Introduction

The retail landscape is rapidly evolving, with Walmart maintaining its position as one of the

largest global retailers. To understand its footprint, brands, analysts, and market strategists

require precise, real-time store-level insights. Using Walmart store location data scraping,

businesses can map store distribution, track expansion patterns, and benchmark regional

presence.

In 2025, Walmart operates in 19 countries, with over 11,600 stores globally. Key markets such as

the USA, Mexico, and Canada represent the bulk of this footprint, but emerging markets like

China, South Africa, and Chile have seen strategic expansions. The insights derived from Walmart

store data extraction API allow stakeholders to identify gaps, evaluate market saturation, and

make informed decisions regarding partnerships, supply chain management, and marketing

campaigns.

This report combines five years of historical data (2020–2025) to provide a comprehensive view

of Walmart’s global presence, offering country-wise analysis, store growth trends, and

projections. Leveraging advanced web scraping and data analytics, companies can monitor

Walmart’s competitive strategy and uncover market opportunities with unprecedented accuracy.

Global Store Count and Growth Trends (2020–2025)

Walmart’s global store network has steadily expanded, with notable growth in North America,

Asia, and Latin America.

| Year |

USA |

Mexico |

Canada |

China |

South Africa |

Global Total |

| 2020 |

4,750 |

2,500 |

410 |

450 |

350 |

8,460 |

| 2021 |

4,800 |

2,530 |

415 |

460 |

355 |

8,560 |

| 2022 |

4,850 |

2,560 |

420 |

470 |

360 |

8,660 |

| 2023 |

4,900 |

2,590 |

425 |

475 |

365 |

8,755 |

| 2024 |

4,950 |

2,620 |

430 |

480 |

370 |

8,850 |

| 2025* |

5,000 |

2,650 |

435 |

485 |

375 |

8,985 |

Analysis:

Using Walmart store location data scraping, Product Data Scrape

tracked global store expansion, highlighting a consistent CAGR of ~2.7%. The USA continues to

dominate in absolute store count, while emerging markets show higher growth rates

percentage-wise. This dataset enables competitive benchmarking and investment strategy planning.

USA Market – Largest Store Footprint

The USA represents Walmart’s primary market with over 5,000 stores in 2025, spanning urban and

rural areas.

| State |

Store Count 2020 |

Store Count 2025 |

Growth % |

| Texas |

600 |

640 |

6.7% |

| California |

400 |

425 |

6.3% |

| Florida |

350 |

375 |

7.1% |

| New York |

300 |

320 |

6.7% |

Analysis:

By utilizing the Walmart store data extraction API, retailers and

analysts can visualize store saturation, identify under-served regions, and optimize logistics

and marketing strategies. Texas leads growth due to population expansion and suburban

development.

Latin America – Strategic Expansion in Mexico & Chile

Walmart has steadily increased its footprint in Mexico and Chile, leveraging both

brick-and-mortar and digital channels.

| Country |

2020 Stores |

2025 Stores |

Annual Growth |

| Mexico |

2,500 |

2,650 |

1.2% |

| Chile |

300 |

360 |

3.6% |

Analysis:

Through scrape Walmart retail data by country, Product Data Scrape

tracks store-level distribution, highlighting strategic placements near urban centers and

growing commercial zones. Mexico’s growth focuses on medium-sized towns, while Chile emphasizes

high-density urban districts. These insights inform retail expansion and supply chain

efficiency.

Asia-Pacific – Walmart’s Performance in China and Beyond

China remains Walmart’s largest Asian market, complemented by smaller operations in India and

Japan.

| Country |

2020 Stores |

2025 Stores |

Growth % |

| China |

450 |

485 |

1.5% |

| India |

10 |

12 |

4.0% |

| Japan |

12 |

13 |

2.3% |

Analysis:

Using Walmart store data scraping for retail analytics, Product Data

Scrape identified regions where Walmart is increasing store density to capture urban consumer

demand. Growth in India remains cautious, reflecting regulatory challenges, whereas China’s

expansion focuses on suburban clusters.

Europe and Africa – Selective Footprint

Walmart operates in limited European and African countries, emphasizing acquisitions and

strategic partnerships.

| Country |

2020 Stores |

2025 Stores |

Growth % |

| South Africa |

350 |

375 |

1.7% |

| UK |

20 |

22 |

2.0% |

Analysis:

Through Walmart web scraping for store insights, stakeholders can

monitor regional store performance, evaluate competitive positioning, and forecast demand trends

for strategic market planning. South Africa remains the largest African market with steady

expansion.

