Quick Overview

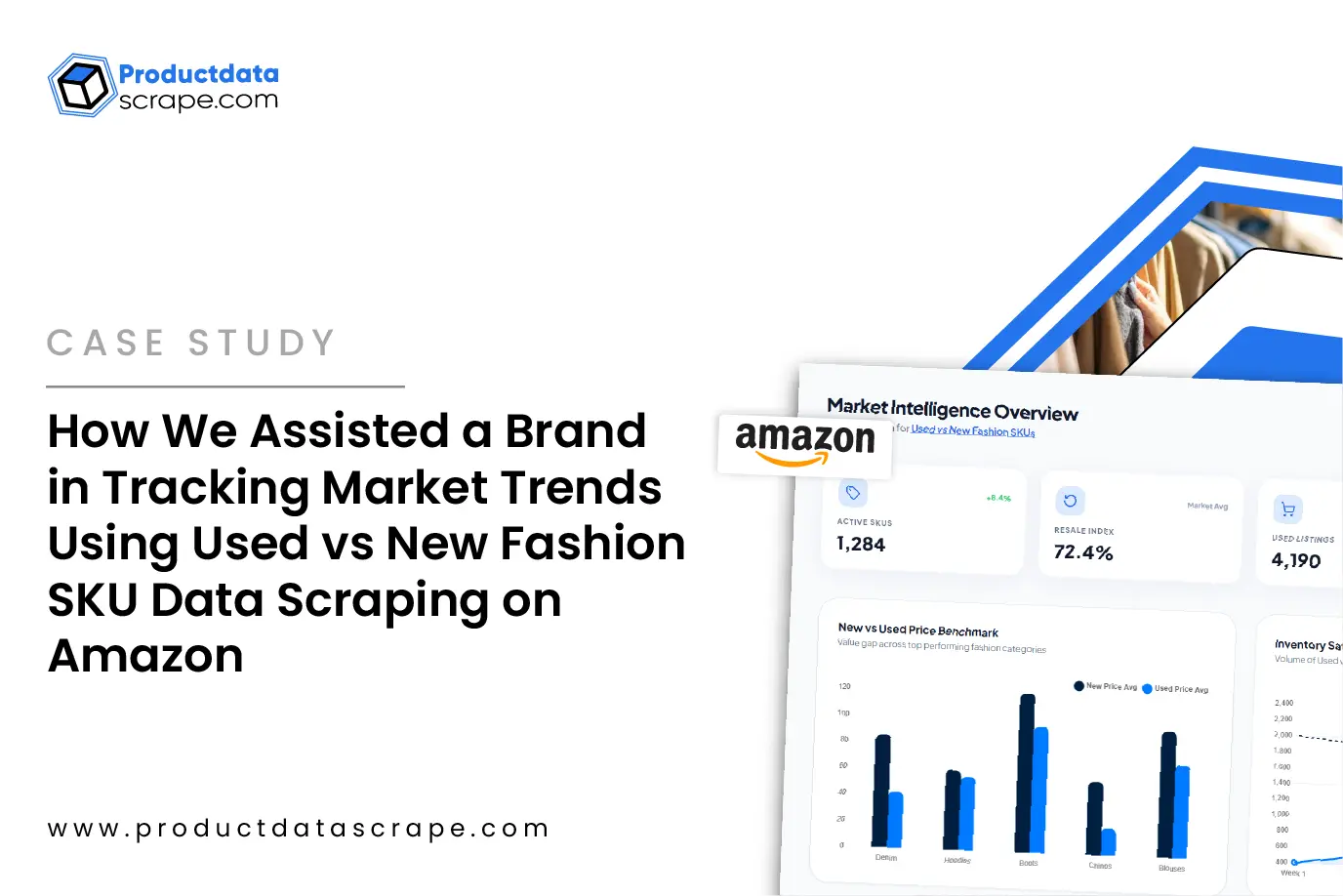

A mid-sized global fashion retailer partnered with Product Data Scrape to gain visibility into resale and primary fashion markets. Operating in the apparel and accessories industry, the brand struggled to track pricing gaps between new and pre-owned SKUs on Amazon. Over a 4-month engagement, we implemented Used vs New Fashion SKU Data Scraping on Amazon using structured feeds from the Amazon Products E-commerce Product Dataset. The solution delivered real-time insights into pricing shifts, SKU availability, and demand trends. As a result, the client achieved a 22% improvement in trend forecasting accuracy, a 17% reduction in excess inventory, and significantly faster market response cycles.

