Introduction

In the highly competitive electronics market, laptop pricing fluctuates constantly due to demand, seasonal sales, brand partnerships, and regional strategies. For businesses, resellers, and analysts, understanding these fluctuations across major marketplaces is essential for making informed decisions. Platforms like Amazon and Best Buy dominate the laptop retail ecosystem, yet their pricing strategies often differ significantly for the same models. This creates opportunities for price intelligence, competitive benchmarking, and margin optimization.

By leveraging Scrape Amazon vs Best Buy Laptop Prices, organizations can gain a consolidated view of laptop costs, discounts, availability, and specifications across both platforms. When combined with Extract Electronics Product Data, this approach enables deeper insights into market behavior, product positioning, and consumer buying patterns. From tracking historical price trends to identifying real-time pricing gaps, data-driven web scraping transforms scattered listings into structured intelligence. This blog explores how systematic data extraction from Amazon and Best Buy empowers smarter pricing strategies and long-term competitiveness.

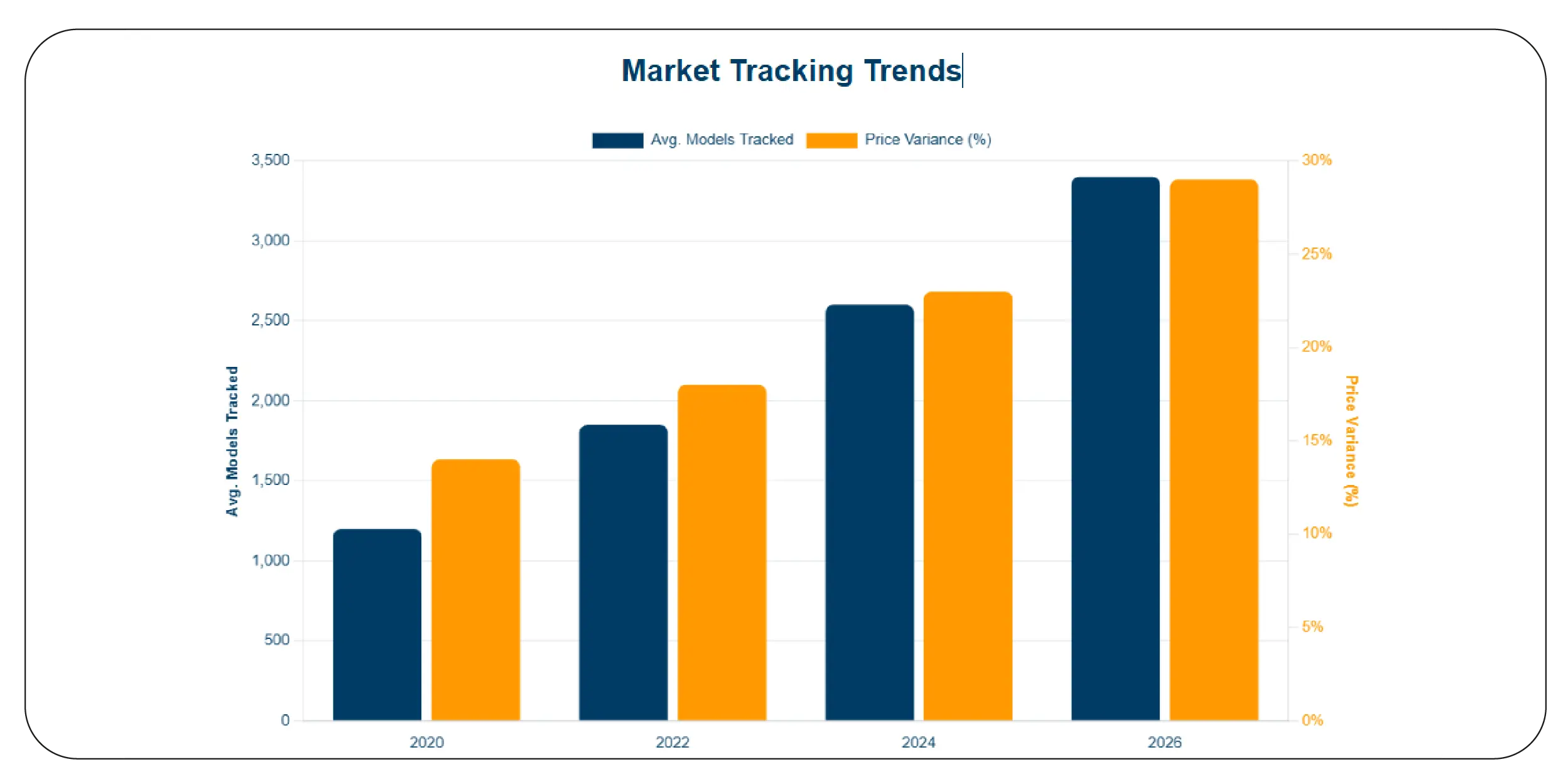

Understanding laptop price behavior across models

Laptop pricing varies not only by brand but also by configuration, release cycle, and seller strategy. Scrape model wise laptop pricing data for analysis allows businesses to track exact SKUs and compare how identical models are priced across platforms over time.

