Introduction

The Middle East’s booming digital fashion ecosystem has witnessed unprecedented expansion in recent years, with Namshi emerging as one of the most dominant players. The ability to scrape real-time fashion pricing data from Namshi API is enabling brands, retailers, analysts, and investors to understand rapidly shifting trends in the UAE’s highly competitive eCommerce market. As real-time pricing, availability, and competitor activity evolve daily, structured access to Namshi’s product-level data provides actionable insights that help businesses navigate seasonal fluctuations, promotions, and consumer buying patterns. This blog explains how real-time Namshi price extraction is helping companies stay ahead and how Product Data Scrape supports end-to-end automated data collection for accurate, scalable decision-making.

Understanding Consumer Shifts in UAE Fashion Market

Brands and retailers operating in the Middle East increasingly require precise intelligence to assess the evolution of fashion demands across demographics. Using automated solutions, businesses now extract SKU-level sales and inventory data from Namshi to decode the lifecycle of trending apparel categories such as sneakers, abayas, streetwear, sustainable fashion, and global sneaker releases. This helps organizations build a Custom eCommerce Dataset based on real-time metrics that highlight shifting market preferences.

2020–2025 Namshi Fashion Market Evolution in UAE

| Year |

Avg. Top-SKU Price (AED) |

Inventory Fluctuation (%) |

Online Fashion Buyers (M) |

Discount Frequency (%) |

| 2020 |

220 |

14% |

1.6 |

32% |

| 2021 |

258 |

18% |

2.3 |

38% |

| 2022 |

295 |

23% |

3.1 |

46% |

| 2023 |

325 |

29% |

4.2 |

54% |

| 2024 |

361 |

31% |

5.5 |

62% |

| 2025* |

398 |

35% |

6.7 |

69% |

Analysis:

Between 2020 and 2025, UAE’s online fashion buyers increased by over 318%, while average SKU prices rose 80%, signaling brand premiumization and rising digital spending. Businesses leveraging Namshi data gain clarity into pricing elasticity and discount-driven conversions across categories.

Leveraging API-Based Fashion Pricing Insights

Businesses are increasingly relying on Namshi API scraping for dynamic price optimization, enabling automated extraction of real-time pricing and promotional fluctuations. Such insights reveal strategic patterns like seasonal price drops, festival discounts (Ramadan, Eid, White Friday), and category-specific clearance events. Brands can deploy pricing models to track competitor movement, identify reduced SKUs, and detect price anomalies before they impact margins.

2020–2025 Price Optimization Adoption in UAE

| Year |

Retailers Using Pricing Tools (%) |

Avg. Price Change Per Month |

Product Duplication Alerts (%) |

| 2020 |

12% |

3.4 |

8% |

| 2021 |

19% |

4.1 |

12% |

| 2022 |

28% |

5.9 |

17% |

| 2023 |

41% |

7.8 |

21% |

| 2024 |

55% |

9.2 |

26% |

| 2025* |

67% |

11.6 |

33% |

Analysis:

The UAE is experiencing rapid pricing tool adoption, growing from 12% in 2020 to a forecasted 67% in 2025. Retailers extracting Namshi pricing data are outperforming those without structured insights.

Integrating API-Driven Fashion Pricing Intelligence

Fashion brands today rely on structured data to anticipate consumer demand, bundle pricing, and optimize promotions. A Fashion pricing API for Namshi products allows continuous monitoring of product-level shifts in high-velocity categories like athleisure, footwear, bags, modest wear, and premium brands like Nike, Adidas, Puma, and Aldo. Retailers gain competitive advantages by aligning pricing decisions with seasonal influences and consumer behavioral shifts.

2020–2025 Discount & Brand Performance

| Year |

Avg. Discount % |

Fastest Growing Category |

Top Brand Share (%) |

| 2020 |

22% |

Sneakers |

14% |

| 2021 |

27% |

Activewear |

18% |

| 2022 |

33% |

Sustainable Fashion |

21% |

| 2023 |

41% |

Handbags & Footwear |

25% |

| 2024 |

48% |

Smart Casual Wear |

29% |

| 2025* |

52% |

Premium Streetwear |

33% |

Analysis:Premium streetwear leads the UAE fashion spectrum by 2025, driven by global brand endorsements and influencer-based buying trends, significantly influencing digital pricing dynamics.

