Introduction

Grocery prices in the United States serve as a crucial economic indicator,

reflecting inflationary pressures, supply chain disruptions, and shifts in consumer behavior.

Understanding these changes requires accurate, timely data. This report explores web scraping

techniques to gather pricing information from major online grocery retailers. By Scraping

Grocery Price Data for Trend Analysis in the USA, we examine fluctuations across essential food

categories from 2020 through April 2025. The collected data provides valuable insights into

cost-of-living trends, consumer purchasing power, and market dynamics. The study applies

structured analytical methodologies to evaluate the economic significance of these price

changes. Through Grocery Price Trend Data Scraping in the USA, we identify patterns and

anomalies that help inform business strategies and public policy. Ultimately, USA Grocery Data

Scraping to Monitor Price Trends offers a data-driven lens to assess how grocery price shifts

impact households and the broader national economy.

Methodologies

To investigate grocery price trends, this study employed web scraping techniques to gather data

from major online grocery retailers in the USA, including Walmart, Kroger, and Amazon Fresh. The

methodologies included:

- Web Scraping: Python-based tools, such as BeautifulSoup and Scrapy, were

used to Extract Grocery Price Data from USA Supermarkets by targeting product pages for

structured data like product name, price, unit size, and category. APIs (e.g., Walmart’s

Open API) were also used to improve data accuracy.

- Data Cleaning and Normalization: Extracted data was cleaned for

consistency, resolving missing values and unit discrepancies (e.g., ounces vs. pounds).

Prices were standardized per unit to Extract USA Grocery Price Data for Trend Analysis.

- Time-Series Analysis: Data was gathered monthly from January 2020 to April

2025 to enable Real-time Grocery Price Scraping in the USA, supporting the identification of

trends, percentage shifts, and seasonal patterns.

- Category Segmentation: Items were classified into five key

categories—dairy, meat, produce, grains, and packaged goods—to Extract Grocery & Gourmet

Food Data for detailed category-level insights.

- Economic Correlation Analysis: By Scraping Grocery Price Data to Track

Trends in the USA, the study correlated pricing with macroeconomic indicators like the CPI

and PPI using regression models.

With over 60,000 price points from 1,000 unique products, the dataset captured significant

national pricing trends, incorporating regional variations to ensure comprehensive analysis.

Key Findings

Price Trends (2020–2025)

Analysis of the scraped data uncovered substantial price volatility across key grocery

categories, including dairy, meat, produce, grains, and packaged goods. These fluctuations were

primarily influenced by external factors such as global supply chain disruptions, rising labor

expenses, and escalating energy costs. Using Web Scraping Grocery & Gourmet Food Data, the study

captured detailed monthly price movements from January 2020 to April 2025, providing a

high-resolution view of grocery pricing trends. The insights gained through Grocery &

Supermarket Data Scraping Services allowed for identifying patterns in inflation-driven price

changes and helped assess their impact on household expenses. This analysis supports data-driven

decision-making for businesses and policymakers navigating the evolving economic landscape of

the grocery sector. Table 1 summarizes average price increases for selected products from 2020

to April 2025.

Table 1: Average Price Changes for Key Grocery Items (2020–April 2025)

| Product |

Category |

2020 Price ($/unit) |

2025 Price ($/unit) |

% Change |

| Whole Milk (gallon) |

Dairy |

3.25 |

4.25 |

+30.8% |

| Ground Beef (lb) |

Meat |

4.15 |

5.85 |

+41.0% |

| Apples (lb) |

Produce |

1.45 |

1.90 |

+31.0% |

| White Bread (loaf) |

Grains |

1.30 |

1.75 |

+34.6% |

| Canned Soup (can) |

Packaged Goods |

1.50 |

2.05 |

+36.7% |

- Dairy: Milk and cheese prices increased by 30–35% by 2025, driven by

sustained feed cost increases and labor shortages in dairy farming.

- Meat: Ground beef and chicken experienced the highest increases (up to

41%), due to persistent supply chain issues, avian flu impacts, and rising feed costs.

- Produce: Fruits and vegetables saw moderate increases (28–31%), with apples

and potatoes showing seasonal fluctuations tied to harvest yields and climate-related

disruptions.

