Introduction

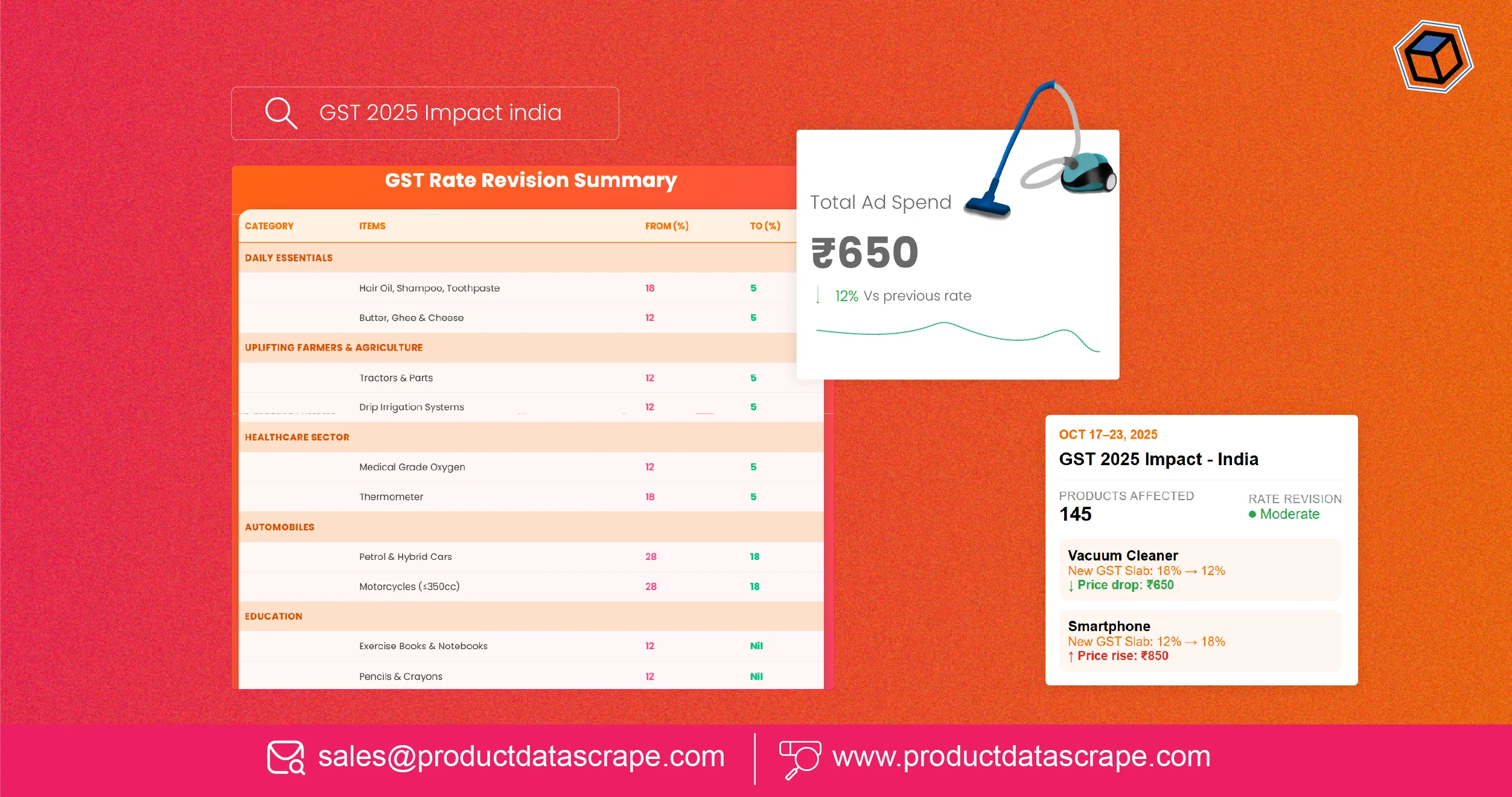

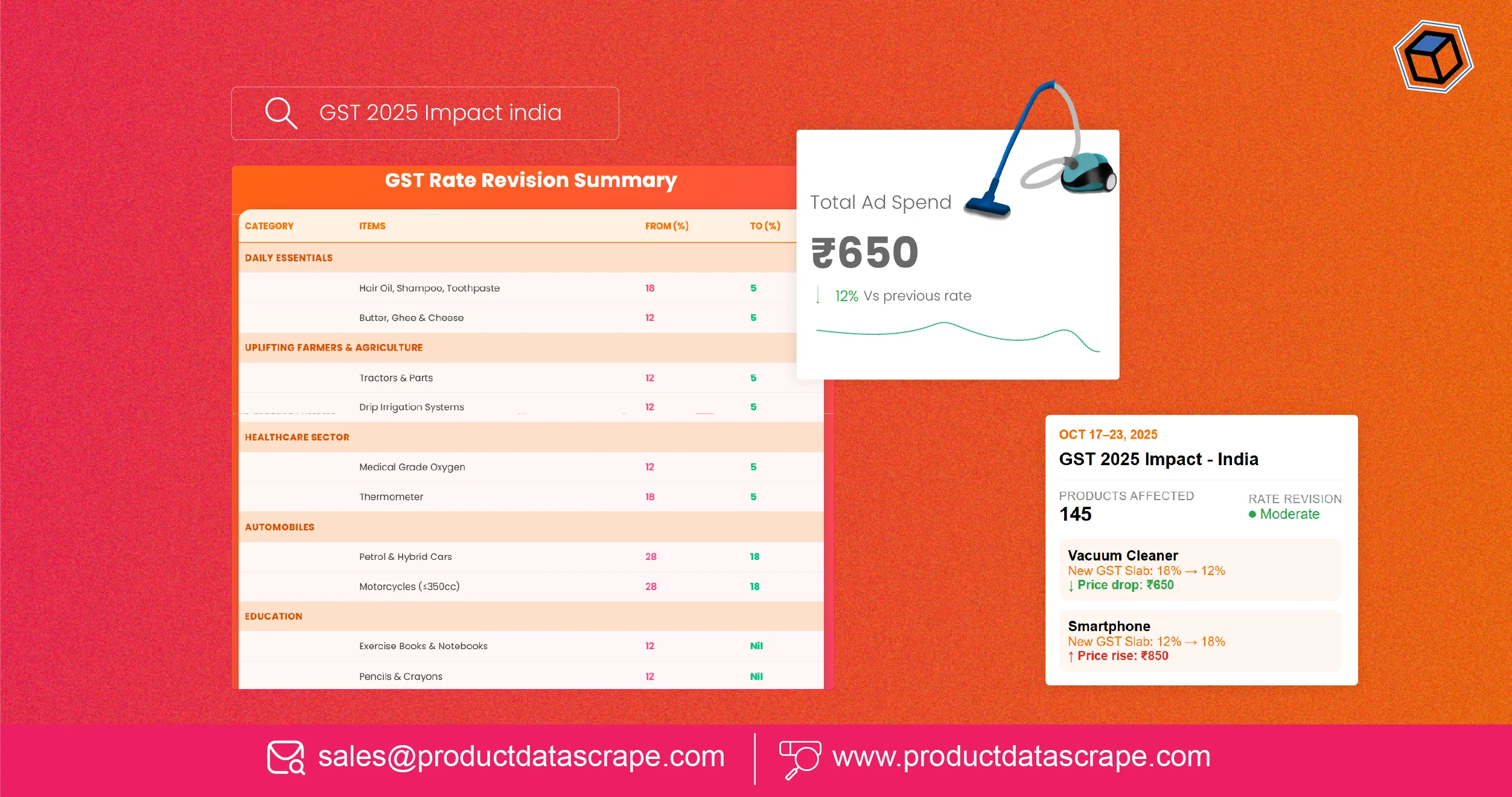

The rollout of GST 2025 in India has reshaped pricing structures across retail

and eCommerce platforms. Businesses must understand how new tax slabs impact product prices to

adjust strategies, remain competitive, and maintain profitability. Extract product price changes

after GST 2025 India enables companies to track price fluctuations and identify trends across

multiple product categories.

