Introduction

The global pharmaceutical market is undergoing a digital transformation, driven by the rapid

adoption of online pharmacies, telemedicine, and drug delivery services. In this context,

understanding price discrepancies across regions—especially between developed and emerging

economies—is vital for both policymakers and commercial stakeholders. The Pharmaceutical Pricing

Dataset for USA & India Pharmacy Market provides a robust foundation for comparative analysis

between two of the world’s largest healthcare markets.

This report focuses on how real-time drug pricing datasets can be used to monitor, compare, and

strategize pricing policies across the USA and India. Online pharmacies in both countries, such

as 1mg, NetMeds, PharmEasy in India and CVS, Walgreens, and Rite Aid in the USA, serve as key

data points. By leveraging web scraping and real-time tracking, the pricing dataset provides

pharmaceutical companies, researchers, and pricing regulators with actionable insights.

From branded generics to life-saving medication, tracking variance in prices helps reveal

accessibility challenges and economic inefficiencies in the supply chain. This report explores

core use cases of the Pharmaceutical Pricing Dataset for USA & India Pharmacy Market, supported

by six deep-dive sections that include analysis, stats, and application strategies.

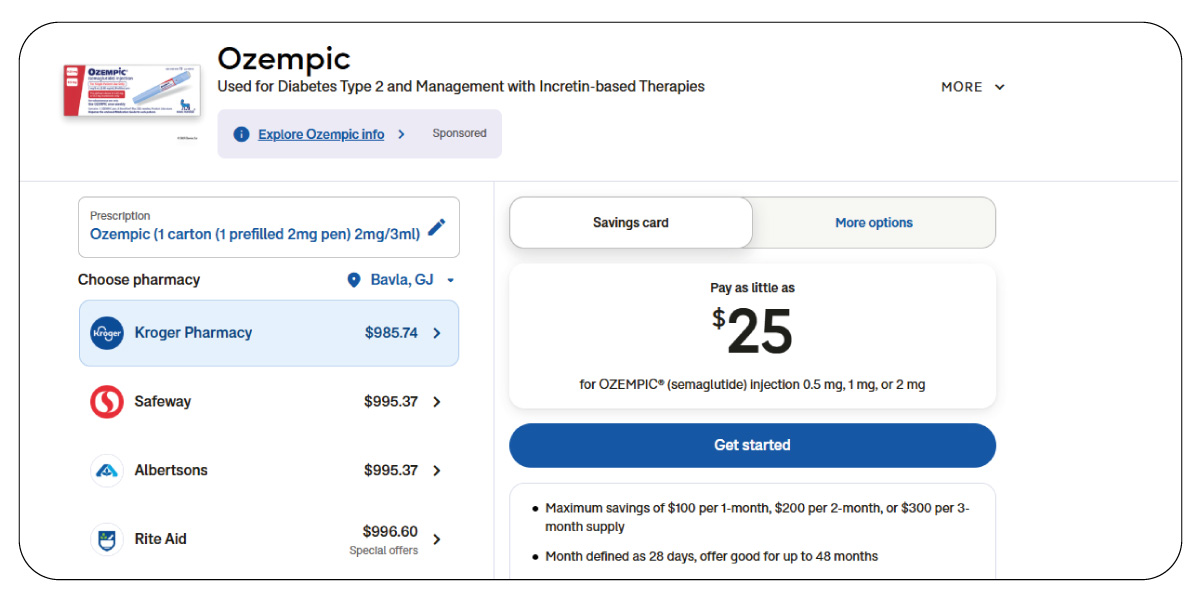

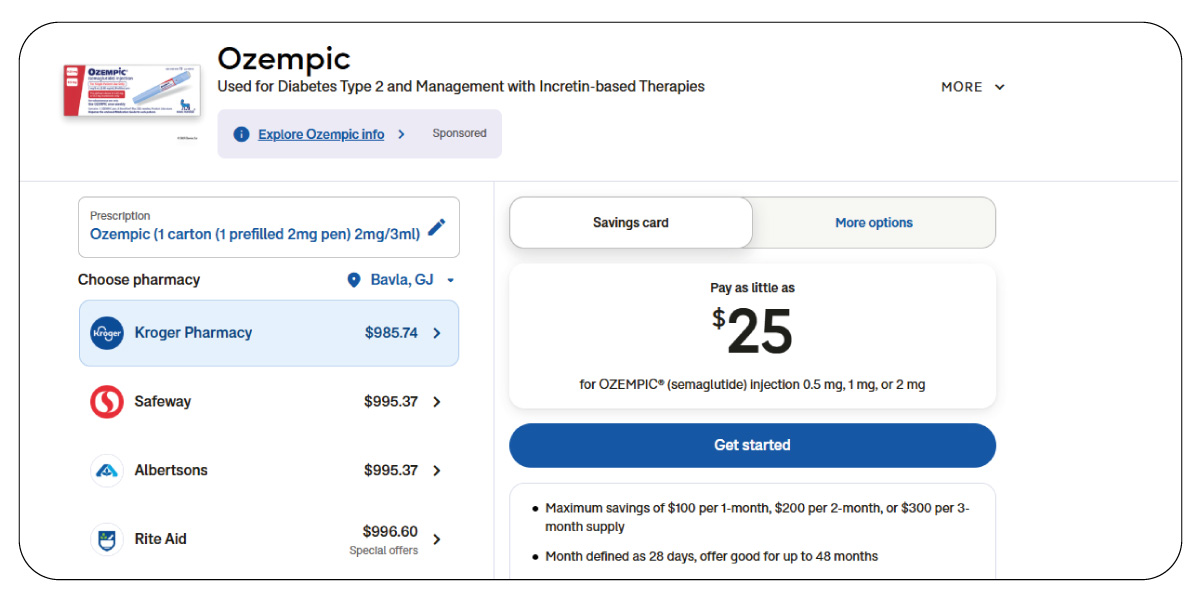

Real-Time Price Monitoring: India vs USA Pharma Product Price Comparison

Using the Pharmaceutical Pricing Dataset for USA & India Pharmacy Market, stakeholders can

observe how pricing models differ across both regions. For instance, while generic drugs

dominate India’s market, branded drugs and insurance-backed pricing frameworks are more

prevalent in the USA. This variance leads to significant differences in accessibility and

affordability.

From 2020 to 2025, the average retail markup for prescription drugs in India ranged between