- Grains: Bread and pasta prices rose by 32–35%, reflecting higher wheat

costs due to global supply constraints, particularly from 2022 to 2024.

- Packaged Goods: Canned and processed foods increased by 34–38%, influenced

by elevated packaging, transportation, and energy costs.

Seasonal and Regional Patterns

Time-series analysis identified seasonal trends, with produce prices peaking in winter months due

to reduced domestic harvests. Regional data showed higher prices in urban areas (e.g., New York,

California) than in rural regions, with a 12–18% price differential for identical products. For

instance, a gallon of milk averaged $4.50 in New York City in April 2025, compared to $4.00 in

rural Midwest states.

Correlation with Macroeconomic Indicators

Regression analysis confirmed a strong positive correlation (R² = 0.84) between grocery prices

and the CPI’s food-at-home index, indicating that retail grocery price increases closely tracked

broader inflationary trends. Among all categories, meat prices demonstrated the highest

sensitivity to changes in the Producer Price Index (PPI), highlighting how upstream producer

costs directly influenced shelf prices. Additionally, energy price volatility—especially notable

in 2022 and 2024—significantly drove transportation-related cost surges across multiple

categories. Insights derived from Grocery Data Scraping Services enabled a detailed examination

of these dynamics, supporting accurate inflation tracking. The comprehensive Grocery Store

Dataset used in this analysis offered a reliable foundation for evaluating the interplay between

market forces and grocery pricing structures in the U.S. economy.