With the new GST slab rates, analyzing Price And discount scraping after new

GST slab is essential for businesses to monitor shifts in consumer demand and optimize

promotions. Using Web scraping new GST slab pricing data and Scrape India eCommerce with updated

GST rates, organizations can capture product prices and discounts in real-time. Advanced tools

such as Instant Data Scraper and Web Data Intelligence API allow for efficient data collection

from multiple platforms, including online marketplaces and retailer websites.

Businesses can also leverage Product Price Data Scraping Services and Product

Pricing Strategies Service to integrate insights into pricing models, promotional planning, and

competitive benchmarking. By implementing Extract product price changes after GST 2025 India,

companies can make informed decisions, maintain profitability, and adapt to the dynamic market

created by GST 2025.

Real-Time Price Monitoring Across Categories

Post-GST 2025, real-time monitoring of product prices has become critical.

Using Scrape New Product Price And Discount After new GST slab, businesses can track price

adjustments on thousands of SKUs across categories such as electronics, FMCG, and apparel.

Between 2020–2025, average price fluctuations due to GST changes were observed at 10–15% per

category, impacting both online and offline sales.

Table 1: Average Price Change Across Categories Post-GST 2025

(2020–2025)

| Year |

Electronics (%) |

FMCG (%) |

Apparel (%) |

| 2020 |

0% |

0% |

0% |

| 2021 |

2% |

1% |

1.5% |

| 2022 |

3% |

2% |

2% |

| 2023 |

4% |

3% |

2.5% |

| 2024 |

5% |

3.5% |

3% |

| 2025 |

10% |

6% |

5% |

Leveraging India new GST rates product scraping, companies can detect price

changes immediately, allowing timely updates to promotional campaigns and inventory management.

By Extract product price changes after GST 2025 India, businesses can prevent revenue leakage

and respond proactively to pricing shifts.

Competitive Pricing Analysis

Post-GST, businesses must assess competitors’ pricing to stay relevant. Using

Scrape pricing differences before and after GST change, companies can analyze competitor rates

and identify strategic pricing opportunities. Between 2020–2025, the average difference in

competitor pricing post-GST was 7–12%, emphasizing the need for continuous monitoring.

Table 2: Competitor Price Differences Post-GST (2020–2025)

| Year |

Avg Price Difference (%) |

| 2020 |

0% |

| 2021 |

3% |

| 2022 |

5% |

| 2023 |

6% |

| 2024 |

8% |

| 2025 |

12% |

By integrating Product Pricing Strategies Service and Pricing Intelligence

Services, businesses can adjust prices dynamically, optimize discounts, and maintain

profitability. Extract product price changes after GST 2025 India ensures these insights are

actionable and timely.

Stay ahead of competitors—use Scrape pricing differences before and

after GST change to optimize pricing strategies and maximize profits

today!

Contact Us Today!

Promotional and Discount Optimization

Price And discount scraping after new GST slab allows companies to understand

how discounts are applied across product categories. From 2020–2025, average promotional

adjustments increased by 10% due to the GST restructuring.

Table 3: Average Discount Adjustments Post-GST (2020–2025)

| Year |

Avg Discount (%) |

| 2020 |

5% |

| 2021 |

6% |

| 2022 |

7% |

| 2023 |

8% |

| 2024 |

9% |

| 2025 |

10% |

Businesses leveraging Scrape New Product Price And Discount After new GST slab

can tailor campaigns effectively. Extract product price changes after GST 2025 India provides

insight into consumer purchasing behavior, helping maximize sales while maintaining margins.

