Introduction

In the dynamic UAE landscape of 2025, retail grocery is evolving fast. At the heart of

this transformation are the extract top 12 supermarket chains in Dubai and UAE—brands

expanding stores, increasing digital reach, and leveraging data driven pricing. For

businesses seeking competitive edge, the ability to Track Stock Availability and Pricing

Data offers a blueprint: monitor millions of SKUs, correlate availability with pricing,

and benchmark performance. While LCBO refers to the Ontario liquor market, the

methodology of real time data extraction and retail intelligence applies

globally—including the UAE. By combining insights across chains and regions, retailers

can predict shifts in demand, optimise inventory and pricing, and capture consumer

value. This article explores how web scraping grocery chain websites in Dubai can

deliver actionable analytics, showcasing market growth from 2020 25 and unpacking how

data led strategies are redefining supermarkets in the region.

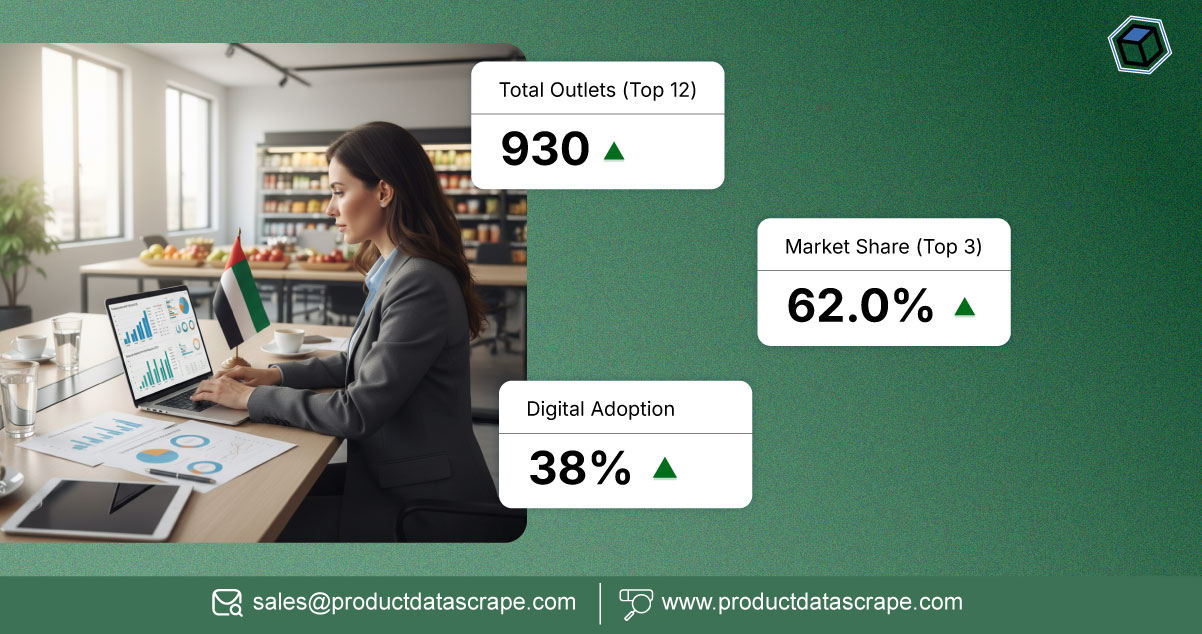

UAE Supermarket Retail Market Landscape 2025

From 2020 to 2025, the UAE supermarket sector has experienced

significant expansion, driven by expatriate population growth, e-commerce adoption, and

increased FMCG demand. Major players among the extract top 12 supermarket chains in

Dubai and UAE have expanded their network, opened omnichannel operations, and invested

in private label lines. Between 2020 and 2023, the volume of grocery box deliveries

climbed by an estimated 45%, and by 2025, online penetration is expected to exceed 25%

of total supermarket transactions. Retailers looking to Track Stock Availability and

