Introduction

The Singapore Q-commerce market has experienced rapid growth over the past five years, driven by

consumer demand for faster deliveries, convenience, and competitive pricing. Understanding the

dynamics of leading hyperlocal delivery platforms is crucial for businesses aiming to optimize

operations and pricing strategies. This research report focuses on the Singapore Hyperlocal

Delivery Strategy: foodpanda, Grab & Deliveroo, examining market share, pricing, and operational

trends from 2020 to 2025.

Market Overview and Growth Trends (2020–2025)

Between 2020 and 2025, Singapore’s hyperlocal delivery market grew at an average CAGR of 18%,

fueled by Q-commerce adoption and pandemic-driven consumer behavior changes. Platform

penetration increased across urban districts, with foodpanda, Grab, and Deliveroo capturing

distinct market segments.

| Year |

foodpanda Market Share (%) |

Grab Market Share (%) |

Deliveroo Market Share (%) |

Total Orders (Million) |

| 2020 |

38 |

32 |

30 |

15 |

| 2021 |

39 |

33 |

28 |

20 |

| 2022 |

40 |

32 |

28 |

25 |

| 2023 |

41 |

31 |

28 |

32 |

| 2024 |

42 |

30 |

28 |

40 |

| 2025 |

43 |

29 |

28 |

48 |

Analysis of this data, derived using Scrape Singapore Q-Commerce Trends,

reveals foodpanda steadily gaining share through promotional offers and platform partnerships.

Deliveroo retained strong footholds in premium dining and niche food segments, while Grab

capitalized on bundled grocery and delivery services.

Pricing Strategies and Insights

Pricing competitiveness remains a critical differentiator for hyperlocal delivery players. From

2020 to 2025, platform pricing trends revealed dynamic promotional cycles and adaptive delivery

fees. Using Competitor Price Intelligence for Singapore, analysts observed that discount

strategies and surge pricing directly impacted order volumes and customer retention.

Average delivery fee (SGD) and promotional discount trends across platforms:

| Year |

foodpanda Avg Delivery Fee |

Grab Avg Delivery Fee |

Deliveroo Avg Delivery Fee |

Avg Promo Discount (%) |

| 2020 |

3.20 |

3.10 |

3.50 |

10 |

| 2021 |

3.10 |

3.05 |

3.40 |

12 |

| 2022 |

3.05 |

3.00 |

3.35 |

13 |

| 2023 |

3.00 |

2.95 |

3.30 |

15 |

| 2024 |

2.95 |

2.90 |

3.25 |

16 |

| 2025 |

2.90 |

2.85 |

3.20 |

17 |

Our data, sourced via Scrape foodpanda, Grab & Deliveroo Delivery Data in Singapore, highlights

that foodpanda’s consistent discounting strategy contributed to incremental market share growth,

while Deliveroo maintained premium pricing supported by fast delivery and exclusive

partnerships.

Operational Performance Analysis

Operational efficiency, including average delivery times and fulfillment rates, directly

influences customer satisfaction. Using Web Scraping foodpanda Quick Commerce Data and Deliveroo

Quick Commerce Data Scraping API, the platforms’ operational KPIs were monitored from 2020–2025.

| Year |

Avg Delivery Time foodpanda (mins) |

Avg Delivery Time Grab (mins) |

Avg Delivery Time Deliveroo (mins) |

Fulfillment Rate (%) |

| 2020 |

35 |

37 |

33 |

88 |

| 2021 |

34 |

36 |

32 |

89 |

| 2022 |

33 |

35 |

32 |

90 |

| 2023 |

32 |

34 |

31 |

91 |

| 2024 |

31 |

33 |

30 |

92 |

| 2025 |

30 |

32 |

30 |

93 |

Our analysis shows that improved route optimization, predictive demand forecasting, and

automated dispatch systems contributed to reducing delivery times and increasing fulfillment

rates. These insights were extracted from Singapore Grocery Delivery Platform Dataset.