The Client

The client is a fashion and lifestyle brand selling apparel across online marketplaces, with growing exposure to resale competition. Between 2021 and 2024, the fashion resale market expanded rapidly, pushing brands to understand how used listings impacted demand and pricing for new products. Competitive pressure from resellers and third-party sellers on Amazon made visibility into both markets essential.

Before working with us, the client relied on fragmented reports and manual checks to compare new and used fashion SKUs. This approach lacked consistency, scalability, and accuracy. Pricing teams were unable to track how resale listings influenced consumer behavior, while merchandising teams struggled to identify which SKUs were losing value in secondary markets.

Transformation became essential as leadership recognized the need for unified intelligence across resale and primary listings. By implementing Web Scraping Used vs New Fashion Data from Amazon and structured pipelines to Extract Fashion & Apparel Data, the brand transitioned from reactive decision-making to proactive trend tracking, gaining a holistic view of market dynamics across Amazon’s fashion ecosystem.

Goals & Objectives

Gain real-time visibility into used and new fashion SKU pricing

Improve market trend identification across apparel categories

Scale data collection without increasing manual effort

Automate Scrape Used vs New Fashion Prices from Amazon

Enable cross-platform intelligence using Scrape Data From Any Ecommerce Websites

Integrate insights into internal analytics and merchandising tools

Improve pricing trend accuracy by 20%

Reduce time-to-market analysis cycles by 40%

Increase SKU-level visibility across resale and new listings

Enhance demand forecasting precision across key categories

These goals ensured success was measurable from both a business and technical perspective.

The Core Challenge

The client’s primary challenge was the lack of structured insight into how used fashion listings influenced new product pricing and demand. Amazon’s fashion category is highly dynamic, with frequent price changes, condition-based variations, and seller-driven competition.

Operational bottlenecks emerged due to manual tracking, inconsistent SKU mapping, and delayed data updates. Teams often worked with outdated pricing snapshots, leading to inaccurate market assumptions. This severely impacted the ability to respond to fast-moving trends and seasonal shifts.

Data quality was another concern. Without automation, the client struggled to normalize condition-based pricing differences or maintain consistent SKU identifiers across listings. These issues directly affected pricing strategy development and trend analysis.

To resolve this, the client needed a reliable way to Extract Amazon Fashion Category Pricing Data at scale, ensuring accuracy, speed, and continuous updates across thousands of fashion SKUs.

