Introduction

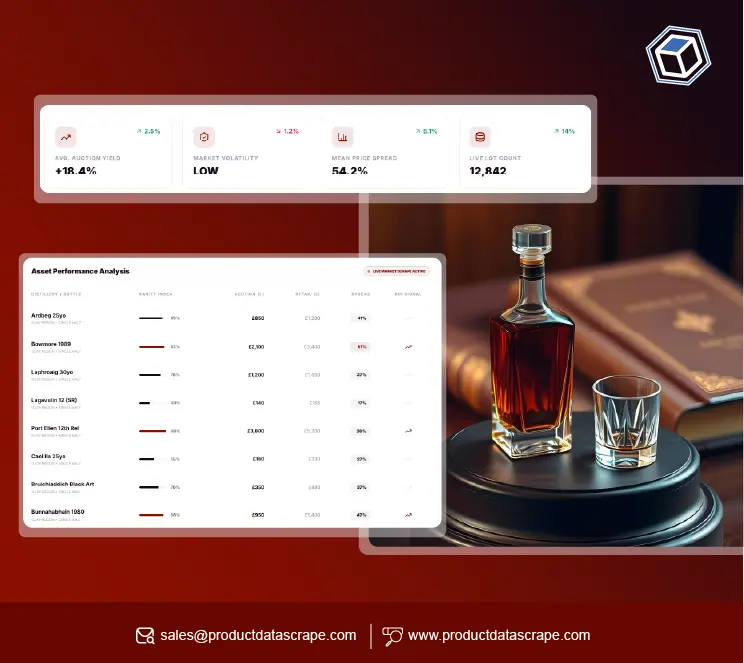

In the highly competitive market of rare whiskey, accurate pricing and

inventory intelligence is essential for both investors and retailers. Leveraging real-time

insights can significantly improve buying and selling strategies, minimize risks, and optimize

returns. Product Data Scrape specializes in delivering high-quality intelligence through

advanced APIs that track product trends, price fluctuations, and inventory across multiple

platforms. By utilizing a whiskey data scraping API for monitoring, investors can analyze

patterns, detect market gaps, and make data-driven decisions to maximize the value of their

portfolios. The solution integrates with multiple retail sources, allowing extraction of

comprehensive pricing information, including USA Rare whiskey price tracking API and liquor and

whiskey product pricing API, to provide a holistic view of market dynamics. With historical data

spanning several years, users can benchmark investments, understand seasonal price fluctuations,

and identify emerging collector trends, ensuring that every transaction is informed and

strategic.

The Client

The client is a boutique investment firm specializing in high-value spirits,

with a focus on rare and limited-edition whiskey. Catering to both individual collectors and

institutional buyers, the firm needed a comprehensive solution to track whiskey product data

scraping API across multiple online and offline retailers. Their goal was to gain a competitive

advantage by monitoring price movements, inventory levels, and consumer trends in real time.

Previously, the firm relied on manual research and scattered data sources, which was

time-consuming and prone to errors. By partnering with Product Data Scrape, they gained access

to a centralized platform that integrated multiple APIs, including whiskey inventory monitoring

API for collectors and whiskey retail analytics API for tracking, enabling automated monitoring

of market activity. This allowed their analysts to focus on strategy rather than data

collection, and provided actionable insights that informed investment decisions, product

acquisitions, and pricing strategies for rare whiskey collections.

Key Challenges

The client faced several challenges that limited their ability to operate

efficiently in the rare whiskey market. Firstly, data fragmentation made it difficult to

maintain a comprehensive view of prices and inventory across multiple retailers and online

