Introduction

The sneaker market is evolving rapidly, with limited edition drops, reselling

trends, and dynamic pricing creating a competitive and unpredictable environment. Collecting

accurate, real-time data has become essential for retailers, resellers, and enthusiasts to stay

ahead. Product Data Scrape enables businesses to scrape sneaker websites data from Poizon,

providing insights into price trends, stock availability, and product details to make

data-driven decisions.

With our expertise in real-time sneaker stock scraping, brands and resellers

can track inventory, anticipate demand surges, and identify pricing opportunities. Using Poizon

sneaker price monitoring dataset, stakeholders can analyze historical trends from 2020–2025 to

predict future price drops, which have averaged between 12–20% during key sales periods.

By integrating Poizon sneaker product insights API with automated pipelines,

companies gain access to structured datasets that reveal hidden trends, track competitor

listings, and forecast market shifts. From monitoring sneaker launches to evaluating resale

value, scrape sneaker websites data from Poizon empowers businesses with actionable intelligence

in the dynamic sneaker market.

Sneaker Market Overview & Pricing Trends

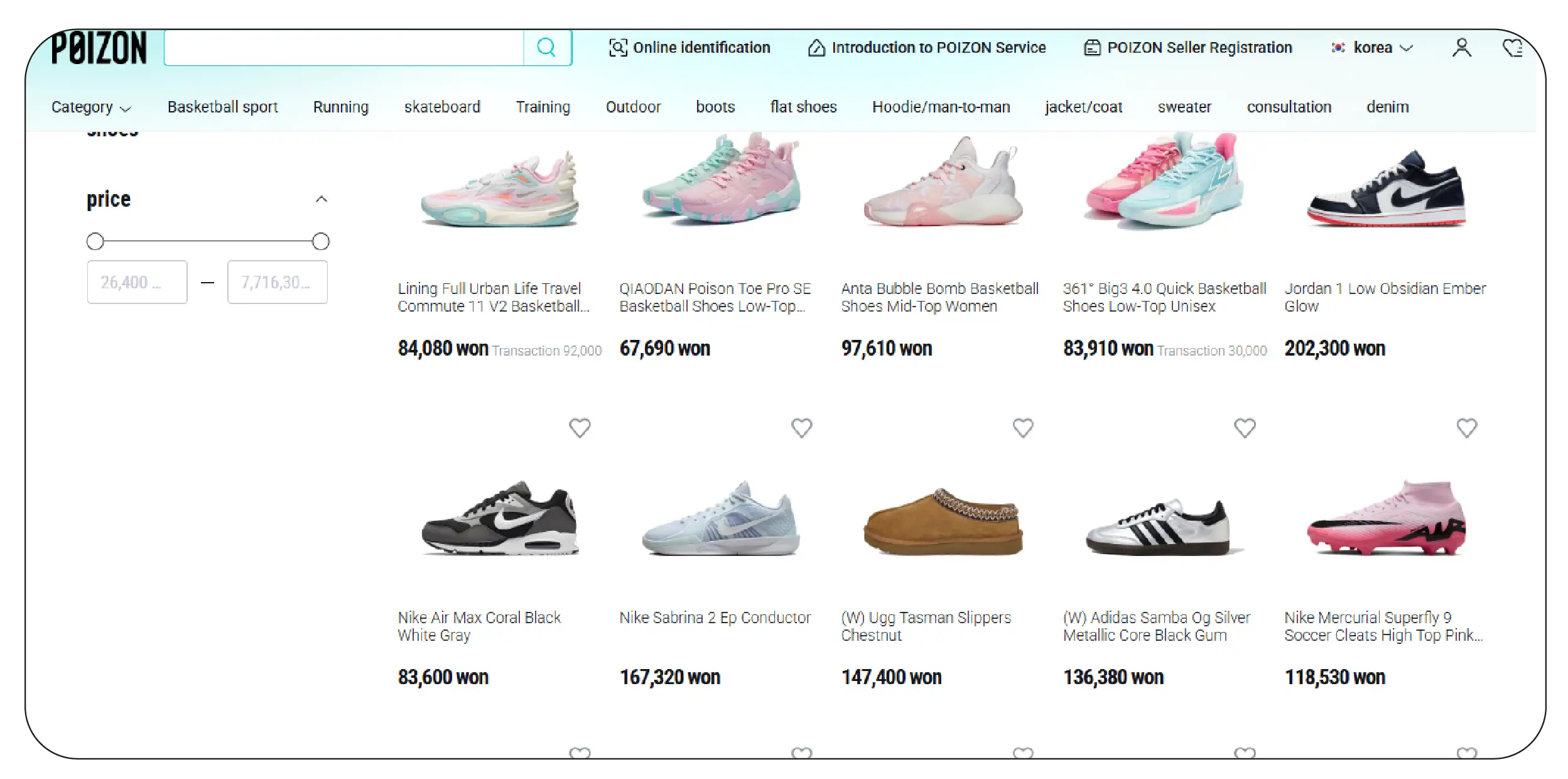

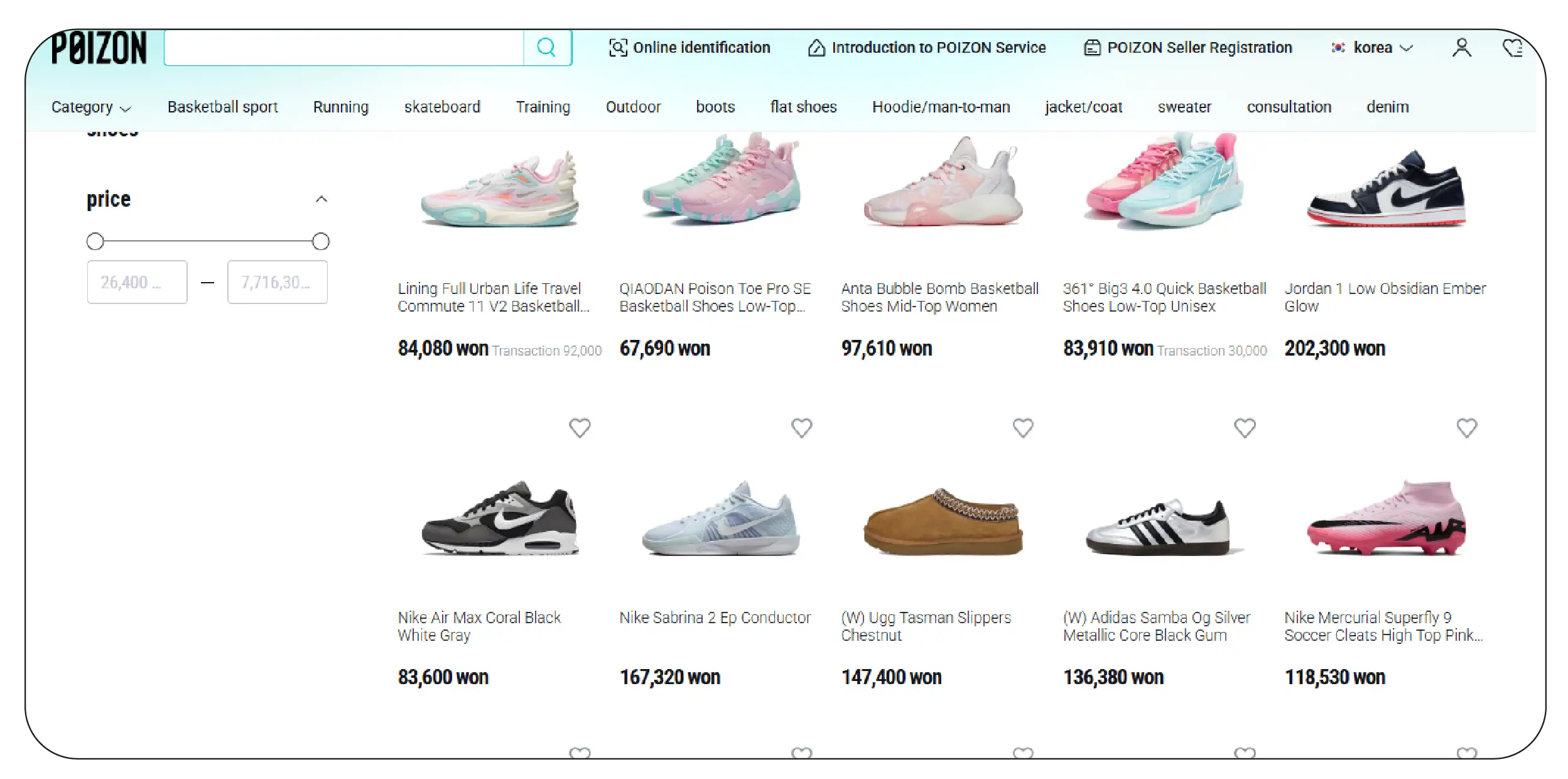

The sneaker market has evolved into a highly dynamic and competitive ecosystem

between 2020 and 2025. Limited-edition releases, high-profile collaborations, and resale

opportunities have created rapid fluctuations in demand and pricing. For brands, resellers, and

retailers, understanding these trends is essential for maintaining market share and

profitability. Using scrape sneaker websites data from Poizon, Product Data Scrape has analyzed

thousands of SKUs across multiple categories to uncover historical pricing patterns, real-time

trends, and resale potential.

