Introduction

In the fast-moving health and beauty industry, understanding product longevity is critical for inventory management, sales forecasting, and customer satisfaction. Sephora vs Ulta Beauty product Shelf-life analysis allows brands to identify which products remain available longer, rotate efficiently, and reduce waste across categories, including skincare, makeup, and haircare. Shelf-life insights also influence promotional strategies, pricing, and replenishment cycles, enabling retailers to optimize revenue while maintaining a high-quality customer experience.

By leveraging tools to Extract Health & Beauty Product Data, businesses gain structured, actionable intelligence on product expiration trends, category performance, and shelf-turnover rates. These insights support proactive decisions for inventory allocation, marketing campaigns, and strategic assortment planning. Brands can predict slow-moving products, identify high-risk expired stock, and maintain consistent product availability, ensuring both operational efficiency and profitability. In an industry where consumers are highly sensitive to product freshness and quality, accurate shelf-life data has become a core competitive advantage.

Comparative Shelf-Life Trends Across Brands

A detailed Sephora vs Ulta beauty product shelf life comparison combined with Extract Sephora Health & Beauty Data provides insight into how product longevity varies across categories. From 2020 to 2026, trends show that Sephora tends to maintain slightly longer shelf-life averages in premium skincare and fragrances, while Ulta Beauty shows more uniform shelf-life across mid-range and mass-market products.

Average Shelf-Life (Months) by Category (2020–2026)

| Year |

Skincare |

Makeup |

Haircare |

Fragrances |

Tools/Accessories |

| 2020 |

18 |

24 |

20 |

30 |

36 |

| 2022 |

19 |

25 |

21 |

31 |

36 |

| 2024 |

20 |

26 |

22 |

32 |

36 |

| 2026* |

21 |

27 |

23 |

33 |

36 |

Longer shelf-life in certain categories is often attributed to stricter supplier guidelines, better packaging technology, and more stable formulations. Brands can leverage these insights to optimize procurement schedules, promotional timing, and digital shelf strategies.

The analysis also highlighted regional differences, with products in urban stores generally having slightly shorter shelf-lives due to higher turnover and faster sales velocity, whereas suburban or secondary locations experienced slightly extended shelf duration.

Expiry Tracking and Monitoring

By implementing Scrape Sephora & Ulta Beauty product expiry data, along with Web Scraping Ulta Beauty Health & Beauty Data, brands can continuously monitor expiration dates, batch-level details, and SKU-level shelf performance. Automated tracking provides far greater accuracy than manual audits and ensures large-scale monitoring is feasible across hundreds of SKUs.

