Introduction

The rivalry between Adidas and Nike extends far beyond sports sponsorships and product

launches—it is a retail strategy battle that defines global consumer choices. From pricing and

store locations to e-commerce and promotions, both brands leverage data to stay ahead in a

hyper-competitive market.

For FMCG-like apparel, data-driven insights are the difference between leading and lagging in

market share. By conducting an Adidas vs Nike store strategy analysis with USA datasets, brands,

investors, and researchers gain clarity on how these sportswear giants capture shopper loyalty.

Data reveals which brand dominates in physical store networks, which excels in online sales, and

which employs the smarter retail strategy.

This blog explores six problem-solving sections backed by 2020–2025 statistics. We analyze

pricing, store location networks, inventory trends, and e-commerce presence, revealing how

Adidas and Nike approach shoppers differently. For businesses and analysts, these insights

highlight the growing role of data scraping in evaluating retail competition.

Pricing Intelligence and Competitive Benchmarking

Pricing plays a defining role in consumer choice, especially in the U.S. apparel and sportswear

market

projected to grow from $110 billion in 2020 to $160 billion by 2025. Through Adidas vs Nike

pricing

data scraping, businesses can compare product categories, promotional discounts, and price

adjustments

in real time.

Nike often uses premium pricing for innovation-driven products like Air Max or Jordan lines,

while Adidas

balances premium launches (Yeezy) with mid-tier affordability. This mixed strategy allows Adidas

to

penetrate more demographic segments.

| Year |

U.S. Sportswear Market ($B) |

Adidas Avg. Price ($) |

Nike Avg. Price ($) |

| 2020 |

110 |

75 |

95 |

| 2021 |

120 |

78 |

97 |

| 2022 |

130 |

80 |

100 |

| 2023 |

140 |

82 |

102 |

| 2024 |

150 |

84 |

104 |

| 2025 |

160 |

85 |

105 |

Analyzing pricing trends allows brands to predict consumer behavior and identify profitable

positioning. The results of this Adidas vs Nike store strategy analysis with USA datasets show

that Nike leans on brand prestige, while Adidas leverages accessibility.

Store Locations & Geographic Reach

Physical presence remains critical despite the growth of e-commerce. By using

Store location datasets of Adidas and Nike, analysts can track store openings, closures, and

regional concentration.

As of 2025, Nike operates around 1,040 U.S. stores, while Adidas manages about

960. However, Adidas focuses on urban-centric “flagship” stores, while Nike’s reach extends into

suburban and outlet malls, broadening its shopper base.

| Year |

Adidas U.S. Stores |

Nike U.S. Stores |

| 2020 |

900 |

1,000 |

| 2021 |

910 |

1,015 |

| 2022 |

925 |

1,030 |

| 2023 |

940 |

1,035 |

| 2024 |

950 |

1,038 |

| 2025 |

960 |

1,040 |

Using competitive analysis datasets for Adidas vs Nike, businesses can

determine which geographic strategy delivers better retail engagement. Nike dominates volume,

but Adidas’ fewer, larger experience-driven stores generate stronger brand equity.

Expand your retail footprint—use store location insights to identify

growth hotspots, boost visibility, and win shoppers across every region!

Contact Us Today!

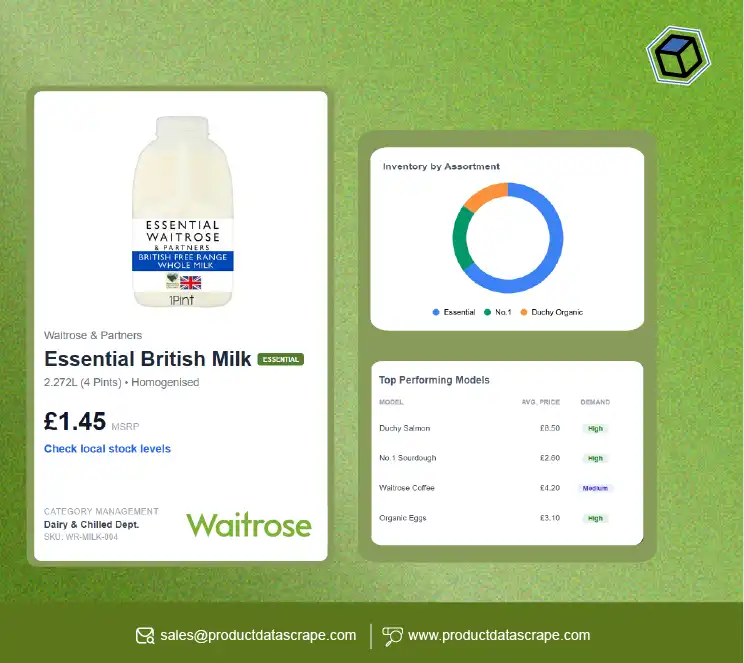

Inventory & Omnichannel Integration

Retail success now depends on omnichannel efficiency. With tools to Extract

online and offline inventory insights, companies can monitor stockouts, replenishment cycles,

and cross-channel synchronization.

