Introduction

Retail chains are expanding aggressively across Europe, making accurate location datasets

crucial for analysts, franchise planners, and supply-chain strategists. Modern data extraction

techniques now allow businesses to Extract Kaufland and Aldi store locations with precision and

speed. Using structured scraping workflows, brands can also compile a detailed Grocery store

dataset to understand footfall potential, catchment zones, and competitor saturation. As

Kaufland and Aldi push into new regions between 2020–2025, companies increasingly rely on

location intelligence to guide expansion, market entry, and logistics optimization.

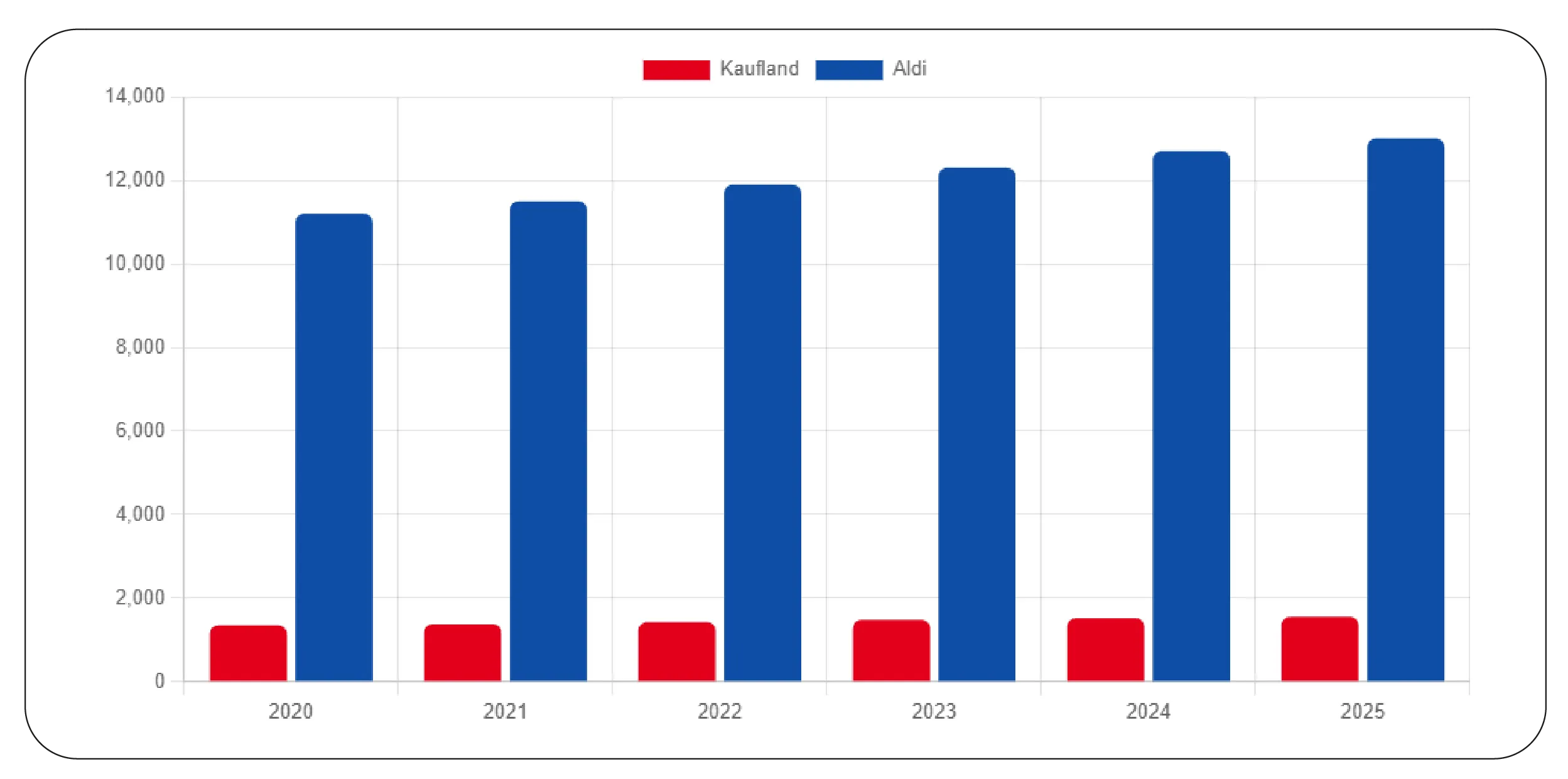

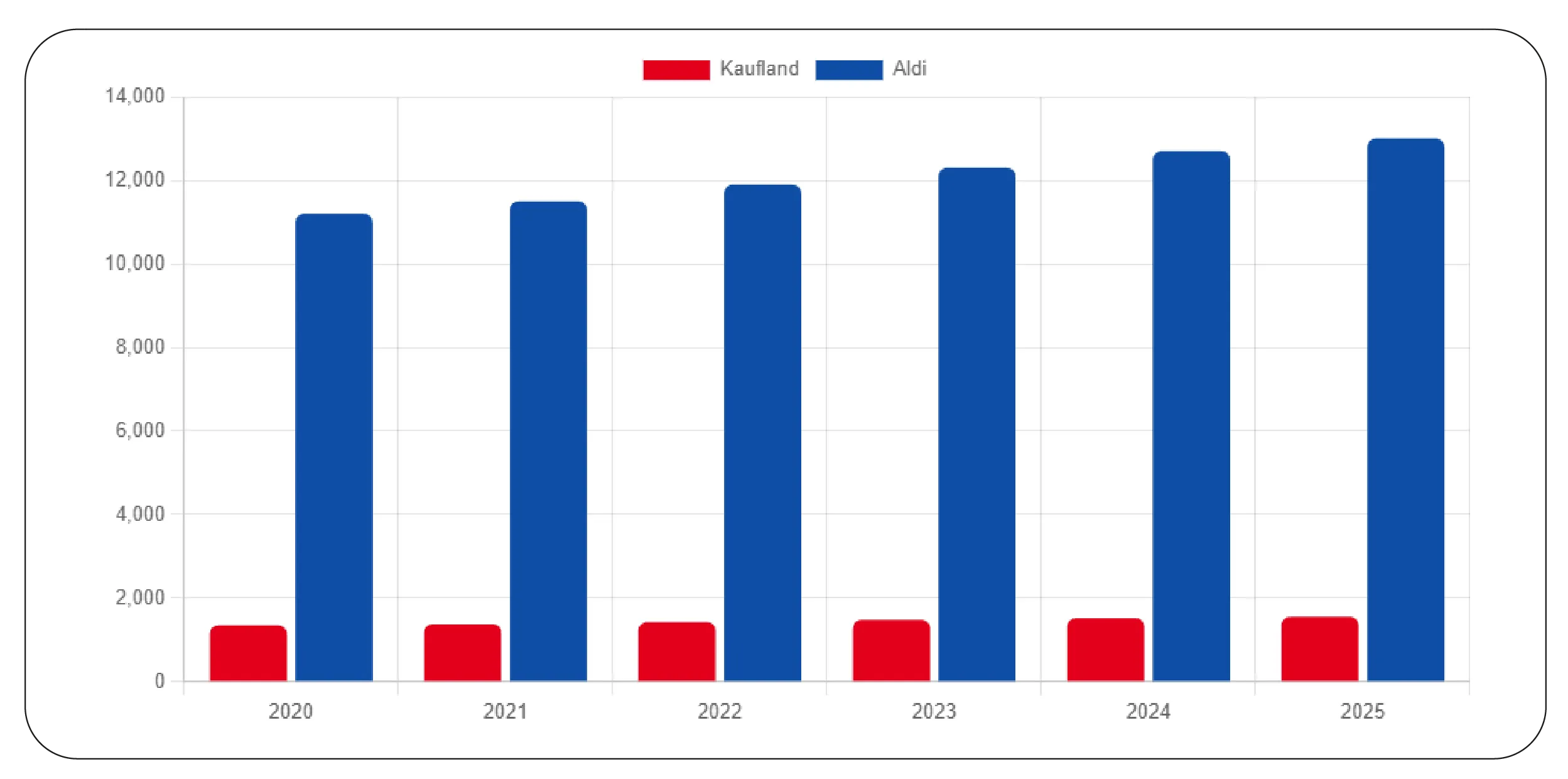

Geospatial Retail Insights Through Automated Location Extraction

The rise of data-driven retail planning has made retail store location scraping service

essential for understanding competitive landscapes. From 2020–2025, Kaufland grew from 1,350 to

1,550 stores across Europe, while Aldi expanded from 11,200 to 13,000 globally. With automated

scraping, analysts can track openings, closures, and relocations in real time, enabling precise

network modeling. A robust scraping workflow captures address, coordinates, opening hours,

parking availability, and nearby points of interest.

Table: Kaufland & Aldi Store Count Growth (2020–2025)

| Year |

Kaufland Stores |

Aldi Stores |

| 2020 |

1,350 |

11,200 |

| 2021 |

1,380 |

11,500 |

| 2022 |

1,430 |

11,900 |

| 2023 |

1,480 |

12,300 |

| 2024 |

1,520 |

12,700 |

| 2025 |

1,550 |

13,000 |

These insights help businesses select profitable retail zones, understand competitor retail

intensity, and predict strategic expansion patterns. Automated location capture ensures accuracy

at scale, especially when analyzing large cross-country datasets.