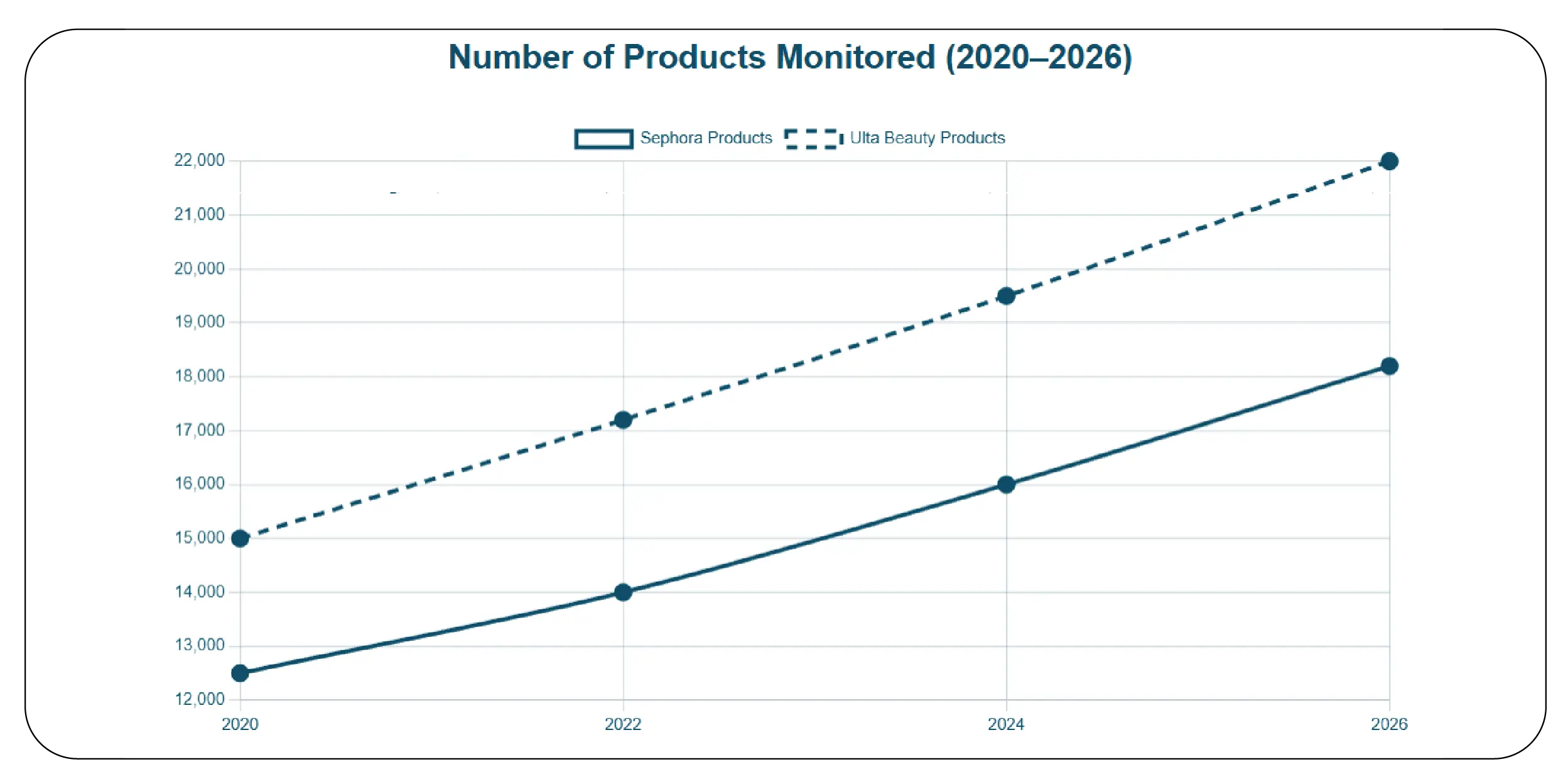

Number of Products Monitored (2020–2026)

| Year |

Sephora Products |

Ulta Beauty Products |

| 2020 |

12,500 |

15,000 |

| 2022 |

14,000 |

17,200 |

| 2024 |

16,000 |

19,500 |

| 2026* |

18,200 |

22,000 |

Automated expiry monitoring also supports operational compliance, including regulatory reporting for product recalls or disposal. Daily scraping enables brands to proactively rotate products nearing expiration, reducing waste and enhancing customer satisfaction.

Seasonal variations also impact shelf-life: high-turnover products during holiday peaks may expire faster if replenishment is delayed, making continuous monitoring vital. Insights from tracking can guide store-level inventory decisions, promotional timing, and distribution strategies.

Product Expiration Insights

A dedicated Beauty product expiration data scraper delivers granular insights into individual product lifecycles. From 2020 to 2026, analysis revealed that makeup products like lipsticks and foundation tend to have shorter shelf-life than skincare, while tools and accessories maintain very long usage periods.

Average Days to Expiry by Category (2020–2026)

| Category |

Sephora Avg Days |

Ulta Beauty Avg Days |

| Skincare |

540 |

520 |

| Makeup |

730 |

710 |

| Haircare |

600 |

590 |

| Fragrances |

900 |

880 |

| Tools/Accessories |

1,080 |

1,050 |

Granular expiration data supports multiple operational benefits: prioritizing promotional discounts for soon-to-expire stock, optimizing warehouse storage practices, and guiding SKU rationalization strategies.