Pricing Data on LCBO style extracts across markets would benefit from similar real-time

visibility here. According to market reports, average basket size rose 8% between 2022

and 2024, while SKU counts per large store grew by 10%.

| Year |

Estimated store count growth (%) |

Online grocery share (%) |

| 2020 |

Base year |

~12% |

| 2022 |

+15% |

~18% |

| 2024 |

+22% |

~23% |

| 2025 |

+28% (forecast) |

~25% (forecast) |

These numbers reflect how chains restructure supply chains and pricing

strategies to match consumer expectations. By using methods for Web Scraping Grocery

Chain Websites in Dubai, businesses gain deep insight into this shifting landscape.

Top 12 Supermarket Chains In Dubai And UAE

1. Carrefour UAE

Carrefour, part of the Majid Al Futtaim Group, is one of the largest

hypermarket chains in the UAE, with over 140 outlets in 2025. Known for its broad SKU

range spanning fresh produce, groceries, and electronics, Carrefour emphasizes

competitive pricing and frequent promotions. Their strong omnichannel presence

integrates online shopping, home delivery, and click-and-collect services, making them a

data-rich environment for Web Scraping Grocery Chain Websites in Dubai. Tracking

Carrefour’s inventory and pricing allows retailers to benchmark product availability,

monitor promotions, and assess competitive positioning, offering insights into consumer

preferences and demand trends across the UAE.

2. Lulu Hypermarket

Lulu Hypermarket is a prominent retail player in the UAE, catering to

both budget-conscious and premium customers. With more than 100 stores nationwide, Lulu

focuses on diverse international products and localized offerings. Its robust online

platform enables shoppers to browse SKUs, track prices, and access promotions. By

employing Scrape UAE Supermarket Product Information Data, businesses can monitor

real-time stock levels and pricing trends across Lulu stores. The chain’s emphasis on

festive promotions, fresh produce variety, and quick commerce initiatives provides

valuable data to predict market demand and optimize supply chain planning, ensuring

timely replenishment and competitive pricing strategies.

3. Spinneys UAE

Spinneys is a premium supermarket chain in the UAE, operating 50+

stores, primarily targeting expatriates and high-income consumers. Known for quality

fresh produce, imported groceries, and specialty foods, Spinneys emphasizes personalized

shopping experiences. Their online portal and app provide detailed product listings,

prices, and stock status, making it ideal for Web Scraping Top UAE Supermarkets for

Price Data. Analyzing Spinneys’ product assortment and pricing helps retailers identify

high-demand SKUs, evaluate price elasticity, and track seasonal trends. The chain’s

focus on quality and imported goods offers critical insights into the evolving

preferences of the UAE’s diverse shopper base.

4. Choithrams

Choithrams operates across Dubai and Abu Dhabi, positioning itself as a

premium yet affordable retailer. With a strong presence in urban neighborhoods, it

offers imported goods, gourmet products, and local essentials. Their online platform

provides a clear view of SKUs, prices, and promotions. By leveraging Extract Grocery &

Gourmet Food Data, businesses can analyze Choithrams’ stock availability, pricing

strategies, and promotional campaigns. Between 2020-2025, the chain expanded private

label SKUs and introduced more organic and health-focused products. Monitoring

Choithrams allows retailers to understand premium product demand, optimize inventory

planning, and enhance competitive strategies in Dubai and the wider UAE market.

5. Union Coop

Union Coop is a UAE government-backed cooperative, with 60+ stores

serving communities in Dubai and the Northern Emirates. Known for affordability, loyalty

programs, and bulk promotions, Union Coop appeals to middle-income families. Their

website and app provide real-time inventory, pricing, and promotional data. Using

Extract Grocery Store Listings from UAE Retailers, analysts can monitor store-level

stock fluctuations, track discount trends, and predict consumer demand. Union Coop’s

growth from 2020-2025 reflects urban expansion and increased digital integration.

Tracking this chain is crucial for understanding mid-market grocery behavior, optimizing

product assortment, and benchmarking pricing strategies in highly competitive suburban

areas.

