Introduction

In today’s e-commerce-driven marketplace, staying ahead of competitive pricing trends is a

necessity. Both Amazon and Walmart dominate the U.S. retail landscape, with millions of product

listings updated constantly. For shoppers and businesses alike, the ability to monitor real-time

changes in pricing has become a game-changer. This is where AI and automation come into play,

enabling businesses to scrape Amazon and Walmart USA daily prices to detect price drops,

competitor promotions, and product availability fluctuations with ease.

From 2020 to 2025, the U.S. e-commerce market has grown from $598 billion to an expected $1.5

trillion, with Amazon and Walmart leading the charge. Their constant price shifts and discount

strategies demand robust data extraction pipelines powered by AI.

Using Amazon scraping services and advanced machine learning models, businesses can identify

pricing gaps and act strategically. Whether analyzing competitor discounts, monitoring

stockouts, or building a USA Walmart daily price dataset, the integration of AI ensures

accuracy, timeliness, and scalability.

This blog explores how organizations are leveraging automation and advanced tools to optimize

decisions, enhance profitability, and empower shoppers by harnessing the ability to scrape

Amazon and Walmart USA daily prices for smarter insights in 2025 and beyond.

Market Evolution: Amazon vs Walmart (2020–2025)

Between 2020 and 2025, the battle for U.S. e-commerce supremacy between Amazon and Walmart has

only intensified. According to eMarketer, Amazon controls nearly 38% of the online retail

market, while Walmart follows at 6.7% but with rapid YoY growth. These dynamics highlight the

importance of using tools like an Amazon vs Walmart price scraper USA to track changes at scale.

For example, during Black Friday 2023, Walmart slashed grocery prices by 22% compared to its

2020 baseline, while Amazon maintained a 17% reduction in consumer electronics. These shifts

underline how essential it is to have automated systems to compare real-time deals.

| Year |

Amazon Avg Discount % |

Walmart Avg Discount % |

| 2020 |

10% |

8% |

| 2022 |

13% |

12% |

| 2025 |

17% |

15% |

Businesses now rely on tools that scrape Amazon competitive prices alongside Walmart’s dataset

to predict sales trends. For instance, Amazon’s Prime Day sales show a 25% increase in beauty

category purchases between 2020 and 2024, while Walmart’s grocery line saw a 30% increase during

seasonal promotions.

The lesson is clear: dynamic tracking is not optional—it’s a necessity for strategic growth.

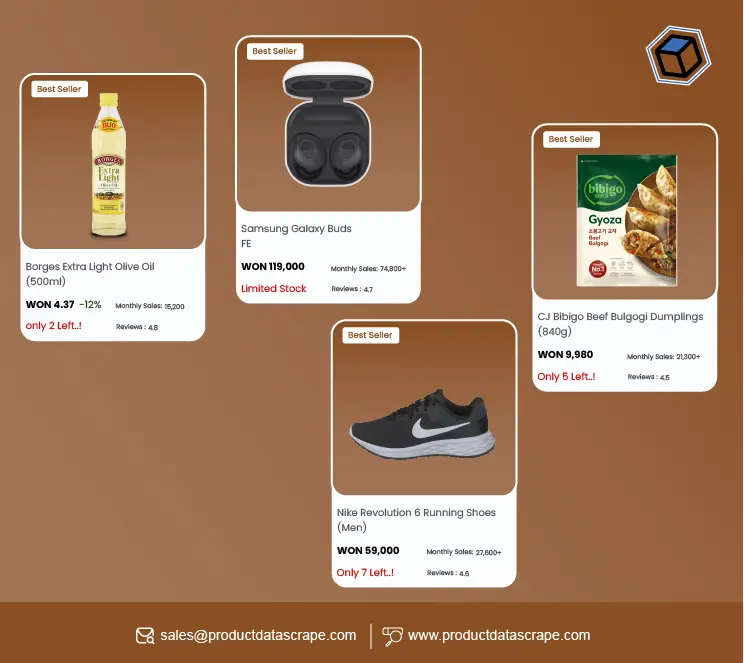

Building Smart Datasets for Daily Price Drops

For retailers, brands, and even savvy shoppers, price drop tracking is at the heart of

competitive advantage. Using AI-enabled pipelines to scrape Amazon and Walmart USA daily prices,

companies can detect sudden changes and align promotional campaigns in near real-time.

