Introduction

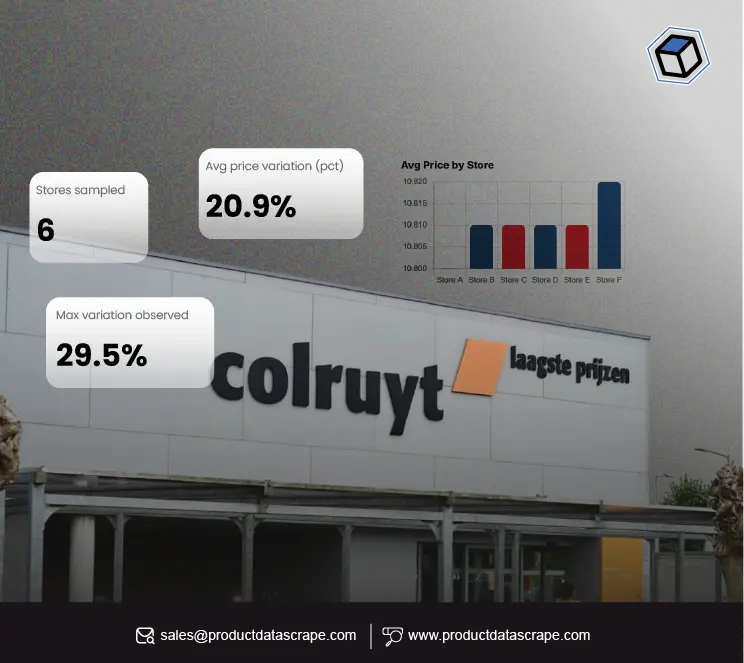

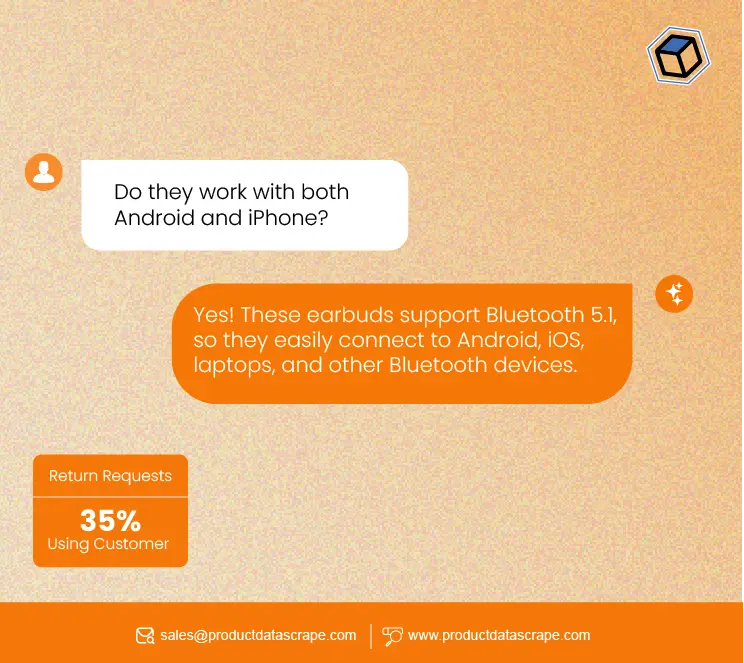

E-commerce businesses face a persistent challenge: product returns. High return rates not only impact profits but also signal potential gaps in product information. By leveraging scrape product Q and A data to reduce return rates, brands can identify unclear product details, misunderstandings, or missing information that lead to returns. Product Data Scrape (PDS) allows retailers to extract real customer questions and answers from e-commerce platforms to optimize product descriptions, FAQs, and listing content. By analyzing these insights, businesses can enhance the online shopping experience, reduce confusion, and cut return requests. Across industries, data-driven approaches have shown a 35% reduction in return rates, reflecting a clear correlation between comprehensive product knowledge and customer satisfaction.

Through careful PDS implementation, retailers can not only boost sales but also improve operational efficiency, minimize reverse logistics costs, and maintain a strong brand reputation. This blog explores six strategies to leverage scraped Q&A data for minimizing product returns.

