Introduction

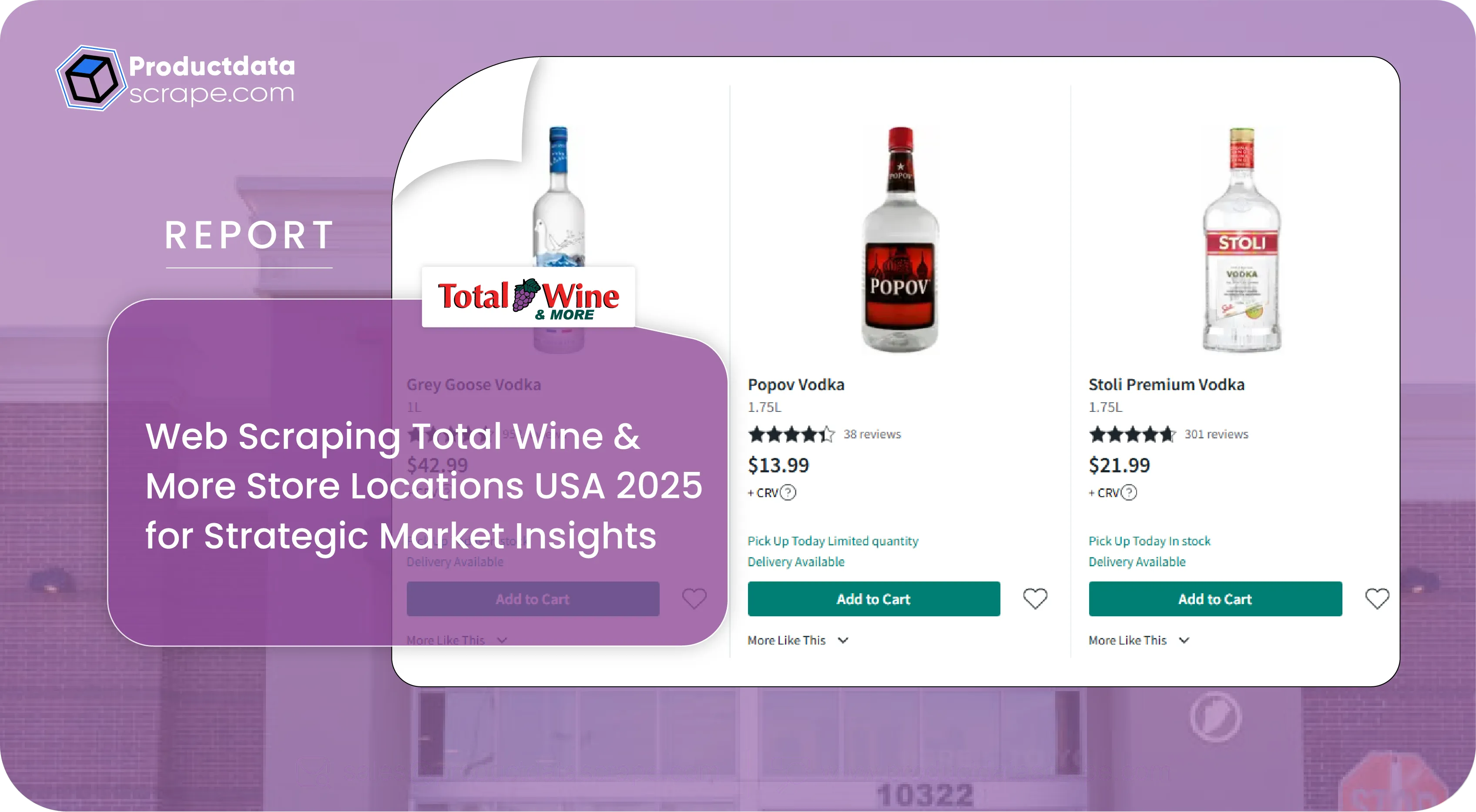

Total Wine & More, the largest independent retailer of wine, spirits, and beer

in the United States, has experienced impressive growth since its founding in 1991 by brothers

