Introduction

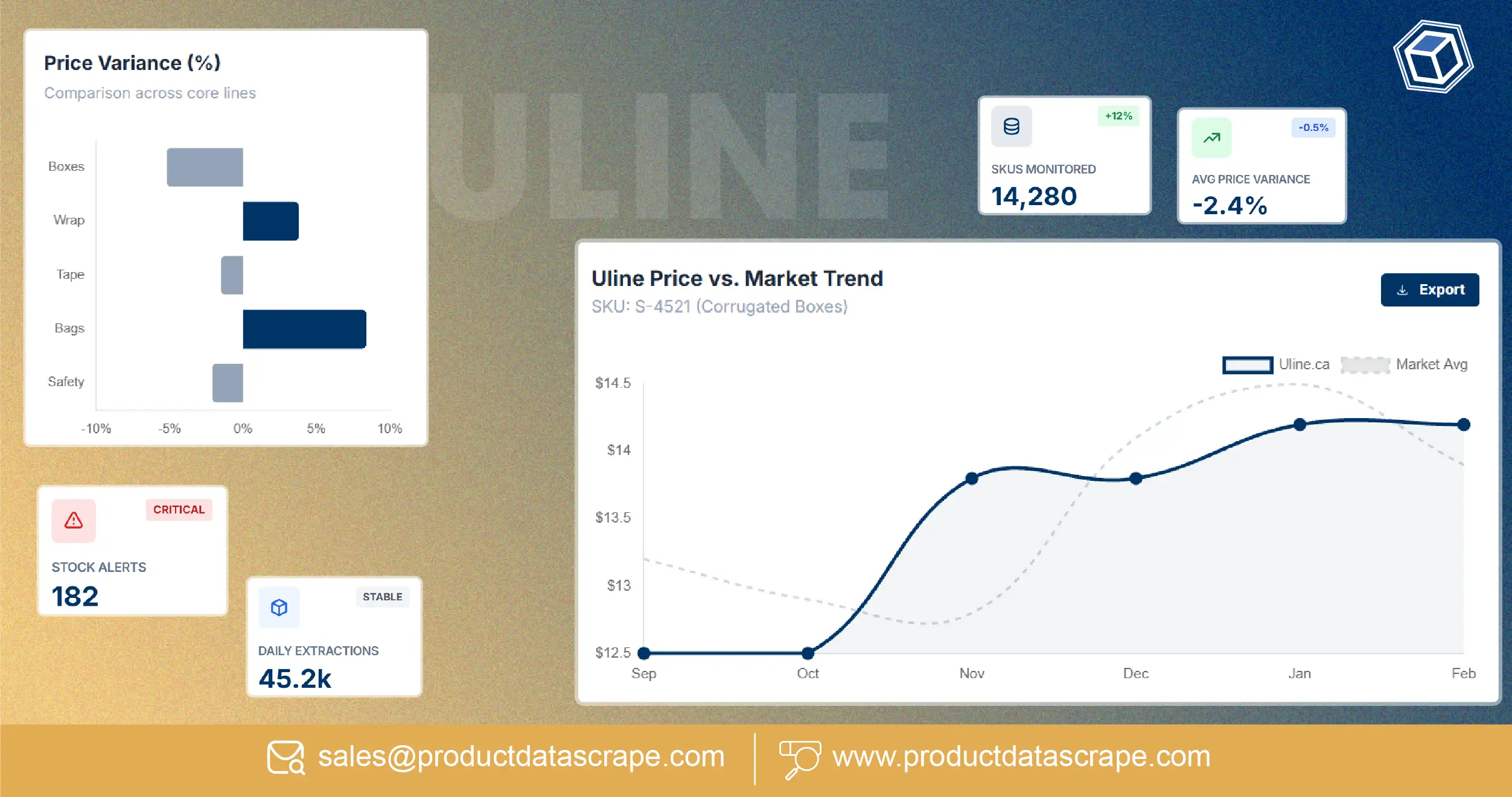

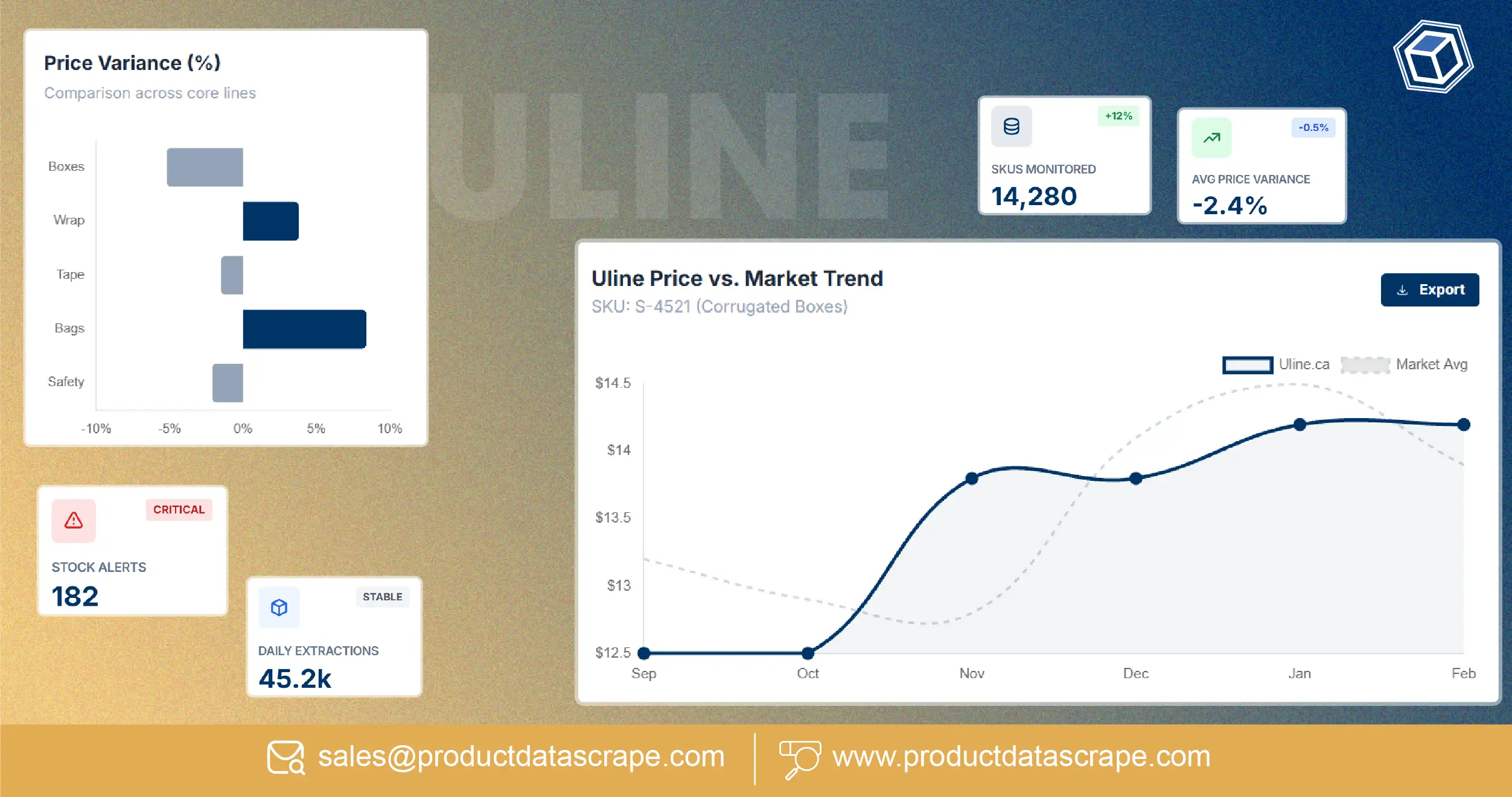

In the B2B supply and industrial procurement ecosystem, pricing accuracy is no longer optional—it is strategic. Companies sourcing packaging, warehouse, safety, and office supplies face constant price fluctuations driven by logistics costs, demand cycles, and supplier competition. This is where Uline.ca Pricing Intelligence Using Web Scraping becomes a game-changer, enabling organizations to convert raw product listings into structured intelligence. With thousands of SKUs changing prices throughout the year, relying on manual tracking leads to missed opportunities and margin erosion.

Modern enterprises increasingly rely on automation to Track Uline product price changes in real time, ensuring that procurement teams, distributors, and resellers stay ahead of market movements. Web scraping transforms Uline.ca’s product data—prices, bulk discounts, availability, and SKU-level variations—into datasets that power smarter decisions. Instead of reacting late to price hikes or stock shortages, businesses gain predictive visibility into trends shaping the B2B supply chain.

By turning unstructured product pages into analyzable datasets, organizations unlock pricing transparency, benchmark supplier competitiveness, and optimize sourcing strategies. The result is faster decision-making, stronger negotiation leverage, and improved profitability across procurement-driven operations.

