Quick Overview

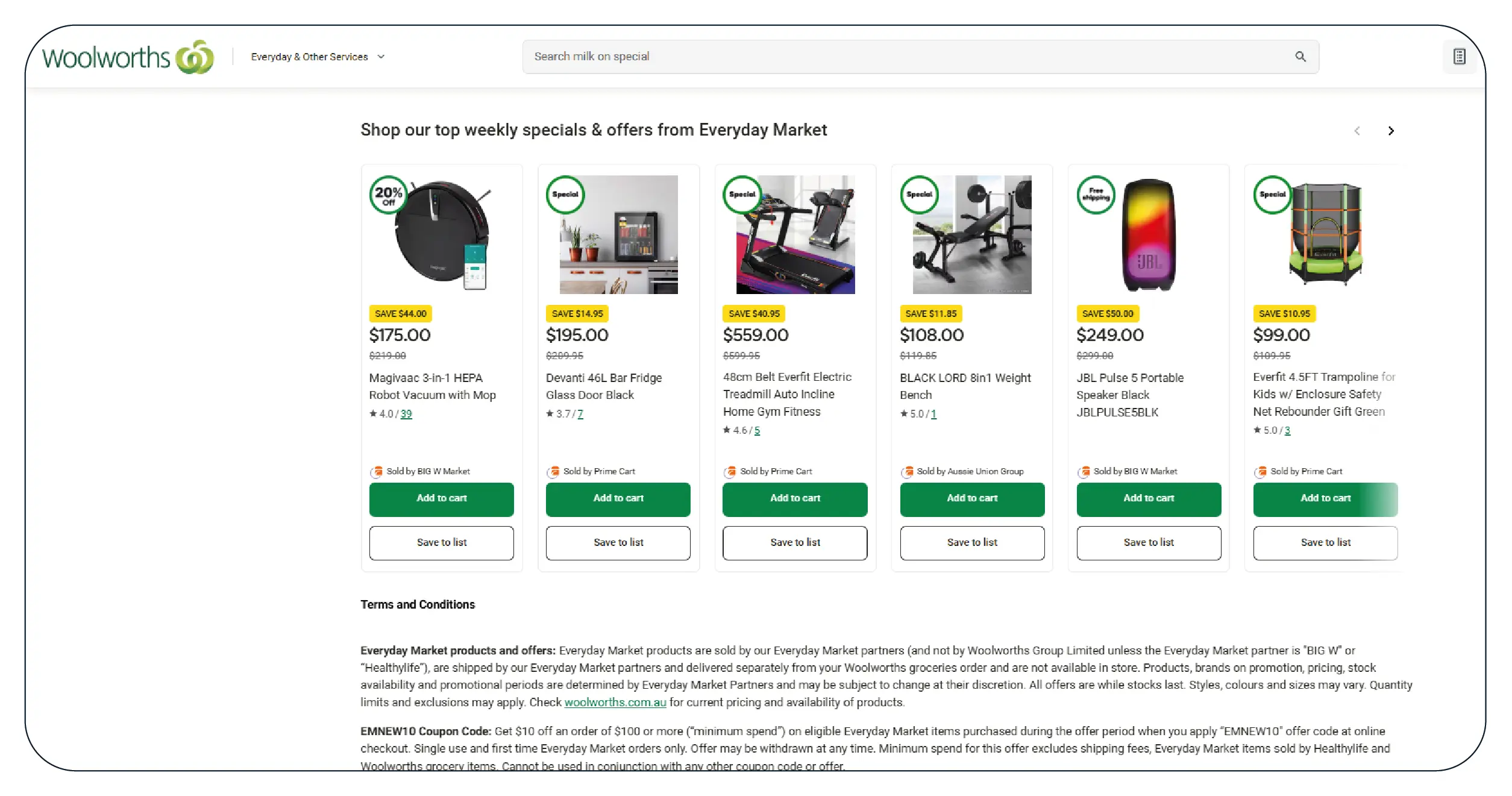

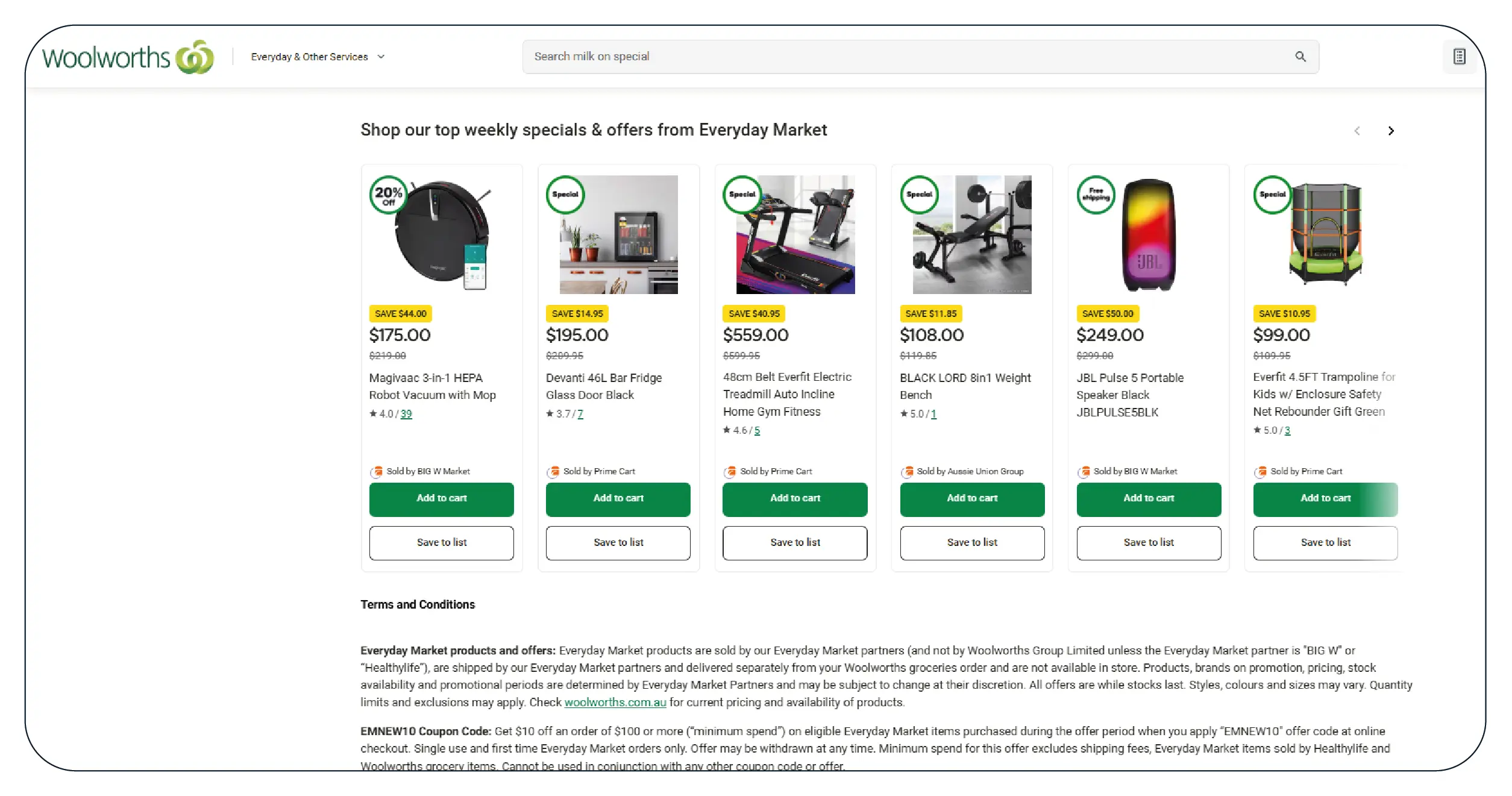

A leading Australian omnichannel retailer partnered with Product Data Scrape to uncover missed opportunities across its massive online catalog. Operating in the general merchandise and consumer goods sector, the client needed a faster, smarter way to analyze competitors and market demand. Through Web scraping Australia's major retailers and the ability to Scrape Data From Any Ecommerce Websites, our team delivered a three-month engagement that transformed how the brand viewed assortment strategy. The solution enabled near real-time visibility into competitor product ranges, availability patterns, and trending categories. As a result, the retailer reduced product blind spots, improved assortment accuracy, and accelerated decision-making across merchandising teams. Within the first quarter, the brand expanded into high-demand subcategories it had previously overlooked and strengthened its competitive position in Australia’s fast-evolving retail landscape.