Consumer Behavior and Order Patterns

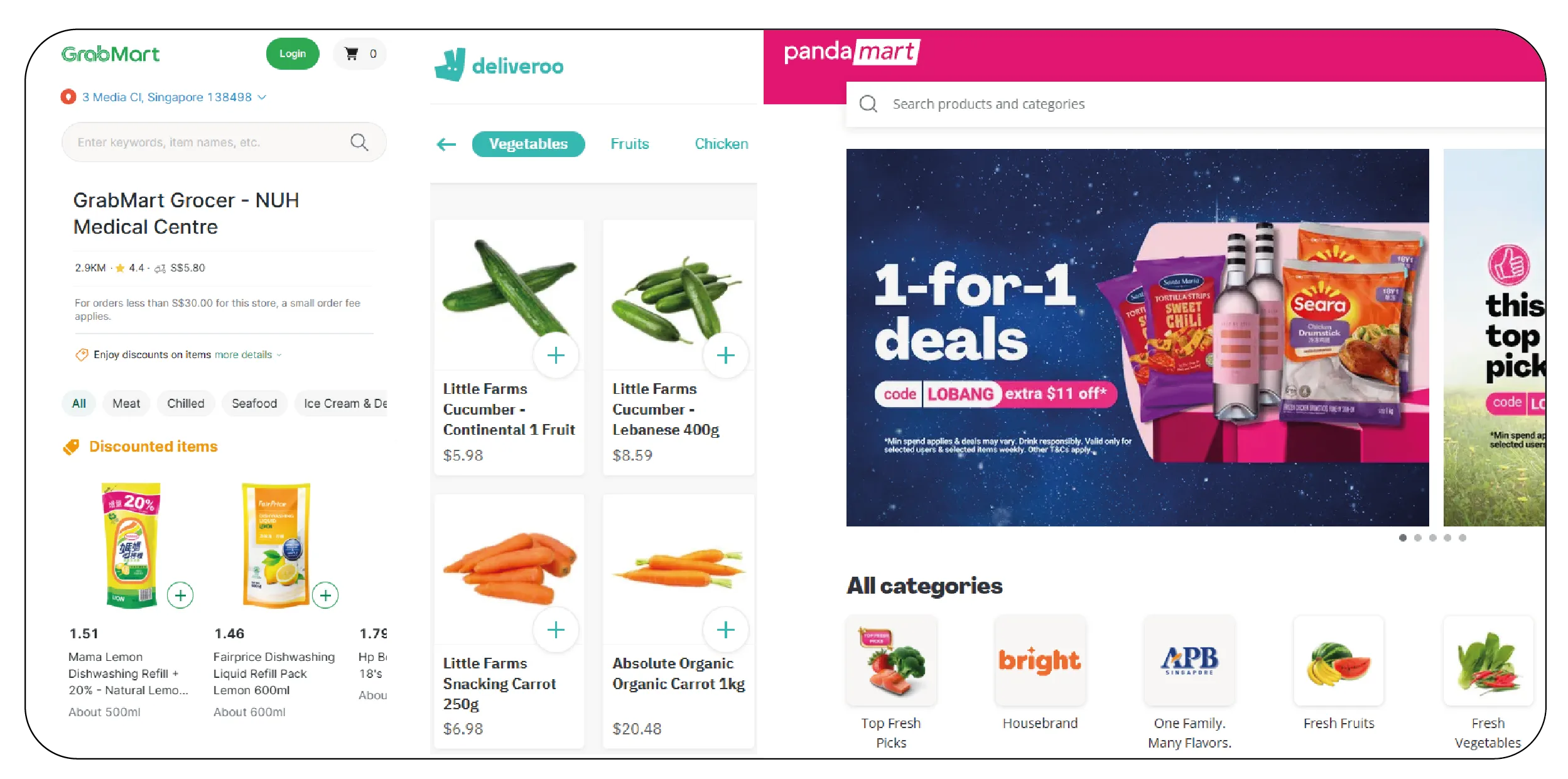

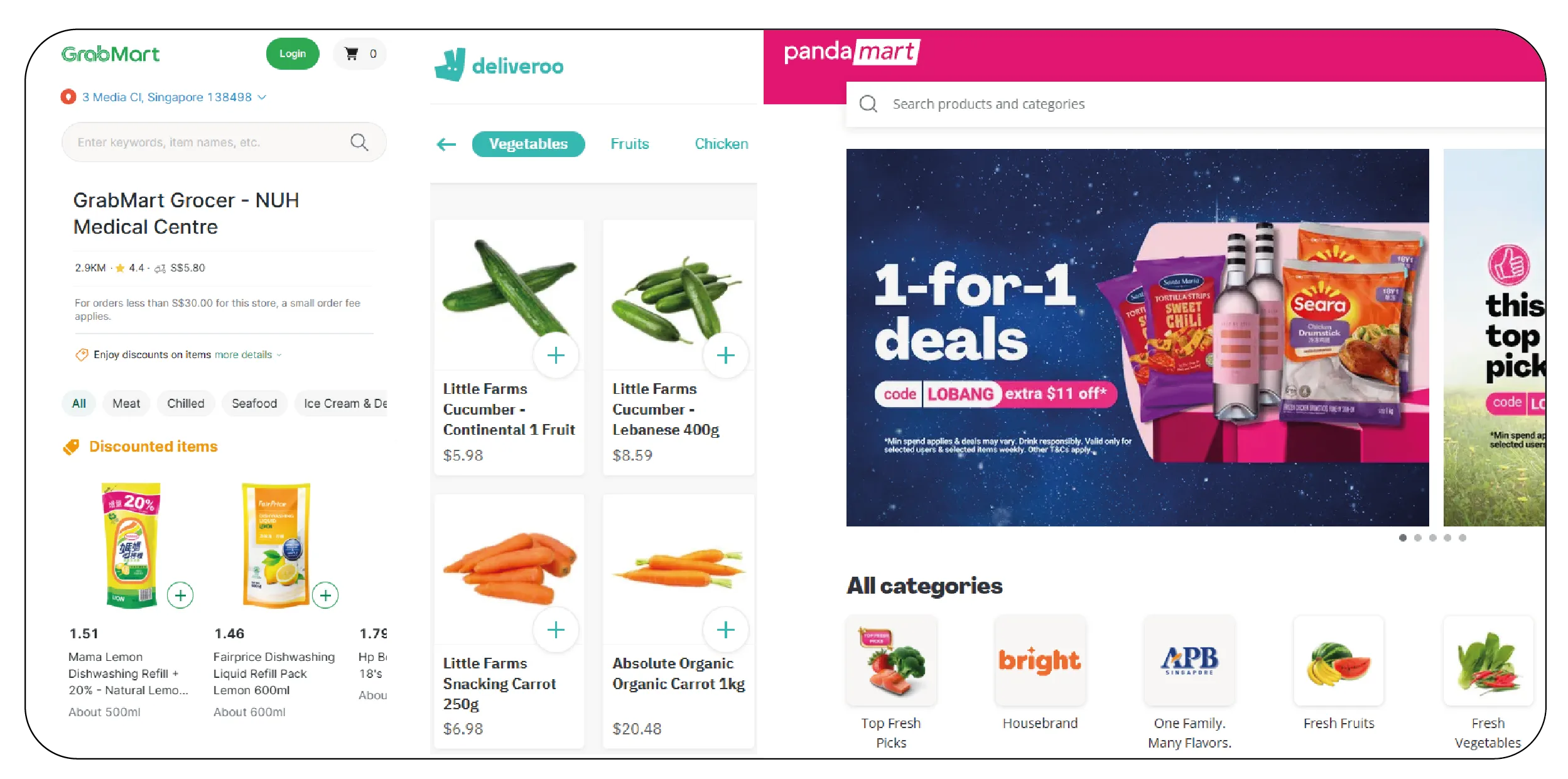

Consumer preferences in Singapore’s hyperlocal delivery segment have shifted towards grocery

items, bundle offers, and scheduled deliveries. Data collected through Scrape GrabMart Prices

