Along with many product categories, Amazon has significantly incurred in fashion and

apparel, a

trending category in eCommerce today. Product Data Scrape researched to get insights on Amazon

on

offers on fashion products in the US.

Since our research report in March, we have observed seismic changes in the categories at both

product

type and brand levels.

Research Process

We collected our analytics on over 1 Million clothing products for both men and women from

the

Amazon platform in 2 steps.

In the first step, we recognized all brands that consist of the top 500 featured products in

both the

clothing category of men and women on Amazon fashion. For example, the top listed products

of men's

t-shirts, and the top listed products of women's tees and tops, etc. We assumed that

these top 500

products are among 95% of Amazon's clothing sales. This represents around 2800 different

brands.

Then, we collected the data for all the product listings within the men's and

women's clothing categories

for every brand among those 2800. This gave us around 1.15 million individual products. This

huge list is

the foundation of our report highlights.

Sharp Rise In Third-Party Seller Listing

We spotted around 1.15 million products across clothing, with a considerable hike of about

30 percent

in the last six months.

The third-party sellers are the drivers of this sharp rise in the listing. However,

according to the report,

there was only a 2 percent rise in the first-party seller listings during the same duration

compared to the

third-party listings with a 30+ percent rise.

Additionally, Amazon just listed 11% of all fashion and clothing products on Sale.

Third-party sellers

offered the remaining portion of clothing products with the indication of the strong open

marketplace of

Amazon.