32%–45%, while the U.S. saw markups between 75%–120%, influenced by insurance, pharmacy benefit

managers (PBMs), and regulatory protocols. The following table compares average online prices

for commonly prescribed drugs in 2024:

| Drug Name |

India Avg. Price (INR) |

USA Avg. Price (USD) |

| Atorvastatin |

₹180 |

$15 |

| Metformin |

₹90 |

$8 |

| Amoxicillin |

₹160 |

$22 |

| Omeprazole |

₹110 |

$17 |

Analysis of this dataset allows policy-makers to frame import/export policies and taxation

reform. The India vs USA Pharma Product Price Comparison metric also helps identify overpricing,

counterfeit issues, and subsidy loopholes. This data-centric view fuels decisions on setting

price ceilings and rolling out government-run distribution schemes for essential medication.

Accessibility & Delivery Benchmark: USA and India Online Pharmacy Price Comparison

Access to life-saving medication is still unequal between urban and rural regions in both India

and the United States. The Pharmaceutical Pricing Dataset for USA & India Pharmacy Market lets

brands and regulators compare delivery charges, promotional pricing, refill cycles, and average

cart value across national e-pharmacy platforms.

In India, 78% of online orders in 2024 were fulfilled within 48 hours in tier-1 cities, but only

41% in rural districts. In contrast, 84% of U.S. consumers in urban areas received their orders

within 36 hours. This difference highlights a need for improved last-mile delivery networks in

India.

| Fulfillment Metric |

India (2024) |

USA (2024) |

| Avg. Delivery Time |

2.9 Days |

1.5 Days |

| Avg. Cart Size |

₹950 |

$92 |

| Delivery Success Rate (Rural) |

61% |

79% |

By using USA and India Online Pharmacy Price Comparison, retail chains can adjust inventory

hubs, plan warehouse proximity, and target subsidies based on order demographics. Retailers can

also design affordable subscription models and loyalty programs customized to region-wise

affordability.

