Introduction

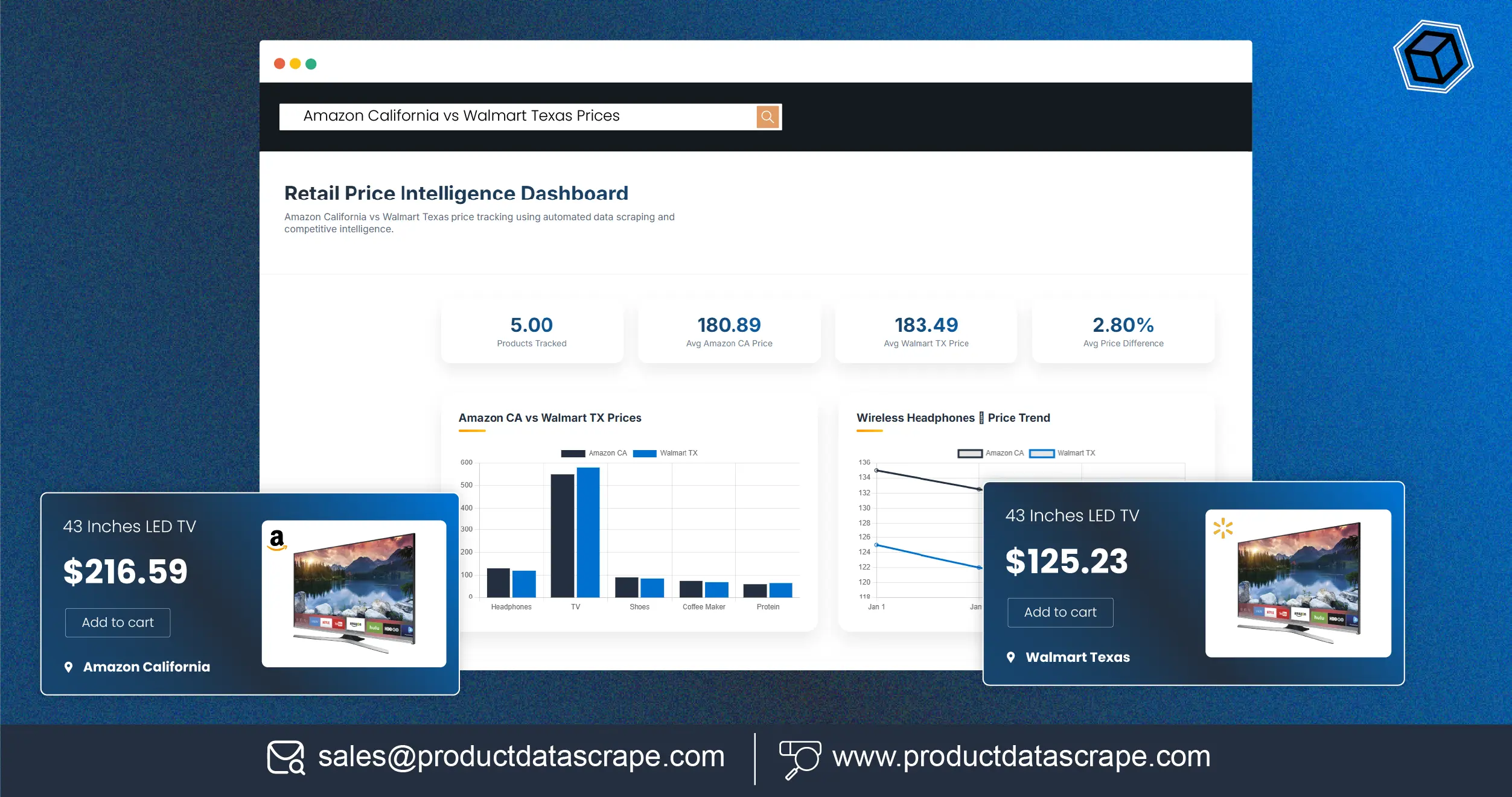

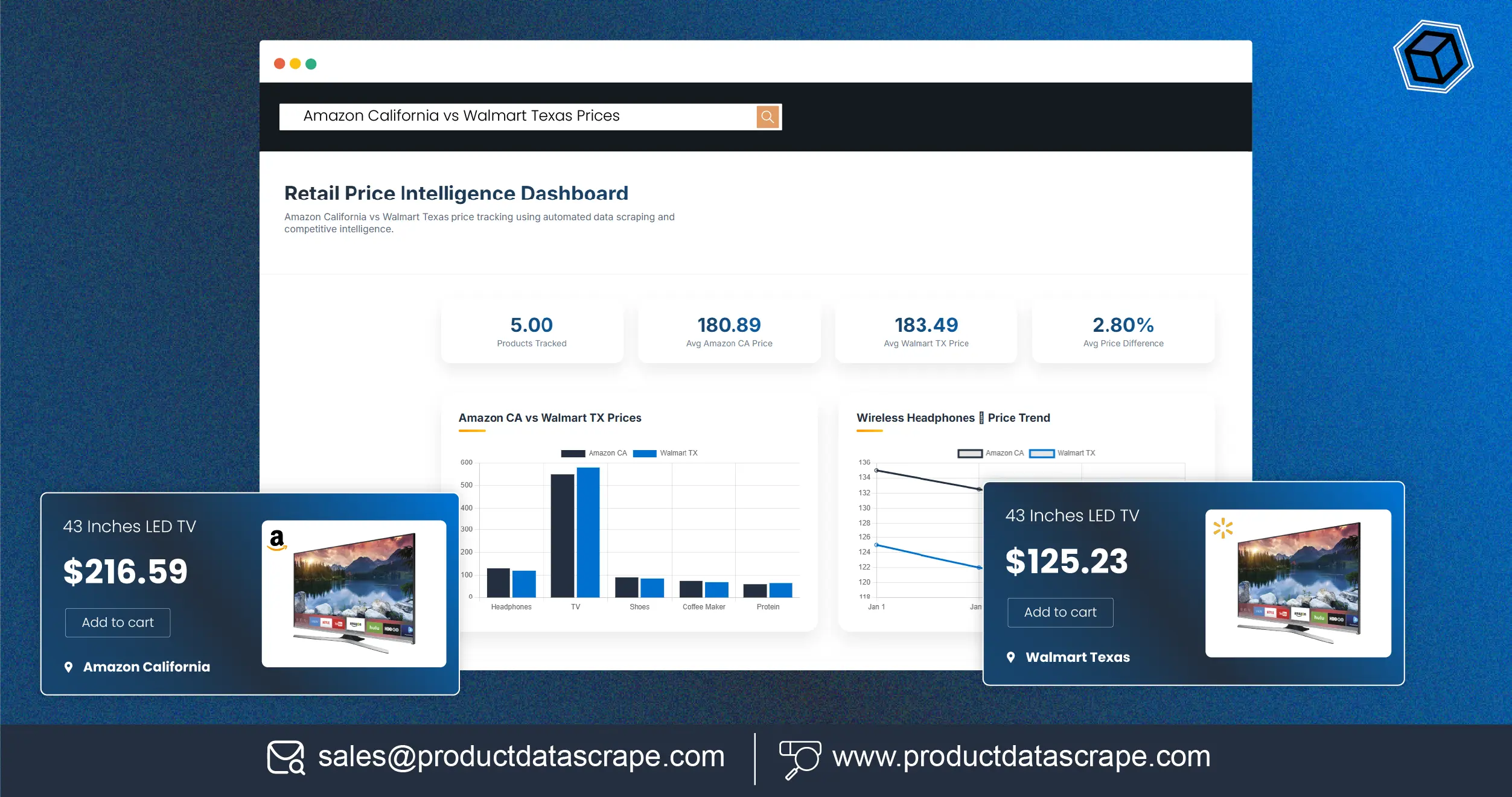

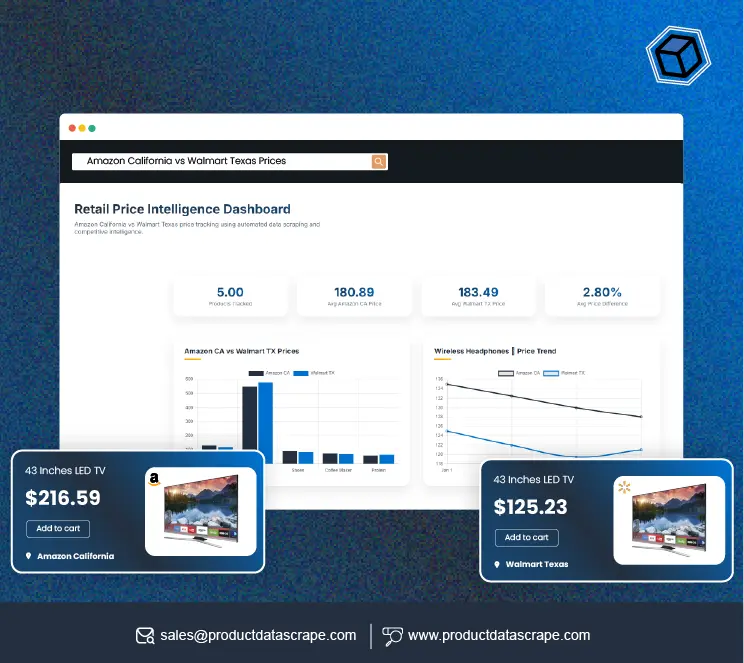

In today’s hypercompetitive retail landscape, pricing intelligence has become a strategic necessity rather than an operational luxury. Brands operating across multiple regions face constant challenges in understanding how geography, logistics, and consumer demand influence product pricing. One of the most effective ways to solve this challenge is Amazon California vs Walmart Texas Prices Using Data Scraping, which enables retailers to compare real-time prices across locations and platforms with unmatched accuracy.

At the same time, customer perception plays a growing role in purchasing behavior. That’s why many retailers also leverage Scrape Amazon and Walmart Reviews Without Coding solutions to analyze buyer sentiment alongside price movements. Together, these technologies help brands gain a complete picture of market positioning—what customers pay, how they feel about products, and why certain regions outperform others. By combining pricing intelligence with review insights, retailers can build stronger pricing strategies, smarter promotions, and more localized retail experiences that truly resonate with consumers.

Regional Pricing Insights That Drive Strategy

Retail brands increasingly rely on Amazon California Walmart Texas price scraping to understand how regional dynamics affect product costs and customer demand. California’s market often reflects premium pricing due to higher logistics and tax structures, while Texas frequently demonstrates competitive pricing driven by lower overheads and strong warehouse distribution networks.