6. Al Maya Supermarket

Al Maya Supermarket operates in Dubai, Abu Dhabi, and other emirates,

with 45+ outlets offering diverse groceries, fresh produce, and imported goods. The

chain targets both mid-range and premium shoppers, emphasizing convenience and

competitive pricing. Their e-commerce platform enables customers to check product

availability and prices online. By applying Quick Commerce Grocery & FMCG Data Scraping ,

businesses can analyze Al Maya’s SKU-level data and track stock trends across stores.

Between 2020-2025, the chain expanded its online delivery capabilities and private-label

SKUs. Monitoring Al Maya provides actionable insights into fast-moving goods, inventory

planning, and pricing strategies tailored for urban consumers.

7. Al Ain Coop

Al Ain Coop operates predominantly in the UAE’s Eastern Region, with a

focus on community-centered retail. Offering groceries, fresh produce, and household

essentials, the chain balances affordability with quality. Their online portal provides

access to pricing, promotions, and stock status. Through Extract Grocery & Gourmet Food

Data, retailers can monitor Al Ain Coop’s inventory and pricing patterns to anticipate

demand shifts. Between 2020-2025, store expansions and enhanced digital offerings

increased customer engagement. Analyzing this chain helps understand regional

consumption trends, price sensitivity, and seasonal product demand in the UAE’s growing

suburban markets.

8. Waitrose UAE

Waitrose operates as a premium UK brand in Dubai and Abu Dhabi,

targeting high-income expatriates. Their stores emphasize organic produce, imported

groceries, and specialty food products. Waitrose’s online platform provides real-time

stock and pricing information, making it suitable for Extract FMCG Data from UAE Quick

Commerce Apps. Monitoring Waitrose’s product availability, promotions, and seasonal

offers helps retailers identify high-value SKUs, adjust pricing strategies, and track

imported product trends. Between 2020-2025, the chain expanded online delivery and

loyalty programs, reflecting rising digital adoption among premium consumers in the UAE.

9. Carrefour Market

A smaller-format branch of Carrefour, Carrefour Market focuses on urban

convenience shopping, offering essential groceries, fresh produce, and packaged goods.

With 50+ outlets across Dubai and Sharjah, it serves busy residents seeking quick

access. Using Extract Grocery Store Listings from UAE Retailers, analysts can track

pricing, stock availability, and promotions. Between 2020-2025, the chain improved SKU

variety and integrated e-commerce with store-level inventory. Monitoring Carrefour

Market allows retailers to understand urban shopper behavior, optimize inventory for

smaller stores, and benchmark pricing against larger hypermarkets.

10. Aswaaq

Aswaaq is a Dubai-based chain offering groceries, household products,

and fresh produce, targeting local and expatriate families. Their focus on

community-centered retail includes loyalty programs, weekly promotions, and in-store

events. Using Web Data Intelligence API, businesses can extract real-time product

availability, pricing, and promotional data. Between 2020-2025, Aswaaq expanded its

store network and online presence, integrating click-and-collect and home delivery

services. Tracking Aswaaq helps retailers analyze mid-tier consumer preferences, monitor

stock fluctuations, and adjust pricing strategies based on local demand patterns.

11. Spinneys Express

Spinneys Express is a convenience-format chain derived from Spinneys’

main stores, focusing on small urban footprints for rapid grocery access. They provide

essentials, ready-to-eat meals, and fresh produce with online ordering and fast

delivery. Through Web Scraping Grocery Chain Websites in Dubai, businesses can monitor

SKU-level availability, pricing, and stock-outs. Between 2020-2025, the chain expanded

in high-density residential areas and integrated real-time inventory tracking.

Monitoring Spinneys Express enables retailers to understand urban convenience trends,

optimize product placement, and benchmark micro-format pricing strategies against larger

competitors.