The Client

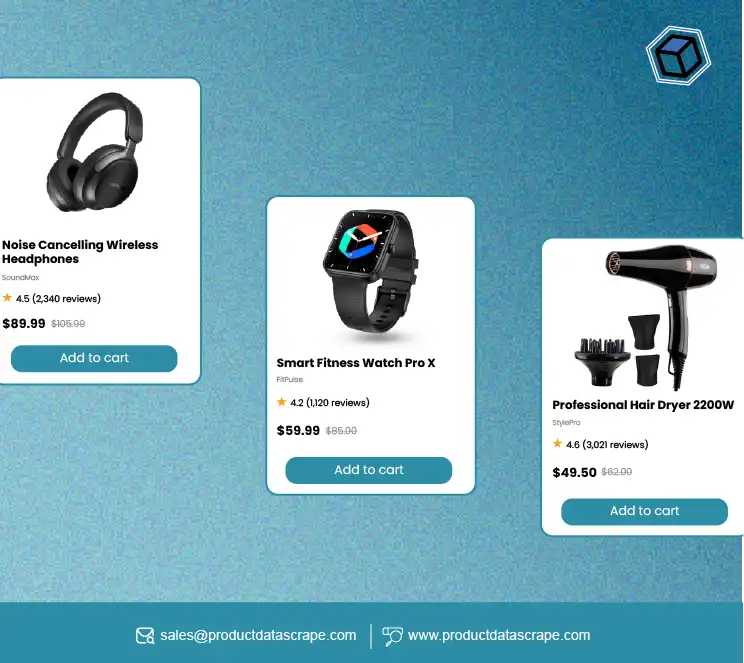

The client is one of Australia’s largest digital-first retail platforms, operating across electronics, home essentials, lifestyle products, and seasonal merchandise. In recent years, the Australian ecommerce market has become intensely competitive, driven by global marketplaces, rapid delivery expectations, and data-driven merchandising strategies. This pressure made transformation unavoidable.

Before working with Product Data Scrape, the retailer relied heavily on internal sales reports and limited third-party tools. While these systems showed what was selling, they failed to reveal what customers were searching for but could not find. Leadership realized that competitor data scraping in the Australian market was essential to remain relevant and future-ready. However, their existing methods lacked scalability and consistency. They had no centralized scraped product dataset australia to support category planning or innovation.

The situation created blind spots in assortment planning, delayed product launches, and missed revenue opportunities. To stay competitive, the retailer needed a partner that could deliver actionable insights at speed—transforming raw market data into strategic intelligence that merchandising and category teams could trust.

Goals & Objectives

Build a scalable intelligence system to track competitor assortments.

Improve speed and accuracy in identifying emerging product trends.

Strengthen category planning with data-backed insights.

Implement web scraping australian retail websites to collect product, pricing, and availability data at scale.

Automate data pipelines to eliminate manual research.

Enable real-time dashboards for merchandising and strategy teams.

Increase competitor product coverage by 3x.

Reduce time-to-insight by 60%.

Improve assortment accuracy by 40% within six months.

The Core Challenge

Despite its strong digital presence, the retailer struggled with limited visibility into the broader market. Teams manually monitored a small set of competitors, which created fragmented insights and delayed responses to trends. The inability to consistently Scrape Products from E-Commerce Websites meant that many high-demand categories went unnoticed until competitors had already established dominance.

Operational bottlenecks were common. Analysts spent hours compiling data that was outdated by the time it reached decision-makers. Quality issues also emerged, as inconsistent data sources led to conflicting interpretations of market demand. These challenges slowed innovation and created risk in category expansion decisions. Without a reliable, automated system, the brand was constantly playing catch-up—reacting to the market instead of shaping it.

Our Solution

Product Data Scrape designed a phased, insight-driven approach to help the client transform assortment intelligence and identify product gaps using web scraping.

Phase 1 – Strategic Discovery: We began by aligning with merchandising, category, and digital teams to understand business priorities. High-impact product categories and competitor groups were mapped to ensure data relevance from day one.