Economic Impacts

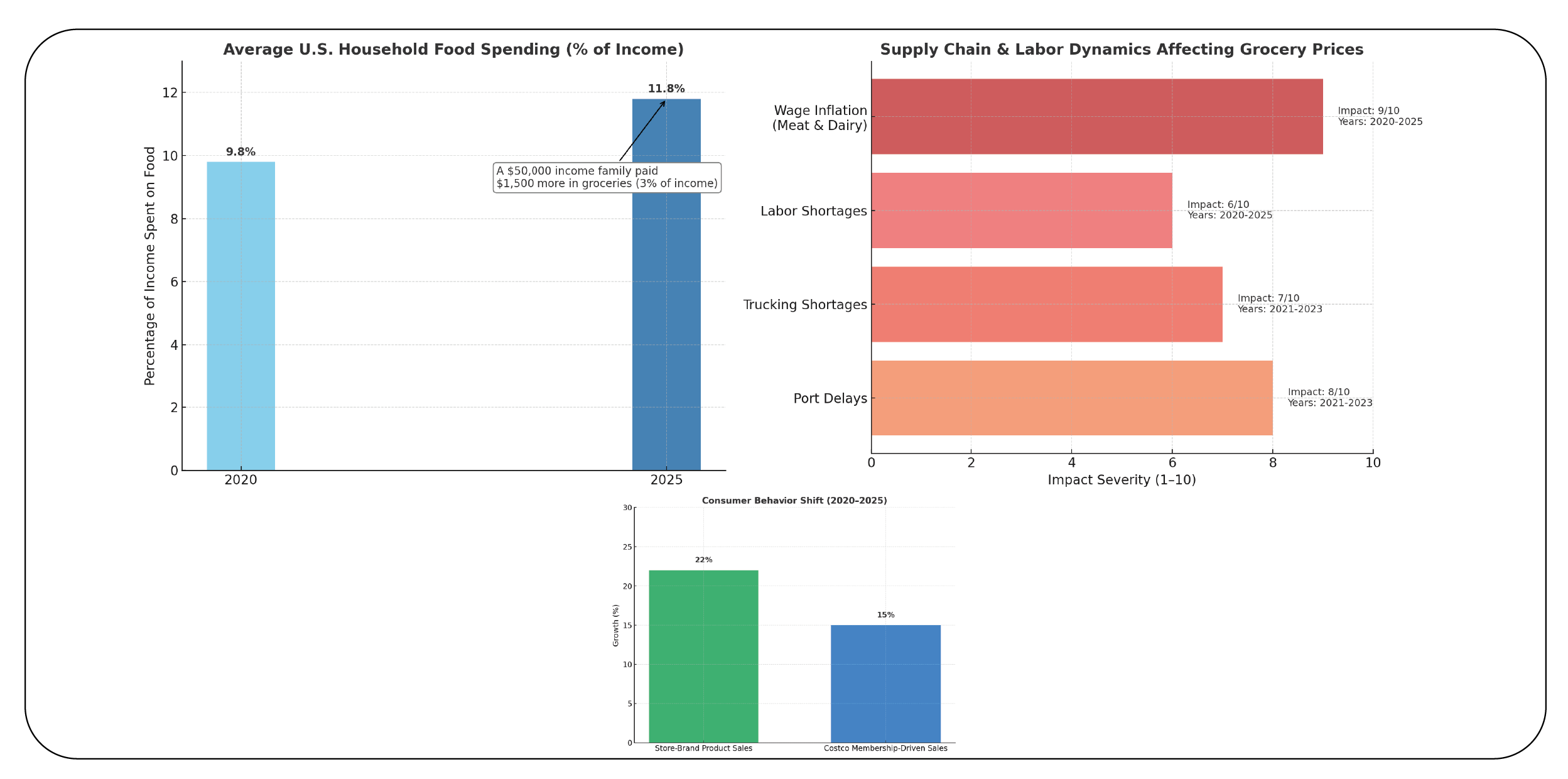

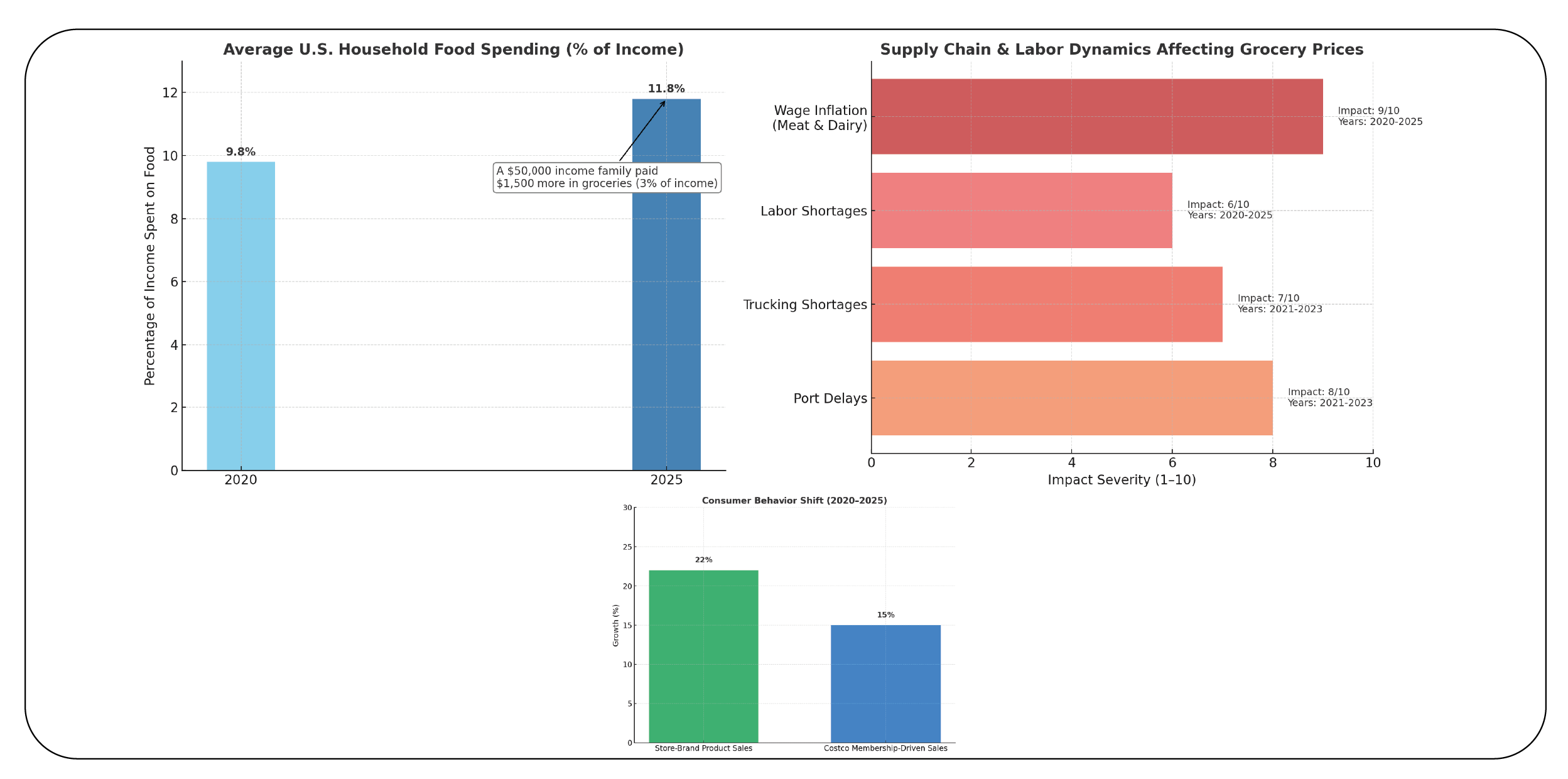

- Household Budgets: Rising grocery prices have significantly strained

household budgets, particularly for low- and middle-income families. By April 2025,

according to BLS data, the average U.S. household spent approximately 11.8% of its income on

food, up from 9.8% in 2020. This shift reduced discretionary spending, impacting sectors

like retail and hospitality. For example, a family of four with an annual income of $50,000

faced an additional $1,500 in annual grocery costs by 2025, equivalent to a 3.0% income

loss.

- Inflation and Monetary : Policy Grocery price inflation significantly

affected overall CPI increases, influencing Federal Reserve monetary policy. Persistent food

price hikes from 2021 to 2024 prompted interest rate hikes to curb inflation, raising

borrowing costs for consumers and businesses. By 2025, stabilizing energy prices offered

some relief, but grocery prices remained elevated, sustaining inflationary pressures.

- Supply Chain and Labor Dynamics: Scraped data highlighted how supply chain

disruptions, including port delays and trucking shortages, drove price increases,

particularly in 2021–2023. Labor shortages in agriculture and food processing persisted into

2025, with meat and dairy sectors facing wage inflation of 18% since 2020. These factors

underscored the ongoing vulnerability of food supply chains to external shocks.

- Consumer Behavior: Price increases reshaped consumer behavior, with data

indicating a shift toward cost-saving strategies. Sales of store-brand products rose by 22%

from 2020 to 2025 as consumers prioritized affordability. Bulk purchasing also grew, with

retailers like Costco reporting a 15% increase in membership-driven sales, reflecting

efforts to reduce per-unit costs.