Nike has invested heavily in its digital supply chain, ensuring high

availability across Nike.com, SNKRS app, and physical outlets. Adidas, meanwhile, integrates

sustainability into its inventory strategies—pledging that 90% of its products will feature

sustainable materials by 2025.

| Year |

Nike Online Fill Rate % |

Adidas Online Fill Rate % |

| 2020 |

87 |

83 |

| 2021 |

89 |

85 |

| 2022 |

91 |

87 |

| 2023 |

92 |

88 |

| 2024 |

93 |

89 |

| 2025 |

94 |

90 |

By analyzing competitive datasets for Adidas vs Nike retail presence,

businesses can see that Nike wins on fulfillment speed, while Adidas gains consumer trust by

aligning stock with eco-conscious shoppers.

E-Commerce Data & Online Strategy

Digital channels now account for over 30% of sportswear sales. Using Adidas and

Nike location datasets for retail analysis, researchers track how stores integrate with online

performance. Additionally, companies can Scrape data from any e-commerce website to benchmark

pricing and visibility against third-party sellers.

Nike’s direct-to-consumer digital sales exceeded $20 billion in 2024, powered

by platforms like Nike.com. Meanwhile, Adidas posted $10 billion in online sales, focusing on

collaborations and personalized shopping experiences.

| Year |

Nike E-Commerce Revenue ($B) |

Adidas E-Commerce Revenue ($B) |

| 2020 |

7 |

4 |

| 2021 |

10 |

5.5 |

| 2022 |

13 |

7 |

| 2023 |

16 |

8.5 |

| 2024 |

20 |

10 |

| 2025 |

23 |

11.5 |

With tools to Extract Nike.com E-Commerce Product Data , Nike E-commerce Product

Dataset, and Adidas E-commerce Product Dataset , analysts can measure SKU visibility, pricing,

and promotional activity. These insights reveal how both brands optimize digital shelf space.

Pricing Strategies & Market Positioning

Competitive positioning relies on continuous tracking. With Product Pricing

Strategies , Adidas emphasizes affordability for mass-market penetration, while Nike reinforces

premium positioning.

E-commerce Price Monitoring helps identify when brands discount, for how long,

and at what depth. For instance, Nike applies fewer, shorter discount cycles, while Adidas

leverages seasonal promotions to capture value-conscious shoppers.

| Year |

Avg. Nike Discount % |

Avg. Adidas Discount % |

| 2020 |

15% |

25% |

| 2021 |

14% |

24% |

| 2022 |

13% |

23% |

| 2023 |

13% |

22% |

| 2024 |

12% |

21% |

| 2025 |

12% |

20% |

This section of the Adidas vs Nike store strategy analysis with USA datasets

highlights how Nike’s restraint strengthens its premium image, while Adidas leverages price

accessibility to broaden reach.

Drive smarter decisions—leverage pricing strategies and market

positioning data to boost competitiveness, maximize margins, and capture

shopper loyalty today!

Contact Us Today!

Shopper Engagement & Retail Experience

Beyond pricing and locations, shopper experience defines long-term loyalty.

Nike emphasizes digital engagement through AR try-ons and exclusive app drops. Adidas focuses on

sustainability-led campaigns and experiential flagship stores.

Both strategies leverage advanced data scraping. By studying shopper behaviors

from competitive platforms, brands can refine campaigns. For example, Nike’s SNKRS app retains

over 50 million active users worldwide, while Adidas’ eco-campaigns boosted Gen Z brand

preference by 18% between 2020 and 2025.

| Year |

Nike App Active Users (M) |

Adidas Gen Z Brand Preference % |

| 2020 |

25 |

62% |

| 2021 |

30 |

65% |

| 2022 |

35 |

68% |

| 2023 |

42 |

72% |

| 2024 |

47 |

77% |

| 2025 |

50 |

80% |

This reinforces that consumer engagement is as important as pricing or location

strategies in winning retail battles.

Why Choose Product Data Scrape?

At Product Data Scrape, we deliver actionable intelligence through retail

datasets and scraping solutions. Whether you want to benchmark prices, track store locations, or

analyze e-commerce sales, our tools enable businesses to decode competition effectively.

Our expertise lies in building tailored solutions for retail research,

including pricing intelligence, inventory tracking, and digital performance monitoring. With

structured, clean, and real-time datasets, we empower companies to conduct precise Adidas vs

Nike store strategy analysis with USA datasets and beyond.

From competitive benchmarking to SKU-level monitoring, Product Data Scrape

ensures that raw data becomes a strategic advantage. Our scalable APIs, customizable reports,

and advanced crawling infrastructure give brands the insights needed to outpace rivals.

Conclusion

The battle between Adidas and Nike reflects the larger story of modern retail

strategy—where data dictates who captures shoppers. By analyzing pricing, store footprints,

inventory, and e-commerce performance, it becomes clear that both brands excel differently: Nike

through premium positioning and digital innovation, Adidas through affordability and

sustainability.

The insights gained from an Adidas vs Nike store strategy analysis with USA

datasets demonstrate that businesses can’t rely on assumptions; they must leverage accurate

datasets and scraping technologies to compete effectively. Between 2020 and 2025, the U.S.

sportswear market grew 45%, yet only brands with sharp retail strategies expanded their

dominance.

Don’t just observe the competition—outperform it. Partner with Product Data Scrape to unlock powerful retail insights and make smarter business decisions today.

.webp)