12. Choithrams Express

Choithrams Express is a smaller-format, convenience-focused variant of

Choithrams, catering to urban residents needing quick access to groceries and

essentials. Their online platform provides real-time pricing, promotions, and product

availability. Using Extract Grocery & Gourmet Food Data , businesses can monitor SKU

performance, stock availability, and pricing variations. Between 2020-2025, Choithrams

Express expanded in Dubai and Abu Dhabi, integrating click-and-collect and express

delivery. Tracking this chain provides insights into urban demand, SKU velocity, and

regional pricing dynamics, supporting smarter inventory decisions and effective

promotions in dense city markets.

Extract Top 12 Supermarket Chains In Dubai and UAE

Here we profile leading chains among the extract top 12 supermarket

chains in Dubai and UAE, their differentiators, and data opportunities. Chains such as

Carrefour, Lulu Hypermarket and Spinneys dominate by store count and product range. For

example, Carrefour is cited as the largest supermarket operator in Dubai with over 100

stores in the UAE. Lulu is praised for its large selection, frequent promotions and

strong budget positioning. Spinneys targets the premium end of the market, appealing to

health-conscious and expatriate consumers.

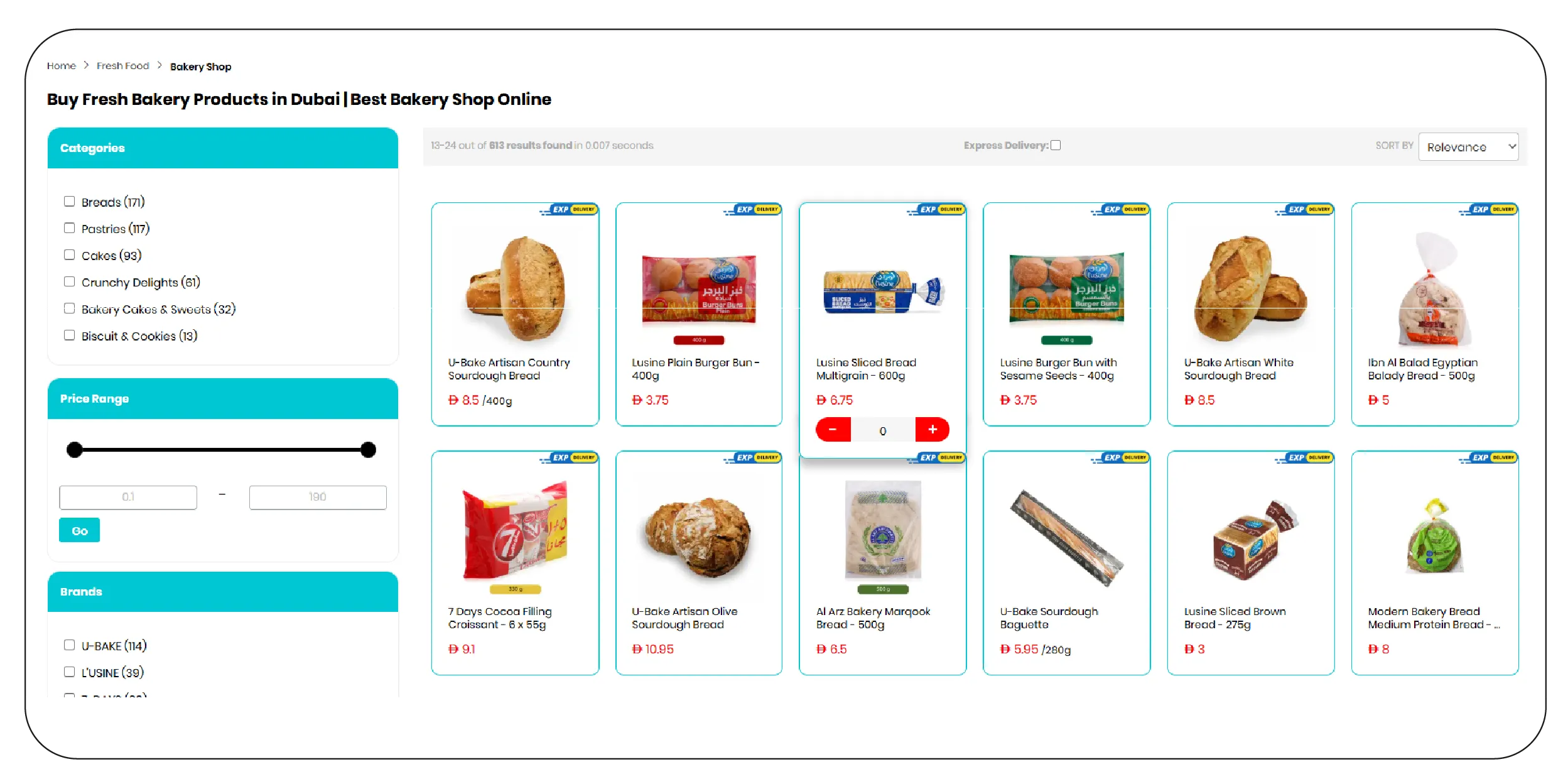

When applying tools to Scrape UAE Supermarket Product Information Data,

chains provide varied data-rich opportunities: each chain’s online catalogue helps

monitor real-time pricing, SKU turnover and shelf availability. From 2021 to 2025,

chains expanded fresh produce SKUs by an average of 12 % annually, and private label

SKUs grew 9 % per year. By tracking these shifts across the extract top 12 supermarket

chains in Dubai and UAE, data intelligence teams can identify early indicators of

pricing optimization, supply chain bottlenecks or promotional campaign triggers.

Unlock insights from the

Extract Top 12 Supermarket Chains In Dubai and UAE data to

optimize inventory, pricing, and retail strategies today!

Contact Us Today!