From 2020 to 2026, retailers observed significant price variations between these two states, especially in electronics, apparel, and household essentials. The table below highlights average price differences for selected categories.

| Year |

Category |

California Avg Price ($) |

Texas Avg Price ($) |

Price Gap (%) |

| 2020 |

Electronics |

520 |

485 |

7.2% |

| 2021 |

Apparel |

78 |

72 |

8.3% |

| 2022 |

Home Goods |

145 |

132 |

9.8% |

| 2023 |

Electronics |

540 |

500 |

8.0% |

| 2024 |

Apparel |

82 |

75 |

9.3% |

| 2025 |

Home Goods |

152 |

138 |

10.1% |

| 2026 |

Electronics |

560 |

515 |

8.7% |

These insights help brands adjust regional pricing strategies, introduce geo-targeted promotions, and optimize warehouse allocation. Instead of setting one national price, companies now use granular data to create localized offers that improve sales conversion and customer satisfaction.

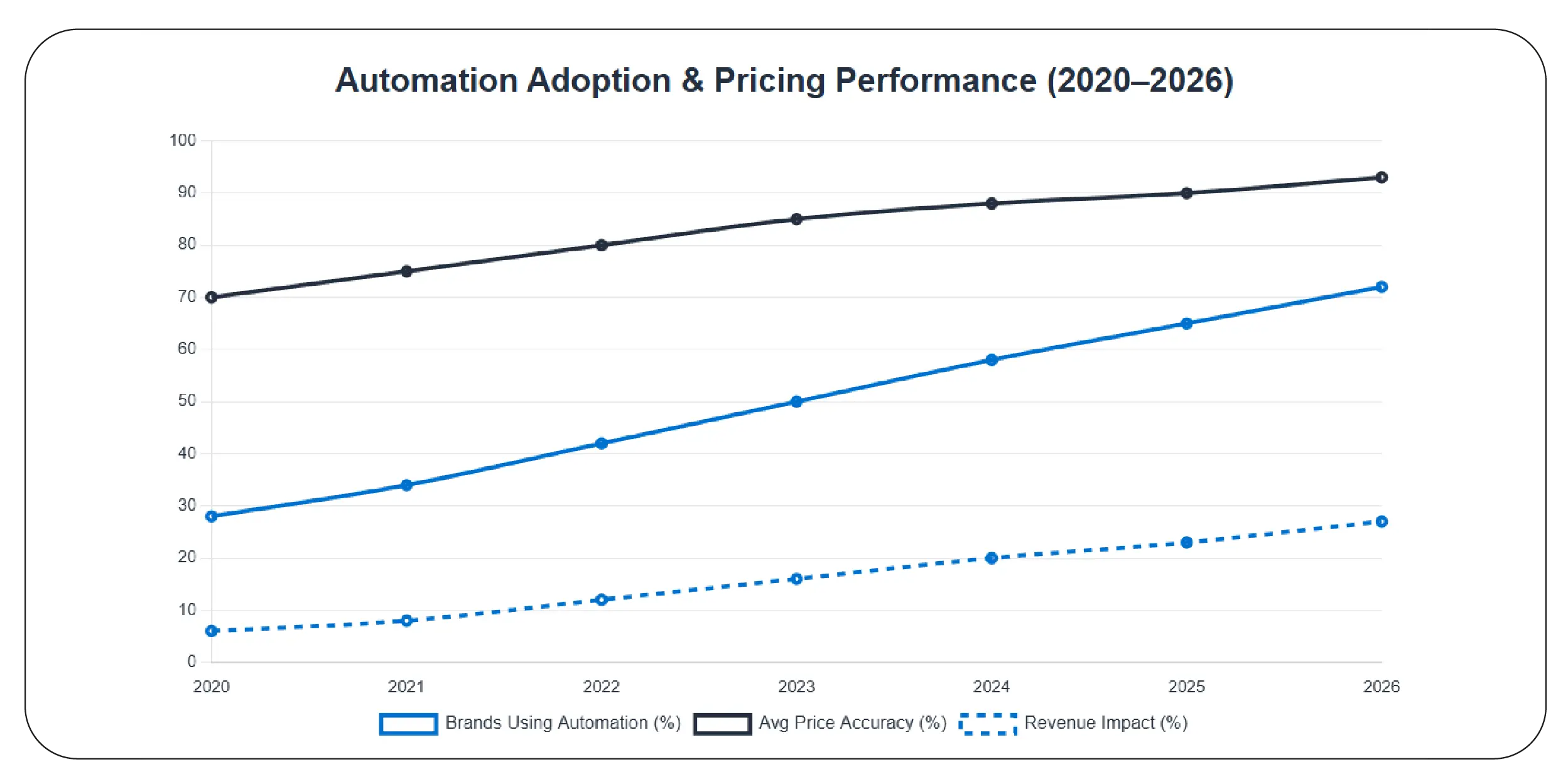

Building Smarter Pricing Models Across Regions

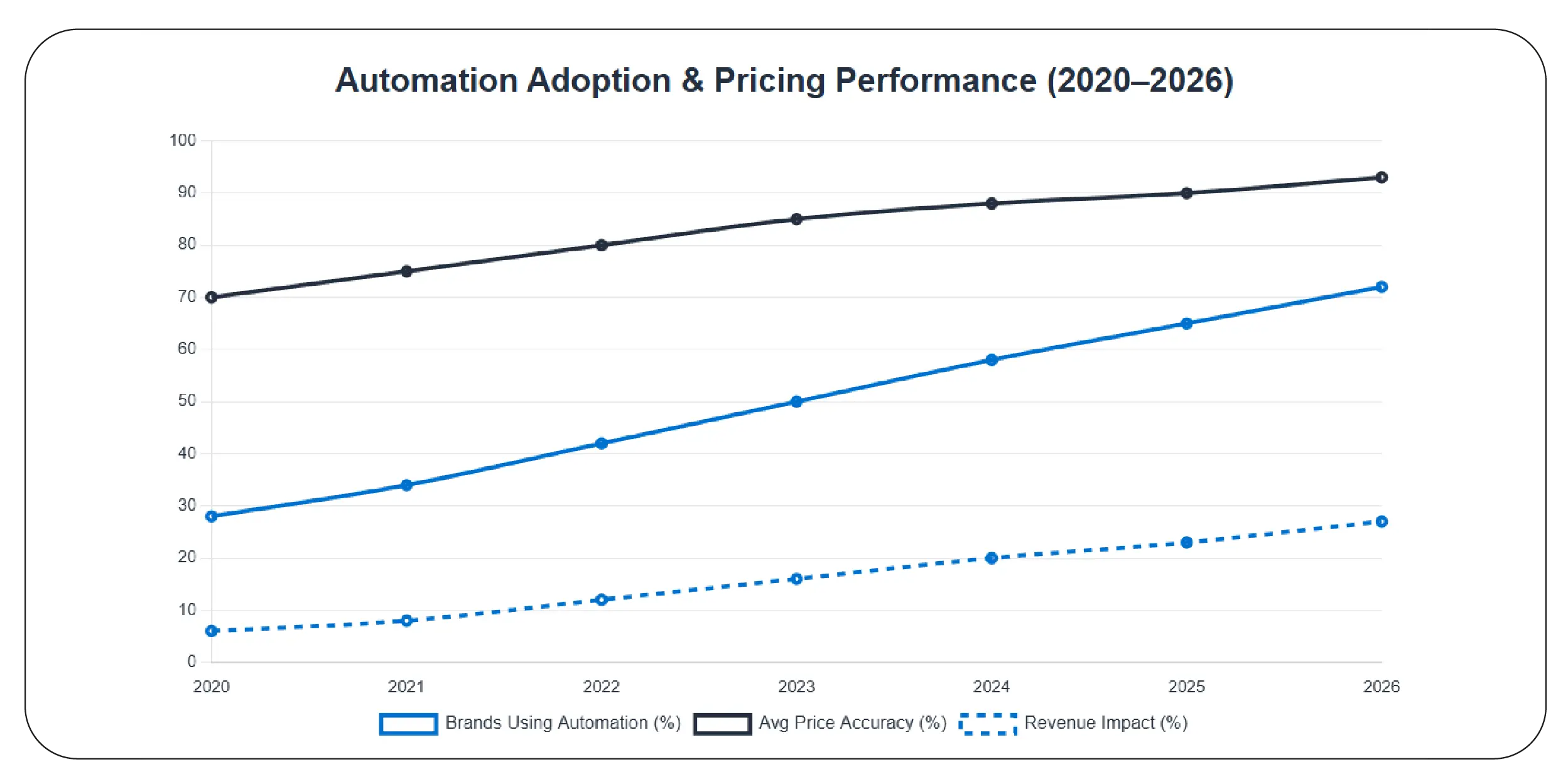

When brands scrape Amazon California and Walmart Texas pricing data, they unlock a powerful mechanism for real-time price comparison and forecasting. This practice allows retailers to move beyond manual audits and spreadsheets, replacing guesswork with automated intelligence.

Between 2020 and 2026, brands that adopted automated pricing data solutions reported up to 35% improvement in price competitiveness. The table below shows how adoption of scraping technology influenced pricing efficiency.

| Year |

Brands Using Automation (%) |

Avg Price Accuracy (%) |

Revenue Impact (%) |

| 2020 |

28 |

70 |

+6 |

| 2021 |

34 |

75 |

+8 |

| 2022 |

42 |

80 |

+12 |

| 2023 |

50 |

85 |

+16 |

| 2024 |

58 |

88 |

+20 |

| 2025 |

65 |

90 |

+23 |

| 2026 |

72 |

93 |

+27 |

Retailers now use this data to implement dynamic pricing engines that automatically adjust product costs based on competitor movements. This ensures they never fall behind on price perception while maintaining healthy margins.

Understanding Long-Term Market Movements

To extract California vs Texas retail price trends data, brands analyze historical datasets to identify patterns that shape future strategies. Long-term trend analysis reveals seasonal fluctuations, economic impacts, and promotional cycles that differ by region.