David and Robert Trone. Known for its vast product assortment, competitive pricing, and

exceptional customer service, the company has established a strong national footprint. This

report focuses on analyzing the distribution of Total Wine & More stores across the United

States in 2025, identifying key states and territories with the highest concentration of outlets

and regions currently lacking a presence. Using Web Scraping Total Wine & More Store Locations

USA 2025, the study gathers real-time data from the company’s official site and relevant

industry sources. By applying techniques to Extract Total Wine & More Store Locations USA 2025,

the analysis provides a clear view of expansion trends, market opportunities, and strategic

positioning that continue to drive the retailer’s national growth and market penetration.

Methodology

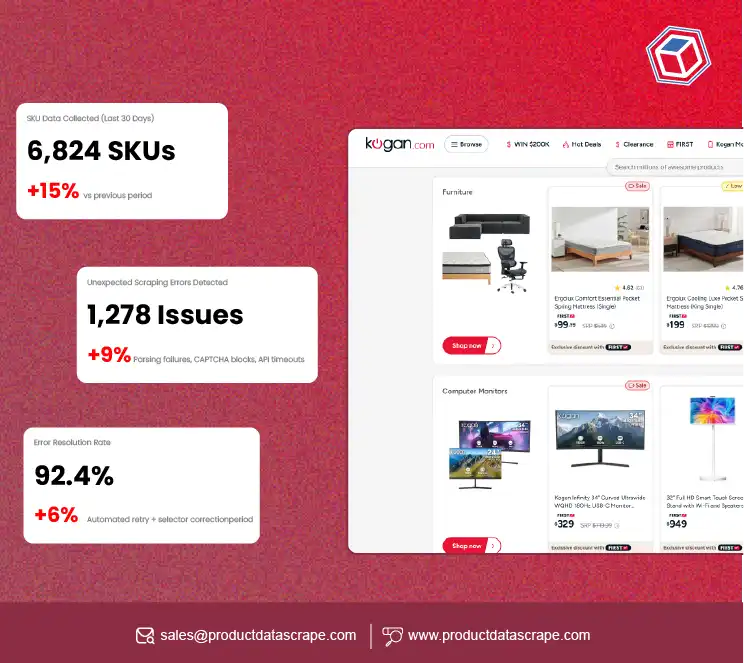

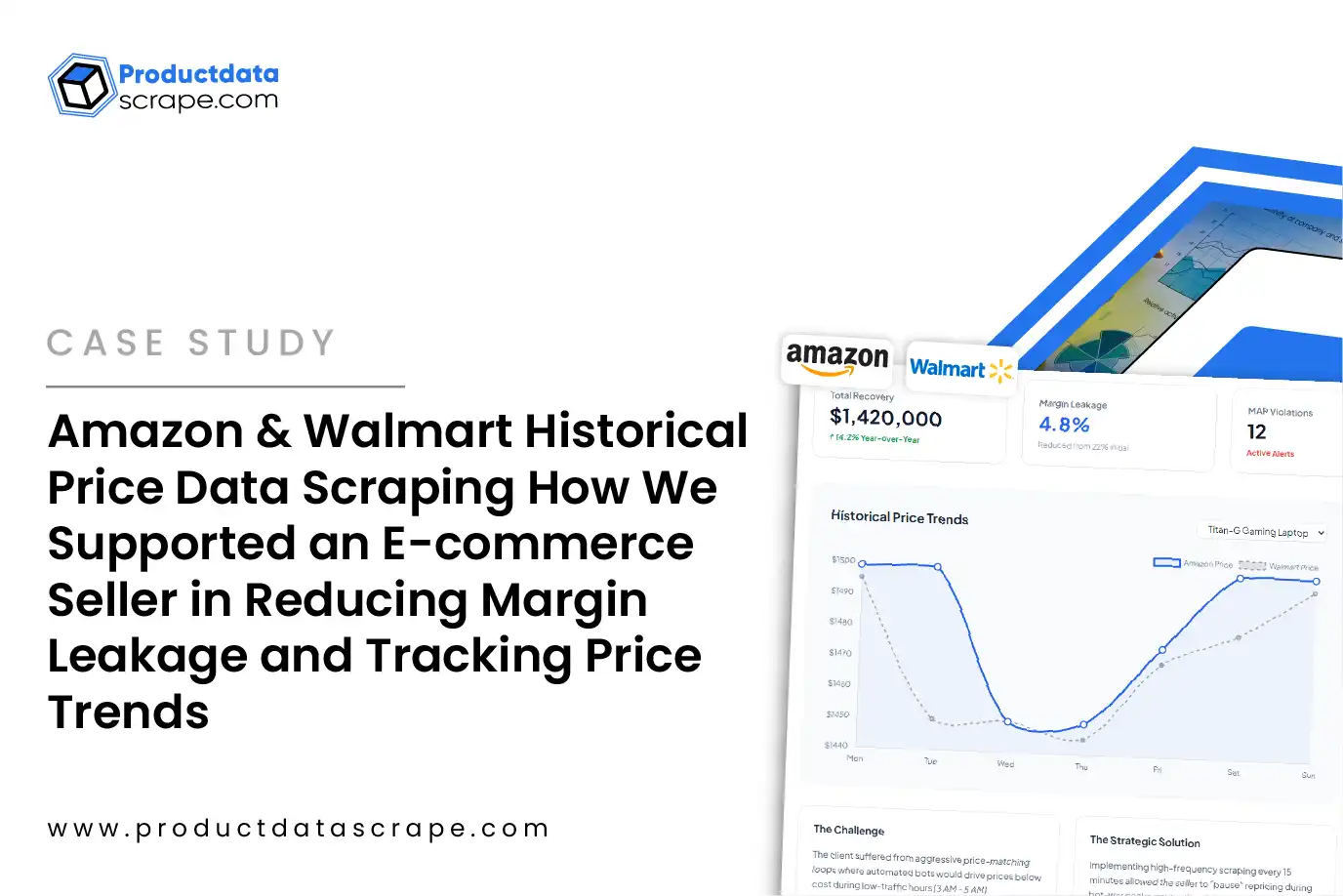

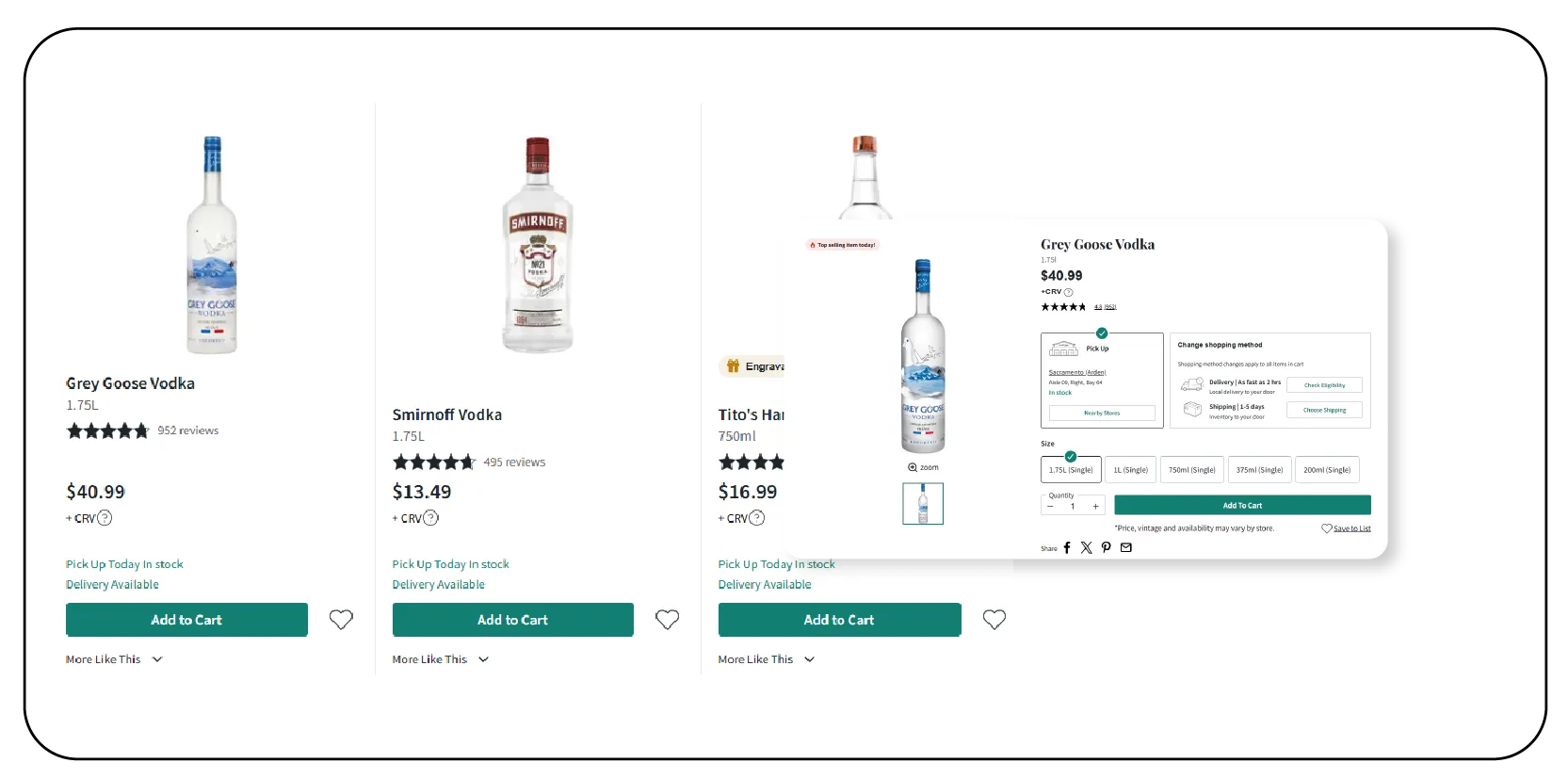

Data for this report was gathered using Web Scraping Total Wine & More Retail

Chain Data USA, focusing on the official store locator and verified industry datasets updated in

May 2025. The objective was to Scrape Total Wine & More Store Count by State – 2025, analyzing

geographic spread, total outlets, and gaps in coverage. The report includes two key tables: one

ranks states with the most Total Wine & More stores, and the other lists states and territories

with no stores, supplemented by three columns—Population (2025 Est.), Alcohol Regulation Type,

and Key Barrier to Entry. Leveraging the US Total Wine & More Store Locations Dataset, the

report also examines regulatory landscapes and market forces, providing context to the

retailer’s expansion patterns and outlining strategic challenges in new markets.

Findings

Total Number of Stores

State with the Most Total Wine & More Locations

California ranks first with 44 Total Wine & More stores, accounting for around

16% of the brand’s national presence. A large population, strong wine culture, and wealthier

metro markets like Los Angeles and San Francisco fuel its dominance. This aligns with findings