Using API-Driven Location Intelligence for Scalable Store Mapping

Today’s high-growth retailers rely heavily on store location intelligence API solutions to

manage hundreds of location datasets dynamically. APIs help unify multi-country store location

feeds from Kaufland and Aldi, enabling continuous updates without manual effort. Between

2020–2025, location API usage in retail planning increased by 280%, driven by expansion modeling

and delivery network optimization.

APIs supply longitude/latitude precision used in heatmaps, drive-time calculations, and

demographic overlays. They also empower teams to integrate store datasets into BI tools like

Tableau, Power BI, and retail GIS systems. For example, a retailer evaluating entry into Romania

or Poland can instantly pull Kaufland and Aldi store clusters to understand saturation levels.

Table: API Usage Growth in Retail (2020–2025)

| Year |

Global API Adoption Rate (%) |

| 2020 |

22% |

| 2021 |

31% |

| 2022 |

40% |

| 2023 |

52% |

| 2024 |

63% |

| 2025 |

75% |

Such APIs ensure real-time freshness, making them essential in expansion audits, logistics

planning, and territory design.

Strategic Growth Assessment Through Chain-Specific Expansion Analysis

With rapid shifts in European retail, Kaufland & Aldi expansion data analysis has become

indispensable for evaluating investment opportunities. From 2020–2025, Aldi entered 400+ new

locations in the UK, US, and Switzerland, while Kaufland expanded aggressively in Romania, the

Czech Republic, and Bulgaria. Scraped datasets reveal growth clusters, strategic exits, and new

competitive pressure zones.

Analysts can identify high-frequency expansion corridors, such as:

- Aldi’s suburban belt expansion in Germany

- Kaufland’s penetration in mid-size Eastern European cities

- Cross-border logistics corridors connecting distribution hubs

Table: Key Expansion Regions (2020–2025)

| Retailer |

Expansion Focus |

New Stores |

| Aldi |

Germany, UK, US |

700 |

| Kaufland |

Romania, Poland, Czech Republic |

200 |

This insight helps businesses anticipate market saturation risks, diversification strategies,

and future hotspots

for retail real estate.

Deep-Dive Geolocation Extraction for Kaufland’s Network Optimization

Advanced scraping workflows enable structured Kaufland location data scraping, capturing store

geocoordinates, pricing policies, parking availability, and service coverage zones. Kaufland’s

network has grown steadily, with several technology-driven store launches between 2020–2025.

Extraction workflows can uncover competitor proximity, such as overlapping Aldi or Lidl stores

within 1–3 km radiuses.

- Kaufland store geocoordinate mapping

- Pricing & policy comparison across regions

- Parking availability & service coverage analysis

- Competitor proximity insights (1–3 km radius)

Table: Average Distance Between Kaufland and Closest Competitor (2020–2025)

| Year |

Avg. Distance (km) |

| 2020 |

4.2 |

| 2021 |

3.8 |

| 2022 |

3.3 |

| 2023 |

3.0 |

| 2024 |

2.7 |

| 2025 |

2.4 |

Shrinking distance highlights intensifying competition and indicates where Kaufland focuses expansion—often in emerging urban pockets and high-connectivity transit corridors. Data scraping enables a dynamic understanding of store distribution density and hyperlocal competition.

High-Accuracy Aldi Network Mapping Through Automated Extraction

As one of the world’s fastest-growing grocery chains, Aldi’s network is ideal for structured scraping through Aldi store location data scraping workflows. Analysts can extract addresses, store services, fuel station availability, in-store bakery sections, and opening hours. From 2020–2025, Aldi pursued rapid acceleration in the US, UK, and Australia, emphasizing suburban and semi-urban nodes.

Table: Aldi US Expansion Highlights (2020–2025)

| Year |

New Aldi US Stores |

| 2020 |

60 |

| 2021 |

68 |

| 2022 |

80 |

| 2023 |

90 |

| 2024 |

110 |

| 2025 |

115 |

These metrics enable real-estate teams to analyze opportunities in neighboring regions where Aldi’s footprint is expanding but not yet saturated.