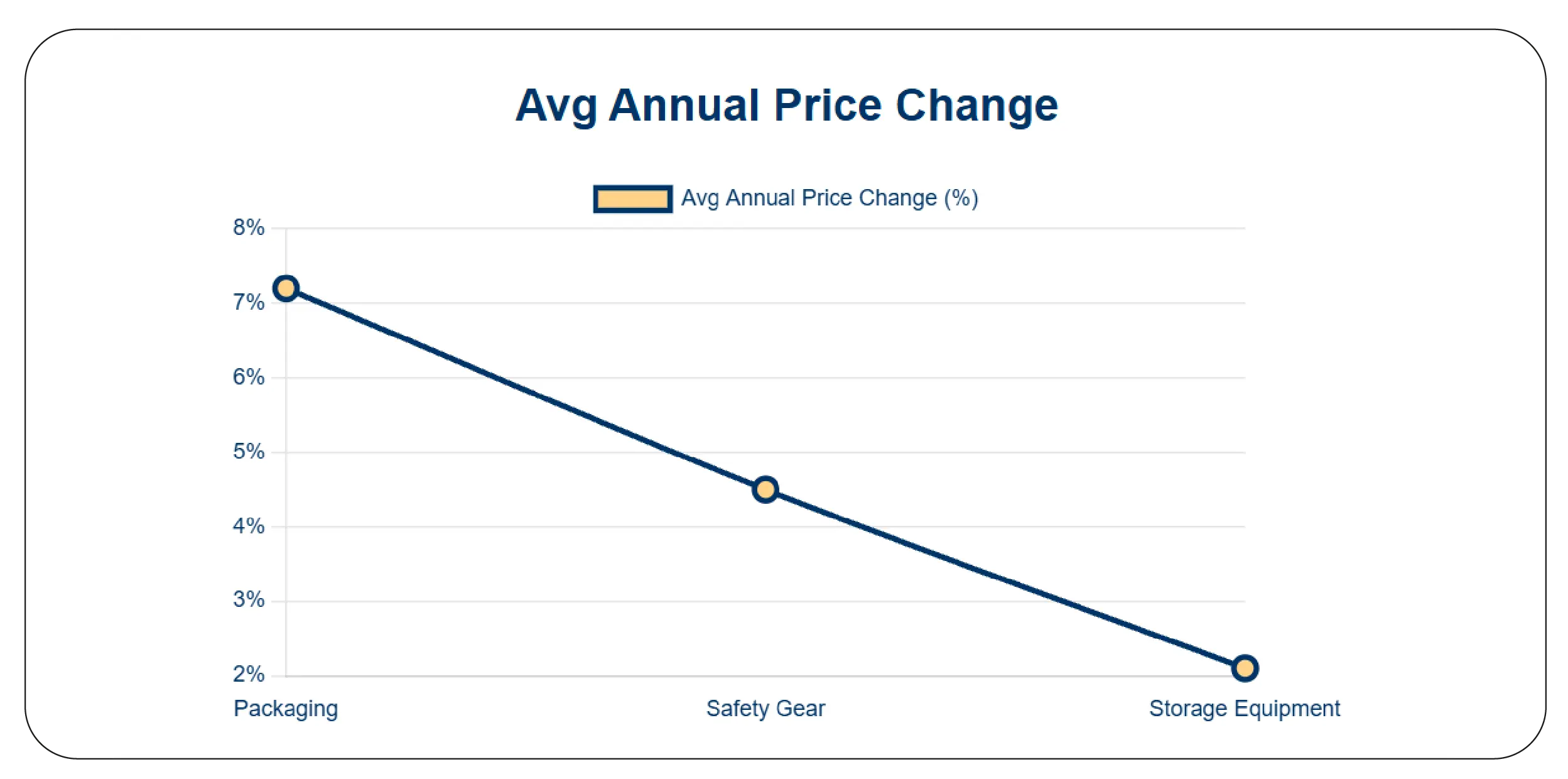

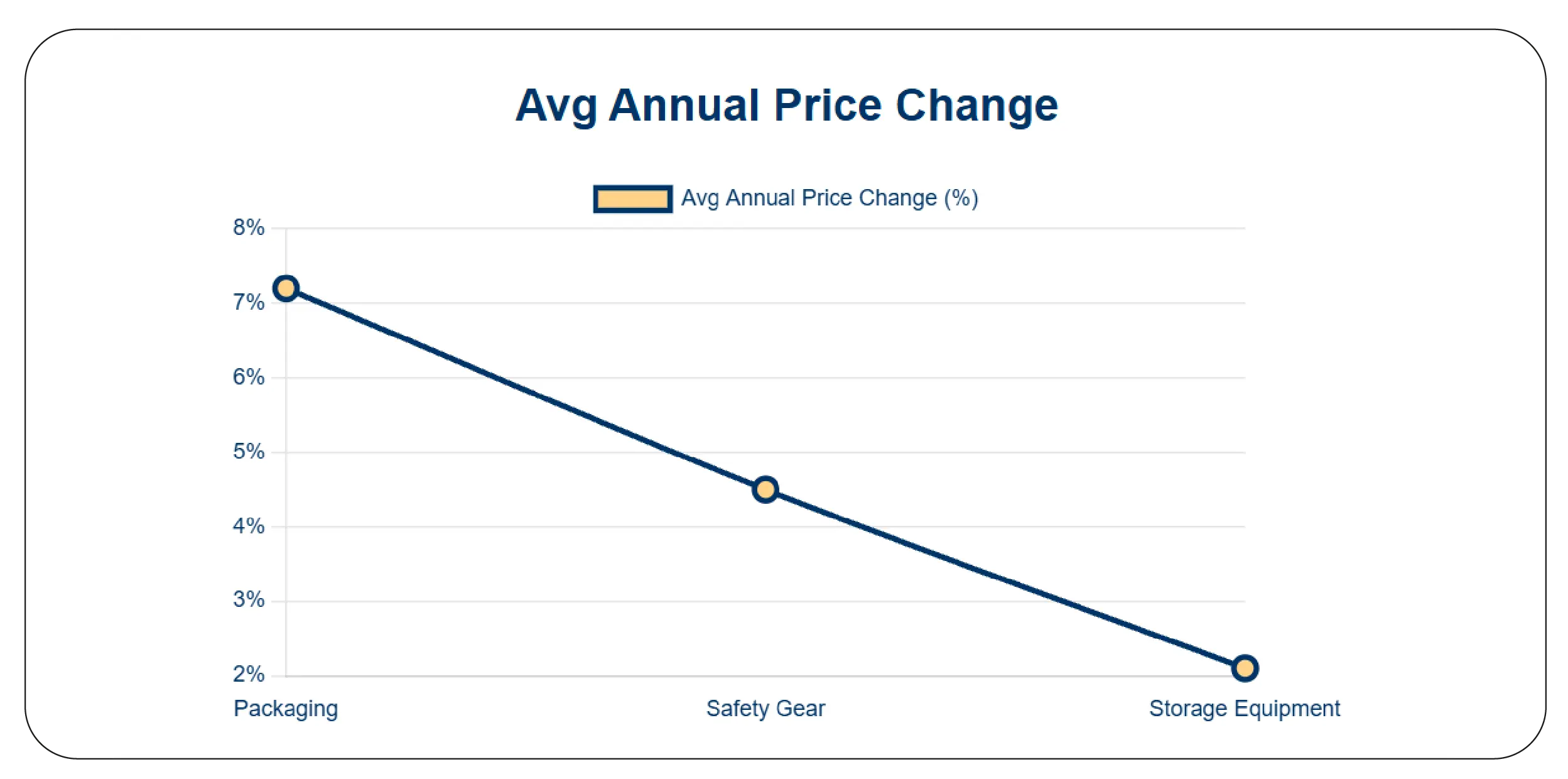

Shaping Competitive Cost Structures with Market Comparisons

Using B2B Price Benchmarking Using Uline Data, organizations compare supplier pricing across years to identify cost trends and negotiation opportunities. Historical data from 2020 to 2026 reveals how industrial pricing evolved in response to global disruptions, inflation, and logistics volatility. For example, packaging supplies experienced notable price increases during 2021–2022, while office consumables stabilized post-2023.

Companies leveraging benchmarking analytics can align procurement budgets with market reality instead of supplier assumptions. By evaluating unit prices, bulk discounts, and seasonal pricing patterns, businesses gain a clearer understanding of when to buy, how much to stock, and which SKUs deliver the best cost efficiency.

Sample Pricing Trend (2020–2026)

| Year |

Avg Packaging SKU Price ($) |

Avg Office Supply Price ($) |

| 2020 |

18.40 |

12.60 |

| 2022 |

24.90 |

15.80 |

| 2024 |

22.10 |

14.30 |

| 2026 |

23.40 |

14.90 |

This intelligence helps enterprises proactively adjust sourcing strategies and reduce exposure to sudden cost spikes.

