Introduction

The rapid rise of quick commerce has reshaped how modern retail brands compete in hyperlocal, on-demand markets. With delivery windows shrinking to minutes, success now depends on real-time visibility into pricing, availability, promotions, and consumer demand. This is where Top Use Cases of Quick Commerce Data Scraping become a strategic advantage—helping brands turn raw platform data into actionable intelligence.

In 2026, retailers are no longer just collecting data; they are operationalizing it through automation, dashboards, and predictive models. From tracking flash sales to optimizing inventory at the neighborhood level, data scraping fuels smarter decisions across marketing, merchandising, and supply chains. When integrated with tools like a Web Data Intelligence API, brands gain seamless access to structured datasets that power analytics, AI forecasting, and competitive benchmarking—without manual effort.

This blog explores six powerful ways modern retailers use product data scraping in quick commerce, backed by market statistics from 2020 to 2026, practical use cases, and real business outcomes.

Turning Market Signals into Strategy

Retail brands increasingly rely on data scraping to stay competitive in fast-moving q-commerce ecosystems. The most common applications include competitor price monitoring, SKU availability tracking, dynamic assortment planning, demand forecasting, customer sentiment analysis, promotion benchmarking, supply chain optimization, new product launch tracking, regional performance analysis, and compliance monitoring. Together, these use cases help brands respond faster to market shifts and consumer needs.

From 2020 to 2026, the adoption of automated data collection tools has surged as retailers realized the limitations of manual tracking. What once took weeks of spreadsheet work now happens in near real time—enabling brands to react to competitor moves within hours.

Adoption Trend of Q-Commerce Data Use (2020–2026)

.webp)

| Year |

Brands Using Scraping (%) |

Avg. Decision Time (Days) |

| 2020 |

28% |

14 |

| 2021 |

36% |

11 |

| 2022 |

45% |

8 |

| 2023 |

58% |

6 |

| 2024 |

67% |

4 |

| 2025 |

74% |

3 |

| 2026 |

82% |

2 |

As shown above, faster access to competitive data directly correlates with quicker business decisions. Brands that leverage scraping for multiple operational areas report higher agility, improved margins, and better customer satisfaction. In 2026, these top use cases are no longer optional—they define how modern retail operates in a real-time economy.

Smarter Pricing in a Minute-by-Minute Market

Pricing in quick commerce changes faster than in any other retail channel. Flash discounts, time-bound offers, and algorithmic pricing make it essential for brands to track competitors continuously. With Q-commerce data scraping for pricing insights, retailers capture real-time price movements across platforms and regions, helping them optimize margins without losing competitiveness.

Between 2020 and 2026, price volatility in q-commerce increased by nearly 2.5x, driven by intense competition and consumer demand for instant deals. Brands that adopted automated pricing intelligence tools early were able to respond dynamically—adjusting promotions, bundles, and minimum order values based on live data.

Average Daily Price Changes per SKU (2020–2026)

| Year |

Avg. Price Changes / Day |

Brands Using Dynamic Pricing (%) |

| 2020 |

1.2 |

22% |

| 2021 |

1.6 |

30% |

| 2022 |

2.1 |

41% |

| 2023 |

2.7 |

53% |

| 2024 |

3.2 |

61% |

| 2025 |

3.8 |

70% |

| 2026 |

4.1 |

79% |

By analyzing competitor price trends, brands can design smarter promotional calendars and avoid unnecessary price wars. In 2026, data-driven pricing strategies are not just about being cheaper—they’re about being smarter, faster, and more relevant to local demand patterns.

Winning the Hyperlocal Shelf Space

In quick commerce, availability is as important as price. Consumers choose platforms and brands that consistently deliver products in minutes. Hyperlocal availability use cases in quick commerce enable retailers to monitor which SKUs are in stock across micro-markets—often at the neighborhood or even building level.

From 2020 to 2026, the number of dark stores and micro-fulfillment centers grew exponentially. This created a complex inventory landscape where a product could be available in one zone but unavailable two kilometers away. Data scraping helps brands visualize these gaps, optimize distribution, and improve last-mile success rates.

