Introduction

The online fashion market has witnessed a dramatic surge in SKUs (Stock Keeping Units) over

the past decade. As major players like Myntra and SHEIN expand their product lines to cater

to rapidly changing consumer demands, brands and analysts alike need robust data extraction

strategies to stay competitive. Scrape Fashion SKU Listings Product from Myntra & SHEIN is

now crucial for brands, resellers, and researchers who want to understand trends, monitor

pricing shifts, and track new arrivals in real-time.

For context, Myntra’s SKU count rose from approximately 30,000 in 2016 to

well over 1 million unique listings by 2025, while SHEIN’s explosive inventory strategy took

their SKU count from around 50,000 to nearly 1.5 million in the same period. This SKU

explosion represents both an opportunity and a challenge: more choices mean more data to

analyze and more insights to gain.

In this blog, we break down how to Web Scraping Fashion SKUs from Myntra &

SHEIN, key methods for Extracting Fashion SKU Listings Product Data from Myntra, leveraging

a SHEIN Fashion Product SKU Scraper, and using advanced tools for Extract Real-Time Fashion

SKU Tracking For Myntra & SHEIN. We’ll also show you practical stats, datasets, and benefits

of partnering with a reliable Product Data Scrape provider.

Why You Need to Scrape Fashion SKU Listings Product from Myntra & SHEIN?

The fashion e-commerce boom is rewriting how brands manage inventory,

pricing, and promotions. As platforms like Myntra and SHEIN aggressively expand their

catalogs, businesses must keep pace with this SKU avalanche. Scrape Fashion SKU Listings

Product from Myntra & SHEIN is no longer just a nice-to-have — it’s a must for fashion

brands, research agencies, and marketplace sellers who want to stay ahead of the curve.

