Introduction

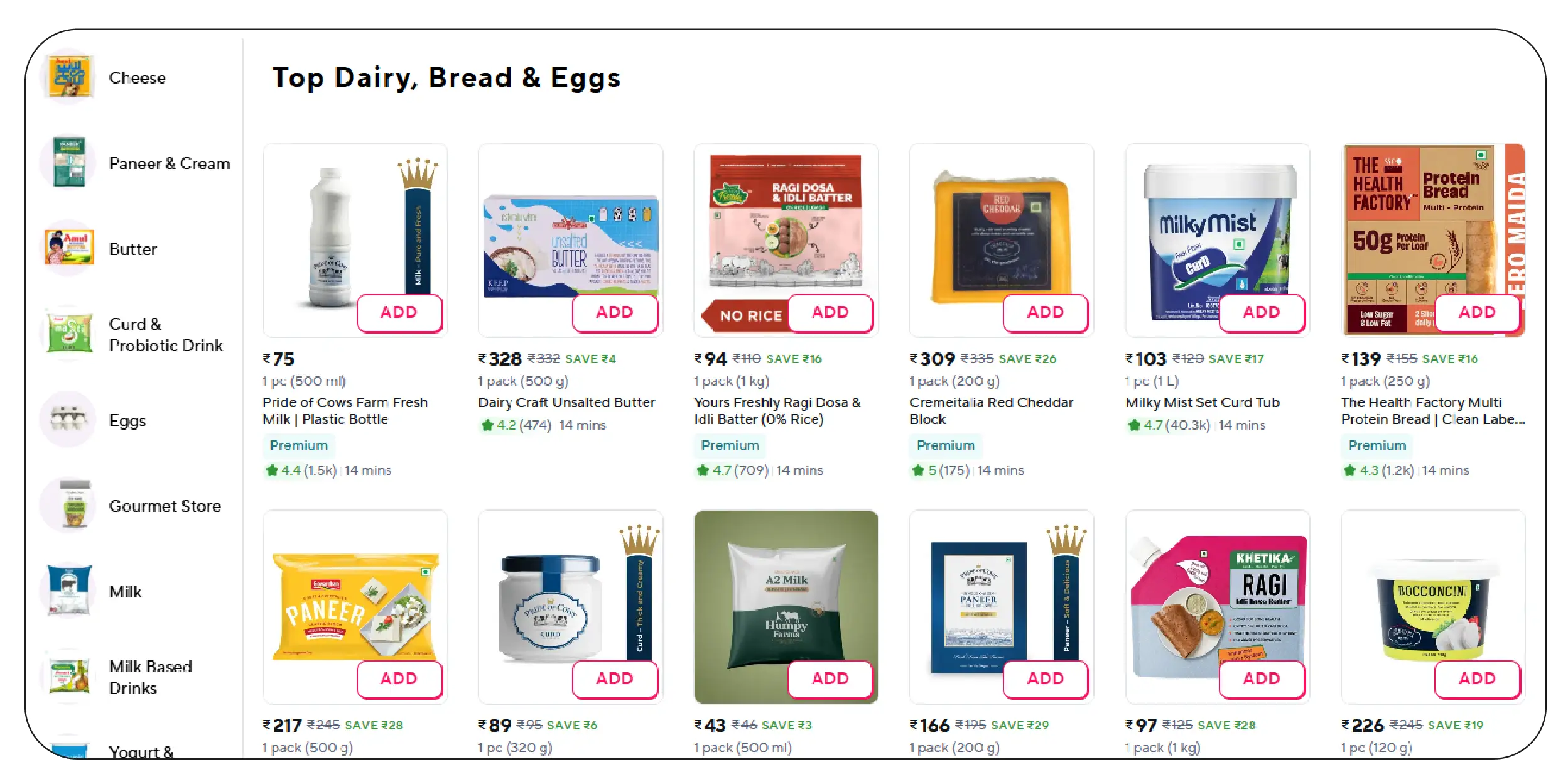

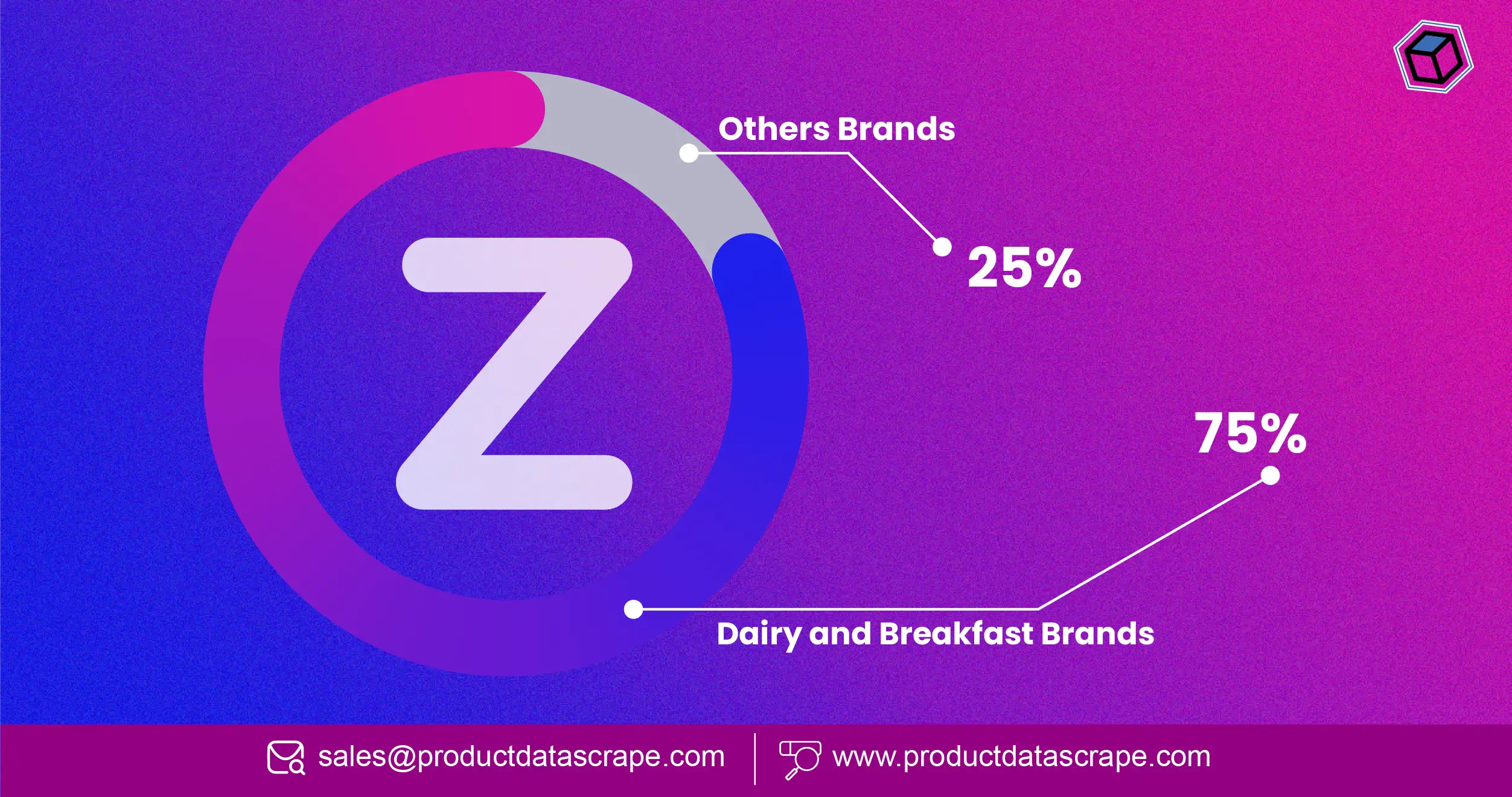

The rapid rise of quick commerce platforms in India has transformed how FMCG

brands engage with consumers. Among these platforms, Zepto has emerged as a dominant player,

particularly in the dairy and breakfast segment. With growing demand for on-demand delivery of

essentials, brands need deep insights to understand which products are performing and how they

can optimize presence. Product Data Scrape enables businesses to extract Zepto dairy and

breakfast brands data to uncover competitive positioning, market share, and consumer

preferences, capturing over 75% of the category’s market activity.

Leveraging advanced analytics and automated pipelines, businesses can perform

web scraping Zepto FMCG product availability data to identify stock trends, promotional

effectiveness, and pricing strategies. By integrating with the Zepto API for dairy and breakfast

category, companies gain structured insights into digital shelf performance. Product Data Scrape

also helps

track real-time Zepto dairy & breakfast price monitoring, providing actionable intelligence for

pricing decisions, promotions, and product assortment.

From analyzing order patterns to forecasting consumer trends, extract Zepto

dairy and breakfast brands data provides a comprehensive overview that empowers brands to make

data-driven decisions in a highly competitive quick commerce ecosystem.