Our Solution

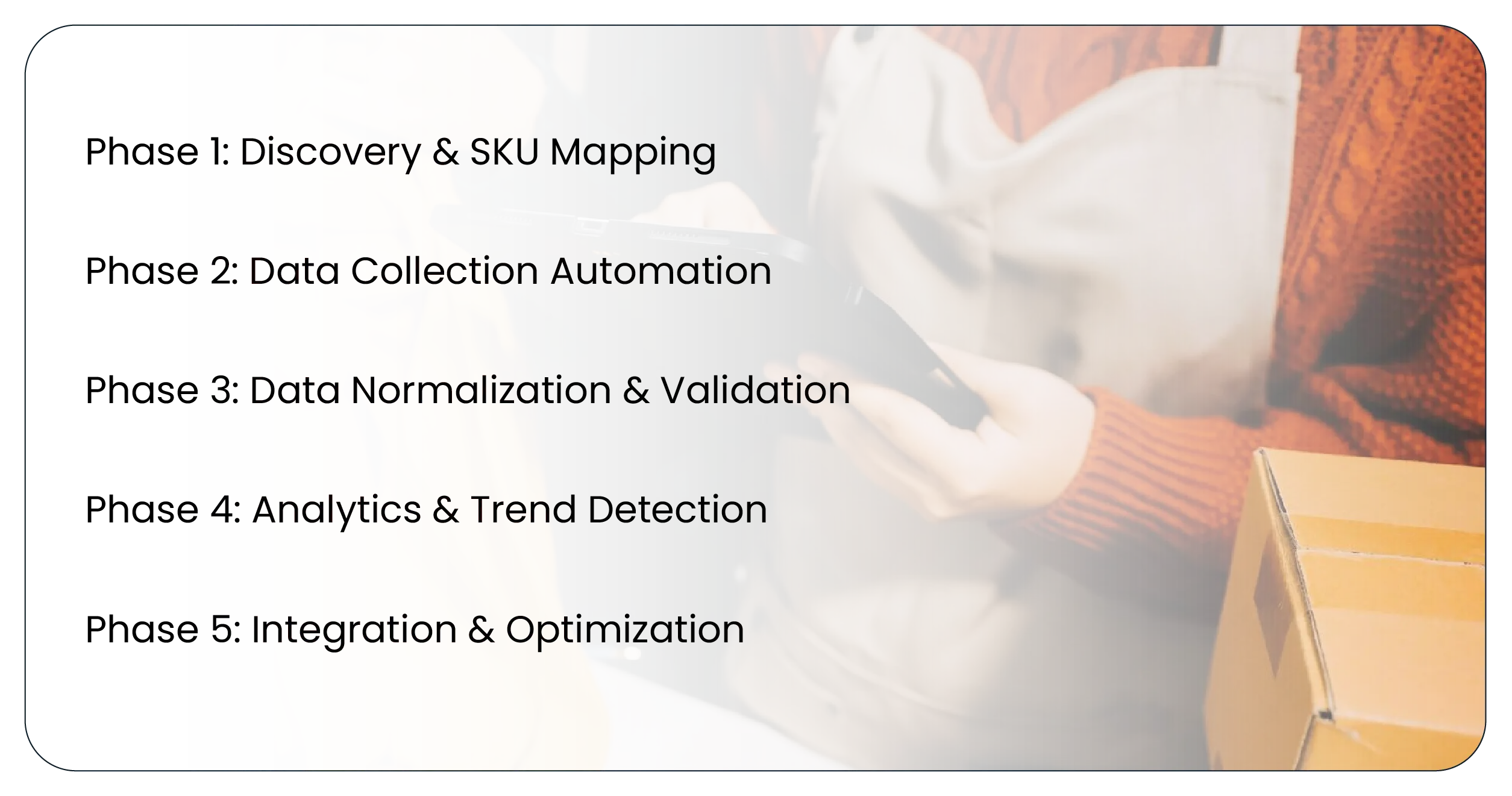

We approached the project in a phased, structured manner to ensure maximum impact:

Phase 1: Discovery & SKU Mapping

We analyzed the client’s product catalog and mapped it against Amazon listings to identify overlaps between new and used SKUs. This ensured accurate comparisons across conditions, sellers, and categories.

