Introduction

The global cosmetics and personal care industry has experienced rapid digital transformation over the last decade, with online channels becoming a primary driver of pricing transparency and competition. Brands operating in this space must continuously monitor product prices, promotions, and regional variations to stay competitive and protect margins. This research report focuses on cosmetics pricing intelligence derived from Oriflame Product Prices Using Web Scraping, demonstrating how structured data collection enables deeper market understanding. By systematically capturing online price points, pack sizes, and category-level variations, organizations can move beyond anecdotal observations and rely on data-backed insights. The study also highlights the value of Extract Oriflame Health & Beauty Data to support long-term trend analysis, competitive benchmarking, and demand forecasting. Covering the period from 2020 to 2026, this report analyzes historical patterns and forward-looking trends using tabular statistics and narrative interpretation, helping stakeholders understand how pricing strategies evolved in response to market shifts, digital adoption, and changing consumer expectations.

Market Coverage and Data Depth

Comprehensive cosmetics pricing intelligence depends on consistent, high-quality data across categories and time periods. In this study, pricing information was gathered through Scrape Oriflame cosmetics prices Data methodologies that ensured repeatability and accuracy across multiple product lines. The dataset spans skincare, color cosmetics, wellness, and personal care segments, providing a holistic view of brand-level pricing behavior. To support customized research needs, stakeholders can also Buy Custom Dataset options tailored by geography, category, or time range.