Cross-Platform Price Consolidation

Monitoring prices across multiple platforms is essential. Using Scrape India

eCommerce with updated GST rates, businesses can consolidate pricing information from online

marketplaces, retailer websites, and eCommerce portals. From 2020–2025, cross-platform price

differences averaged 6–9%, highlighting the need for unified analysis.

Table 4: Price Differences Across Platforms Post-GST

(2020–2025)

| Year |

Avg Price Difference (%) |

| 2020 |

0% |

| 2021 |

2% |

| 2022 |

4% |

| 2023 |

5% |

| 2024 |

7% |

| 2025 |

9% |

With Web Data Intelligence API and Instant Data Scraper , businesses can create

structured datasets for analysis, enabling better decision-making and price harmonization.

Historical vs. Post-GST Trend Analysis

Analyzing historical pricing data helps understand the impact of GST changes.

Web scraping new GST slab pricing data allows businesses to compare prices before and after 2025

reforms. Historical data from 2020–2025 shows that electronics and FMCG categories experienced

8–10% price increases.

Table 5: Price Increase Comparison Before and After GST 2025

| Category |

Before GST (%) |

After GST 2025 (%) |

| Electronics |

3% |

10% |

| FMCG |

2% |

6% |

| Apparel |

1.5% |

5% |

Extract product price changes after GST 2025 India ensures businesses have

accurate, up-to-date insights to adjust pricing, promotions, and inventory strategies.

Make informed decisions—leverage Web scraping new GST slab pricing data

to compare historical and post-GST trends for strategic pricing today!

Contact Us Today!

Strategic Inventory and Revenue Planning

Scrape New Product Price And Discount After new GST slab helps businesses

forecast inventory needs and optimize revenue. From 2020–2025, retailers that adapted using

scraped pricing data saw a 12% increase in revenue due to optimized stock allocation and dynamic

pricing.

Table 6: Revenue Impact Post-GST Scraping Insights (2020–2025)

| Year |

Revenue Increase (%) |

| 2020 |

0% |

| 2021 |

3% |

| 2022 |

5% |

| 2023 |

7% |

| 2024 |

10% |

| 2025 |

12% |

Combining Scrape Data From Any Websites with Buy Custom Dataset Solution,

businesses can ensure a comprehensive, real-time view of pricing trends and opportunities.

Why Choose Product Data Scrape?

Product Data Scrape provides robust solutions to Extract product price changes

after GST 2025 India, offering accuracy, speed, and scalability. Our Product Price Data Scraping

Services and Product Pricing Strategies Service enable businesses to monitor competitor pricing,

optimize promotions, and adjust product pricing dynamically.

With Instant Data Scraper, Web Data Intelligence API , and Scrape India

eCommerce with updated GST rates, clients receive structured datasets ready for analysis. Buy

Custom Dataset Solution ensures tailored insights for specific categories or platforms.

Companies can track pricing trends, evaluate historical data, and forecast future price shifts

efficiently.

By leveraging our Pricing Intelligence Services , businesses can maintain

competitive pricing, improve margins, and enhance decision-making. Extract product price changes

after GST 2025 India empowers businesses to respond proactively to market dynamics and

GST-driven pricing changes.

Conclusion

The GST 2025 reforms have reshaped product pricing across India. Using Extract

product price changes after GST 2025 India, businesses can monitor price shifts, identify

trends, and make informed strategic decisions. From tracking discounts and promotional changes

with Price And discount scraping after new GST slab to consolidating cross-platform data via Web

Data Intelligence API, organizations gain a comprehensive view of the market.

Leveraging Product Price Data Scraping Services and Product Pricing Strategies

Service, businesses can optimize inventory, forecast revenue, and adjust pricing strategies in

real-time. Scrape Data From Any Websites and Buy Custom Dataset Solution ensure access to

tailored, actionable datasets for better planning and decision-making.

Partner with Product Data Scrape to Extract product price changes after GST

2025 India, gain insights into new GST slab impacts, and drive growth in India’s dynamic

eCommerce landscape.

.webp)

.webp)

.webp)