Introduction

The retail fashion landscape is evolving rapidly, and having accurate data on store networks, pricing, and regional trends has become crucial for brands, analysts, and investors. For companies operating in competitive segments, insights into expansion, closures, and regional presence directly influence strategic planning.

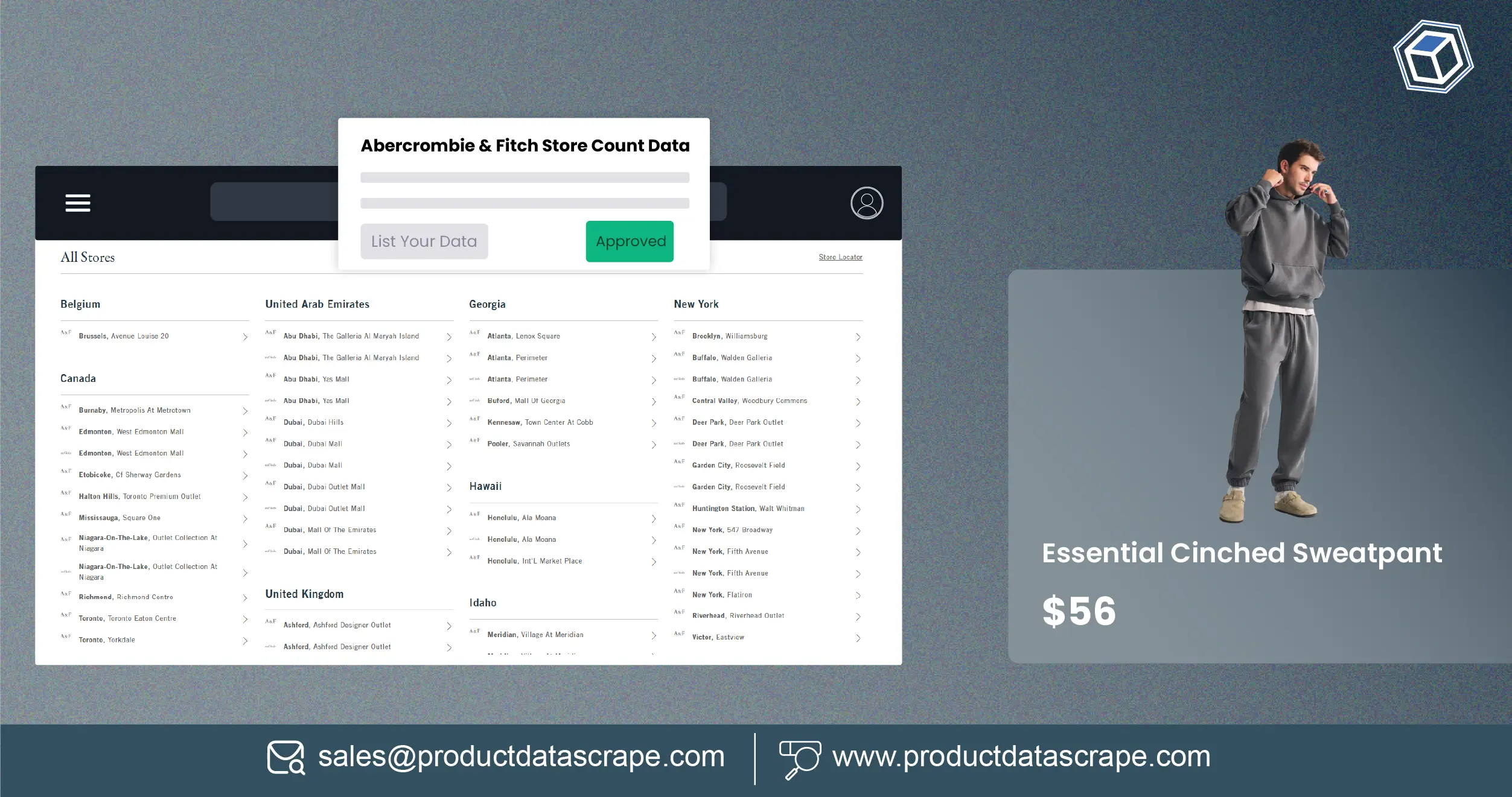

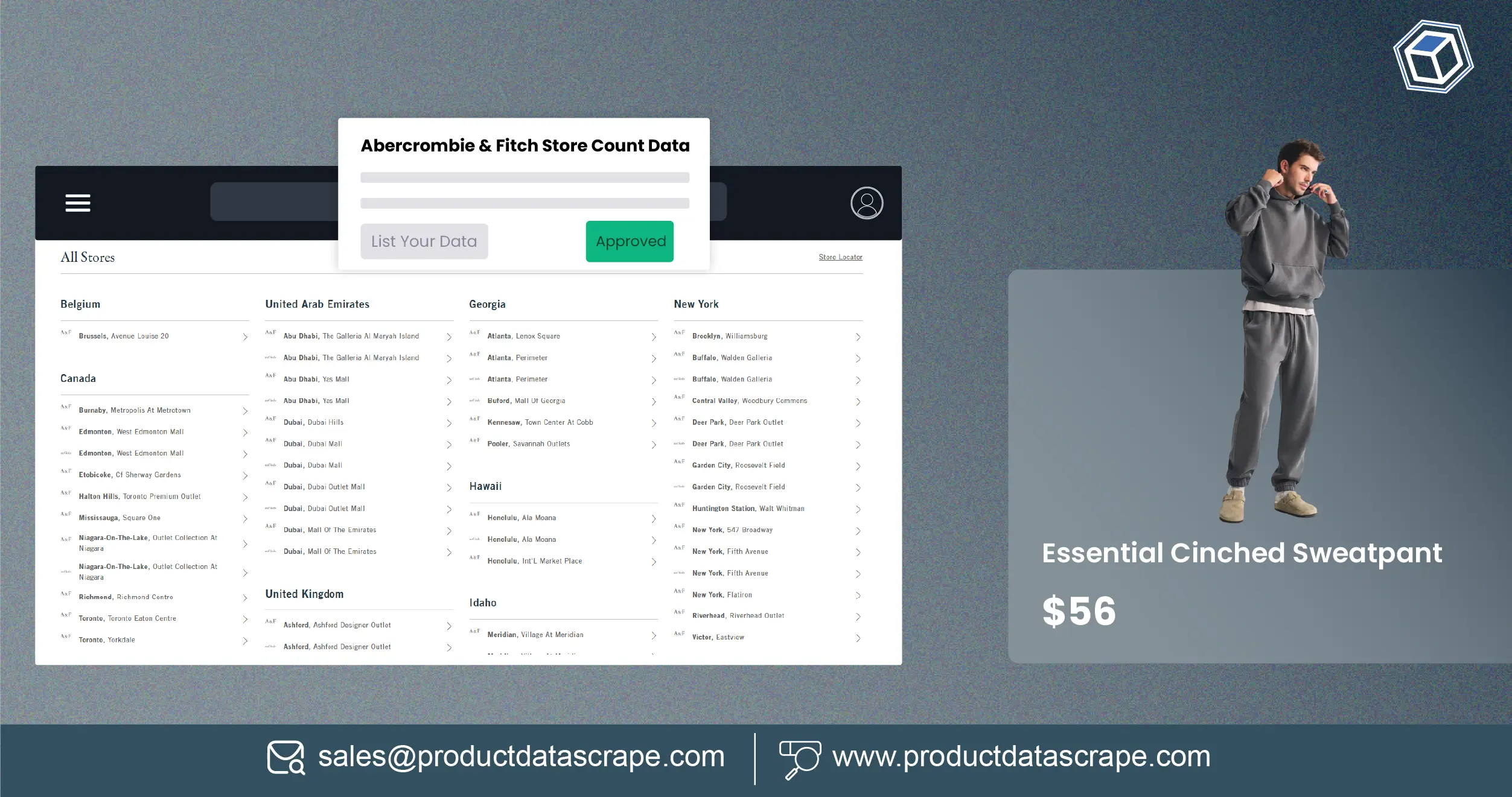

The Scrape Abercrombie & Fitch Store Count in the US 2026 allows businesses to monitor the brand’s footprint, analyze regional performance, and forecast market potential. Combined with the ability to Extract Abercrombie Kids China Fashion & Apparel Data, brands can assess international trends, understand consumer preferences, and optimize cross-market strategies.

From 2020 to 2026, Abercrombie & Fitch has experienced both expansion and consolidation, reflecting broader trends in retail adaptation, e-commerce growth, and shifting demographics. Accessing structured datasets enables decision-makers to identify growth opportunities, track competitor movements, and make informed merchandising and investment choices.

Expansion and Market Positioning

The brand’s expansion strategy over the last six years shows a mix of aggressive growth and selective closures. Leveraging Extract Fashion & Apparel Data, analysts can track store openings, closures, and regional saturation to optimize business decisions.

From 2020–2026, Abercrombie & Fitch’s US store count fluctuated due to e-commerce growth, pandemic-related disruptions, and strategic consolidation.