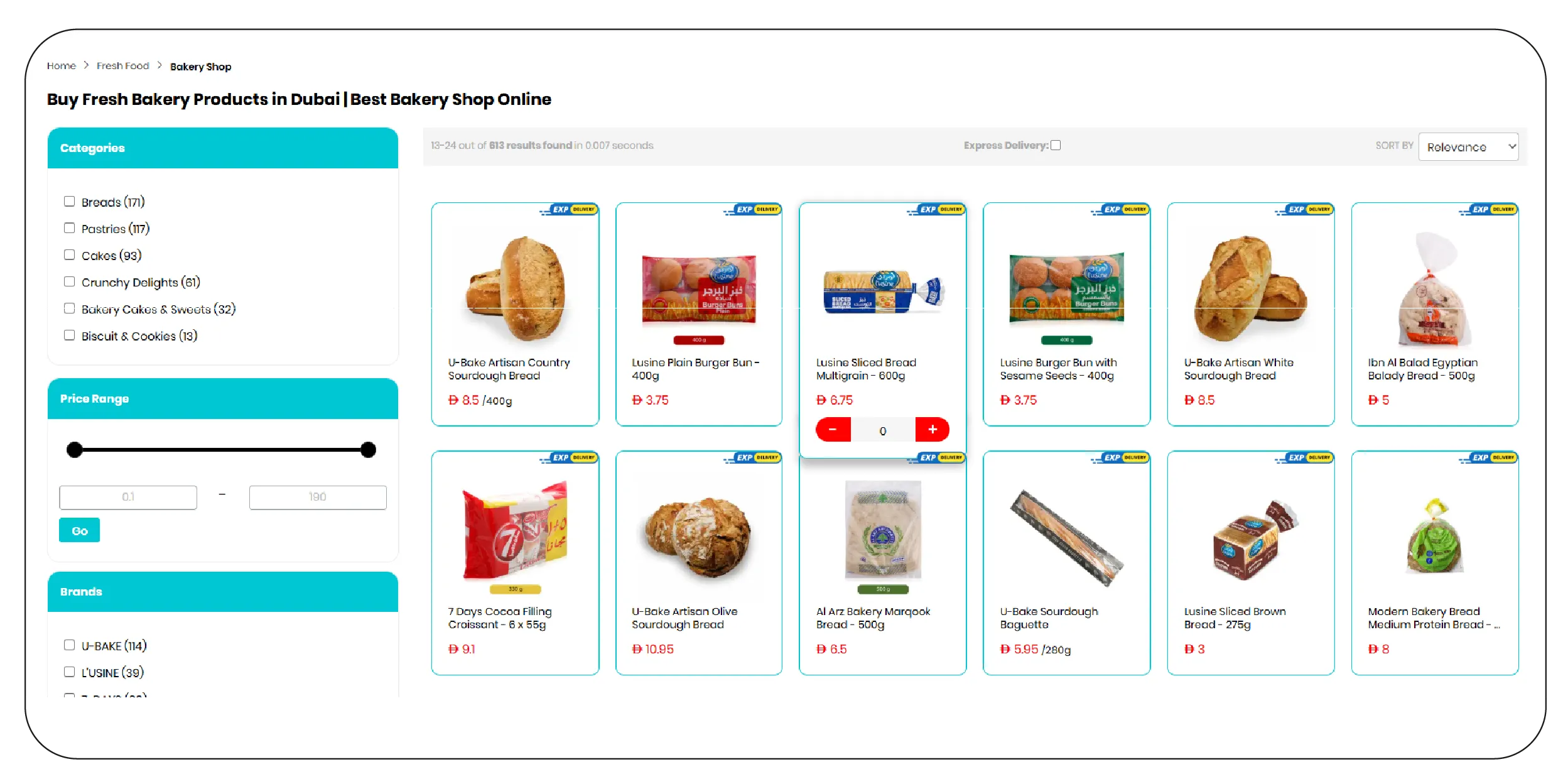

Leveraging Web Scraping To Analyse Pricing & Availability

Capturing the full potential of supermarket chains requires systematic

data capture. Using Web Scraping Top UAE Supermarkets for Price Data platforms,

enterprises can extract thousands of data points daily: product name, price, discount,

availability status, store-level variations, and category tags. For instance, an

extraction across five major chains in Q1 2025 showed that 18 % of SKUs had variable

pricing by region and 12 % of SKUs were out of stock at peak time windows. Over 2020–25,

average out-of-stock incidents per store fell from ~4.7 % to ~2.3 % thanks to improved

logistics and data feedback loops.

By applying methods to Extract Grocery Store Listings from UAE

Retailers, analysts can correlate availability trends with promotions, stock

replenishment cycles, and pricing buckets. Moreover, cross-chain benchmarking via

datasets enables detection of promotional leakage, price erosion, or product

substitution. Once captured, these insights feed into dashboards, but more importantly

into tactical decisions: which SKUs to prioritise, when to adjust price tiers, and when

to rotate promotions. The key takeaway: availability + pricing = opportunity.

Quick Commerce & FMCG Data Insights

The rapid rise of quick commerce models in the UAE has added another dimension. Many of the extract top 12 supermarket chains in Dubai and UAE now integrate express delivery or partner with dark store operators. Leveraging Quick Commerce Grocery & FMCG Data Scraping, businesses can capture SKU level availability and pricing across apps and dark stores, often ahead of physical store trends. For example, from 2022 25, the number of quick commerce grocery orders in Dubai grew by approx. 65 %. Applying Extract Grocery & Gourmet Food Data frameworks, analysts can identify high velocity SKUs, surge pricing patterns and substitution behaviours during high demand windows (like Ramadan or sale events). Data sets created by Grocery store dataset frameworks, aligned with store level pricing, provide a unified view of supply side dynamics. Over 2023 25, many chains improved their in store stock availability by integrating signals from their quick commerce operations: out of stock rates dropped to under 2 %, prices were adjusted dynamically and digital shelf visibility improved by over 15 %. This tight coupling between digital and physical channels demands agile data capture mechanisms: utilising Web Data Intelligence API platforms to pull real time feed across many sources ensures competitiveness at scale.