Stock Availability Accuracy (2020–2026)

.webp)

| Year |

Avg. Stock-Out Rate |

Brands Using Hyperlocal Data (%) |

| 2020 |

18% |

25% |

| 2021 |

16% |

34% |

| 2022 |

14% |

45% |

| 2023 |

12% |

57% |

| 2024 |

10% |

65% |

| 2025 |

8% |

73% |

| 2026 |

6% |

81% |

By reducing stock-outs, brands improve conversion rates and customer loyalty. In 2026, hyperlocal availability intelligence is a key differentiator—helping retailers ensure that the right products are always in the right place at the right time.

Mastering Promotions with Real-Time Intelligence

Promotions in quick commerce are short-lived but highly impactful. Flash sales, app-only deals, and regional discounts can drive massive spikes in demand—if brands act quickly. A Discount & Promotion Tracking API allows retailers to capture these campaigns as they happen, providing insights into competitor strategies and consumer response.

From 2020 to 2026, promotional intensity in q-commerce grew steadily, with brands running up to three times more campaigns per month than traditional e-commerce. Automated tracking tools make it possible to analyze which discounts perform best, how long they last, and which regions respond most.

Monthly Promotion Campaigns (2020–2026)

| Year |

Avg. Campaigns / Month |

Brands Using Promo APIs (%) |

| 2020 |

4 |

20% |

| 2021 |

6 |

28% |

| 2022 |

8 |

40% |

| 2023 |

10 |

52% |

| 2024 |

12 |

61% |

| 2025 |

14 |

70% |

| 2026 |

16 |

78% |

With accurate promotion intelligence, brands can avoid reactive discounting and instead build smarter campaigns that protect margins while driving volume. In 2026, promotion tracking is no longer a marketing add-on—it’s a core revenue optimization strategy.

Building a Local-First Data Strategy

As quick commerce expands into Tier 2 and Tier 3 cities, hyperlocal data becomes even more critical. A Hyperlocal Quick Commerce Data Scraper enables brands to capture store-level insights—from pricing and availability to delivery times and customer ratings—across hundreds of micro-markets.

Between 2020 and 2026, the number of active q-commerce zones tripled in many regions. Brands that invested in localized data strategies gained a clear advantage by tailoring assortments, promotions, and messaging for each neighborhood.

Growth of Hyperlocal Zones (2020–2026)

| Year |

Active Zones (Index) |

Brands Using Localized Data (%) |

| 2020 |

100 |

24% |

| 2021 |

135 |

32% |

| 2022 |

175 |

44% |

| 2023 |

220 |

56% |

| 2024 |

260 |

65% |

| 2025 |

300 |

72% |

| 2026 |

340 |

80% |

Hyperlocal scraping empowers retailers to move from a one-size-fits-all strategy to precision retail—where every decision is guided by neighborhood-level insights. In 2026, this level of granularity is what separates leaders from laggards in quick commerce.