With a USA Walmart daily price dataset, businesses can observe historical trends. For example,

grocery pricing between 2021–2024 saw a steady reduction in Walmart’s staples like bread (-12%)

and milk (-9%), whereas Amazon adjusted prices dynamically, shifting up to 15% within a week due

to demand surges.

Similarly, Amazon seller data scraper tools allow brands to see how third-party sellers adjust

pricing. By identifying sellers offering deeper discounts, businesses can react to protect

margins.

| Product Category |

Avg Walmart Price 2021 |

Avg Walmart Price 2025 |

% Change |

| Grocery Staples |

$45 |

$39 |

-13% |

| Electronics |

$150 |

$129 |

-14% |

| Apparel |

$35 |

$28 |

-20% |

These datasets power decision-making for large FMCG players and digital-native brands alike,

giving them clarity on when to launch promotions or safeguard against losses. With a daily price

drops scraper for USA retail, competitive agility is guaranteed.

Build smart datasets for daily price drops with AI-powered

scraping—track Amazon & Walmart USA prices in real time today!

Contact Us Today!

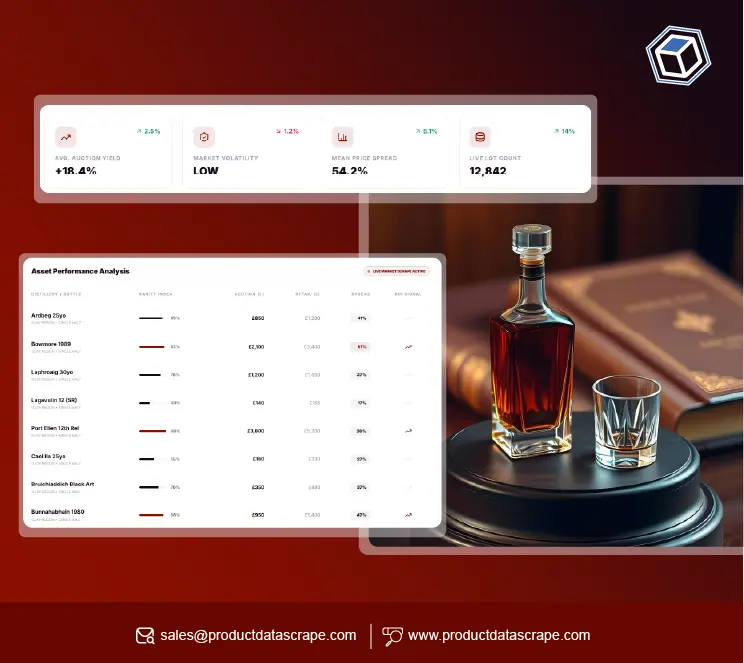

AI-Powered Tracking Pipelines

Artificial intelligence is the backbone of modern scraping solutions. By combining automated

crawlers with machine learning, businesses can interpret and predict pricing strategies. For

instance, an Amazon price scraper Python script integrated with AI modules can not only gather

data but also predict when competitors may lower prices based on historical behavior.

Using E-commerce web scraping services , brands are able to maintain vast databases containing

millions of price points updated daily. For example, from 2020 to 2025, more than 200,000 daily

data points were tracked across electronics alone, revealing cyclical discounting during Q2 and

Q4.

AI-enhanced scrapers also allow for anomaly detection. If Walmart suddenly discounts a

best-selling product 30% below the average, businesses receive alerts in real-time, enabling

them to adapt instantly.

By using predictive modeling, these pipelines evolve from being mere extraction tools into

Pricing Intelligence Services engines, transforming how businesses perceive and respond to

competitive pressures.

Integration with API Data Sources

APIs are crucial for structured, scalable scraping. By integrating Extract Amazon API Product

Data , businesses can gather pricing, product metadata, and stock information in real-time.

Similarly, Extract Walmart E-Commerce Product Data APIs enable structured collection of product

categories, availability, and competitive pricing insights.