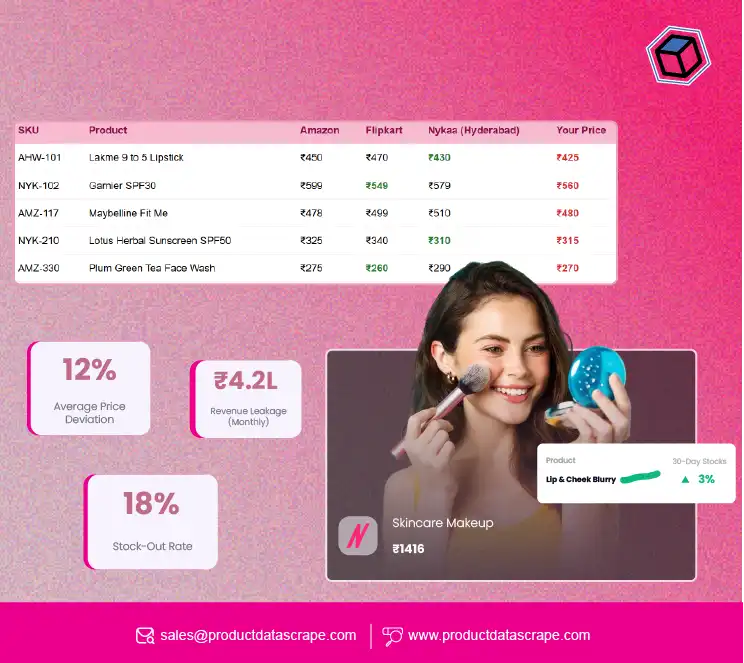

from the Total Wine Liquor Prices Dataset and broader efforts to

Extract Total Wine & More

Alcohol and Liquor Price Data for market analysis.