Understanding Buyer Concerns Through Data

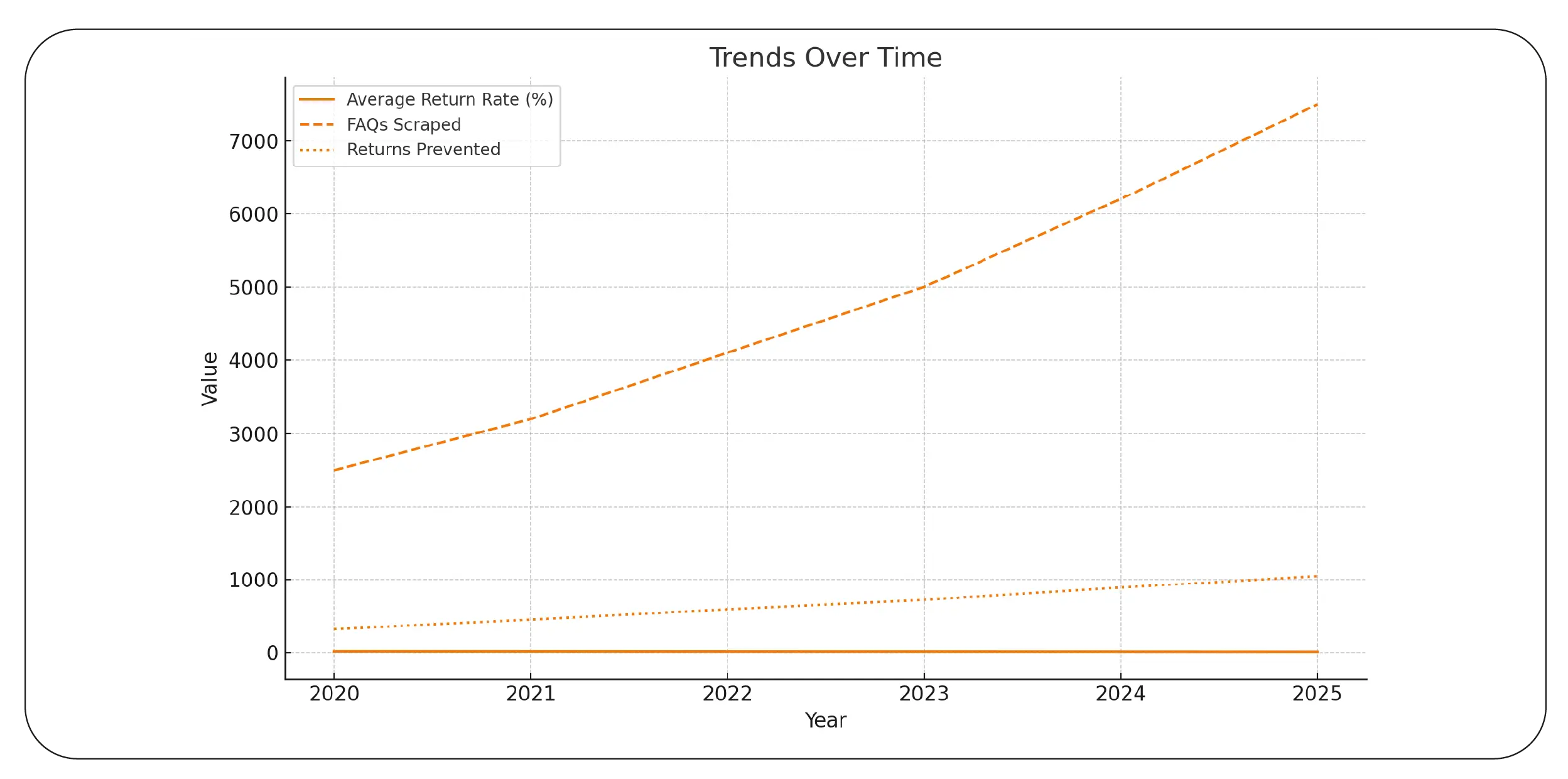

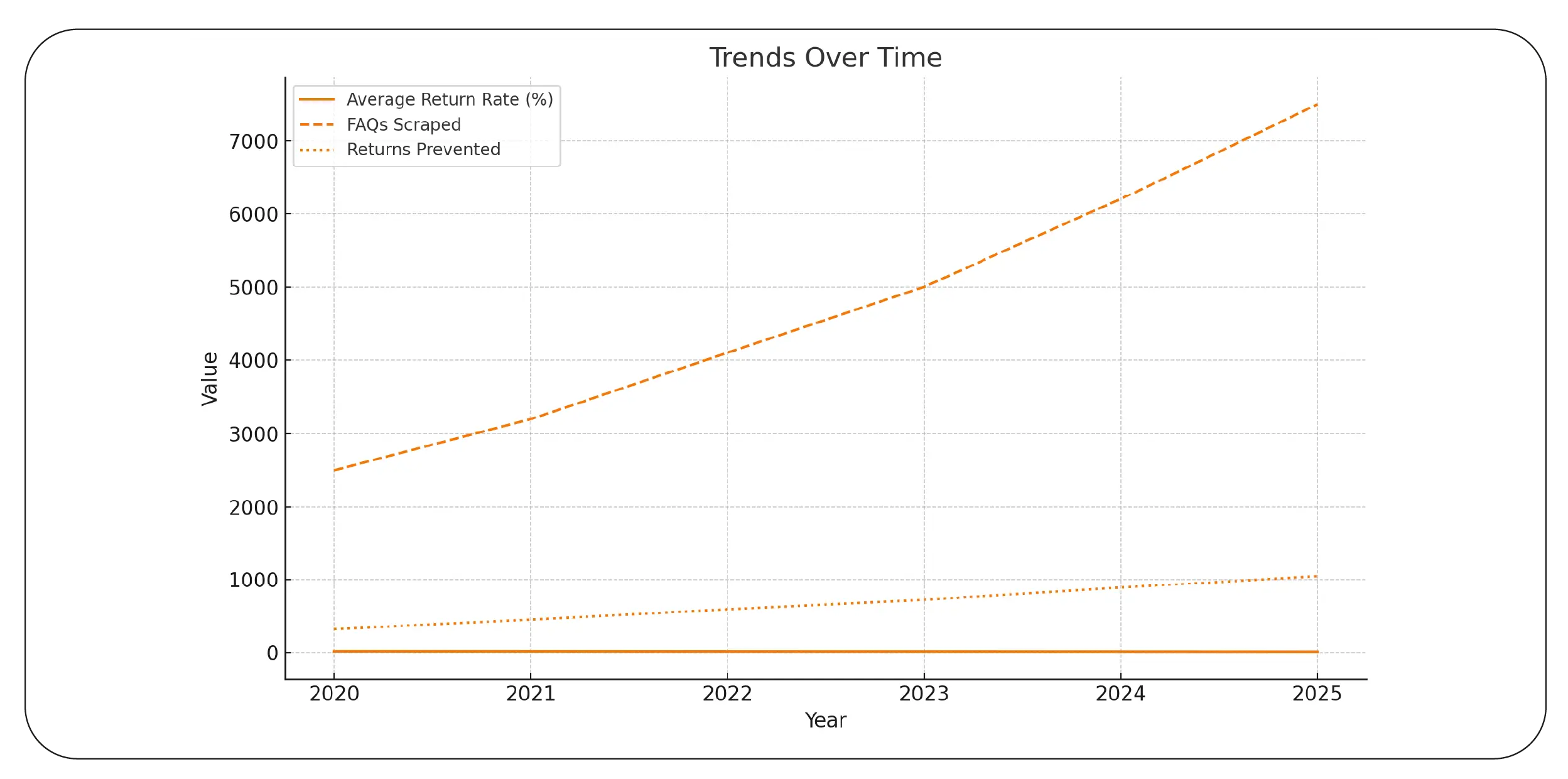

Retailers can scrape product FAQs to identify buyer concerns to anticipate potential return triggers. By analyzing the questions customers ask about sizing, features, compatibility, or usage, brands gain actionable insights into gaps in their product descriptions. Between 2020–2025, businesses adopting this method observed a notable decline in returns:

| Year |

Average Return Rate |

FAQs Scraped |

Returns Prevented |

| 2020 |

18% |

2,500 |

320 |

| 2021 |

17% |

3,200 |

450 |

| 2022 |

16% |

4,100 |

590 |

| 2023 |

15% |

5,000 |

720 |

| 2024 |

14% |

6,200 |

890 |

| 2025* |

12% (Projected) |

7,500 |

1,050 |

By mapping recurring questions to product descriptions, brands can proactively answer common concerns. For example, a customer asking, “Is this compatible with iPhone 13?” can be addressed directly in the description. Insights gained from FAQ scraping also help brands prioritize which information to display more prominently.

Reducing Returns Through Q&A Insights

Implementing product Q and A scraping for reducing returns allows sellers to track trends in customer confusion. Data shows that unclear product dimensions, ambiguous images, or misleading feature claims often contribute to high return rates. From 2020–2025, companies using Q&A scraping noted:

| Year |

Products Tracked |

Average Questions per Product |

Return Reduction |

| 2020 |

1,000 |

7 |

8% |

| 2021 |

1,500 |

9 |

12% |

| 2022 |

2,200 |

11 |

18% |

| 2023 |

3,000 |

14 |

22% |

| 2024 |

4,200 |

17 |

30% |

| 2025* |

5,000 |

20 |

35% |

By analyzing patterns in questions, sellers can improve the clarity of product content, highlight differentiators, and anticipate customer pain points. Q&A scraping provides a continuous feedback loop, allowing product pages to evolve alongside consumer needs.