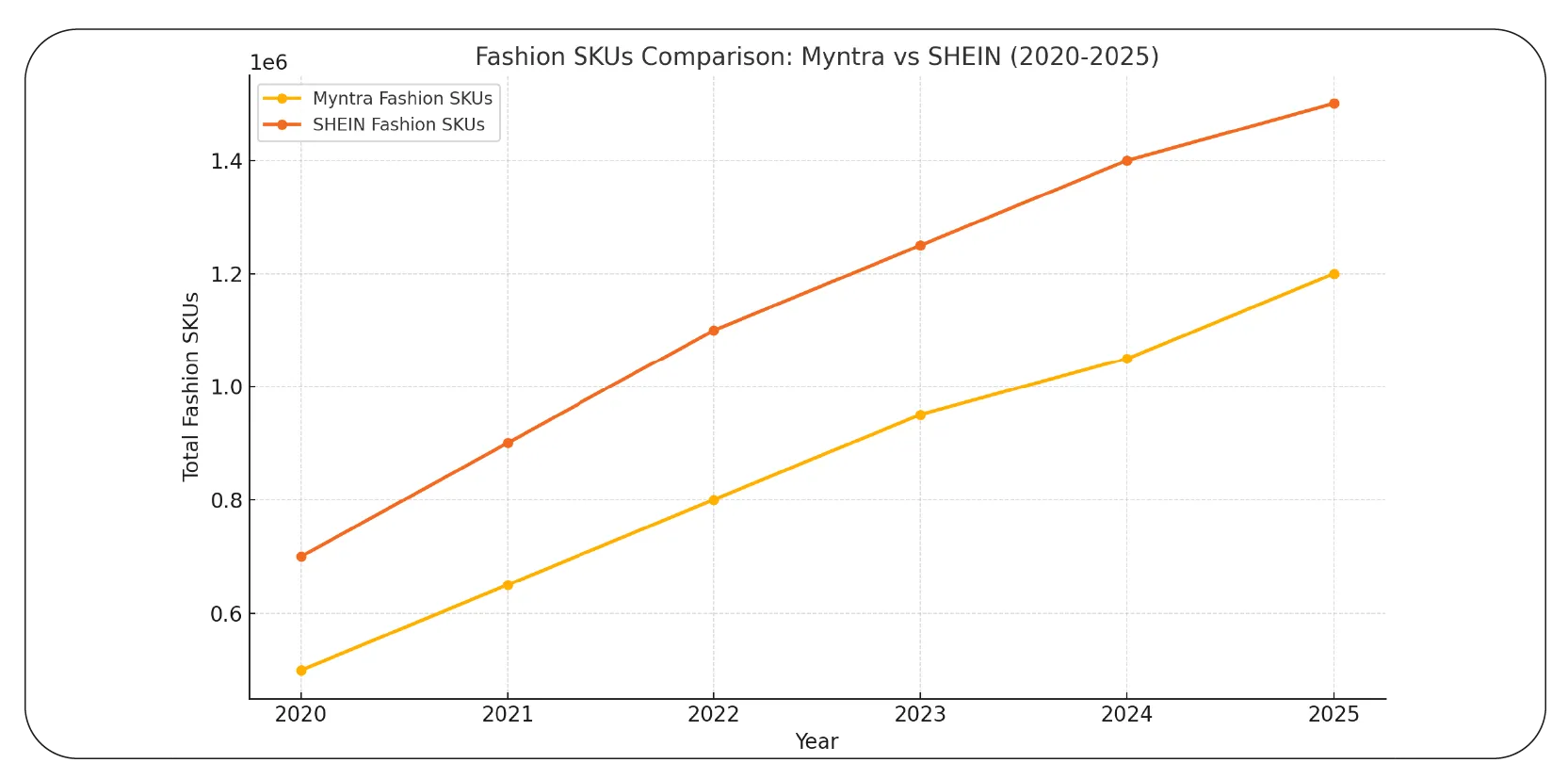

Today’s shoppers demand fresh styles and endless options. In 2016, Myntra

offered about 30,000 SKUs. By 2025, that figure is projected to reach over 1.2 million,

driven by micro-segmentation, regional collections, and brand collaborations. SHEIN’s model

is even more aggressive: from 50,000 SKUs in 2016 to an estimated 1.5 million by 2025, it

thrives on fast churn, short production cycles, and rapid launch of new collections.

| Year |

Myntra SKU Count |

SHEIN SKU Count |

| 2020 |

500,000 |

700,000 |

| 2021 |

650,000 |

900,000 |

| 2022 |

800,000 |

1,100,000 |

| 2023 |

950,000 |

1,250,000 |

| 2024 |

1,050,000 |

1,400,000 |

| 2025 |

1,200,000 |

1,500,000 |

This staggering SKU growth means more choices for buyers — but for

sellers, it means fierce competition, faster sell-through cycles, and the need for real-time

data. By using Web Scraping Fashion SKUs from Myntra & SHEIN, you can keep tabs on which

products are trending, which ones are discounted, and which categories are getting

saturated.

Access to fresh data also improves marketing ROI. Brands that Extract

Popular E-Commerce Website Data can benchmark against competitors, plan smarter ad spend,

and tweak pricing dynamically. Staying blind to this SKU explosion is no longer an option —

real-time Product Data Scrape is the new edge.

