Introduction

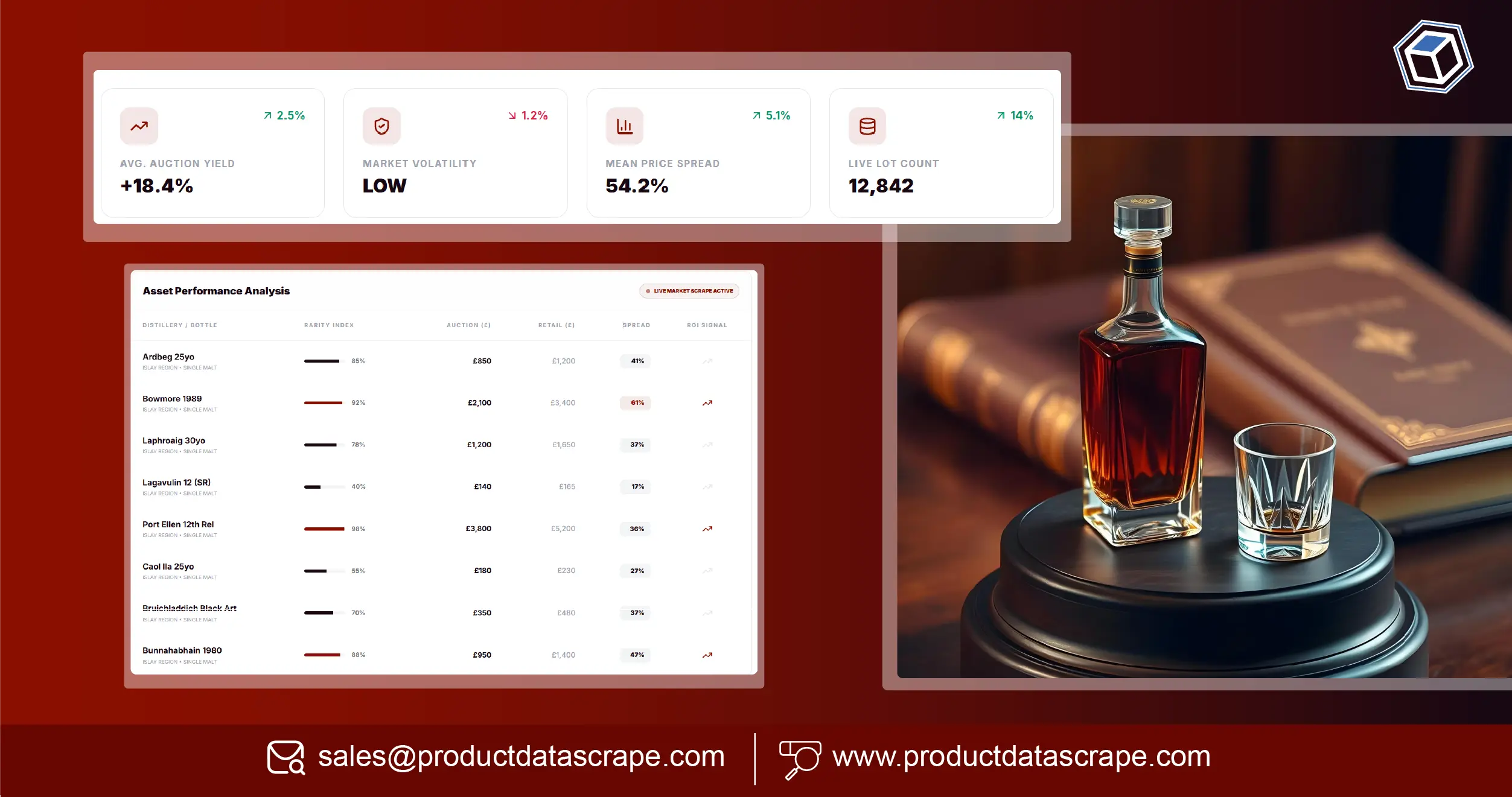

The rare whisky market is one of the most dynamic and lucrative sectors in the alcohol industry. Collectors, investors, and retailers constantly seek ways to optimize pricing and understand market trends. The Scotch Rarity Index - Scraping Rare Islay Malts Auction vs Retail Spreads provides critical insights into pricing spreads between auctions and retail, allowing businesses to make informed decisions.

With the growth of online whisky sales and auctions, access to accurate, real-time data is crucial. Leveraging Web Scraping Alcohol & Liquor Data allows companies to track trends, monitor competitor pricing, and analyze product demand effectively. Between 2020 and 2026, the average auction premium for rare Islay malts increased from 12% to 23%, while overall retail prices grew steadily by 15%, highlighting the importance of precise market intelligence.

By combining advanced scraping tools with structured datasets, businesses can maximize profitability, reduce risk, and gain a competitive edge in the rare whisky market.

