Quick Overview

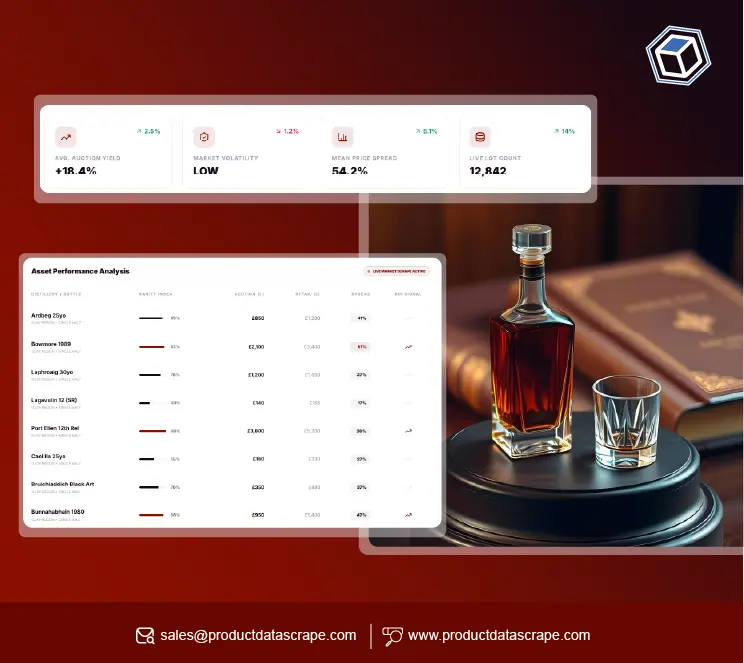

This case study showcases how Product Data Scrape helped a U.S.-based retail intelligence firm successfully implement Scraping Lowe's and Home Depot to uncover complex multi-level pricing models. The client operates in the home improvement analytics industry and required accurate visibility into contractor pricing, bulk discounts, and regional price variations. Over an 8-week engagement, our team delivered a scalable solution to Extract Lowe's Home & Kitchen Data with high accuracy. The impact was immediate: faster data refresh cycles, improved pricing transparency, and reliable insights across thousands of SKUs. The solution empowered the client to enhance competitive benchmarking and deliver deeper value to enterprise customers.

The Client

The client is a North American market intelligence provider specializing in home improvement, construction materials, and retail pricing analytics. Their customers include manufacturers, distributors, and professional contractors who rely on precise pricing intelligence to remain competitive in a rapidly evolving market.

The home improvement retail sector has seen increased complexity in recent years. Large retailers introduced contractor programs, loyalty-based discounts, and region-specific pricing to manage supply chains and demand fluctuations. This shift created pressure on analytics firms to capture granular pricing structures instead of simple shelf prices.

Before partnering with Product Data Scrape, the client struggled to Extract Home Depot Home & Kitchen Data consistently due to dynamic pricing logic and account-based visibility. Their legacy tools lacked the flexibility to handle tiered pricing and often failed during promotional events. Manual validation processes further slowed delivery timelines and increased error rates.

Transformation was essential for the client to maintain credibility and scale operations. They needed a modern solution supported by a reliable Lowe’s Product Data API to ensure structured, repeatable access to pricing intelligence across multiple customer segments and geographic regions.

Goals & Objectives

The primary business goal was to establish a reliable system for capturing complex, multi-level pricing across Lowe’s and Home Depot. Scalability was critical, as pricing varied by contractor status, order volume, and location. Accuracy and speed were essential to support real-time pricing insights enabled by lowe's and home depot data scraping.

From a technical standpoint, the client aimed to fully automate data extraction workflows. The system needed seamless integration with existing analytics dashboards and the ability to capture pricing logic behind logged-in contractor accounts. Advanced monitoring and validation mechanisms were required for Scraping Home Depot Product Data at scale.