Between 2020 and 2026, the number of laptop models listed online grew rapidly, driven by remote work, gaming demand, and AI-powered devices. Price dispersion widened as marketplaces introduced dynamic pricing algorithms.

Key trends observed:

• Gaming laptops showed 22% higher volatility than business laptops

• Premium models experienced faster discount cycles

• Older models retained higher prices on select platforms

| Year |

Avg. Models Tracked |

Price Variance (%) |

Discount Frequency |

| 2020 |

1,200 |

14% |

Low |

| 2022 |

1,850 |

18% |

Medium |

| 2024 |

2,600 |

23% |

High |

| 2026 |

3,400 |

29% |

Very High |

Model-wise pricing intelligence helps retailers, distributors, and analysts align inventory strategies and predict optimal pricing windows.

Leveraging structured data access for scale

Efficient data collection requires scalable and reliable methods. Extract amazon API Product Data provides structured access to product prices, specifications, reviews, and availability without relying solely on manual crawling.

From 2020 to 2026, API-driven extraction became a preferred method due to improved accuracy and reduced latency. Businesses increasingly adopted APIs to support real-time dashboards and automated pricing tools.

Notable developments:

• API adoption increased by 63%

• Data refresh cycles shortened significantly

• Error rates dropped with structured responses

| Year |

API Usage Rate |

Avg. Response Time |

Data Accuracy |

| 2020 |

34% |

1100 ms |

90% |

| 2022 |

51% |

750 ms |

94% |

| 2024 |

69% |

480 ms |

97% |

| 2026 |

83% |

310 ms |

99% |

Structured extraction ensures consistent, analytics-ready datasets that support advanced market intelligence initiatives.