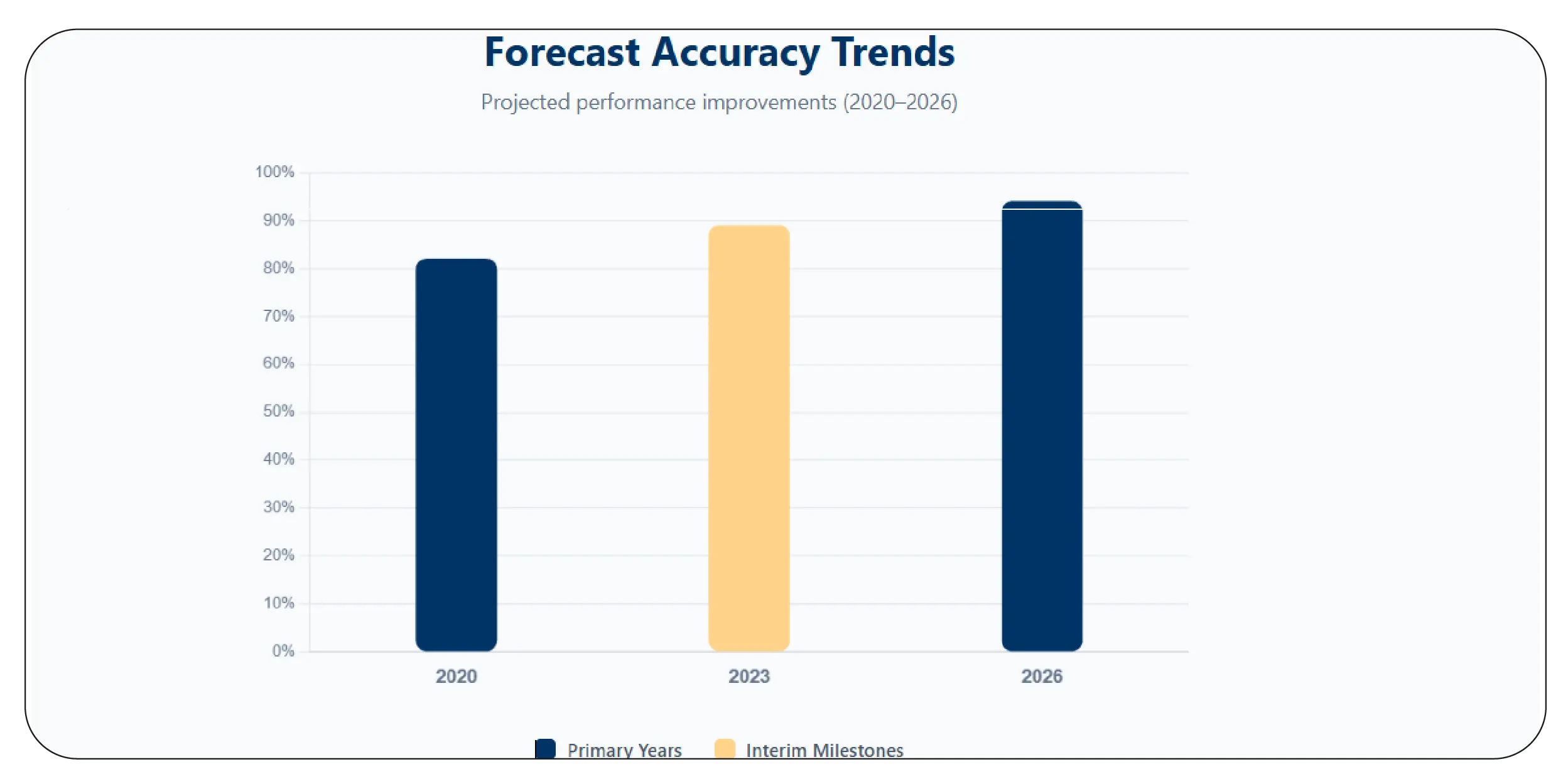

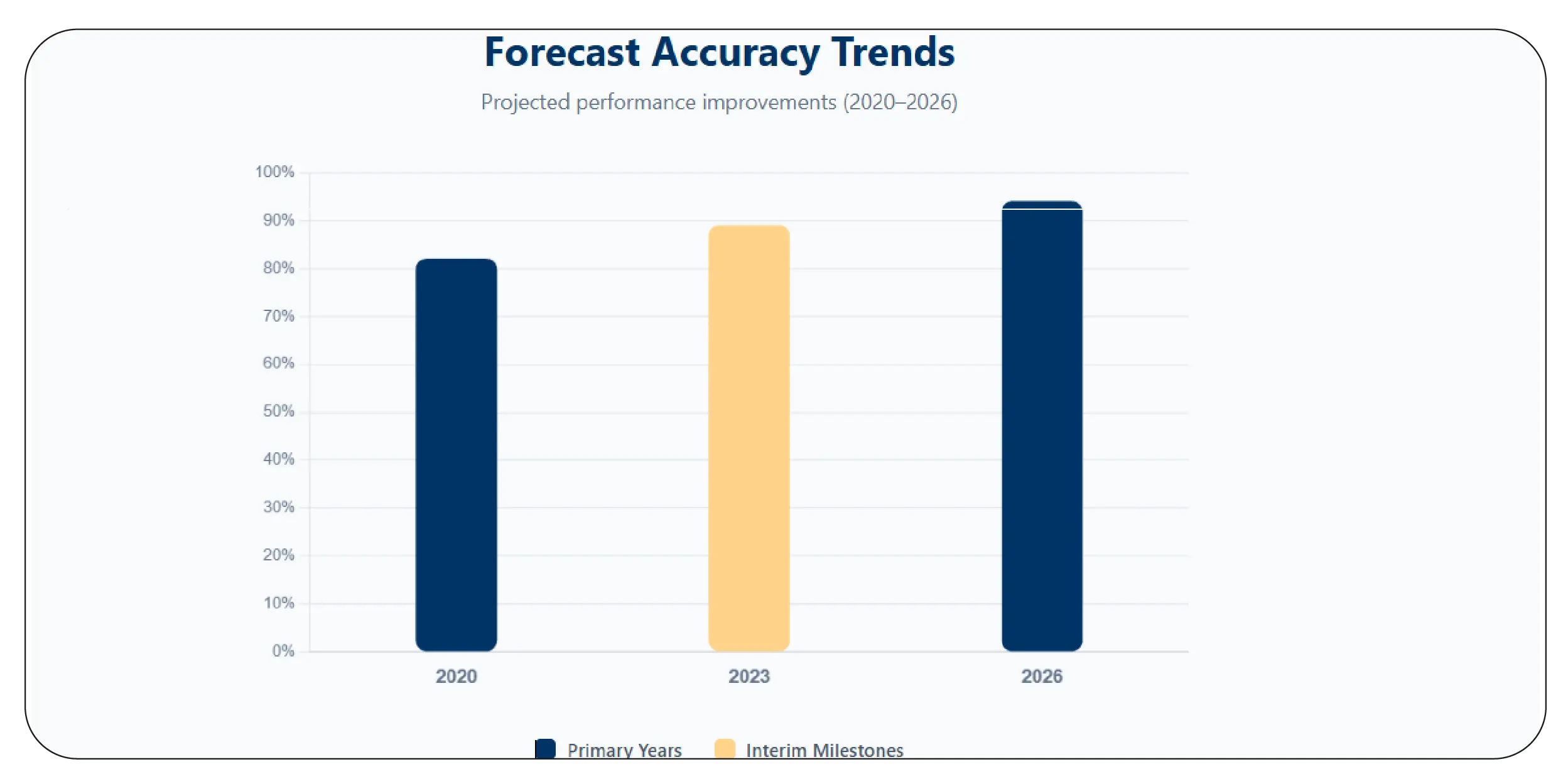

Turning Raw Numbers into Predictive Intelligence

With AI-Powered Industrial Pricing Analytics, businesses move beyond static data into predictive insights. Machine learning models analyze historical price movements, seasonal demand shifts, and category-level volatility to forecast future pricing scenarios. This is particularly valuable in industrial and logistics-driven categories where price sensitivity directly impacts operational budgets.

Between 2020 and 2026, AI-driven pricing models have helped companies identify early indicators of price inflation—such as raw material cost signals or demand surges in packaging supplies. These insights enable procurement teams to lock in favorable pricing before market-wide increases occur.

AI-Driven Price Forecast Accuracy

By embedding AI into pricing analytics, businesses replace reactive buying with forward-looking strategies that protect margins and ensure supply continuity.

