Introduction

As eCommerce in India matures in 2025, one truth is undeniable—price isn’t one-size-fits-all. Consumers in Mumbai see different prices than those in Jaipur. A product on Meesho might be cheaper in Patna but costlier in Pune. Regional Pricing Trends from Flipkart, Meesho & Amazon India highlight how deeply localized these differences are. Understanding these regional fluctuations is critical for brands aiming to win across Tier-1, Tier-2, and Tier-3 cities.

With millions of listings updated daily, marketplaces like Flipkart, Amazon India, and Meesho adjust prices based on local demand, seller stock, logistics, and competition.

This blog explores how Product Data Scrape empowers Indian brands and sellers with hyperlocal price intelligence—by scraping pricing data pin code-wise and category-wise from India’s top platforms.

Why Regional Price Tracking Is Critical in India

India’s unique market diversity creates massive price variation:

- Tier-1 vs Tier-3 cities: Logistics and supply chain cost impact final pricing.

- State-wise taxes (GST brackets) and local delivery charges shift pricing.

- Festival timing: Offers in Chennai may differ from those in Lucknow due to regional events.

- Seller ecosystem: Local sellers on Meesho or Flipkart adjust pricing for area-level competition.

If your brand isn't tracking these shifts in real time, you're flying blind.

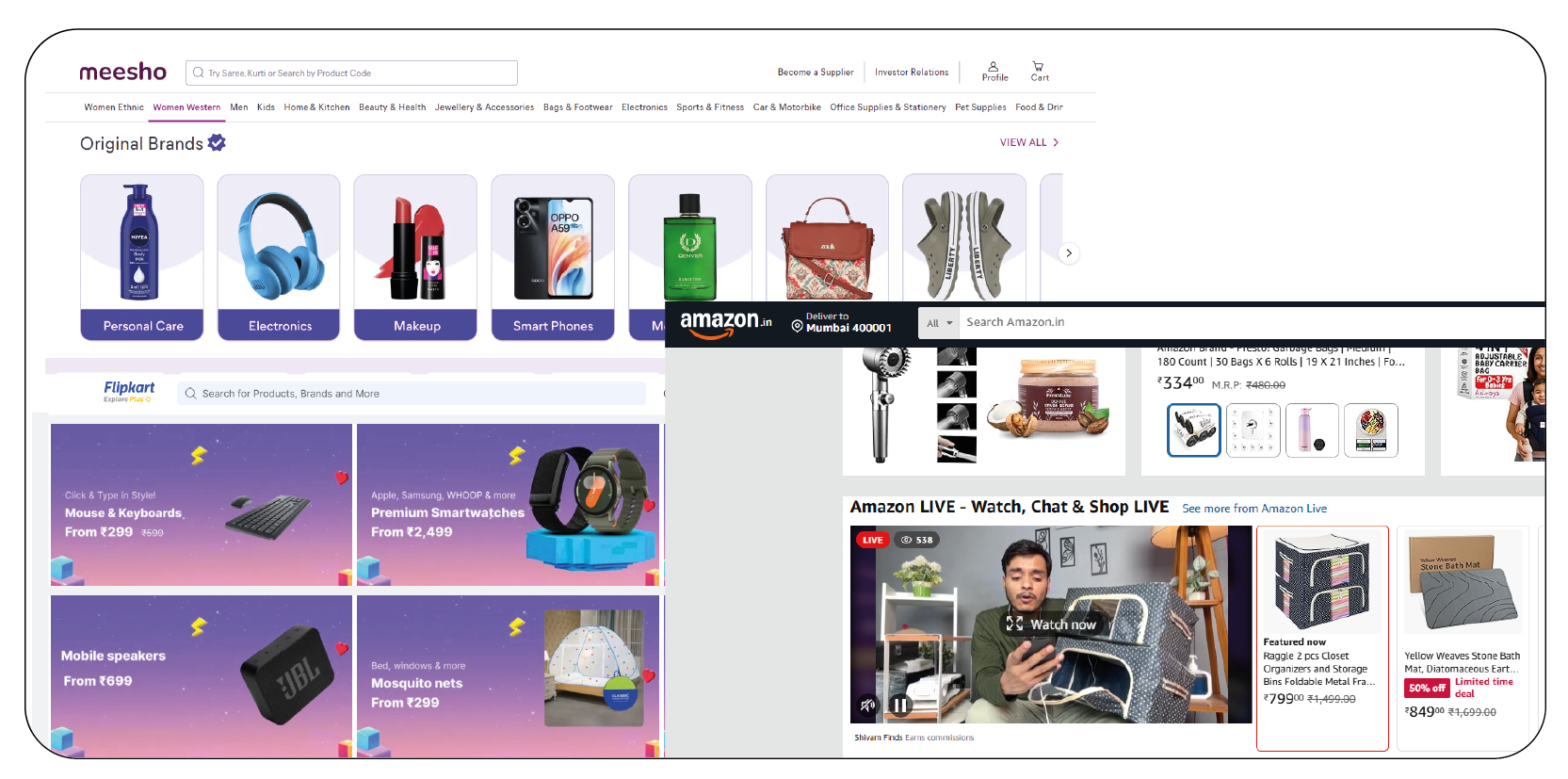

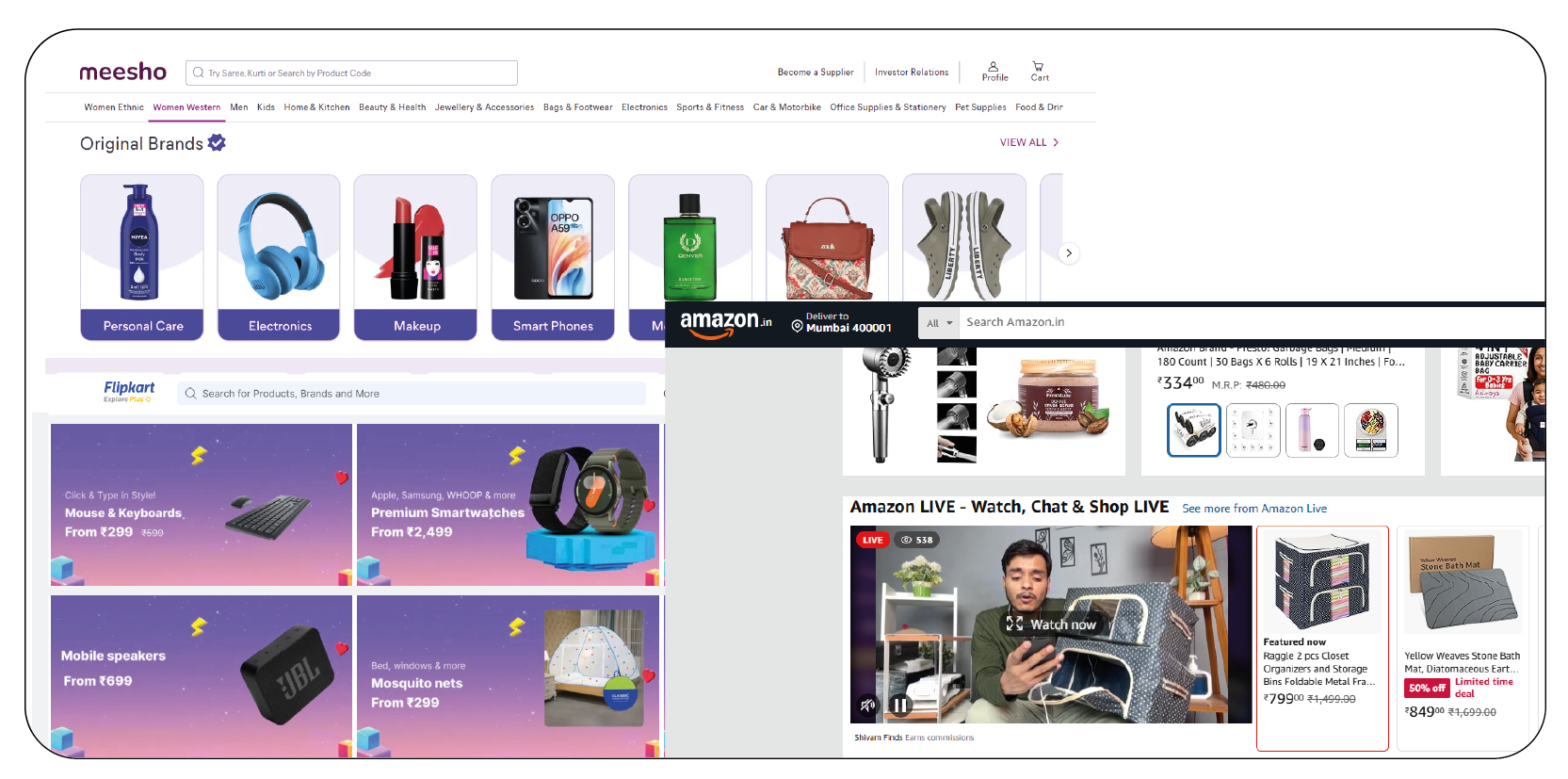

Platforms We Monitor: Flipkart, Meesho & Amazon India

Flipkart

- Nationwide reach with logistics via Ekart.

- City-specific offers, Plus member discounts, and Flash Deals.

Meesho

- Heavy presence in Tier-2 & Tier-3 cities.

- Reseller-driven pricing based on localized demand.

- Dynamic margins on fashion, beauty, home essentials.

Amazon India

- Region-wise sellers competing for Buy Box.

- Coupon-based pricing shifts by location.

- Pincode-specific availability and shipping cost impact.

Use Case: A D2C Brand Decoding Regional Discounts

Product: Bluetooth Neckband

Brand Category: Personal Electronics

Tracking Locations: Delhi, Ahmedabad, Nagpur, Kolkata, Kochi

Scraped Data (April 10, 2025)

| Platform |

City |

Price (INR) |

Coupon |

Seller |

Availability |

| Flipkart |

Delhi |

₹999 |

₹100 off |

RetailTech Pvt Ltd |

In Stock |

| Amazon |

Ahmedabad |

₹1,049 |

₹150 off |

Cloudtail |

In Stock |

| Meesho |

Nagpur |

₹1,099 |

₹50 off |

Local Seller |

In Stock |

| Flipkart |

Kolkata |

₹1,179 |

No |

Appario |

In Stock |

| Amazon |

Kochi |

₹1,299 |

₹200 off |

RetailXpress |

3 Left |

Insights:

- Flipkart had the lowest base price in Delhi.

- Amazon had the steepest discount in Kochi despite the highest base price.