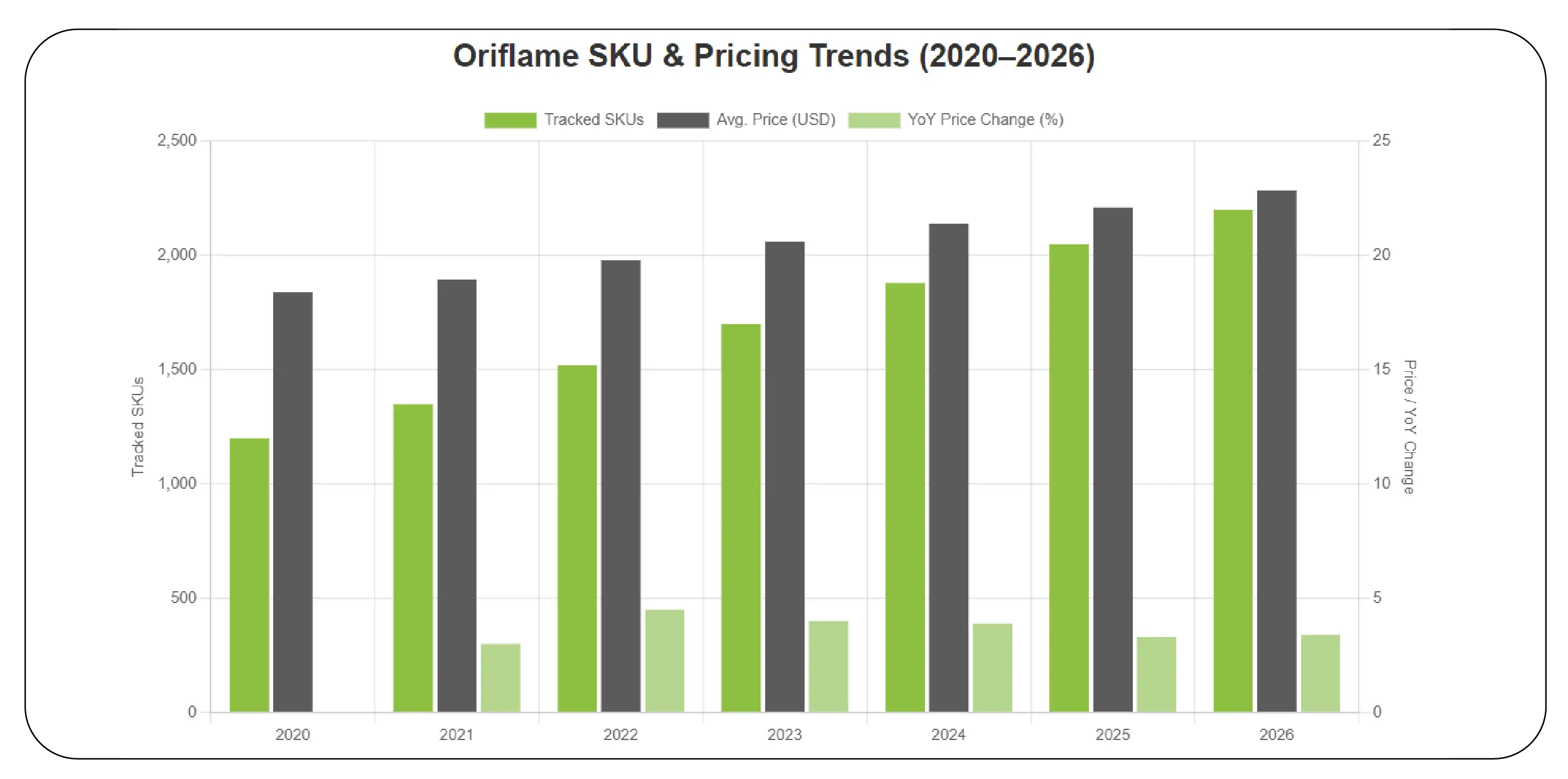

The table below summarizes the growth in tracked Oriflame SKUs and average online prices between 2020 and 2026.

| Year |

Tracked SKUs |

Avg. Price (USD) |

YoY Price Change |

| 2020 |

1,200 |

18.40 |

– |

| 2021 |

1,350 |

18.95 |

+3.0% |

| 2022 |

1,520 |

19.80 |

+4.5% |

| 2023 |

1,700 |

20.60 |

+4.0% |

| 2024 |

1,880 |

21.40 |

+3.9% |

| 2025 |

2,050 |

22.10 |

+3.3% |

| 2026 |

2,200 |

22.85 |

+3.4% |

These figures indicate steady SKU expansion and moderate price inflation, reflecting portfolio growth and cost pressures balanced against competitive positioning.

API-Driven Data Accessibility

Modern analytics teams increasingly rely on programmatic access to pricing data rather than static reports. In this research, structured access was enabled through the Oriflame beauty product Data API, allowing continuous ingestion of updated prices into analytics environments. API-based delivery ensured consistency across reporting cycles and reduced latency between data capture and analysis.

The following table illustrates the percentage of price updates detected annually, highlighting increased pricing agility after 2022.

| Year |

Price Updates Detected |

% Products Updated |

| 2020 |

420 |

35% |

| 2021 |

480 |

36% |

| 2022 |

610 |

40% |

| 2023 |

760 |

45% |

| 2024 |

890 |

47% |

| 2025 |

1,020 |

50% |

| 2026 |

1,150 |

52% |

The data suggests a shift toward more dynamic pricing strategies as digital maturity increased.