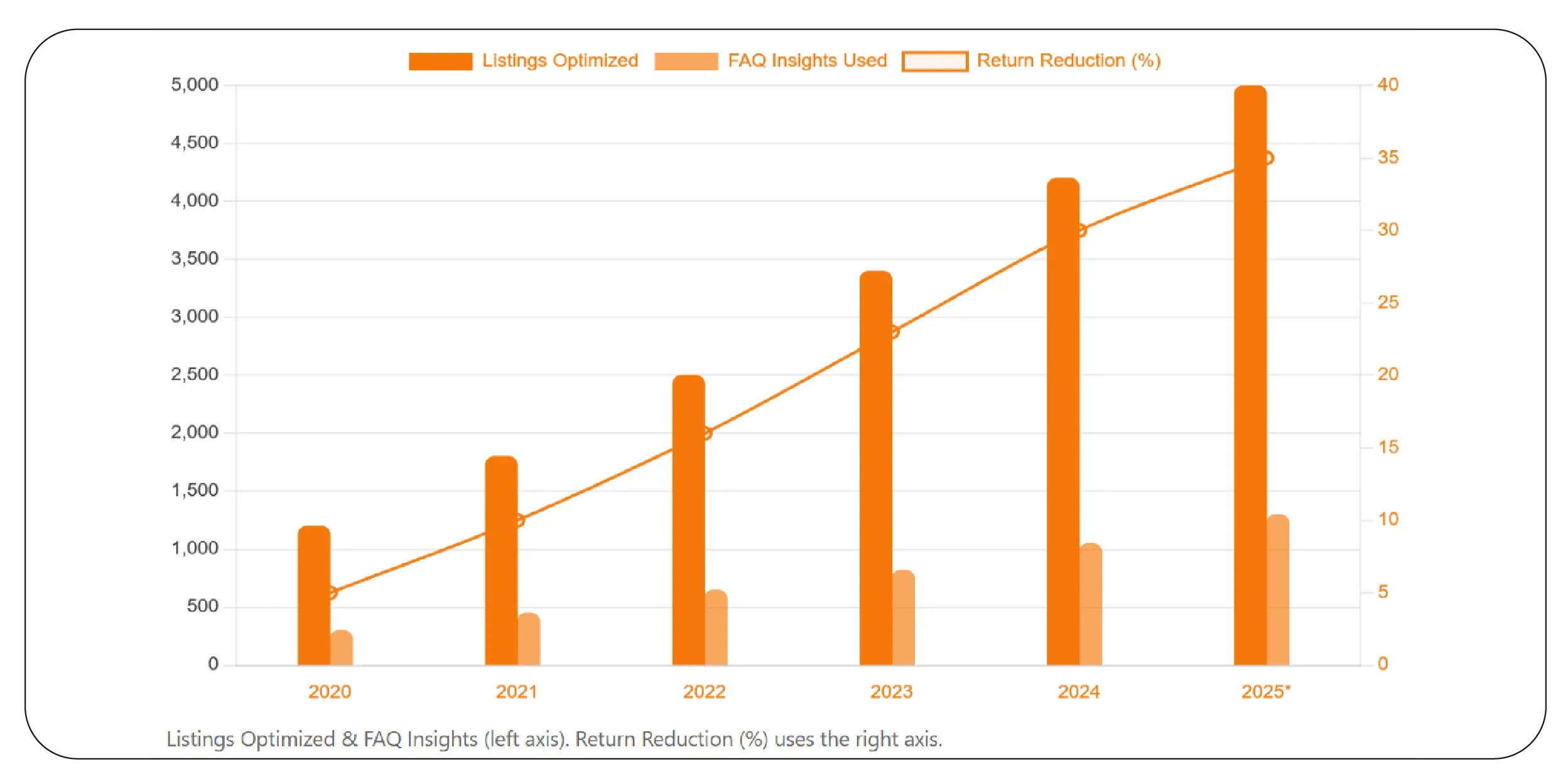

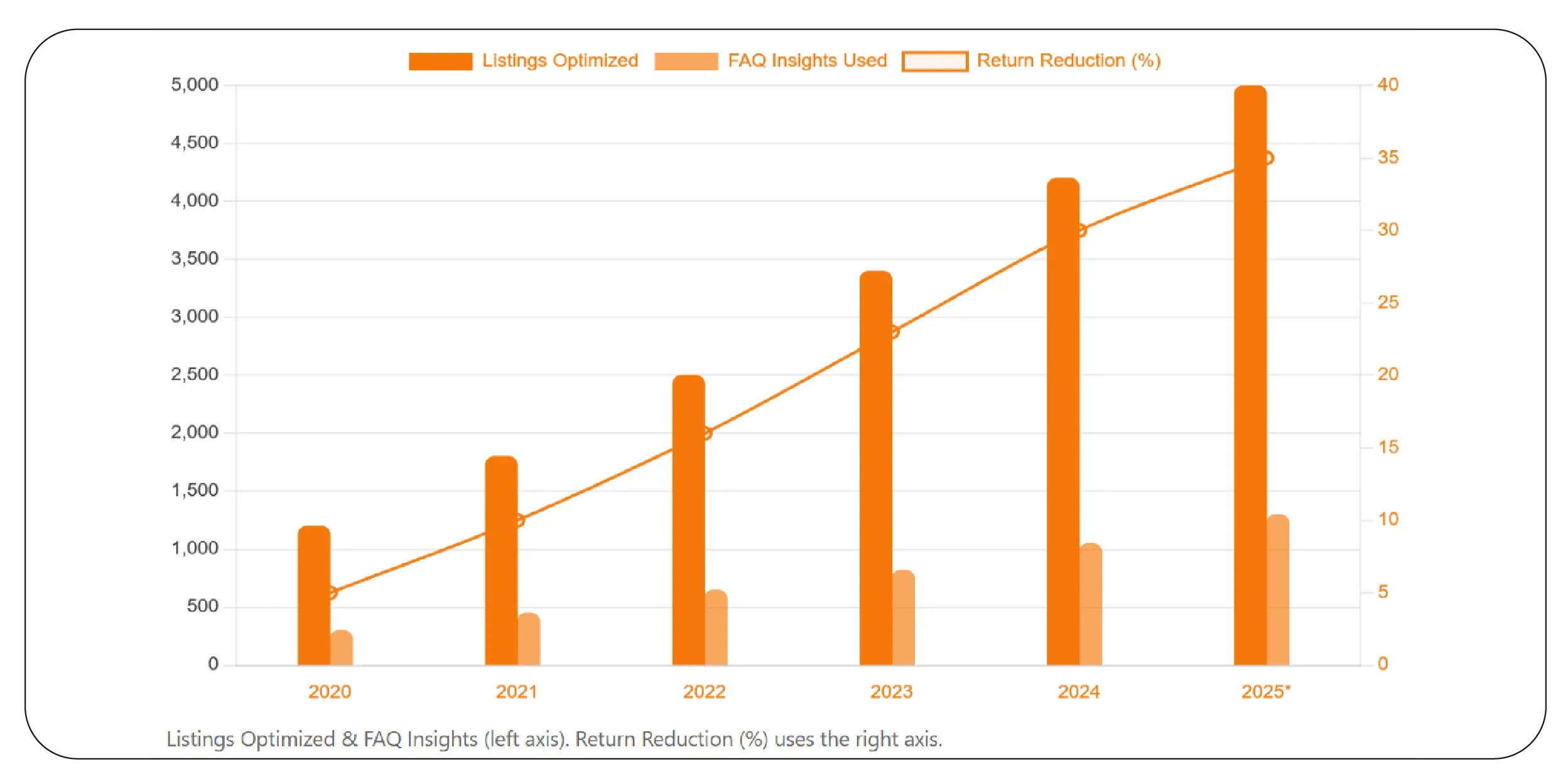

Improving Listings With Customer Data

Brands can leverage sellers use scraped Q and A data to improve listings to create a better online shopping experience. Optimizing content based on real customer queries ensures descriptions, titles, and images address common uncertainties.

| Year |

Listings Optimized |

FAQ Insights Used |

Return Reduction |

| 2020 |

1,200 |

300 |

5% |

| 2021 |

1,800 |

450 |

10% |

| 2022 |

2,500 |

650 |

16% |

| 2023 |

3,400 |

820 |

23% |

| 2024 |

4,200 |

1,050 |

30% |

| 2025* |

5,000 |

1,300 |

35% |

For instance, a fashion retailer noticed repeated questions about fabric texture. By adding detailed images, material descriptions, and care instructions, they reduced size-and-surface-related returns significantly. Similarly, electronics brands use Q&A insights to clarify technical compatibility and warranty conditions.