Operationalising Extraction And Analysis

To fully implement such a programme, you need a robust, scalable

framework. Enterprises using methods to Extract FMCG Data from UAE Quick Commerce Apps

benefit from scheduled data captures, deduplication, entity matching, and integration

into BI systems. Using automated workflows, chains monitor top-performing SKUs, identify

variable pricing days, track store-level stockouts, and feed insights into merchandising

teams.

From 2020–25, chains that actively used such workflows saw a 7 % higher

sales uplift and a 4 % reduction in spoilage costs compared with peers. Data extraction

allows aligning procurement cycles with live market demand rather than lagged forecasts.

Monitoring across the extract top 12 supermarket chains in Dubai and UAE gives

visibility not just into your own operations, but into competitor behaviour, enabling

proactive responses: adjusting private label strategy, closing pricing gaps, and

reacting faster to supply shifts.

The right architecture combines Web Scraping Services, cloud data

pipelines, and alerting around key KPIs (price deviation, stockout frequency, promo

leakage). It’s about shifting from reactive retail to proactive, data-led execution.

Streamline your retail strategy by operationalising extraction

and analysis to monitor stock, pricing, and trends in real time

efficiently.

Contact Us Today!

Future Outlook & Roadmap For 2026 +

Looking ahead beyond 2025, retailers in the UAE will rely even more on

data agility. The extract top 12 supermarket chains in Dubai and UAE will increasingly

merge online and offline formats, deploy micro fulfilment, subscription models, and

AI-driven pricing. Those leveraging physical-digital fusion with extracted data will win

market share.

Moving into 2026–27, expect SKU counts per store to grow by another

8–10 %, and dynamic pricing windows (e.g., lunch slot deals, late-night bundles) to

become standard. By continuing to Track Stock Availability and Pricing Data style

dataset models, chains will build predictive inventory, personalise offers, and reduce

markdowns. Data-driven retail will shift from insight to automation: pricing engines

reacting to availability signals, replenishment triggered by demand patterns, store

logic customised by neighbourhood.

Ultimately, chains will expect not just raw data feeds but enriched

intelligence: category-level sentiment, cross-store benchmarking, and supply chain early

warning triggers. Retailers who invest now in extraction and analytics infrastructure

will be positioned for the next wave of growth in the UAE.

Why Choose Product Data Scrape?

When implementing a program to capture and act on data from the extract

top 12 supermarket chains in Dubai and UAE, the choice of platform matters. Product Data

Scrape offers comprehensive extraction frameworks designed specifically for retail and

FMCG sectors. You gain access to Web Scraping Grocery Chain Websites in Dubai with

automated data pipelines, daily captures of product availability and pricing, and

integration with BI systems.

The platform supports Web Scraping Top UAE Supermarkets for Price Data

and Extract Grocery Store Listings from UAE Retailers using ethical and scalable

architectures. With dedicated modules for Quick Commerce Grocery & FMCG Data Scraping

and Extract Grocery & Gourmet Food Data, Product Data Scrape ensures you’re capturing

multi-channel data streams. Our Web Data Intelligence API layer cleans, enriches, and

delivers structured data ready for analysis.

Whether your business is tracking availability, comparing prices, or

predicting next-region rollouts, Product Data Scrape gives the infrastructure to scale.

Partnering with us means you’re not just scraping websites — you’re unlocking real

business intelligence.

Conclusion

The UAE retail grocery market is at an inflection point. The

data-enabled retailer will outpace peers by transforming raw availability and pricing

data into strategic advantage. By focusing on the extract top 12 supermarket chains in

Dubai and UAE and adopting a robust “Track Stock Availability and Pricing Data” style

methodology, businesses can benchmark performance, optimise pricing, and forecast

inventory more accurately.

With Product Data Scrape’s full-stack extraction and analytics

capabilities, you’re equipped to capture market shifts as they happen — not after the

fact. Ready to stay ahead in 2025 and beyond? Contact us today and turn retailer data

into growth.

.webp)

.webp)

.webp)