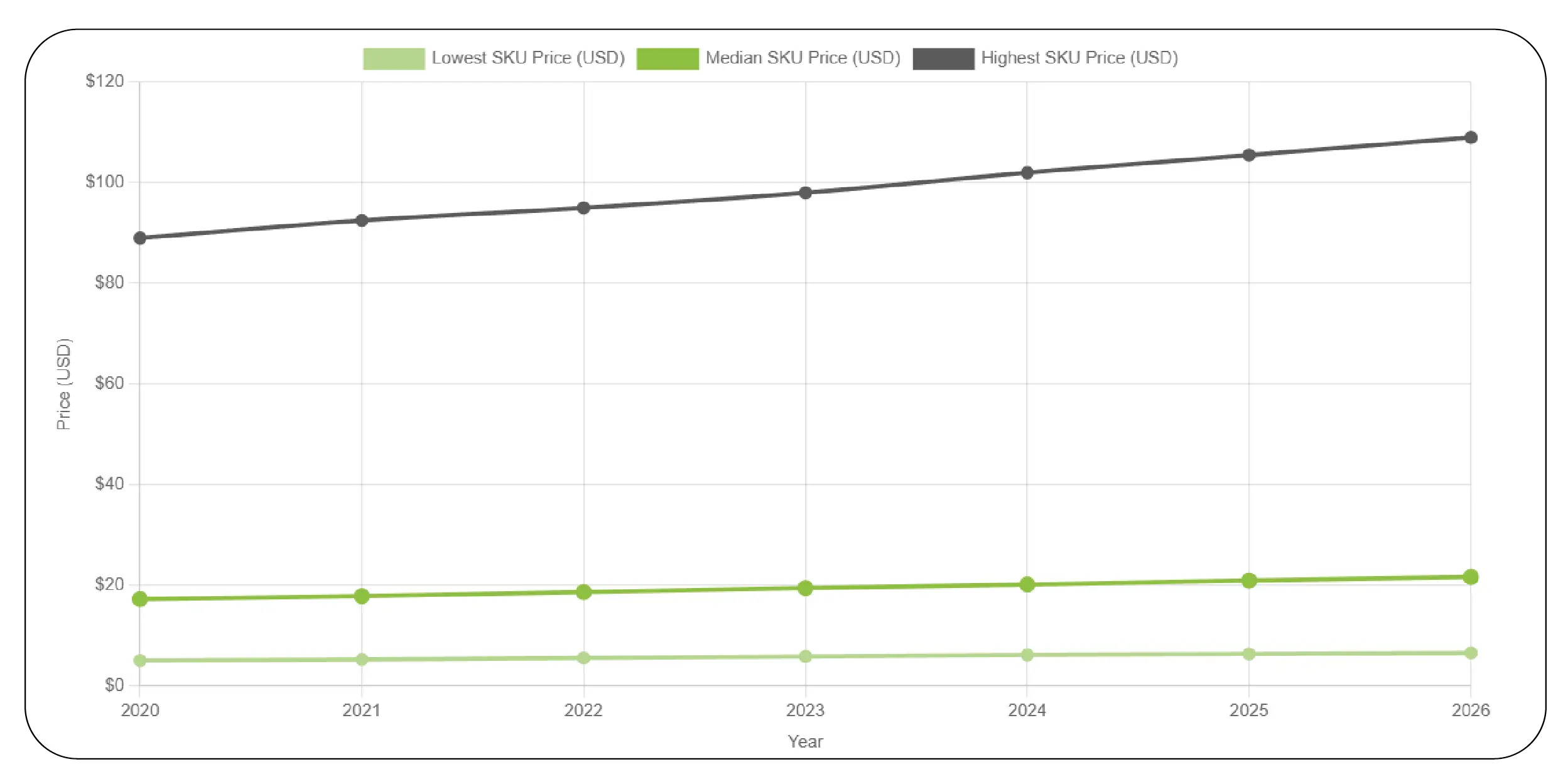

Granular SKU-Level Insights

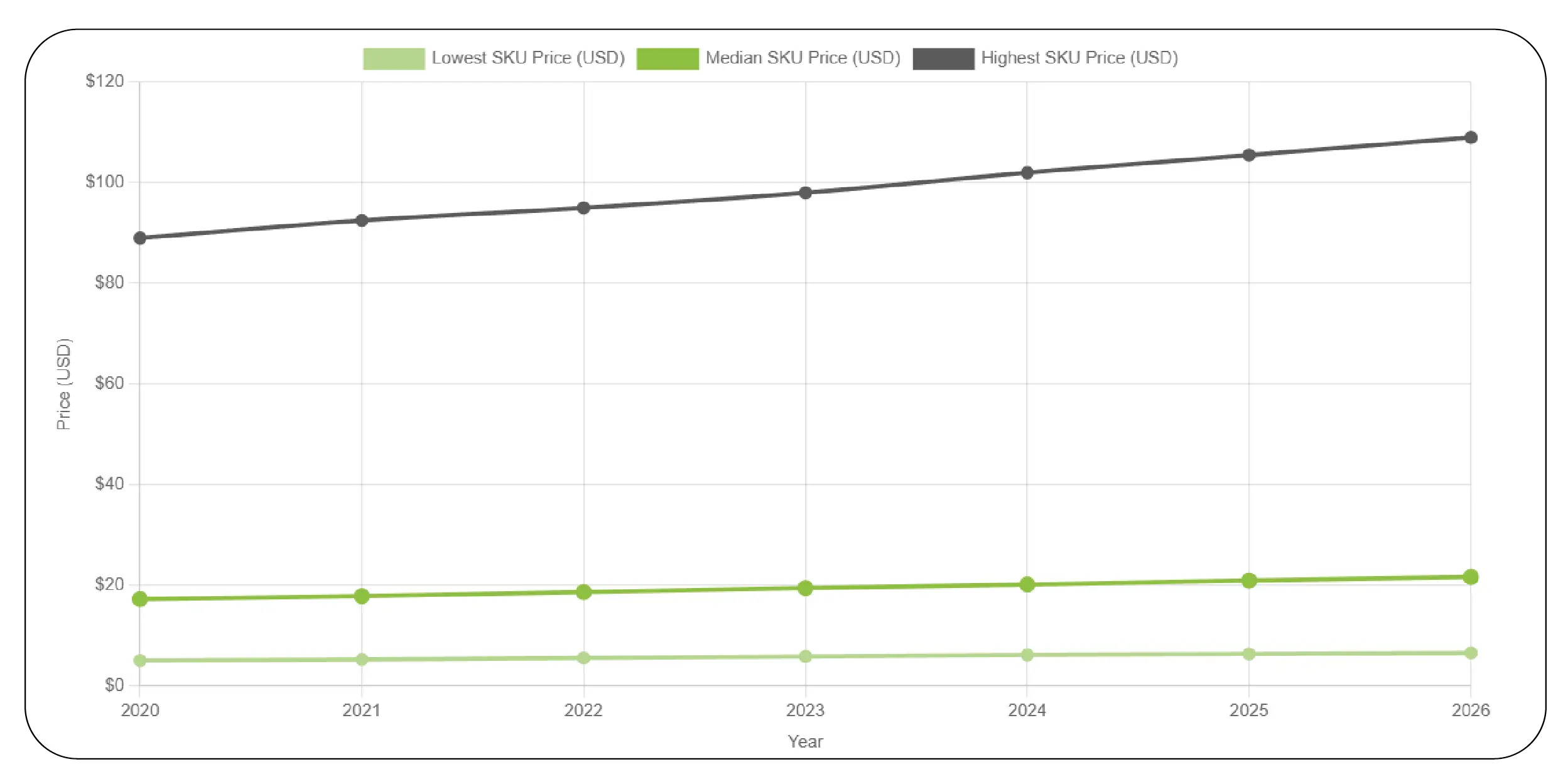

High-level averages often mask important competitive signals. This report therefore emphasizes granular analysis using Scrape Oriflame SKU-level pricing data to understand variation across individual products, pack sizes, and formulations. SKU-level intelligence enables precise identification of entry-price products, premium tiers, and promotional elasticity.

| Year |

Lowest SKU Price |

Highest SKU Price |

Median SKU Price |

| 2020 |

4.99 |

89.00 |

17.20 |

| 2021 |

5.20 |

92.50 |

17.80 |

| 2022 |

5.50 |

95.00 |

18.60 |

| 2023 |

5.80 |

98.00 |

19.40 |

| 2024 |

6.10 |

102.00 |

20.10 |

| 2025 |

6.30 |

105.50 |

20.90 |

| 2026 |

6.50 |

109.00 |

21.60 |

The widening gap between entry-level and premium SKUs reflects portfolio diversification and premiumization strategies.

Automation and Scalability

Maintaining longitudinal datasets from 2020 through 2026 would be impractical without automation. This research leveraged an Automated Oriflame Data Scraper to ensure consistent data capture at predefined intervals. Automation minimized human error, improved coverage, and enabled rapid scaling as new products were introduced.

| Metric |

2020 |

2023 |

2026 |

| Crawl Frequency (per month) |

2 |

4 |

8 |

| Data Accuracy Rate |

94% |

97% |

99% |

| Manual Effort (hrs/month) |

120 |

40 |

10 |

The improvements demonstrate how automation supports both efficiency and data reliability over time.