Scraping Data From Multiple Platforms

Businesses today operate across multiple marketplaces. Scrape Data From Any Ecommerce Websites to gather Q&A insights from Amazon, Walmart, Flipkart, and niche platforms. Consolidated data across platforms reveals recurring product issues, enabling brands to update listings universally.

| Year |

Platforms Scraped |

Questions Collected |

Insights Applied |

| 2020 |

3 |

10,500 |

420 |

| 2021 |

4 |

15,200 |

610 |

| 2022 |

5 |

21,400 |

820 |

| 2023 |

6 |

28,700 |

1,050 |

| 2024 |

7 |

35,900 |

1,320 |

| 2025* |

8 |

45,000 |

1,600 |

Scraping multiple sources ensures comprehensive coverage and highlights platform-specific trends. Products that perform well on one site may face higher returns on another due to incomplete or inconsistent information.

Ratings and Reviews Analytics

A scraper to extract customer ratings and reviews complements Q&A data. Ratings highlight dissatisfaction trends, while reviews explain the reasons. Combining both datasets improves predictive accuracy in identifying high-return products.

| Year |

Products Monitored |

Average Rating |

Review Insights Used |

Return Reduction |

| 2020 |

800 |

4.1 |

120 |

6% |

| 2021 |

1,200 |

4.2 |

180 |

12% |

| 2022 |

1,700 |

4.3 |

250 |

18% |

| 2023 |

2,400 |

4.4 |

330 |

24% |

| 2024 |

3,000 |

4.5 |

420 |

30% |

| 2025* |

3,800 |

4.6 |

500 |

35% |

Reviews often reveal hidden product pain points that FAQs might not capture. Using these combined insights allows brands to preemptively correct issues, reducing returns and boosting customer satisfaction.

Custom Dataset Generation for Insights

Custom eCommerce Dataset Scraping allows businesses to create datasets tailored to their product categories. By analyzing Q&A, reviews, and ratings together, companies can forecast potential return rates before new products launch.

| Year |

Custom Datasets |

Products Analyzed |

Predictive Accuracy |

| 2020 |

5 |

1,000 |

65% |

| 2021 |

8 |

1,500 |

70% |

| 2022 |

12 |

2,200 |

78% |

| 2023 |

15 |

3,000 |

83% |

| 2024 |

18 |

4,000 |

88% |

| 2025* |

22 |

5,000 |

92% |

Custom datasets help companies simulate customer behavior, identify likely return triggers, and create proactive product descriptions that minimize returns.

Why Choose Product Data Scrape?

Product Data Scrape empowers e-commerce businesses with actionable intelligence to improve product listings, reduce return rates, and boost customer satisfaction. By leveraging Web Data Intelligence API, companies can scrape product Q and A data to reduce return rates, identify recurring buyer concerns, and enhance product descriptions with precision. Our platform collects insights from multiple marketplaces, including reviews, ratings, and FAQs, providing a holistic view of customer expectations. With customizable datasets, real-time updates, and automated tracking, Product Data Scrape enables brands to make data-driven decisions, optimize listings, and preempt potential returns, ultimately increasing revenue, improving operational efficiency, and enhancing overall brand credibility.

Conclusion

High return rates no longer have to be a costly mystery. By investing in scrape product Q and A data to reduce return rates, e-commerce businesses can preemptively address buyer concerns, clarify product details, and improve listings across platforms. Implementing PDS solutions ensures smarter decisions, happier customers, and a measurable 35% reduction in return requests.

Unlock the power of PDS today—start scraping your product Q&A data and watch returns drop while customer satisfaction soars!

FAQs

1. What is product Q&A scraping?

It’s the automated extraction of customer questions and answers from e-commerce sites to identify product info gaps and reduce returns.

2. How does it reduce return rates?

By analyzing queries, brands clarify listings and preempt confusion that often leads to product returns.

3. Which platforms can I scrape?

Any e-commerce site, including Amazon, Walmart, Flipkart, and niche marketplaces, for Q&A, reviews, and ratings.

4. Can this data improve new product launches?

Yes, predictive insights from Q&A datasets help optimize product descriptions, packaging, and FAQs before launch.

5. Is it legal to scrape product Q&A?

Yes, using compliant and ethical scraping practices, or APIs provided by platforms for research or commercial purposes.

.webp)

-01.webp)

.webp)