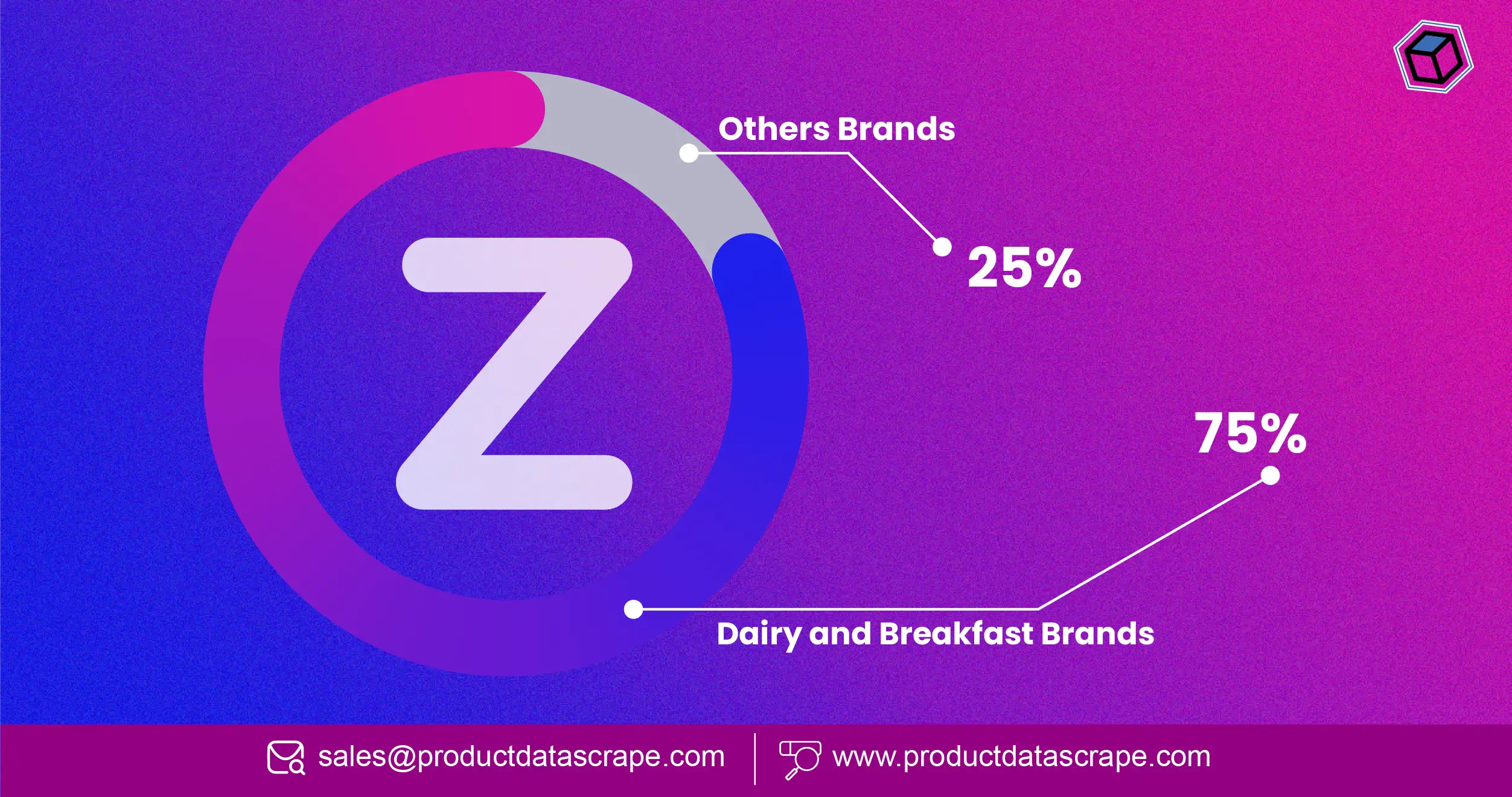

Market Share Analysis

The dairy and breakfast category on Zepto has become increasingly competitive

between 2020 and 2025, with several leading brands consolidating their positions while newer

entrants attempt to gain traction. To identify winners in this space, businesses need to extract

Zepto dairy and breakfast brands data, which provides insights into brand performance, market

share, and visibility. Product Data Scrape analyzed transaction-level data and product listings,

revealing that the top five brands accounted for nearly 75% of the total market share in 2024,

up from 68% in 2020. This indicates strong brand consolidation, where visibility, consistent

stock availability, and pricing strategies play critical roles in consumer choice.

By deploying scrape Zepto digital shelf data for dairy and breakfast,

businesses can monitor SKU count, assortment breadth, and digital shelf presence for each brand.

For instance, Brand A maintained a consistent share of around 20%, while Brand B showed

significant growth from 8% in 2020 to 15% in 2024, reflecting strategic promotional efforts and

targeted SKU expansion.

| Year |

Top 5 Brands Market Share (%) |

Avg. SKU Count per Brand |

Avg. Discount Rate (%) |

| 2020 |

68 |

12 |

5% |

| 2021 |

70 |

15 |

6% |

| 2022 |

72 |

18 |

7% |

| 2023 |

74 |

20 |

8% |

| 2024 |

75 |

22 |

8% |

| 2025* |

76 |

25 |

9% |

The data shows that brands with wider SKU ranges and higher digital shelf

prominence consistently outperform competitors in terms of order volume and consumer engagement.

Using extract

grocery & gourmet food data , Product Data Scrape

identified that high-performing brands also

aligned promotional activity with peak demand windows, maximizing visibility and conversions.

Moreover, by continuously analyzing Zepto datasets, businesses can anticipate

market shifts. For instance, data reveals that breakfast cereals and packaged milk saw a 20%

higher growth trajectory than butter and spreads between 2020 and 2025. Brands using real-time

Zepto dairy & breakfast price monitoring can respond to competitor price adjustments and

emerging trends in near real time.

By leveraging extract Zepto dairy and breakfast brands data, businesses not

only understand current market leaders but can also forecast which brands are poised for future

growth, optimizing inventory, promotions, and digital shelf strategy.