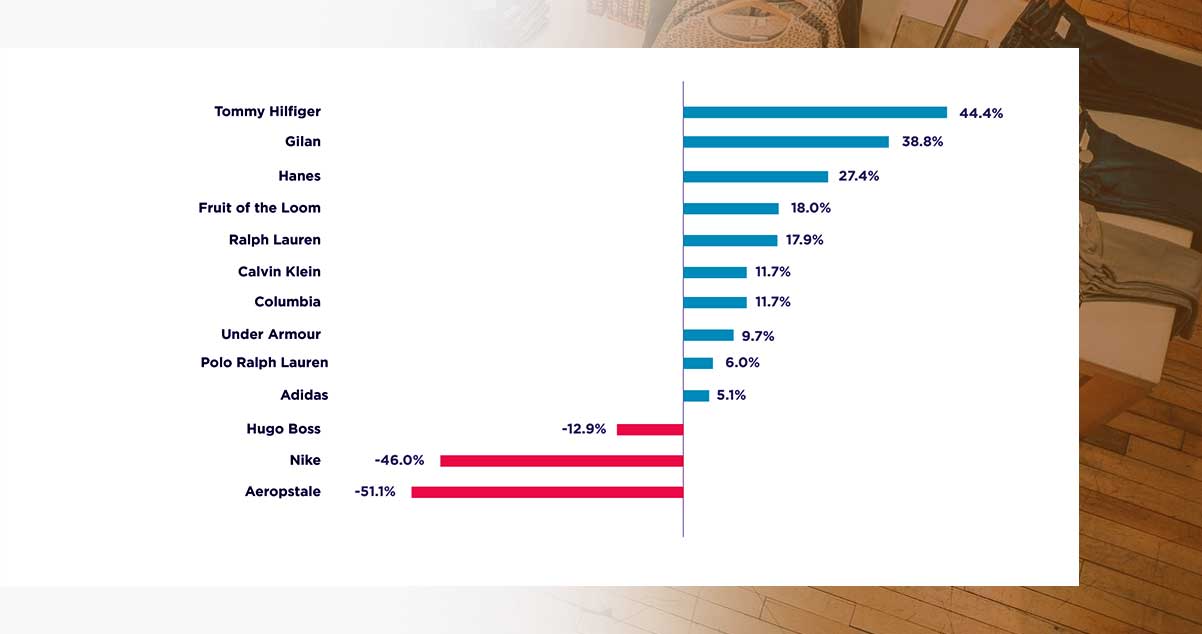

The Major Fashion Brand Shift On Amazon Is On The Way

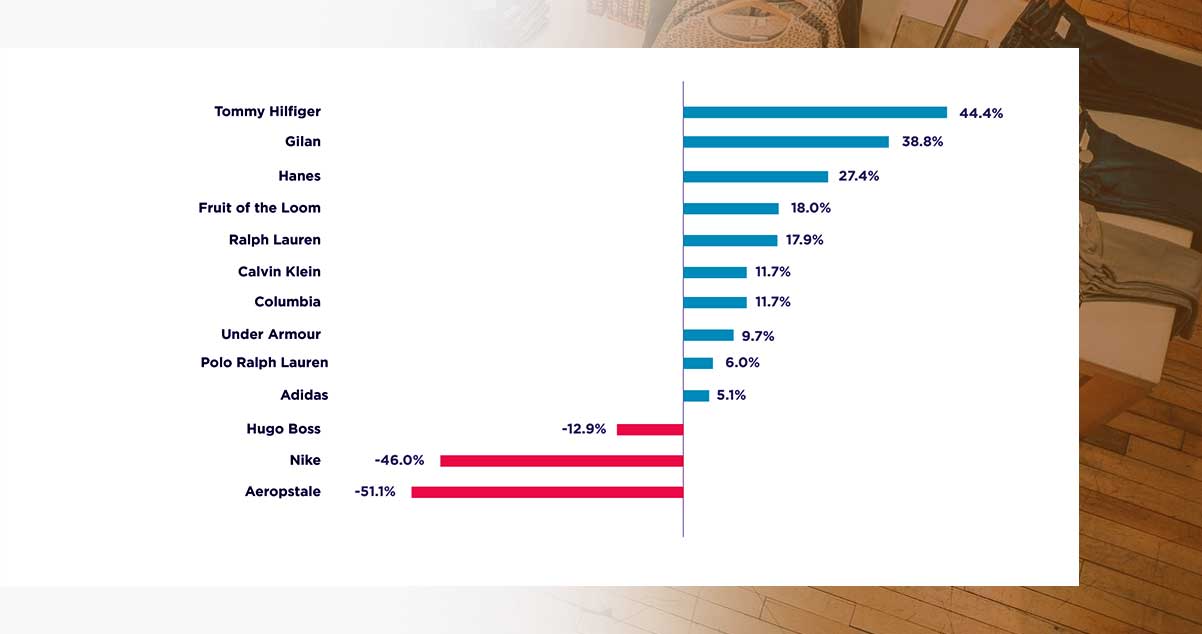

In only six months recently, most of the brand shift in Amazon fashion is done. Nike's

listing of around

45 percent plummeted and was driven in the third-party listing after the partnership of

Amazon with

Nike by a slum, as per the Quartz story. Here, Nike's first-party listing for clothing

could have

compensated for the decline due to limited growth.

Gildan's rise in all the product listings is pushed due to the raised first-party

listings at a low base. The

agreement of Calvin Klein to product assortment with Amazon helped them to appear in the

double-

digit percentage in the first-party listings for fashion products on Amazon.

Further, Aeropostale saw a fall due to its third-party listing. This brand is not there on

Amazon as a

seller.

Amazon Is Reforming Its Clothing Portfolio And Turning The Focus On Suits From Sportswear

As the fashion and apparel footprint of Amazon matures rapidly, it is reforming its

portfolio, considering

the potential growth for formal categories like suits away from sportswear. We observed

about 98.6% of

the hike in women's suits and blazers compared to men's sports coats and suits,

listing about 52 percent

between February to September when we analyzed.