For example, California often shows price stability during Q4 due to higher consumer spending, while Texas experiences sharper discount cycles driven by volume-based sales strategies. The following table illustrates regional trend shifts over time.

| Year |

California Avg Inflation Impact |

Texas Avg Inflation Impact |

Trend Insight |

| 2020 |

3.1% |

2.4% |

Pandemic-driven demand spike |

| 2021 |

4.2% |

3.6% |

Supply chain disruptions |

| 2022 |

6.8% |

5.9% |

Inflation surge |

| 2023 |

5.1% |

4.3% |

Market stabilization |

| 2024 |

4.6% |

3.9% |

Improved logistics |

| 2025 |

4.2% |

3.5% |

Cost optimization |

| 2026 |

3.8% |

3.2% |

Balanced pricing |

Such insights empower retailers to forecast better, negotiate smarter with suppliers, and align marketing strategies with real-world demand patterns.

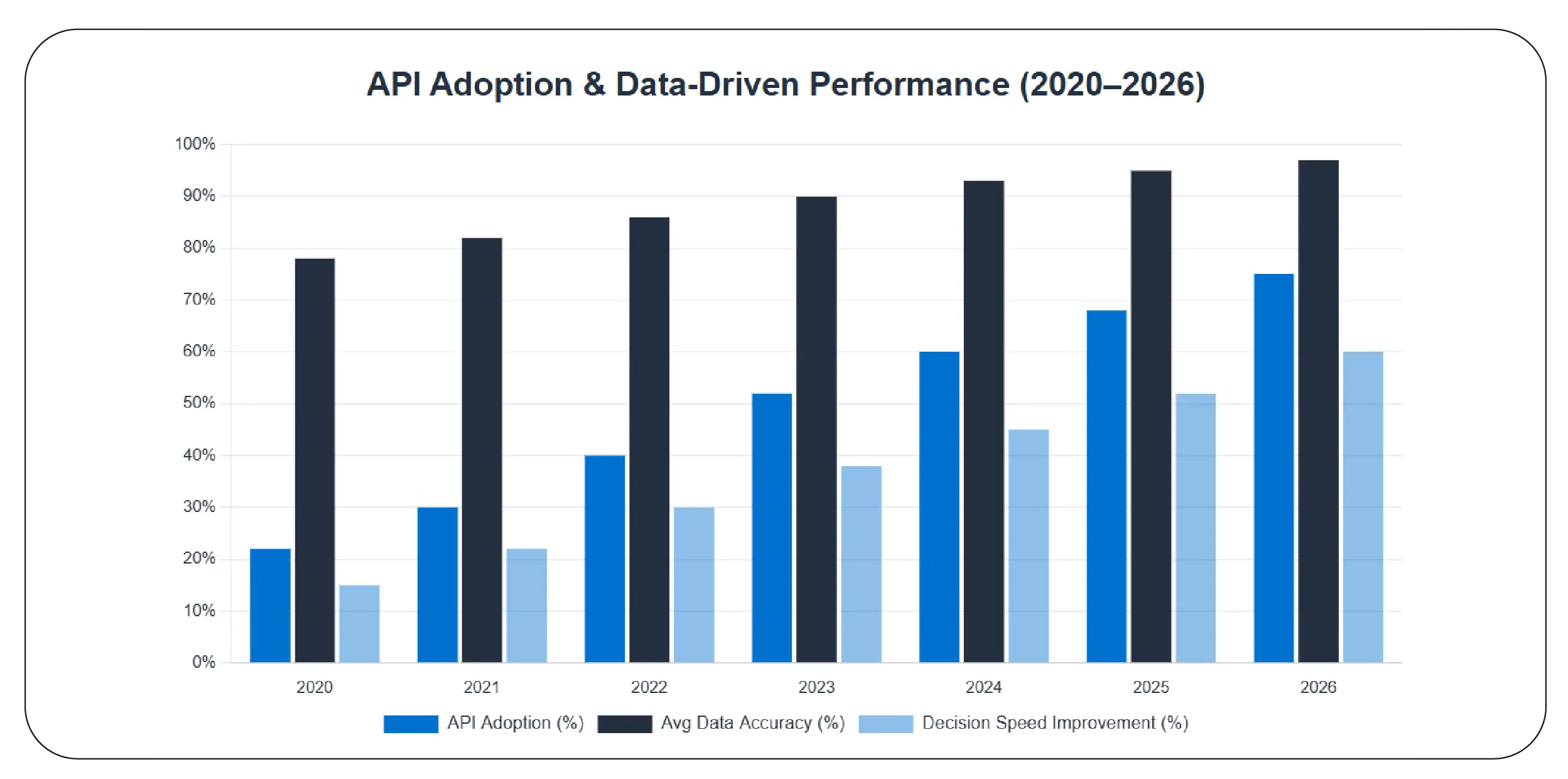

Technology That Powers Modern Price Intelligence

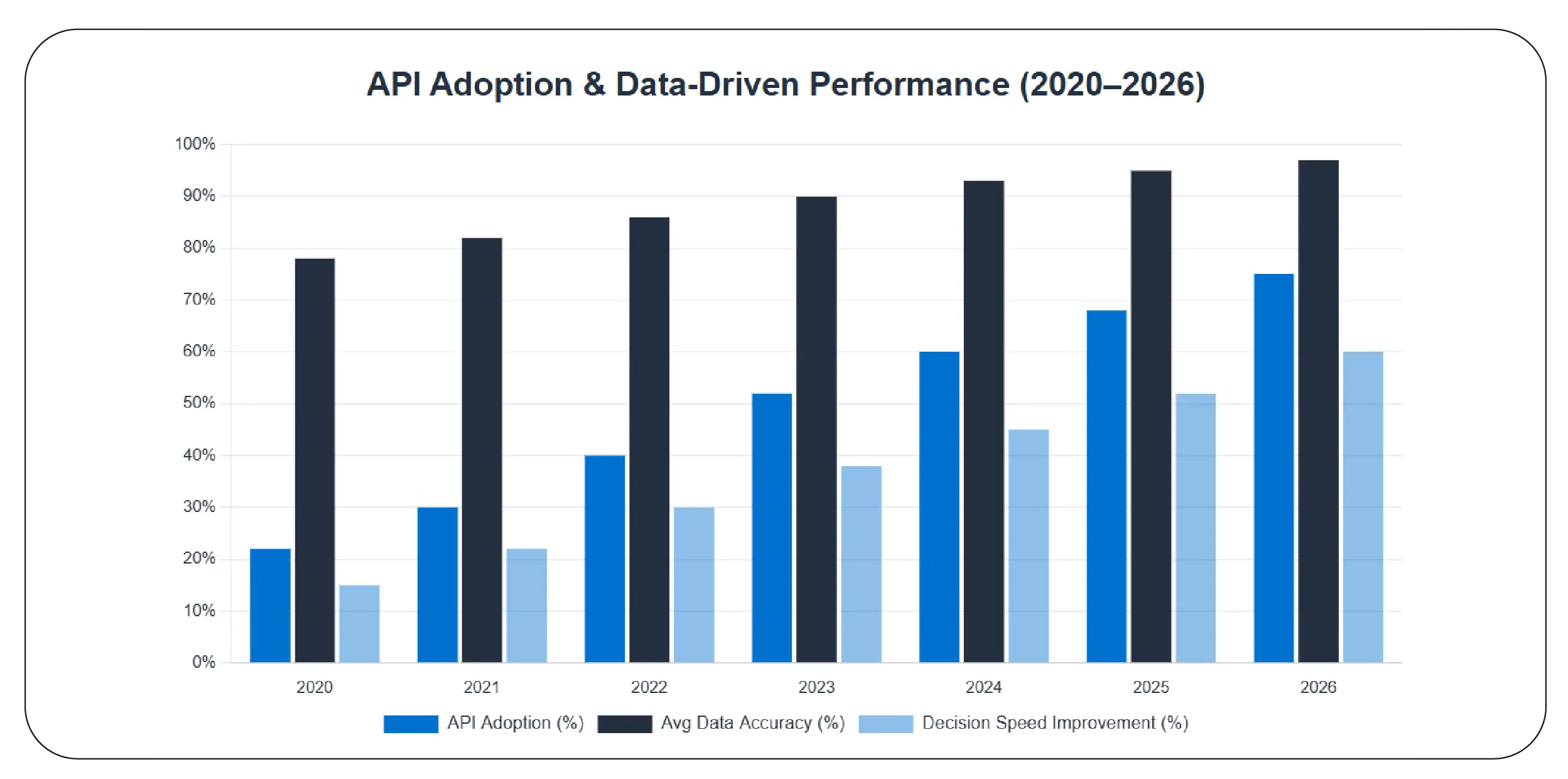

Modern retailers depend heavily on an Amazon Walmart Price Scraping API to automate the collection of millions of pricing data points daily. These APIs transform raw information into structured datasets that integrate seamlessly with analytics dashboards, ERP systems, and AI-powered pricing tools.

From 2020 to 2026, adoption of API-driven pricing intelligence grew exponentially.

| Year |

API Adoption (%) |