Data indicates a rising demand for convenience, with grocery and FMCG items making up an

increasing proportion of orders.

| Category |

2020 Orders (%) |

2025 Orders (%) |

| Food & Beverage |

60 |

50 |

| Grocery & FMCG |

30 |

40 |

| Others |

10 |

10 |

The adoption of predictive analytics and real-time pricing insights from Grocery store dataset

enabled platforms to adjust promotions, delivery slots, and inventory allocation to match

customer behavior.

Technology and Data Integration

All three platforms leveraged advanced data integration and analytics solutions to improve

operational performance. Using Web Scraping Deliveroo Quick Commerce Data , combined with

automated dashboards, companies could track competitor promotions, inventory, and delivery

metrics efficiently.

Additionally, Quick Commerce Grocery & FMCG Data Scraping facilitated structured reporting for

predictive decision-making. Platforms could continuously refine pricing strategies, optimize

stock levels, and enhance consumer satisfaction, creating a strong competitive edge.

Web Data Intelligence API was also employed for seamless integration of datasets into analytics

tools, supporting scenario analysis, demand forecasting, and strategic planning.

Competitive Insights and Recommendations

By continuously monitoring competitor platforms and leveraging Web Scraping Singapore Delivery

Apps, businesses can identify emerging trends, pricing anomalies, and operational bottlenecks.

Scrape foodpanda, Grab & Deliveroo Delivery Data in Singapore provides granular visibility into

promotions, delivery times, and order volumes.

The key recommendations for businesses entering or expanding in Singapore’s hyperlocal delivery

market include maintaining dynamic pricing, leveraging predictive analytics for inventory

management, and integrating automated scraping pipelines for real-time competitor insights.

These strategies enable faster decision-making, enhanced operational efficiency, and improved

customer retention.

Product Data Scrape offers comprehensive solutions for extracting, cleaning, and analyzing

hyperlocal delivery data. By leveraging our expertise in Extract Singapore Hyperlocal Delivery

Data, businesses can access structured, accurate datasets that inform pricing, operations, and

marketing strategies. Our custom scraping solutions allow companies to Scrape Singapore

Q-Commerce Trends, track promotions, and monitor competitor platforms efficiently.

We provide end-to-end services, including Scrape GrabMart Prices Data , Web Scraping foodpanda

Quick Commerce Data, and Deliveroo Quick Commerce Data Scraping API , ensuring access to

actionable insights across multiple platforms. Our Grocery store dataset and Singapore Grocery

Delivery Platform Dataset support predictive analytics, campaign planning, and operational

optimization. With automated data pipelines, clients can respond in real-time to market changes,

improve decision-making speed by up to 50%, and gain a competitive advantage in Singapore’s

dynamic hyperlocal delivery ecosystem.

Conclusion

The Singapore Hyperlocal Delivery Strategy: foodpanda, Grab & Deliveroo demonstrates the value

of real-time data in shaping operational efficiency, pricing strategies, and market positioning.

By leveraging insights from web scraping, predictive analytics, and automated dashboards,

businesses can make faster, smarter decisions, enhance customer satisfaction, and increase

market share.

Product Data Scrape empowers retailers and Q-commerce players to harness these insights through

comprehensive, real-time data solutions. By integrating custom datasets, competitor

intelligence, and hyperlocal delivery metrics, businesses can optimize pricing, improve

operational workflows, and drive strategic growth.

Unlock actionable insights today with Product Data Scrape and stay ahead in Singapore’s

competitive hyperlocal delivery market.

.webp)