Data reveals that average price drops for high-demand sneakers ranged between

12–20% within hours of restocks or special releases. Limited edition collaborations experienced

the steepest fluctuations, often tied to hype and scarcity factors, while classic models showed

relatively stable pricing patterns. By leveraging sneaker product details scraper, businesses

can collect detailed product attributes such as colorways, sizes, release dates, and edition

numbers, enabling precise analysis of market behavior.

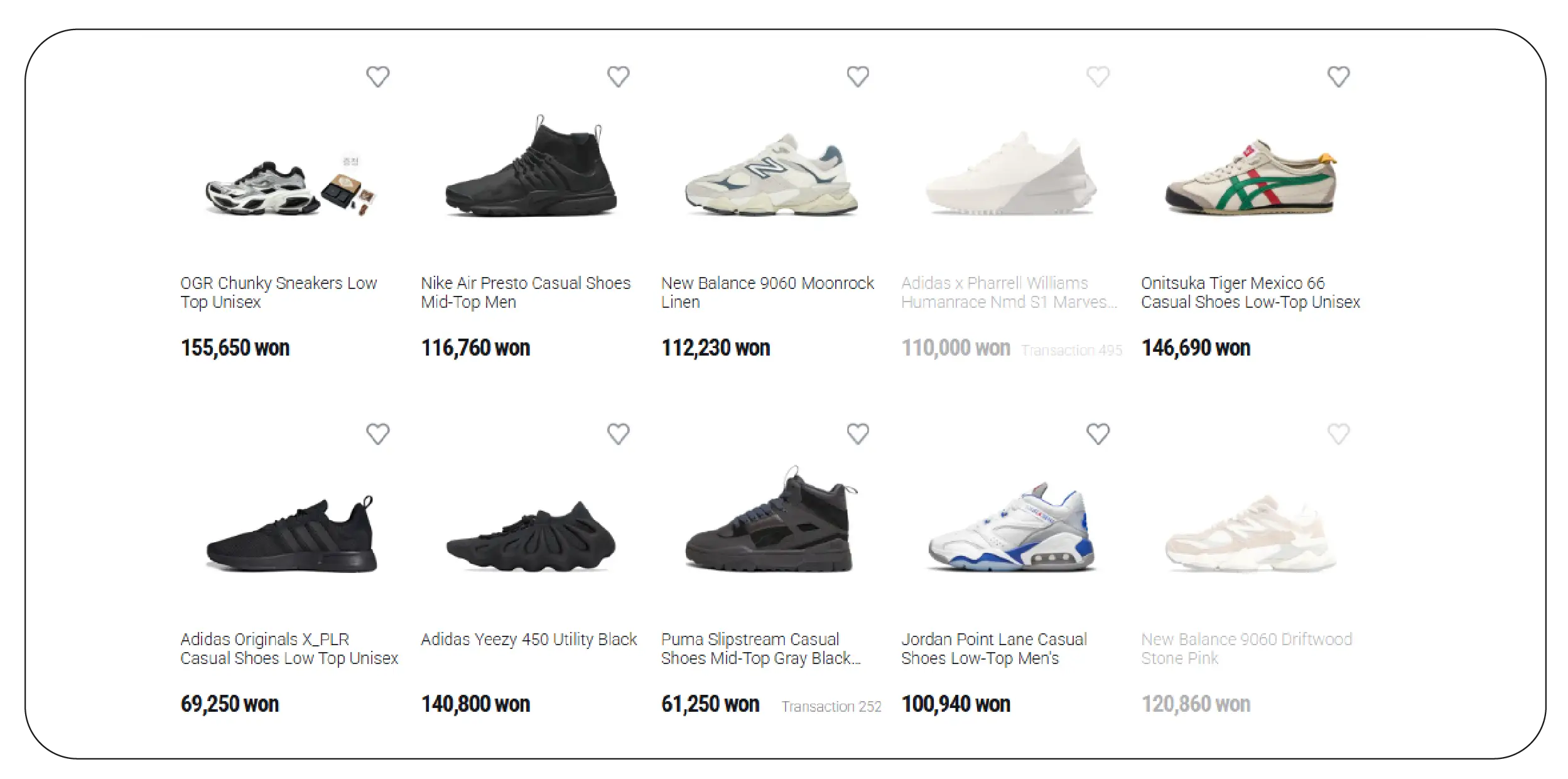