Phase 2: Data Collection Automation

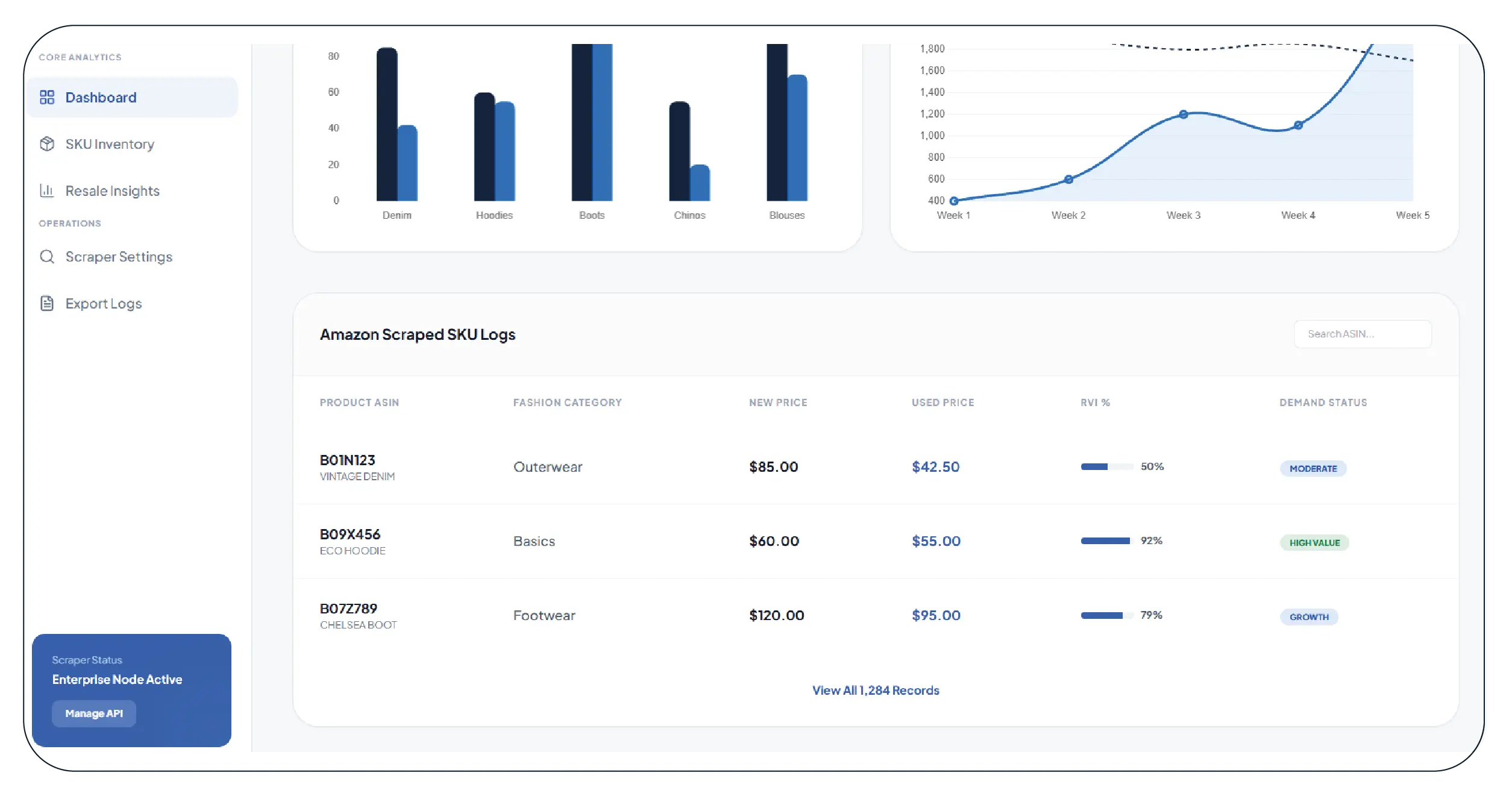

Using our Amazon Used vs New Fashion Data Scraper, we automated the extraction of pricing, condition, seller type, availability, and historical changes. Data was structured into a unified eCommerce Dataset for seamless analysis.

Phase 3: Data Normalization & Validation

We standardized condition labels, currency formats, and SKU identifiers to ensure consistency. Automated validation checks removed duplicates and pricing anomalies.

