Introduction

In the fast-moving world of consumer goods, pricing changes by the hour. Whether you're a global CPG brand or a challenger startup, staying competitive on Walmart and Amazon USA requires more than strategy—it requires real-time data. FMCG brands are now turning to web scraping as a powerful tool to gain real-time pricing intelligence and optimize across regions, SKUs, and seasons. By extracting Amazon Grocery product data and web scraping Walmart Grocery product data , businesses can gather insights that help them respond to pricing fluctuations and market trends faster.

This blog explains how companies are leveraging scraped pricing data from Walmart and Amazon to track their competitors, align with retail partners, and dynamically adjust their strategies in the high-demand USA market.

Why Walmart & Amazon Matter for FMCG Brands

Why Walmart & Amazon Matter for FMCG Brands

- The largest grocery retailer in the U.S.

- Online + offline presence with regional pricing

- Massive influence over in-store price expectations

Amazon

- Real-time price shifts (sometimes hourly)

- Dynamic algorithms + third-party seller competition

- Bulk deals, coupons, subscriptions, and lightning offers

Both platforms are highly dynamic and data-rich, but hard to track manually. That’s where Product Data Scrape comes in.

What is Real-Time Price Intelligence?

Real-time FMCG price intelligence means tracking:

- Product-level pricing (MRP, selling price, discounts)

- Promo structures (BOGO, flat %, loyalty discounts)

- Stock availability & delivery time

- Seller type (retail vs 3P)

- Regional or zip code-based price differences

- Price changes over time (hourly, daily, weekly)