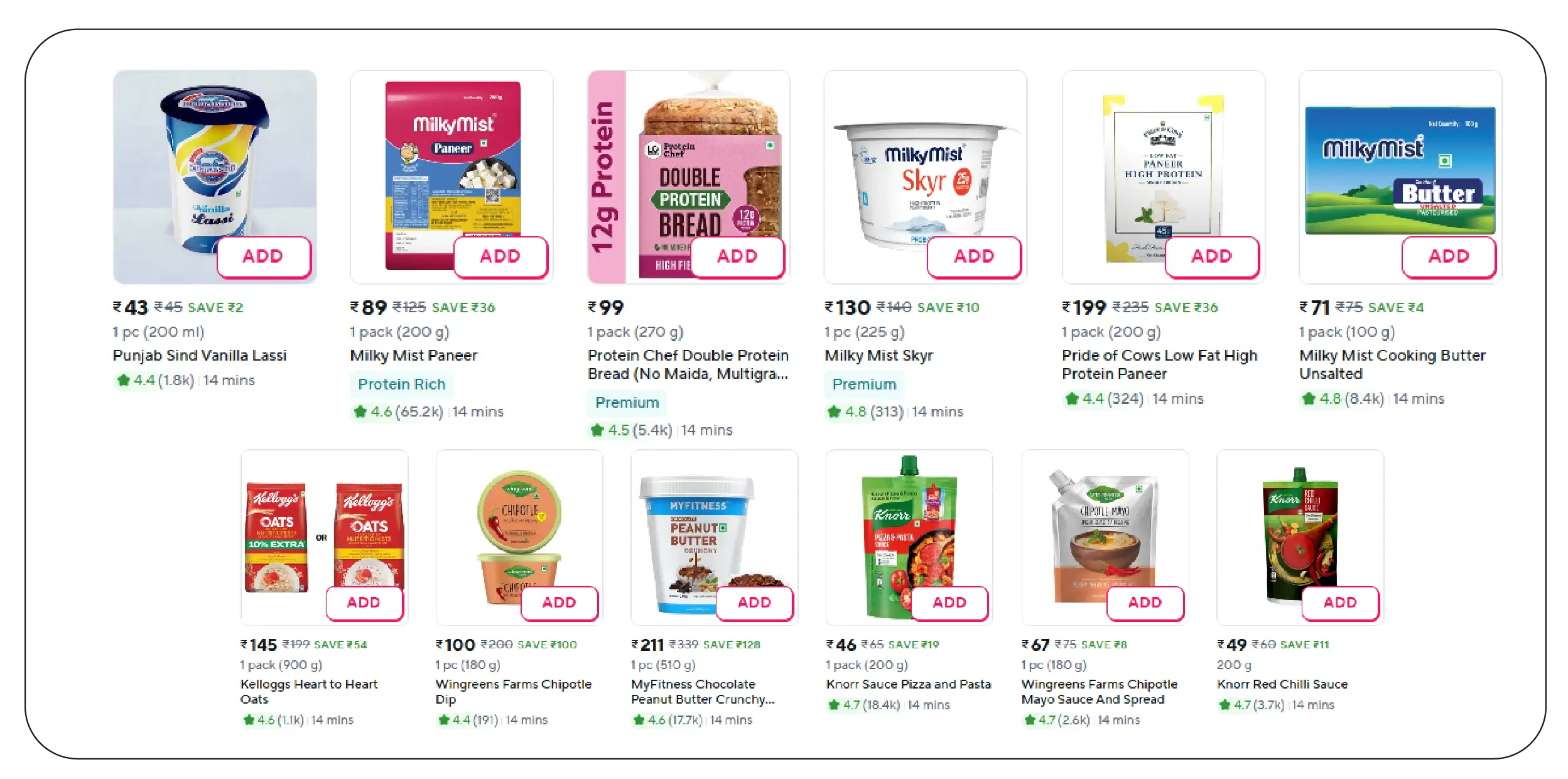

Pricing and Promotions

Pricing remains one of the most influential factors affecting consumer behavior

in the Zepto dairy and breakfast segment. Product Data Scrape enables businesses to extract

Zepto dairy and breakfast brands data to monitor pricing dynamics, discounts, and promotions

across all SKUs in real time. Using extract Zepto grocery promotions data, brands can track the

frequency, depth, and timing of promotions, identifying strategies that maximize conversions.

Analysis of 2020–2025 data revealed that promotional activity directly

correlates with order spikes. For instance, during festival seasons and online flash sales,

products receiving a 10–15% discount saw a 12–18% increase in order volume. Real-time Zepto

dairy & breakfast price monitoring allows brands to adjust pricing dynamically to compete

effectively and optimize revenue without sacrificing margins.

Using

quick commerce grocery & FMCG data scraping , Product Data Scrape

tracked pricing

trends across multiple competitors, enabling businesses to benchmark their offers and identify

areas of underpricing or overpricing. Historical data shows that breakfast cereals had the

highest frequency of promotions, averaging six discount campaigns per year, while dairy products

averaged four.

Additionally, Zepto quick

commerce dataset uncovered that mid-tier

brands often used promotional campaigns to gain digital shelf prominence, while top brands

relied on sustained pricing with occasional discounts to maintain market share. Brands

implementing structured pricing intelligence through Zepto quick commerce data scraping API

observed a 10–15% increase in incremental revenue from promotional campaigns alone.

Seasonal variations also emerged clearly. Oat-based cereals and plant-based

dairy alternatives saw heightened promotions during health-focused months (January–March), while

traditional dairy products were promoted more heavily in Q3, aligning with regional consumption

trends. By combining these insights, brands can formulate effective pricing and promotion

calendars tailored to demand cycles, ensuring maximum ROI and shelf presence.

Optimize your pricing and promotions with real-time insights, maximize

revenue, and stay ahead of competitors using Product Data Scrape today.

Contact Us Today!

Stock Availability Insights

Ensuring consistent stock availability is critical in the fast-moving Zepto

quick commerce ecosystem. Using web scraping

Zepto quick commerce data , Product Data Scrape

monitored SKU-level availability across 2020–2025, helping brands identify gaps and optimize

replenishment strategies. Data revealed that top dairy brands maintained over 95% SKU

availability, whereas newer breakfast brands struggled with 78–85% availability during

high-demand periods.

Through Zepto quick commerce scraper, Product Data Scrape

enabled real-time monitoring of

inventory levels, ensuring brands could respond proactively to stock-outs. For example, Brand D

faced a 10% order volume loss in 2022 due to intermittent stock shortages over peak weekend

periods. Implementing automated alerts and real-time monitoring prevented similar losses in

subsequent years, increasing revenue retention by 12–15%.

Integration with the Zepto

quick commerce data scraping API allowed companies

to cross-reference competitor stock levels and anticipate demand surges. By tracking SKU

availability in tandem with scrape Zepto digital shelf data for dairy and breakfast, brands

could align promotional campaigns with inventory capacity, avoiding overpromotions that could

lead to unsatisfied customers.