- The brand reallocated ad spend to Delhi and Ahmedabad to capitalize on aggressive pricing.

Key Features of Product Data Scrape’s Regional Monitoring Tool

| Feature |

Benefit |

| Pin Code Level Tracking |

Monitor pricing and availability by exact area |

| Platform-Wise Comparison |

Flipkart vs Meesho vs Amazon per SKU |

| Category Filters |

View trends across Electronics, Fashion, Beauty, Grocery |

| Coupon & Offer Detection |

Identify additional savings mechanisms |

| Real-Time Alerts |

Be notified when a region sees unusual price fluctuation |

| Data Export/API Feed |

Integration-ready for internal dashboards or pricing tools |

Trends Unlocked by Hyperlocal Data

| Feature |

Benefit |

| Pin Code Level Tracking |

Monitor pricing and availability by exact area |

| Platform-Wise Comparison |

Flipkart vs Meesho vs Amazon per SKU |

| Category Filters |

View trends across Electronics, Fashion, Beauty, Grocery |

| Coupon & Offer Detection |

Identify additional savings mechanisms |

| Real-Time Alerts |

Be notified when a region sees unusual price fluctuation |

| Data Export/API Feed |

Integration-ready for internal dashboards or pricing tools |

Trends Unlocked by Hyperlocal Data

1. Fashion is Cheapest on Meesho in East India

Scraped pricing across 25 SKUs in Women’s Kurtis showed:

- Kolkata, Ranchi, and Guwahati had lower prices by 14–20% on Meesho.

- Likely due to increased reseller penetration and regional sourcing.

2. Electronics Cheaper in North India

In Delhi, Noida, and Chandigarh:

- Amazon and Flipkart prices were 6–9% lower than in Mumbai or Bengaluru.

- Possibly due to warehousing logistics and seller clusters in NCR.

3. High Discount Volatility in South India

Cities like Hyderabad and Kochi saw price fluctuations of ₹200–₹500 daily for fast-moving products like phone accessories, small kitchen appliances.

Sample Dataset Output

Product: LED Table Lamp

ASIN / FKID / Product ID: Common across platforms

Date: May 1, 2025

| Platform |

Pin Code |

Region |

Price |

Coupon |

Final Price |

In Stock |

| Flipkart |

560001 |

Bangalore |

₹799 |

₹50 off |

₹749 |

Yes |

| Amazon |

400001 |

Mumbai |

₹849 |

₹100 off |

₹749 |

Yes |

| Meesho |

302001 |

Jaipur |

₹739 |

₹0 |

₹739 |

Yes |

The client used this to standardize marketplace pricing logic and aligned their in-store pricing accordingly.

Business Impact for Brands

| KPI |

Before Product Data Scrape |

After Product Data Scrape |

% Change |

| Price Matching Accuracy |

58% |

91% |

↑ 57% |

| Campaign Efficiency (CTR) |

1.9% |

2.8% |

↑ 47% |

| Tier-3 Region Conversion |

1.2x |

2.1x |

↑ 75% |

| Stock Misalignment Events |

22/month |

9/month |

↓ 59% |

Use Case Extension: Offline Price Mapping

One client used the scraped data to align prices in their physical stores in Kerala and West Bengal with local Flipkart and Meesho prices—ensuring a seamless omnichannel experience.

Integration & Output Options

- Dashboard Reports: Region-wise SKU heatmaps with pricing variance

- API Access: Plug into ERP, pricing tools, or marketing platforms

- CSV Reports: Weekly/monthly pricing snapshots for leadership

- Alert System: Set thresholds for instant notifications

Industries Benefiting from Regional Price Tracking

- D2C & Retail Brands (Electronics, Apparel, Beauty)

- Online Sellers/Resellers (Amazon, Flipkart, Meesho)

- Price Aggregators & Shopping Platforms

- AdTech/MarTech Agencies running geo-targeted ads

- Consumer Research & Market Intelligence Firms

SEO Keywords Embedded

Final Thoughts

The Indian eCommerce battlefield is no longer national—it’s hyperlocal. Brands succeeding in 2025 are those that adjust SKU pricing and availability not monthly, but hourly, and not nationally, but pin code-wise.

With Product Data Scrape, businesses gain access to regional intelligence across Flipkart, Meesho, and Amazon India—unlocking strategic pricing, targeted marketing, and operational precision.

About Product Data Scrape

Product Data Scrape is India’s leading provider of web scraping services for real-time eCommerce data . Our clients include D2C brands, price comparison engines, and retail aggregators who rely on hyperlocal, accurate, and structured product intelligence.

From SKU pricing to stock tracking across Flipkart, Amazon, and Meesho, we deliver competitive insights that drive profitable decisions.

.webp)

.webp)

.webp)