Key Use Cases for Scraping Walmart & Amazon

| Use Case |

Benefit |

| Competitor Price Matching |

Stay within pricing corridors to win Buy Box & shelf space |

| Promo Timing Optimization |

Align your promotions with competitors' flash deals |

| Regional Price Benchmarking |

Identify price inconsistencies across U.S. cities |

| Subscription Strategy Planning |

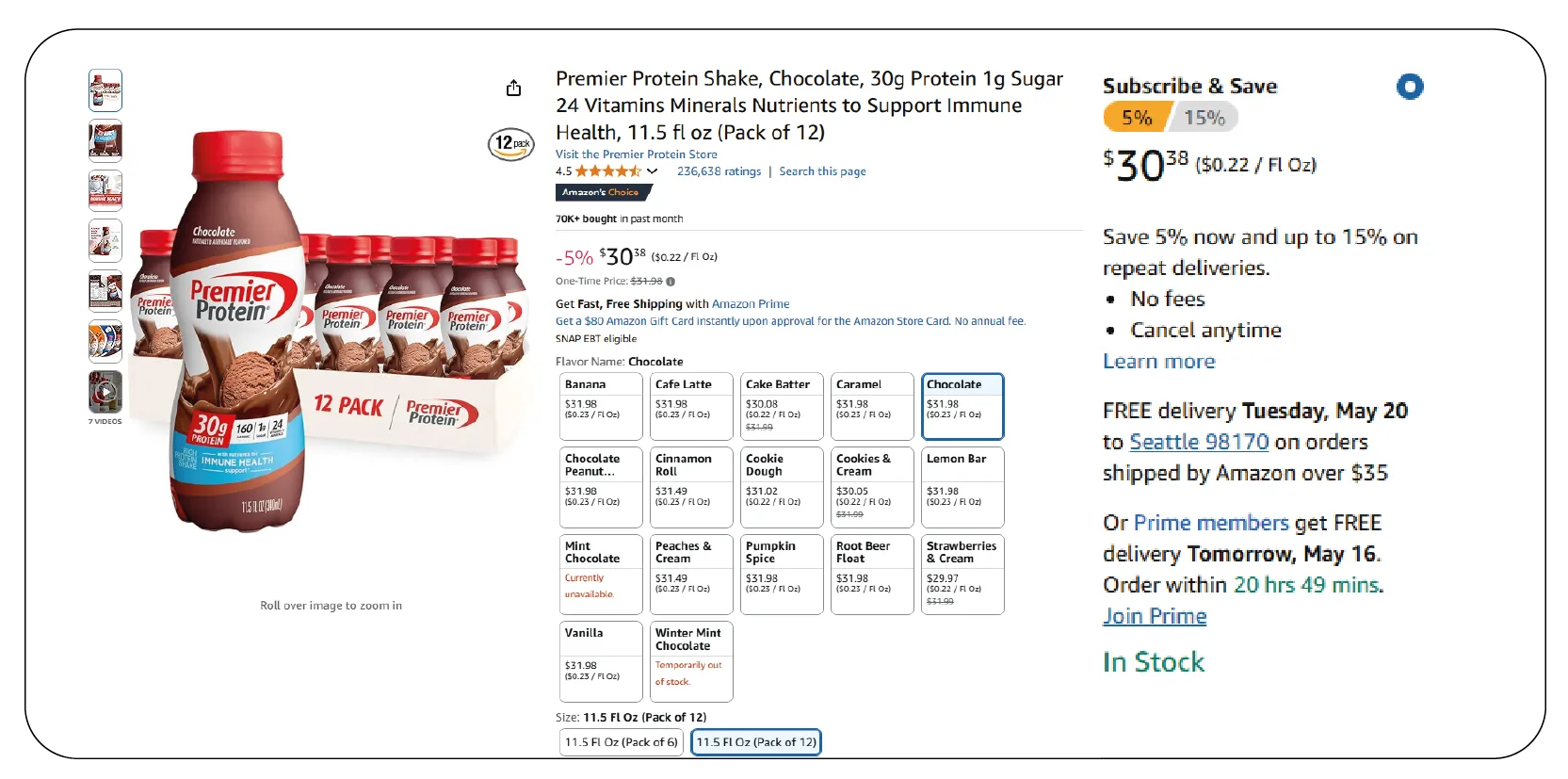

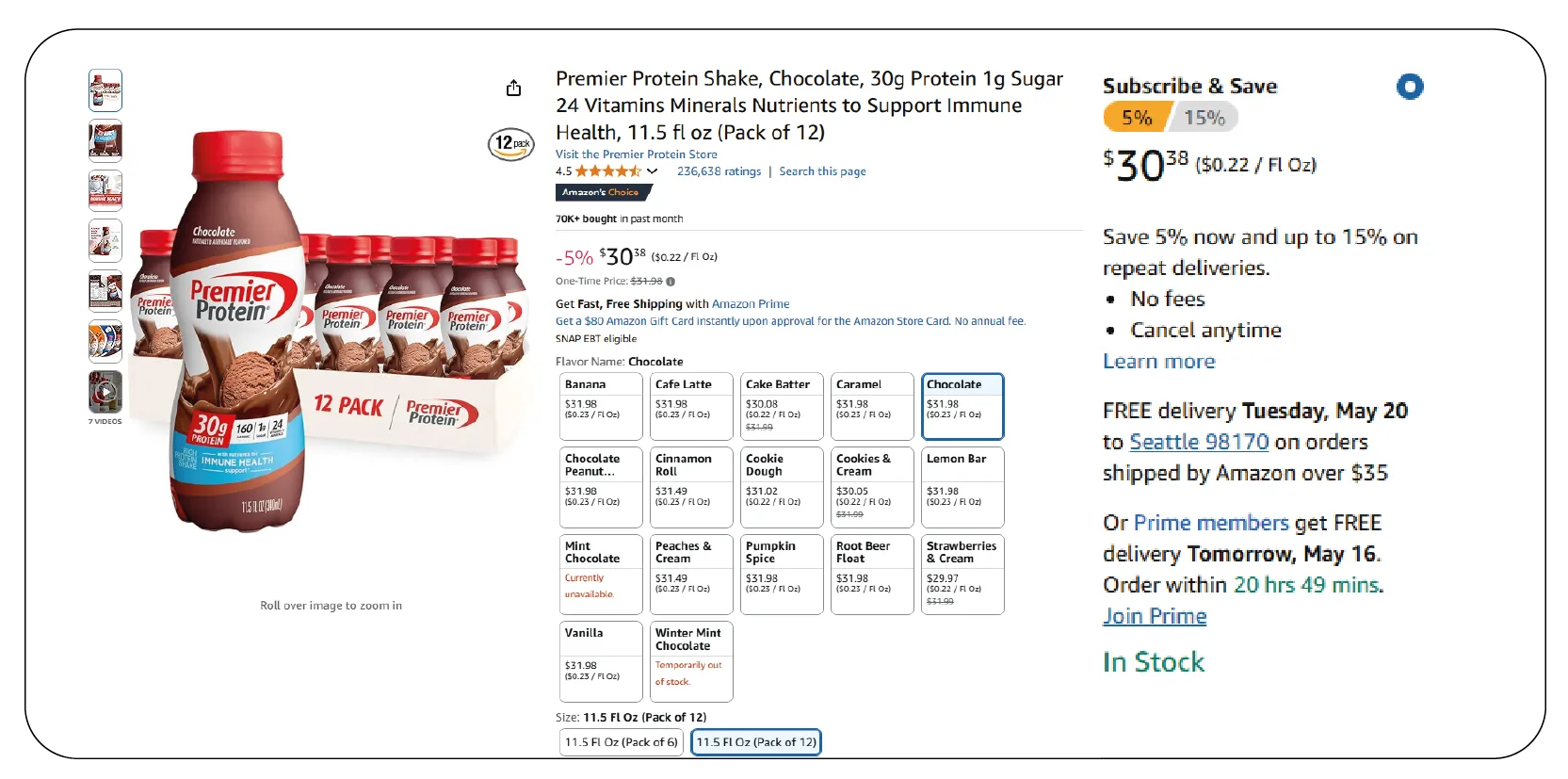

Analyze Amazon's Subscribe & Save discounts |

| Inventory & OOS Monitoring |

Spot stock-outs in competitors and capture demand |

Sample Data Snapshot (May 2025)