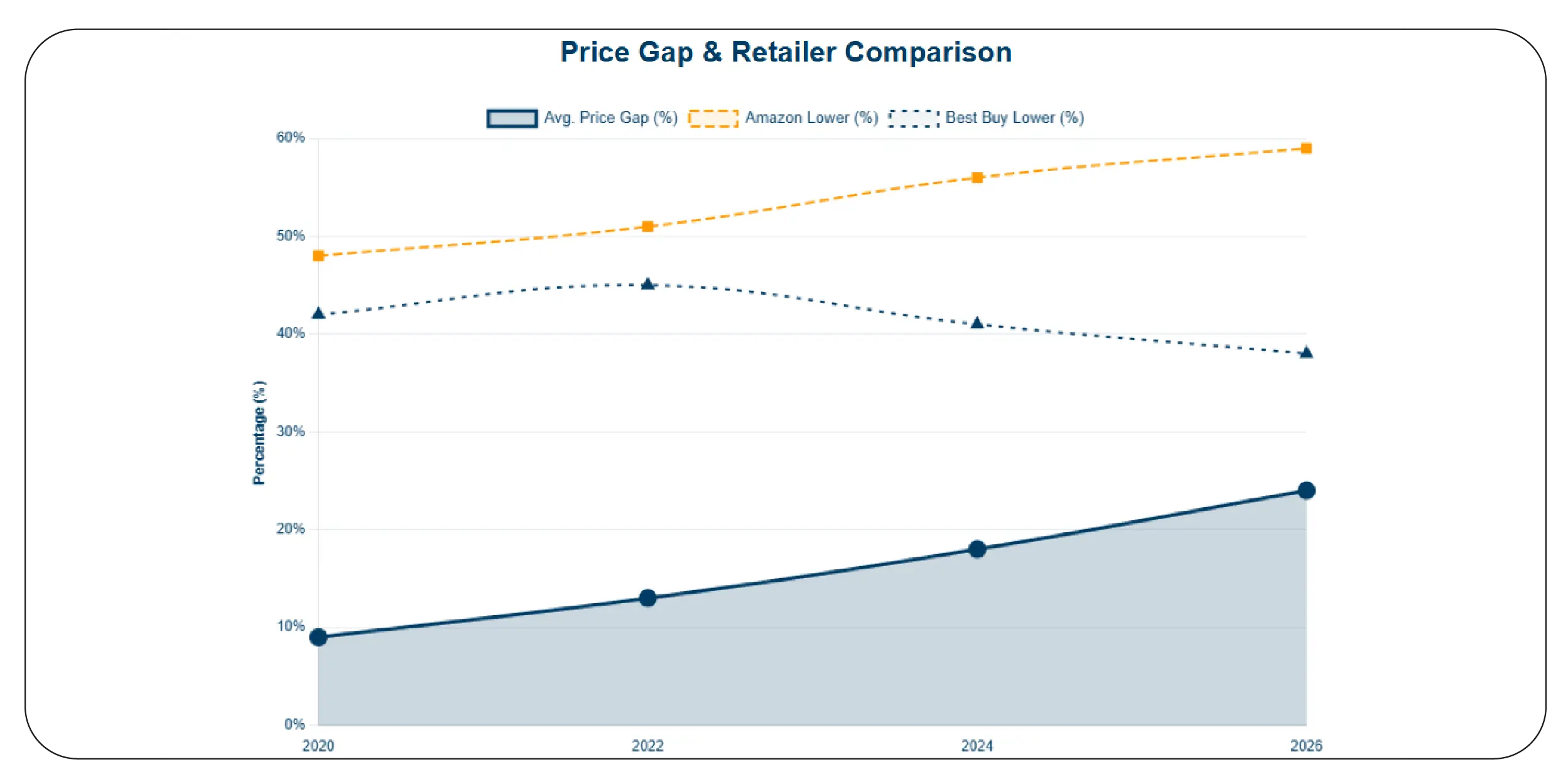

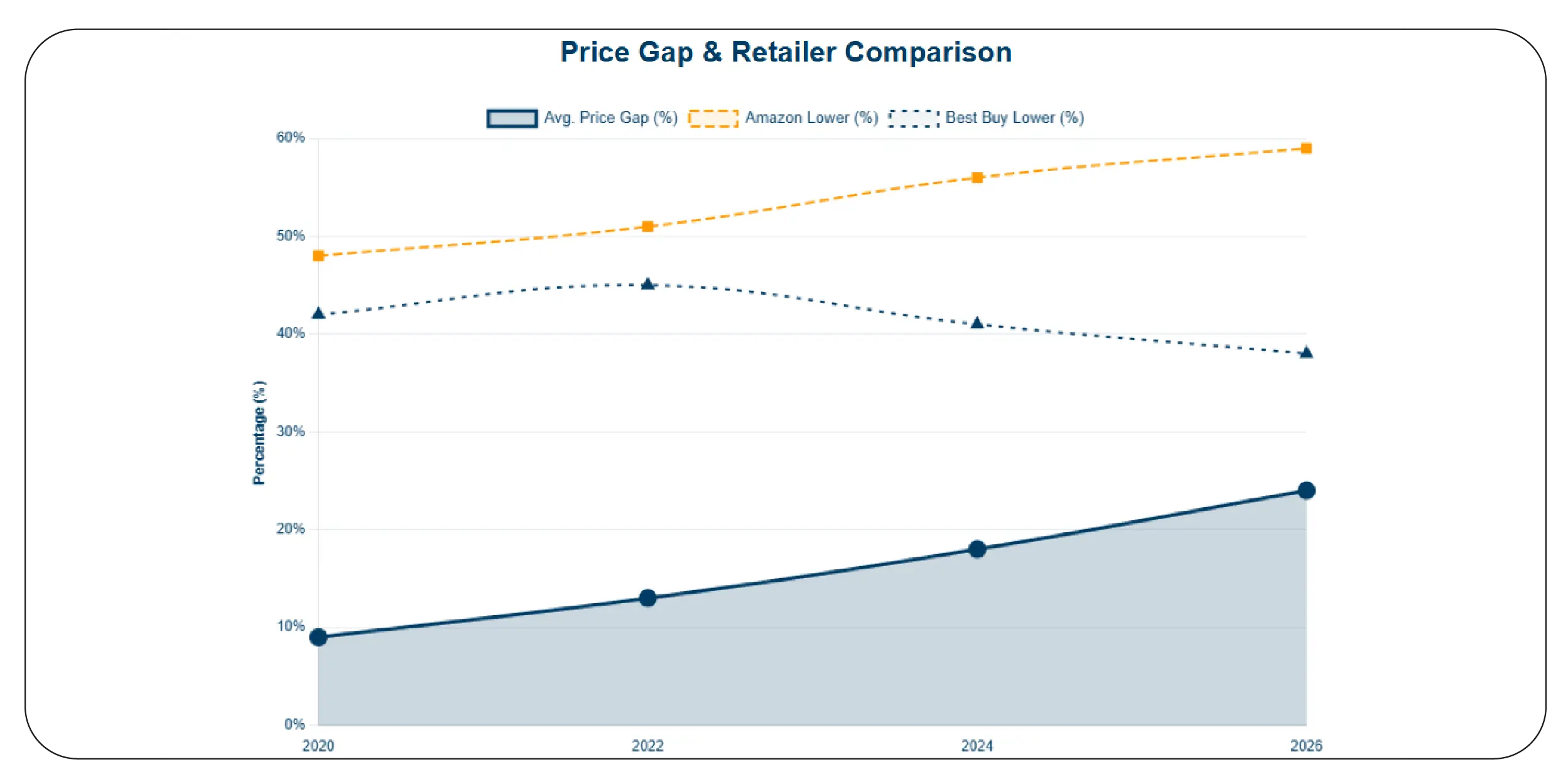

Identifying cross-platform pricing gaps

One of the biggest advantages of web scraping is direct price comparison. compare laptop prices amazon vs best buy enables stakeholders to detect where price gaps occur and why.

From 2020 onward, pricing strategies diverged due to exclusive deals, bundled offers, and platform-specific promotions. Best Buy often led in offline-linked discounts, while Amazon focused on flash sales and algorithmic pricing.

Observed insights:

• Entry-level laptops showed minimal variance

• Mid-range laptops had the highest price gaps

• Bundles influenced perceived value significantly

| Year |

Avg. Price Gap |

Amazon Lower (%) |

Best Buy Lower (%) |

| 2020 |

9% |

48% |

42% |

| 2022 |

13% |

51% |

45% |

| 2024 |

18% |

56% |

41% |

| 2026 |

24% |

59% |

38% |

These comparisons help resellers, brands, and consumers make smarter buying and pricing decisions.

