Introduction

In today’s fast-moving quick-commerce ecosystem, businesses rely heavily on accurate product visibility, dynamic price monitoring, and real-time assortment intelligence. As thousands of users browse online grocery platforms every minute, brands and sellers must stay updated with changes across titles, descriptions, sizes, offers, and competitor pricing. Understanding how to efficiently extract Instashop product details and pricing empowers companies to remain competitive and make profitable decisions by leveraging fast, structured, and actionable datasets. With automated scraping technology, you can track products, analyze trends, benchmark competitors, optimize stock availability, and enhance category-level insights. This guide helps you understand detailed workflows, historical data perspectives, and best practices for grocery-focused data extraction from Instashop.

Understanding Category-Wide Behavioural Shifts in Grocery & Gourmet Products

To stay competitive in the fast-moving grocery segment, brands and aggregators increasingly rely on structured tools to Extract Instashop Grocery & Gourmet Food Data. Grocery and gourmet food categories evolve rapidly due to fluctuating consumer demand, new product launches, seasonal assortments, and vendor-specific promotions. When analyzing product behavior at scale, businesses can uncover deeper insights such as trending items, rising price segments, shifting stock patterns, and delivery-time variations. From pantry staples to imported gourmet foods, accurate data helps identify the categories that witness the highest cart-to-checkout conversions. Moreover, comprehensive extraction enables brands to evaluate competitor shelf placement, discounting patterns, and replenishment cycles. Below is a mock dataset highlighting overall category trends between 2020 and 2025:

Grocery & Gourmet Food Data Trends (2020–2025)

| Year |

Avg Product Price (USD) |

Active Listings |

Availability % |

| 2020 |

4.80 |

12,500 |

84% |

| 2021 |

5.10 |

13,800 |

86% |

| 2022 |

5.40 |

15,200 |

88% |

| 2023 |

5.75 |

17,600 |

90% |

| 2024 |

6.10 |

19,900 |

92% |

| 2025 |

6.45 |

22,300 |

94% |

Monitoring Price Movements in Large-Volume Grocery Listings

Businesses aiming for consistent growth find it essential to scrape Instashop grocery listings and compile datasets that reflect live market conditions. Scraping helps track dynamic changes such as daily price drops, limited-time deals, pack-size variations, and cart-based discount triggers. Since grocery products move faster than other categories, automated visibility becomes crucial for predicting upcoming promotional waves or understanding how retailers adjust pricing after inventory updates. With clear year-over-year statistics, companies gain a better understanding of how competitive pricing evolves and how listing volumes expand as more brands join online marketplaces. This form of monitoring enables data-driven decisions, supporting optimized procurement, smarter ad-spend allocation, accurate price benchmarking, and better forecasting models.

Grocery Listing Growth Dataset (2020–2025)

.webp)

| Year |

Total Listings Scraped |

Avg Daily Price Changes |

Promo Items % |

| 2020 |

45,000 |

8% |

12% |

| 2021 |

53,200 |

9% |

15% |

| 2022 |

61,400 |

11% |

17% |

| 2023 |

72,100 |

13% |

19% |

| 2024 |

84,500 |

14% |

21% |

| 2025 |

97,800 |

16% |

23% |

Improving Product-Level Visibility Using Automated Data Technology

Businesses can now streamline online grocery operations by using a simple grocery store API connected to automated scraping systems. Such APIs ensure high-frequency data collection that includes product images, titles, availability, variant differentiation, and shelf-level ranking. Companies adopting this approach can easily extract Instashop product details and pricing to compare SKUs across multiple sellers and understand pricing gaps across regions. With product intelligence powering smart dashboards, brands can track competitor launches, identify fast-moving consumer goods, evaluate market saturation, and understand cross-category performance. As API integrations improve, businesses gain near real-time updates, enabling quicker decisions across supply chain management, marketing, and analytics.