97%+ pricing accuracy across contractor and bulk tiers

Data refresh cycles reduced by 65%

Successful capture of regional price differences across all U.S. states

The Core Challenge

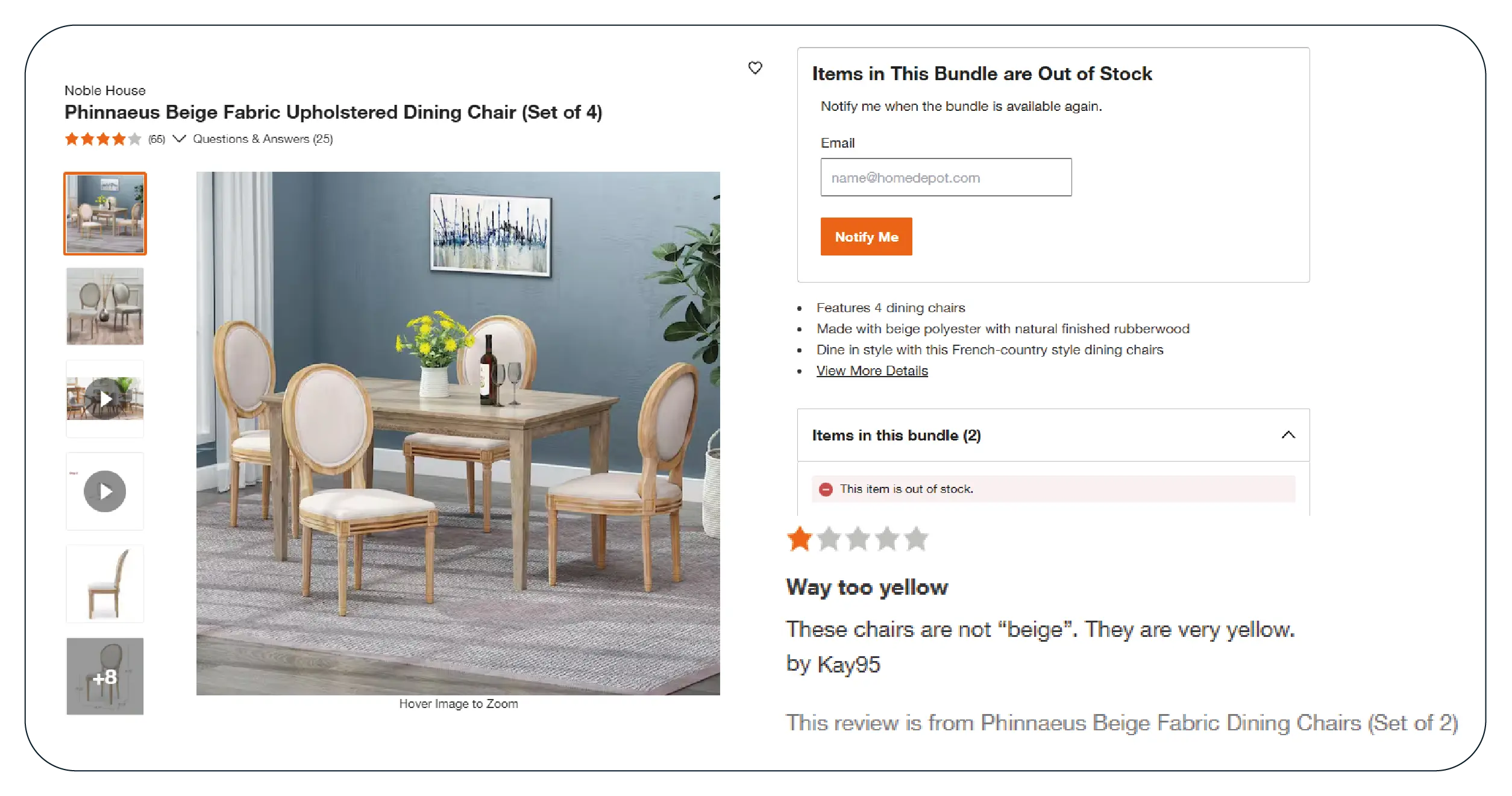

The client faced significant challenges in extracting accurate pricing data. Lowe’s and Home Depot do not present uniform pricing across users; prices vary based on contractor eligibility, order volume, and fulfillment location. Traditional scraping tools failed to identify and segment these variations.

