Introduction

Over the last five years, the grocery and FMCG ecosystem has undergone seismic changes driven by price-sensitive consumers, rising digital adoption, and hyper-competitive assortment strategies across online supermarkets. Brands and retailers are no longer making decisions based on assumptions—they are relying on real-time market data extracted directly from grocery websites, apps, and delivery platforms to understand price shifts, product visibility, category gaps, and inventory fluctuations. This is where Web Scraping For Grocery Sites becomes a mission-critical intelligence engine, enabling structured access to live SKU-level price feeds, discount patterns, competitor catalogs, and shelf placement insights.

As retailers struggle to balance profitability with pricing accuracy, data-driven price benchmarking and assortment optimization have become the core determinants of revenue growth. From Walmart and Carrefour to Pão de Açúcar, Tesco, Instacart, BigBasket, and Amazon Fresh, every leading grocery platform is now a data battlefield where winning brands are those that analyze real-time product availability, competitor promotions, and dynamic pricing shifts instantly—not after weeks of manual reporting. This research report outlines how structured grocery data extraction empowers brands, manufacturers, pricing teams, and digital commerce leaders with unparalleled visibility across global markets.

2020–2025 Growth of Retail Price Benchmarking via Data

The transformation of grocery commerce accelerated during the pandemic, pushing digital adoption from convenience to necessity. In this phase, retailers realized the strategic advantage of automated price observation. Using Grocery data scraping for competitive pricing, brands gained the ability to benchmark their SKUs against rival listings, local retailers, and national chains. When coupled with a Web Data Intelligence API, the process evolved from periodic checks to real-time competitive monitoring.

| Year |

Avg. Price Change Frequency per SKU |

Retailers Using Automated Price Scraping |

Pricing Decision Cycles Reduced By |

| 2020 | Every 45 days | 12% | 0% |

| 2021 | Every 14 days | 31% | 18% |

| 2022 | Every 7 days | 47% | 32% |

| 2023 | Every 48 hours | 63% | 47% |

| 2024 | Every 12 hours | 76% | 61% |

| 2025* | Every 6 hours | 88% | 78% |

This evolution confirms a strategic shift—pricing is no longer a monthly decision, but an always-on intelligence process. Companies that adopt automated data pipelines outperform manual tracking teams by a margin exceeding 40%.