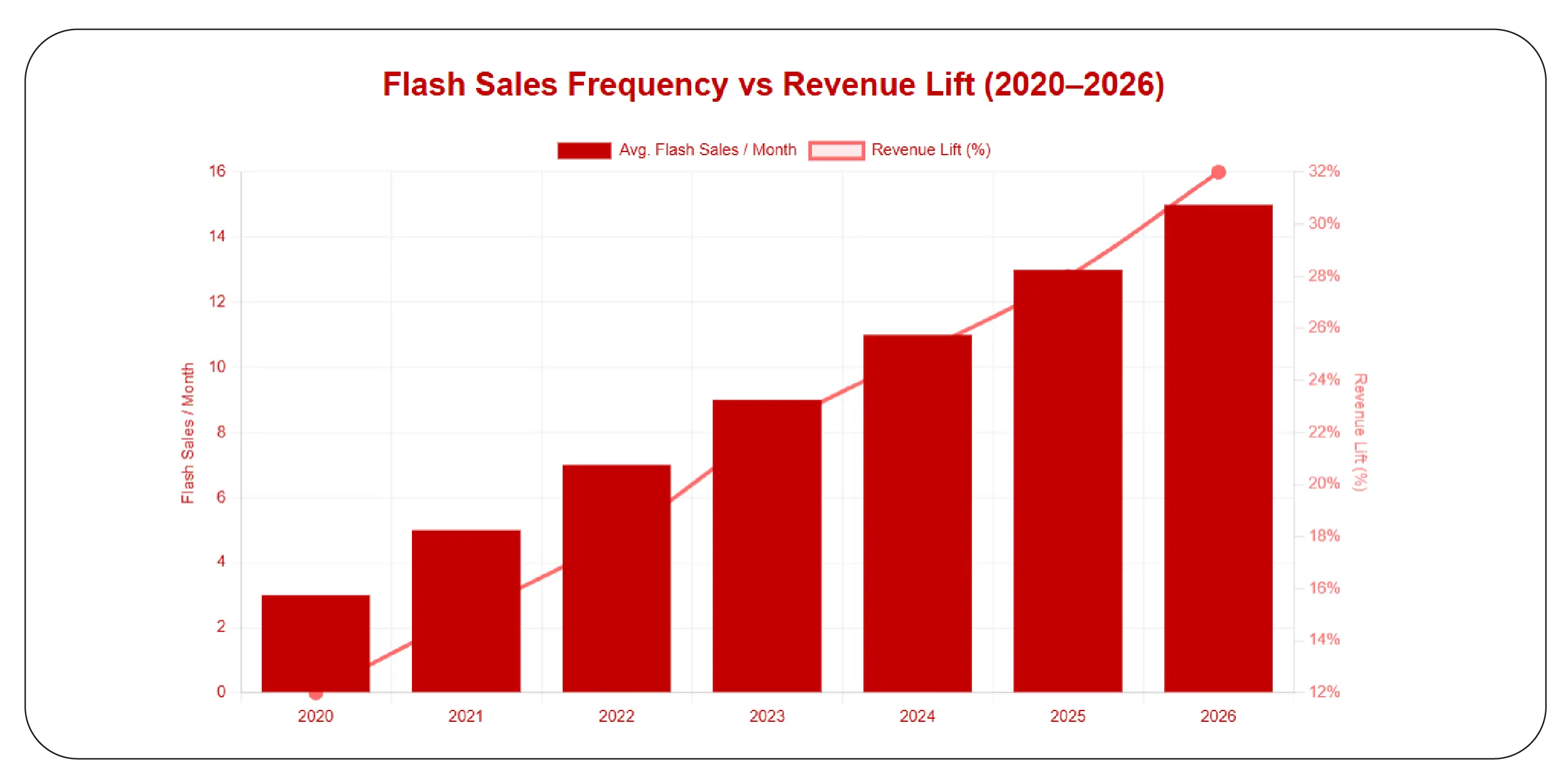

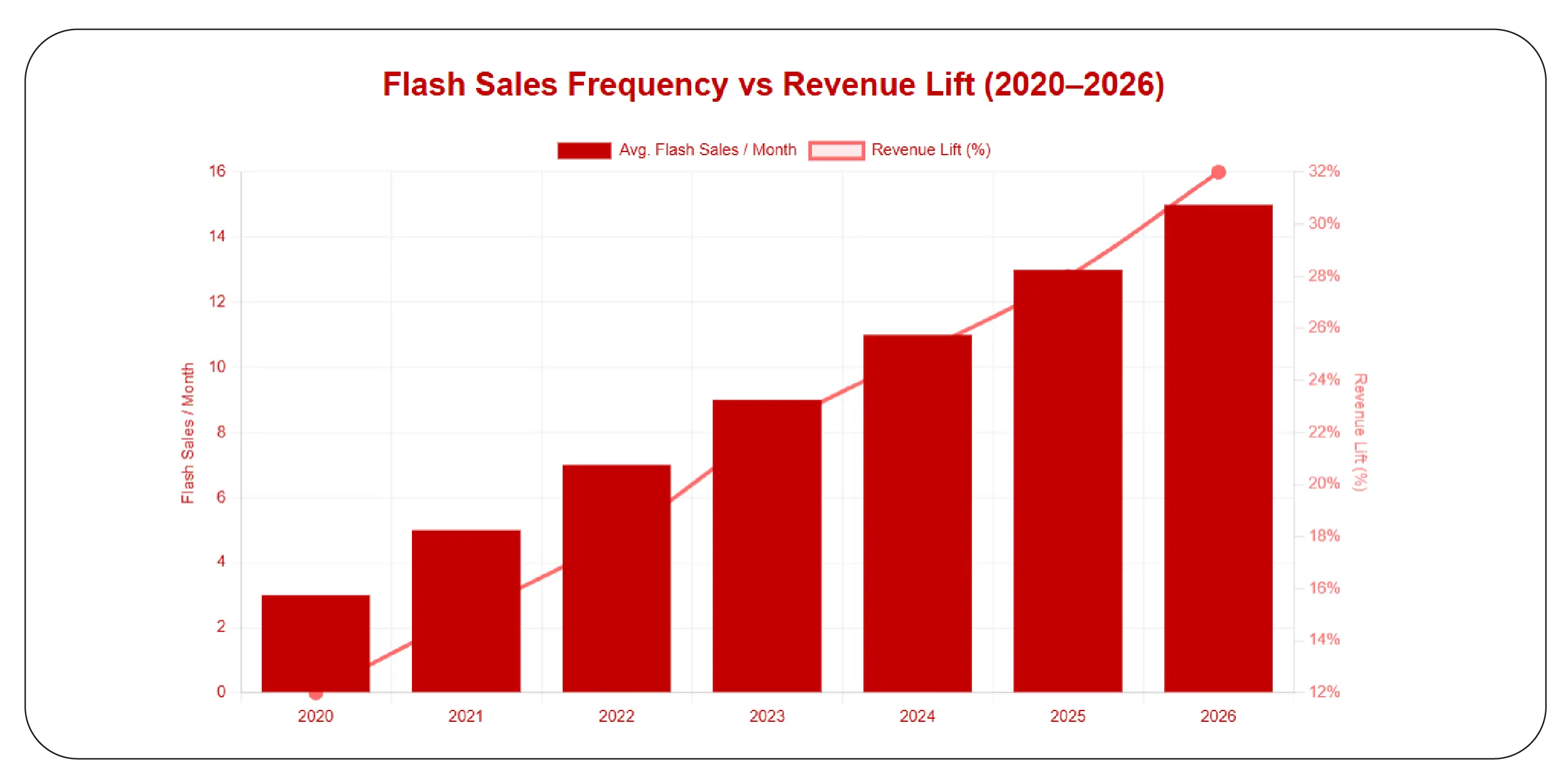

Capturing the Power of Flash Sales

Flash sales are the heartbeat of quick commerce—driving urgency, trial, and impulse purchases. When brands Scrape Quick Commerce Platforms for Flash Sale Data, they gain visibility into timing, discount depth, and product categories that perform best during these high-intensity events.

From 2020 to 2026, flash sale frequency increased dramatically as platforms competed for consumer attention. Data-driven brands analyze these events to refine launch strategies, optimize inventory buffers, and forecast demand spikes more accurately.

Flash Sale Impact Metrics (2020–2026)

| Year |

Avg. Flash Sales / Month |

Revenue Lift (%) |

| 2020 |

3 |

12% |

| 2021 |

5 |

15% |

| 2022 |

7 |

18% |

| 2023 |

9 |

22% |

| 2024 |

11 |

25% |

| 2025 |

13 |

28% |

| 2026 |

15 |

32% |

By understanding what works in flash sales, brands can shift from reactive participation to proactive planning—ensuring they maximize both revenue and brand visibility during these crucial moments.

Why Choose Product Data Scrape?