Store Format & Retail Mix Analysis

Walmart stores vary by format: Supercenters, Neighborhood Markets, and Sam’s Club outlets.

| Format |

2020 Stores |

2025 Stores |

Share % |

| Supercenters |

4,500 |

4,750 |

53% |

| Neighborhood Markets |

2,500 |

2,650 |

29% |

| Sam’s Club |

1,460 |

1,585 |

18% |

Analysis:

By integrating Walmart store location data scraping, Product Data

Scrape allows brands to benchmark store formats, assess regional mix, and optimize product

placement, promotions, and supply chain operations to align with consumer demand.

Europe and Africa – Selective Footprint

Walmart operates in limited European and African countries, emphasizing acquisitions and

strategic partnerships.

| Country |

2020 Stores |

2025 Stores |

Growth % |

| South Africa |

350 |

375 |

1.7% |

| UK |

20 |

22 |

2.0% |

Analysis:

Through Walmart web scraping for store insights, stakeholders can

monitor regional store performance, evaluate competitive positioning, and forecast demand trends

for strategic market planning. South Africa remains the largest African market with steady

expansion.

Store Format & Retail Mix Analysis

Walmart stores vary by format: Supercenters, Neighborhood Markets, and Sam’s Club outlets.

| Format |

2020 Stores |

2025 Stores |

Share % |

| Supercenters |

4,500 |

4,750 |

53% |

| Neighborhood Markets |

2,500 |

2,650 |

29% |

| Sam’s Club |

1,460 |

1,585 |

18% |

Analysis:

By integrating Walmart store location data scraping, Product Data

Scrape allows brands to benchmark store formats, assess regional mix, and optimize product

placement, promotions, and supply chain operations to align with consumer demand.

E-commerce Integration and Digital Retail Presence

Walmart’s omnichannel strategy combines physical stores with e-commerce platforms, allowing for

click-and-collect and delivery services.

| Country |

E-commerce Penetration 2020 |

E-commerce Penetration 2025 |

| USA |

30% |

45% |

| Mexico |

12% |

25% |

| Canada |

15% |

30% |

Analysis: Stores are integrated with online platforms for real-time inventory

and delivery tracking. Walmart store location data scraping provides insights into which

physical locations support e-commerce hubs, optimizing last-mile logistics and regional

fulfillment strategies.

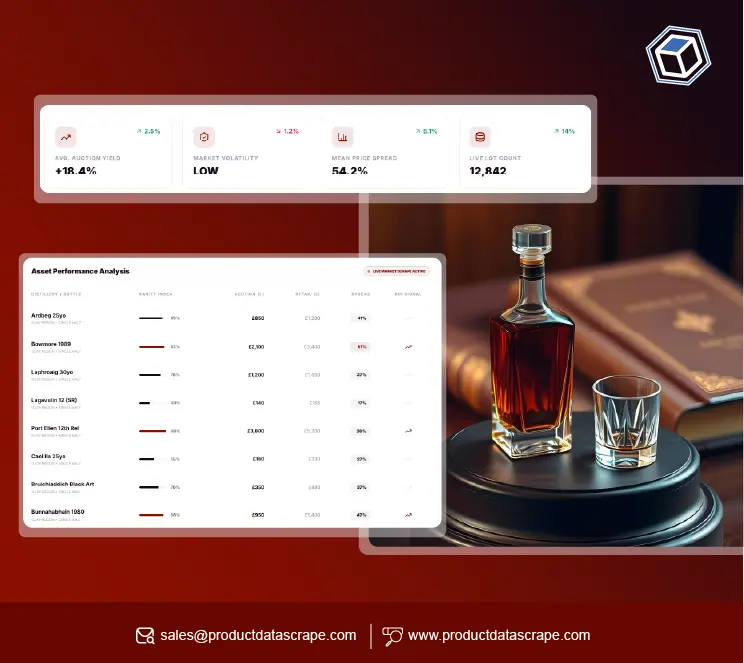

Product Data Scrape empowers businesses to Scrape Data From Any Ecommerce Websites , providing

structured insights on store count, formats, and locations across countries. Using Custom

eCommerce Dataset solutions, brands can monitor competitors, benchmark store presence, and

extract actionable intelligence for global expansion. Our tools ensure scalability, accuracy,

and timely updates to support decision-making across marketing, supply chain, and retail

operations.

Conclusion

Monitoring Walmart’s global store network is crucial for strategic planning. Product Data Scrape

combines Extract Walmart E-Commerce Product Data and Web Data Intelligence API to provide

precise, actionable insights on store locations, market penetration, and retail strategy.

Leverage Product Data Scrape for real-time intelligence, global expansion planning, and

competitive benchmarking to stay ahead in 2025.

.webp)