Avg Data Accuracy |

Decision Speed Improvement |

| 2020 |

22 |

78% |

15% |

| 2021 |

30 |

82% |

22% |

| 2022 |

40 |

86% |

30% |

| 2023 |

52 |

90% |

38% |

| 2024 |

60 |

93% |

45% |

| 2025 |

68 |

95% |

52% |

| 2026 |

75 |

97% |

60% |

These APIs enable brands to track flash sales, limited-time discounts, and stock fluctuations instantly. Instead of reacting days later, retailers now respond within hours—or even minutes—giving them a critical competitive advantage.

Turning Raw Numbers into Strategic Assets

An Amazon vs Walmart pricing intelligence dataset goes beyond surface-level price comparison. It allows retailers to analyze deeper correlations between pricing, reviews, availability, and sales velocity.

Between 2020 and 2026, brands using structured datasets achieved significant gains in campaign performance.

| Year |

Dataset Users (%) |

Campaign ROI Growth |

Conversion Rate Increase |

| 2020 |

25 |

+10% |

+6% |

| 2021 |

32 |

+14% |

+9% |

| 2022 |

41 |

+18% |

+12% |

| 2023 |

50 |

+22% |

+15% |

| 2024 |

58 |

+26% |

+18% |

| 2025 |

66 |

+30% |

+21% |

| 2026 |

74 |

+35% |

+25% |

Retailers use these datasets to optimize bundle offers, refine discount thresholds, and align pricing strategies with consumer expectations. Instead of reacting to competitors, brands proactively shape market trends.