Extracting UAE SKU-Level Pricing Signals

Today, businesses need the agility to detect price drops instantly, especially for best-selling fashion products. Companies that Scrape Namshi SKU-level price data gain early access to SKU-specific changes, enabling proactive price modeling, inventory forecasting, and promotional timing accuracy. This data benefits analysts tracking out-of-stock patterns, bestseller velocity, and pricing trends.

2020–2025 SKU Price Elasticity Trends

| Year |

Avg SKU Variants |

Price Drops YOY (%) |

OOS Alerts (Monthly) |

Discount-Driven Conversion (%) |

| 2020 |

1.8 |

6% |

45 |

34% |

| 2021 |

2.2 |

9% |

71 |

41% |

| 2022 |

3.1 |

11% |

96 |

52% |

| 2023 |

3.6 |

15% |

131 |

61% |

| 2024 |

4.8 |

19% |

184 |

69% |

| 2025* |

5.5 |

22% |

243 |

75% |

Analysis:

SKU depth increased 206% from 2020–2025. More variants lead to faster pricing changes, making automated Namshi SKU-level data scraping essential.

Continuous Access to Price Insights

Businesses require pipeline-based access to real-time datasets rather than manual snapshots. The Real-time Namshi fashion pricing dataset API provides structured data aligned with trends such as influencer promotions, social endorsements, and limited-edition drops. This allows brands to benchmark pricing shifts, analyze discount cycles, and protect margins.

2020–2025 Inventory & Pricing Volatility

| Year |

Avg Price Fluctuation |

Inventory Replenishment Time (Days) |

Price Surge Events (Annual) |

| 2020 |

4.2% |

18 |

19 |

| 2021 |

6.1% |

15 |

26 |

| 2022 |

8.4% |

11 |

39 |

| 2023 |

11.6% |

8 |

53 |

| 2024 |

13.7% |

7 |

77 |

| 2025* |

15.9% |

5 |

94 |

Analysis:

As volatility grows, businesses need real-time dataset feeds rather than periodic snapshots to maintain pricing accuracy at scale.

Unified Namshi Fashion Data Delivery

The Namshi Product Data Scraping API consolidates attributes such as titles, images, pricing, availability, category metadata, and promotions. This harmonized dataset empowers AI-driven forecasting, marketing personalization, and product feed optimization for marketplaces and D2C brands.