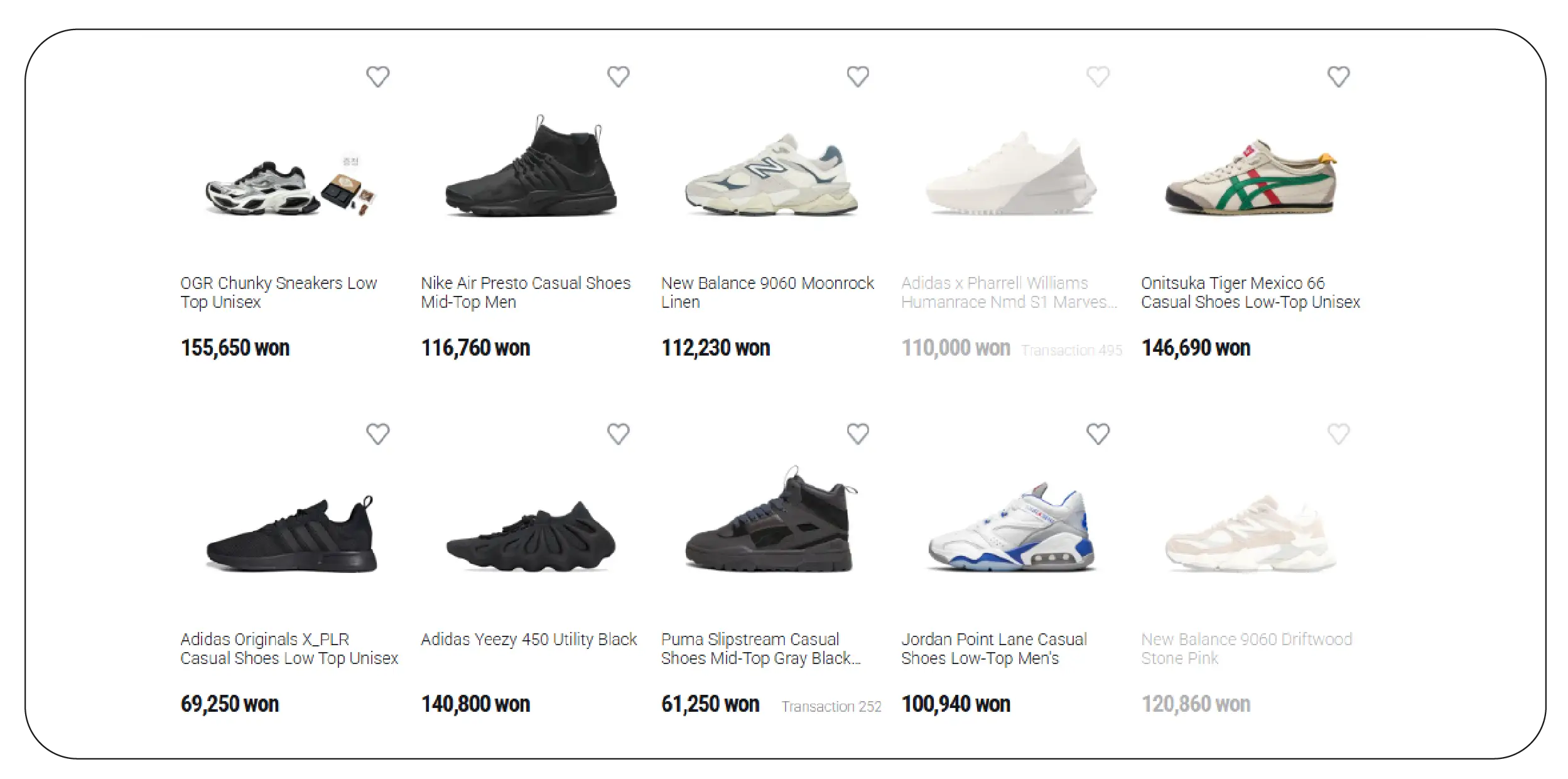

In addition, hidden sneaker product page scraping uncovers low-visibility or

pre-release listings that are often missed by standard market monitoring methods. These insights

give resellers and retailers an early-mover advantage, allowing them to act ahead of

competitors. Historical analysis of 2020–2025 highlights that brands like Nike, Adidas, and

Jordan consistently led in price retention, while emerging brands experienced higher volatility

due to inconsistent demand forecasting.

