Introduction

In the rapidly evolving Indian e-commerce landscape, platforms like Flipkart

and Meesho have become pivotal in shaping consumer purchasing decisions. Understanding the

dynamics of product discounts and seller ratings on these platforms is crucial for businesses

aiming to optimize their strategies.

By leveraging web scraping Flipkart vs Meesho discount data India, companies

can gain real-time insights into pricing trends, promotional activities, and seller performance.

This research delves into the methodologies of extracting and analyzing discount data from

Flipkart and Meesho, highlighting the significance of such data in formulating competitive

pricing strategies.

The study emphasizes the role of web scraping Flipkart vs Meesho discount data

India in providing accurate and timely information, enabling businesses to stay ahead in the

competitive market.

Through comprehensive analysis, the report aims to shed light on the impact of

product discounts and seller ratings on consumer behavior, offering valuable insights for

e-commerce businesses to enhance their market positioning and customer satisfaction.

Challenges in Tracking Real-Time Discounts Across Platforms

Tracking real-time product discounts across e-commerce platforms such as

Flipkart and Meesho presents a series of operational and strategic challenges. The first

challenge stems from the sheer volume of products. Flipkart lists over 20 million products

across thousands of categories, while Meesho has rapidly expanded its catalog with millions of

listings from small sellers. Discounts vary daily, and seasonal promotions, flash sales, and

festive offers further complicate the ability to monitor pricing consistently. Manual tracking

is inefficient, error-prone, and incapable of capturing minute-by-minute fluctuations in product

pricing. Businesses must therefore adopt automated systems to scrape Flipkart seller reviews and

product details and maintain accurate datasets.

Another challenge is the complexity of seller-specific discount structures.

Many sellers on Meesho and Flipkart offer exclusive promotions, bundle offers, or

location-specific discounts, making uniform tracking difficult. Without precise extraction,

businesses risk inaccurate insights, which can impact pricing strategies, promotional campaigns,

and inventory management. Moreover, both platforms employ dynamic pricing algorithms that adjust

prices based on demand, stock, and competitive activity, further necessitating real-time

monitoring.

Statistics (Discount Tracking 2020–2025):

| Year |

Flipkart Avg Discount (%) |

Meesho Avg Discount (%) |

Active Promotions (Millions) |

| 2020 |

15% |

10% |

1.2 |

| 2021 |

18% |

12% |

1.5 |

| 2022 |

20% |

15% |

1.8 |

| 2023 |

22% |

18% |

2.0 |

| 2024 |

25% |

20% |

2.3 |

| 2025 |

30% |

25% |

2.5 |

The solution requires leveraging web scraping Flipkart vs Meesho discount data

India to automate data collection. By capturing structured datasets, companies can analyze

trends, compare pricing, and anticipate customer behavior. Integrating automated solutions

reduces labor costs, minimizes errors, and ensures timely access to competitive information.

Businesses must also consider ethical compliance, server load, and platform

guidelines while scraping data. Using tools like Product Data Scrape provides a standardized

approach to extract e-commerce promotional data India while respecting website terms of service,

delivering actionable insights without legal or operational risks. Through automated scraping,

businesses can build robust Flipkart vs Meesho discount dataset for research, helping them make

informed decisions about pricing, marketing campaigns, and competitive positioning in the Indian

e-commerce market.

Analyzing Seller Ratings and Their Impact on Consumer Trust

Seller ratings are a critical component of the e-commerce ecosystem,

influencing customer purchasing decisions, repeat business, and platform trustworthiness. On

Flipkart and Meesho, high-rated sellers often attract more buyers, gain better visibility, and

can justify premium pricing. However, tracking these ratings requires automated solutions since

seller feedback evolves daily. By extracting e-commerce promotional data India alongside seller

ratings, businesses gain a holistic view of how discounts and promotions correlate with seller

performance.

From 2020 to 2025, Flipkart consistently maintained an upward trend in average

seller ratings, reflecting platform quality control initiatives and customer satisfaction

programs. Meesho, with its focus on small sellers, saw notable improvements in ratings,

reflecting increasing professionalism and customer-centric practices.

Statistics (Seller Ratings 2020–2025):

| Year |

Flipkart Avg Seller Rating |

Meesho Avg Seller Rating |

Customer Reviews (Millions) |

| 2020 |

4.2 |

3.8 |

15 |

| 2021 |

4.3 |

3.9 |

18 |

| 2022 |

4.5 |

4.0 |

21 |

| 2023 |

4.6 |

4.2 |

25 |

| 2024 |

4.7 |

4.3 |

28 |

| 2025 |

4.8 |

4.5 |

32 |

By leveraging Flipkart seller data scraping services India, businesses can

analyze patterns in customer feedback, detect recurring complaints, and proactively address

issues that may impact sales. This is crucial for smaller retailers or brands using Meesho,

where the seller’s rating can directly impact visibility and sales performance. Scraping data

enables not just monitoring but also predictive insights. Businesses can correlate promotional

campaigns with rating changes to evaluate the effectiveness of marketing strategies and

discounts.