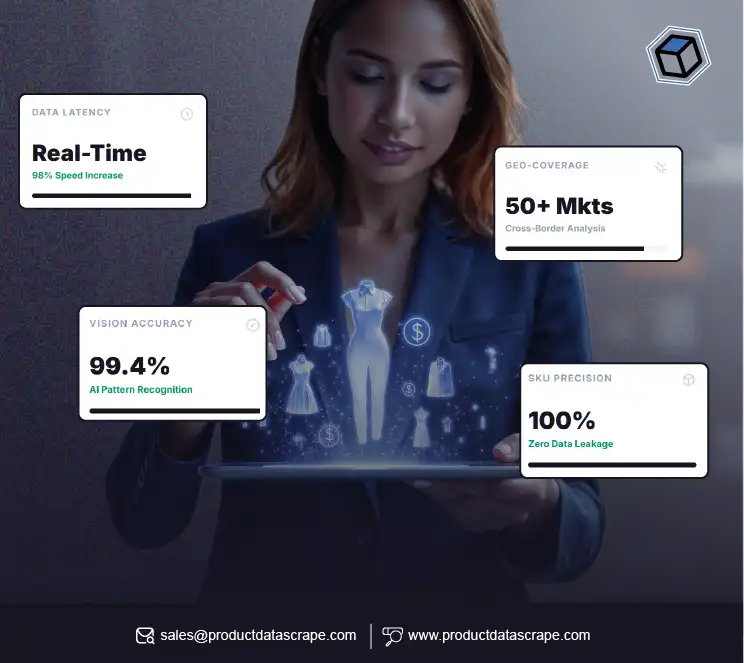

Phase 2 – Scalable Data Collection: Using advanced crawling frameworks and adaptive scraping technology, we automated the extraction of product listings, prices, stock levels, and customer ratings across major Australian retail platforms. This ensured continuous, high-quality data flow without manual intervention.

Phase 3 – Intelligence Layer: Collected data was normalized and enriched to build a unified product intelligence hub. Advanced analytics models compared the client’s catalog with competitor assortments, highlighting whitespace opportunities—products customers wanted but the brand did not yet offer.

Phase 4 – Actionable Insights: We integrated dashboards and automated alerts into the client’s BI environment, enabling teams to spot trends instantly. Merchandisers could now identify emerging categories, fast-growing subsegments, and underrepresented brands in real time.

Phase 5 – Optimization & Scale: Finally, we refined crawl schedules and validation rules to ensure accuracy at scale. The system expanded from a pilot across a few categories to full-market coverage—supporting long-term strategic planning and innovation.

This structured approach transformed raw data into a decision-making engine that empowered the client to move faster, smarter, and with greater confidence.