Table 1: States with the Most Total Wine & More Stores

| Rank |

State |

Number of Stores |

Percentage of Total Stores |

| 1 |

California |

44 |

16.0% |

| 2 |

Florida |

38 |

13.8% |

| 3 |

Texas |

37 |

13.5% |

| 4 |

Minnesota |

10 |

3.6% |

| 5 |

Virginia |

9 |

3.3% |

Table 2: States and Territories with No Total Wine & More Stores

| State/Territory |

Population (2025 Est.) |

Alcohol Regulation Type |

Key Barrier to Entry |

| Alabama |

5.1M |

Control State |

State-controlled liquor sales |

| Alaska |

0.7M |

License State |

High distribution costs |

| Arkansas |

3.1M |

License State |

Restrictive licensing laws |

| Hawaii |

1.4M |

License State |

Geographic isolation, high costs |

| Idaho |

2.0M |

Control State |

State-run liquor stores |

| Iowa |

3.2M |

Control State |

Limited private retail opportunities |

| Kansas |

2.9M |

License State |

Restrictive alcohol regulations |

| Maine |

1.4M |

Control State |

State-controlled liquor distribution |

| Mississippi |

2.9M |

Control State |

State monopoly on liquor sales |

| Montana |

1.1M |

Control State |

State-run liquor stores |

| Nebraska |

2.0M |

License State |

Limited market size |

| New Hampshire |

1.4M |

Control State |

State-controlled liquor sales |

| North Dakota |

0.8M |

License State |

Small population, low demand |

| Oklahoma |

4.1M |

License State |

Restrictive licensing laws |

| Oregon |

4.3M |

Control State |

State-run liquor stores |

| Pennsylvania |

12.9M |

Control State |