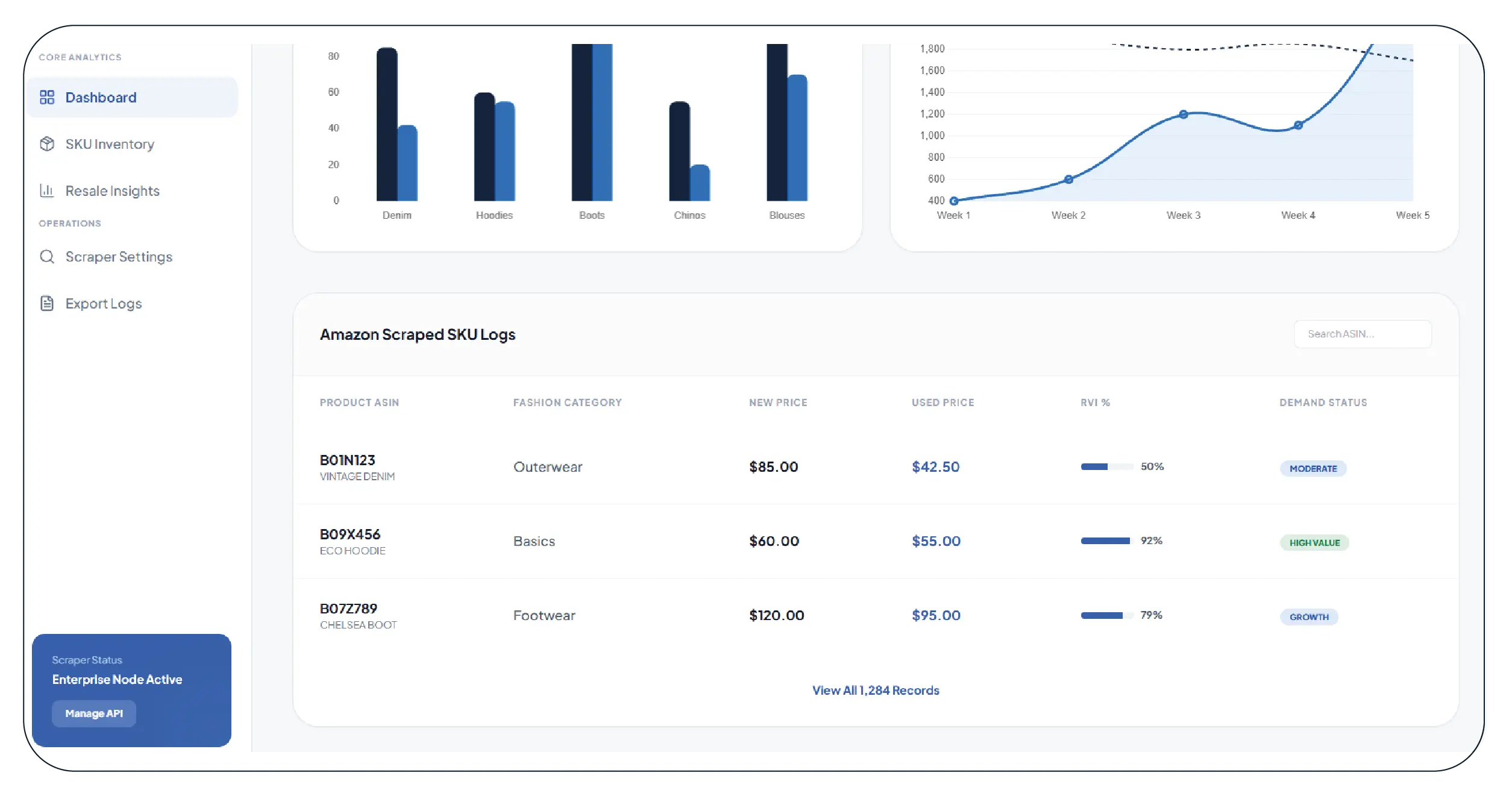

Phase 4: Analytics & Trend Detection

Our system identified pricing gaps, resale pressure points, and demand signals across categories. Dashboards highlighted SKUs where used prices undercut new listings, signaling potential cannibalization or brand dilution.

Phase 5: Integration & Optimization

Insights were integrated into the client’s analytics stack, enabling merchandising and pricing teams to act on trends in near real time.

This end-to-end approach delivered actionable intelligence while eliminating manual inefficiencies.