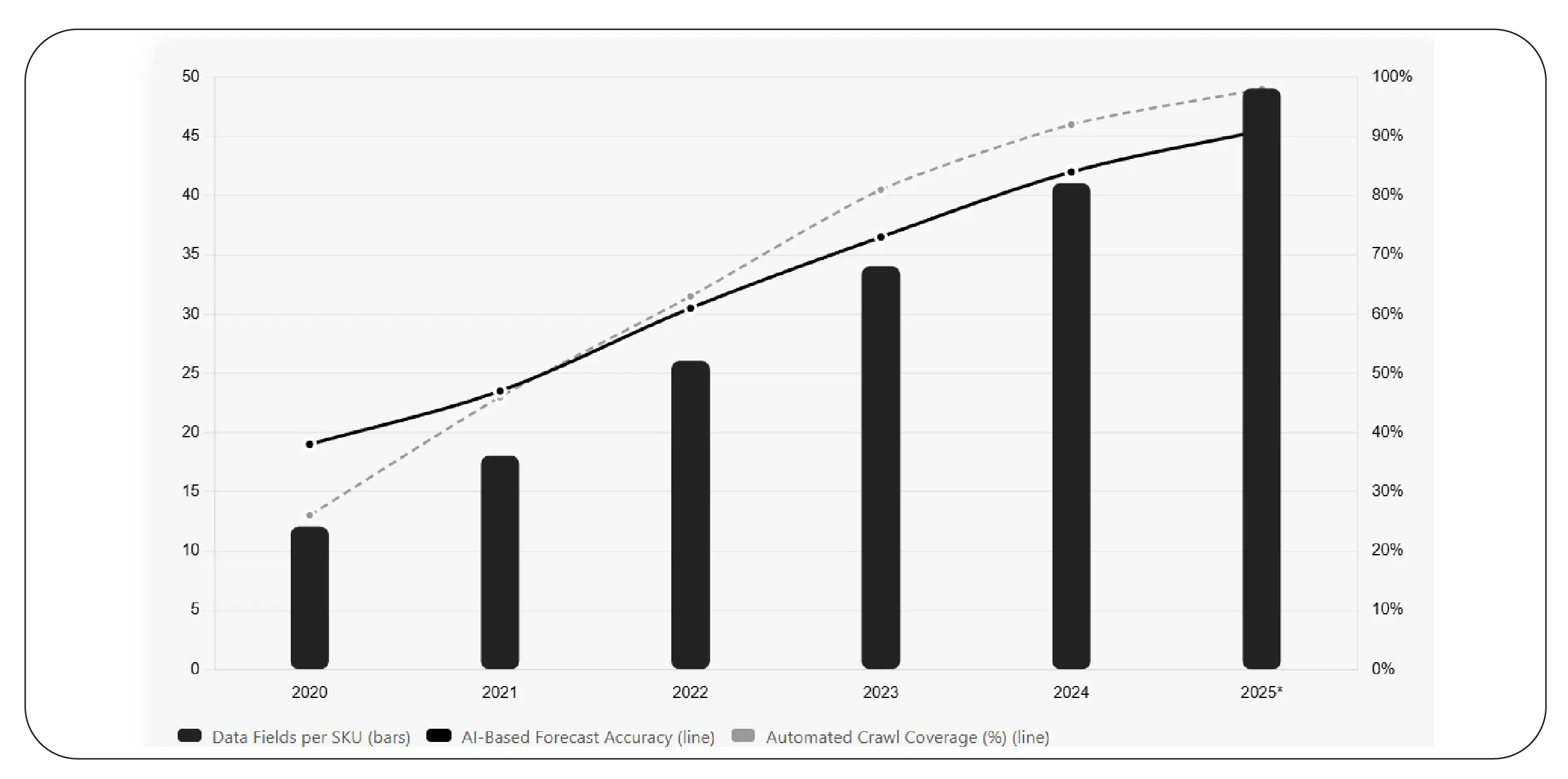

2020–2025 Data Product Expansion

| Year |

Data Fields per SKU |

AI-Based Forecast Accuracy |

Automated Crawl Coverage (%) |

| 2020 |

12 |

38% |

26% |

| 2021 |

18 |

47% |

46% |

| 2022 |

26 |

61% |

63% |

| 2023 |

34 |

73% |

81% |

| 2024 |

41 |

84% |

92% |

| 2025* |

49 |

91% |

98% |

Analysis:

With 98% crawl coverage projected by 2025, UAE fashion pricing automation is entering a phase where manual checks will become obsolete.

Why Choose Product Data Scrape?

Businesses that require structured apparel and fashion pricing feeds prioritize reliability, coverage, and flexibility in API access. Product Data Scrape enables clients to Extract Namshi Fashion & Apparel Data with structured pricing, category depth, promotion details, and out-of-stock signals. Combined with the ability to seamlessly scrape real-time fashion pricing data from Namshi API, organizations gain end-to-end automation without infrastructure overheads. Product Data Scrape integrates with BI tools, predictive models, and ERP systems, allowing enterprises to react faster to market shifts and price-sensitive consumer segments.

Conclusion

Fashion pricing in the UAE is driven by dynamic promotions, rising digital adoption, and increasing SKU complexity. Businesses that leverage structured real-time data pipelines gain a measurable advantage over competitors relying on manual tracking. With automated access, forecasting, and market readiness becomes a predictable process rather than a reactive task. Now is the time to automate your Namshi pricing intelligence and unlock operational clarity.

Start your Data Extraction Service From Namshi UAE today and scrape real-time fashion pricing data from Namshi API to transform your pricing operations instantly.

FAQs

1. What type of data can be extracted from Namshi?

You can collect pricing, inventory status, discounts, category attributes, product metadata, availability, image URLs, and brand-level identifiers for fashion and lifestyle products.

2. How frequently can Namshi data be updated?

Data can be updated every minute, hourly, or daily depending on subscription tiers and required monitoring levels, ensuring complete pricing visibility and competitive advantage.

3. Is Namshi scraping legal?

Scraping publicly available product information is legal when following ethical guidelines, respecting access rules, and avoiding confidential, personal, or restricted content.

4. Who benefits most from Namshi fashion data?

eCommerce brands, retailers, investors, aggregators, and AI-driven recommendation platforms benefit from pricing, inventory, and promotional intelligence extracted from Namshi.

5. Does Product Data Scrape support custom integrations?

Yes, Product Data Scrape provides tailored API pipelines, custom fields, and multi-format outputs for integrations with BI dashboards, ERP platforms, and AI-based pricing engines.

.webp)