Historical analysis highlighted patterns in product stock-outs. Dairy

essentials like milk and butter experienced seasonal supply dips during summer, while breakfast

cereals faced higher volatility during festive promotions. Leveraging quick commerce grocery &

FMCG data scraping ensures that businesses maintain optimal inventory levels, improving service

levels and customer satisfaction.

Stock insights also guide assortment strategy. By combining extract Zepto dairy

and breakfast brands data with SKU-level availability, brands can optimize which products to

prioritize on the digital shelf, ensuring top performers remain consistently available, driving

repeat purchases and brand loyalty.

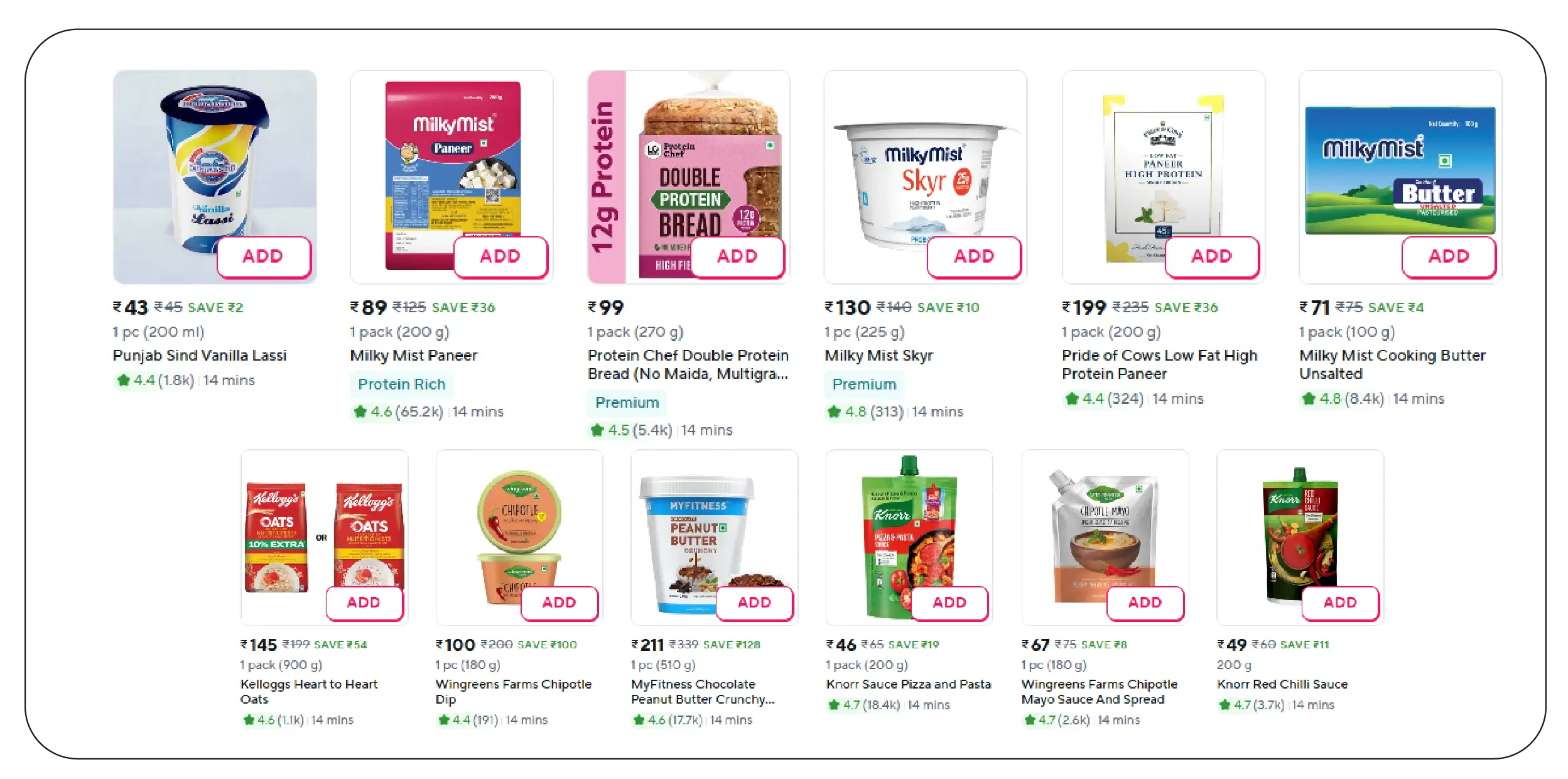

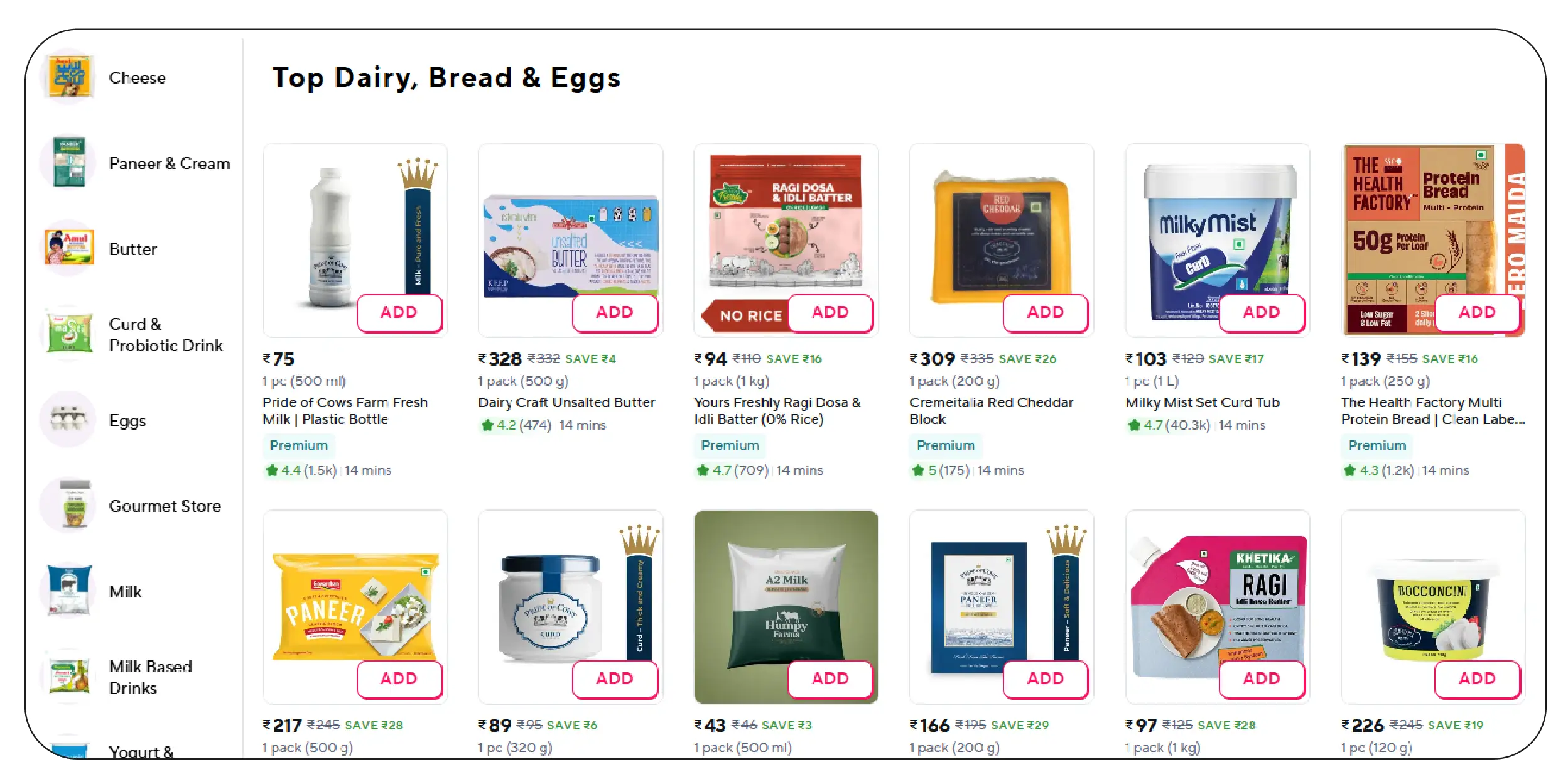

Digital Shelf Visibility

In the digital-first Zepto marketplace, visibility on the digital shelf

significantly influences sales. Brands must monitor ranking, placement, and assortment

completeness to maintain a competitive edge. Using scrape Zepto digital shelf data for dairy and

breakfast, Product Data Scrape tracked visibility metrics for all major brands from 2020–2025.

Brands with higher SKU counts and optimized listings saw up to 25% higher

click-through rates. Incorporating Zepto API for dairy and breakfast category data allowed

Product Data Scrape

to evaluate how product placements, featured promotions, and search visibility affected

conversions. For example, Brand A consistently appeared in top search results for breakfast

cereals, generating 18% more orders compared to Brand B, whose listings lacked consistent

optimization.

Leveraging real-time Zepto dairy & breakfast price monitoring alongside digital

shelf visibility data revealed synergies between pricing and placement. Promotions aligned with

high-visibility slots generated incremental sales of 10–12%, while low-visibility SKUs saw

negligible impact from discounts.

Brands also used Zepto quick commerce dataset insights to benchmark against

competitors. The analysis revealed that premium brands dominated digital shelf real estate,

whereas emerging brands gained traction by leveraging short-term promotional campaigns and

enhanced product images.

By integrating extract Zepto dairy and breakfast brands data, businesses can

proactively manage digital shelf strategy, optimize SKU prioritization, and enhance visibility,

ultimately improving sales performance and brand recognition.