Creating Fair and Competitive Pricing Structures

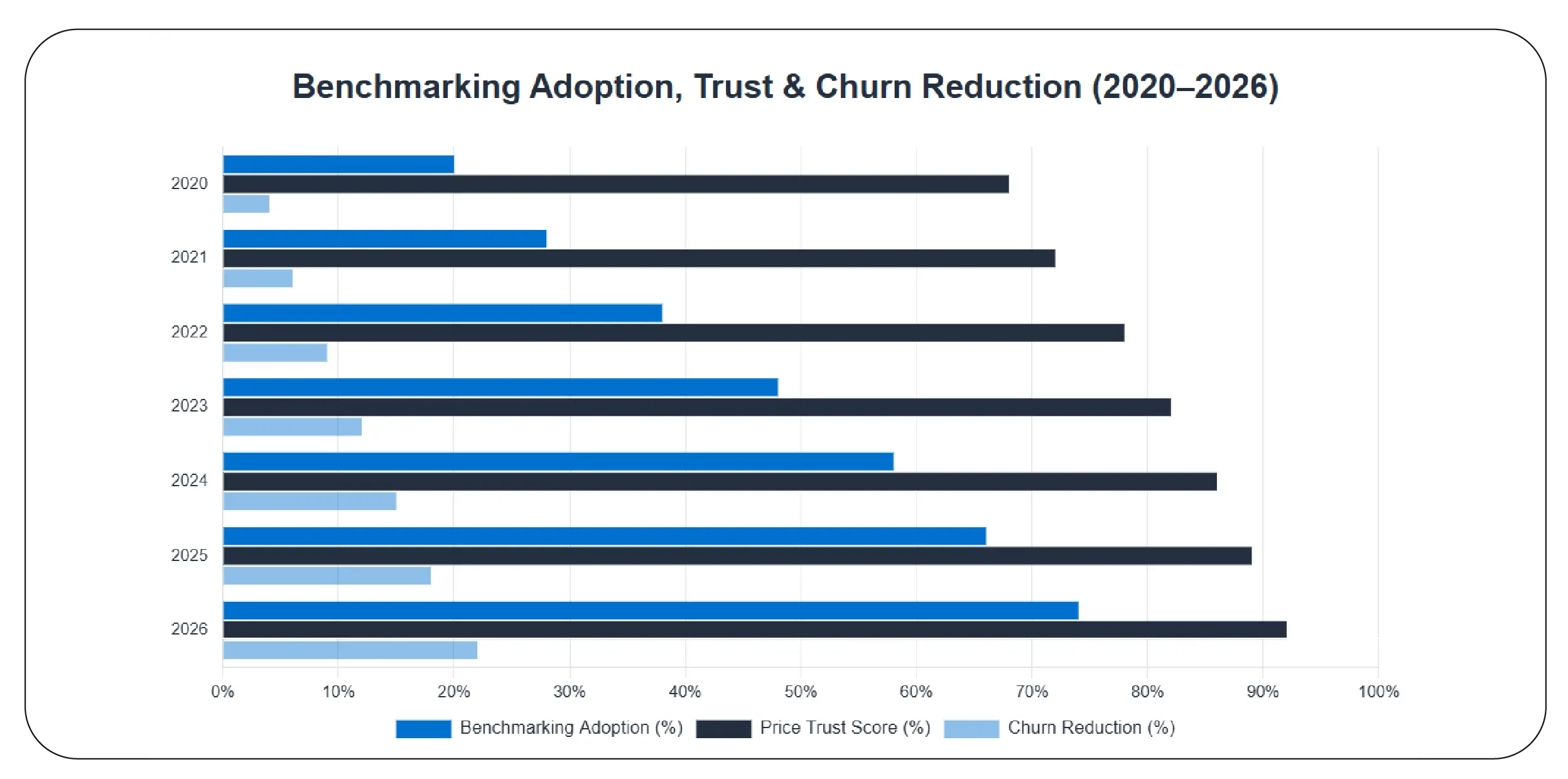

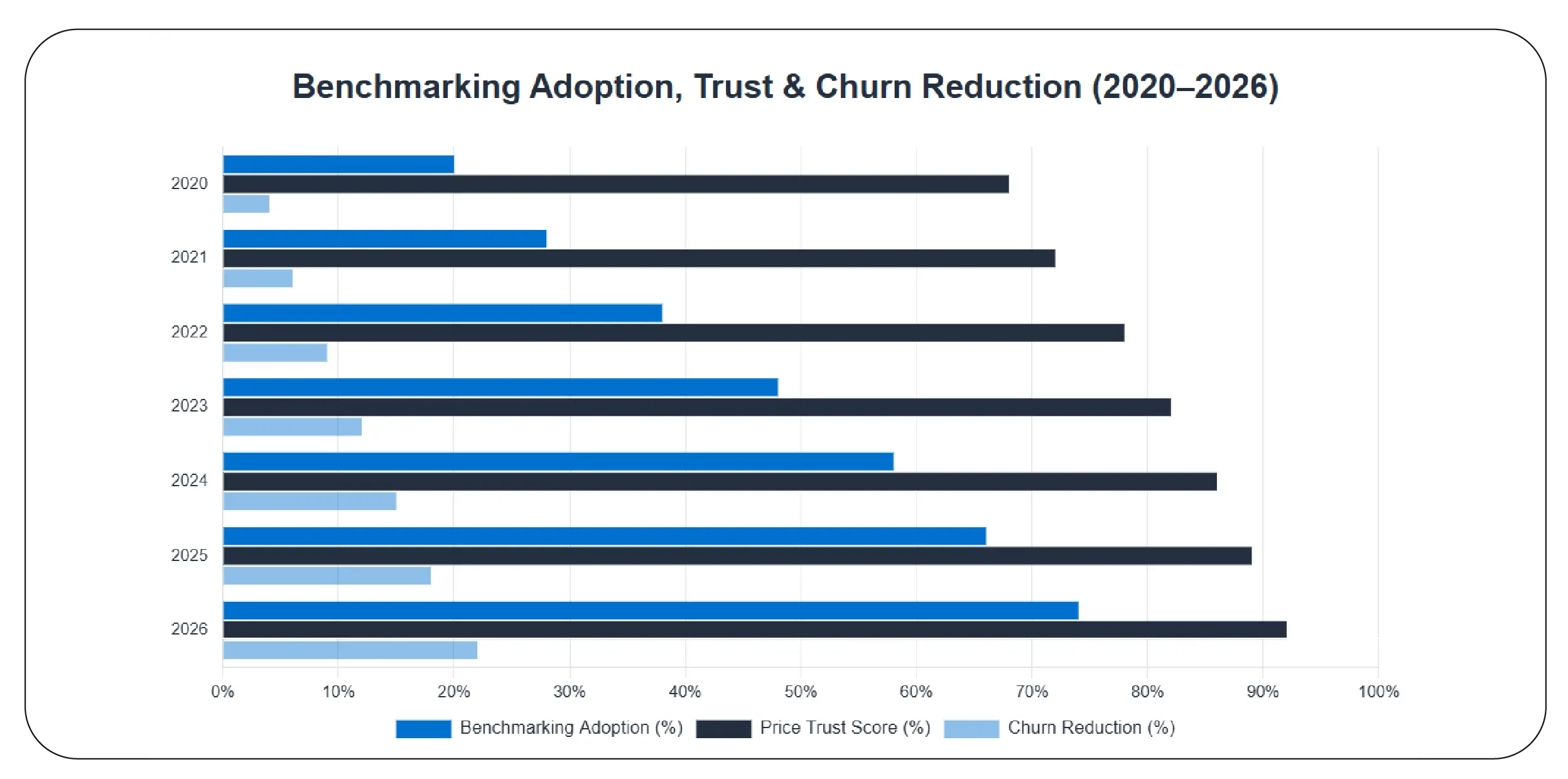

Retail Price Benchmarking Using Data Scraper allows brands to maintain fairness, transparency, and competitiveness across diverse regions. Benchmarking helps ensure that customers in California and Texas perceive consistent value, even when underlying costs differ.

From 2020 to 2026, companies that adopted systematic benchmarking achieved better price trust scores and reduced customer churn.

| Year |

Benchmarking Adoption (%) |

Price Trust Score |

Churn Reduction |

| 2020 |

20 |

68% |

4% |

| 2021 |

28 |

72% |

6% |

| 2022 |

38 |

78% |

9% |

| 2023 |

48 |

82% |

12% |

| 2024 |

58 |

86% |

15% |

| 2025 |

66 |

89% |

18% |

| 2026 |

74 |

92% |

22% |

This structured approach ensures pricing fairness while preserving brand credibility in competitive marketplaces.

Why Choose Product Data Scrape?

Choosing the right data partner is essential for building a future-ready pricing strategy. With our advanced solutions, retailers gain access to actionable insights powered by Web Data Intelligence API capabilities that transform raw information into strategic assets. By Tracking Daily Price Drops from Amazon & Walmart USA, brands can react faster to market shifts, identify promotional opportunities, and stay competitive across regions. Our technology ensures accuracy, scalability, and compliance—helping you unlock consistent value from your data investments while building stronger pricing frameworks for long-term success.

Conclusion

In a world where price transparency defines brand trust, retailers can no longer rely on manual monitoring or outdated strategies. With Scrape Amazon and Walmart USA Daily Prices, brands gain real-time visibility into regional dynamics and competitive movements. By leveraging Amazon California vs Walmart Texas Prices Using Data Scraping, businesses transform complex data into clear, actionable insights that drive smarter decisions.