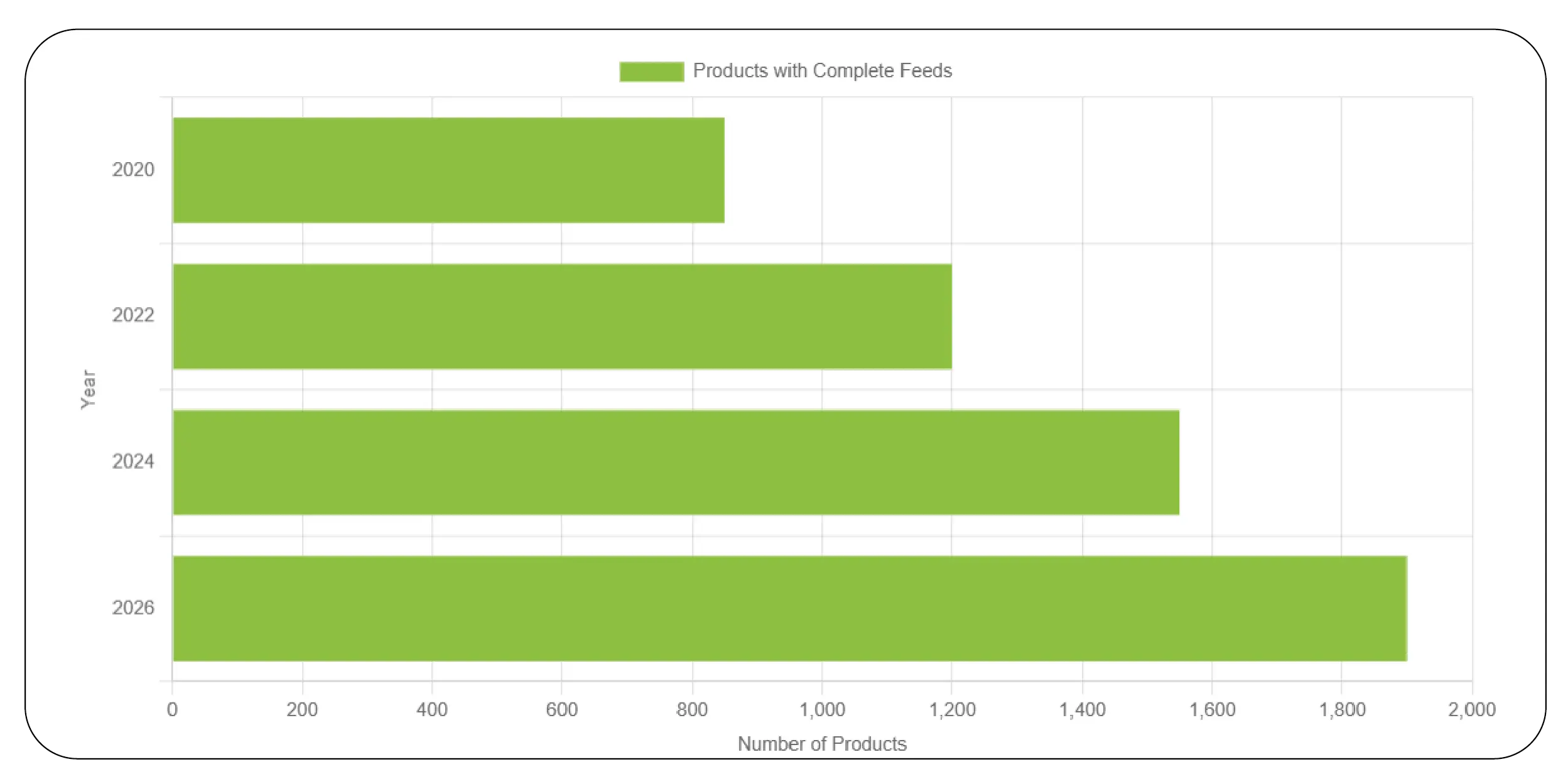

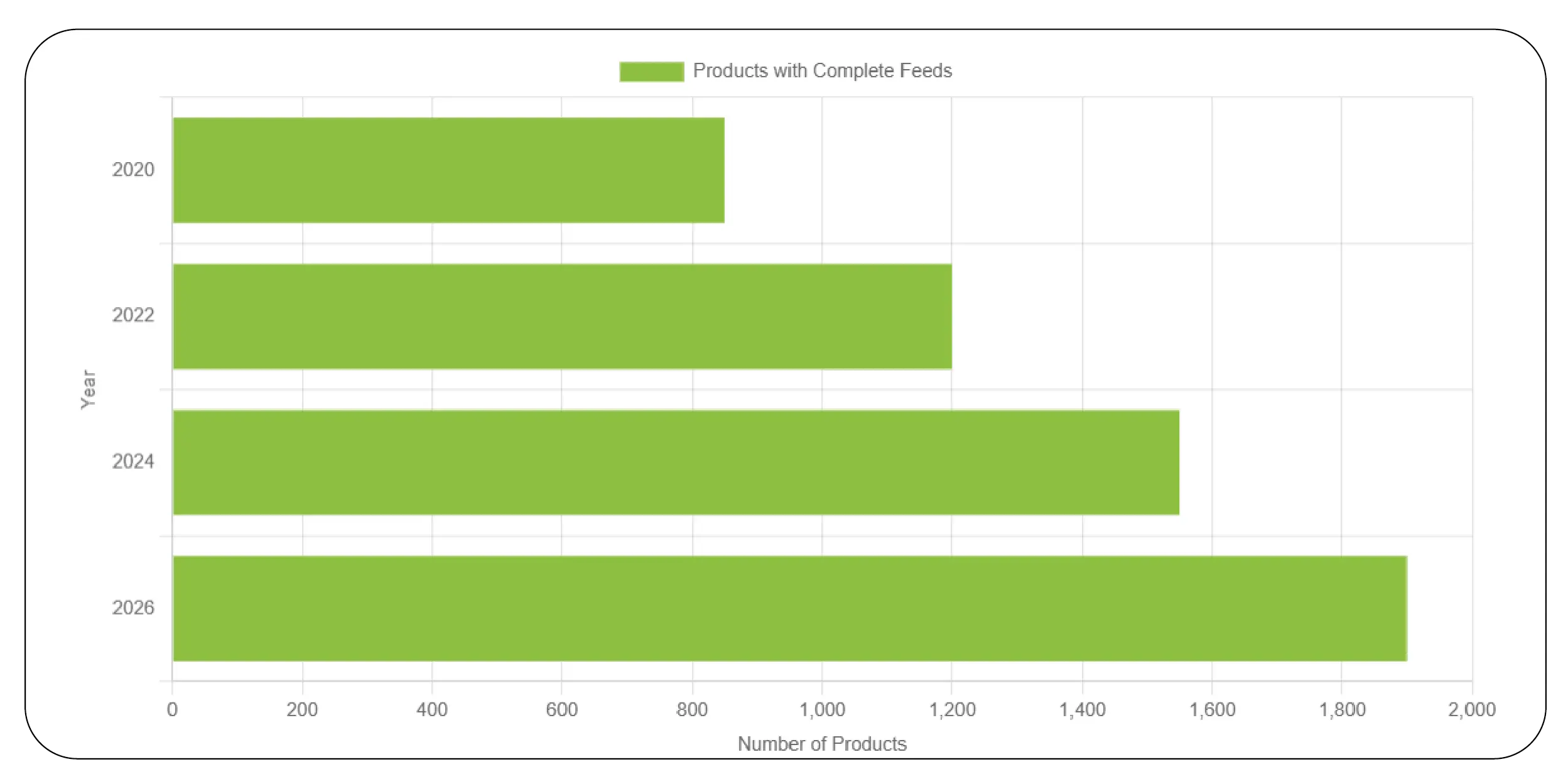

Product Feed Structuring

Beyond pricing, structured product attributes are essential for advanced analytics. The study incorporated Extract Oriflame product feed data to align prices with attributes such as category, skin concern, ingredient positioning, and pack size. This enrichment enabled multidimensional analysis, including price-per-ml comparisons and category-level benchmarks.

| Year |

Products with Complete Feeds |

Feed Completeness |

| 2020 |

850 |

71% |

| 2022 |

1,200 |

79% |

| 2024 |

1,550 |

83% |

| 2026 |

1,900 |

86% |

Improved feed completeness directly enhanced the accuracy of pricing intelligence outputs.

Advanced Analytics Readiness

To support forecasting and competitive modeling, the final datasets were consolidated into an Oriflame beauty product price analytics dataset optimized for BI tools and statistical analysis. This enabled trend modeling, inflation impact assessment, and scenario planning across regions and categories.

| Year |

Avg. Annual Price Growth |

Premium Segment Share |

| 2020 |

2.8% |

22% |

| 2022 |

4.2% |

26% |

| 2024 |

3.9% |

29% |

| 2026 |

3.5% |

32% |

The analytics-ready structure allowed stakeholders to translate raw data into strategic insights efficiently.

Why Choose Product Data Scrape?

Product Data Scrape enables scalable and compliant web data collection designed specifically for complex pricing intelligence requirements. By leveraging a robust Web Data Intelligence API, organizations gain consistent access to structured cosmetics pricing data with high accuracy and minimal operational overhead. The platform supports automated data extraction, flexible customization, and seamless integration with BI tools and analytics systems. This allows teams to eliminate manual data handling, improve data freshness, and focus on high-value analysis. As market conditions evolve rapidly, Product Data Scrape ensures dependable, enterprise-grade data pipelines that support informed, data-driven decision-making.

Conclusion

This research report illustrates how systematic web scraping and structured data delivery unlock actionable cosmetics pricing intelligence for long-term strategic planning. By examining Oriflame pricing trends from 2020 to 2026, stakeholders gain deeper insight into inflation patterns, premiumization strategies, and portfolio shifts across categories. Reliable pricing intelligence empowers brands, analysts, and decision-makers to benchmark performance, anticipate market changes, and refine pricing strategies with confidence. Organizations seeking similar outcomes can accelerate results and improve competitive positioning by adopting professional Pricing Intelligence Services tailored to their business goals.

Partner with Product Data Scrape to build reliable, scalable pricing intelligence datasets that turn online cosmetic data into actionable market advantage.

.webp)