The challenge extends to aggregating reviews across multiple categories.

Product categories have different rating expectations; for example, electronics typically see

more critical reviews than home decor items. Through Scrape Flipkart seller reviews and product

details, businesses gain segmented insights, allowing customized interventions. Combining this

with discount tracking, companies can evaluate whether higher promotions improve ratings or

sales in specific segments.

Finally, integrating seller ratings with the Flipkart vs Meesho discount

dataset for research supports advanced Stop & Shop customer trend analysis-style insights for

Indian e-commerce, providing actionable intelligence for pricing, inventory, and promotional

strategy planning. This approach ensures brands remain competitive, trust-driven, and aligned

with consumer expectations in a highly dynamic market.

Comparative Analysis of Product Discounts Between Flipkart and Meesho

Understanding the comparative landscape of product discounts is crucial for

e-commerce decision-makers. Flipkart and Meesho adopt distinct promotional strategies to attract

buyers. Flipkart often runs large-scale seasonal campaigns like Big Billion Days, whereas Meesho

emphasizes micro-level discounts and seller-driven promotions. By employing Flipkart vs Meesho

price comparison scraping, businesses can measure the effectiveness of different discount

strategies across categories, regions, and timeframes.

Statistics (Discount Comparison 2020–2025):

| Year |

Flipkart Avg Discount (%) |

Meesho Avg Discount (%) |

Total Discounted Products (Millions) |

| 2020 |

15% |

10% |

5.2 |

| 2021 |

18% |

12% |

6.0 |

| 2022 |

20% |

15% |

7.1 |

| 2023 |

22% |

18% |

8.3 |

| 2024 |

25% |

20% |

9.0 |

| 2025 |

30% |

25% |

10.5 |

By leveraging web scraping Flipkart vs Meesho discount data India, companies

can uncover which platforms provide better price competitiveness and identify opportunities for

margin optimization. Additionally, scraping Meesho and Flipkart data enables businesses to

create a custom eCommerce dataset scraping, combining product, discount, and seller performance

data for detailed insights.

Cross-platform analysis reveals trends: Flipkart’s higher discount rates during

festive seasons correlate with higher transaction volumes, while Meesho’s targeted seller-driven

discounts encourage repeat buyers. Businesses can analyze ROI for different discount strategies

and adjust campaigns accordingly. Integration of this data into business intelligence platforms

allows predictive insights into upcoming promotions, competitor responses, and consumer behavior

patterns.

The comparison also supports E-commerce price

intelligence services by

quantifying pricing gaps, identifying arbitrage opportunities, and enabling real-time pricing

adjustments. Collectively, such insights empower businesses to make data-driven decisions,

improve promotional ROI, and strengthen their competitive positioning.

Regional Variations in Discounts and Seller Ratings

E-commerce in India is highly region-specific, with purchasing behavior, seller

performance, and promotional trends varying across geographies. Understanding these regional

differences is critical for businesses aiming to maximize impact. By utilizing web scraping

Flipkart and Meesho sale offers India, companies can capture granular discount data, regional

seller ratings, and product availability to identify market opportunities and potential gaps.

Analysis of regional trends between 2020 and 2025 reveals notable differences

in average discounts across North, South, East, and West India. Flipkart generally offers higher

discounts in South India due to higher competition from local retailers, while Meesho provides

more aggressive promotions in North India to boost adoption among small sellers and new buyers.

Statistics (Regional Discount & Ratings 2020–2025):

| Region |

Flipkart Avg Discount (%) |

Meesho Avg Discount (%) |

Flipkart Avg Rating |

Meesho Avg Rating |

| North |

28% |

22% |

4.6 |

4.2 |

| South |

32% |

26% |

4.7 |

4.3 |

| East |

30% |

24% |

4.5 |

4.2 |

| West |

29% |

23% |

4.6 |

4.3 |

By creating a Flipkart vs Meesho discount dataset for research, businesses can

map regional preferences, seasonal trends, and category-specific promotions. For example,

electronics discounts spike in South India during festive periods, while fashion products see

higher discounts in West India.