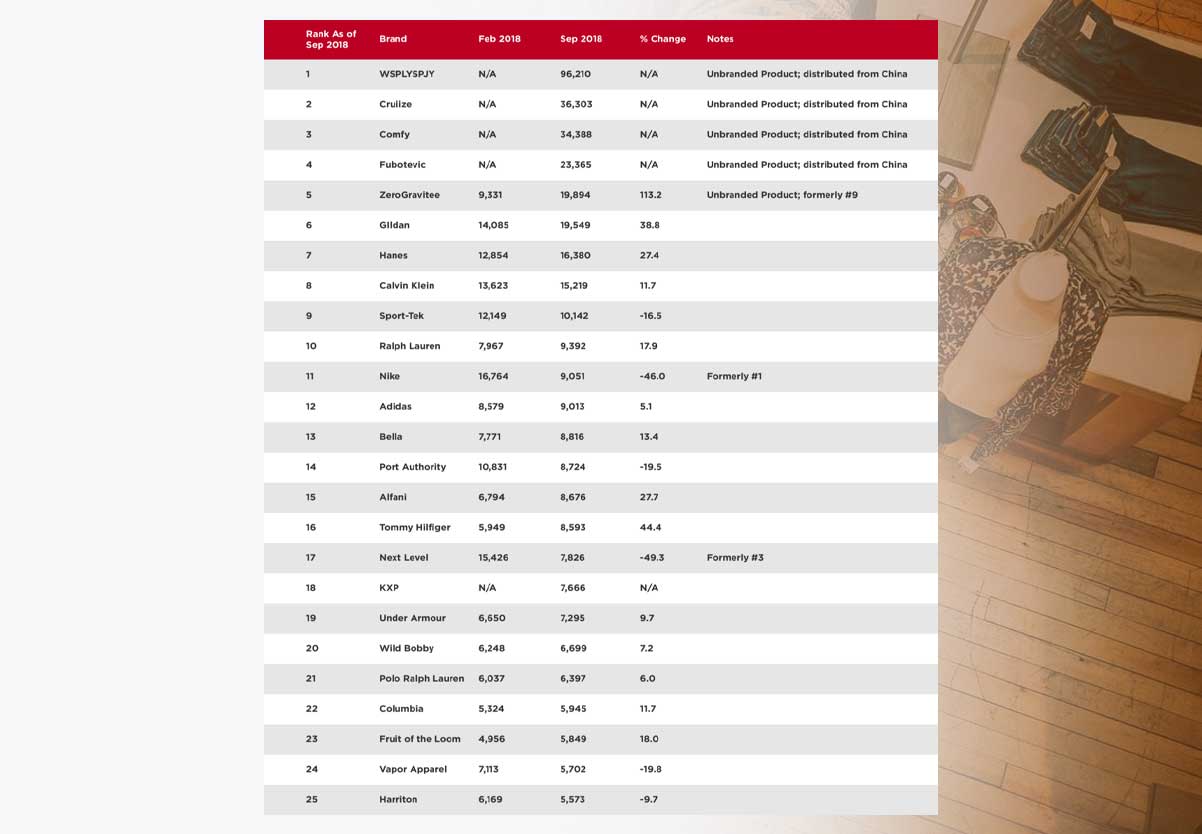

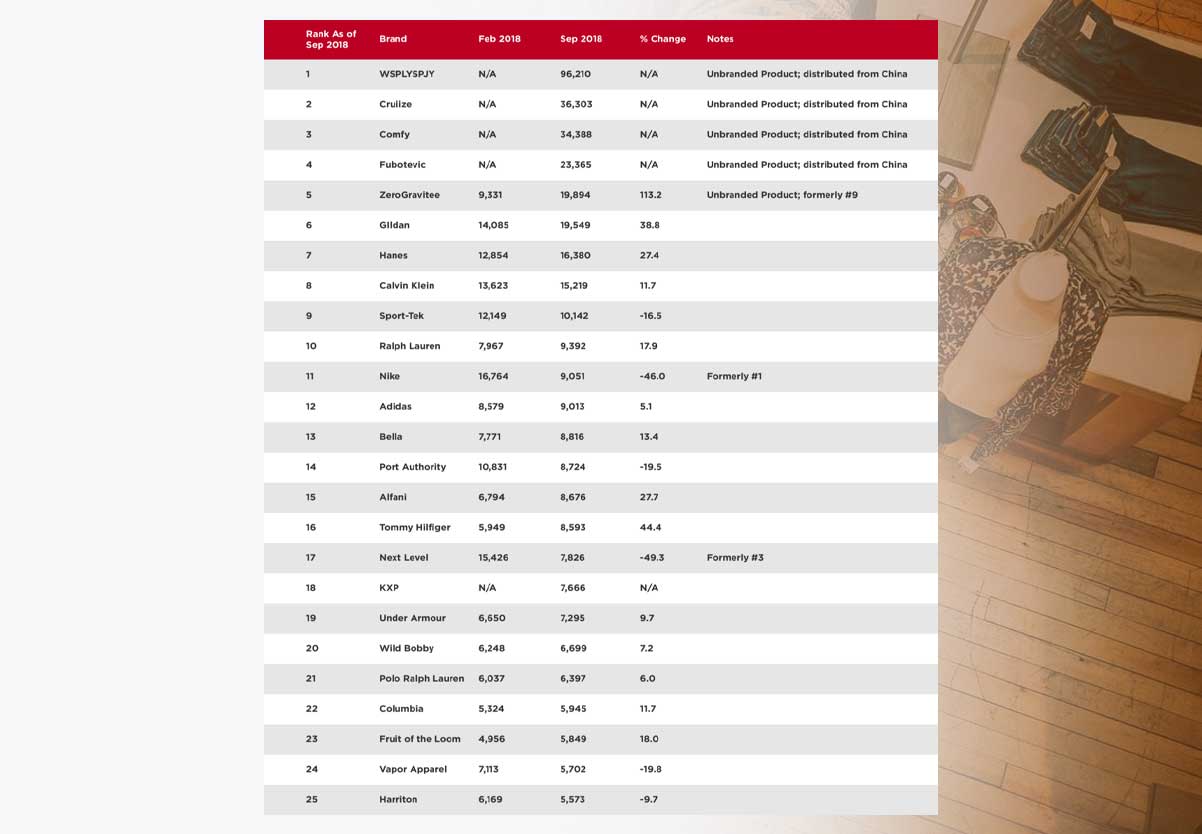

Generic Non-Brands Are Appearing In Top 25 Brand List

In the last six months, a few generic brands with low prices have penetrated Amazon

listings. Four

unknown brands secured the top ranks in the list of top brands on Amazon Fashion. The brands

WSPLYSPJY, Confy, and Cruiize seem to ship products to their customers directly from China.

