Introduction

In today’s fast-paced eCommerce ecosystem, businesses rely heavily on data to

make informed pricing, marketing, and inventory decisions. The web scraping backbone of

ecommerce growth has become a critical enabler for companies seeking real-time insights into

product trends, competitor pricing, and consumer behavior. By leveraging web scraping supports

eCommerce growth, organizations can track thousands of listings across multiple platforms,

gaining actionable intelligence that drives revenue, reduces costs, and informs strategic

planning.

From 2020 to 2025, eCommerce companies that integrated ecommerce product

intelligence API and ecommerce data scraping for market research saw an average 18% improvement

in pricing accuracy and a 22% increase in product assortment efficiency. Tools such as web

scraping ecommerce data insights and web scraping for online retailers allow brands to monitor

competitors, anticipate market changes, and optimize promotions. The product intelligence API

for ecommerce ensures structured, reliable datasets while highlighting the importance of web

scraping for ecommerce data in predictive analytics. Additionally, ecommerce trend prediction

using web scraping enables companies to forecast demand and plan inventory efficiently,

demonstrating how the web scraping backbone of ecommerce growth powers sustainable

profitability.

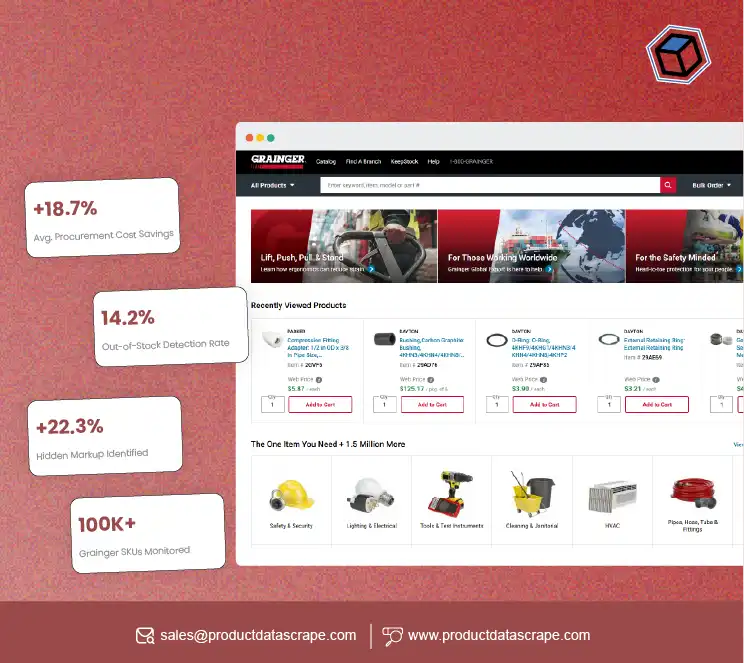

Competitive Price Monitoring

Monitoring competitor pricing is crucial for online retail profitability. Businesses leveraging

the web scraping backbone of ecommerce growth implemented solutions such as Scrape Data From Any

Ecommerce Websites and Custom eCommerce Dataset Scraping to track thousands of SKUs across

multiple marketplaces including Amazon, Flipkart, and niche eCommerce platforms. Real-time

pricing insights allow companies to adjust strategies dynamically, improving margins while

remaining competitive.

Between 2020 and 2025, average price fluctuations in electronics, home appliances, and FMCG were

significant, with electronics experiencing the highest volatility. By tracking competitor

listings in real time, brands could respond promptly to discounts, flash sales, and seasonal

promotions. The integration of Pricing Intelligence Services and E-commerce Price Monitoring

Services enabled automated alerts for price drops, allowing faster reaction times.

| Category |

2020 Avg Price (₹) |

2021 Avg Price (₹) |

2022 Avg Price (₹) |

2023 Avg Price (₹) |

2024 Avg Price (₹) |

2025 Avg Price (₹) |

| Electronics |

15,500 |

15,800 |

16,200 |

16,500 |

16,800 |

17,000 |

| Home Appliances |

8,200 |

8,400 |

8,800 |

9,000 |

9,200 |

9,300 |

| FMCG |

1,200 |

1,250 |

1,350 |

1,400 |

1,450 |

1,500 |

Leveraging web scraping ecommerce data insights allowed companies to track promotional cycles

and discount trends, providing actionable intelligence to adjust retail strategies. The web

scraping backbone of ecommerce growth ensures that businesses maintain visibility across

multiple platforms, enabling predictive pricing strategies and improved decision-making

efficiency. Real-time competitor monitoring reduces missed revenue opportunities and helps

maintain a strong market position.