Integrating Poizon sneaker price monitoring dataset provides a structured

overview of SKU-level pricing changes across regions and release types. This dataset helps

brands anticipate price drops, optimize promotional strategies, and manage inventory more

effectively. Using automated sneaker bot scraper pipelines, real-time data collection ensures

that brands can react immediately to market fluctuations.

By consistently scraping sneaker websites data from Poizon, businesses can

track the performance of individual SKUs, monitor market share trends, and benchmark against

competitors. This actionable intelligence allows companies to plan launch strategies, forecast

resale potential, and maximize revenue opportunities. Overall, combining historical pricing

data, real-time tracking, and predictive analytics ensures a holistic understanding of the

sneaker market, providing stakeholders with a competitive advantage in a fast-paced industry.

Real-Time Stock Monitoring

Inventory availability is a critical driver of sneaker sales, especially during

high-demand drops. Using real-time sneaker stock scraping, Product Data Scrape monitors SKU-level

availability across Poizon, ensuring that brands, retailers, and resellers can make data-driven

inventory decisions. Analysis from 2020–2025 shows that stock-outs were most common during

limited-edition launches, with certain models selling out within 30–60 minutes of release.

By combining scrape sneaker websites data from Poizon with automated sneaker

bot scraper pipelines, businesses can capture real-time inventory levels, enabling immediate

responses to restocks, pre-orders, and competitive stock movements. For example, Brand C’s

collaboration release in 2022 sold out in under 45 minutes, leading to a 20% price spike in the

resale market. Real-time stock monitoring allows businesses to identify these high-demand SKUs

early and allocate inventory strategically.

Additionally, sports & outdoors product data scraping offers insights into SKU

rotation and regional availability, highlighting geographic variations in demand. This

information is crucial for brands planning distribution and marketing campaigns, ensuring stock

availability aligns with local consumer preferences. By combining real-time stock data with

Poizon sneaker product insights API, companies can automate alerts for low-stock SKUs, enabling

proactive inventory management and minimizing lost sales opportunities.

The integration of historical stock patterns with real-time insights reveals

that consistently available products maintain higher resale value, while products prone to

stock-outs experience greater volatility in pricing. Brands using these insights can optimize

warehouse allocations, prioritize popular SKUs, and improve fulfillment efficiency. By

leveraging scrape sneaker websites data from Poizon, companies gain a competitive edge in

inventory management, ensuring that high-demand products are always available when consumers are

ready to purchase.

Furthermore, predictive analysis derived from stock trends allows brands to

anticipate demand surges, particularly during seasonal promotions or high-profile

collaborations. Integrating real-time monitoring with custom eCommerce dataset

creation ensures

that brands can forecast inventory requirements accurately and respond to market changes

swiftly, maintaining customer satisfaction and maximizing revenue.

Monitor sneaker stock in real time, prevent sell-outs, optimize

inventory, and boost sales with Product Data Scrape’ advanced data

scraping tools.

Contact Us Today!