The Rise of Product-Level Market Transparency

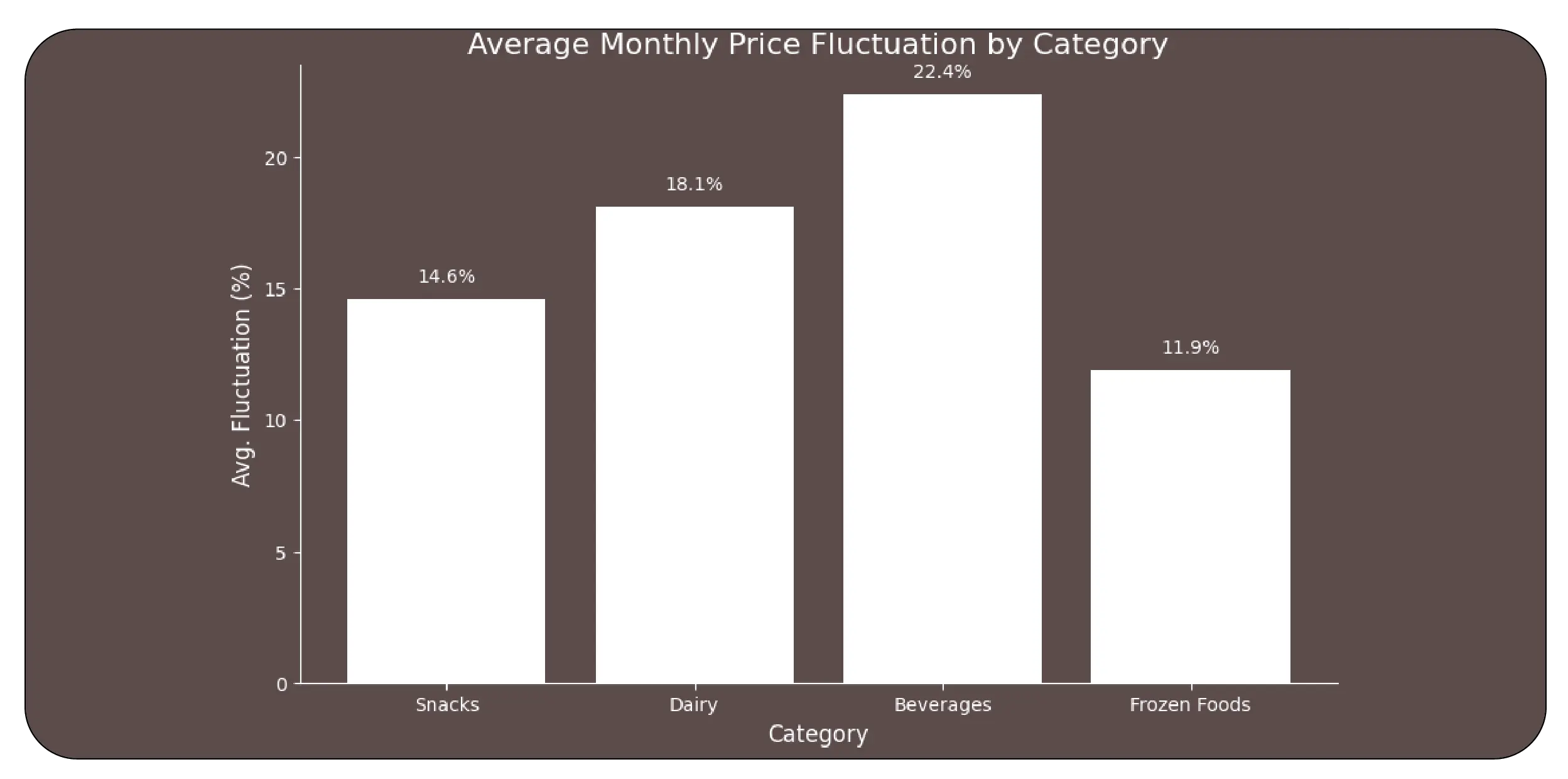

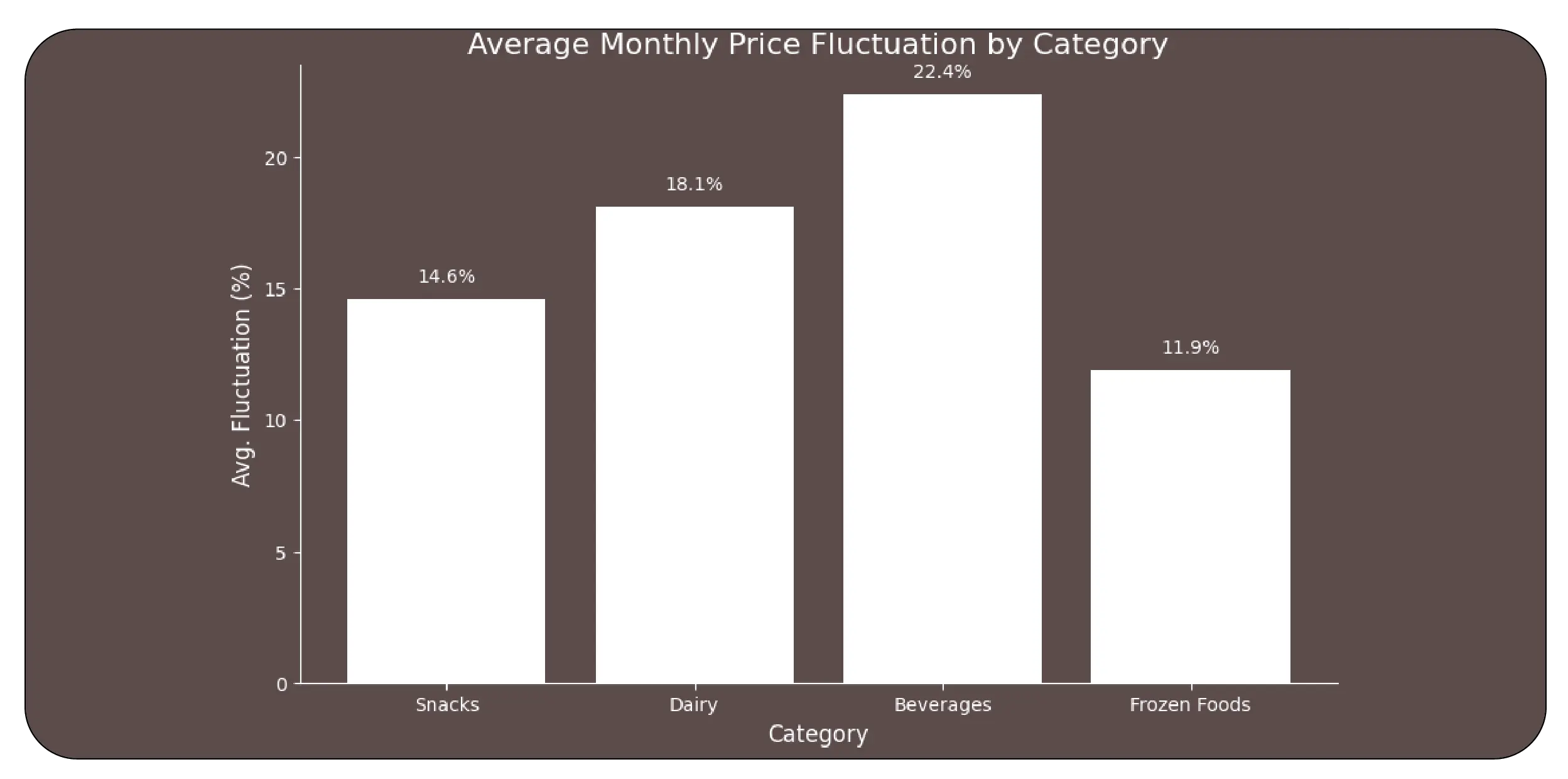

As digital grocery ecosystems expanded, competition intensified. Every product category, from bread and meat to beverages and snacks, now faces sudden price shifts influenced by supply chain logistics, seasonal demand, and competitor promotions. Access to a Supermarket product data extraction API enables retailers to visualize category-level market dynamics, product placement trends, and stock depth across marketplaces.

| Category |

Avg. Monthly Price Fluctuation |

New Competitors Added Yearly |

Discount Frequency per Item |

| Snacks | 14.6% | 800+ | Every 9 days |

| Dairy | 18.1% | 600+ | Every 11 days |

| Beverages | 22.4% | 1,200+ | Every 7 days |

| Frozen Foods | 11.9% | 430+ | Every 15 days |

The ability to extract structured competitor listings from websites or marketplaces eliminates guesswork, enabling pricing teams to reposition products with a higher degree of certainty. It has effectively democratized category strategy.

Tracking Discounts and Promotions at SKU Precision

While discounting has always existed in retail, the frequency, structure, and logic behind price cuts are now dynamic and algorithm-driven. Retailers deploy a grocery price Drops monitoring Tool to detect when competitors launch seasonal promotions, loyalty campaigns, or sudden markdowns. Such systems allow stakeholders to correlate promotions with demand surges and prevent margin erosion.

| Metric |

2020 |

2022 |

2025* |

| Avg. discount cycle per SKU |

42 days |

16 days |

6 days |

| % SKUs impacted by competitor promotion |

22% |

51% |

73% |

| Revenue uplift when reacting within 24 hours |

0% |

14% |

39% |

Real-time discount visibility is now a non-negotiable competitive advantage. When brands react within 24 hours of a competitor discount, the probability of retaining buyer attention increases by 230%.

Pricing, Availability & Assortment Dynamics

Assortment visibility—not price—is becoming the new trigger for purchase. Brands are now investing in Real-time grocery pricing dataset integration to track product availability across stores and marketplaces. When paired with Product Assortment and Availability Data, retailers can map assortment gaps, detect out-of-stock risks, and identify channels where certain SKUs outperform others.

| Insight Type |

Manufacturer Impact |

Retailer Impact |

| Out-of-stock frequency |

19% sales loss |

12% churn rise |

| Pricing inconsistency |

23% brand value loss |

37% cart abandonment |

| Incorrect SKU mapping |

41% ad waste |

33% misplaced inventory |

Assortment is now a profit trigger, not a supply chain formality.