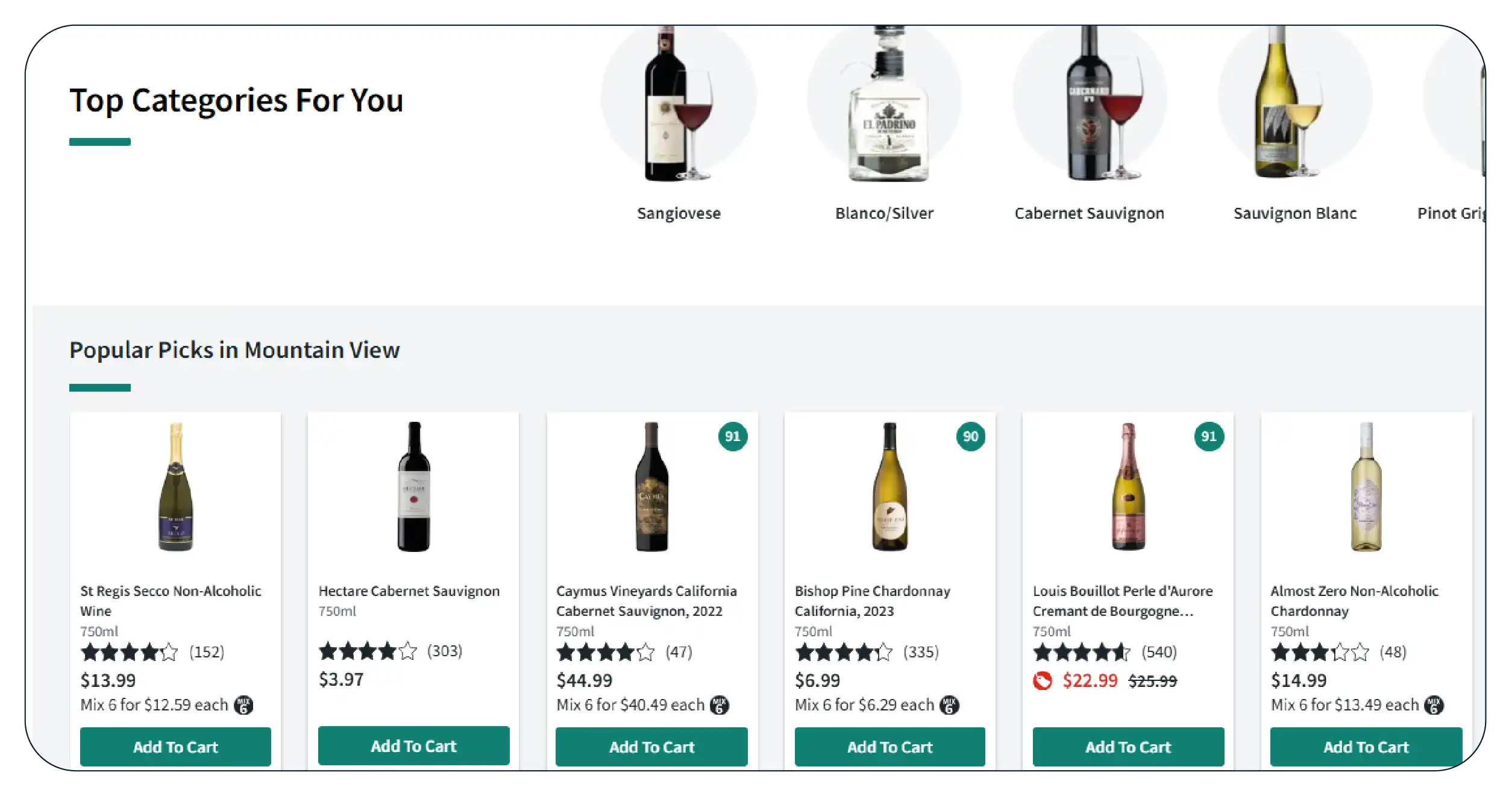

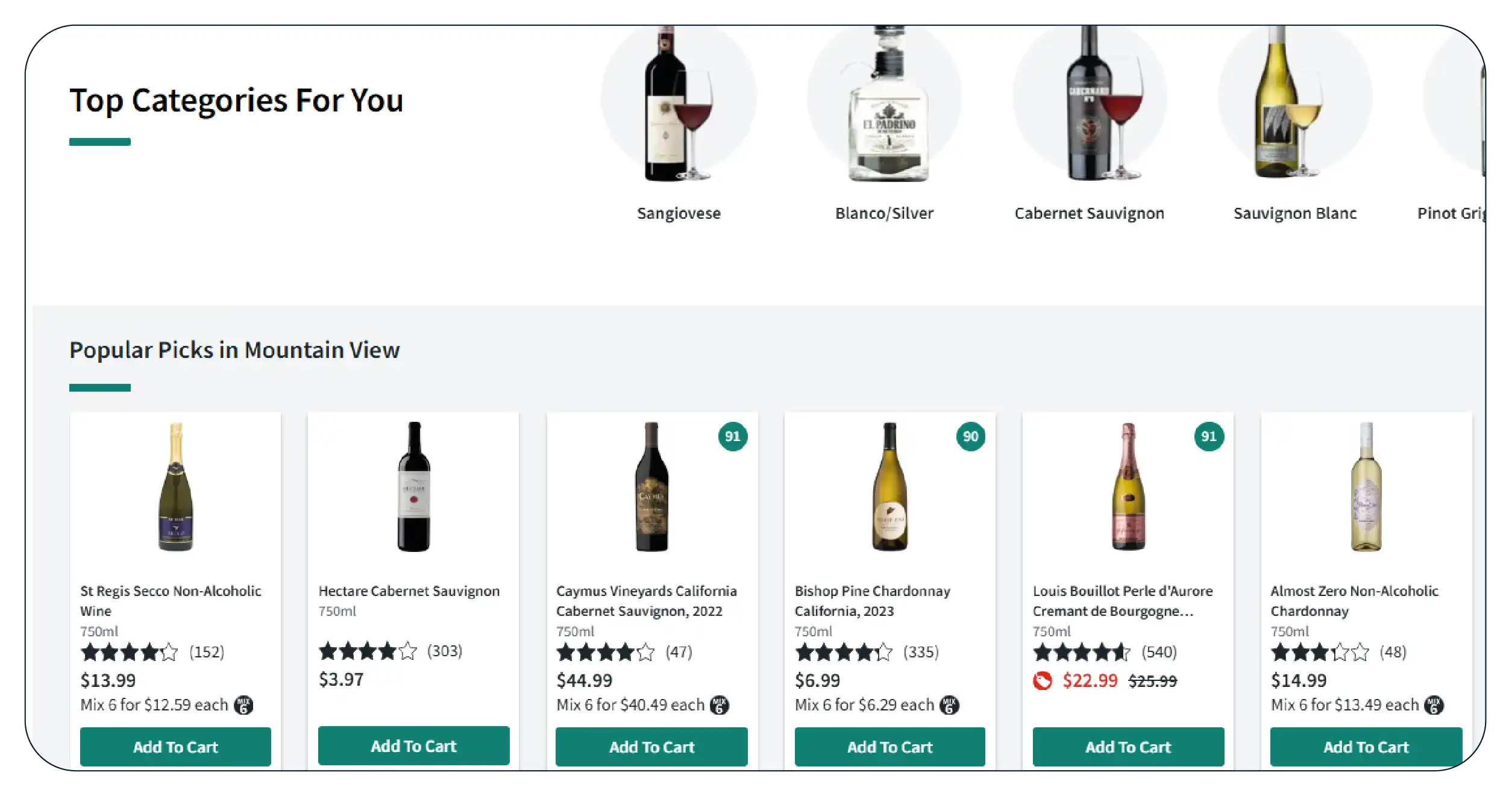

platforms. Extracting information from sources such as TotalWine and Minibar Delivery required

manual effort, increasing the risk of errors and delayed decision-making. Secondly, the highly

volatile nature of rare whiskey pricing meant that small delays could result in missed

opportunities for profitable investments. There was also the challenge of monitoring both

collector-focused and retail-focused platforms simultaneously, which required different metrics

and reporting formats. Additionally, comparing Whiskey vs Vodka Prices with Scraping was

necessary to understand broader trends in the alcohol investment market, but consolidating this

data manually proved impractical. Finally, the client needed historical price tracking and trend

analysis to inform Product Pricing Strategies Service decisions, but lacked a centralized

solution to store, analyze, and visualize this data efficiently. These challenges highlighted

the urgent need for a scalable, automated, and accurate data extraction solution.

Key Solutions

Product Data Scrape implemented a robust whiskey data scraping API for

monitoring solution tailored to the client’s specific investment needs. The platform integrated

multiple data sources to automatically extract pricing and inventory information from both

online and offline retailers. Using the Extract Alcohol & Liquor Price Data module, analysts