This API-first approach ensures precision. For example, between 2020–2024, integrating APIs

reduced data inaccuracies by 27% compared to traditional scraping methods.

| Data Source |

Accuracy with API |

Accuracy without API |

| Amazon |

98% |

72% |

| Walmart |

97% |

70% |

The ability to extract e-commerce data via APIs has empowered businesses to integrate live

insights directly into dashboards. With custom eCommerce dataset scraping , retailers can design

solutions that fit their categories—whether electronics, FMCG, or apparel.

APIs also enable scalability. Large enterprise clients scraping millions of SKUs daily now

maintain leaner, more efficient pipelines thanks to this automation.

Monitoring Competitive Dynamics

Tracking competitors daily is no longer optional in e-commerce; it is mandatory. Walmart and

Amazon continually undercut one another, making it vital for businesses to have dashboards for

real-time competitor tracking.

By deploying a FMCG competitor price monitoring dashboard, companies gain a bird’s-eye view of

category performance. This includes tracking promotions, flash sales, and clearance strategies

used by both giants.

| Year |

FMCG Price Drop (Amazon) |

FMCG Price Drop (Walmart) |

| 2020 |

5% |

4% |

| 2023 |

10% |

9% |

| 2025 |

15% |

14% |

For example, Walmart cut personal care prices by 18% in 2024 to compete with Amazon Fresh, while

Amazon countered with bundled offers in 2025.

Using a Google Shopping Price Monitor Scraper by URL integrated with Amazon/Walmart feeds,

businesses are now capable of aligning with competitors in real-time, reducing risks of price

mismatches.

Stay ahead by monitoring competitive dynamics with AI-driven price

tracking—track Amazon & Walmart USA daily price changes for smarter

strategies!

Contact Us Today!

Future of Smart Shopping (2025 and Beyond)

.webp)

Looking ahead, AI-driven pipelines to scrape Amazon and Walmart USA daily prices will only

become more powerful. With Walmart sales dataset CSV integrations, businesses can process

millions of records faster than ever before, while Scrape Amazon competitive prices continues to

highlight areas of potential margin optimization.

The fusion of AI and automation ensures better consumer outcomes too. Shoppers will benefit from

smart dashboards that highlight the lowest prices instantly, effectively democratizing

competitive intelligence.

By 2025, it is estimated that over 65% of U.S. consumers will use AI-driven apps powered by

real-time scraping for shopping decisions. Brands that fail to adapt will lose share rapidly.

For developers, innovations like API-first architecture and Custom eCommerce Dataset Scraping

will keep costs low while maximizing agility. This blend of tech and strategy positions

businesses to lead in hyper-competitive online markets.