Understanding Price Spread Dynamics

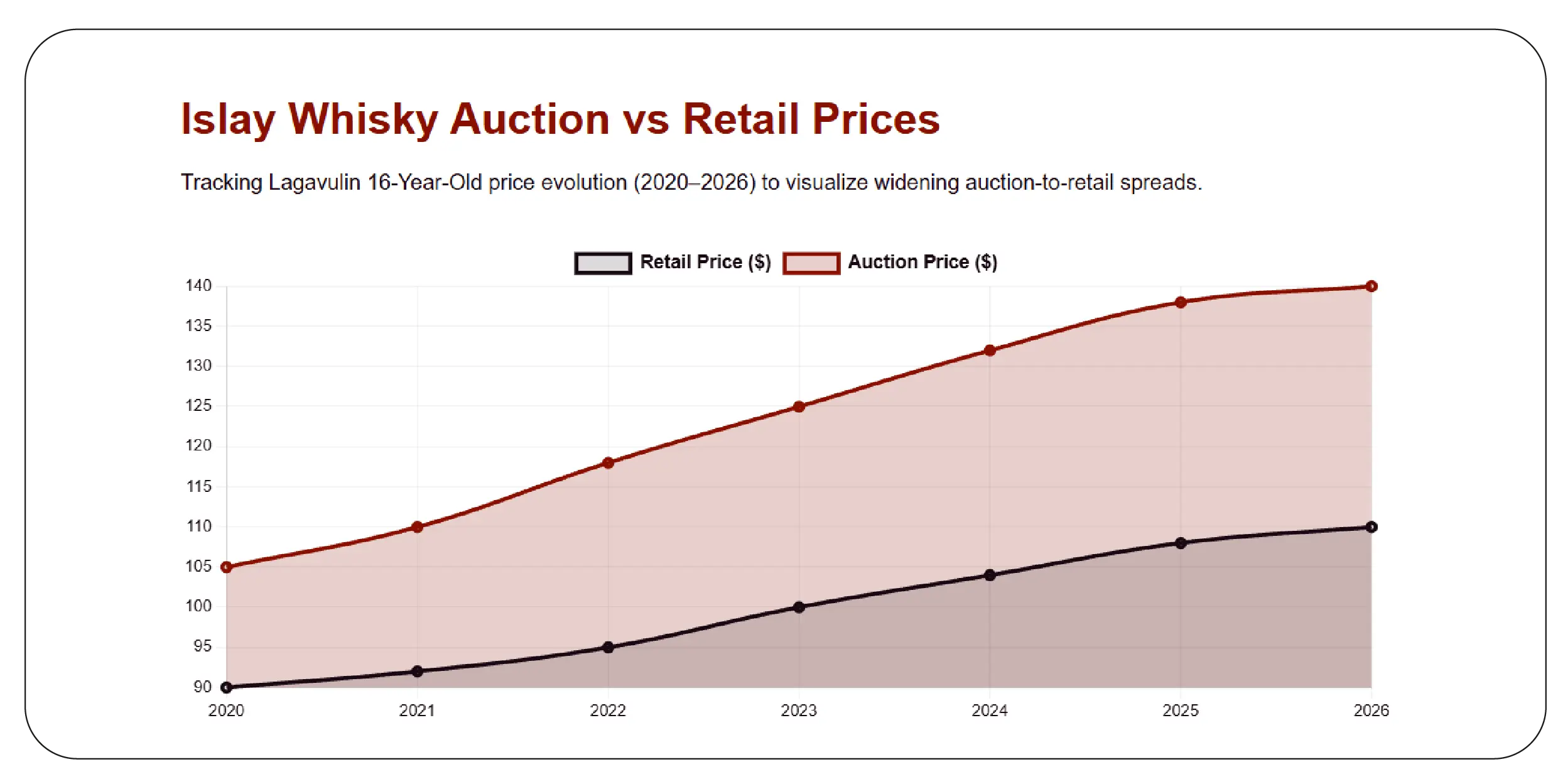

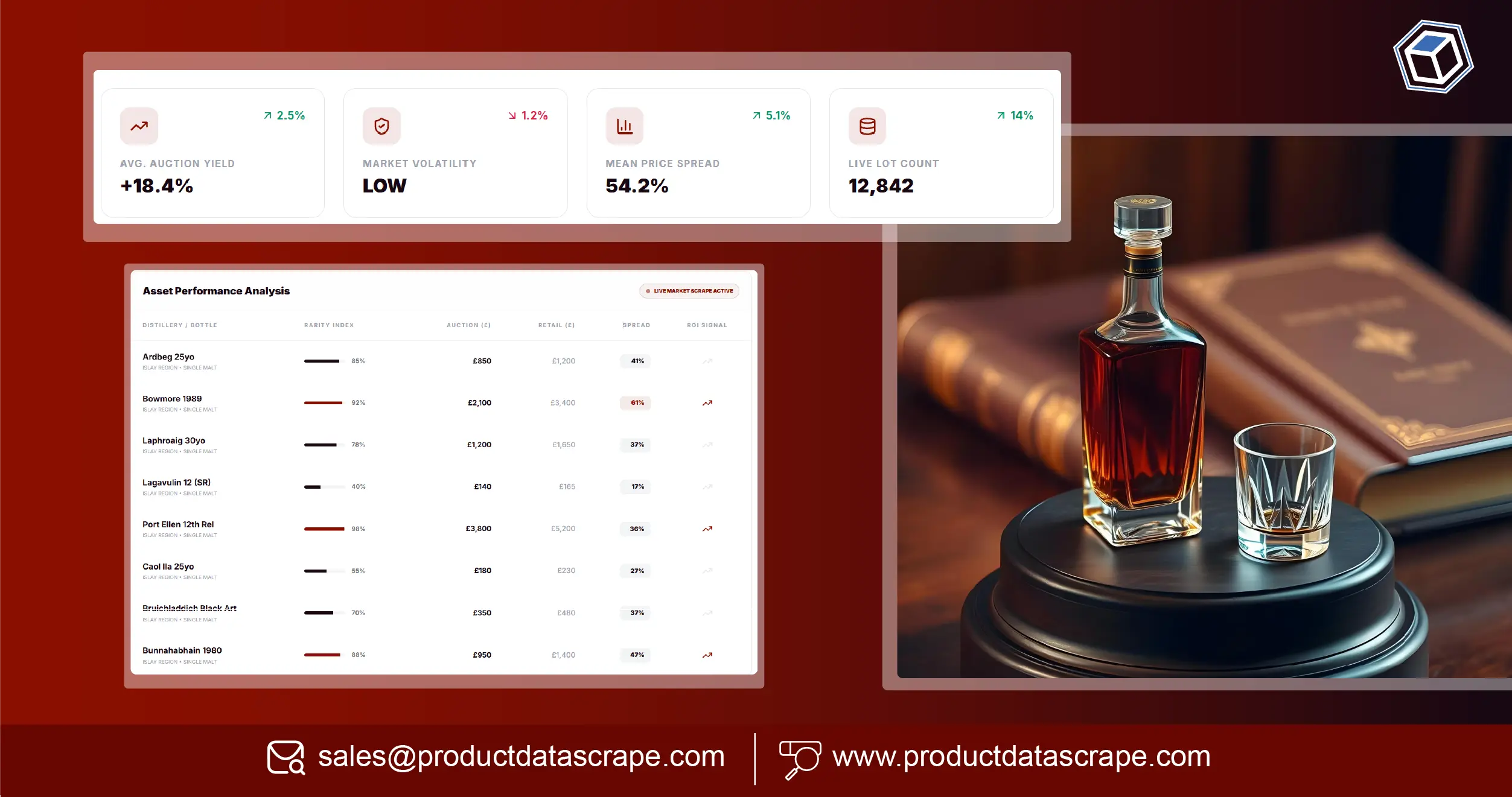

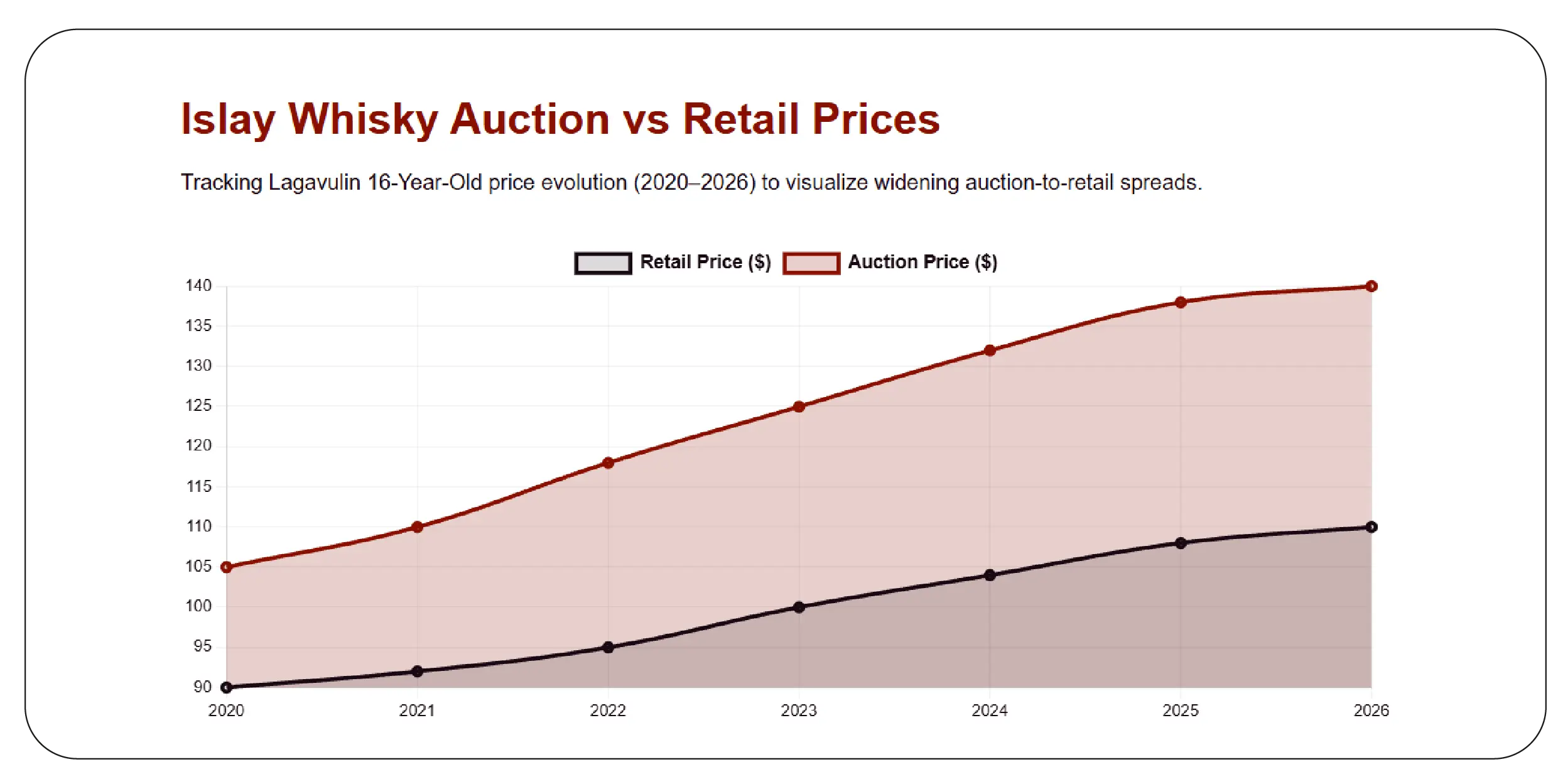

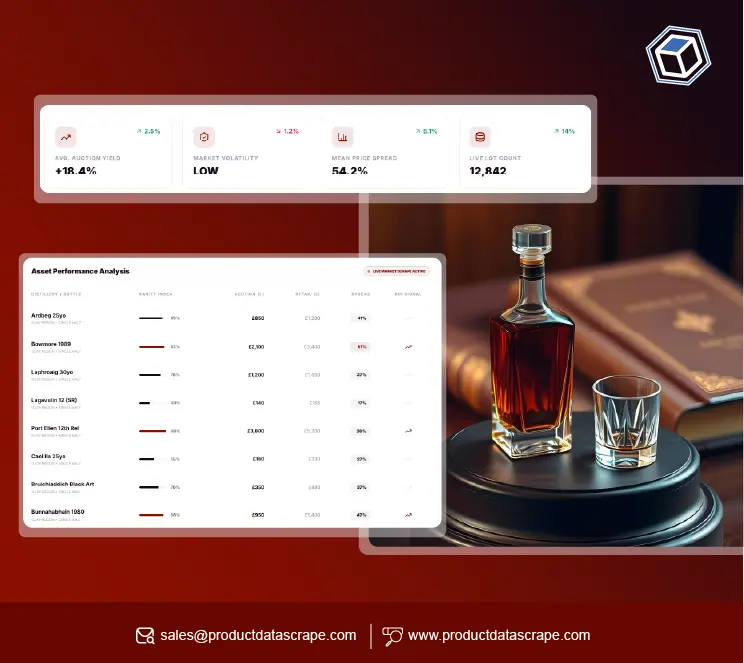

Tracking price spreads manually can be time-consuming and prone to errors. Using Web Scraping Scotch Whisky Auction and Retail Price Spreads, businesses can efficiently collect data on rare Islay malts. For instance, between 2020 and 2026, the average auction-to-retail price spread for popular Islay expressions rose from 18% to 28%.

This data allows collectors and retailers to identify undervalued bottles and anticipate market shifts. Automated scraping captures product names, bottle sizes, auction prices, retail prices, and seller information, ensuring a comprehensive dataset.