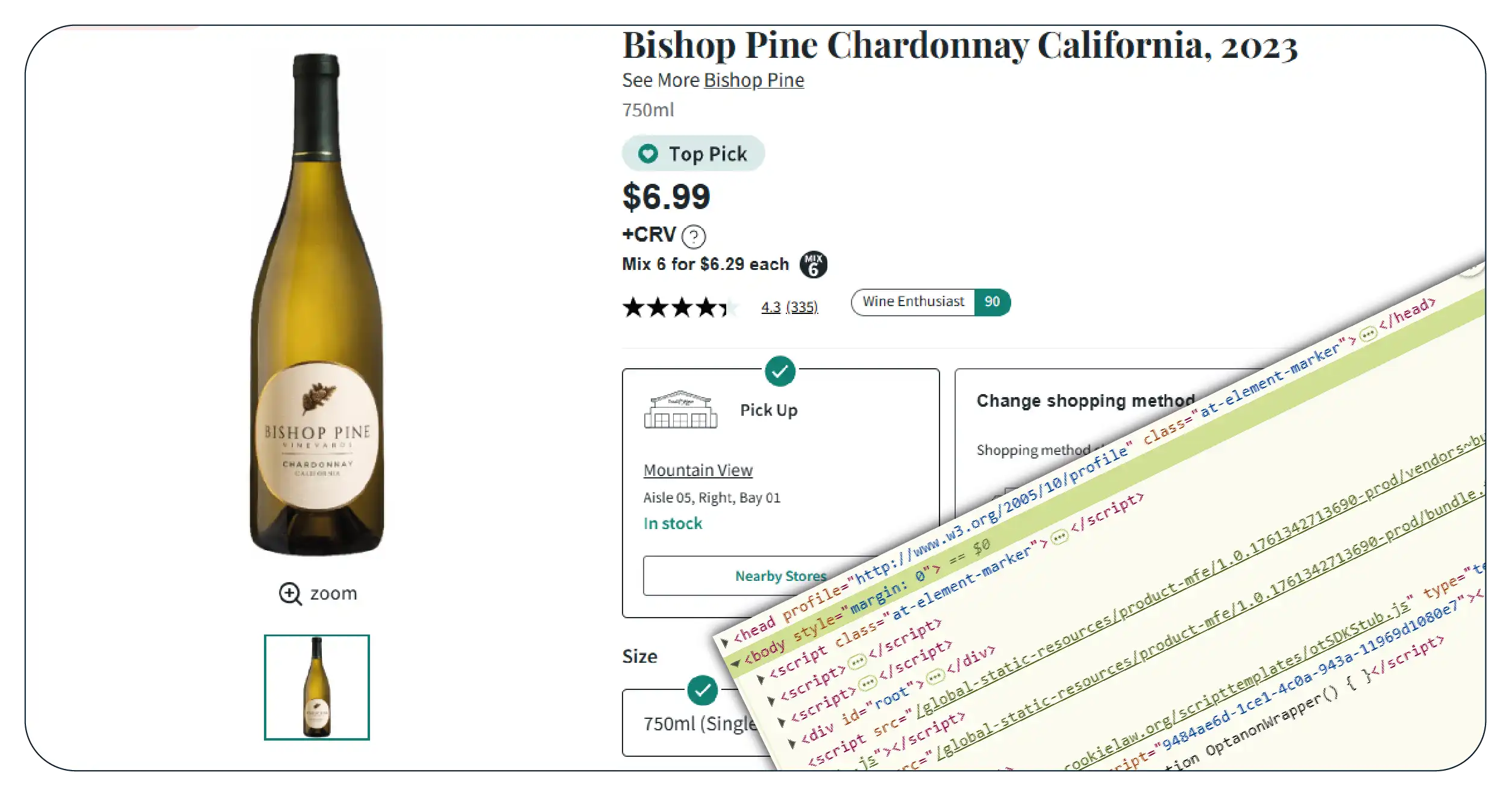

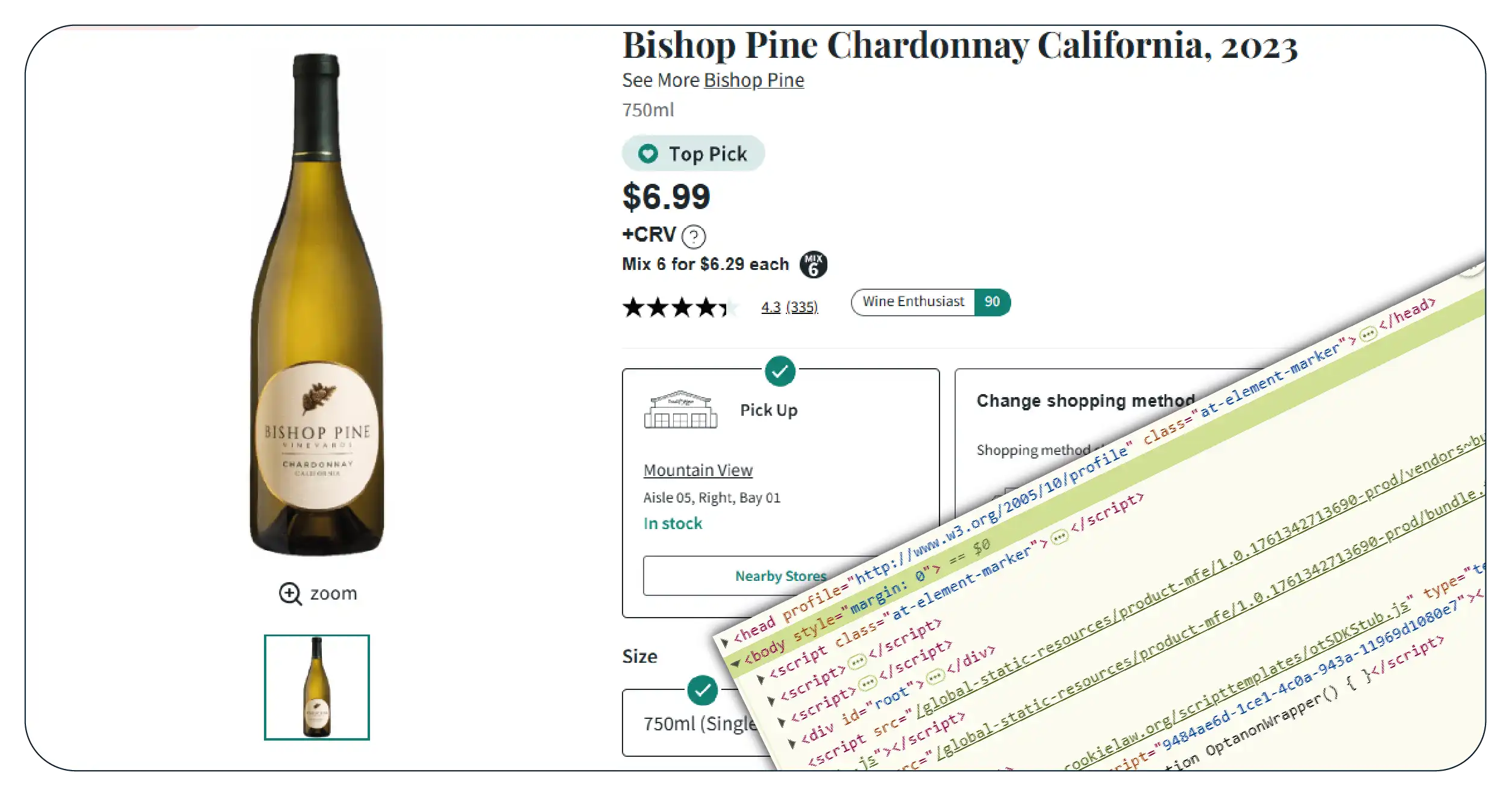

were able to track rare whiskey listings across TotalWine and Minibar Delivery with the Extract

TotalWine Alcohol and Liquor Price Data and Extract Minibar Delivery Alcohol and Liquor Price

Data APIs. Historical and real-time price trends were captured to benchmark fluctuations,

optimize investment timing, and detect undervalued opportunities.

Additionally, the system utilized whiskey retail analytics API for tracking to identify

high-demand products and anticipate market trends. The Pricing Intelligence Services layer

provided actionable insights on price volatility, enabling proactive purchasing decisions. For

collectors, the whiskey inventory monitoring API for collectors ensured visibility into

limited-edition releases and restocks, reducing missed acquisition opportunities. By combining

these tools with the whiskey product data scraping API, the client could compare whiskey and

vodka price trends, analyze investment returns, and make informed decisions with greater

confidence. The platform’s reporting capabilities allowed the client to generate automated

dashboards, track portfolio performance, and implement Web Data Intelligence API insights

directly into their strategy. Overall, the solution streamlined data collection, improved

accuracy, and transformed raw market information into measurable investment intelligence.

Client’s Testimonial