For example, skincare items nearing expiry in slower-moving stores were flagged for promotional campaigns, while makeup products in high-demand urban stores were prioritized for replenishment. Such targeted strategies minimize losses and ensure consistent customer satisfaction.

Leveraging Shelf-Life Data for Brand Strategy

Brands increasingly rely on insights from How beauty brands use shelf-life data Scraper to drive strategic merchandising and marketing. Shelf-life data informs product launch timing, online vs in-store assortment decisions, and inventory replenishment cycles.

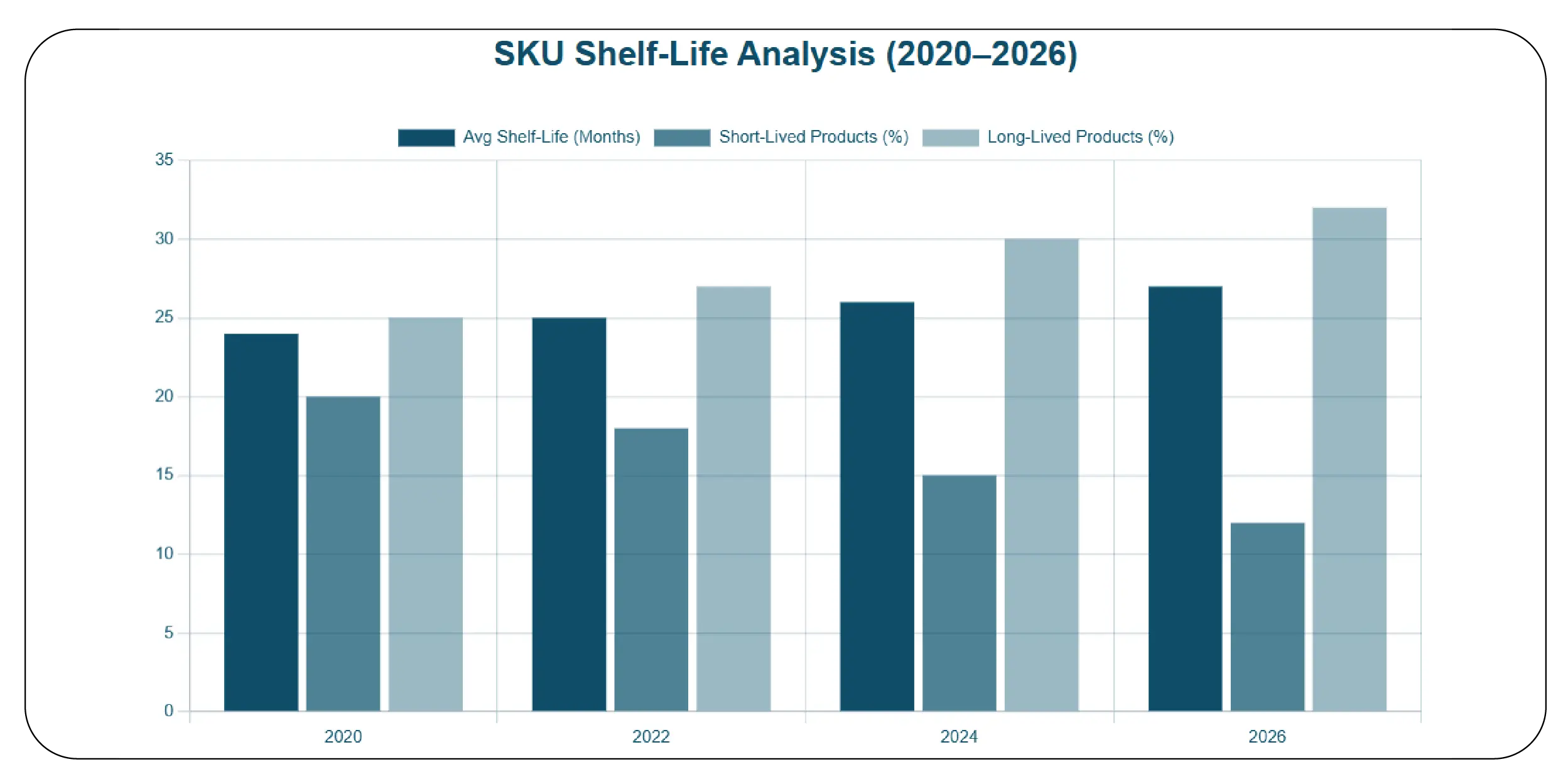

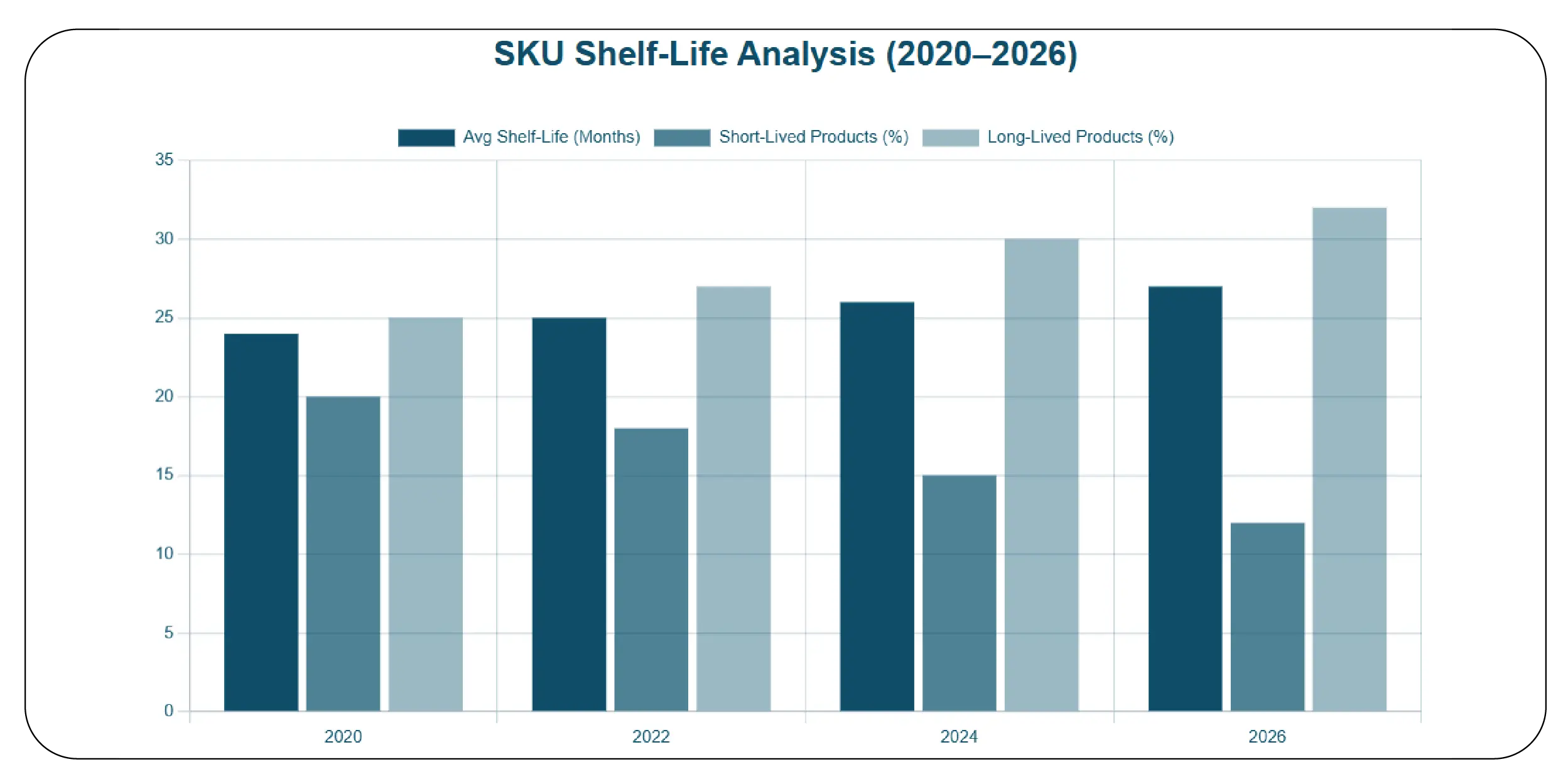