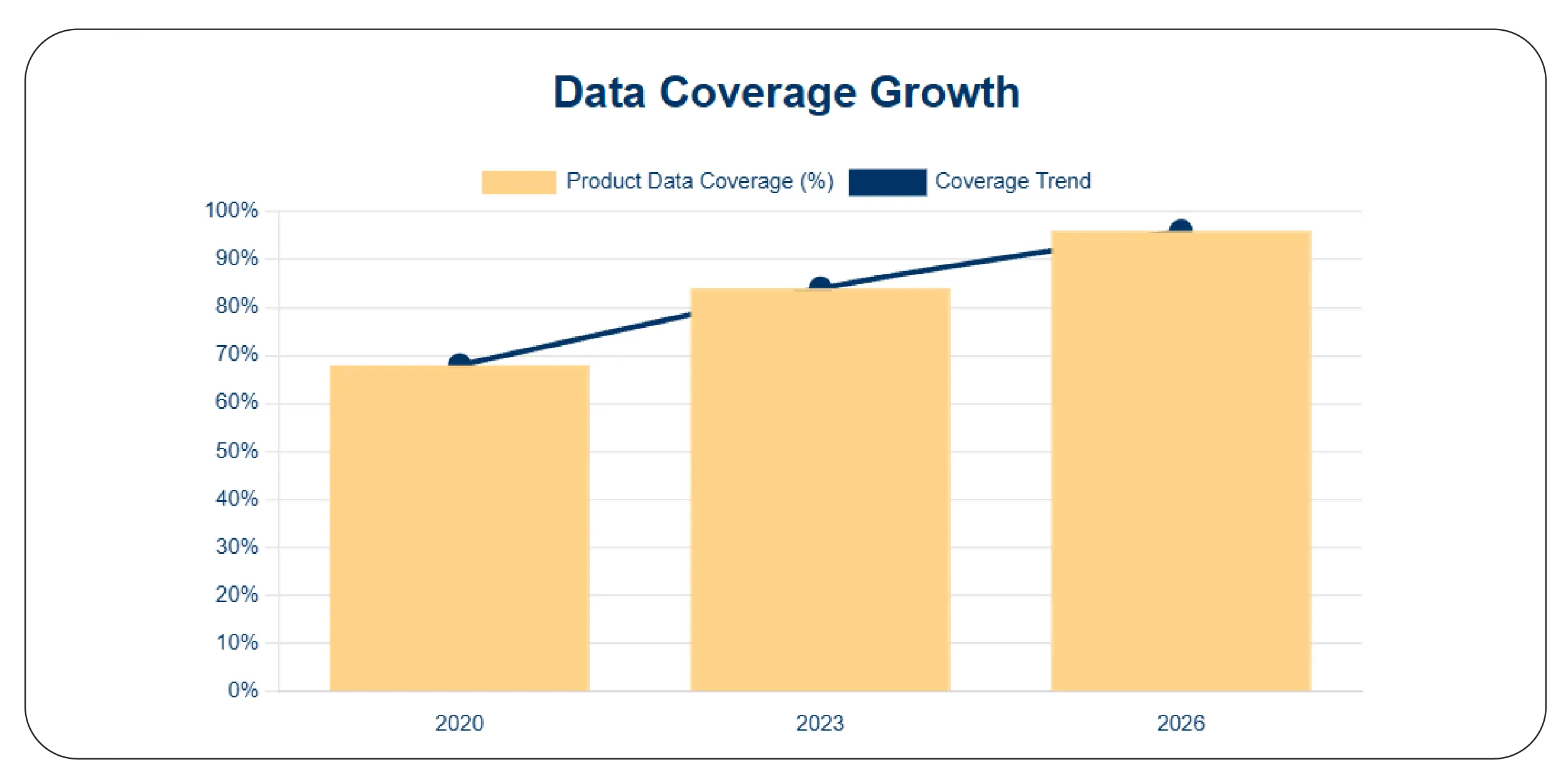

Building Reliable Pricing Intelligence Pipelines

To Extract Uline product pricing data, organizations deploy automated scraping systems that capture structured information directly from product listings. This includes base prices, bulk-tier pricing, SKU variations, and availability indicators. Unlike manual monitoring, automated extraction ensures consistency, accuracy, and scalability.

From 2020 onward, companies increasingly adopted automated data pipelines to support procurement analytics, resulting in faster pricing updates and fewer errors. As SKU counts grow year over year, scalable extraction becomes critical to maintaining data reliability.

SKU Coverage Growth

| Year |

SKUs Tracked |

| 2020 |

3,500 |

| 2023 |

6,800 |

| 2026 |

9,200 |

This level of coverage empowers organizations to analyze pricing behavior at both macro and SKU-specific levels.

Monitoring Price Shifts at the SKU Level

With Uline SKU-Level Pricing Analytics Data Scraper, businesses track price changes at the most granular level. SKU-level intelligence highlights which products experience frequent price changes and which remain stable over time. This insight is crucial for inventory planning and contract negotiations.

For instance, high-volume consumables such as cartons and gloves often exhibit quarterly price adjustments, while durable storage solutions remain relatively stable. Understanding these patterns allows procurement teams to prioritize strategic buying.

SKU Price Volatility Example

Granular monitoring ensures procurement decisions are data-backed rather than assumption-driven.

Transforming Data into Strategic Services

Through advanced Pricing Intelligence Services, scraped Uline.ca data is transformed into dashboards, alerts, and reports that support decision-making across departments. Finance teams assess budget impact, procurement teams negotiate better contracts, and leadership teams evaluate supplier performance.

Between 2020 and 2026, organizations using pricing intelligence services reduced procurement costs by identifying overpriced SKUs and shifting volume toward cost-efficient alternatives. These services enable cross-functional collaboration through shared visibility.

Cost Optimization Impacts

| Year |

Avg Cost Savings |

| 2021 |

6% |

| 2024 |

11% |

| 2026 |

15% |

Pricing intelligence becomes a strategic asset rather than a tactical tool.

