Introduction

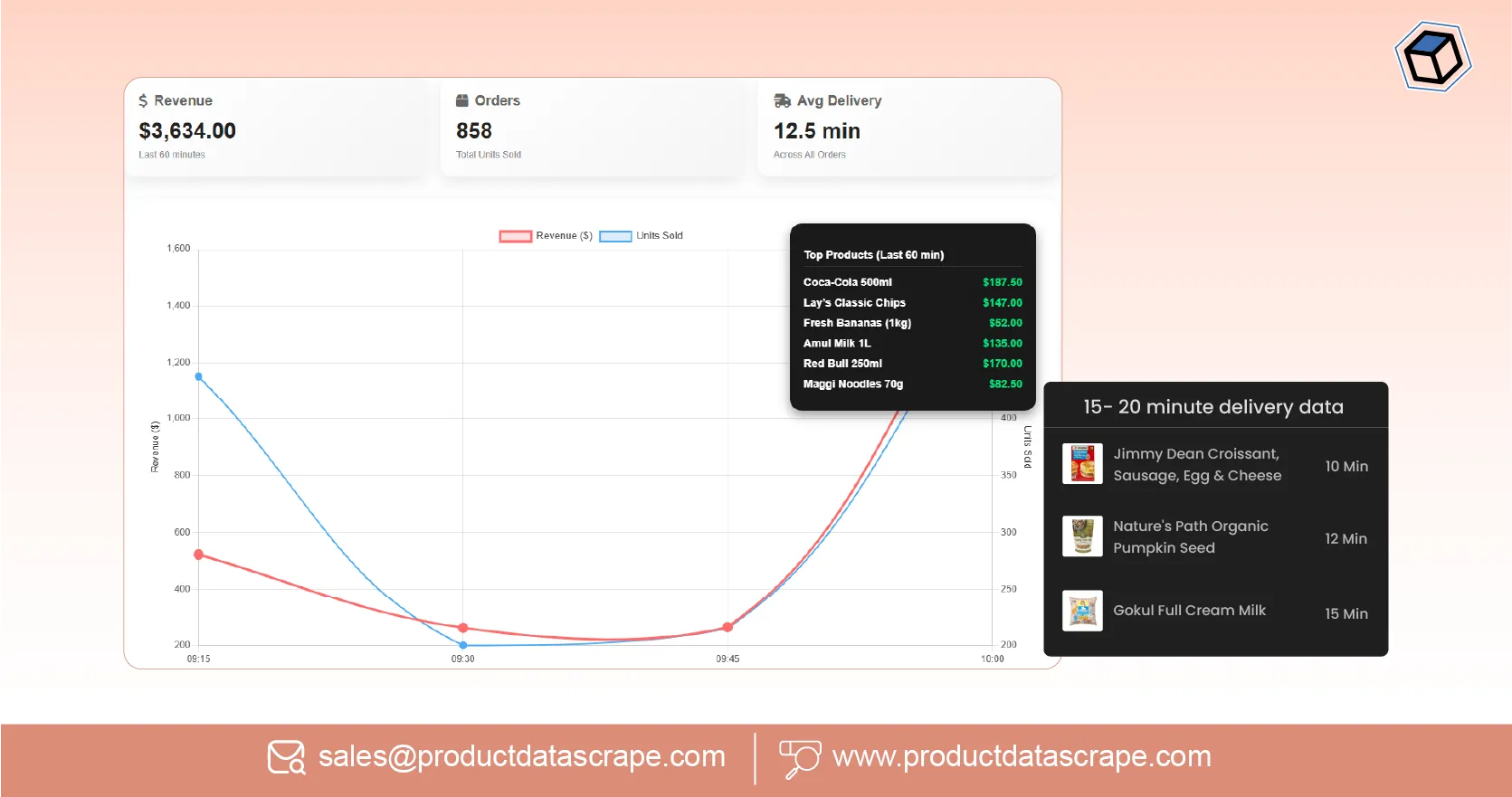

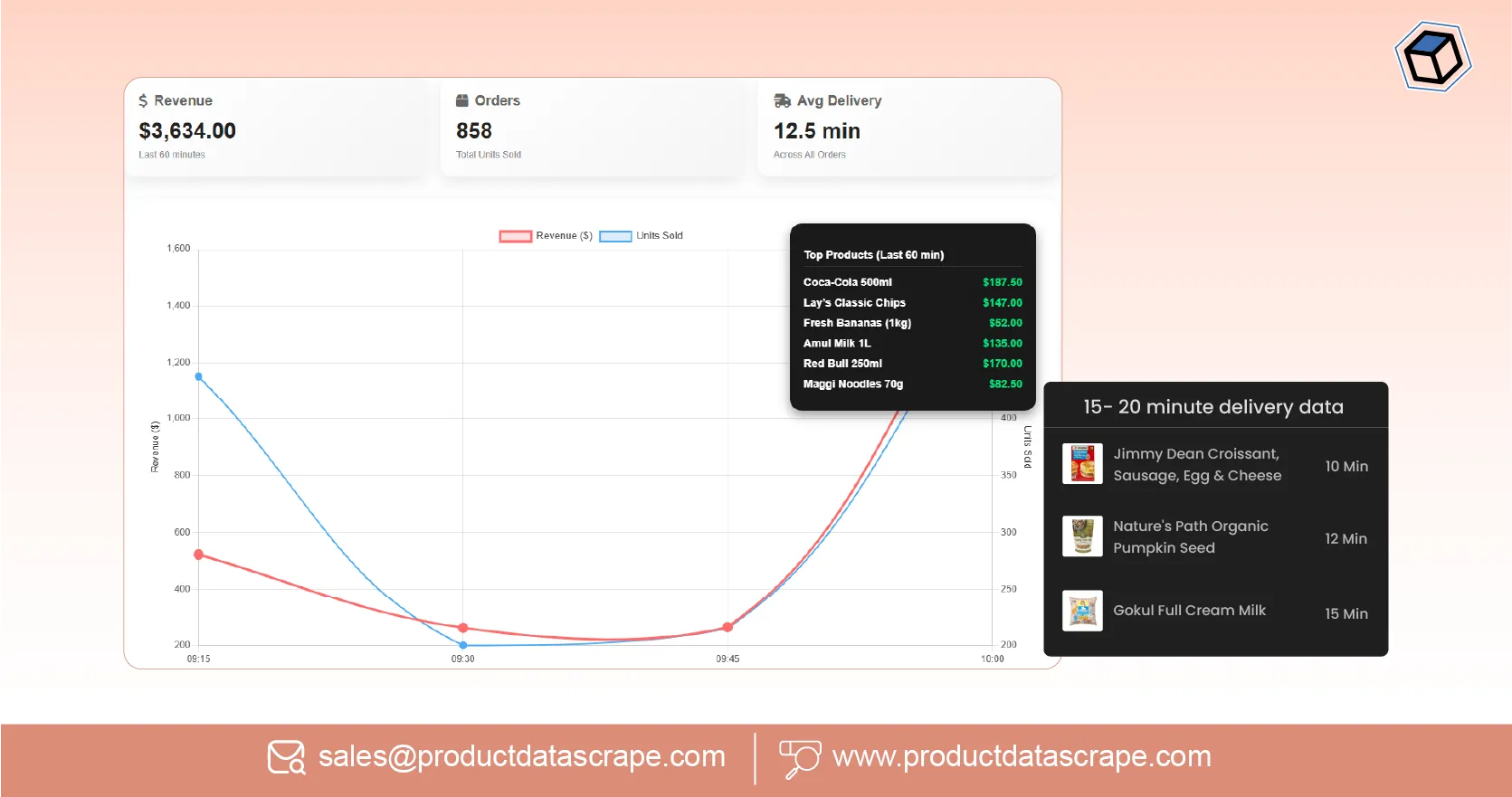

In today’s ultra-competitive quick commerce market, timely insights can make or break a retail

business. 15-minute delivery data extraction and SQL analysis from scraped data allows retailers

to make informed decisions in real-time, ensuring they remain agile in a fast-moving

environment. With customer expectations shifting toward hyperlocal and instant delivery,

businesses must understand pricing trends, delivery efficiency, and competitor strategies to

stay ahead.

Scraping and analyzing quick commerce platforms enables retailers to capture granular details

about product availability, delivery times, and price fluctuations. For example, data from

grocery and FMCG platforms reveals which items are moving fastest and which are lagging in local

demand. Using SQL-based analysis, this data can be quickly transformed into actionable insights,

supporting strategic decisions for inventory management, pricing, and promotions.

From SQL insights from scraped quick commerce data to tracking competitive pricing, combining

scraping with ultrafast analysis creates a powerful toolkit. This blog explores practical

problem-solving techniques for capturing, storing, and analyzing delivery data efficiently,

providing actionable insights for real-time retail decision-making.

Hyperlocal Delivery Data Extraction

In today’s quick commerce market, consumers expect products delivered within minutes. Hyperlocal

delivery plays a crucial role in meeting these expectations. Businesses that implement

hyperlocal delivery data extraction can map demand geographically, optimize routes, and monitor

delivery performance for different zones.