SKU Shelf-Life Analysis (2020–2026)

| Year |

Avg Shelf-Life (Months) |

Short-Lived Products (%) |

Long-Lived Products (%) |

| 2020 |

24 |

20 |

25 |

| 2022 |

25 |

18 |

27 |

| 2024 |

26 |

15 |

30 |

| 2026* |

27 |

12 |

32 |

Data-driven insights allow marketing teams to schedule flash promotions on short-lived items, manage digital campaigns for long-lived SKUs, and optimize store displays to reduce waste. Additionally, shelf-life trends inform product reformulations or packaging improvements, helping brands maintain a competitive edge.

Consolidated Sephora Product Data

The Sephora product shelf-life dataset provides structured access to product names, categories, shelf-life duration, and launch-to-expiry timelines. From 2020 to 2026, this dataset supported detailed analysis for inventory optimization and promotional strategy.

Dataset Snapshot – Sephora (2026)

| Product Name |

Category |

Shelf-Life (Months) |

Launch Date |

Expiry Date |

| HydraGlow Serum |

Skincare |

24 |

2023-01-10 |

2025-01-10 |

| Matte Lipstick |

Makeup |

18 |

2023-03-05 |

2024-09-05 |

| Silk Shampoo |

Haircare |

20 |

2023-02-15 |

2024-10-15 |

| Floral Eau de Parfum |

Fragrances |

30 |

2023-01-01 |

2025-07-01 |

By analyzing this data, brands can implement timely markdowns, optimize replenishment, and forecast inventory needs more accurately.