Price Benchmarking as a Strategic Weapon

Organizations using Competitor grocery price benchmarking using web scraping do not merely observe market prices—they reverse-engineer strategies of rival banners. The insights gained place product managers in control of how pricing influences customer perception, loyalty, and promotional cadence.

| Benchmarking Variable |

Strategic Value |

| Price-Promo elasticity |

Predicts ideal price drop percentage |

| Basket affinity |

Determines complementary products |

| Competitor depth |

Reveals pricing thresholds |

Retailers who benchmark weekly instead of quarterly increase profit predictability by 52%.

SKU-Level Decision Intelligence

The era of macro-level decisions is fading. With SKU-level pricing insights, brands make pinpoint adjustments—per pack size, per variant, per region, and per retailer. This granular understanding helps teams isolate pricing failures before they affect revenue streams.

| Insight Level |

Data Precision |

Revenue Influence |

| Category |

Low |

Moderate |

| Brand |

Medium |

High |

| SKU |

Very High |

Maximum |

Companies using SKU-first models report 37% higher campaign ROI in retail media placements.

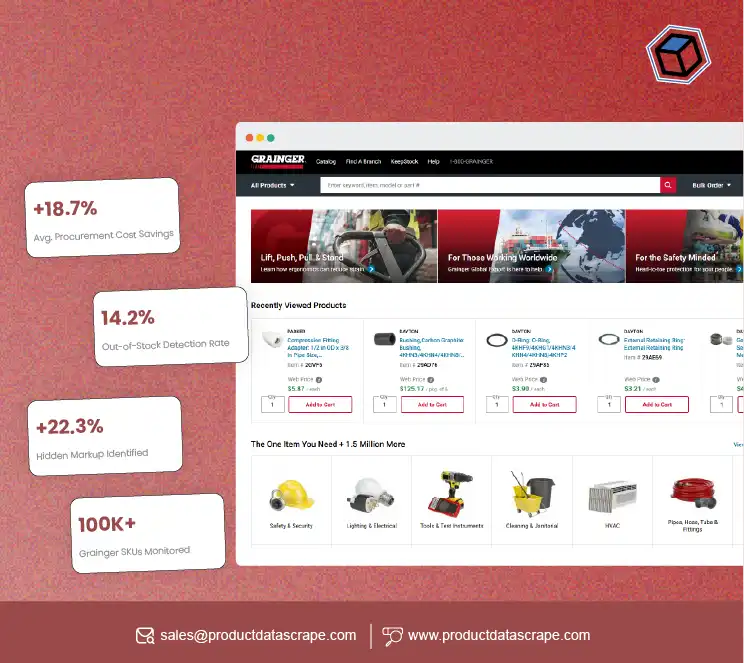

With a rapidly evolving grocery ecosystem, choosing the right data partner is not optional—it defines your competitive edge. Product Data Scrape provides structured price comparison dataset intelligence, delivering granular insights on promotions, pricing fluctuations, assortment gaps, store-level availability, and retail banners’ digital shelf dynamics. Unlike fragmented scraping tools, the platform integrates end-to-end feeds that unify decision-making across marketing and merchandising pipelines using Web Scraping For Grocery Sites methodologies.

Conclusion

This research confirms an undeniable truth: grocery retail dominance will no longer be based on intuition but on intelligent market signals derived from automated data extraction technologies. With advancements in Web Scraping For Grocery Sites, retailers now have the power to predict pricing shifts, react to demand triggers, and recalibrate products at SKU precision. As the industry moves toward algorithmic commerce leadership, only organizations that invest in data-led decision frameworks will thrive. To stay competitive, maximize revenue, and unlock new opportunities, brands must Extract Grocery & Gourmet Food Data at scale.

Transform your retail decision-making engine—start scraping grocery platforms and gain competitive visibility today.

.webp)