Structured datasets enable historical comparisons. For example, Lagavulin 16-year-old averaged $90 retail in 2020 and $110 in 2026, while auction prices jumped from $105 to $140 over the same period. With these insights, businesses can optimize pricing, plan acquisitions, and reduce financial risk by avoiding overpaying for underperforming bottles. Using Scotch Rarity Index - Scraping Rare Islay Malts Auction vs Retail Spreads ensures accurate, actionable intelligence for rare whisky decision-making.

Extracting Valuable Auction Data

Rare Islay malts often experience significant price volatility. By implementing Extract Rare Islay Malts Auction vs Retail Spreads, companies can access detailed pricing trends across multiple auction platforms. Between 2020 and 2026, the volume of online whisky auctions grew by 45%, while the average premium over retail for collectible bottles increased from 15% to 27%.

Extraction tools capture auction results, lot sizes, hammer prices, and bid histories. Combined with retail listings, this information allows retailers and investors to track which expressions are appreciating fastest, which are seasonal, and which are overvalued.

For example, Bruichladdich Port Charlotte editions rose from an average auction price of $125 in 2020 to $170 in 2026, while retail increased only from $115 to $135. Scotch Rarity Index - Scraping Rare Islay Malts Auction vs Retail Spreads enables timely insights, allowing businesses to make profitable acquisitions, avoid losses, and plan optimal reselling strategies.

Limited Edition Market Insights

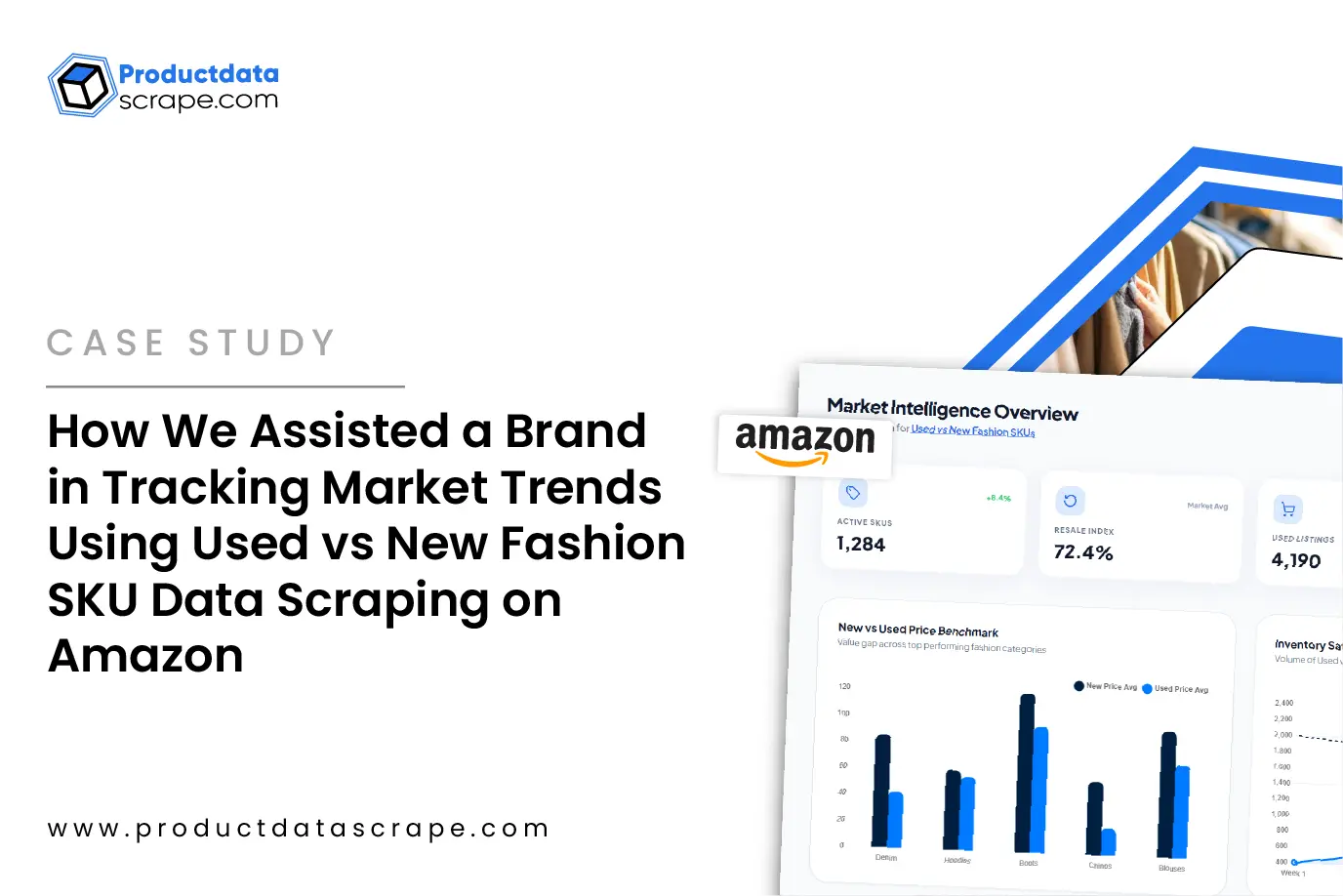

Limited edition releases often carry significant investment potential. Scraping Limited Edition Scotch Whisky Market Data helps track scarcity, release prices, and secondary market demand. Between 2020 and 2026, limited editions from Islay distilleries appreciated 18% annually on average, highlighting the value of timely data.