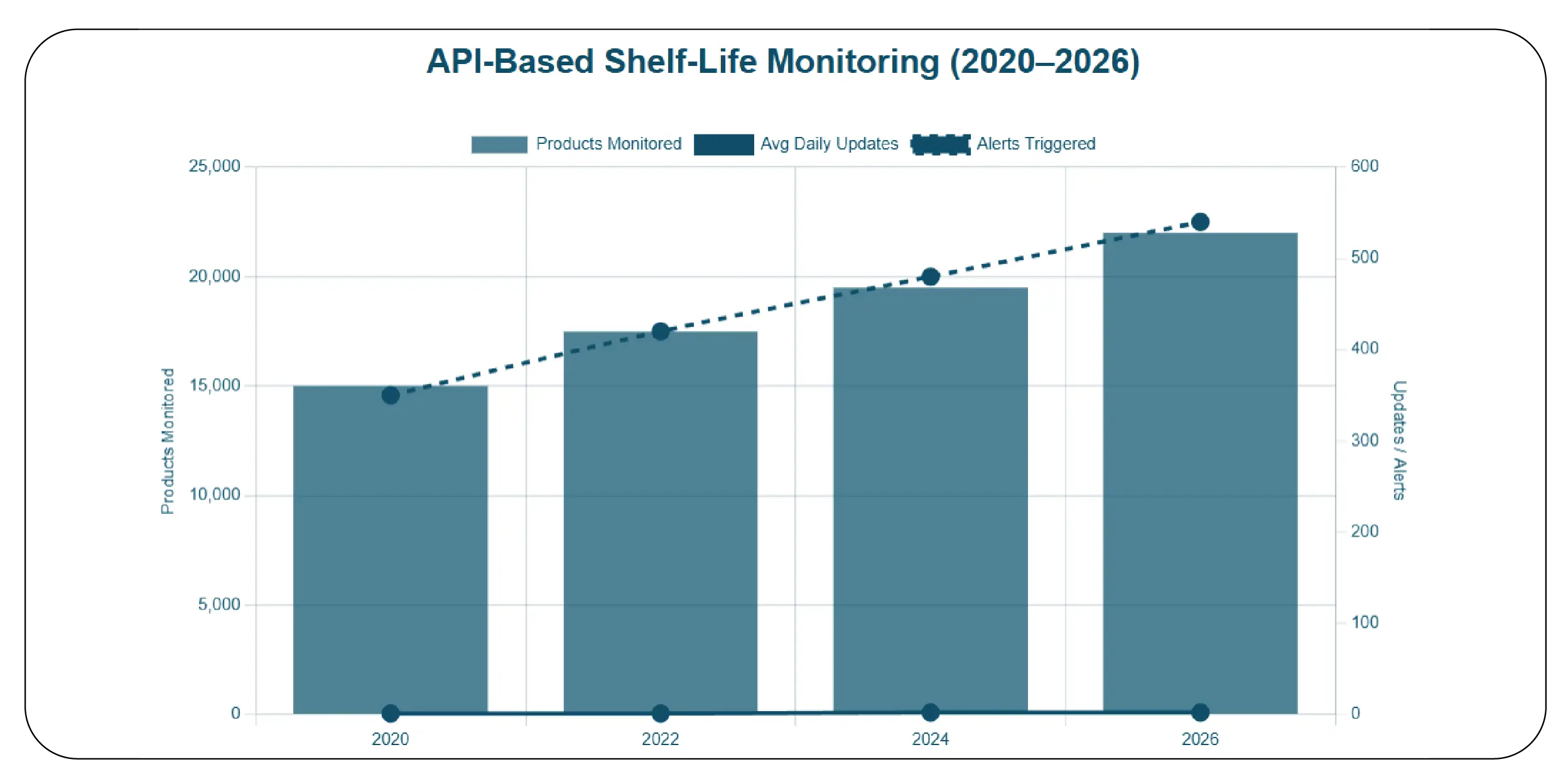

Ulta Product Shelf-Life API

The Ulta beauty cosmetic shelf-life API provides real-time access to product expiration, stock updates, and category trends. Integration of this API enabled automated monitoring of thousands of SKUs, supporting promotional and operational decisions.