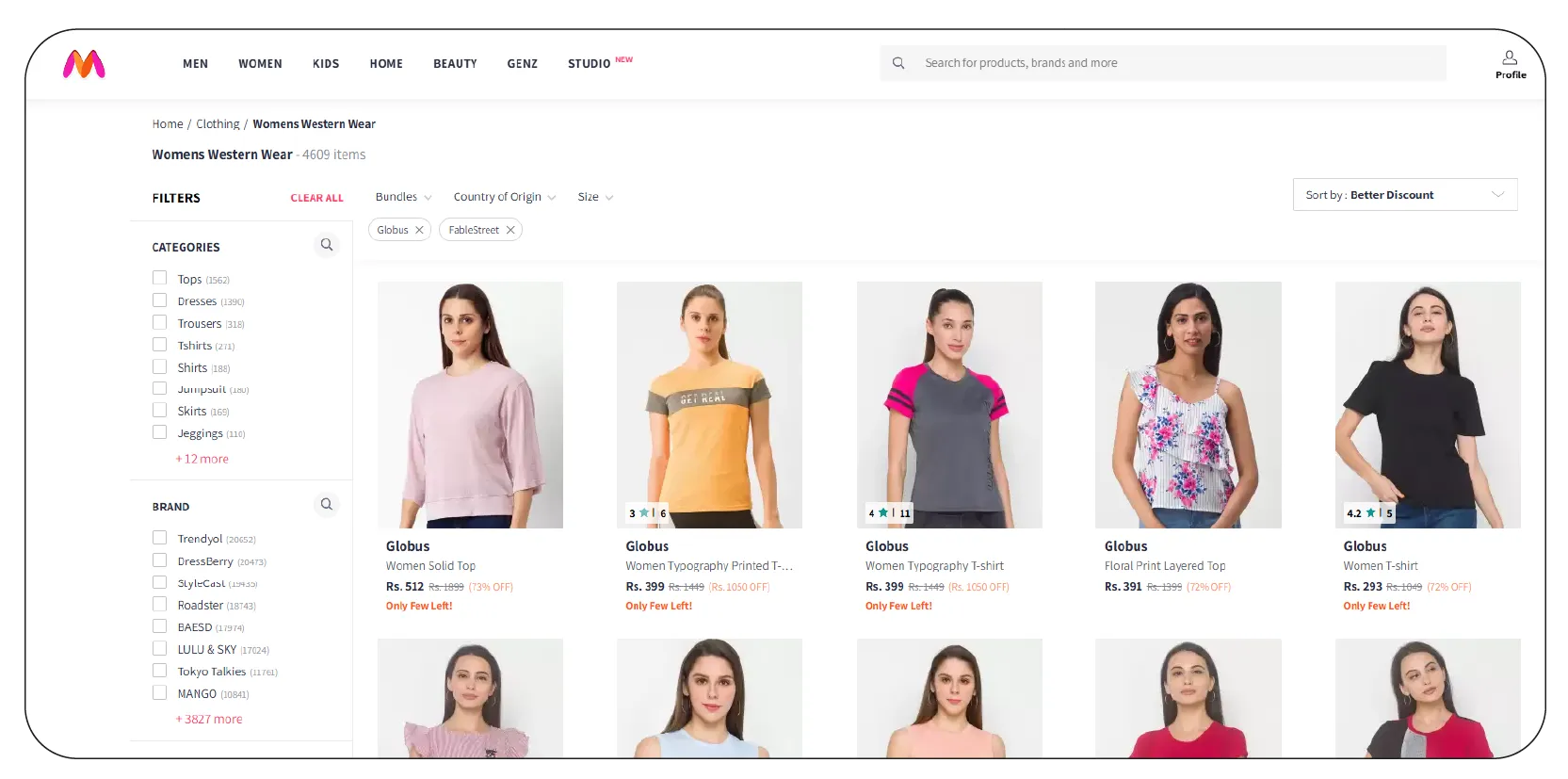

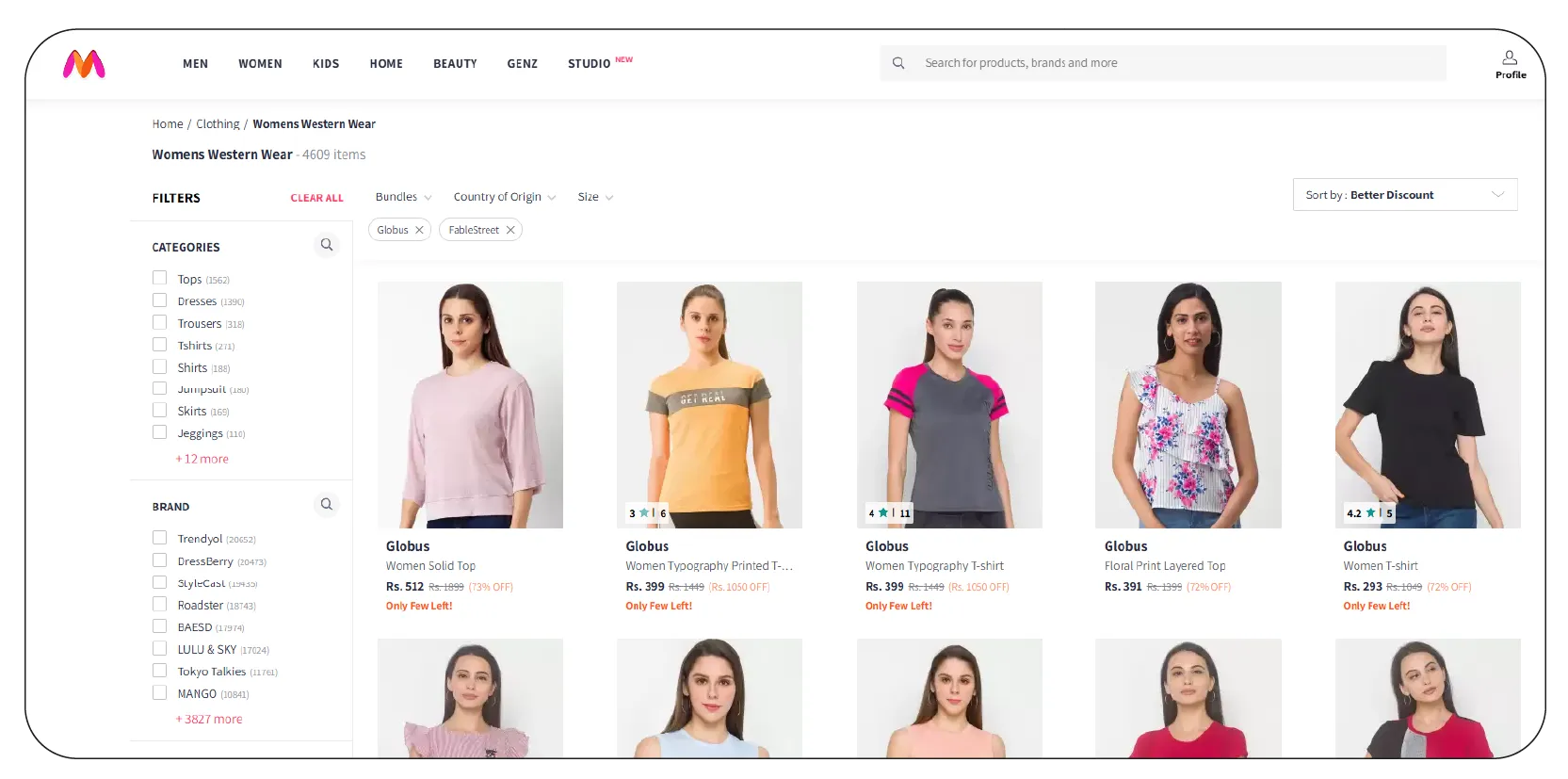

How to Extract Fashion SKU Listings Product Data from Myntra?

Myntra, owned by Flipkart, is India’s largest online fashion retailer.

With thousands of brands and regular flash sales, Myntra’s listings are a goldmine for

fashion intelligence — if you know how to mine it. To stay relevant, sellers and analysts

should learn how to Extract Fashion SKU Listings Product Data from Myntra in a scalable way.

Each product listing on Myntra holds valuable details: titles,

descriptions, SKUs, size options, colorways, pricing history, discounts, stock status, and

customer ratings. Building a structured Myntra Product and Review Dataset lets you slice

this data for trend analysis, competitor mapping, and dynamic repricing.

| Year |

Ethnic Wear SKUs |

Athleisure SKUs |

Western Wear SKUs |

| 2020 |

120,000 |

80,000 |

150,000 |

| 2021 |

150,000 |

110,000 |

200,000 |

| 2022 |

180,000 |

140,000 |

250,000 |

| 2023 |

220,000 |

180,000 |

300,000 |

| 2024 |

250,000 |

210,000 |

350,000 |

| 2025 |

300,000 |

250,000 |

400,000 |

The table shows how categories like ethnic wear and athleisure are

expanding rapidly. An exporter or D2C brand can’t afford to guess which trends will sell —

you need to Extract Myntra E-Commerce Product Data systematically. Using automated tools for

Web Scraping for Fashion & Apparel Data means you don’t waste time with manual checks or

outdated data.

Combine this with user review scraping to get sentiment insights: are

buyers complaining about sizing? Do they mention fabric quality? These micro-insights are

game changers for product design and inventory planning.

With clean Myntra datasets, you can build real-time dashboards that help

your team react faster than the competition. That’s how smart players win in India’s crowded

online fashion game.

Unlock growth: Extract Fashion SKU Listings Product

Data from Myntra today and power smarter pricing, trends, and

inventory decisions.

Contact Us Today!