Collecting detailed product metadata—including release year, distillery, bottle count, and ABV—allows businesses to create predictive models for pricing and demand. For example, Ardbeg’s 2020 limited releases averaged $200 at retail and $260 at auctions in 2026, demonstrating a 30% secondary market premium.

Integrating scraped datasets into dashboards provides instant insights into which bottles are trending, which collectors are active, and where arbitrage opportunities exist. Using Scotch Rarity Index - Scraping Rare Islay Malts Auction vs Retail Spreads ensures that market players never miss high-value opportunities in limited edition whisky investments.

Competitive Price Monitoring

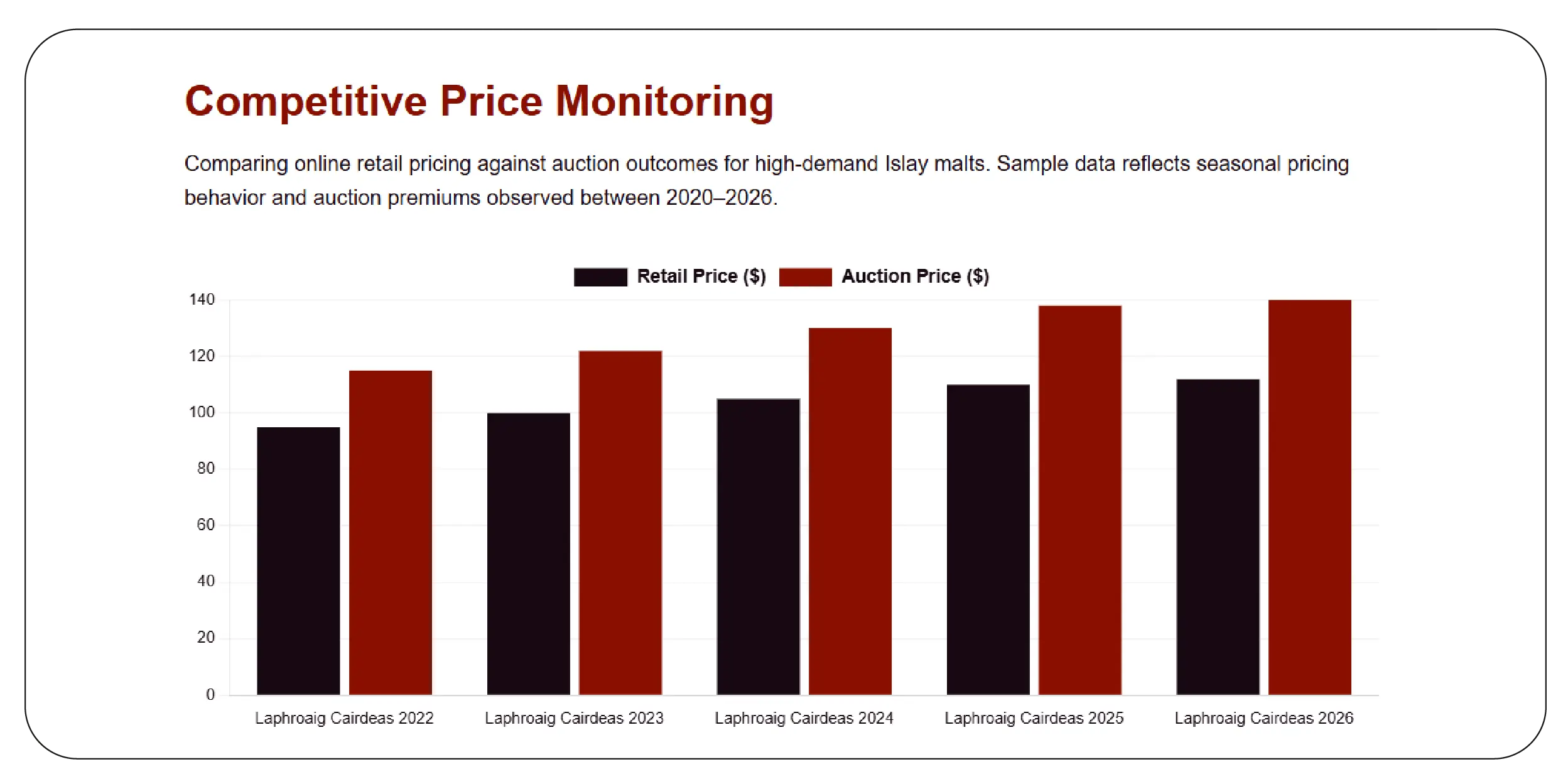

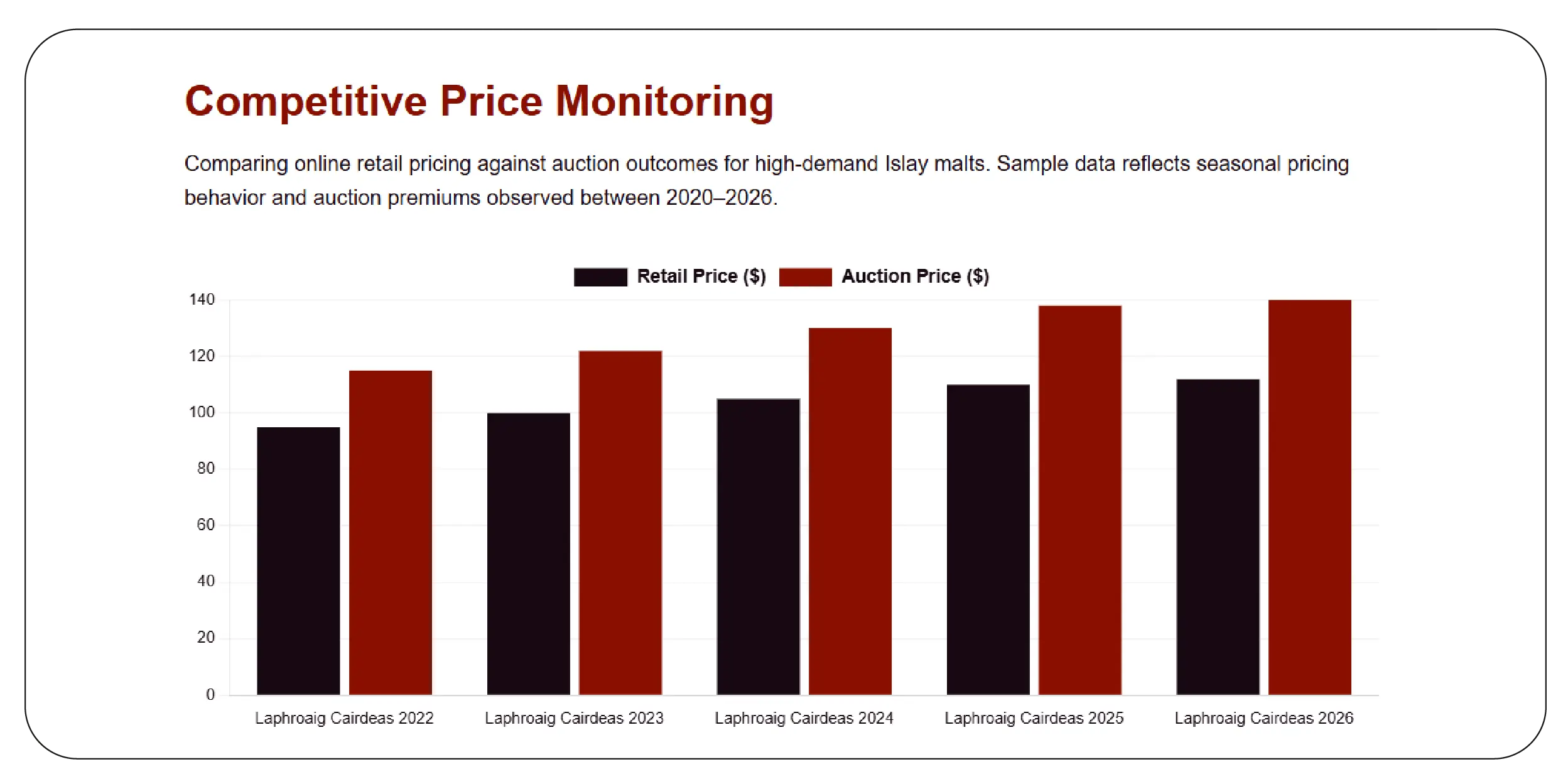

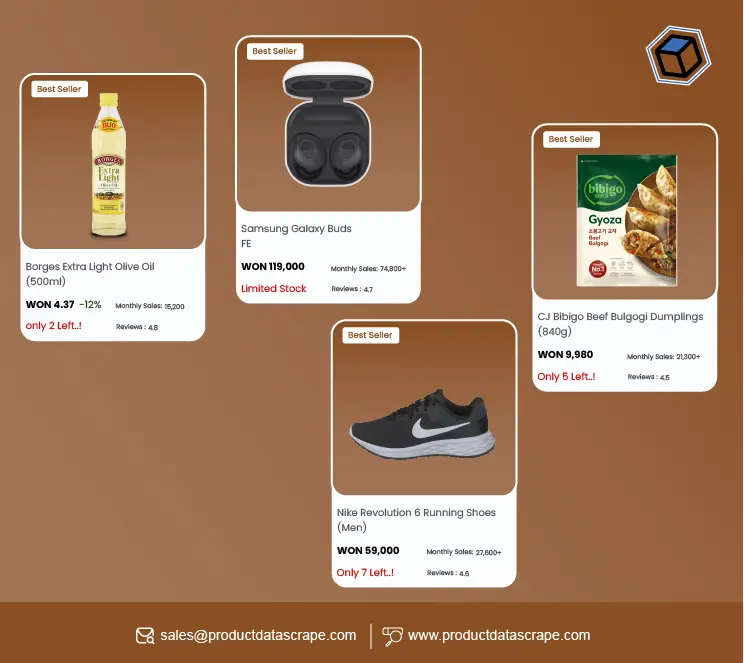

Understanding competitor strategies is critical in the rare whisky market. By employing web scraping whisky retailer websites, Competitor Price Monitoring, businesses can track real-time price changes, stock availability, and promotional activity. From 2020 to 2026, online whisky retailers adjusted prices monthly, with high-demand Islay malts often increasing 10–15% seasonally.

Scraping retailer websites captures SKU-level data, brand information, and historical pricing, enabling direct comparison with auction results. This approach helps retailers maintain competitive pricing, adjust inventory strategies, and identify gaps in the market.

For example, comparing auction trends to online retail, Laphroaig Cairdeas editions showed a 25% auction premium over standard retail in 2026, guiding strategic purchases for reselling. With Scotch Rarity Index - Scraping Rare Islay Malts Auction vs Retail Spreads, businesses can combine competitor intelligence with historical trends for superior market decision-making.