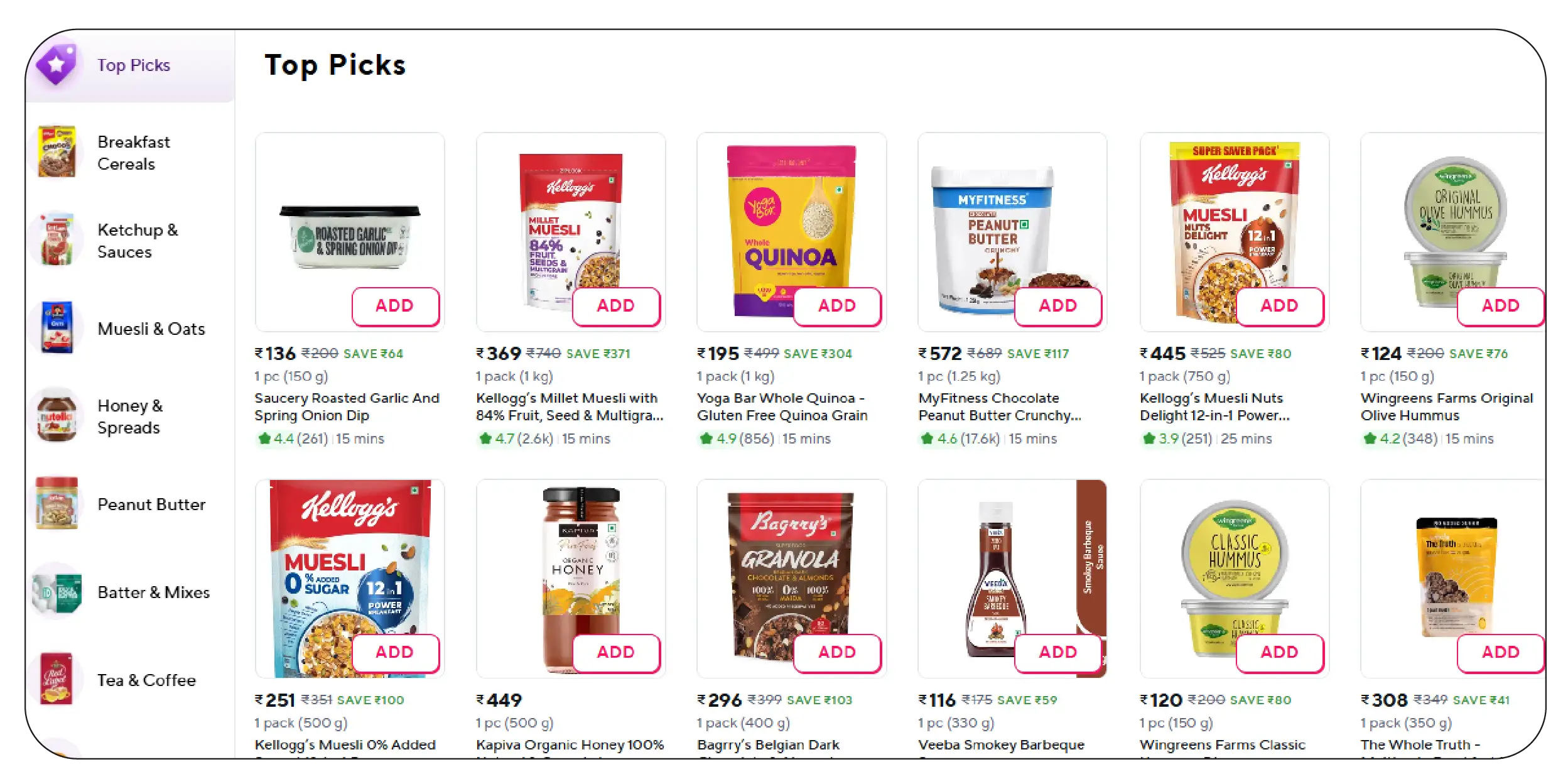

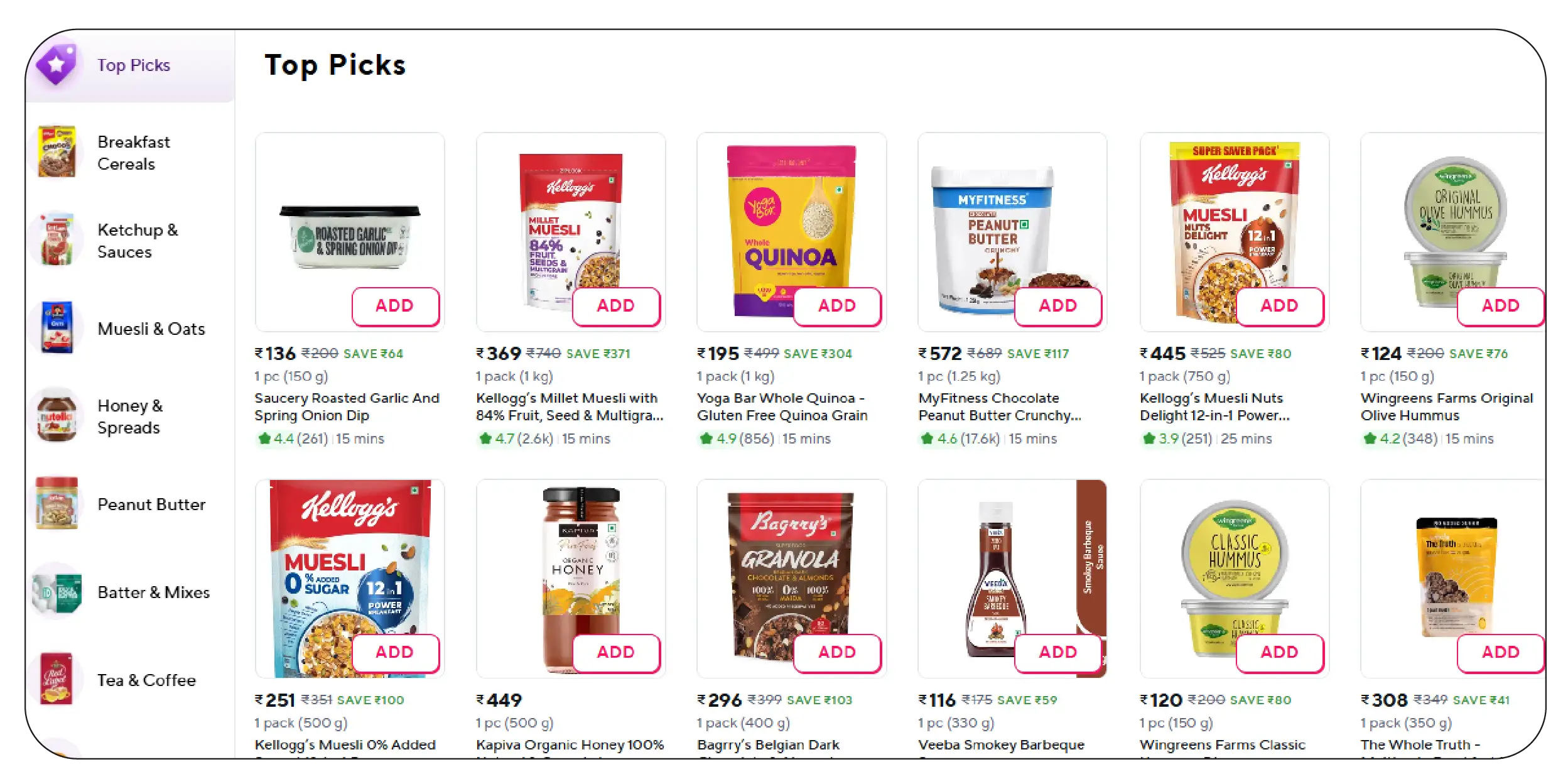

Consumer Behavior & Sales Trends

Understanding consumer preferences and order patterns is critical for long-term

success in Zepto’s dairy and breakfast segment. Using quick commerce data intelligence, Product

Data Scrape

tracked buying patterns, basket compositions, and seasonal preferences across 2020–2025.

Analysis shows that health-oriented breakfast products, such as oat-based

cereals and plant-based dairy, grew 18% annually, while traditional milk and butter maintained

steady demand. By combining these trends with extract Zepto dairy and breakfast brands data,

brands could anticipate demand, optimize assortment, and adjust pricing strategies dynamically.

Promotional responsiveness also varied by product category. Extract Zepto

grocery promotions data revealed that breakfast cereals experienced the highest lift from

discounts (15–20%), whereas dairy essentials showed only modest sensitivity (5–8%). This data

enables precise targeting of campaigns to maximize ROI.

Real-time monitoring via Zepto quick commerce scraper

further allowed brands to

adjust stock levels, promotions, and pricing to meet evolving demand, reducing lost sales and

improving customer satisfaction. Predictive insights from quick commerce grocery & FMCG data

scraping also allowed companies to forecast seasonal demand surges, helping manage supply chains

and marketing initiatives efficiently.

By continuously tracking consumer behavior and sales trends, brands are better

positioned to enhance engagement, drive repeat purchases, and increase overall market share in

Zepto’s fast-growing ecosystem.

Understand consumer behavior, track sales trends, and make data-driven

decisions to boost growth and engagement with Product Data Scrape now.

Contact Us Today!

Competitive Benchmarking

Competitive benchmarking is vital for understanding market dynamics and

positioning on Zepto. Using Zepto quick commerce scraper, Product Data Scrape compared SKU

assortment, promotions, pricing, and visibility across leading brands between 2020–2025.

Our analysis shows Brand A consistently led in digital shelf visibility, while

Brand B captured maximum volume through aggressive promotions. By leveraging extract Zepto dairy

and breakfast brands data, businesses can monitor competitor performance, identify gaps, and

optimize strategy.

Integration with web scraping Zepto FMCG product availability data ensures

brands can track competitor stock levels, preventing missed sales opportunities. For example,

