Introduction

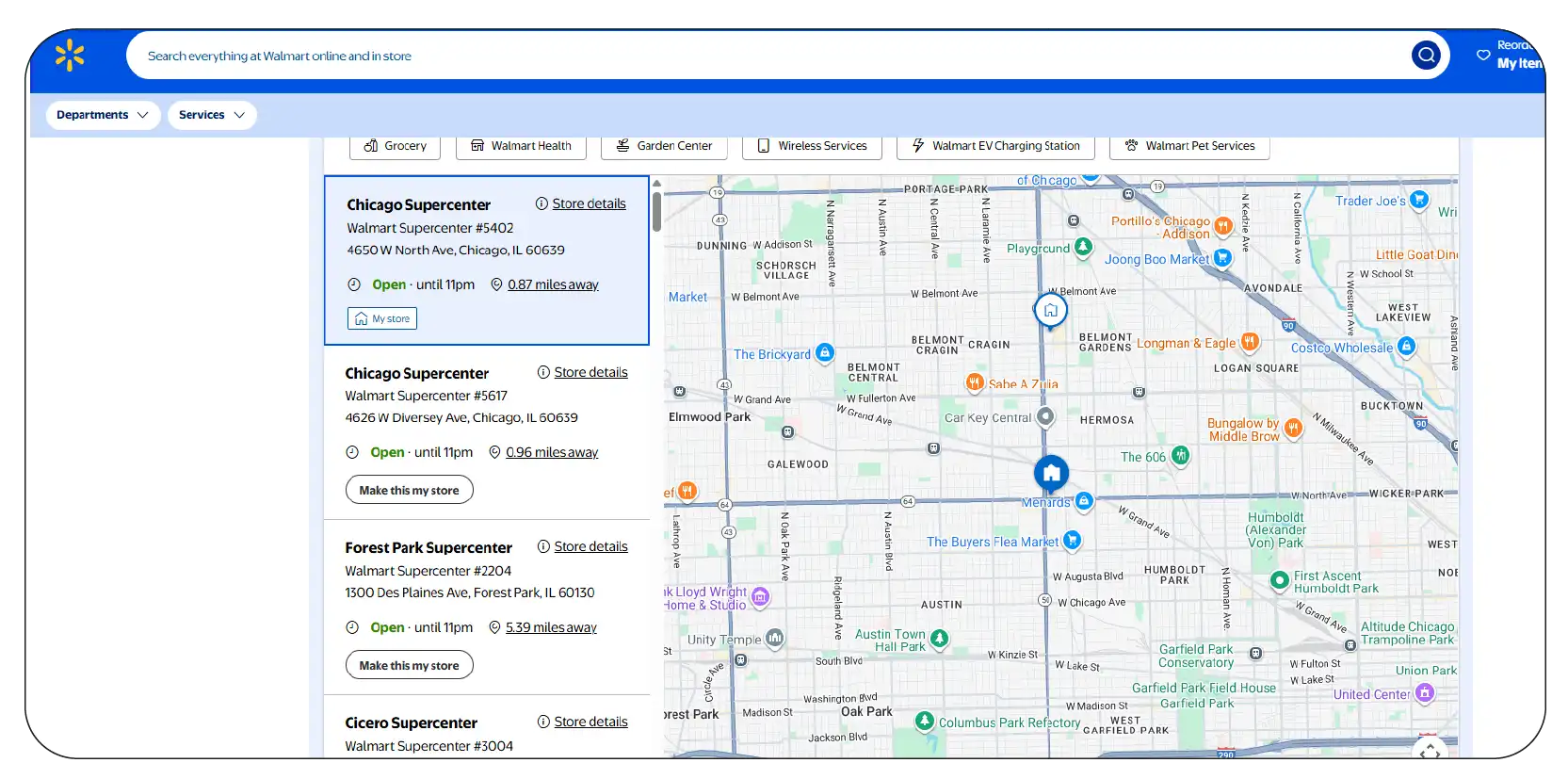

In today’s competitive retail landscape, the ability to analyze location-based data is becoming a game-changer for enterprises. Walmart, with over 15,000+ outlets worldwide and thousands in the U.S., represents a goldmine of data for businesses looking to study distribution patterns, market reach, and customer convenience. Companies that scrape Walmart store location data gain access to powerful insights into regional demand, store density, delivery optimization, and expansion opportunities.