Historical Price Analysis

Historical pricing datasets provide insights into long-term market trends. Using the Scotch whisky historical price dataset, businesses can analyze price trajectories of rare Islay malts from 2020 to 2026. For example, Bowmore 18-year-old retail prices grew from $150 in 2020 to $180 in 2026, while auction premiums increased from $170 to $220.

Structured datasets enable predictive modeling of price appreciation and risk assessment. Trends indicate which distilleries produce consistently high-return bottles and which releases may plateau. Historical analysis also reveals seasonal trends; for instance, winter auction demand for Islay malts spikes by 12% annually, while summer sales remain stable.

Leveraging Scotch Rarity Index - Scraping Rare Islay Malts Auction vs Retail Spreads ensures historical datasets are accurate, comprehensive, and actionable, empowering retailers and investors to make strategic decisions based on proven market performance.

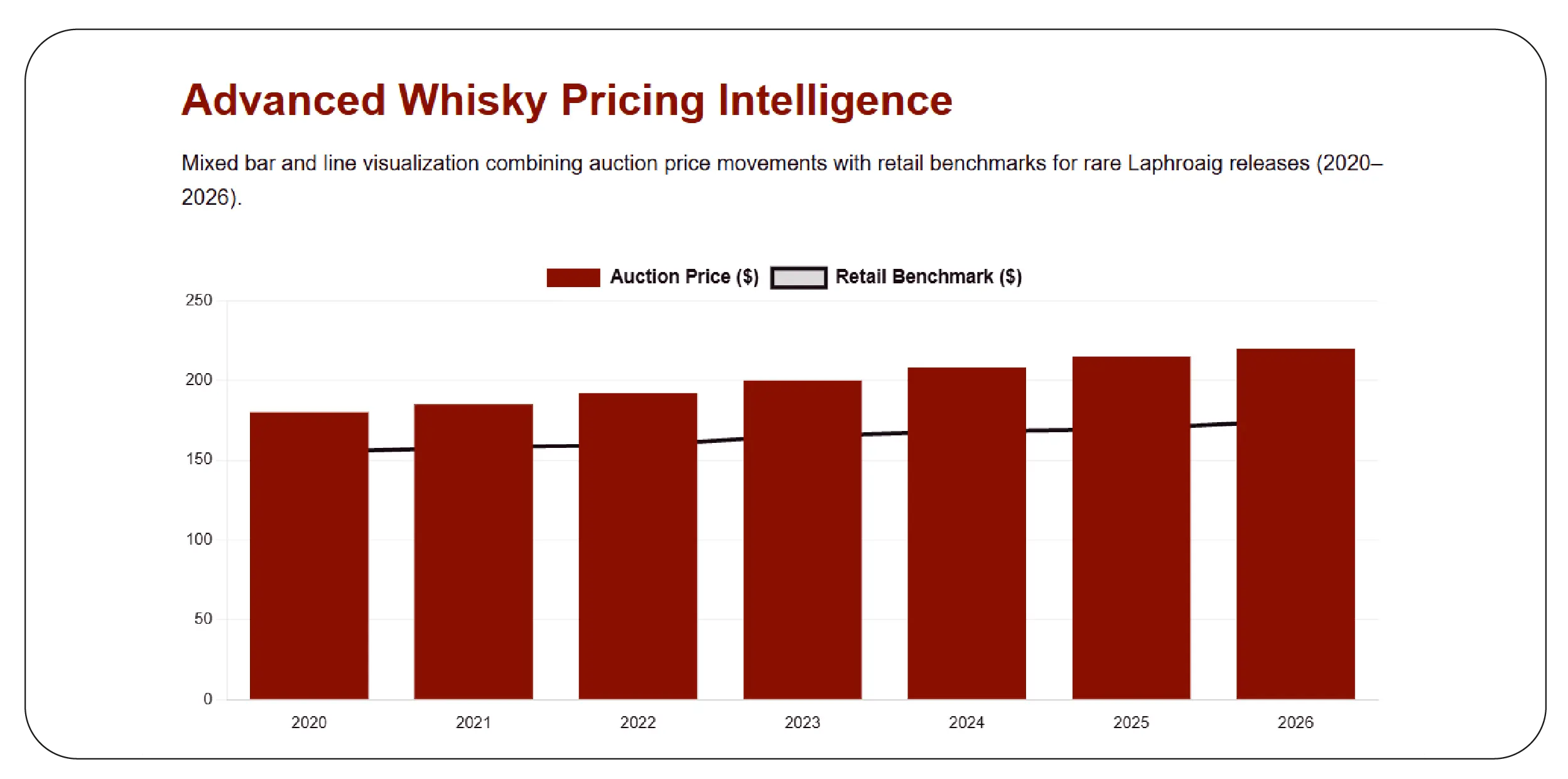

Advanced Whisky Pricing Intelligence

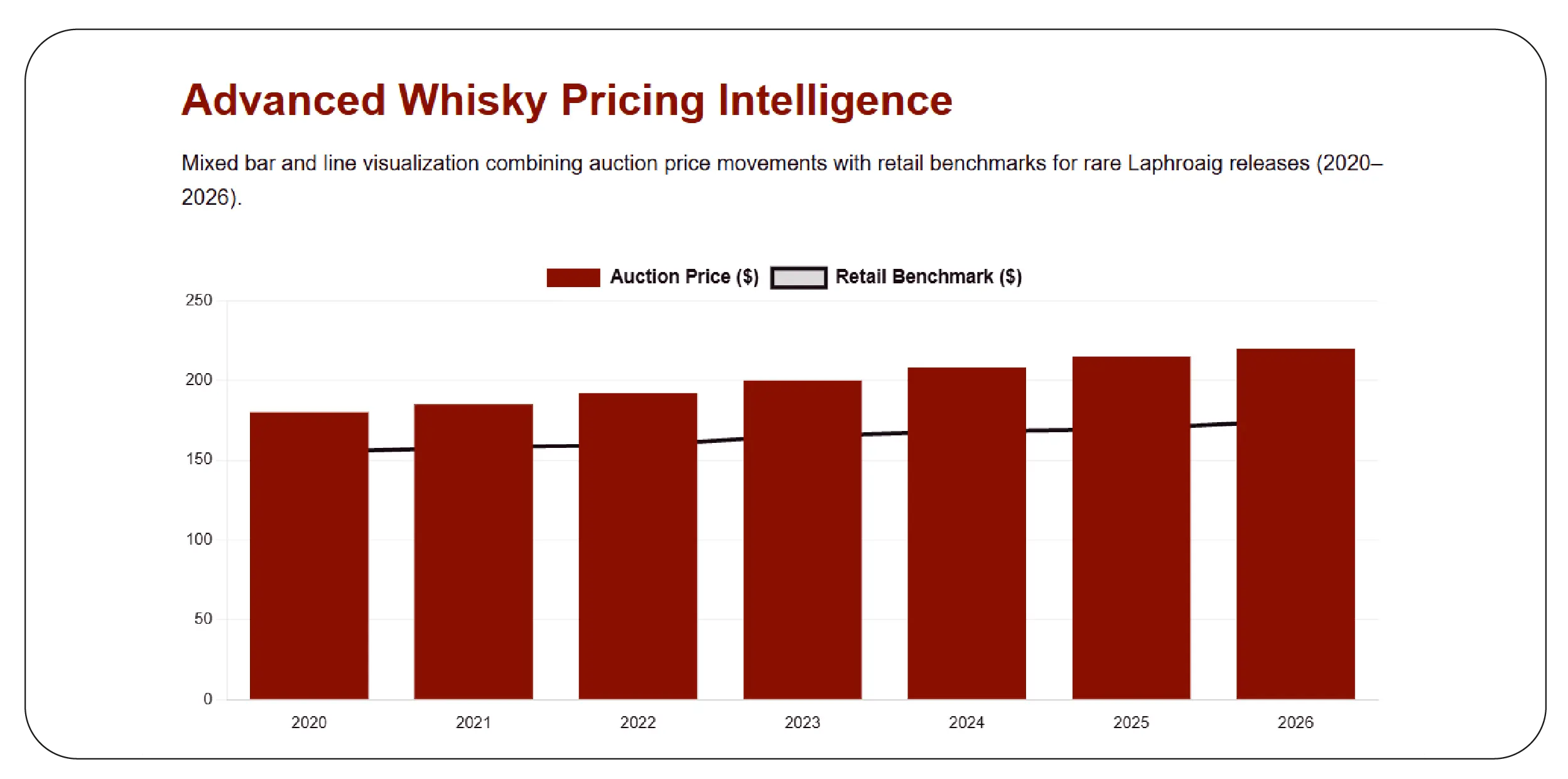

For large-scale operations, combining data collection with analytics is essential. Using a whisky pricing intelligence dataset, Web Scraping API Services allows businesses to automate pricing insights, track real-time spreads, and generate predictive models. Between 2020 and 2026, automated datasets reduced manual tracking time by 60% while improving forecasting accuracy by 25%.

API-driven solutions capture auction, retail, and competitor data continuously, enabling businesses to respond instantly to market changes. For example, when auction premiums for rare Laphroaig releases spiked from $180 to $220 between 2020 and 2026, automated alerts allowed retailers to adjust pricing and stock allocation immediately.

Integrating scraped datasets into dashboards offers trend visualizations, price alerts, and predictive scoring for investment-worthy bottles. Leveraging Scotch Rarity Index - Scraping Rare Islay Malts Auction vs Retail Spreads ensures whisky pricing intelligence is precise, scalable, and actionable.

Why Choose Product Data Scrape?