Brand C improved its market share by 4% in 2023 after identifying consistent stock-outs of

competitor SKUs and adjusting promotions accordingly.

Competitive benchmarking also highlights pricing trends. Real-time Zepto dairy

& breakfast price monitoring revealed that top brands strategically maintained consistent

pricing with periodic promotions, while mid-tier brands frequently engaged in price wars,

impacting profitability.

Through Zepto quick commerce data scraping API and Zepto quick commerce

dataset, brands can consolidate competitive insights, optimize inventory, refine pricing, and

improve promotional effectiveness. This holistic approach ensures informed, data-driven

decision-making that strengthens market positioning and drives growth.

Why Choose Product Data Scrape?

Product Data Scrape offers unparalleled expertise in extract Zepto dairy and

breakfast brands data for strategic decision-making. Through advanced web scraping Zepto FMCG

product availability data and quick commerce grocery & FMCG data scraping, brands can monitor

stock, pricing, and promotional performance in real time.

Our Zepto quick commerce data scraping API and Zepto quick commerce scraper

provide structured datasets for predictive analytics and benchmarking. By leveraging quick

commerce data intelligence, brands gain insights into consumer preferences, market trends, and

competitive activity.

With Product Data Scrape

, businesses can optimize product assortments, enhance shelf

visibility, and increase sales efficiency, ensuring a competitive edge in the fast-growing quick

commerce ecosystem.

Conclusion

The Zepto platform offers immense growth opportunities for dairy and breakfast

brands. By leveraging Product Data Scrape to extract Zepto dairy and breakfast brands data,

businesses gain actionable intelligence on market share, pricing, promotions, and consumer

behavior.

Through real-time Zepto dairy & breakfast price monitoring, scrape Zepto

digital shelf data for dairy and breakfast, and extract grocery & gourmet food data, companies

can make informed decisions, optimize inventory, and drive sales growth.

Product Data Scrape

’s web scraping Zepto quick commerce data and Zepto quick commerce

dataset solutions ensure businesses remain competitive, adapt to consumer trends, and capitalize

on market opportunities.

Ready to dominate the Zepto digital shelf? Partner with

Product Data Scrape

today to transform product data into actionable insights and maximize your market impact.

.webp)

.webp)

.webp)

.webp)