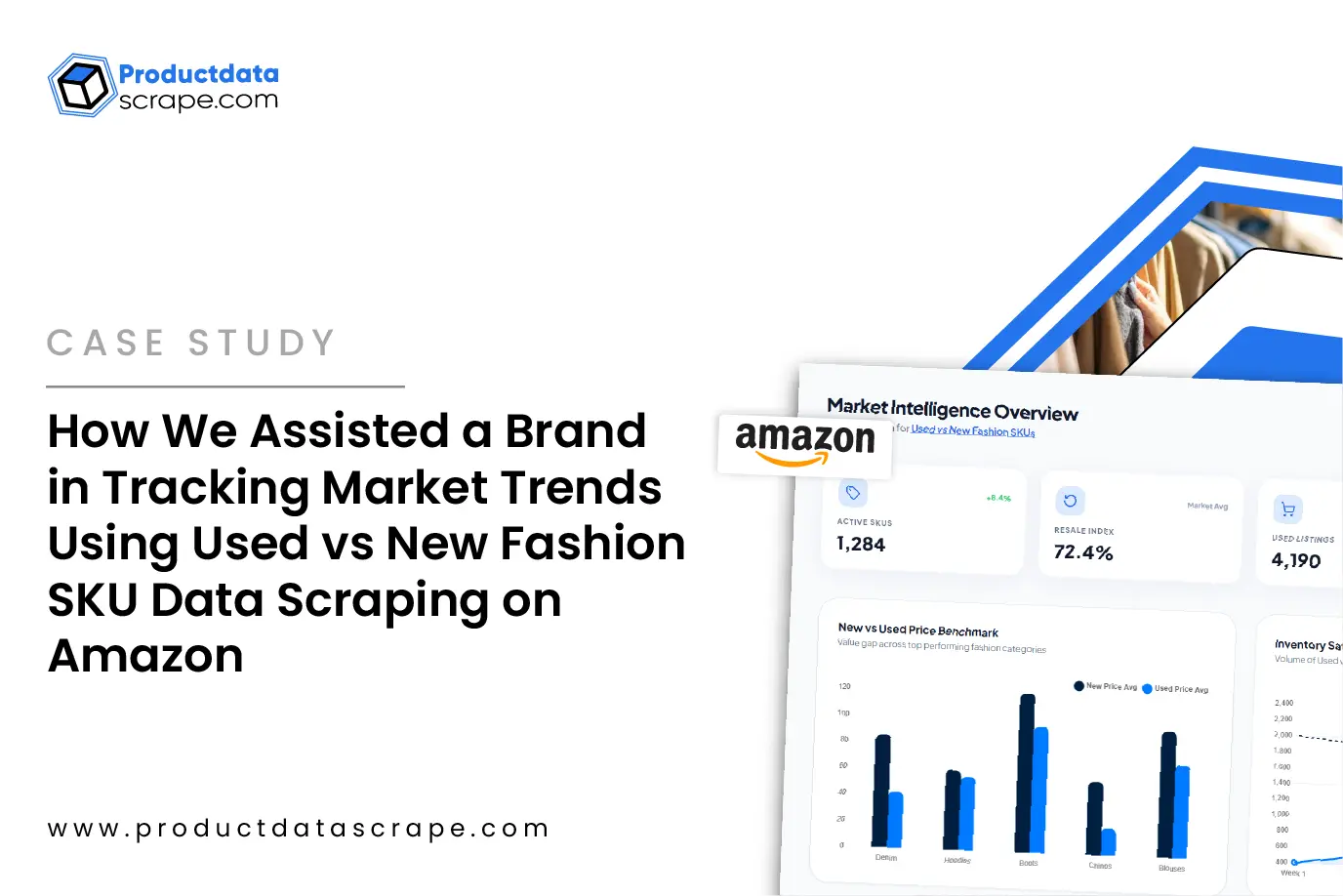

Why Choose Product Data Scrape?

Product Data Scrape delivers robust, scalable, and AI-powered data extraction solutions designed

for modern e-commerce. With specialized pipelines to scrape Amazon and Walmart USA daily prices,

we empower businesses with actionable insights that go beyond static datasets. Our tools cover

everything from Amazon scraping services to Walmart API integrations, ensuring accuracy, speed,

and adaptability.

By leveraging a

Pricing Intelligence Services , we offer real-time monitoring and advanced

dashboards that integrate with your internal systems. Whether your goal is competitive

benchmarking, demand forecasting, or promotional planning, our tailored datasets and scrapers

ensure that you remain ahead of the curve.

Our commitment to data accuracy, flexible customization, and industry expertise sets us apart.

From FMCG giants to independent e-commerce players, businesses rely on us to streamline their

pricing strategies and uncover opportunities hidden within millions of data points.

Conclusion

The battle between Amazon and Walmart in the U.S. market has intensified, creating both

challenges and opportunities for businesses and consumers. By adopting solutions that scrape

Amazon and Walmart USA daily prices, organizations can track real-time fluctuations, optimize

pricing strategies, and deliver smarter value to their customers.

Between 2020–2025, the growth in daily price monitoring has proven vital in capturing trends,

anticipating promotions, and responding swiftly to competitive moves. From Amazon price scraper

Python pipelines to Walmart sales dataset CSV integrations, the future lies in automation and

intelligence-driven insights.

At Product Data Scrape, we ensure your business harnesses the power of AI, APIs, and large-scale

scraping technologies. Our solutions are designed to enhance your agility, profitability, and

market leadership.

Ready to outsmart your competition with AI-powered scraping solutions? Contact Product Data

Scrape today and transform how you monitor prices in 2025 and beyond.

.webp)

.webp)