State monopoly on liquor sales |

| Puerto Rico |

3.2M |

Territory Regulations |

Logistical and regulatory barriers |

| Rhode Island |

1.1M |

License State |

Small market size, high competition |

| South Dakota |

0.9M |

License State |

Small population, low demand |

| U.S. Virgin Is. |

0.1M |

Territory Regulations |

Logistical challenges, small market |

| Utah |

3.5M |

Control State |

Strict state-controlled liquor system |

| Vermont |

0.6M |

Control State |

Small population, state regulations |

| West Virginia |

1.8M |

Control State |

State-controlled liquor sales |

| Wisconsin |

5.9M |

License State |

Restrictive distribution laws |

| Wyoming |

0.6M |

Control State |

Small population, state regulations |

Detailed Analysis

States with High Store Concentrations

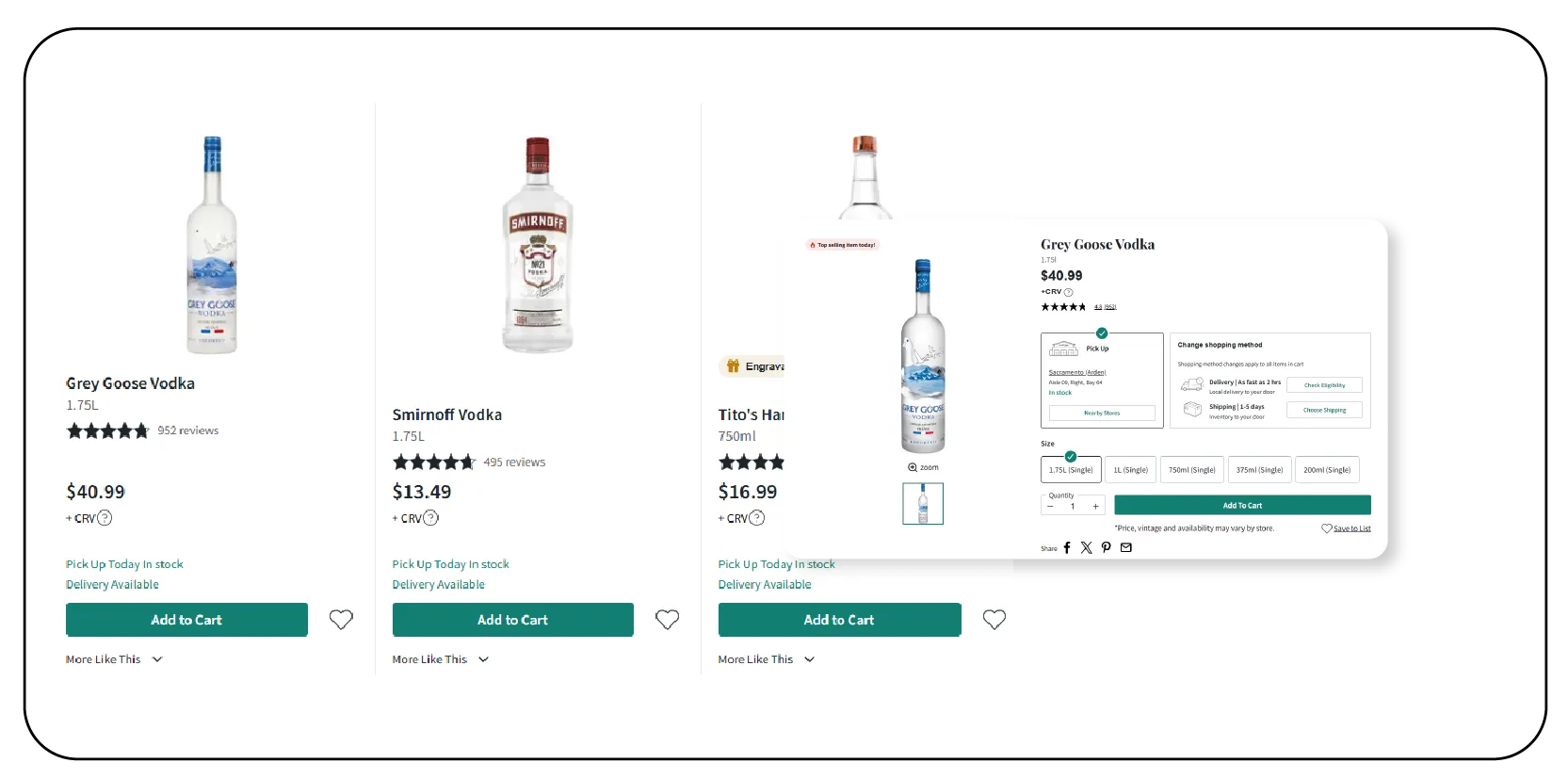

California’s 44 stores reflect its status as a prime market, driven by a

population of nearly 40 million and a wine industry that dominates U.S. production. Affluent

urban centers and a cultural affinity for wine make it ideal for Total Wine’s superstores,

offering over 8,000 wines, 3,000 spirits, and 2,500 beers. Florida, with 38 stores, benefits

from a growing population, significant tourism in cities like Miami and Orlando, and a retiree

demographic with disposable income. Texas, with 37 stores, capitalizes on its large metropolitan

areas, such as Houston and Austin, and lenient alcohol regulations, supporting large-scale

retail operations and insights gained from Liquor Data Scraping Services.

