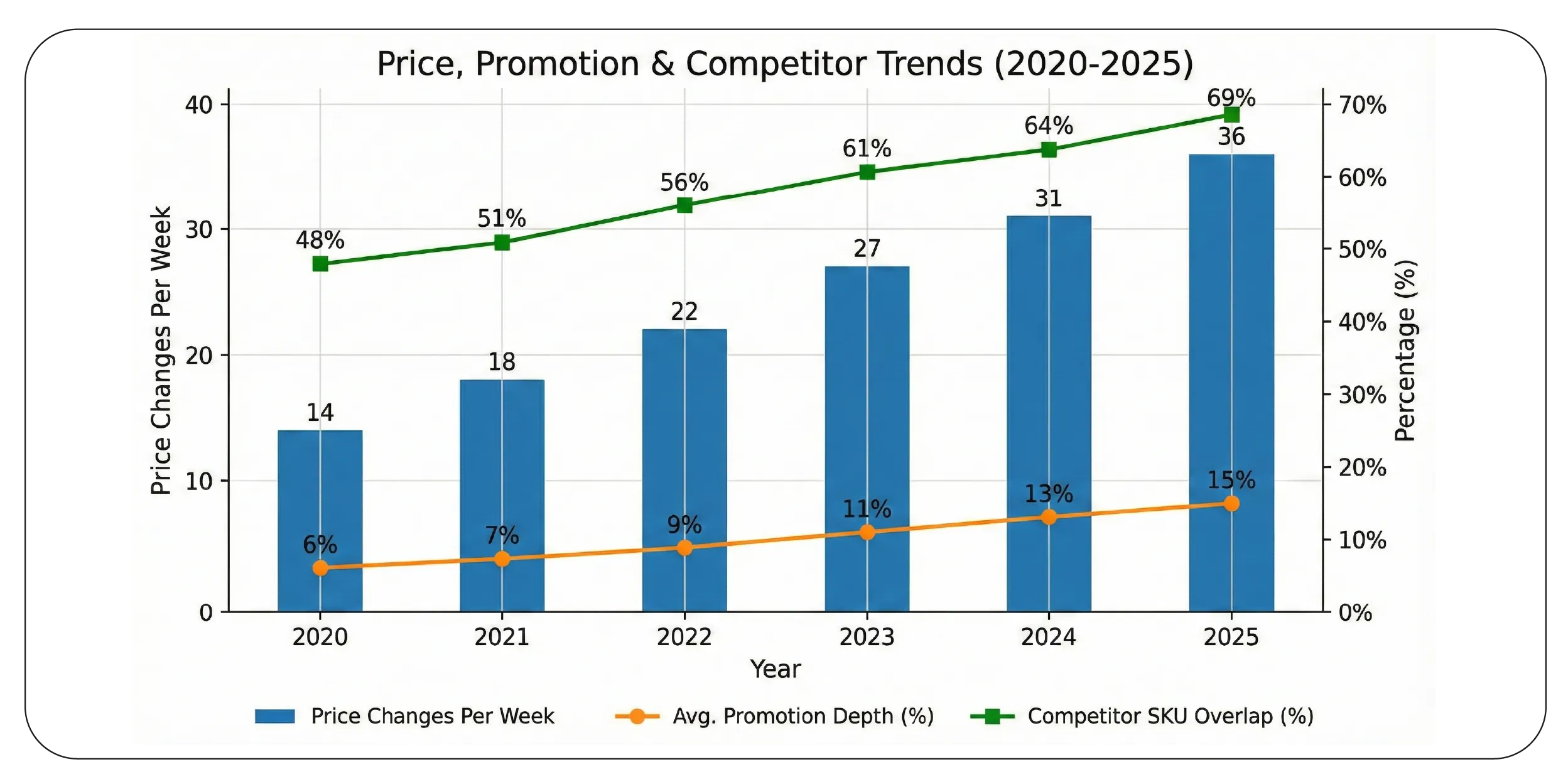

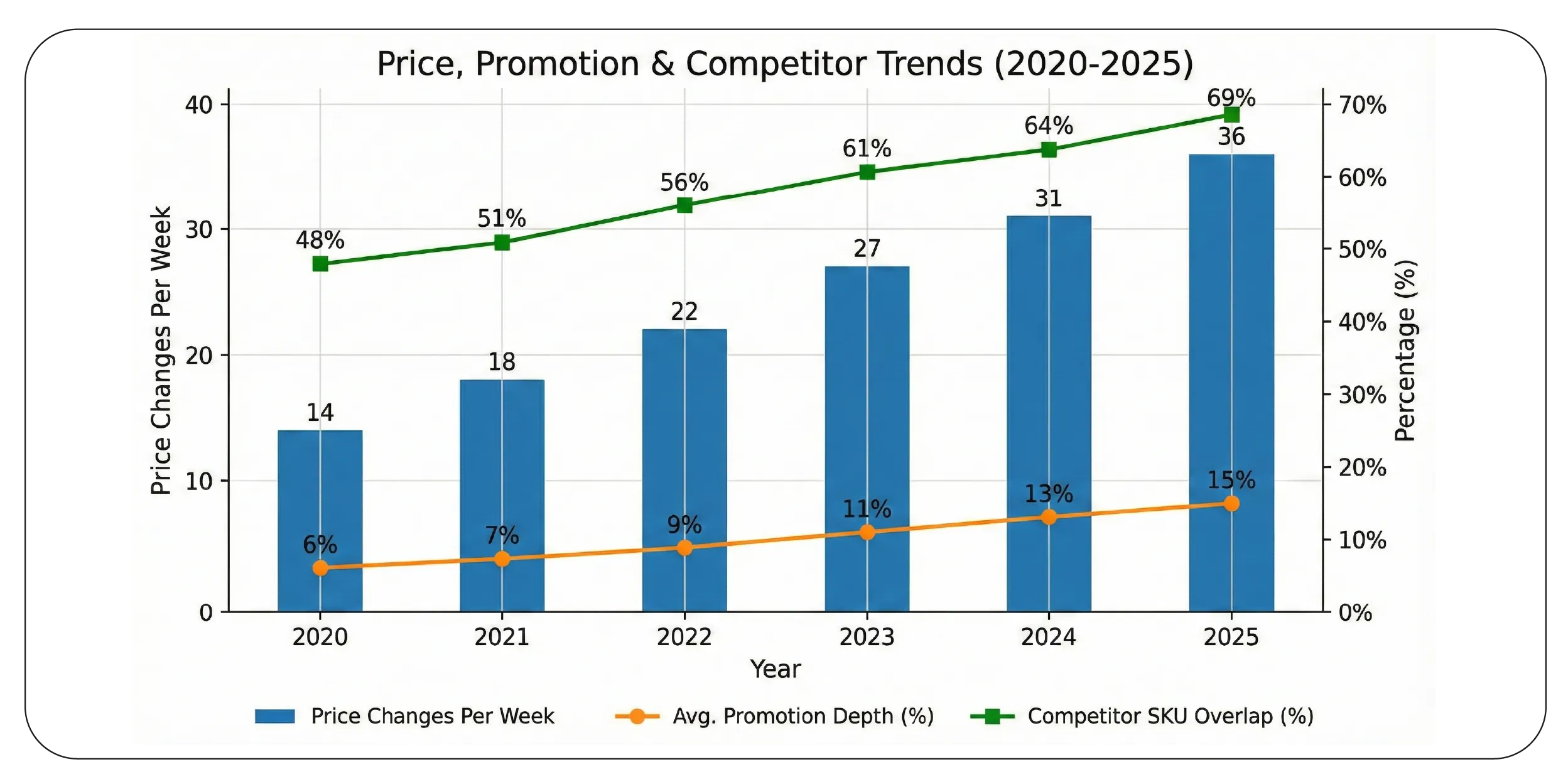

Price Intelligence & Competitive Strategy

Staying competitive requires detailed pricing visibility across all major retail and delivery

platforms. With tools that Extract Alcohol & Liquor Price Data , businesses can track promotional

changes, identify emerging brands, monitor MAP violations, and benchmark pricing strategies.

2020–2025 competitive pricing insights:

| Year |

Price Changes Per Week |

Average Promotion Depth (%) |

Competitor SKU Overlap (%) |

| 2020 |

14 |

6% |

48% |

| 2021 |

18 |

7% |

51% |

| 2022 |

22 |

9% |

56% |

| 2023 |

27 |

11% |

61% |

| 2024 |

31 |

13% |

64% |

| 2025 |

36 |

15% |

69% |

The increasing volatility in pricing makes ongoing monitoring essential for sustainable margins.

Why Choose Product Data Scrape?

Product Data Scrape offers unmatched expertise in alcohol industry data extraction. With robust

crawling systems, rapid deployment capabilities, and compliance-aligned solutions, businesses

gain precise data at scale. Companies seeking to Extract UK Liquor Price Intelligence Data or

U.S. alcohol datasets benefit from high-accuracy scrapers, dedicated support, and clean

structured outputs. Key strengths include:

- High-fidelity data pipelines ensuring reliable, structured datasets

- Compliance-secure scraping workflows with region-appropriate guidelines

- Enterprise-grade scalability for brands, retailers, and market analysts

- Rapid delivery cycles for real-time decision-making

Conclusion

The alcohol industry is becoming more competitive, complex, and digitally interconnected.

Accurate, timely datasets help businesses optimize pricing, track competitors, and forecast