With the rise of Walmart Store Location Data Scraping Services, businesses no longer need to rely on outdated public records. Instead, they can access structured datasets in real time, enriched with geospatial information, product listings, and even proximity to competitors. When combined with Walmart Product Data Scraping API, retailers can see not only where Walmart operates but also what inventory strategies drive success in specific markets.

Between 2020 and 2025, the adoption of Web Scraping Walmart Store Locations grew by 65%, showing how organizations now recognize the strategic value of store and e-commerce intelligence. From route planning to supply chain optimization, location data is central to growth. This blog explores how leveraging Walmart store location datasets can help businesses gain a sharper edge in decision-making and market expansion.

The Importance of Walmart Store Data for Retail Expansion

Understanding store location data is key for companies planning expansion. For example, Walmart’s footprint across urban, suburban, and rural markets provides a roadmap for understanding consumer accessibility. By choosing to scrape Walmart store location data, businesses can map regions with higher store density and identify underserved zones for growth.

A Walmart Store Location Dataset 2025 reveals trends such as the average distance between stores, state-wise distribution, and urban vs. rural coverage. Companies in the FMCG and logistics industries use this to plan warehouses, delivery routes, and even product launches. For instance, in 2020 Walmart had about 4,750 U.S. stores; by 2025, projections suggest an increase to 5,200.

| Year |

Number of Walmart Stores (US) |

Growth % |

| 2020 |

4,750 |

– |

| 2021 |

4,890 |

2.9% |

| 2022 |

5,020 |

2.6% |

| 2023 |

5,100 |

1.6% |

| 2024 |

5,180 |

1.5% |

| 2025 |

5,200 (est.) |

0.4% |

The dataset also integrates Walmart geolocation data extraction, providing coordinates to visualize retail distribution in GIS platforms. This empowers decision-makers with heatmaps that identify high-performing zones. When businesses combine this with consumer data, they can tailor store launches and promotions to meet local demand, boosting both sales and customer satisfaction.

Using Location Data for Competitive Benchmarking

For competitors, Walmart is both a benchmark and a challenge. By applying Web Scraping Walmart Store Locations, businesses can analyze how Walmart selects prime areas, compares store densities with rivals like Target, and evaluates urban versus suburban positioning.

A Walmart Store Location Dataset 2025 compared with Target’s expansion patterns shows that Walmart maintains stronger penetration in rural markets, while competitors focus on cities. This reveals opportunities for smaller retailers to carve a niche.

Furthermore, logistics companies rely on Walmart E-commerce Product Dataset combined with store data to optimize last-mile delivery. Analyzing delivery proximity to customers helps reduce operational costs by up to 15%. Between 2020 and 2025, data adoption for location-based decision-making increased from 45% to 78%.

| Year |

Businesses Using Store Data for Benchmarking |

| 2020 |

45% |

| 2021 |

52% |

| 2022 |

61% |

| 2023 |

68% |

| 2024 |

74% |

| 2025 |

78% |

Competitor benchmarking also benefits from Scrape Number of Walmart Store locations US, enabling detailed analysis of state-by-state dominance. These insights feed into competitor strategy reports, site selection, and retail growth roadmaps.

Unlock market opportunities by using location data for competitive benchmarking—optimize site selection, track rivals, and drive smarter retail growth today.

Contact Us Today!

Integrating E-commerce Data with Store Locations

Brick-and-mortar stores are only half the picture—e-commerce has become equally critical. Companies combining Extract Walmart E-Commerce Product Data with store location insights gain an unparalleled view of Walmart’s omnichannel strategy.