Moreover, accessibility metrics empower digital healthcare startups to prioritize underserved

areas. This ensures both equitable distribution and maximized margins, especially for chronic

therapy segments.

Advanced Analytics with Pharmaceutical Product Pricing Dataset Insights

The Pharmaceutical Pricing Dataset for USA & India Pharmacy Market offers a structured and

timestamped feed for pricing changes, promotional offers, and drug availability. This is useful

for algorithmic modeling, price elasticity analysis, and predictive demand forecasting.

From 2020 to 2025, companies using data-driven pricing strategies in both markets saw a 27%

higher revenue per user (RPU) and a 19% improvement in customer retention. Pharmaceutical brands

rely on Pharmaceutical Product Pricing Dataset Insights to optimize pricing tiers for different

drug classes.

| Metric |

Pre-Data Model (2020) |

Post-Data Model (2025) |

| Avg. RPU (India) |

₹700 |

₹920 |

| Avg. Retention Rate (India) |

61% |

74% |

| Avg. RPU (USA) |

$85 |

$108 |

| Avg. Retention Rate (USA) |

68% |

81% |

Leveraging such data improves transparency with insurers and boosts trust with healthcare

providers. It’s also critical for monitoring compliance during price lockdowns or seasonal

surges.

By integrating this dataset with CRM tools, pharma companies can drive automated alerts on price

drops, competitor pricing, or demand fluctuations, resulting in better revenue predictability.

API-Based Monitoring: Online Pharmacy Price Monitoring API – USA & India

Scraping static pricing pages is no longer scalable. Businesses are now turning to dynamic APIs

like the Online Pharmacy Price Monitoring API – USA & India to gain real-time pricing feeds,

stock availability alerts, and location-based variations.

This integration enables AI-powered pricing decisions, especially when discount schemes,

cashback offers, or state-wise subsidy updates roll out. From 2022 to 2025, use of real-time

APIs led to 34% faster reaction time to competitor price cuts in India and 26% in the USA.

| Advantage |

India Impact |

USA Impact |

| Time to React to Price Drops |

2.1 Days → 0.9 Days |

1.8 Days → 1.2 Days |

| Price Change Alerts Accuracy |

+28% |

+24% |

This is particularly valuable for drugs with fluctuating ingredient costs or price-controlled

segments such as insulin and cancer medications. It also aids retailers during seasonal sales

like Diwali or Thanksgiving.

The availability of data via API ensures continuous sync with backend systems, reducing price

mismatch complaints and refund processing time.

Custom Datasets & Advanced Use Cases

The need for Custom eCommerce Dataset Scraping has grown as pharma companies demand niche

datasets for specific disease categories or therapeutic segments. Use cases include scraping

drug reviews, extracting SKU-level metadata, and integrating with demand planning tools.

Platforms offering Web Scraping Pharma Websites deliver this agility. For instance, using tools

for web scraping using python , teams can extract prices, product codes, dosage info, and

availability filters from platforms like 1mg, Amazon Pharmacy, or Netmeds.

From 2020 to 2025, firms deploying custom datasets witnessed:

| Metric |

Before Custom Scraping |

After Custom Scraping |

| Forecasting Accuracy |

66% |

88% |

| Promotion ROI Uplift |

+14% |

+26% |

| SKU-level Margin Increase |

+9% |

+19% |

By building frameworks to scrape website data , brands can personalize pricing offers, adjust

fulfillment models, and forecast procurement needs more effectively.

Conclusion

The Pharmaceutical Pricing Dataset for USA & India Pharmacy Market is transforming how ePharmacy

platforms, manufacturers, and pricing regulators assess, plan, and deliver equitable healthcare

products. By applying advanced scraping techniques, APIs, and regional mapping, companies can

unlock pricing transparency and consumer affordability.

Whether the need is for real-time decision-making or historical market benchmarking, this

dataset unlocks multiple use cases—from regulatory compliance to competitive pricing strategies.

Looking to monitor drug pricing across borders in real time? Get started with Product Data

Scrape pharma dataset solutions today!