US Store Count Trend (2020–2026)

| Year |

Total Stores |

| 2020 |

850 |

| 2021 |

840 |

| 2022 |

845 |

| 2023 |

855 |

| 2024 |

860 |

| 2025* |

870 |

| 2026* |

875 |

Using this data, brands can forecast growth potential in under-served regions and evaluate historical performance against market trends. Insights from fashion & apparel datasets help retailers align inventory and promotional strategies with store distribution patterns.

Consumer Footfall and Regional Analysis

Understanding customer engagement at different locations requires comprehensive insights from Scrape Abercrombie & Fitch US store data insights. Footfall patterns indicate store performance, local demand, and consumer behavior variations across states.

Between 2020–2024, stores in metropolitan areas like New York, Los Angeles, and Chicago consistently contributed over 40% of revenue, while smaller urban locations showed moderate performance. Monitoring this data allows for better allocation of marketing and staffing resources.

Footfall Index (Representative Cities)

.webp)

| City |

2020 |

2022 |

2024 |

2025* |

| New York |

100 |

105 |

110 |

112 |

| Los Angeles |

95 |

100 |

104 |

107 |

| Chicago |

90 |

94 |

98 |

100 |

| Dallas |

85 |

87 |

90 |

92 |

Tracking these trends enables brands to anticipate seasonal peaks, optimize promotions, and plan expansions in high-potential markets.

Data Accuracy for Strategic Planning

A reliable abercrombie & fitch store count dataset 2026 provides stakeholders with precise insights into store locations, closures, and expansions. Data integrity ensures that retailers and investors make decisions based on verified information rather than estimations or incomplete reports.

From 2020 to 2026, the company maintained a slight growth trajectory, reflecting a balanced strategy between e-commerce integration and physical store optimization. Accurate datasets enable analysis of revenue contribution by store, identifying underperforming outlets, and planning for strategic closures or relocations.

Store Growth & Closures (2020–2025)

| Year |

Openings |

Closures |

Net Change |

| 2020 |

10 |

20 |

-10 |

| 2021 |

12 |

15 |

-3 |

| 2022 |

15 |

10 |

+5 |

| 2023 |

18 |

8 |

+10 |

| 2024 |

16 |

6 |

+10 |

| 2025* |

17 |

7 |

+10 |

By maintaining a structured dataset, businesses can optimize expansion and predict performance trends across markets.