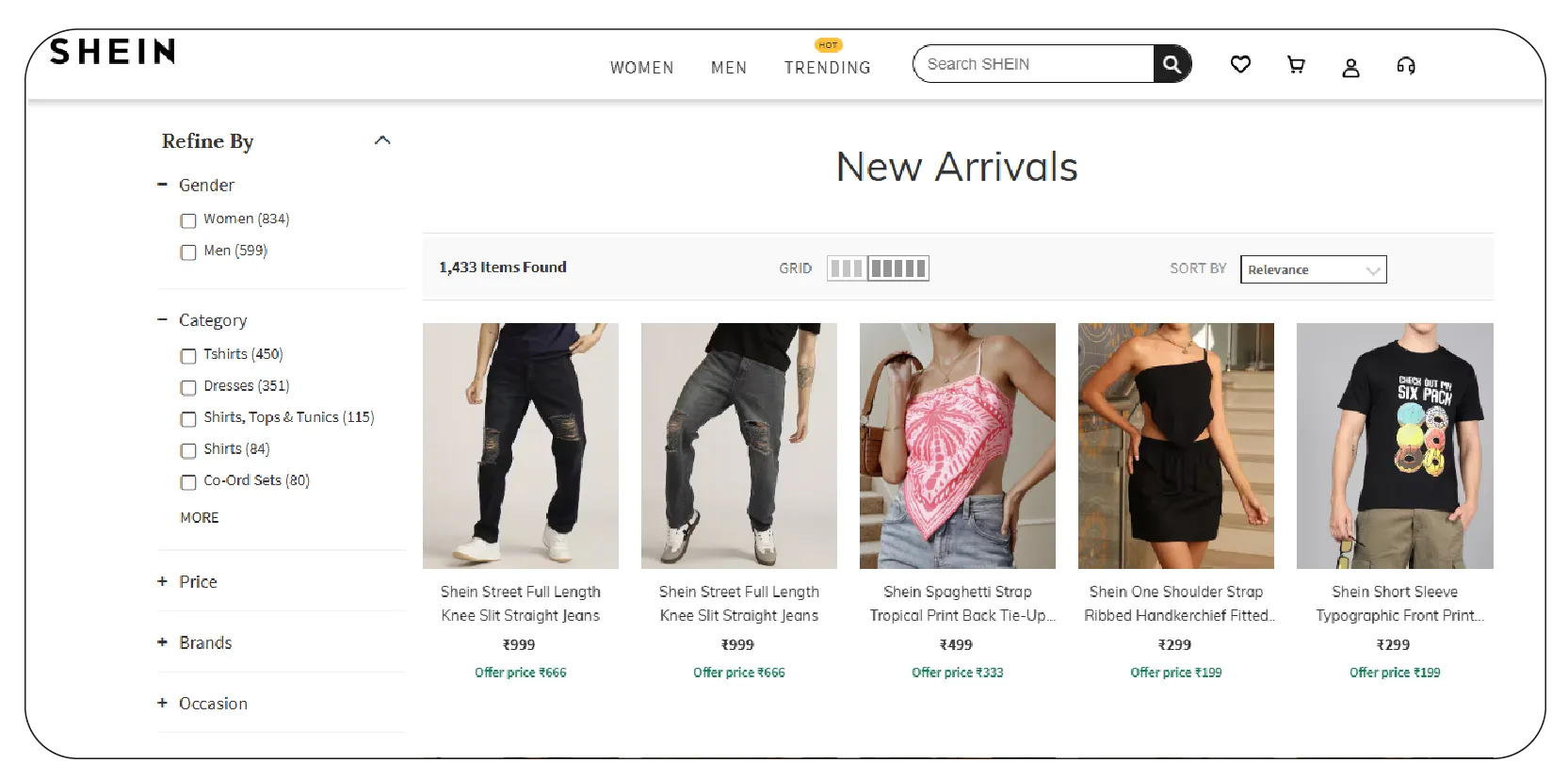

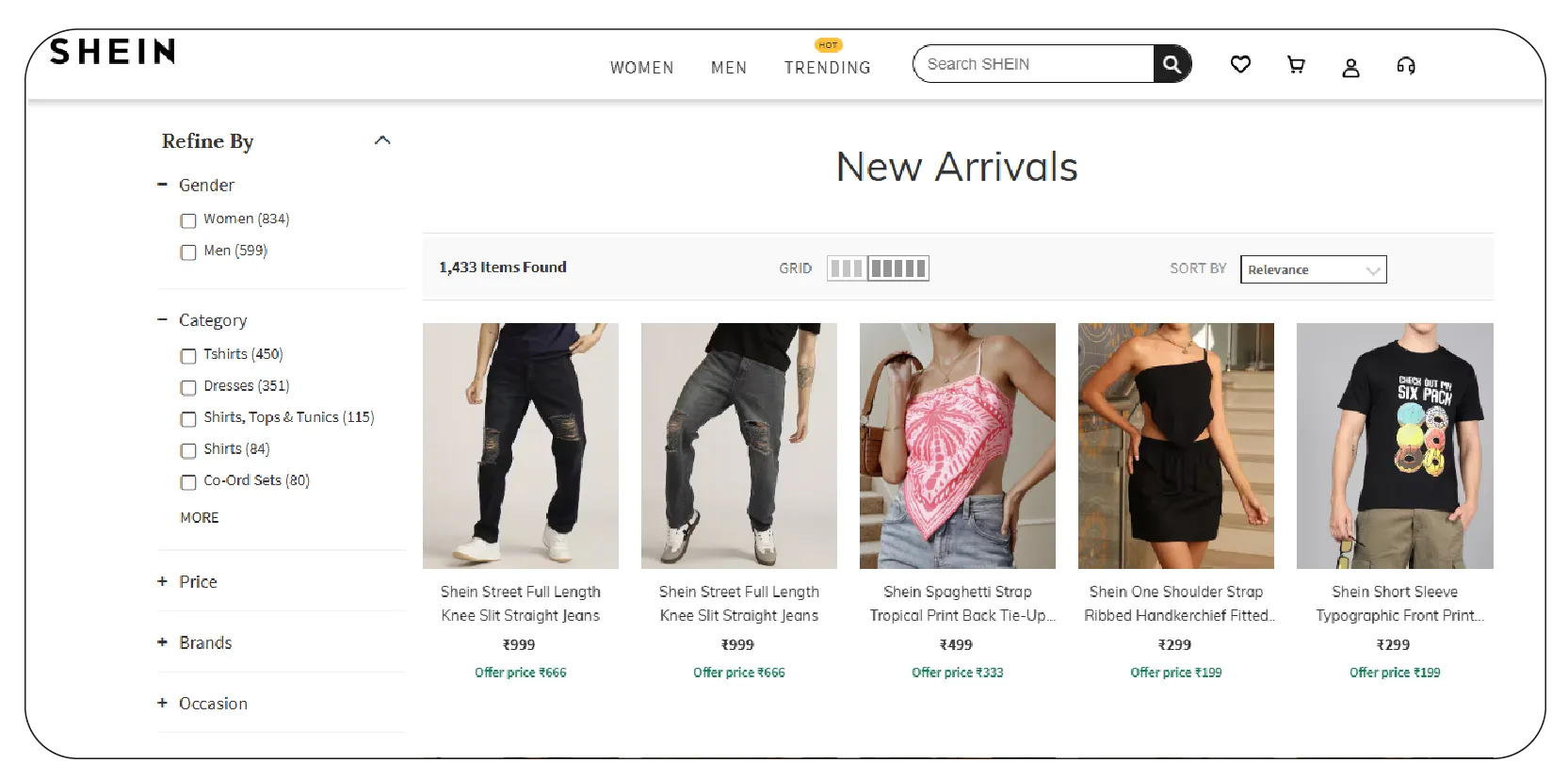

Benefits of Using a SHEIN Fashion Product SKU Scraper

No brand does hyper-fast fashion at scale like SHEIN. The Chinese

powerhouse has mastered churning thousands of new products every week, dropping limited

batches, and pulling listings that don’t sell — all in real-time. This model demands

constant monitoring. A SHEIN Fashion Product SKU Scraper gives you this edge by turning

chaos into clean, actionable data.

SHEIN’s churn rate is among the highest in the industry. From 2020–2025,

the average SKU churn grew from 45% to an estimated 65% per year. That means if you check

today and come back next month, up to two-thirds of listings could be gone or replaced.

| Year |

Avg. Monthly New SKUs |

SKU Churn % |

| 2020 |

20,000 |

45% |

| 2021 |

25,000 |

50% |

| 2022 |

30,000 |

55% |

| 2023 |

35,000 |

60% |

| 2024 |

40,000 |

62% |

| 2025 |

50,000 |

65% |

Using Web Scraping SHEIN E-Commerce Product Data means you can spot hot

sellers before they hit peak demand. Dropshippers and marketplace sellers especially benefit

from fast signals: which categories are booming, which products to replicate, and when to

pivot.

A SHEIN Fashion Product SKU Scraper also helps you monitor flash sales and

discount timings — crucial for pricing strategies. When you Extract Real-Time Fashion SKU

Tracking For Myntra & SHEIN, you’re not playing catch-up. You’re making data-backed choices

that match SHEIN’s speed.

For global brands, scraping SHEIN can also reveal design trends and

consumer preferences across different geographies. Combined with other Ecommerce Data

Scraping Services, this data helps you adapt catalog size, design, and pricing for maximum

market fit.

Real-Time Fashion SKU Tracking For Myntra & SHEIN

Fast fashion isn’t just about volume — it’s about speed. Once, quarterly

updates were enough. Now, brands must react daily. Using Extract Real-Time Fashion SKU

Tracking For Myntra & SHEIN gives you the ability to monitor listings, stock status, price

drops, and new launches as they happen.

SHEIN and Myntra combined account for millions of SKUs with rapid churn.