Amazon Seems To Be Implementing The Strategic Pivot

The fashion offering of Amazon is rapidly maturing. We observed considerable growth in the

listings

count for more categories. The restructuring in the third-party listing by Nike, along with

first-party

listings of Gildan and Calvin Klein, seems to be driven by a partnership with Amazon.

Parallelly, generic fashion items with cheap prices shipped orders from china have inundated

the ranking

of most listed products. Here, third-party listings acquired around 90 percent of

Amazon's fashion

offerings.

While Amazon Fashion buyers enjoy broader choices compared to their choices before the last

six

months, we firmly trust a first-party listing to grow eligible products for prime delivery

in the coming

time. This technique could give strength to the fashion category of Amazon in the long term

as a

shopping platform.

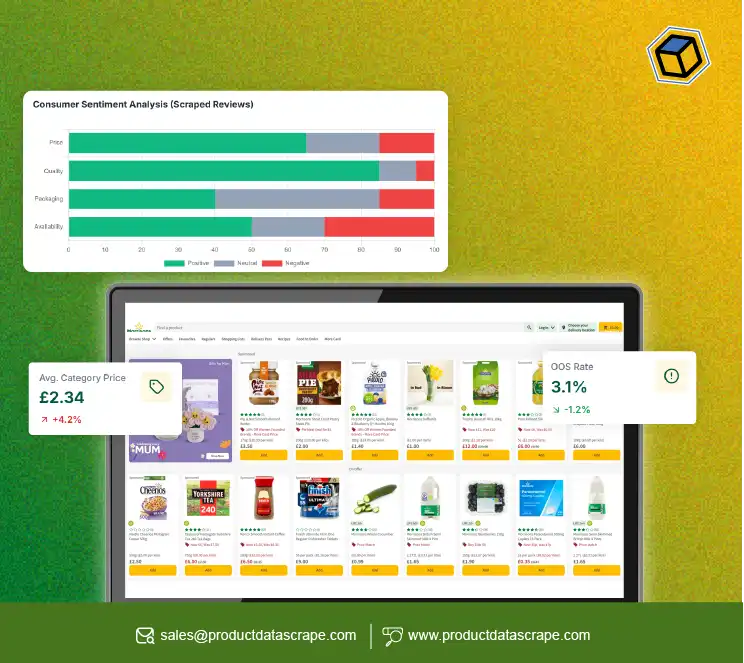

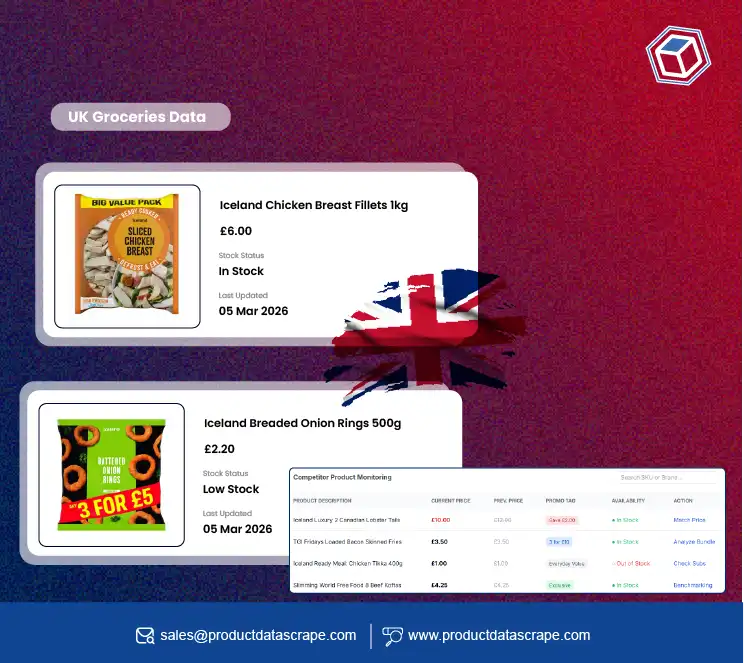

If you want eCommerce data from the web for your product listing market research, pricing

strategy,

and retail analytics, do check out our website. You can also contact the product data scrape

team at any

time.

.webp)