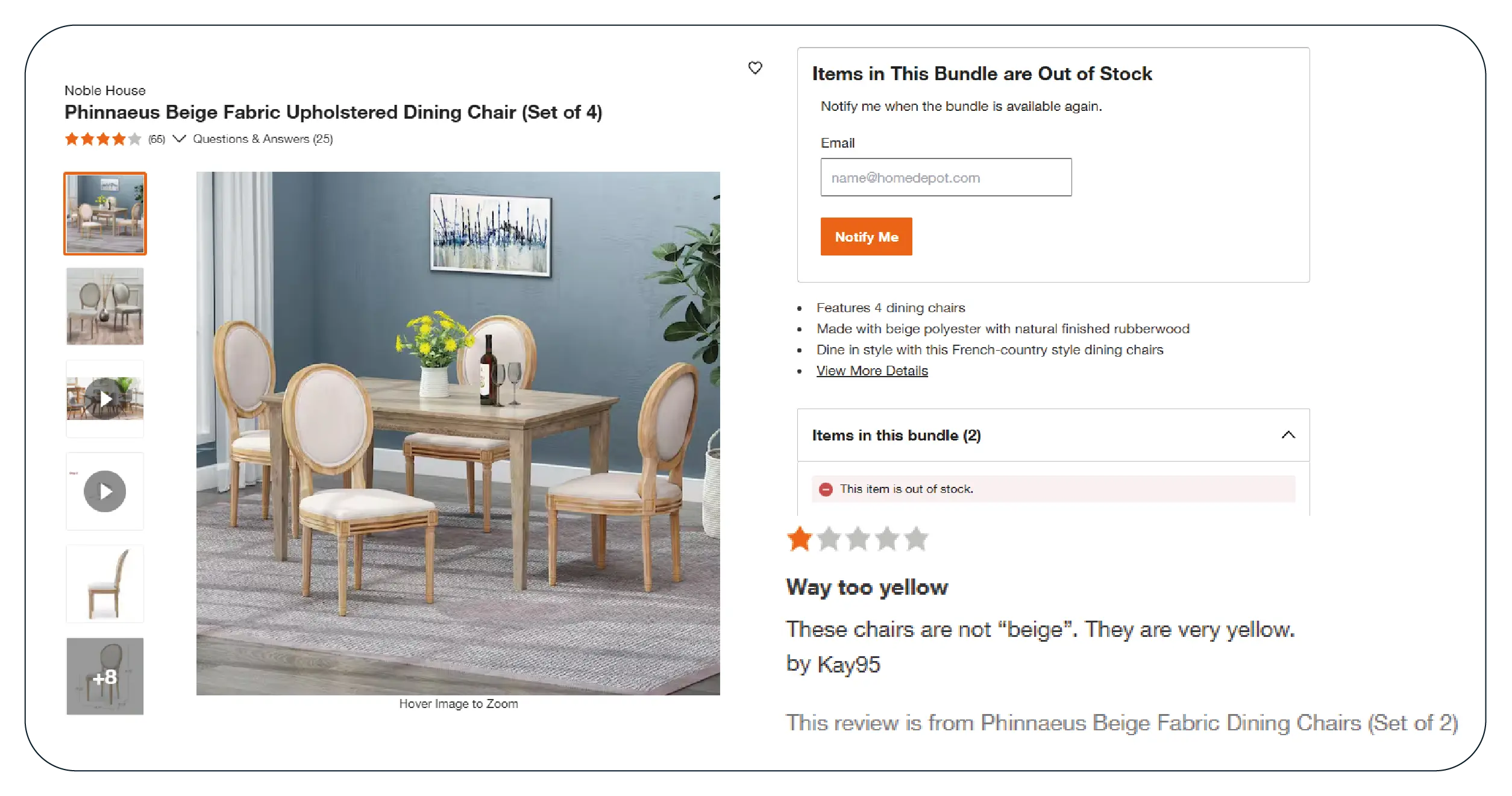

Operational bottlenecks emerged due to frequent site changes and anti-bot mechanisms. Scripts often broke during high-traffic periods, causing incomplete datasets. The inability to reliably Extract Home & Kitchen Data resulted in outdated insights and reduced trust from downstream customers.

Additionally, pricing inconsistencies made it difficult to model competitive positioning. Without structured tiered pricing, the client’s Product Pricing Strategies Service lacked the depth needed for enterprise-level decision-making. These limitations slowed growth and constrained the client’s ability to differentiate in a crowded analytics market.