The Problem

Without capturing location-specific data, retailers cannot identify which areas experience high

demand or delayed deliveries. Standard scraping techniques often miss hyperlocal nuances such as

delivery slots, courier efficiency, and stock availability across micro-locations. Incomplete

data leads to poor planning and customer dissatisfaction.

The Solution

Here’s how to handle it:

- Dynamic API Monitoring – Inspect the platform’s API

endpoints to capture delivery estimates and stock for each postal code. Many quick commerce

apps use location-based APIs to return delivery times dynamically.

- Automated Extraction Pipelines – Implement Python or

Node.js scrapers to continuously extract hyperlocal delivery data. Store it in a structured

SQL database for quick queries and historical comparisons.

- Data Validation – Cross-check timestamps, delivery slots,

and stock availability to ensure accuracy. Invalid data can distort decision-making.

- Visualization & Analytics – Map delivery efficiency and

stock availability by zone to identify bottlenecks or high-demand regions.

Example

A grocery retailer using hyperlocal extraction discovered that Zone A consistently had 20%

longer delivery times than average. By reallocating couriers and adjusting stock, delivery times

improved, reducing customer complaints by 15%.

Stats: Hyperlocal Delivery Trends (2020–2025)

| Year |

Avg Delivery Time (min) |

Hyperlocal Coverage (%) |

| 2020 |

35 |

25 |

| 2021 |

30 |

40 |

| 2022 |

25 |

55 |

| 2023 |

20 |

65 |

| 2024 |

18 |

75 |

| 2025 |

15 |

85 |

By leveraging 15-minute delivery data extraction and SQL analysis from scraped data, retailers

gain a competitive edge by identifying zones with the highest potential and optimizing

operations accordingly.

Scrape Delivery Time & Pricing Insights

Monitoring both delivery time and pricing is critical in fast-moving retail. Businesses that

scrape delivery time & pricing insights can understand cost dynamics and offer competitive

prices while maintaining service quality.

The Problem

Quick commerce platforms adjust fees frequently based on demand, peak hours, or location.

Without real-time monitoring, retailers risk underpricing, losing revenue, or overpricing,

causing customer churn. Additionally, fluctuating delivery times impact customer satisfaction

and fulfillment efficiency.

The Solution

Here’s how to handle it:

- Frequent Data Capture – Schedule scrapers to extract

delivery times and fees multiple times daily to capture real-time fluctuations.

- Structured SQL Analysis – Store data in tables with

columns like product_id, delivery_time, delivery_fee, zone, and timestamp. Use SQL queries

to detect trends, outliers, and patterns.

- Dashboard Visualization – Utilize SQL-powered BI tools

like Power BI or Tableau to visualize peak delivery times, fastest zones, and pricing

trends.

- Predictive Insights – Historical SQL data enables

forecasting of peak hours, helping in resource allocation and dynamic pricing.

Example

A retailer tracking delivery fees discovered surge pricing during evening hours. By

pre-positioning stock in local warehouses, delivery times decreased by 12%, and cost per

delivery reduced by 8%.

Stats: Delivery Fee Trends (2020–2025)

| Year |

Avg Delivery Fee (₹) |

Price Variance (%) |

| 2020 |

25 |

10 |

| 2021 |

28 |

12 |

| 2022 |

30 |

15 |

| 2023 |

32 |

18 |

| 2024 |

35 |

20 |

| 2025 |

38 |

22 |

Integrating ultrafast delivery data monitoring with SQL ensures that businesses can proactively

adjust pricing and delivery schedules, improving revenue and customer satisfaction.

Boost your quick commerce strategy—scrape delivery time & pricing

insights to optimize costs, speed, and customer satisfaction instantly!

Contact Us Today!

Quick Commerce Price Tracker Scraping

In a competitive landscape, monitoring competitor prices is essential. Quick commerce price

tracker scraping automates competitor monitoring to identify promotions, price drops, and

trending products.

The Problem

Manual tracking is slow, error-prone, and insufficient for rapid decision-making. Competitor

prices fluctuate multiple times per day, and missed opportunities lead to lost revenue.

The Solution

Here’s how to handle it:

- Automated Scrapers – Build scripts to extract competitor

prices for top SKUs several times per day. Capture product ID, price, discount, and

promotion details.

- SQL Database Storage – Organize historical competitor

data for comparison, trend analysis, and price elasticity calculation.

- Real-Time Alerts – Set thresholds to receive

notifications whenever competitor prices drop or promotions are launched.