Minnesota’s 10 stores indicate a strategic push into the Midwest, targeting

affluent suburbs around Minneapolis and St. Paul, where demand for premium beverages is rising.

Virginia’s 9 stores align with its proximity to Total Wine & More’s headquarters in Maryland and

its wealthy suburbs, reinforcing the retailer’s data-driven expansion supported by tools to

Extract Alcohol Price Dataset.

States and Territories Without Stores

The absence of Total Wine & More in 25 states and territories, as detailed in

Table 2, is influenced by regulatory, logistical, and market factors. Population (2025 Est.)

highlights the market size, with smaller states like Wyoming (0.6M) and North Dakota (0.8M)

lacking the customer base to support Total Wine’s superstore model, which requires significant

foot traffic. Larger states like Pennsylvania (12.9M) are absent due to other barriers.

Alcohol Regulation Type reveals a key divide: 11 of the 25 regions are control

states, where state governments monopolize liquor sales or distribution, severely limiting

private retailers like Total Wine. For example, Utah’s strict state-controlled system and

Pennsylvania’s state-run stores create significant entry barriers. License states like Kansas

and Oklahoma impose restrictive licensing laws, capping the number of private retailers or

requiring complex compliance.

Key Barrier to Entry identifies specific challenges. States like Alabama,

Idaho, and Montana face state-controlled liquor sales, restricting private retail. Alaska and

Hawaii’s geographic isolation drives high distribution costs, making large-scale stores less

viable. Smaller markets like Vermont and South Dakota lack sufficient demand, while territories

like Puerto Rico and the U.S. Virgin Islands face logistical and regulatory hurdles.

Strategic Expansion and Market Dynamics

Total Wine & More’s expansion strategy prioritizes profitability, ensuring each

store is financially viable before opening new locations, resulting in no closures since 1991.

Growth from 120 stores in 2015 to 275 in 2025—a 129% increase—reflects a compound annual growth

rate (CAGR) of approximately 8.6%. The focus on high-growth regions like the South and Southwest

leverages population growth and rising incomes.

Regulatory challenges limit expansion in states like New York, where a

single-license rule restricts Total Wine to one store. Navigating state-specific laws, described

as operating in “50 unique countries,” remains a significant hurdle, as seen in rejected license

applications in some regions due to local opposition.

Competitive Positioning and Challenges

Total Wine & More’s market dominance is driven by its scale, enabling

competitive pricing and an average transaction size of $75, compared to the industry’s $25. Its

extensive inventory and educational offerings, like tastings and classes, foster customer

loyalty. However, regulatory scrutiny in some states for below-cost pricing and occasional

customer complaints about service consistency pose challenges. Shifting consumer preferences,

particularly among younger demographics, require ongoing adaptation through premiumization and

digital sales.

Implications for Stakeholders

Investors benefit from Total Wine’s robust growth and untapped potential in 25

states. Suppliers can leverage partnerships to reach Total Wine’s large customer base, while

consumers enjoy competitive pricing and variety, though access is limited in regulated states.

Policymakers must balance consumer choice with local laws, as Total Wine’s expansion challenges

existing frameworks.

Conclusion

In 2025, Total Wine & More operates 275 stores across the U.S., with California

leading at 44 locations—highlighting its strategic focus on affluent, high-demand markets. The

absence of stores in 25 states and territories, as shown in Table 2, points to regulatory,

logistical, and market-specific barriers. The company’s disciplined expansion model ensures

continued dominance. Leveraging Alcohol

Prices Data Scraping Services , it can identify regional

pricing trends. Through Web Scraping

Liquor Data , the retailer gains real-time insights to

support further market penetration and data-driven decision-making in untapped areas.

At Product Data Scrape, we strongly emphasize ethical

practices across all our services,

including Competitor Price Monitoring and Mobile

App Data Scraping. Our commitment to

transparency and integrity is at the heart of everything we do. With a global presence and a

focus on personalized solutions, we aim to exceed client expectations and drive success in data

analytics. Our dedication to ethical principles ensures that our operations are both responsible

and effective.