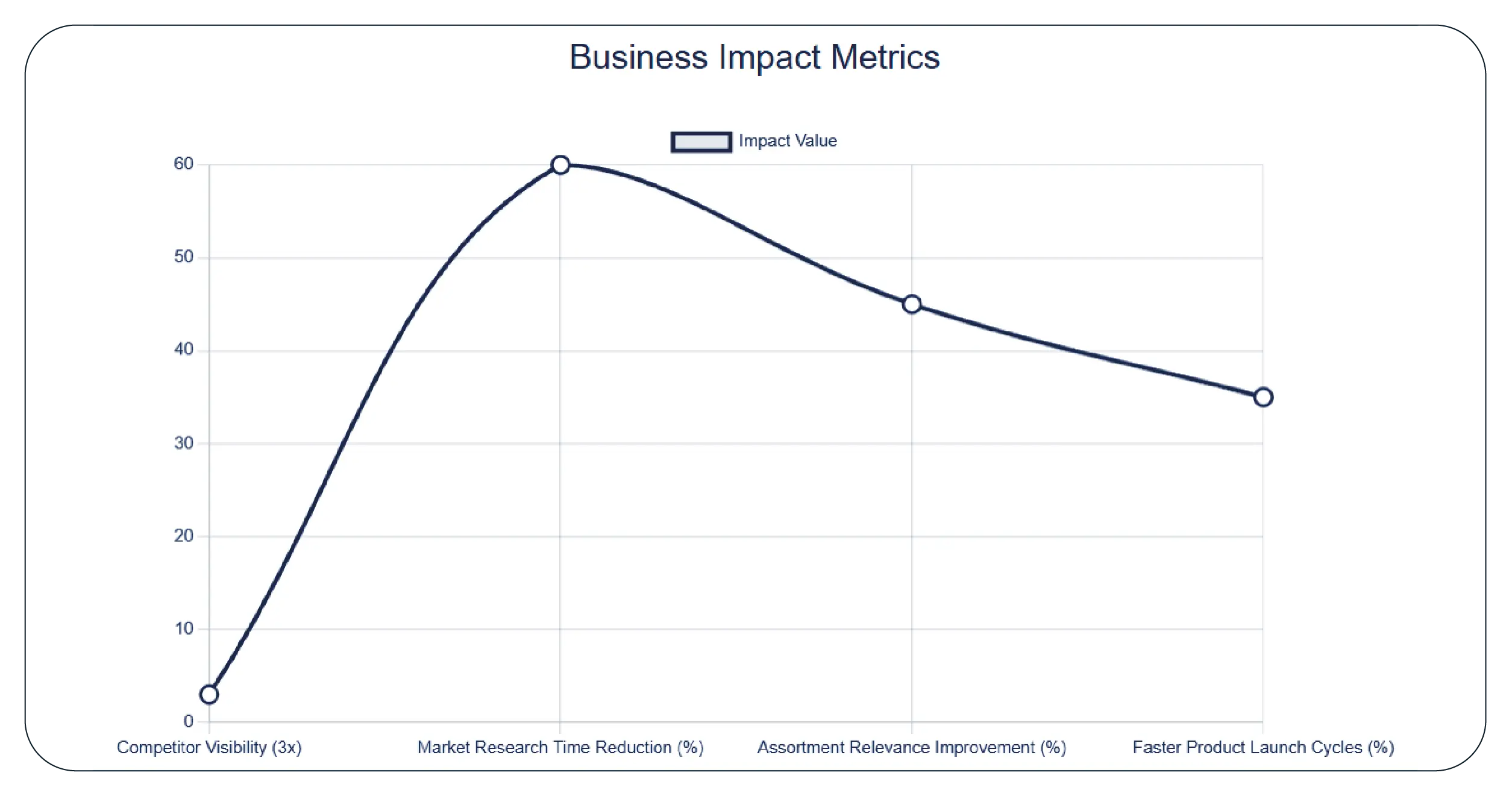

Results & Key Metrics

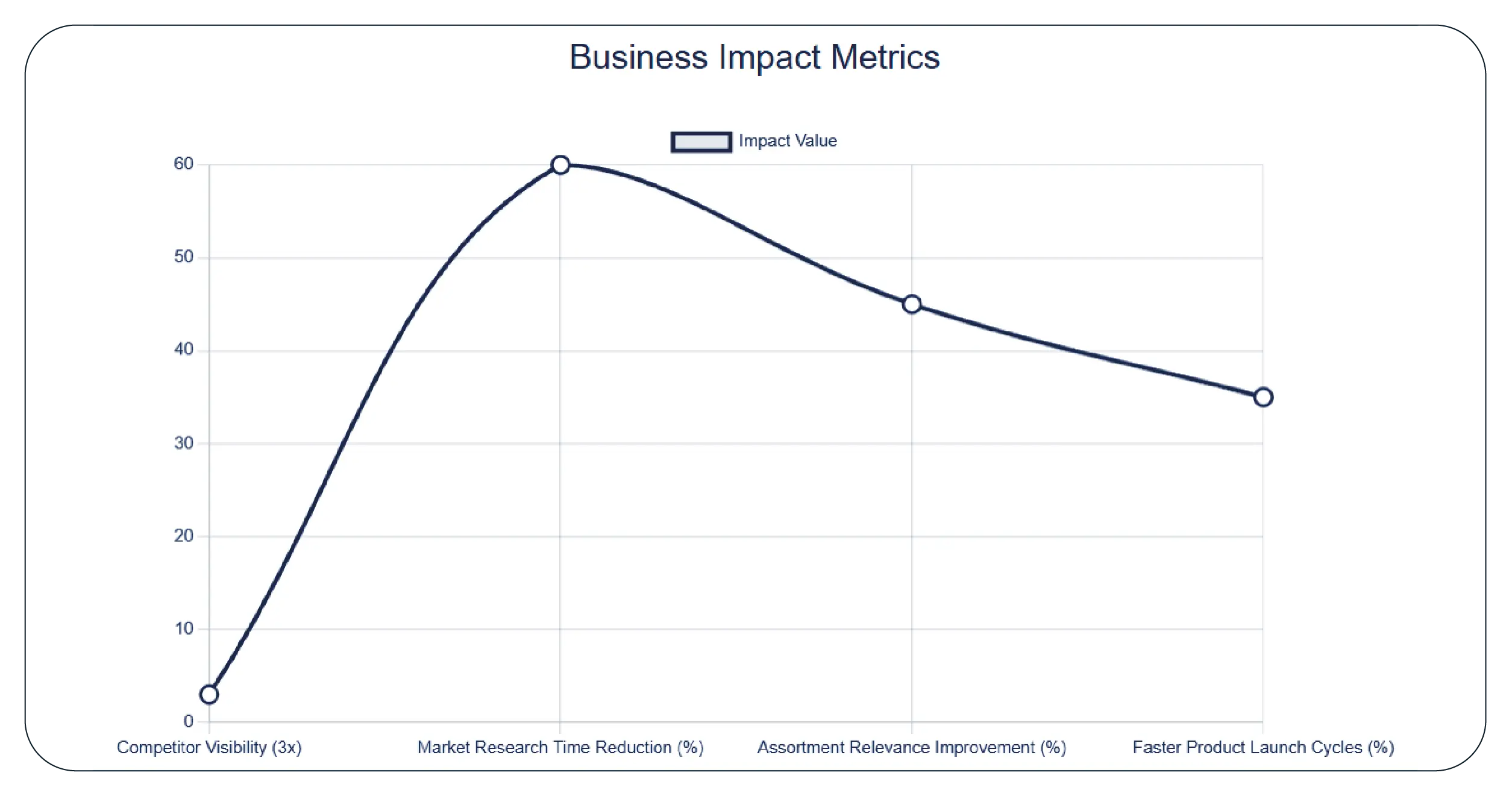

3x increase in competitor product visibility.

60% reduction in time spent on market research.

45% improvement in assortment relevance scores.

35% faster product launch cycles.

Results Narrative

With insights powered by Product Marketplace Selling Services, the retailer shifted from reactive merchandising to proactive market leadership. Category managers gained a clear picture of unmet demand, enabling them to introduce new products ahead of competitors. The organization improved collaboration across merchandising, supply chain, and marketing teams, all working from a single source of truth. The outcome was not just better data—but better decisions that directly impacted growth and customer satisfaction.

What Made Product Data Scrape Different?

What set us apart was our ability to blend strategy with execution. Through advanced australian ecommerce data scraping, we delivered not just datasets, but decision-ready intelligence. Our proprietary frameworks, smart automation, and continuous optimization ensured scalability without compromising accuracy. This combination of technology and business insight helped the client move beyond traditional analytics into a truly intelligence-led retail model.

Client’s Testimonial

“Product Data Scrape helped us see our market in a completely new way. We uncovered product opportunities we didn’t even know we were missing. Their insights now guide our category expansion and innovation strategy.”

— Head of Merchandising, Leading Australian Retailer

Conclusion

This case study demonstrates how modern retailers can transform competitive challenges into growth opportunities through data intelligence. By leveraging automation and the ability to Extract Data from Website to Excel, the client gained full visibility into market demand and competitor strategies. Today, the retailer operates with confidence—using real-time insights to shape assortments, launch faster, and deliver what customers truly want. With Product Data Scrape as a strategic partner, the brand is well-positioned to lead Australia’s next wave of ecommerce innovation.

FAQs

1. Why is web scraping important for Australian retailers?

It provides real-time visibility into competitor assortments, pricing, and trends—helping brands make faster, smarter decisions.

2. Is competitor data scraping legal in Australia?

Yes, when done ethically and using publicly available information in compliance with data usage standards.

3. How quickly can results be seen?

Most clients see actionable insights within weeks of implementation, depending on category scope.

4. Can this integrate with existing analytics tools?

Absolutely. Our solutions integrate seamlessly with BI platforms, ERP systems, and merchandising tools.

5. Who benefits most from this solution?

Large retailers, D2C brands, marketplaces, and category managers seeking to uncover demand gaps and improve product strategy.

.webp)