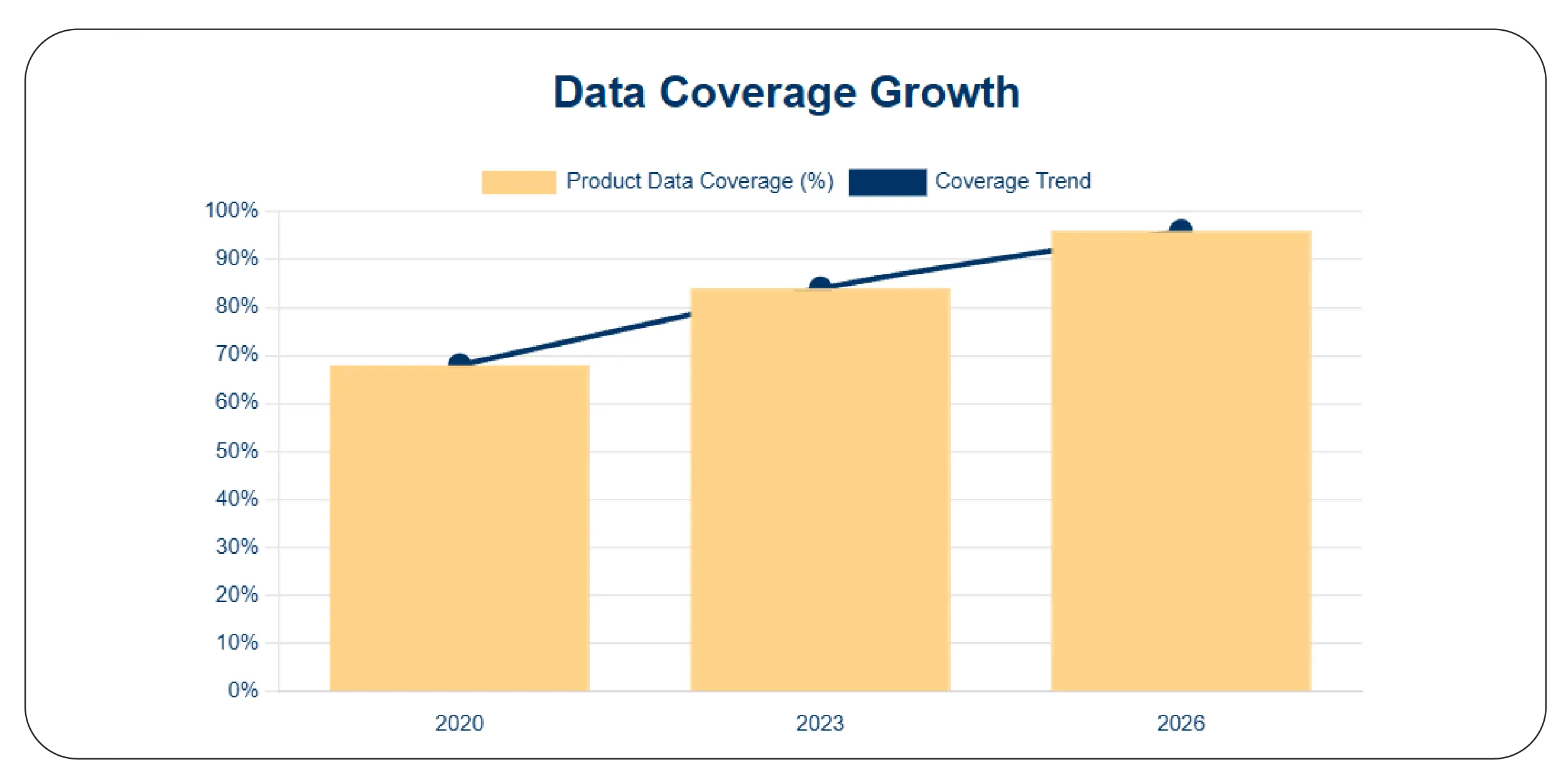

Unlocking Full Product Visibility

Using Data scraping for Uline.ca to get product data, companies gain access to a holistic view of product catalogs—pricing, availability, pack sizes, and updates. This visibility supports demand planning, supplier evaluation, and long-term sourcing strategies.

By 2026, businesses leveraging comprehensive scraping frameworks experienced faster response times to market changes and reduced dependency on supplier-provided pricing feeds.

Data Coverage Growth

Complete visibility ensures no critical pricing signals are missed.

Why Choose Product Data Scrape?

Product Data Scrape delivers scalable solutions to Extract Uline Office & Supply Data with accuracy, speed, and reliability. Our platforms support real-time pipelines, historical tracking, and enterprise-ready dashboards. By enabling Uline.ca Pricing Intelligence Using Web Scraping, we help businesses replace manual monitoring with automated, insight-driven workflows that improve procurement efficiency and pricing confidence.

Conclusion

Access to structured, real-time product intelligence is essential for modern B2B operations. By leveraging a reliable Uline Product Dataset, organizations turn raw listings into actionable insights that support smarter sourcing, stronger negotiations, and better cost control. With Uline.ca Pricing Intelligence Using Web Scraping, businesses gain the clarity needed to adapt quickly to market changes and maintain a competitive edge.

Ready to transform Uline.ca product data into pricing intelligence? Partner with us to unlock smarter decisions today!

FAQs

1. What data can be extracted from Uline.ca?

Pricing, SKU details, availability, bulk discounts, and historical changes for procurement analytics.

2. How often can pricing data be updated?

Near real-time or scheduled updates depending on business requirements and data volume.

3. Is scraped data suitable for enterprise analytics?

Yes, structured datasets integrate seamlessly with BI tools and procurement platforms.

4. Can historical pricing trends be analyzed?

Absolutely, multi-year datasets support long-term trend analysis and forecasting.

5. Who should use Product Data Scrape?

Manufacturers, distributors, and procurement teams seeking automated pricing intelligence solutions.

.webp)

.webp)

.webp)