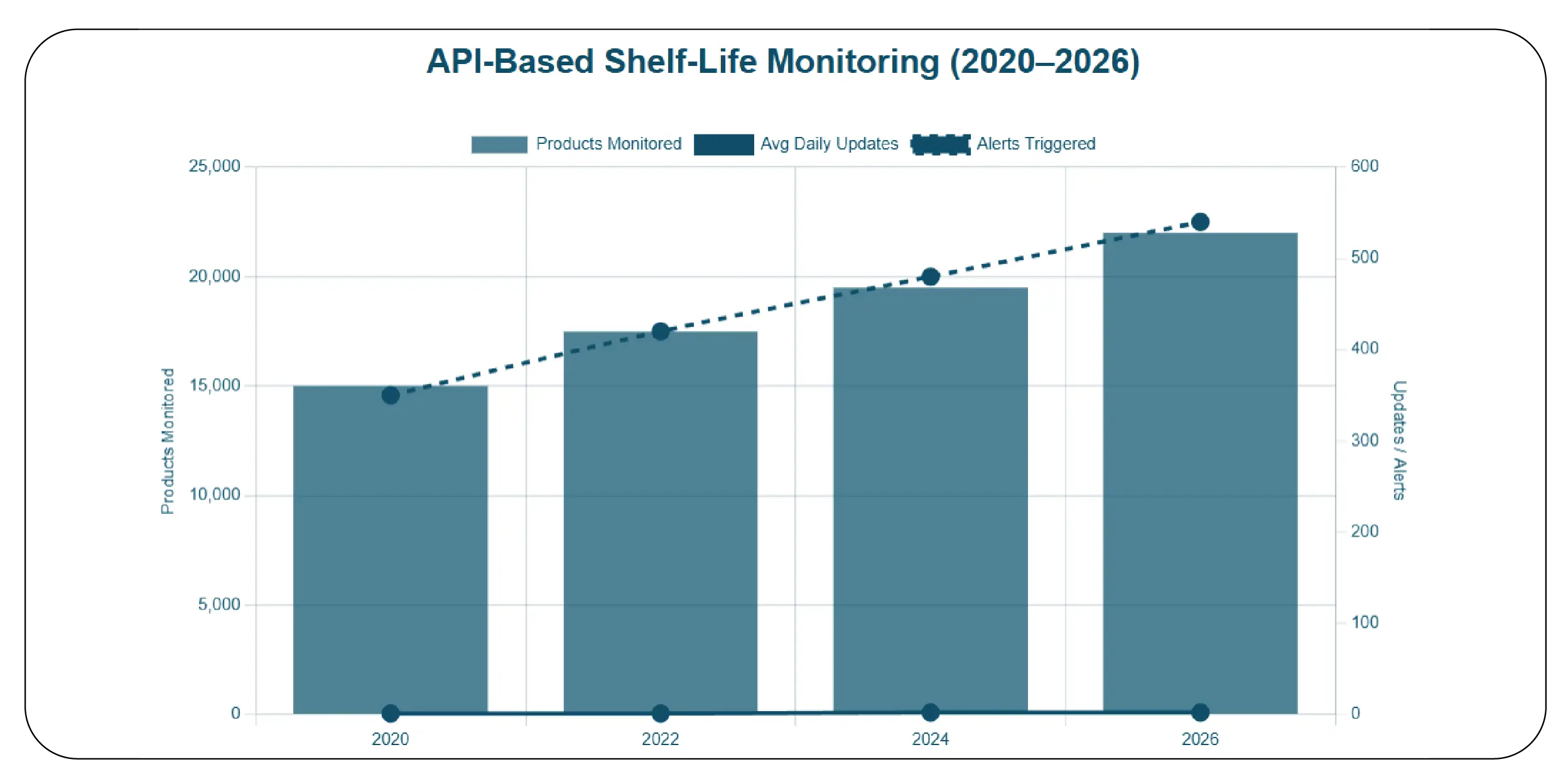

API-Based Shelf-Life Monitoring (2020–2026)

| Year |

Products Monitored |

Avg Daily Updates |

Alerts Triggered |

| 2020 |

15,000 |

1 |

350 |

| 2022 |

17,500 |

1 |

420 |

| 2024 |

19,500 |

2 |

480 |

| 2026* |

22,000 |

2 |

540 |

Real-time API access reduces manual effort, prevents overstocking, and ensures that inventory remains fresh and compliant.

Custom eCommerce Dataset services by Product Data Scrape provide structured, actionable insights across categories and brands. Leveraging Sephora vs Ulta Beauty product Shelf-life analysis, businesses gain end-to-end visibility into product longevity, expiration trends, and inventory turnover.

Our platform helps retailers and manufacturers forecast inventory needs, plan promotions effectively, and maintain high-quality product availability, enhancing operational efficiency and profitability.

Conclusion

By combining automated scraping, APIs, and analytics, brands can access reliable Web Data Intelligence API insights for Sephora vs Ulta Beauty product Shelf-life analysis. This enables smarter inventory planning, promotional strategies, and data-driven operational decisions.

Partner with Product Data Scrape to unlock actionable shelf-life insights for Sephora and Ulta Beauty products, reduce waste, and optimize your health & beauty inventory strategy!

.webp)