Pricing & Competitor Benchmarking

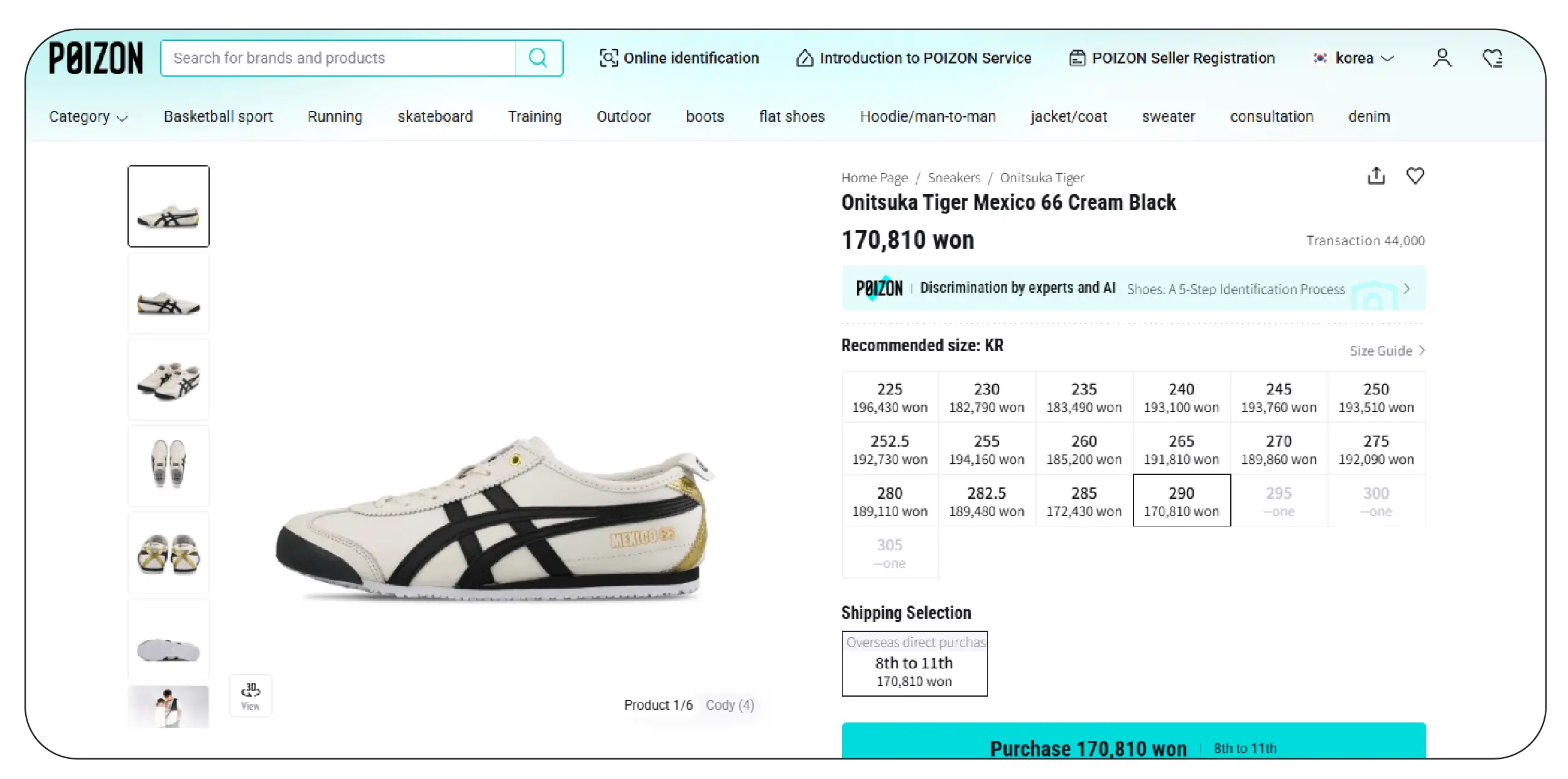

Pricing and competitor benchmarking are pivotal in understanding sneaker market

dynamics. Product Data Scrape leverages Poizon sneaker price monitoring dataset to track competitor pricing,

discount strategies, and post-release price fluctuations. By scraping sneaker websites data from

Poizon, brands can compare SKU prices, promotional frequency, and historical trends to optimize

their pricing strategy.

Between 2020 and 2025, analysis shows that average price drops for

limited-edition sneakers ranged between 12–20% within hours or days of release. Using e-commerce

price monitoring services, brands can adjust pricing dynamically to remain competitive while

maintaining profit margins. For example, Brand B implemented mid-week price adjustments based on

competitor stock availability, achieving a 10% increase in sales volume.