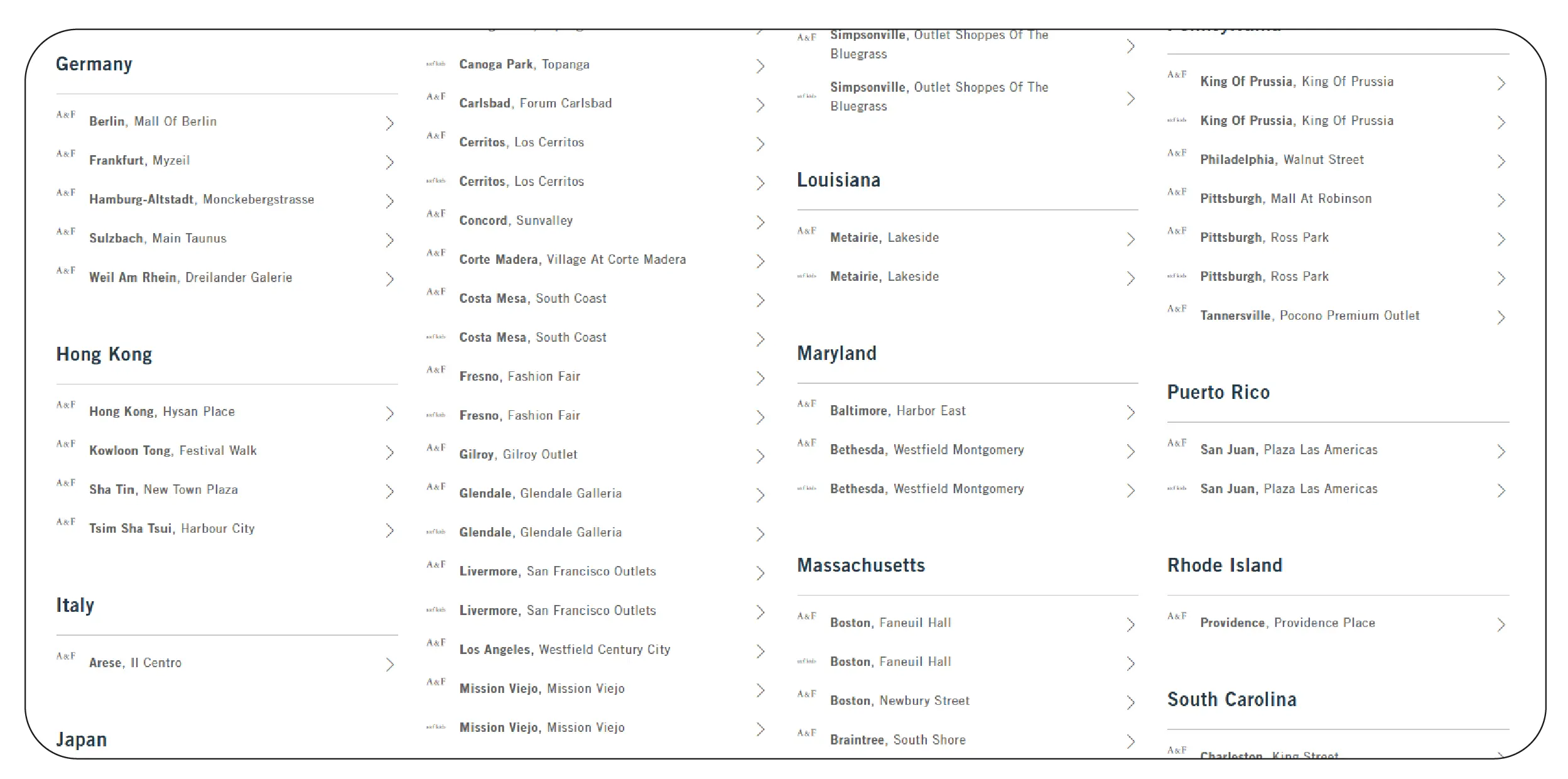

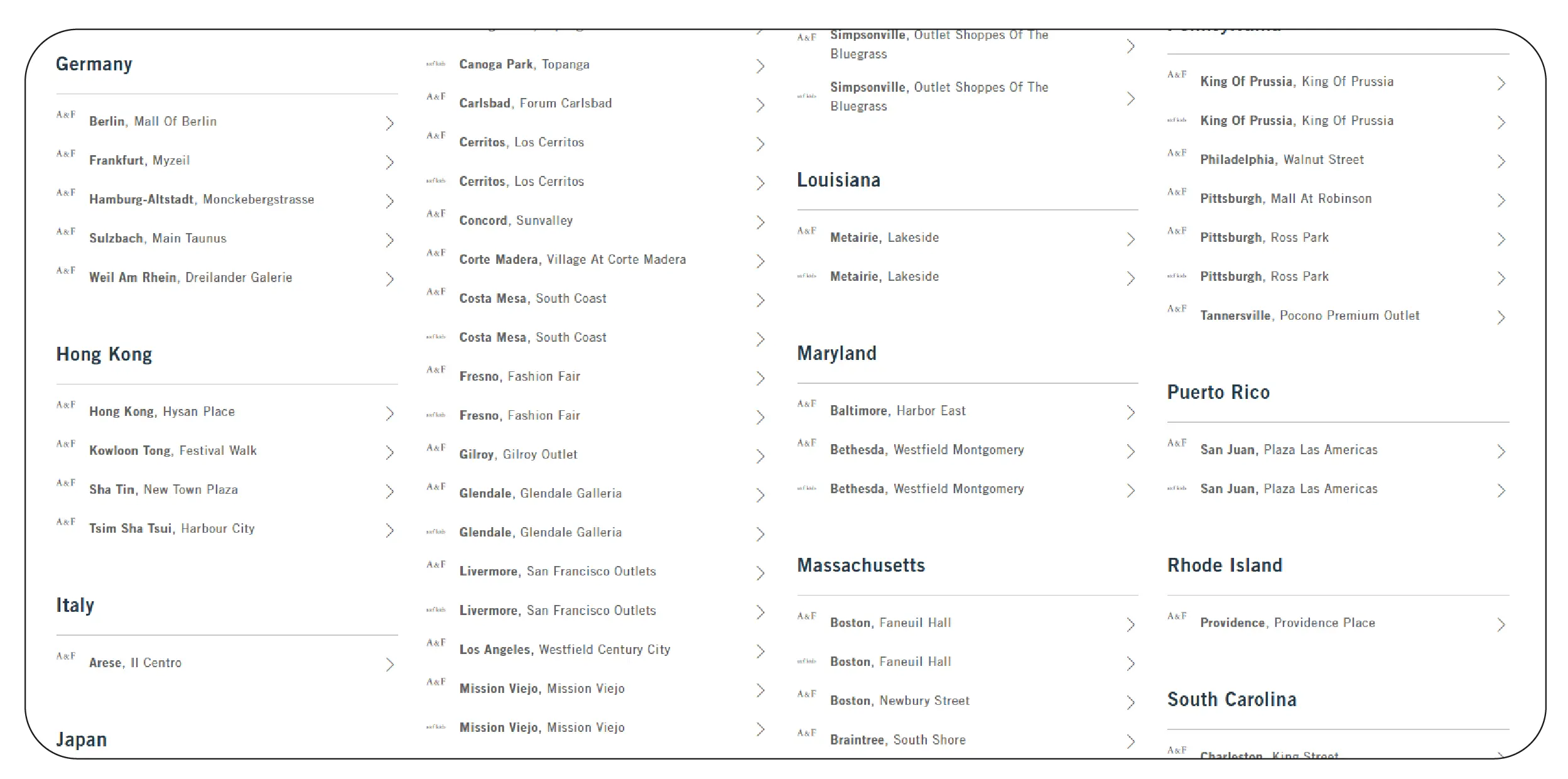

State-wise Distribution and Insights

Mapping the Abercrombie & Fitch US store count by state highlights regional concentration and identifies growth opportunities. States like California, Texas, and New York lead in store count, while Midwest and smaller states have untapped potential.

Between 2020 and 2026, coastal states accounted for nearly 45% of total stores, while emerging urban markets contributed steadily to growth. Tracking state-level data supports inventory management, marketing campaigns, and strategic real estate decisions.

Store Count by State (2025)

.webp)

| State |

Number of Stores |

| California |

120 |

| Texas |

95 |

| New York |

110 |

| Florida |

80 |

| Illinois |

55 |

| Others |

410 |

| Total |

870 |

State-level insights allow brands to prioritize expansion, evaluate local competition, and enhance supply chain efficiency.

Retail Pricing and Clothing Sales Trends

For the fashion retail sector, Clothing Sales Intelligence For 2026 helps correlate store count with revenue, average basket size, and regional pricing patterns. Using store datasets alongside sales intelligence, retailers can optimize pricing, promotions, and inventory planning.

Between 2020 and 2026, average sales per store increased by 8%, reflecting strategic product placement and seasonal promotions. Analysis of sales patterns also highlighted differences in premium vs. mid-range offerings, guiding inventory decisions.

Average Sales per Store ($ Thousands)

| Year |

Avg Sales |

| 2020 |

750 |

| 2021 |

770 |

| 2022 |

790 |

| 2023 |

810 |

| 2024 |

830 |

| 2025* |

850 |

This data helps forecast revenue for new store openings and refine marketing investments.

Location Mapping for Retail Strategy

Precise location information enables brands to scrape Abercrombie & Fitch store locations, analyze proximity to competitors, and optimize customer reach. Geographic insights inform real estate decisions and promotional focus.

From 2020 to 2026, mapping revealed that stores near high-traffic shopping centers generated 20% higher footfall, emphasizing the importance of data-driven site selection.