Product-Level Data Extraction Trends (2020–2025)

.webp)

| Year |

Avg API Calls/Day |

Product Accuracy % |

Price Update Frequency |

| 2020 |

20,000 |

89% |

Every 12 hrs |

| 2021 |

28,000 |

91% |

Every 8 hrs |

| 2022 |

37,500 |

93% |

Every 6 hrs |

| 2023 |

49,200 |

95% |

Every 4 hrs |

| 2024 |

61,700 |

97% |

Every 2 hrs |

| 2025 |

77,300 |

98% |

Hourly |

Tracking Market Dynamics Through Advanced Data Automation

Understanding how to scrape product data from Instashop empowers businesses to analyze category shifts, demand spikes, and competitor footprints efficiently. Automated scraping allows analysts to track price variations during festivals, low-stock alerts, and vendor-specific promotional changes. Product data is also invaluable for identifying bundle strategies, regional pricing differences, and SKU-level gaps between online and offline channels. By gathering structured datasets consistently, companies can create historical trend lines and train machine-learning models to anticipate market behavior. Retailers benefit from understanding new-brand penetration, better assortment planning, and optimizing digital shelf presence in real time.

Instashop Market Dynamics Dataset (2020–2025)

| Year |

Avg Market Volatility Index |

Price Gap Variability % |

New Brands Added |

| 2020 |

3.2 |

7% |

430 |

| 2021 |

3.6 |

8% |

510 |

| 2022 |

4.1 |

10% |

620 |

| 2023 |

4.8 |

12% |

740 |

| 2024 |

5.3 |

td>14%

890 |

| 2025 |

5.9 |

15% |

1020 |

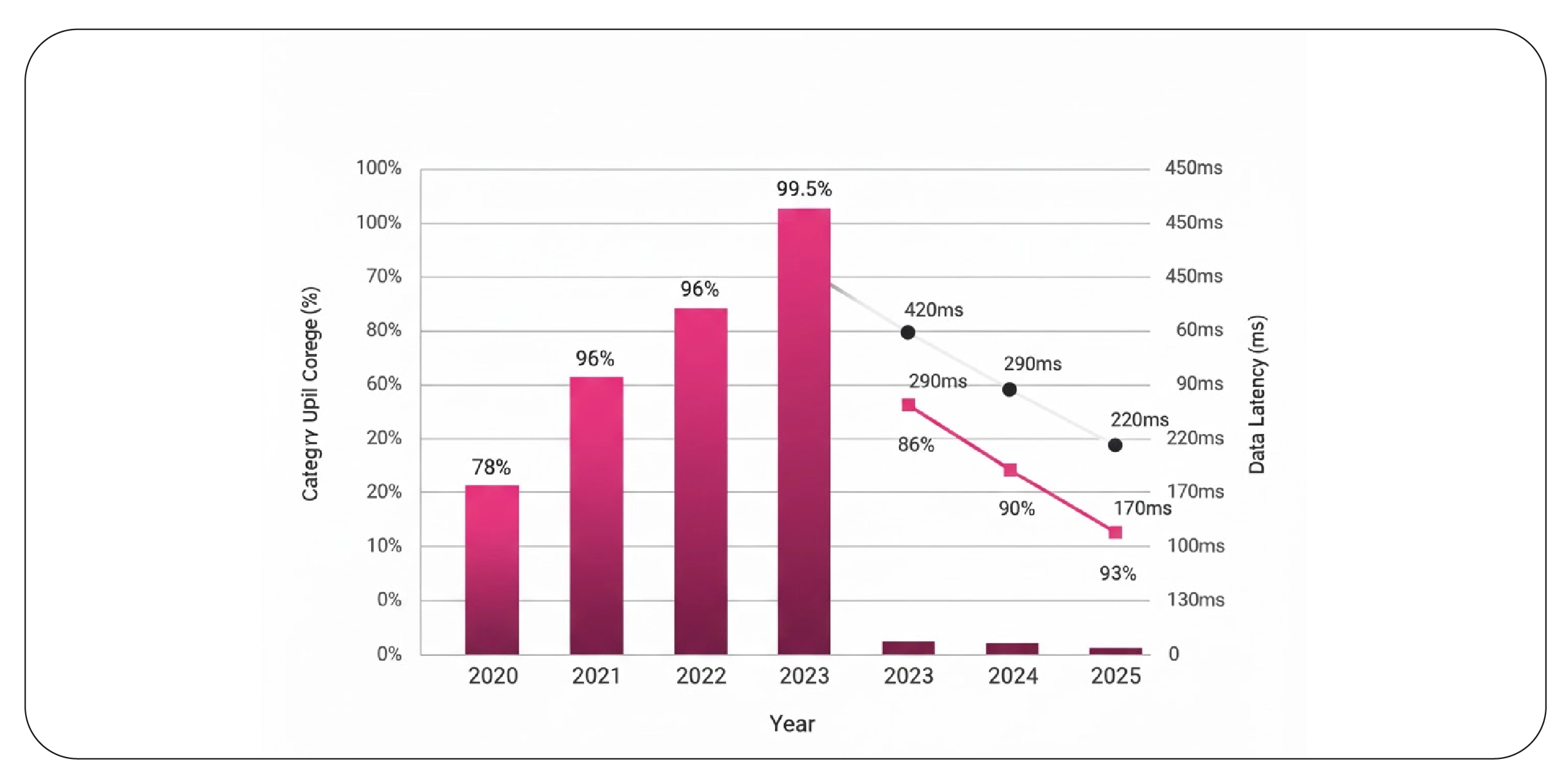

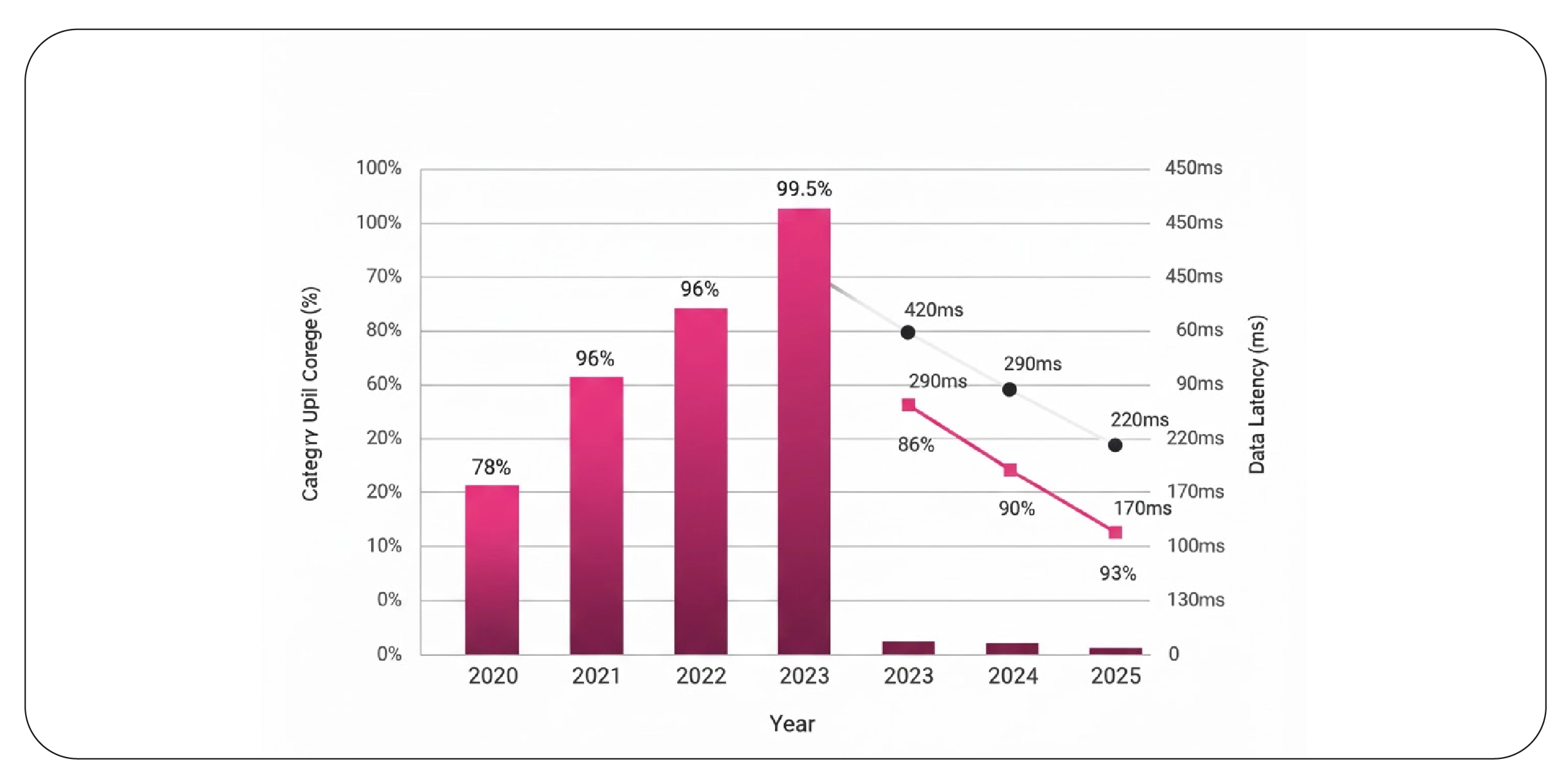

Enhancing Business Intelligence Through Automated Grocery APIs