For instance, in 2020, brands needed an average of two weeks to adjust pricing to competitor

moves. By 2025, leading sellers using Web Scraping Fashion SKUs from Myntra & SHEIN reduce

this lag to under 24 hours.

| Year |

Avg. Price Update Lag (days) |

Avg. Out-of-Stock Reaction Time (days) |

| 2020 |

14 |

7 |

| 2021 |

10 |

5 |

| 2022 |

7 |

3 |

| 2023 |

5 |

2 |

| 2024 |

3 |

1 |

| 2025 |

1 |

<1 |

That means if a top competitor drops prices or restocks trending SKUs,

your team can instantly match or beat the offer. This live feed is only possible when you

Scrape Fashion SKU Listings Product from Myntra & SHEIN with an automated pipeline.

With Web Scraping E-commerce Websites, smart brands feed this SKU and

price data into dashboards that integrate with ad platforms, marketplaces, and ERP systems.

This level of automation boosts margins, prevents dead stock, and supports dynamic repricing

at scale.

In short, real-time SKU tracking flips the script. Instead of reacting to

the market, you shape it — by leveraging E-commerce Product Prices Dataset and live updates

for every category, every day.

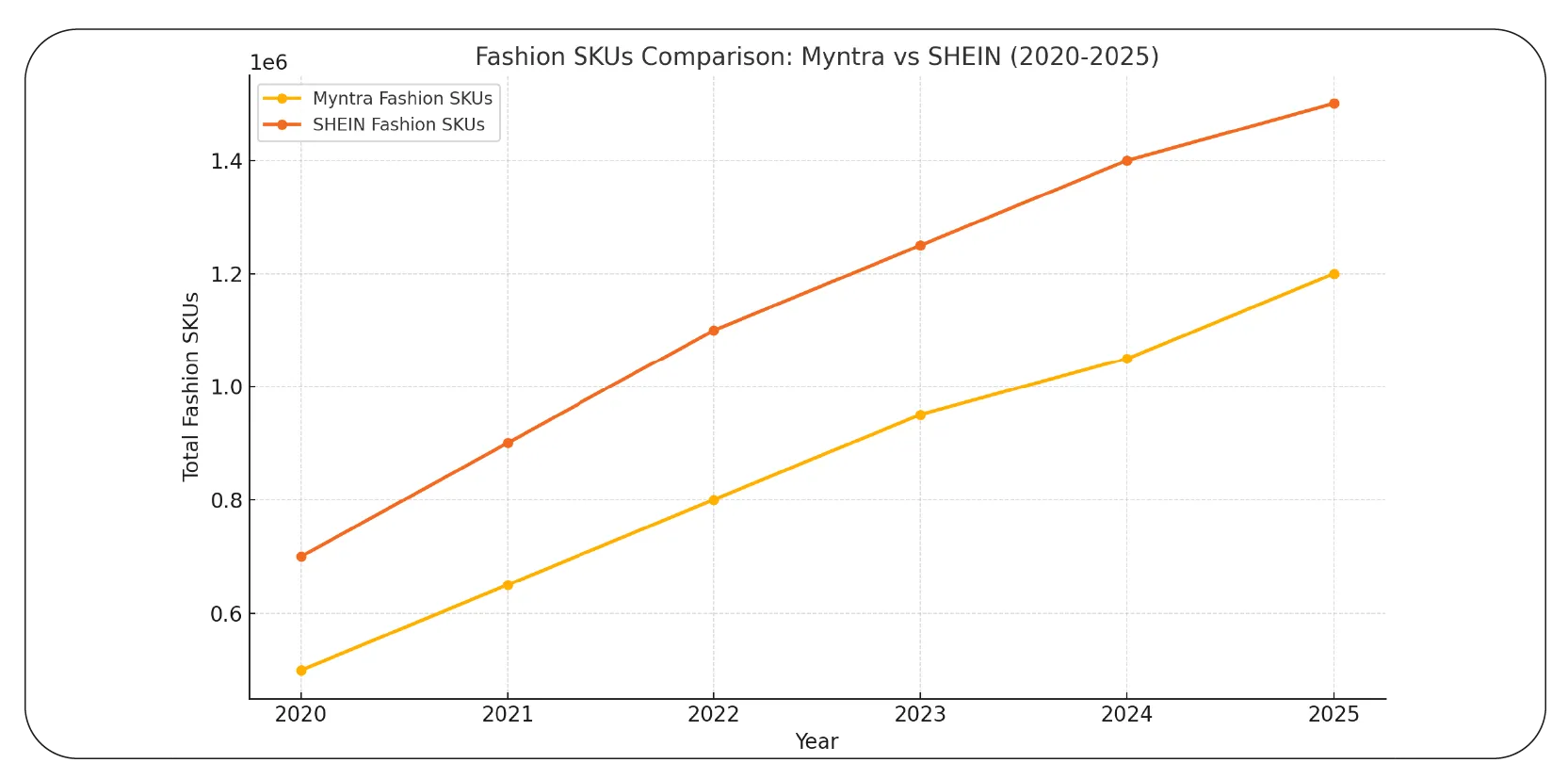

Extract Fashion & Apparel Data for Smarter Merchandising

Fashion buyers and merchandisers depend on accurate, broad datasets to

decide which styles deserve bigger orders, which colors to push, and when to launch