“Partnering with Product Data Scrape has completely transformed the way we manage our whiskey investments. The whiskey data scraping API for monitoring gave us real-time visibility into market prices and inventory that we never had before. Our team can now track trends across multiple retailers without manual research, identify undervalued bottles, and make data-driven decisions that maximize returns. The integration with TotalWine and Minibar Delivery APIs has been a game-changer, and the analytics dashboards allow us to act faster and smarter. This platform has become an indispensable tool for our investment strategy.”

–Portfolio Manager

Conclusion

By leveraging a whiskey data scraping API for monitoring, the client successfully optimized their investment strategies, gaining real-time insights into rare whiskey pricing, inventory, and market trends. Automated data extraction from multiple sources, including TotalWine and Minibar Delivery, reduced manual work and eliminated errors, allowing analysts to focus on strategy and decision-making. The solution also enabled cross-category comparisons, such as Whiskey vs Vodka Prices with Scraping, giving the firm broader market context for investment opportunities. Historical price tracking and predictive analytics helped the client identify emerging trends, anticipate collector demand, and optimize purchase timing. With integrated dashboards and reporting tools, they could monitor portfolio performance and refine pricing strategies using Product Pricing Strategies Service insights. Overall, Product Data Scrape transformed raw data into actionable intelligence, enhancing profitability and reducing risk. For investors and collectors alike, the combination of whiskey inventory monitoring API for collectors and retail analytics capabilities provides a competitive edge in a fast-moving, high-value market.

.webp)