With rising competition, companies increasingly depend on an Instashop Grocery Data Scraping API to collect structured datasets covering products, availability windows, discount cycles, and shelf rankings. APIs provide faster, more stable pipelines that reduce the need for manual checks and speed up extraction workflows. By integrating API-driven scraping models, businesses can maintain consistent price monitoring, detect stockouts instantly, estimate demand surges, and track competitor performance at SKU and store level. This supports improved forecasting, dynamic pricing strategies, and better promotional investments for CPG brands. API-centric scraping also ensures higher uptime and more accurate categorization.

Grocery API Efficiency Metrics (2020–2025)

| Year |

Avg API Uptime |

Data Latency (ms) |

Category Coverage % |

| 2020 |

93% |

420 |

78% |

| 2021 |

95% |

350 |

82% |

| 2022 |

96% |

290 |

86% |

| 2023 |

98% |

220 |

90% |

| 2024 |

99% |

170 |

93% |

| 2025 |

99.5% |

130 |

95% |

Why Choose Product Data Scrape?

Product Data Scrape stands out for its high-precision extraction accuracy, reliable infrastructure, and advanced automation engines that deliver actionable insights using Instashop marketplace analytics. Our systems capture vast amounts of structured product intelligence, enabling brands to improve competitive benchmarking, pricing decisions, category expansion, and retail media strategies. Whether you manage a D2C brand, an FMCG portfolio, or a global retail operation, our scraping frameworks empower smarter planning and real-time intelligence.

Conclusion