Product Assortment Optimization

Optimizing product assortments requires deep visibility into regional demand and sales trends.

Using web scraping backbone of ecommerce growth, businesses applied Instant Data Scraper and Buy

Custom Dataset Solution to collect SKU-level data across geographies and eCommerce platforms.

This enabled them to identify high-demand products, track stock-outs, and adjust inventory

allocation effectively.

From 2020 to 2025, tier-2 cities experienced 10–12% higher stock-out rates for FMCG products

compared to metropolitan areas. Product-level data revealed that electronics and baby care

products had the most significant regional demand variation. By analyzing historical and

real-time data, companies could preemptively stock warehouses to meet demand spikes.

| Category |

Metro Stock-Out Rate (%) |

Tier-2 Stock-Out Rate (%) |

| Electronics |

5 |

10 |

| Baby Care |

8 |

12 |

| Home Appliances |

6 |

9 |

Using web scraping for online retailers, companies implemented data-driven assortment

strategies. Integration with ecommerce product intelligence API enabled automated insights into

category performance, seasonal trends, and regional preferences. Web scraping backbone of

ecommerce growth allowed businesses to monitor competitors’ product launches and adjust their

catalog in response, ensuring higher inventory efficiency and customer satisfaction.

Promotional and Discount Analysis

Effective promotions and discounts drive sales, but timing and depth are critical. Companies

used E-commerce Price Monitoring Services and Pricing Intelligence Services to track competitor

campaigns and optimize their own. By leveraging web scraping backbone of ecommerce growth,

businesses could capture real-time promotional data and historical trends to enhance ROI.

From 2020–2025, analysis revealed that electronics discounts during peak seasons in southern

states were on average 8% higher than northern regions. Baby care promotions showed 12–15%

variability across tier-2 cities.

| Category |

Avg Discount 2020 (%) |

Avg Discount 2021 (%) |

Avg Discount 2022 (%) |

Avg Discount 2023 (%) |

Avg Discount 2024 (%) |

Avg Discount 2025 (%) |

| Electronics |

10 |

11 |

12 |

12 |

13 |

14 |

| Baby Care |

5 |

6 |

7 |

8 |

9 |

9 |

| Home Appliances |

7 |

7 |

8 |

9 |

10 |

10 |

Using web scraping ecommerce data insights, companies identified peak promotional periods,

competitor discount strategies, and regional trends. The combination of E-commerce Price

Monitoring Services and web scraping for online retailers enabled dynamic adjustments to

campaigns, improving conversion rates and ensuring promotions reached the target audience

effectively.

Seller Performance and Market Share Analysis

Monitoring seller performance is critical for understanding market concentration and

competitiveness. Companies leveraged ecommerce product intelligence API to extract seller-level

data across platforms. Using web scraping backbone of ecommerce growth, businesses analyzed

pricing patterns, stock frequency, and regional sales to identify top-performing sellers.

From 2020–2025, data revealed that the top 20% of sellers contributed 65% of electronics sales,

highlighting market concentration.

| Year |

Top Sellers Contribution (%) |

Mid-Level Sellers Contribution (%) |

Others (%) |

| 2020 |

63 |

25 |

12 |

| 2021 |

64 |

24 |

12 |

| 2022 |

65 |

24 |

11 |

| 2023 |

65 |

23 |

12 |

| 2024 |

66 |

23 |

11 |

| 2025 |

65 |

23 |

12 |

Web scraping backbone of ecommerce growth allowed benchmarking seller performance, facilitating

targeted promotions and strategic partnerships. Companies could allocate inventory to

high-performing sellers while predicting potential stock-outs for lower-performing regions.

Integrating Price & Promotions Analysis dashboards further enabled visualization of trends,

improving competitive intelligence and decision-making.

Trend Prediction and Demand Forecasting

Accurate forecasting is vital for inventory planning and revenue optimization.