demand. With powerful tools, companies can run large-scale data operations using Web Data

Intelligence API , leverage deeper insights, and continue to extract liquor product details USA

for long-term competitive advantage. For enterprises looking to scale alcohol data intelligence,

Product Data Scrape provides unmatched expertise, technology, and dedicated support.

Get customized datasets, real-time scrapers, and API-based integrations today to stay ahead in

the evolving digital alcohol marketplace.

FAQs

1. How do businesses use alcohol data scraping?

Businesses collect pricing, product, and availability data from major retailers to optimize

strategies, forecast trends, and benchmark competitors through automated scraping tools and

structured datasets.

2. Is alcohol data scraping legal in the U.S.?

Scraping is legal when done compliantly, without accessing restricted data. Product Data Scrape

follows public-data extraction norms and ensures safe and regulation-aligned scraping practices.

3. What platforms can be scraped for alcohol product details?

Retail websites, delivery apps, marketplaces, distributor portals, and brand catalogs can be

scraped for pricing, stock, bottle sizes, ingredient details, promotions, and regional

availability data.

4. How often should pricing be monitored?

Most businesses track daily or weekly price changes. High-competition categories like wine,

tequila, whisky, and RTD cocktails require continuous monitoring to capture volatile pricing

shifts.

5. Can scraped alcohol datasets integrate with BI tools?

Yes. Structured datasets can be exported into dashboards, CRMs, inventory systems, and BI

platforms like Power BI, Tableau, or Looker for deep analytics and reporting.

.webp)

.webp)

.webp)