Leveraging Instashop data efficiently helps brands strengthen their market presence, optimize supply chains, and make intelligent pricing decisions. By integrating powerful scraping tools such as an InstaShop Quick Commerce Scraper, businesses gain real-time visibility into competitor ecosystems and can consistently extract Instashop product details and pricing for deeper analysis.

Start your Instashop data extraction journey today with Product Data Scrape — get accurate, real-time insights tailored for your business.

FAQs

1. How often can Instashop product data be refreshed?

Instashop data can be refreshed hourly or as needed, depending on the scraping setup and your monitoring requirements for pricing, availability, and stock patterns.

2. Why is historical data important for Instashop analysis?

Historical datasets help identify long-term pricing trends, stock cycles, category shifts, and competitor changes, improving forecasting accuracy and strategic planning.

3. Can scraping help in monitoring competitor promotions?

Yes, scraping captures price drops, bundle deals, offer tags, and seasonal discounts, allowing brands to track competitor promotions instantly and respond effectively.

4. How does API-based extraction improve grocery monitoring?

API-driven extraction ensures higher accuracy, lower latency, faster updates, and more stable data pipelines for tracking prices, availability, and product metadata.

5. What kind of insights can brands gain from Instashop data?

Brands can track pricing, availability, competitor launches, promotional strategies, category demand, and digital shelf rankings for better retail decision-making.

.webp)

.webp)

.webp)

.webp)

.webp)