Why Choose Product Data Scrape?

Product Data Scrape delivers accurate, scalable, and actionable retail datasets for fashion brands. With expertise in Fashion Brands Use Datasets and the Scrape Abercrombie & Fitch Store Count in the US 2026, our solutions provide real-time insights, store performance tracking, and competitive benchmarking. Brands can leverage these datasets for expansion planning, market research, and inventory optimization, ensuring data-driven strategies that drive growth and profitability in 2026 and beyond.

Conclusion

Accurate data is critical for strategic decision-making in fashion retail. By leveraging fashion retail data extraction service and Scrape Abercrombie & Fitch Store Count in the US 2026, brands gain clarity on market trends, store performance, and growth opportunities. Access to structured datasets ensures informed investment, pricing optimization, and expansion planning.

Ready to unlock actionable retail insights and stay ahead in the competitive fashion market? Partner with Product Data Scrape for precise, comprehensive store and sales data today!

FAQs

1. What insights can I gain from scraping Abercrombie & Fitch store data?

You can monitor store count, track regional expansion, analyze sales trends, and identify growth opportunities for strategic planning and market intelligence.

2. How often should store data be updated for accuracy?

Quarterly or real-time updates ensure decisions are based on the latest openings, closures, and regional market changes for competitive advantage.

3. Is it legal to scrape store location data?

Yes, when done ethically and following platform terms, scraping publicly available store data is legal and widely used for market research.

4. Can Product Data Scrape handle large-scale fashion datasets?

Yes, Product Data Scrape provides scalable solutions for store counts, sales data, and geographic insights across national and international fashion brands.

5. How can scraped store data improve inventory planning?

By linking store locations to footfall, sales trends, and regional demand, brands can optimize inventory allocation, reduce stockouts, and improve operational efficiency.

.webp)

.webp)

.webp)