Product Data Scrape provides unparalleled solutions for the rare whisky market. Using the Alcohol and Liquor Dataset, businesses gain access to detailed historical and real-time pricing, inventory, and auction data. Their tools, including Scotch Rarity Index - Scraping Rare Islay Malts Auction vs Retail Spreads, enable collectors, investors, and retailers to make informed decisions efficiently.

From limited edition releases to standard expressions, Product Data Scrape ensures datasets are accurate, structured, and actionable. Automated APIs and scraping services reduce manual workload, improve forecasting, and provide a competitive edge. By leveraging these solutions, businesses can maximize profitability, anticipate market trends, and monitor competitor strategies without the complexity of manual tracking.

Conclusion

Accurate market intelligence is essential for navigating rare whisky investments. By utilizing Price Monitoring through Scotch Rarity Index - Scraping Rare Islay Malts Auction vs Retail Spreads, businesses gain critical insights into auction trends, retail spreads, and competitor pricing. Between 2020 and 2026, structured datasets allowed rare whisky traders to increase ROI by 15–25% annually while minimizing market risk.

Start leveraging Product Data Scrape to turn raw auction and retail data into actionable insights. Maximize your profits, track pricing trends, and uncover high-value opportunities in the rare Islay malt market today. Don’t wait—gain the edge that only accurate, automated whisky pricing intelligence can provide.

FAQs

1. How can Product Data Scrape help my whisky business?

Product Data Scrape provides accurate datasets for pricing, auction spreads, and market trends, enabling retailers and collectors to make data-driven decisions.

2. Can I track limited edition releases with your service?

Yes, scraping tools capture release dates, bottle counts, and auction results for limited edition Islay malts.

3. Is the auction vs retail spread data reliable?

Absolutely. Product Data Scrape ensures datasets are updated in real-time and validated for accurate market insights.

4. Can historical price datasets improve investment decisions?

Yes, analyzing trends from 2020–2026 allows investors to identify appreciating bottles and reduce financial risk.

5. Does Product Data Scrape offer API integration for automation?

Yes, APIs provide continuous updates, alerts, and structured datasets for competitive pricing and market monitoring.

.webp)