Using ecommerce trend prediction using web scraping, companies applied historical data to

predict category-specific demand. Web scraping supports eCommerce growth by providing

consistent, structured data to feed predictive models.

From 2020–2025, electronics demand peaked during festive seasons with a 15–18%

increase, while FMCG categories had steady quarterly growth of 5–7%.

| Category |

Avg Demand Growth 2020 (%) |

2021 (%) |

2022 (%) |

2023 (%) |

2024 (%) |

2025 (%) |

| Electronics |

12 |

14 |

15 |

16 |

17 |

18 |

| Baby Care |

5 |

6 |

6 |

7 |

7 |

7 |

| Home Appliances |

8 |

9 |

10 |

11 |

11 |

12 |

Using product intelligence API for ecommerce, companies forecasted demand,

planned inventory, and optimized promotional campaigns. The web scraping backbone of ecommerce

growth allowed predictive insights to be actionable, reducing stock-outs and increasing revenue.

Web scraping ecommerce data insights provided granular visibility, helping businesses respond

proactively to market trends.

Custom Dataset Creation for Market Research

Compiling unified datasets is critical for in-depth market analysis. Using

Custom eCommerce Dataset Scraping and Scrape Data From Any Ecommerce Websites, companies

integrated historical and real-time data. The web scraping backbone of ecommerce growth enabled

analytics teams to generate reports, perform benchmarking, and assess competitor strategies.

From 2020–2025, the datasets captured over 20,000 SKUs across multiple

categories, enabling web scraping ecommerce data insights and ecommerce data scraping for market

research.

| Dataset Type |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

| Electronics SKUs |

5,000 |

5,200 |

5,400 |

5,600 |

5,800 |

6,000 |

| FMCG SKUs |

7,000 |

7,200 |

7,400 |

7,600 |

7,800 |

8,000 |

| Home Appliances SKUs |

3,000 |

3,100 |

3,200 |

3,300 |

3,400 |

3,500 |

Integration with Web Data Intelligence API and Instant Data Scraper ensured

accuracy, scalability, and real-time monitoring. Businesses could perform Price Benchmarking,

trend analysis, and competitive intelligence efficiently. The datasets enabled data-driven

decision-making, optimized inventory planning, and enhanced eCommerce profitability,

illustrating how the web scraping backbone of ecommerce growth supports sustainable business

growth.

Product data scraping allows eCommerce businesses to gain actionable insights

across pricing, promotions, and product assortment. By leveraging tools such as Instant Data

Scraper, Buy Custom Dataset Solution, and Web Data Intelligence API, companies collect

structured data from multiple marketplaces in real time. Historical data from 2020–2025 supports

trend analysis, predictive modeling, and competitive benchmarking.

With ecommerce product intelligence API and web scraping for online retailers,

organizations can identify high-performing products, anticipate stock-outs, and monitor

competitor promotions. Integrating Pricing Intelligence Services and E-commerce Price Monitoring

Services allows brands to implement dynamic pricing strategies and optimize inventory. Overall,

product data scraping provides a foundation for smarter decision-making, improved ROI, and

sustainable growth.

Conclusion

The web scraping backbone of ecommerce growth is essential for modern retail

intelligence. By using Custom eCommerce Dataset Scraping, Scrape Data From Any Ecommerce

Websites, and Instant Data Scraper, businesses gain comprehensive visibility into pricing,

promotions, and competitor behavior. Integrating web scraping ecommerce data insights, Pricing

Intelligence Services, and E-commerce Price Monitoring Services enables data-driven decisions

that improve margins, optimize inventory, and enhance customer satisfaction.

From 2020–2025, organizations leveraging web scraping backbone of ecommerce

growth achieved faster pricing adjustments, better promotion planning, and improved trend

forecasting. Structured datasets, combined with predictive insights, allow retailers to

anticipate demand, respond to competitor actions, and drive profitability. For businesses

looking to thrive in the highly competitive eCommerce landscape, investing in web scraping

backbone of ecommerce growth and associated analytics solutions is no longer optional—it’s a

strategic imperative. Harness the power of automated data extraction and intelligence with

Product Data Scrape to stay ahead, maximize ROI, and support sustainable growth in online

retail.

.webp)