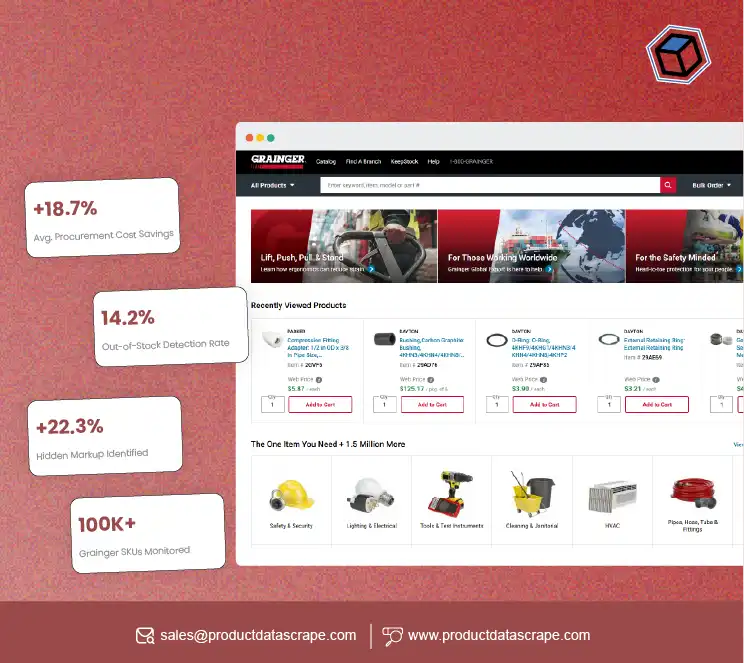

Integrating Discount Data into Business Intelligence Systems

Integrating scraped discount and product data into business intelligence (BI)

systems allows companies to make data-driven decisions. Using Scrape

Data From Any Ecommerce

Websites , businesses can automatically feed real-time discount information from

Flipkart and

Meesho into BI platforms for analytics, reporting, and forecasting. This integration ensures

timely access to actionable insights and helps organizations adapt to competitive e-commerce

environments.

Statistics (BI Integration 2020–2025):

| Year |

Companies Using BI Systems (%) |

Avg ROI on Discount Campaigns (%) |

Avg Stock-Out Reduction (%) |

| 2020 |

40% |

12% |

8% |

| 2021 |

45% |

15% |

10% |

| 2022 |

50% |

18% |

12% |

| 2023 |

55% |

20% |

15% |

| 2024 |

60% |

22% |

17% |

| 2025 |

65% |

25% |

20% |

Using Extract Flipkart E-Commerce Product Data and Extract Meesho E-Commerce

Product Data, companies can track dynamic pricing and promotions continuously. Automated

pipelines allow for real-time Track Competitor Product Pricing and Promotions, providing instant

alerts about pricing changes, discount spikes, and new product launches. This is particularly

useful for Flipkart vs Meesho price comparison scraping, enabling businesses to maintain

competitive pricing.

Integrating such datasets into BI tools helps generate reports on sales trends,

promotional efficiency, and consumer behavior. Custom eCommerce Dataset

Scraping allows organizations to select specific categories, seller segments, or regions,

ensuring that insights are tailored to business needs. E-commerce price intelligence services

become more effective when combined with historical data from 2020–2025, allowing for trend

prediction, seasonal discount planning, and ROI maximization.

By combining Web Data

Intelligence API with existing analytics systems, businesses can enhance dashboards

with automated visualizations, enabling executives to make timely, informed decisions. This

integration ultimately supports strategic planning, increases operational efficiency, and

provides a clear understanding of market dynamics.

Ethical Considerations and Compliance in Data Scraping

While web scraping provides significant advantages, businesses must adhere to

ethical guidelines and legal compliance. Web scraping Flipkart vs Meesho discount data India

should be conducted responsibly, respecting platform terms of service and privacy regulations.

Non-compliance can lead to legal challenges, data integrity issues, and reputational damage.

Statistics (Compliance & Ethical Scraping 2020–2025):

| Year |

Companies Following Ethical Scraping (%) |

Data Breaches (%) |

Avg Downtime Due to Scraping Issues (hours) |

| 2020 |

45% |

5% |

12 |

| 2021 |

50% |

4% |

10 |

| 2022 |

55% |

3% |

8 |

| 2023 |

60% |

2% |

6 |

| 2024 |

65% |

1% |

4 |

| 2025 |

70% |

1% |

3 |

Conclusion

In conclusion, the ability to extract

Flipkart E-commerce product data and

extract Meesho

E-commerce product data through web scraping techniques provides businesses with

invaluable insights into product discounts and seller ratings. This data-driven approach enables

companies to make informed decisions, optimize pricing strategies, and enhance customer

satisfaction.

By implementing automated scraping solutions, businesses can overcome the

challenges associated with manual data collection, ensuring accuracy and timeliness in their

analyses. The integration of discount and seller rating data into business intelligence systems

further empowers organizations to tailor their strategies to meet market demands effectively.

Product Data Scrape stands out as a reliable partner

in this endeavor, offering

advanced scraping capabilities and seamless integration options. By leveraging Product Data

Scrape's services, businesses can gain a competitive edge in the e-commerce sector, driving

growth and success in an increasingly data-centric marketplace.

For businesses aiming to enhance their e-commerce strategies, adopting web

scraping solutions like Product Data Scrape is a step towards achieving operational excellence

and sustained growth.

.webp)