promotions. To win in this game, teams Extract Fashion & Apparel Data at scale and turn

insights into profit.

In India alone, categories like women’s dresses, ethnic wear, and

activewear have doubled SKU counts from 2020–2025 on Myntra. Meanwhile, SHEIN’s global

micro-collection strategy ensures 5,000+ new SKUs hit the market every day.

| Year |

Total Myntra Fashion SKUs |

Total SHEIN Fashion SKUs |

| 2020 |

500,000 |

700,000 |

| 2021 |

650,000 |

900,000 |

| 2022 |

800,000 |

1,100,000 |

| 2023 |

950,000 |

1,250,000 |

| 2024 |

1,050,000 |

1,400,000 |

| 2025 |

1,200,000 |

1,500,000 |

By applying Web Scraping for Fashion & Apparel Data, you can segment

listings by style, price band, brand, and region. Want to know what price point sells best

in Tier-2 cities? Or which fabric blends get the highest ratings? A clean feed from your

Product Data Scrape partner unlocks these insights.

For private labels or new sellers, scraped data highlights underserved

niches. See a gap in plus-size activewear or modest fashion? Fill it before your competitors

do — with facts, not hunches.

This is where good Ecommerce Data Scraping Services pay off: you’re not

pulling random numbers — you’re building a custom Myntra Product and Review Dataset or SHEIN

Fashion Product SKU Scraper pipeline that’s tailored to your category.

The result? Smarter buying, lower dead stock, and bigger margins.

Extract Fashion & Apparel Data now to boost your

merchandising strategy with real-time trends, pricing insights, and

SKU-level intelligence.

Contact Us Today!

Extract Popular E-Commerce Website Data at Scale

While Myntra and SHEIN dominate the online fashion SKU game, smart sellers

don’t stop there. Broader Extract Popular E-Commerce Website Data initiatives help you map

trends across platforms and verticals.

Many brands selling on Myntra also list on Ajio, Amazon Fashion, or niche

marketplaces. Pulling SKU, price, and review data from all these sources using Web Scraping

E-commerce Websites gives you the big picture: which channels push volume? Where are your

competitors investing in ads and discounts? Which SKUs perform best across regions?

| Platform |

Average SKU Overlap % |

Top Category |

| Myntra |

70% |

Apparel |

| SHEIN |

30% (exclusive SKUs) |

Fast Fashion |

| Ajio |

50% |

Premium Wear |

| Flipkart |

60% |

Budget Wear |

Cross-platform scraping helps you adjust your merchandising. Maybe your

bestsellers on Myntra flop on Ajio — why? What can you learn from product reviews? With data

from Web Scraping SHEIN E-Commerce Product Data , you can test new price bands or localize

stock based on real-world trends.

This cross-platform approach strengthens your entire data strategy.

Combined with your E-commerce Product Prices Dataset , you can design geo-targeted campaigns,

competitive pricing, and better promotions.

The future of fashion is connected — and your Product Data Scrape strategy

is what ties it all together.

Why Choose Product Data Scrape?

Choosing the right partner for Scrape Fashion SKU Listings Product from

Myntra & SHEIN is the difference between patchy data and a powerful, reliable feed. The

right provider will offer:

- High-frequency updates for accurate tracking

- Scalable scrapers for millions of SKUs

- Clean, structured datasets with historical depth

- Integration with BI dashboards or APIs

A strong Product Data Scrape partner doesn’t just deliver raw data — they empower your merchandising, pricing, and marketing teams to act on it.

Conclusion

The global fashion SKU race isn’t slowing down. Staying ahead means investing in robust tools to Scrape Fashion SKU Listings Product from Myntra & SHEIN and transform raw data into smarter, faster decisions. Start leveraging reliable E-commerce Data Scraping Services today to unlock the next level of fashion intelligence. Ready to scrape? Contact us now to get your custom dataset!

.webp)

.webp)

.webp)