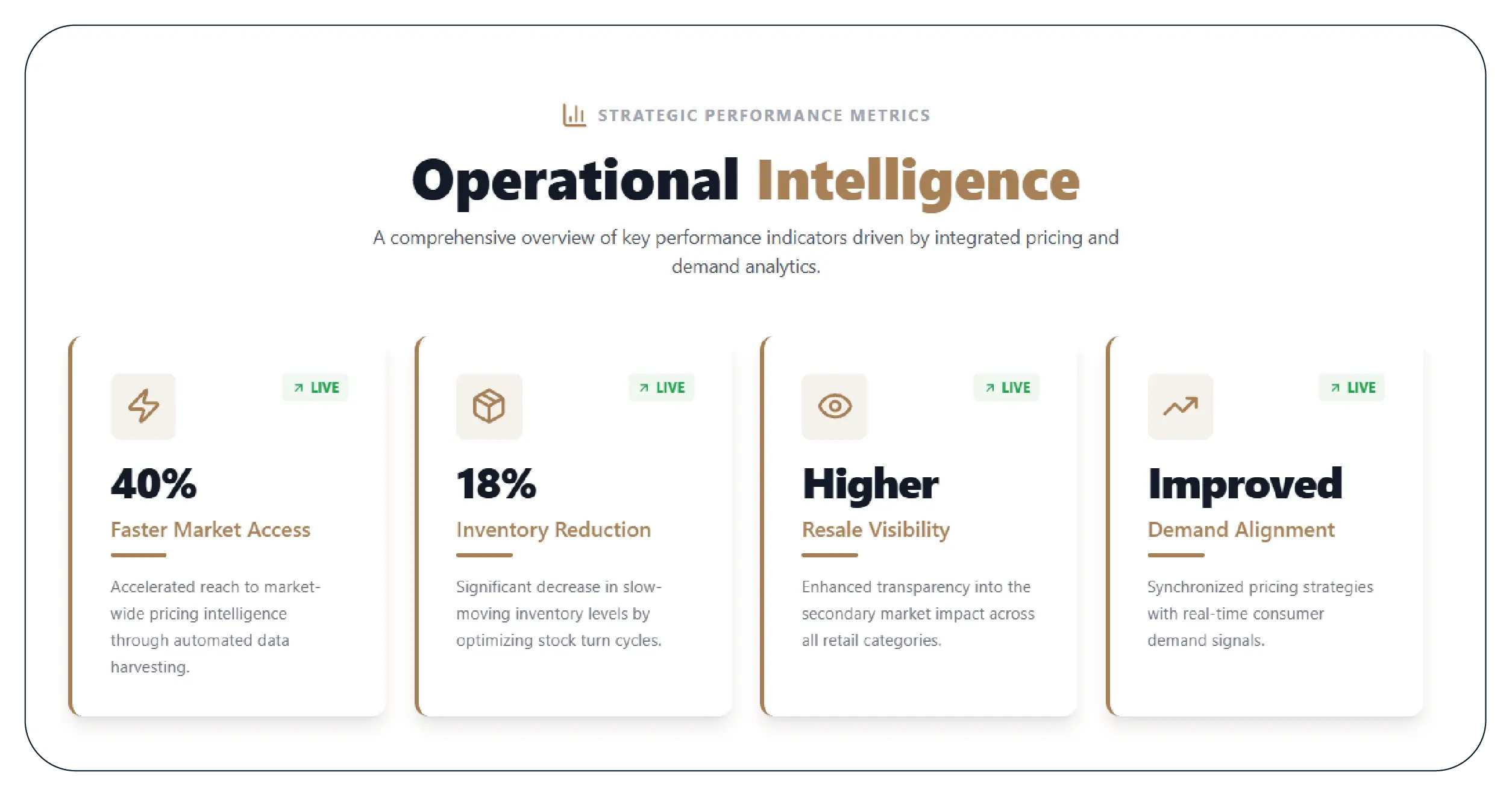

Results & Key Metrics

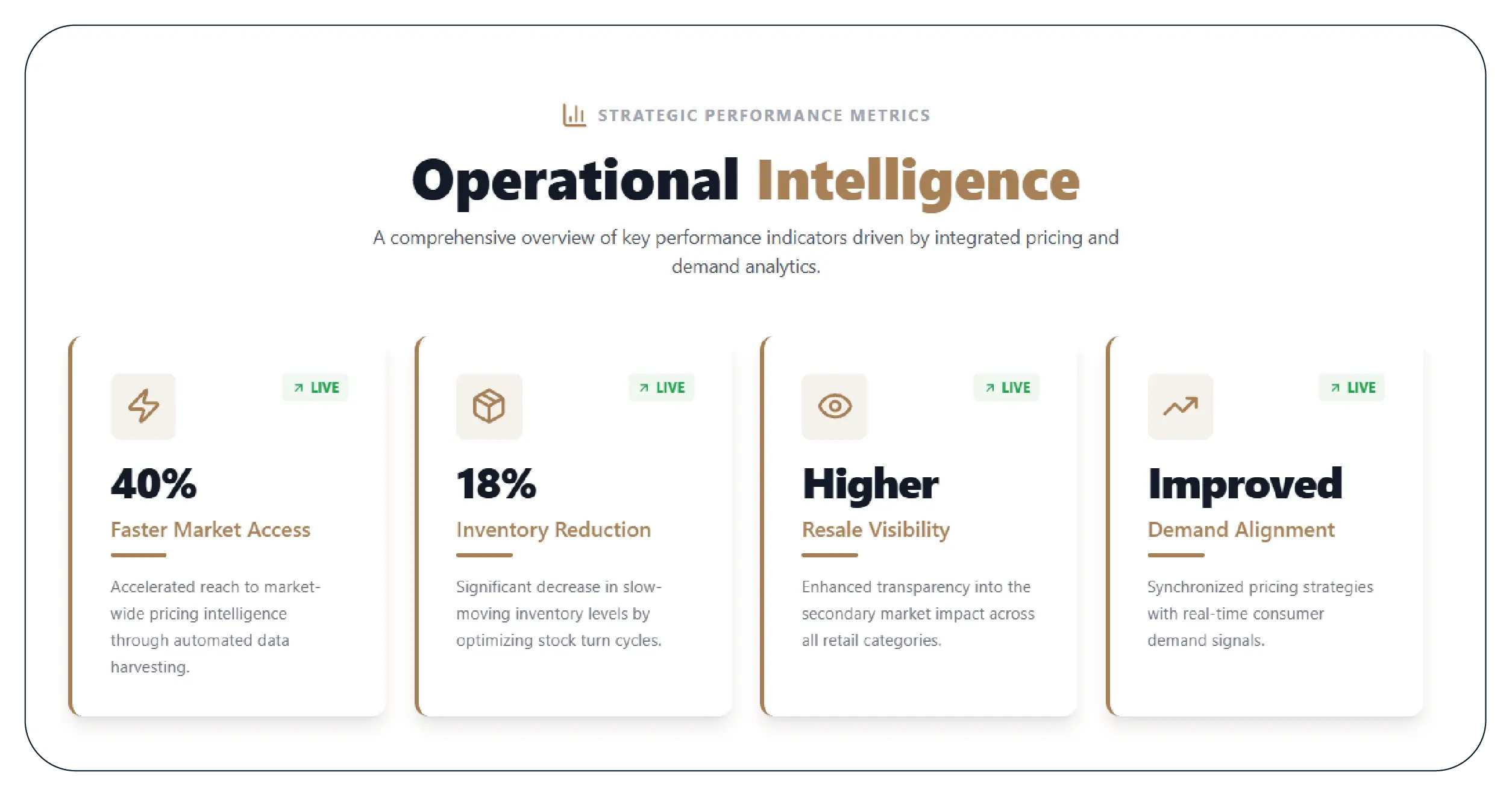

22% improvement in fashion trend forecasting accuracy

40% faster access to market-wide pricing intelligence

18% reduction in slow-moving inventory

Higher visibility into resale impact across categories

Improved alignment between pricing and demand signals

Results Narrative

With Used vs New Fashion Data Extraction from Amazon, the client gained continuous visibility into how resale dynamics influenced new product performance. By combining this with Pricing Intelligence Services, teams could proactively adjust pricing, optimize assortments, and respond faster to emerging trends. The brand moved from reactive monitoring to strategic, data-driven fashion planning, strengthening its competitive position on Amazon.

What Made Product Data Scrape Different?

Our differentiation lay in intelligent automation and fashion-specific logic. We enabled Used vs New Fashion Price Monitoring from Amazon through scalable pipelines supported by robust Web Scraping API Services. Unlike generic tools, our solution normalized condition-based pricing and delivered clean, analysis-ready datasets. This allowed the client to focus on insights, not data cleanup, driving faster and smarter decisions.

Client’s Testimonial