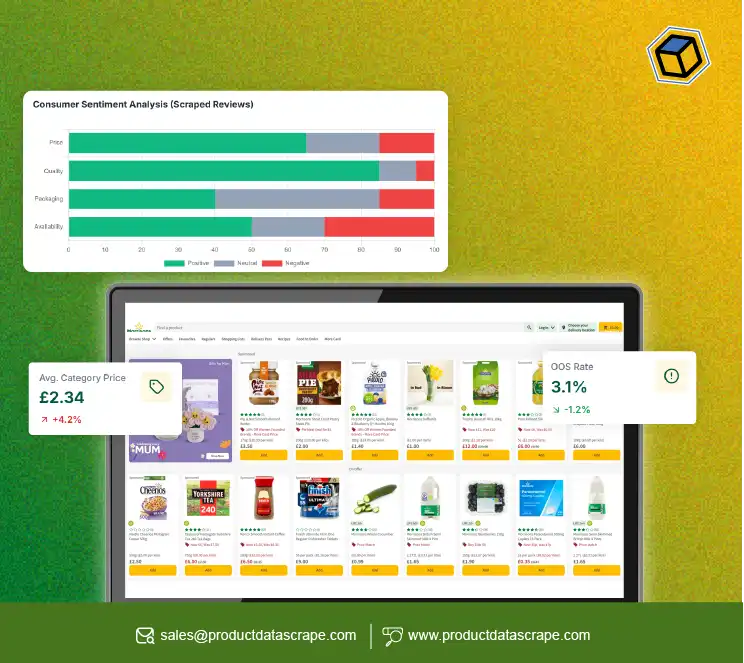

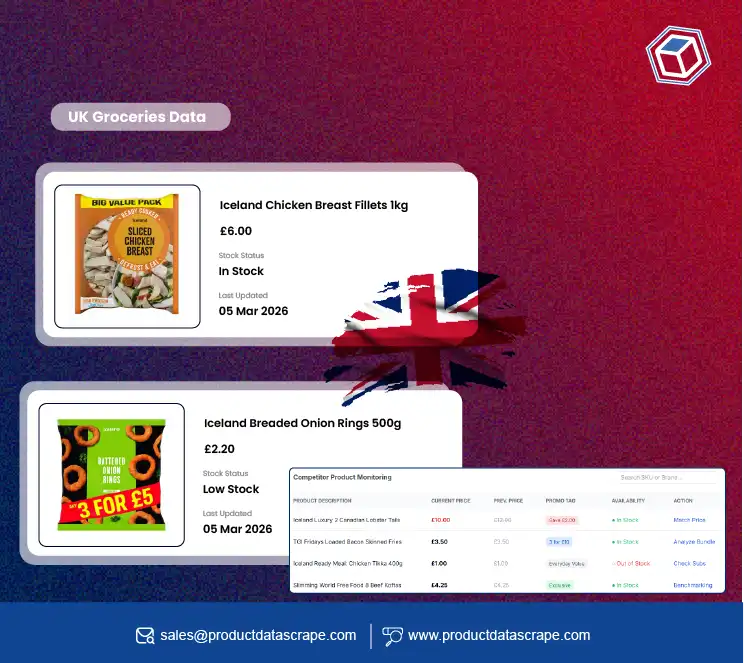

Modern retailers need more than raw data—they need actionable intelligence. Product Data Scrape delivers scalable, compliant, and accurate data solutions tailored for fast-moving q-commerce environments. With advanced automation, brands can track competitors, promotions, and availability across regions without operational overhead.

By combining market analytics with insights like Share of Search, retailers gain a deeper understanding of brand visibility and consumer demand across platforms. This holistic approach ensures better campaign planning, smarter pricing, and stronger competitive positioning in 2026’s hyperlocal retail landscape.

Conclusion

Quick commerce is redefining retail speed, and data is the engine behind this transformation. From pricing intelligence to hyperlocal availability and flash sale optimization, Quick Commerce Grocery & FMCG Data Scraping empowers brands to operate with precision in an on-demand world. As platforms grow more competitive, leveraging the Top Use Cases of Quick Commerce Data Scraping becomes essential for staying ahead—not just reacting to change, but leading it.

Ready to turn real-time market data into measurable growth? Partner with Product Data Scrape today and build a smarter, faster retail strategy for 2026 and beyond!

FAQs

1. How does quick commerce data scraping help modern retailers?

It enables brands to track prices, availability, and promotions in real time, improving decision-making speed, competitive positioning, and overall customer experience across hyperlocal markets.

2. Is data scraping legal for retail intelligence?

When done ethically and in compliance with platform terms and regional regulations, data scraping is a widely used method for competitive analysis and market research.

3. What types of data are most valuable in q-commerce?

Pricing trends, stock availability, delivery times, customer ratings, and promotional campaigns are the most impactful datasets for optimizing retail strategies.

4. How often should brands update scraped data?

In fast-moving markets, hourly or near-real-time updates are ideal to keep pricing, inventory, and promotions aligned with competitor actions.

5. Can Product Data Scrape support large-scale retail operations?

Yes, Product Data Scrape provides scalable solutions that support multi-region, multi-platform data collection for enterprises managing complex quick commerce ecosystems.

.webp)

.webp)

.webp)