Whether your goal is improving margins, boosting conversions, or strengthening customer loyalty, data-driven pricing is the key. Now is the time to invest in intelligent scraping solutions that empower your brand to lead, not follow.

Start transforming your pricing strategy today—because the future of retail belongs to those who act on data, not assumptions!

FAQs

1. Why is regional price comparison important for retailers?

Regional price comparison helps retailers understand how geography affects demand, logistics, and customer perception, enabling smarter pricing strategies that improve competitiveness and profitability across diverse markets.

2. How does data scraping improve pricing accuracy?

Data scraping automates real-time price collection, reducing human error and ensuring brands always rely on accurate, up-to-date market information for strategic decisions.

3. Can small businesses benefit from price scraping?

Yes, small retailers can use scraping tools to monitor competitors, adjust pricing quickly, and compete effectively without investing heavily in large research teams.

4. Is scraping useful beyond pricing insights?

Absolutely. Scraping also supports review analysis, trend forecasting, inventory planning, and customer sentiment tracking across multiple retail platforms.

5. How does Product Data Scrape support retailers?

Product Data Scrape delivers scalable, compliant scraping solutions that help retailers access structured pricing intelligence, enabling smarter decisions, better competitiveness, and long-term growth in dynamic retail markets.

.webp)

.webp)

.webp)