| Product |

Platform |

Region |

MRP ($) |

Price ($) |

Discount |

Stock |

Promo Type |

| Tide Pods 42ct |

Amazon |

NYC |

$19.99 |

$16.49 |

18% |

Yes |

Subscribe & Save |

| Tide Pods 42ct |

Walmart |

NYC |

$19.99 |

$15.98 |

20% |

Yes |

Rollback |

| Lysol Spray 12oz |

Amazon |

Chicago |

$6.99 |

$6.49 |

7% |

Yes |

Limited Time Deal |

| Lysol Spray 12oz |

Walmart |

Chicago |

$6.99 |

$6.79 |

3% |

No |

Regular |

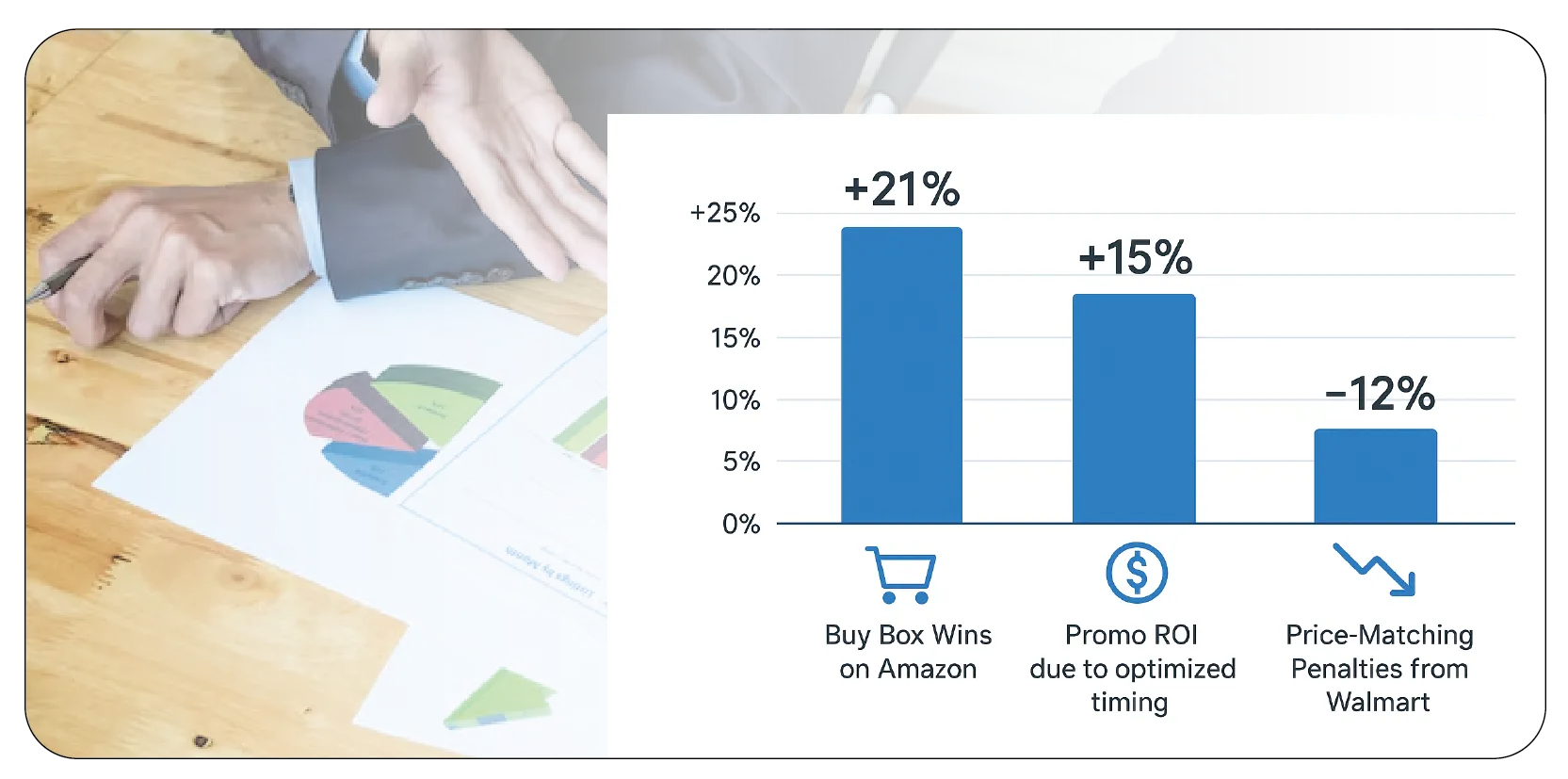

Case Study: Real-Time Pricing Transforms Strategy for CPG Brand

A Fortune 500 CPG brand partnered with Product Data Scrape to track over 5,000 SKUs on Amazon and Walmart.

Goals:

- Beat competitor prices by 2–4% in key metro areas

- Monitor promo cycles for top categories (cleaning, snacks, beverages)

- Prevent over-discounting across retail partners

What They Did:

- Scraped prices every hour for high-velocity SKUs

- Tracked delivery delays and OOS patterns

- Correlated Amazon coupon timings with sales spikes

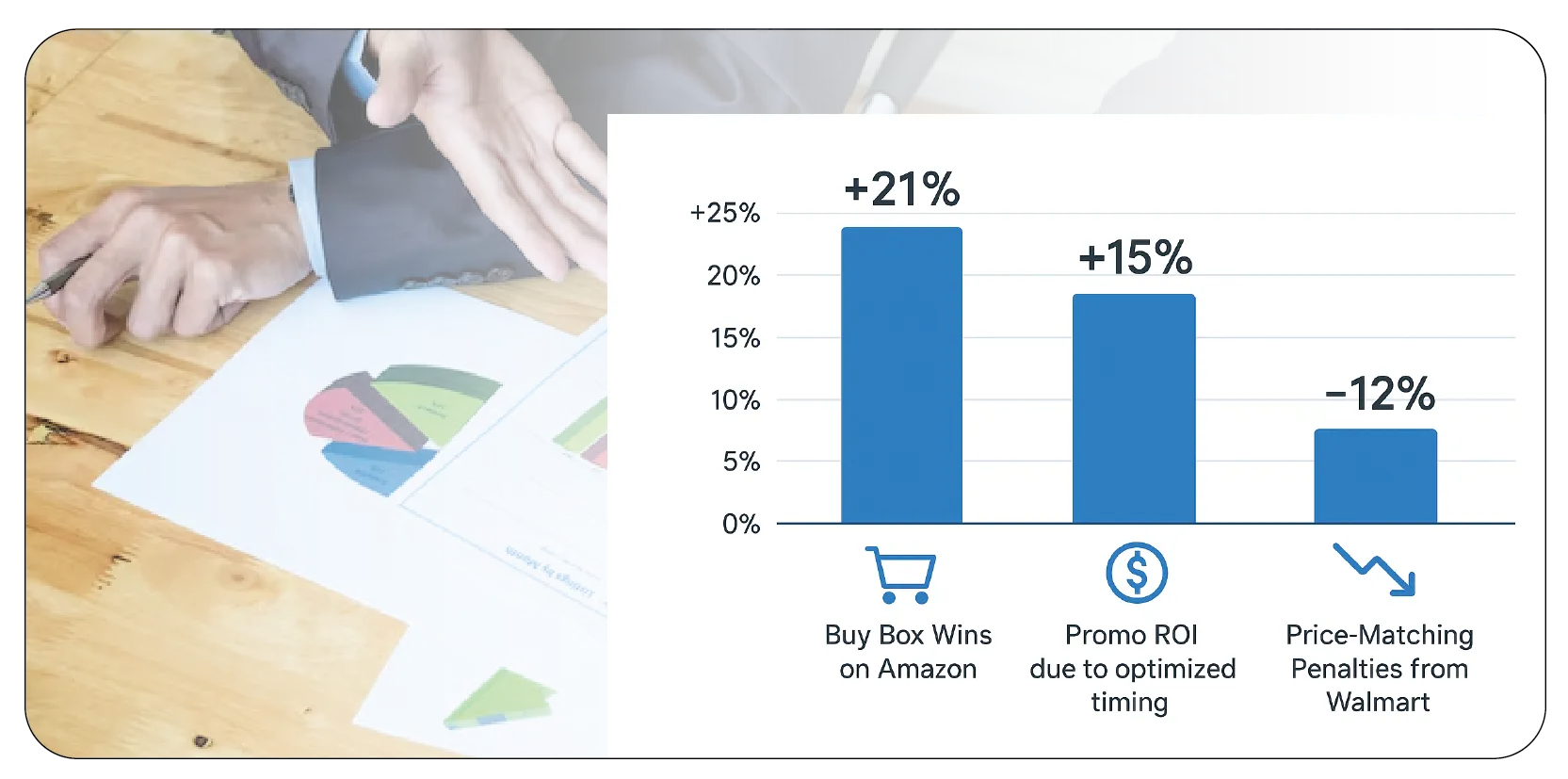

Results:

- +21% Buy Box Wins on Amazon

- +15% promo ROI due to optimized timing

- 12% decrease in price-matching penalties from Walmart

Visual Workflow (Turn into Infographic)

mathematica

CopyEdit

Scrape Walmart & Amazon → Extract Pricing + Promo + Stock Data →

Match SKUs → Analyze Regionally → Push Alerts & Dashboards → Take Action

Benefits of Real-Time Price Intelligence

Faster Reaction Times

Brands can adjust pricing or escalate issues within hours, not weeks.

Better Retailer Relations

Stay in compliance with MAP (Minimum Advertised Pricing) while still staying competitive.

Competitive Promo Strategy

Identify windows where your competitors offer steep discounts and counter them.

Forecasting & Trend Analysis

Track seasonality, Black Friday/Cyber Monday trends, and stock cycles by category.

Country Comparison: Why This Matters Globally

| Country |

Use Case |

| USA |

Walmart + Amazon dynamic pricing + MAP tracking |

| Germany |

REWE, Lidl SKU monitoring & eco-label tracking |

| Australia |

Coles & Woolworths – promo alignment |

| UK |

Tesco & Ocado flash discounts |

| India |

Blinkit, Zepto, and JioMart hyperlocal pricing |

Technical Stack Used

| Component |

Tech Stack |

| Scraping Engine |

Python + Playwright |

| Proxy System |

Rotating Residential IP Pool |

| Scheduler |

AWS Lambda + CloudWatch |

| Storage |

PostgreSQL + S3 |

| Dashboard |

Power BI / Looker Studio |

| Notifications |

Slack, Email Digest, API Webhooks |

Legal & Ethical Considerations

Public-facing pages only (no login-protected or private seller data)

Compliant with U.S. data laws and Walmart/Amazon robots.txt boundaries

Throttled & timed scrapers to minimize server load

No scraping of consumer/personal data

Platform Differences: Walmart vs Amazon

| Feature |

Walmart |

Amazon |

| Discount Type |

Rollback, Clearance, Bundle |

Coupons, Subscribe & Save, Lightning Deals |

| Seller Type |

1P (First-Party) and 3P (Third-Party) |

Heavily 3P (Third-Party) |

| Stock Visibility |

Clear |

Varies by seller |

| Delivery Estimation |

Real-time |

Seller-dependent |

| Price Frequency Change |

Moderate |

High |

Top FMCG Categories to Scrape

1. Detergents & Cleaners

2. Snacks & Beverages

3. Pet Food

4. Health Supplements

5. Baby Care

6. Beauty & Personal Care

Weekly Dashboard Views Provided by Product Data Scrape

- Top Price Drops by City

- Amazon vs Walmart Price Gap Charts

- Stock-Out Alerts for Competitor SKUs

- Category-Wise Promo Heatmaps

- Hourly Price Volatility Tracker

Final Takeaway

If you're selling FMCG products in the USA, you're competing on price—by the minute. Web scraping Walmart and Amazon for real-time pricing data isn't just smart—it's now mandatory for brand survival.

Whether it's ensuring MAP compliance, winning the Buy Box, or identifying competitor weakness, Product Data Scrape gives you the live intelligence you need to win at retail

.webp)

.webp)

.webp)