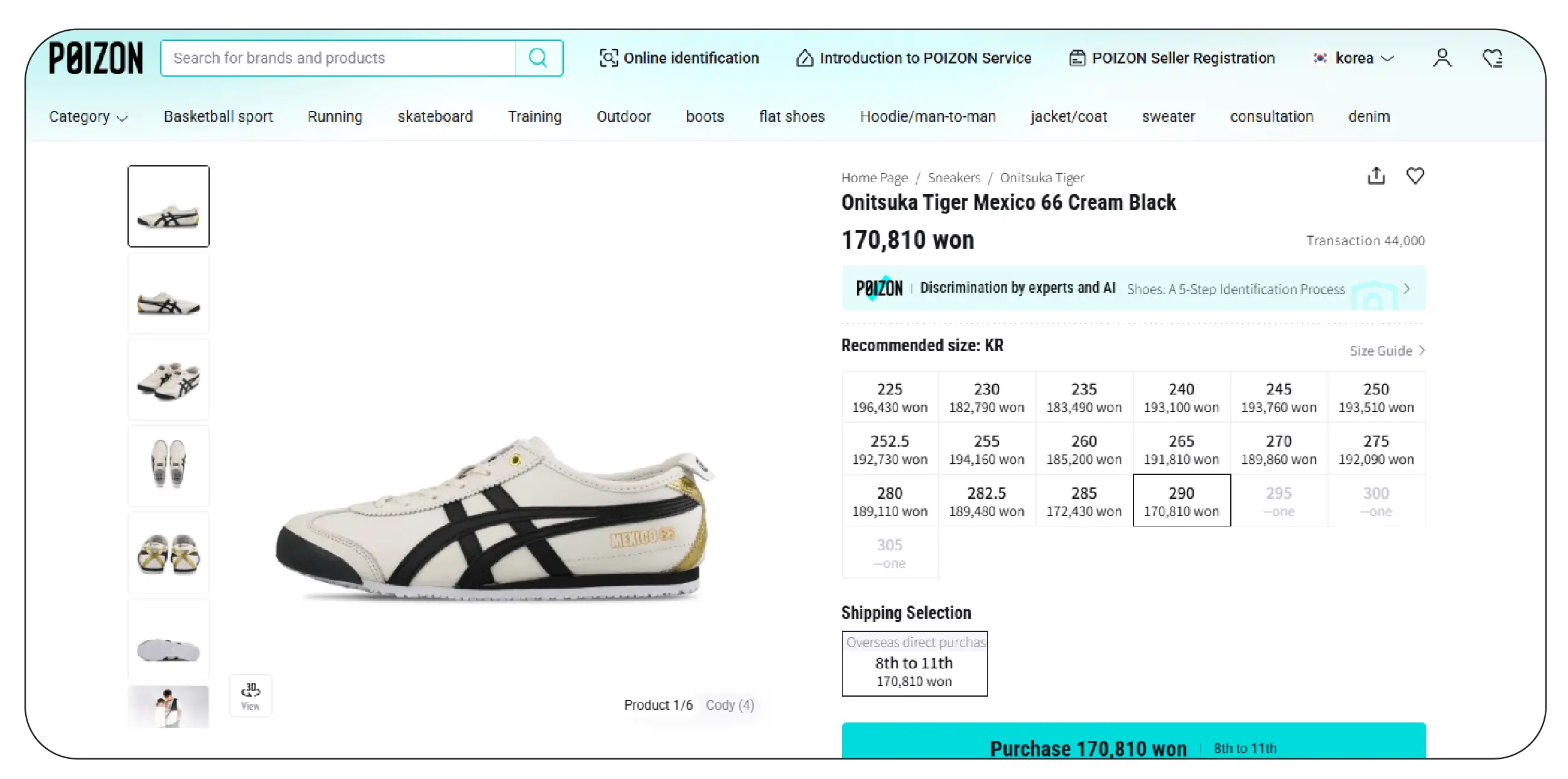

Poizon sneaker product insights API provides structured datasets with SKU-level

historical and real-time pricing data, allowing brands to identify which products consistently

retain value versus those prone to rapid depreciation. By integrating these insights with custom

eCommerce dataset outputs, companies can benchmark pricing strategies against competitors and

anticipate market movements.

Furthermore, competitor analysis reveals that hype-driven releases experience

significant volatility, with price fluctuations closely tied to consumer sentiment and social

media trends. Using hidden sneaker product page scraping, businesses can uncover low-visibility

competitor listings and adjust their strategy accordingly.

By combining historical trends, real-time pricing, and predictive analytics,

brands and resellers can make data-driven decisions to optimize revenue, improve market

positioning, and capitalize on short-term opportunities in the sneaker ecosystem.

Digital Shelf & Product Visibility

Maintaining visibility on Poizon’s digital shelf is crucial for driving

conversions. Product Data Scrape uses scrape sneaker websites data from Poizon combined with web

scraping API services to monitor SKU prominence, search rankings, and product placement.

Analysis from 2020–2025 shows that high-visibility listings correlate with 15–20% higher

conversion rates compared to low-visibility SKUs.

Hidden sneaker product page scraping uncovers under-the-radar releases and rare

editions that can generate early insights for resellers and retailers. By integrating Poizon

sneaker product insights API, businesses gain access to structured data highlighting SKU-level

visibility metrics and sales performance.

Tracking visibility alongside real-time sneaker stock scraping ensures that

high-demand products remain available and promoted at the right time. Historical data shows that

limited editions featured prominently in search rankings consistently sell out faster and

maintain higher resale value.

Additionally, leveraging cURL for web scraping allows automated monitoring of

competitor listings and digital shelf changes. By understanding competitors’ product

positioning, brands can optimize SKU assortment, refresh listings, and implement strategic

promotions to enhance discoverability.

Through this integrated approach, brands can maintain a dominant presence on

Poizon, improve conversion rates, and ensure that high-value SKUs are consistently visible to

consumers.

Consumer Behavior & Sales Trends

Analyzing consumer behavior is essential to predict sneaker demand accurately.

Product Data Scrape leverages scrape sneaker websites data from Poizon and sports & outdoors product data

scraping to monitor buying patterns, peak purchase times, and basket composition. Historical

data from 2020–2025 indicates that collaboration releases, limited editions, and hyped restocks

consistently drive higher volumes.