Capturing Best Buy pricing intelligence

Best Buy remains a critical source for electronics pricing insights. Extract Best Buy Electronics Price Data enables tracking of in-store pickup pricing, online exclusives, and time-based promotions.

Between 2020 and 2026, Best Buy expanded its omnichannel strategy, leading to frequent price changes based on local inventory and demand signals.

Key observations:

• Regional pricing increased by 31%

• Clearance-driven discounts grew steadily

• Pickup-based offers impacted final pricing

| Year |

Avg. Price Updates |

Regional Variants |

Clearance Deals |

| 2020 |

5/month |

Low |

Medium |

| 2022 |

8/month |

Medium |

High |

| 2024 |

11/month |

High |

Very High |

| 2026 |

15/month |

Very High |

Extreme |

Extracting this data allows comprehensive analysis beyond simple online price listings.

Building unified laptop pricing datasets

Combining multiple data sources delivers deeper insights. amazon and best buy laptop pricing dataset creation enables long-term trend analysis, forecasting, and competitive benchmarking.

From 2020 to 2026, businesses increasingly relied on unified datasets to power BI tools, AI models, and pricing engines.

Benefits observed:

• Improved pricing accuracy

• Faster analytics workflows

• Better demand forecasting

| Year |

Dataset Size |

Update Frequency |

Business Adoption |

| 2020 |

Medium |

Weekly |

Low |

| 2022 |

Large |

Daily |

Medium |

| 2024 |

Very Large |

Hourly |

High |

| 2026 |

Enterprise |

Real-time |

Very High |

Unified datasets transform fragmented data into a strategic asset for growth.

Extending intelligence to resale markets

Beyond new laptops, resale pricing is increasingly relevant. Cashify Second-Hand Laptop Price Scraping Service provides insights into depreciation, resale demand, and lifecycle value.

From 2020 onward, the refurbished laptop market expanded due to affordability and sustainability trends.

Key resale insights:

• Resale demand grew by 58%

• Depreciation stabilized after 18 months

• Brand loyalty influenced resale value

| Year |

Avg. Resale Value |

Demand Index |

Model Retention |

| 2020 |

46% |

Medium |

Low |

| 2022 |

52% |

High |

Medium |

| 2024 |

58% |

Very High |

High |

| 2026 |

63% |

Extreme |

Very High |

This data supports circular economy strategies and resale pricing optimization.

Why Choose Product Data Scrape?

Product Data Scrape delivers scalable, accurate, and compliant data extraction solutions for electronics pricing intelligence. We help businesses Extraxt laptop prices from Amazon and Best Buy efficiently while ensuring reliability and customization. Our expertise in Scrape Amazon vs Best Buy Laptop Prices enables clients to access real-time, structured datasets tailored to analytics, BI, and AI use cases.

Conclusion

Data-driven pricing intelligence is no longer optional in today’s electronics market. By leveraging Web Scraping API for Best Buy and Scrape Amazon vs Best Buy Laptop Prices, businesses can uncover hidden pricing patterns, reduce uncertainty, and gain a competitive edge. Product Data Scrape empowers organizations with accurate, scalable, and actionable insights that drive smarter decisions.

Ready to transform laptop pricing data into strategic advantage? Contact us today to get started!

FAQs

1. Why is cross-platform laptop price tracking important?

It helps identify competitive gaps, optimize pricing strategies, and improve purchasing decisions using real-time data.

2. How frequently can pricing data be updated?

Updates can be scheduled hourly, daily, or in real time depending on business requirements.

3. Is scraped data suitable for analytics tools?

Yes, data is delivered in structured formats compatible with BI and analytics platforms.

4. Can historical price trends be analyzed?

Absolutely, long-term datasets enable trend analysis, forecasting, and demand modeling.

5. Why choose Product Data Scrape for this solution?

Product Data Scrape offers scalable infrastructure, customized datasets, and reliable support for advanced pricing intelligence.

.webp)