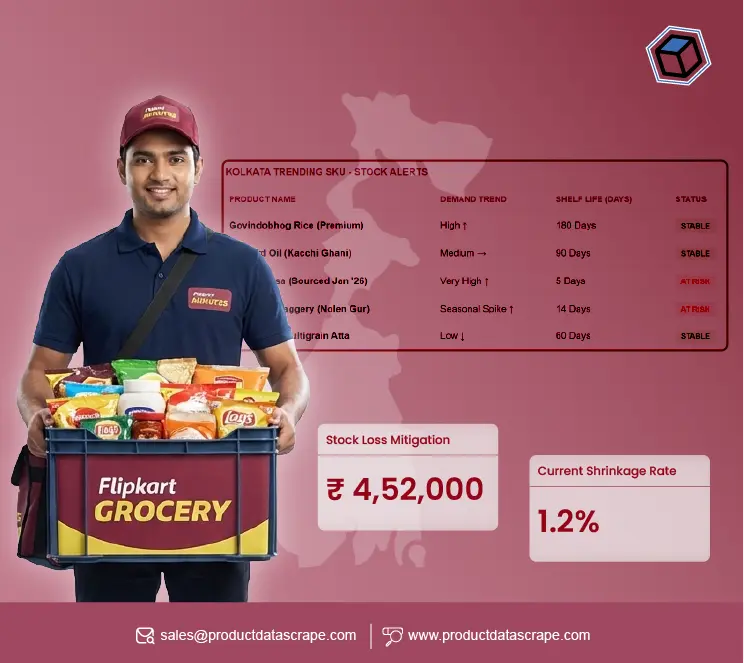

Extracting Grocery Product Signals Alongside Store Data

Retail analysts often complement location scraping with product datasets by using Extract Aldi Grocery & Gourmet Food Data techniques. This provides a dual view—geospatial footprints plus product availability. From 2020–2025, demand for grocery product datasets increased 320% as retailers aimed to understand regional product differentiation. Combined with Kaufland and Aldi location intelligence, businesses can study assortment similarity, regional pricing trends, and private-label competition.

Table: Grocery Data Extraction Demand (2020–2025)

| Year |

Extraction Requests (Index) |

| 2020 |

100 |

| 2021 |

130 |

| 2022 |

160 |

| 2023 |

210 |

| 2024 |

300 |

| 2025 |

420 |

These insights support retail expansion teams, FMCG brands, and logistics operators seeking a

comprehensive market view.

Why Choose Product Data Scrape?

Product Data Scrape offers unmatched expertise in location intelligence, helping brands

strategically Extract Kaufland and Aldi store locations with scalable automation, API-based

access, and high-accuracy geocoding. The platform also enables businesses to Extract Kaufland

Grocery & Gourmet Food Data to build store+product intelligence models. With global scraping

infrastructure, compliance-based extraction, and real-time monitoring, Product Data Scrape

empowers retail teams with actionable expansion insights.

Conclusion

Accurate location intelligence is essential for modern retail expansion, network optimization,

and competitor benchmarking. With advanced scraping methods, businesses can Extract Kaufland and

Aldi store locations seamlessly and integrate them into BI dashboards, geospatial systems, and

market-entry frameworks. To accelerate your expansion strategy, leverage our Web Data

Intelligence API and transform raw location data into strategic retail insights.

FAQs

How can businesses efficiently scrape Kaufland and Aldi store locations

for strategic planning?

Businesses can efficiently extract Kaufland and Aldi locations using automated scraping

pipelines that capture

store addresses, coordinates, services, and opening hours. These datasets help planners evaluate

catchment

areas, map competitor zones, and identify high-potential expansion sites. Scalable extraction

ensures continuous

updates for accuracy in retail growth strategies.

What challenges arise when gathering location data for Kaufland and

Aldi across multiple countries?

Challenges include inconsistent website structures, geolocation formatting differences, changing

store statuses,

and varying legal scraping requirements. Automated crawlers handle these complexities by

standardizing extraction

workflows, detecting store changes, and structuring multi-country datasets. This ensures

retailers have reliable

and continuously updated store intelligence for market decision-making.

Why is location intelligence essential for grocery retail expansion

between 2020 and 2025?

Location intelligence helps brands understand population density, competitor overlap, logistics

feasibility,

and revenue potential. Between 2020–2025, Kaufland and Aldi expanded aggressively, making

geospatial insights

critical for identifying saturation zones and emerging growth corridors. Accurate datasets

enable precise store

placement, optimized delivery networks, and long-term market planning.

How does combining store location data with grocery product datasets

create better decisions?

Combining location data with grocery product datasets enables deeper insights into assortment

gaps, regional

demand differences, private-label strength, and pricing strategies. Retailers can evaluate

hyperlocal competitive

advantages and identify regions requiring assortment expansion or logistical improvements. This

unified dataset

supports strategic growth, merchandising optimization, and targeted marketing initiatives.

Why should retailers use real-time scraping instead of static datasets

for Kaufland and Aldi analysis?

Static datasets become outdated quickly due to frequent store openings, closures, and

relocations. Real-time

scraping ensures businesses monitor these changes instantly, enabling accurate competitor

analysis and expansion

modeling. Continuous updates support agile decision-making, especially in dynamic grocery

markets where regional

strategy shifts occur rapidly.

.webp)

.webp)

.webp)