"Product Data Scrape gave us unmatched visibility into Amazon’s fashion marketplace. Their Amazon Fashion Data Scraping Service helped us clearly understand how resale pricing affects our new collections. The accuracy, speed, and depth of insights transformed how our teams track trends and plan assortments. We now make confident, data-driven decisions backed by real-time market intelligence."

— Head of Merchandising, Fashion Retail Brand

Conclusion

This case study demonstrates how strategic data intelligence can redefine fashion market analysis. By leveraging the Amazon Fashion Data Scraping API, the client gained a unified view of new and used SKU dynamics, enabling smarter pricing and trend forecasting. Product Data Scrape delivered not just data, but clarity—empowering the brand to stay ahead in an increasingly competitive fashion ecosystem and prepare for future marketplace evolution.

FAQs

1. What is Used vs New Fashion SKU Data Scraping on Amazon?

It involves collecting pricing, availability, and condition-based data for both new and used fashion products on Amazon.

2. Why is tracking used fashion data important for brands?

Used listings influence demand, perceived value, and pricing strategies for new products.

3. How frequently is the data updated?

Data can be refreshed daily or near real time, depending on business needs.

4. Can this data integrate with internal analytics tools?

Yes, datasets are delivered in structured formats ready for BI tools and dashboards.

5. Which fashion categories are supported?

All Amazon fashion categories, including apparel, footwear, accessories, and lifestyle products.

.webp)