Our Solution

Product Data Scrape implemented a phased, enterprise-grade solution designed specifically for multi-level pricing extraction. The first phase focused on mapping pricing logic across both retailers, identifying variations based on user roles, cart volume, and geographic location.

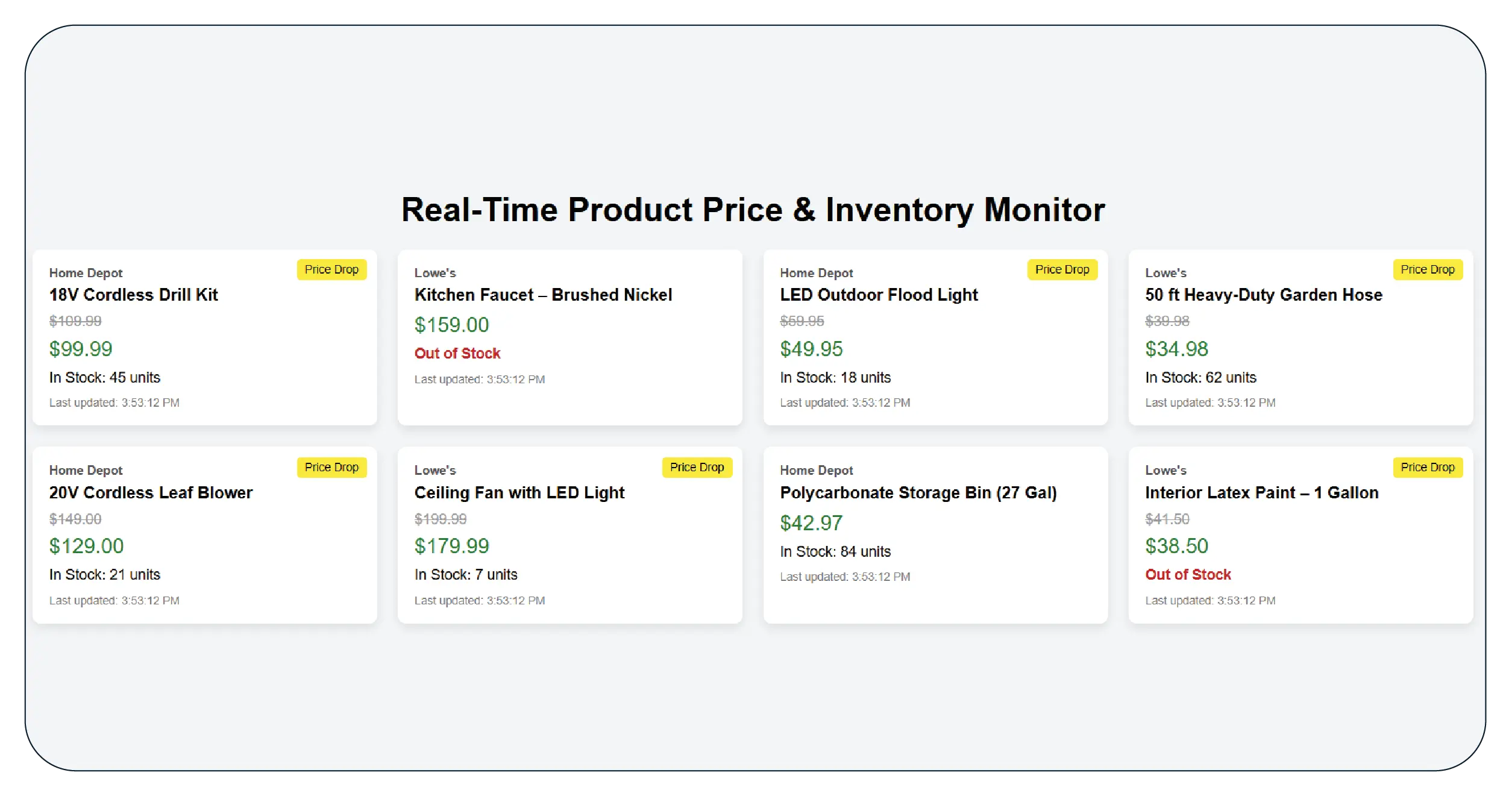

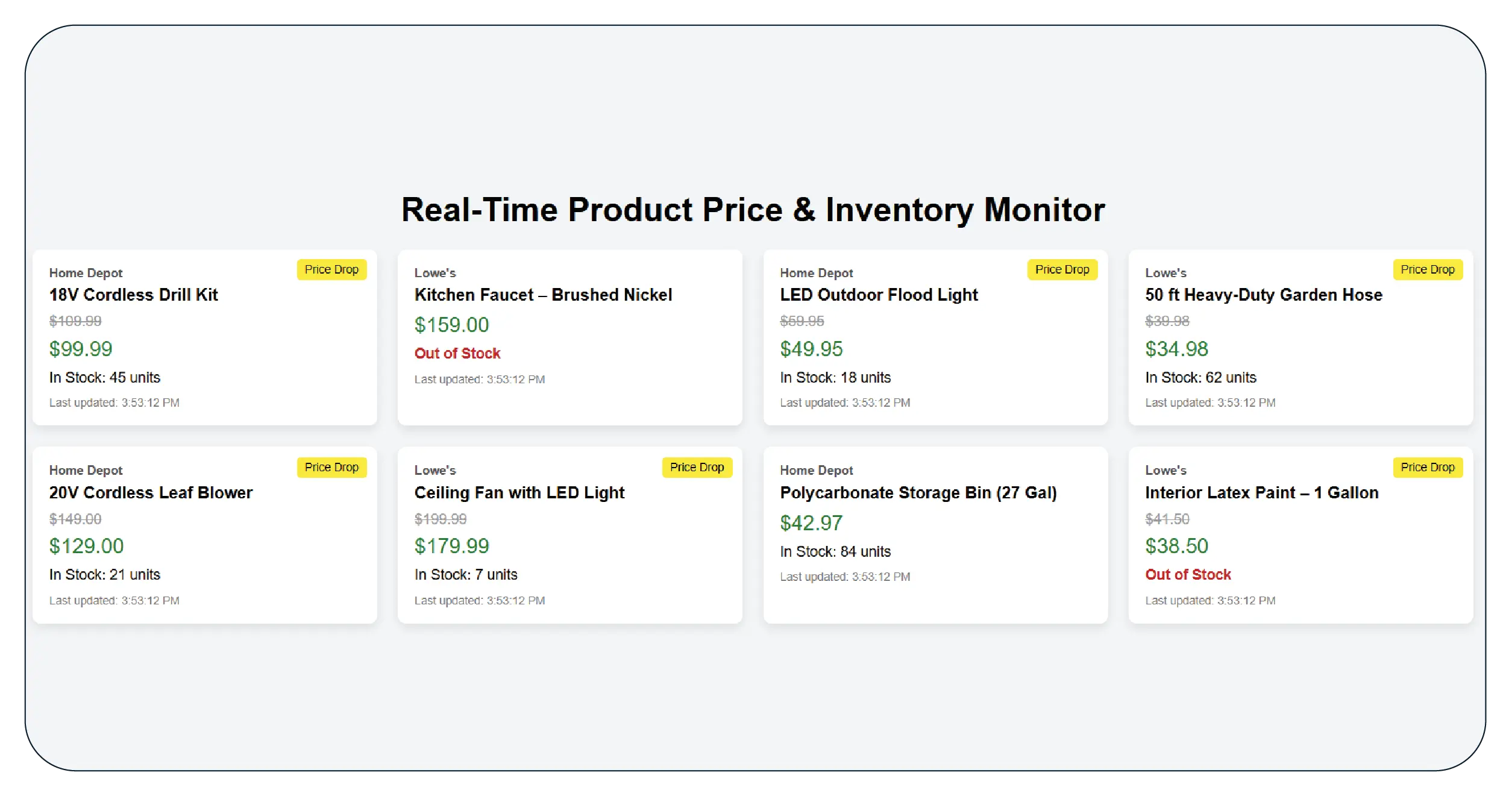

In phase two, we deployed intelligent crawlers capable of authenticated session handling and dynamic content rendering. These crawlers were optimized to scrape product data from lowe's and home depot while adapting to real-time price adjustments and inventory availability. Advanced request orchestration ensured high success rates even during peak demand periods.