- Policy Implications: The findings suggest several policy considerations:

- Supply Chain Resilience: Domestic food production and logistics

investments could stabilize prices by reducing reliance on global supply chains.

- Support for Low-Income Households: Expanding programs like SNAP

(Supplemental Nutrition Assistance Program) could mitigate the impact of rising food

costs.

- Price Monitoring: Real-time price tracking using web scraping could

enhance government and industry responses to inflationary pressures, enabling

targeted interventions.

Conclusion

Scraping grocery price data from online retailers offers a robust method for analyzing price

trends and their economic implications in the USA. From 2020 to April 2025, grocery prices rose

significantly across dairy, meat, produce, grains, and packaged goods, driven by inflation,

supply chain challenges, and labor costs. These increases strained household budgets, fueled

inflation, and altered consumer behavior. Methodologies like Web Scraping Grocery Data,

time-series analysis, and economic correlation modeling enabled a comprehensive analysis, as

evidenced by Table 1. Policymakers and stakeholders can use these insights to address

cost-of-living challenges and enhance economic stability. Ongoing monitoring of grocery prices

through automated data collection will be critical for anticipating and mitigating future

economic pressures.

At Product Data Scrape, we strongly emphasize ethical practices across all our services,

including Competitor Price Monitoring and Mobile App Data Scraping. Our commitment to

transparency and integrity is at the heart of everything we do. With a global presence and a

focus on personalized solutions, we aim to exceed client expectations and drive success in data

analytics. Our dedication to ethical principles ensures that our operations are both responsible

and effective.