- Market Strategy Integration – Feed competitor insights

into dynamic pricing engines to automatically adjust your prices.

Example

By tracking competitor discounts for grocery items, a retailer aligned prices within 5% of the

market average, increasing conversion rates by 10%.

Stats: Competitor Pricing Trends (2020–2025)

| Year |

Avg Price Change (%) |

Competitor Promotions (%) |

| 2020 |

5 |

10 |

| 2021 |

6 |

12 |

| 2022 |

7 |

15 |

| 2023 |

8 |

18 |

| 2024 |

9 |

20 |

| 2025 |

10 |

22 |

Using scrapers to track competitor product pricing and promotions, retailers can respond

instantly to market fluctuations, maintaining competitiveness.

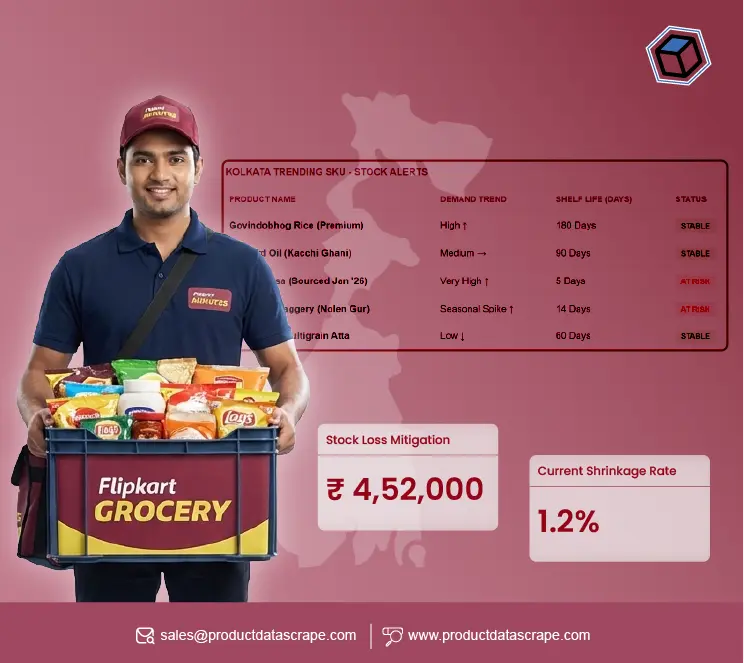

Extract Grocery & Gourmet Food Data

In the quick commerce segment, grocery and gourmet food items account for a large portion of

orders. Efficient Extract Grocery & Gourmet Food Data pipelines allow retailers to capture

SKU-level insights, stock levels, pricing, and promotions. This ensures timely inventory

decisions and targeted marketing campaigns.

The Problem

Manual data collection or partial scraping leads to incomplete datasets. Retailers might miss

high-demand SKUs, localized shortages, or promotional offers, resulting in stockouts or missed

revenue opportunities. Additionally, data inconsistencies across stores or platforms can distort

insights if not properly handled.

The Solution

Here’s how to handle it:

- Targeted Scrapers – Focus on high-demand categories like

fresh produce, packaged foods, beverages, and gourmet items. Capture product details

including SKU, weight, price, delivery time, and promotions.

- SQL Database Structuring – Store extracted data in

structured tables for efficient querying. Include fields like product_id, category, price,

stock, promotion_flag, and timestamp.

- Historical Analysis – Compare current stock and pricing

against historical trends to predict demand surges and optimize inventory allocation.

- Real-Time Updates – Schedule scrapers at intervals (e.g.,

every 15 minutes) to ensure data reflects live availability and price changes.

Example

A retailer used scraped grocery data to identify best-selling items in urban zones. By

pre-stocking high-demand SKUs, they reduced stockouts by 20% and increased order fulfillment

efficiency by 15%.

Stats: Grocery Product Trends (2020–2025)

| Year |

Avg SKU Count |

Fast-Moving SKU % |

| 2020 |

5000 |

40 |

| 2021 |

6000 |

45 |

| 2022 |

7500 |

50 |

| 2023 |

9000 |

55 |

| 2024 |

10500 |

60 |

| 2025 |

12000 |

65 |

Integrating Quick Commerce Grocery & FMCG Data Scraping with SQL analytics allows retailers to

monitor trends, plan promotions, and optimize inventory allocation dynamically.

Competitor Price Monitoring Services

Price competitiveness is critical in quick commerce. Competitor Price Monitoring Services allow

retailers to track rival pricing, discounts, and promotions, ensuring they remain

market-relevant.