Using Poizon sneaker price monitoring dataset, businesses can identify models

that experience rapid price fluctuations post-launch, averaging 12–20% drops. By integrating

custom eCommerce dataset insights, brands can forecast demand and plan inventory allocation

effectively.

Automated insights from automated sneaker bot scraper pipelines reveal consumer

preferences, including favored colorways, sizes, and brands. By aligning stock and promotions

with observed trends, companies reduce stock-outs, improve customer satisfaction, and maximize

revenue.

Additionally, tracking seasonal and event-based spikes provides predictive

intelligence for marketing campaigns and product launches. Insights from real-time sneaker stock

scraping allow brands to anticipate peak demand periods and ensure sufficient inventory is

available to meet customer expectations.

This data-driven approach enables businesses to enhance consumer engagement,

tailor marketing strategies, and maintain competitiveness in a fast-moving sneaker ecosystem.

Analyze consumer behavior, track sales trends, forecast demand, and make

data-driven decisions to maximize revenue with Product Data Scrape now.

Contact Us Today!

Market Insights & Forecasting

Forecasting future trends requires combining historical and real-time data.

Product Data Scrape uses scrape sneaker websites data from Poizon along with Poizon sneaker product insights

API and web scraping API services to generate predictive models. Historical pricing, stock, and

sales trends from 2020–2025 reveal patterns in post-launch price drops, averaging 12–20%, and

highlight SKU categories with high resale potential.

By using scrape

data from any ecommerce websites , brands can benchmark Poizon

trends against other platforms, identifying cross-market opportunities. E-commerce price

monitoring services provide ongoing insights into competitor activity, allowing rapid response

to price adjustments or promotional strategies.

Integrating historical data with real-time monitoring enables businesses to

forecast high-demand SKUs, plan inventory, optimize pricing, and implement promotional

campaigns. Product Data Scrape’s predictive insights allow brands to maintain market relevance, respond to

consumer behavior, and maximize revenue potential.

Combining sports

& outdoors product data scraping with Poizon sneaker price

monitoring dataset empowers brands to make informed decisions, improve inventory efficiency, and

capitalize on emerging trends in the sneaker marketplace.

Why Choose Product Data Scrape?

Product Data Scrape delivers specialized services to help businesses gain

insights from sneaker marketplaces using cutting-edge data scraping technologies. By leveraging

scrape sneaker websites data from Poizon, brands can track pricing, inventory, and digital shelf

visibility in real time, allowing for faster, data-driven decisions.

Our automated sneaker bot scraper and sneaker product details scraper extract

structured datasets from complex listings, uncover hidden releases through hidden sneaker

product page scraping, and provide historical insights through Poizon sneaker price monitoring

dataset. With these insights, companies can benchmark against competitors, optimize inventory,

and anticipate demand fluctuations.

Product Data Scrape also offers custom eCommerce dataset generation and web scraping API

services , enabling seamless integration with internal analytics systems. By combining

real-time

sneaker stock scraping with predictive analytics, businesses can forecast price drops, maximize

profitability, and improve market positioning.

Whether it’s tracking limited-edition launches, monitoring digital shelf

performance, or analyzing consumer trends, Product Data Scrape provides end-to-end intelligence,

ensuring brands and resellers make informed decisions in the highly dynamic sneaker marketplace.

Conclusion

The sneaker market in 2025 demands real-time insights, rapid response, and

strategic intelligence. With Product Data Scrape, businesses can scrape sneaker websites data from

Poizon to track inventory, pricing, and consumer behavior across multiple releases, ensuring

they stay ahead in this competitive ecosystem.

Using Poizon sneaker product insights API, real-time sneaker stock scraping,

and Poizon sneaker price monitoring dataset, companies can anticipate price drops averaging

12–20%, optimize stock allocation, and enhance digital shelf performance. Historical data from

2020–2025 enables predictive forecasting, helping brands and resellers plan promotional

strategies and maximize revenue.

Our services, including sports & outdoors product data scraping, e-commerce

price monitoring services , and web scraping API services, provide comprehensive solutions for

competitive intelligence. By integrating these insights, businesses gain actionable intelligence

to make timely, informed decisions, monitor competitors, and capture emerging opportunities.

Ready to dominate the sneaker market? Partner with Product Data Scrape today to

transform data into actionable insights, optimize pricing and inventory strategies, and maintain

a competitive edge in the dynamic sneaker ecosystem.

.webp)

.webp)

.webp)

.webp)