The third phase introduced structured normalization pipelines. Pricing data was categorized into base, contractor, bulk, and regional tiers. This enabled clean integration into the client’s analytics platform and simplified downstream processing. For Home Depot, we implemented a dedicated Web scraper for the Home Depot website capable of capturing location-based fulfillment pricing and promotional logic.

Finally, automated monitoring and alerting systems were introduced to detect anomalies, pricing shifts, or extraction failures. The result was a resilient, scalable infrastructure that consistently delivered accurate pricing intelligence across thousands of SKUs and multiple pricing layers.

Handling User Segmentation, Login-Based Pricing, and Geo-Fencing

A key differentiator of our approach was the ability to reliably access non-public pricing tiers governed by user identity, purchase eligibility, and geographic location. Lowe’s and Home Depot both employ sophisticated pricing controls where contractor-only discounts, bulk pricing, and regional variations are visible only after authentication and location validation.

To handle user segmentation, we implemented role-based session simulation that mirrored real contractor, bulk buyer, and standard consumer accounts. This allowed the system to dynamically surface pricing tiers tied to account status, order thresholds, and loyalty programs. Each user segment was treated as a distinct extraction profile, ensuring clean separation and accurate attribution of prices.

For login-based pricing, our solution maintained persistent authenticated sessions using secure cookie management and session refresh logic. This prevented price regression during long extraction cycles and ensured that protected pricing layers remained accessible without triggering security defenses or account locks.

Geo-fencing challenges were addressed through location-aware request orchestration. By aligning ZIP codes, store identifiers, and fulfillment parameters, the system accessed region-specific pricing and availability that varied by city, state, or distribution zone. This was critical for capturing localized discounts, delivery-based price adjustments, and store-level promotions.

Together, these capabilities enabled full visibility into multi-level pricing structures that are typically inaccessible to conventional scrapers, delivering comprehensive and actionable pricing intelligence.

Results & Key Metrics

Captured 4+ pricing tiers per SKU across both retailers

Improved data availability during promotions and contractor events

Achieved near real-time pricing updates across regions

Enabled advanced regional price analysis lowe's home depot workflows

The system consistently handled large product volumes without performance degradation.

Results Narrative

With the new solution in place, the client transformed its pricing intelligence capabilities. Automated workflows eliminated manual intervention, while structured tiered pricing unlocked deeper competitive insights. Customers gained confidence in pricing recommendations, and internal teams delivered faster, more accurate analytics. The ability to analyze regional and contractor-based pricing strengthened the client’s market position and supported long-term growth.

What Made Product Data Scrape Different?

What set Product Data Scrape apart was our focus on pricing complexity rather than surface-level extraction. Our E-commerce Price Monitoring framework was designed to adapt to account-based visibility, dynamic pricing rules, and frequent retailer updates. Proprietary logic for session management, pricing tier identification, and automated validation ensured long-term stability. This innovation enabled reliable insights where generic tools consistently failed.

Client’s Testimonial

“Product Data Scrape delivered a solution that truly understands retail pricing complexity. Their approach to contractor and regional pricing transformed our analytics capabilities. We now provide deeper, more actionable insights to our customers with confidence.”

— Director of Market Intelligence, Retail Analytics Firm

Conclusion

This case study demonstrates the power of tailored data extraction for modern retail intelligence. By capturing multi-level pricing across major home improvement retailers, the client unlocked new analytical depth and competitive advantage. The scalable infrastructure now supports advanced modeling, forecasting, and benchmarking. With a robust Lowe’s E-commerce Product Dataset, the client is positioned to lead in pricing intelligence and respond quickly to evolving retail strategies.

FAQs

1. What types of pricing were captured in this project?

We captured base prices, contractor discounts, bulk pricing tiers, and regional price variations.

2. How did you handle contractor-only pricing visibility?

Authenticated sessions and role-based logic were used to access contractor-level pricing.

3. Was the data updated in real time?

High-priority products supported near real-time updates, while others followed scheduled refresh cycles.

4. Can this solution scale to other retailers?

Yes, the framework is modular and adaptable to other large e-commerce platforms.

5. Is the data suitable for analytics and forecasting?

Absolutely. All outputs were structured, validated, and ready for integration into analytics pipelines.

.webp)