The Problem

Manual competitor tracking is slow and often inaccurate. Missed promotions or delayed pricing

adjustments can lead to lost market share. Additionally, competitors may introduce surge pricing

or localized discounts that require real-time monitoring to stay competitive.

The Solution

Here’s how to handle it:

- Real-Time Scraping – Capture competitor product pricing,

promotions, and stock levels multiple times per day. Track all variations across SKU,

location, and delivery time.

- SQL Storage & Analysis – Maintain historical tables for

competitor prices. Use SQL queries to calculate average price changes, promotional

frequency, and price elasticity.

- Alerts & Notifications – Automate notifications when

competitor prices drop or new promotions appear. This enables timely counter-strategies.

- Predictive Insights – Analyze historical trends to

forecast competitor pricing strategies, allowing proactive adjustments rather than reactive

responses.

Example

By monitoring competitor prices for grocery SKUs, a retailer adjusted their prices within

minutes of a competitor promotion. This resulted in a 12% increase in sales for the promoted

items.

Stats: Competitor Pricing Analysis (2020–2025)

| Year |

Price Monitoring Frequency |

Avg Reaction Time (hrs) |

| 2020 |

Weekly |

48 |

| 2021 |

3x Weekly |

36 |

| 2022 |

Daily |

24 |

| 2023 |

2x Daily |

12 |

| 2024 |

Hourly |

6 |

| 2025 |

Real-Time |

1 |

Combining competitor tracking with Pricing Intelligence Services ensures retailers maintain

dynamic pricing strategies, reducing revenue loss and increasing competitiveness.

Stay ahead in retail—use Competitor Price Monitoring Services to track

rival pricing, optimize strategies, and maximize revenue effortlessly!

Contact Us Today!

Ultrafast Delivery Data Monitoring with SQL

Speed and reliability are the backbone of quick commerce. Ultrafast delivery data monitoring

with SQL enables retailers to track delivery efficiency, fulfillment accuracy, and operational

performance in near real-time.

The Problem

Without continuous monitoring, delayed deliveries, stockouts, and incorrect pricing can damage

customer trust and reduce repeat orders. Manual tracking cannot keep pace with rapid changes in

delivery efficiency and demand fluctuations.

The Solution

Here’s how to handle it:

- Real-Time Extraction Pipelines – Implement automated

scrapers to capture delivery times, stock availability, and pricing updates every 15

minutes.

- SQL-Based Analysis – Aggregate and query data to identify

trends, anomalies, and performance bottlenecks. Create historical tables for predictive

analytics.

- Dashboards & Alerts – Visualize delivery times, SKU-level

stock status, and pricing changes on dashboards. Set automated alerts for delays, stock

shortages, or price fluctuations.

- Actionable Insights – Use insights to reallocate

resources, optimize courier deployment, and adjust prices dynamically.

Example

A retailer monitored delivery times across 10 urban zones. SQL dashboards revealed that Zone C

consistently had 10% longer delivery times during evening hours. By reallocating couriers and

pre-positioning stock, average delivery times reduced from 22 minutes to 15 minutes.

Stats: Delivery Monitoring Trends (2020–2025)

| Year |

Avg Data Refresh Time (min) |

Avg Delivery Accuracy (%) |

| 2020 |

120 |

85 |

| 2021 |

60 |

87 |

| 2022 |

30 |

90 |

| 2023 |

15 |

92 |

| 2024 |

10 |

94 |

| 2025 |

5 |

96 |

Why Choose Product Data Scrape?

Product Data Scrape specializes in building automated pipelines for 15-minute delivery data

extraction and SQL analysis from scraped data. We help businesses gather hyperlocal,

competitive, and grocery-specific data efficiently. Our services include Quick Commerce Grocery

& FMCG Data Scraping, competitor monitoring, and delivery performance insights.

With structured SQL storage, our solutions enable fast analytics and visualization, empowering

retailers to optimize pricing, stock, and delivery in real-time. Whether you need scrapers to

track competitor product pricing and promotions or SQL insights from scraped quick commerce

data, we provide reliable, scalable, and actionable datasets.

Conclusion

Real-time retail decision-making relies on speed and accuracy. 15-minute delivery data

extraction and SQL analysis from scraped data equips businesses with actionable insights,

enabling competitive pricing, faster deliveries, and inventory optimization.

From hyperlocal delivery monitoring to grocery-specific analytics and competitor price tracking,

scraping combined with SQL analysis empowers retailers to respond instantly to market changes.

Ready to transform your retail operations? Partner with Product Data Scrape to unlock real-time

insights, optimize pricing, and stay ahead in the quick commerce race!

.webp)

.webp)

.webp)