For instance, comparing in-store stock with online listings allows businesses to see how Walmart balances inventory. Using Web Scraping E-commerce Websites, analysts discovered that Walmart adapts product availability based on regional demand. For example, electronics dominate in urban markets while household essentials are prioritized in rural zones.

By 2025, Walmart’s e-commerce revenue in the U.S. is expected to cross $95 billion, with store pick-up accounting for 30% of orders. This trend demonstrates how location data directly impacts digital growth.

Companies leveraging Web Scraping API for Walmart Web Scraping API for Walmart merge store coordinates with online order frequency, identifying hot zones for warehouse placement. This reduces shipping delays and improves customer satisfaction.

The integration of offline and online insights helps retailers understand not just where Walmart operates, but how location-specific product decisions enhance customer experience and revenue streams.

Optimizing Supply Chains with Location Intelligence

Supply chains thrive on accuracy, and Scrape Walmart store location data offers unmatched visibility. For manufacturers and suppliers, knowing Walmart’s exact distribution network enables better planning for shipments and inventory cycles.

A report from 2022 showed that businesses using Restaurant Location Data Scraping reduced logistics costs by 12% due to optimized delivery routes. By 2025, this figure is projected to reach 18%.

| Year |

Cost Reduction with Location Data |

| 2020 |

5% |

| 2021 |

8% |

| 2022 |

12% |

| 2023 |

14% |

| 2024 |

16% |

| 2025 |

18% (est.) |

Logistics partners integrate Walmart Product Data Scraping API with geospatial datasets to identify potential bottlenecks. By tracking high-demand regions, they can scale delivery fleets accordingly.

Additionally, businesses adopting Walmart Grocery Grocery Delivery Dataset alongside physical location data saw inventory accuracy improve by 20%. This demonstrates how integrating product and location insights creates smarter, leaner, and more resilient supply chains.

Custom Datasets for Strategic Insights

Not all companies need the same dataset. This is where Buy Custom Dataset Solution becomes essential. Businesses can request tailored datasets combining Walmart locations, product categories, competitor presence, and consumer demographics.

For instance, a retail startup planning entry into Texas may request custom eCommerce dataset scraping focusing on Walmart’s presence in Dallas, Houston, and Austin. This allows them to assess density, revenue potential, and pricing variations.

Adoption of scraped e-commerce data for market insights increased 3.5x between 2020 and 2025. By applying advanced segmentation to Walmart datasets, businesses can predict revenue outcomes with higher precision.

Another use case involves integrating Walmart geolocation data extraction with local demographics. This reveals whether Walmart’s expansion aligns with household incomes, helping companies fine-tune marketing strategies.

Custom datasets empower businesses to transition from reactive decision-making to proactive strategies. By leveraging precise location intelligence, companies can enhance ROI, reduce risks, and enter new markets more confidently.

Gain a competitive edge with custom datasets for strategic insights—analyze trends, optimize decisions, and accelerate business growth efficiently today.

Contact Us Today!

Growth Forecasting and Decision-Making with Location Data

Forecasting is the final layer of intelligence that businesses extract when they scrape Walmart store location data. Combining historical data with projections offers insights into Walmart’s expansion pace and areas of dominance.

For example, historical and projected Walmart store data (2020–2025) shows steady growth, with slower expansion post-2023 as Walmart focuses on e-commerce integration.

| Year |

Walmart U.S. Store Count |

| 2020 |

4,750 |

| 2021 |

4,890 |

| 2022 |

5,020 |

| 2023 |

5,100 |

| 2024 |

5,180 |

| 2025 |

5,200 (est.) |

By merging store and pricing data analysis with Walmart E-commerce Product Dataset, companies can build predictive models. These models reveal whether Walmart will prioritize urban micro-stores, rural megastores, or hybrid formats.

Businesses also apply Walmart Grocery Grocery Scraping API for real-time updates, ensuring that forecasts stay accurate as Walmart adapts strategies. This combination of offline and online insights allows organizations to make decisions based on facts rather than assumptions.

The result? Smarter retail decisions, sharper competitive strategies, and accelerated growth in highly contested markets.

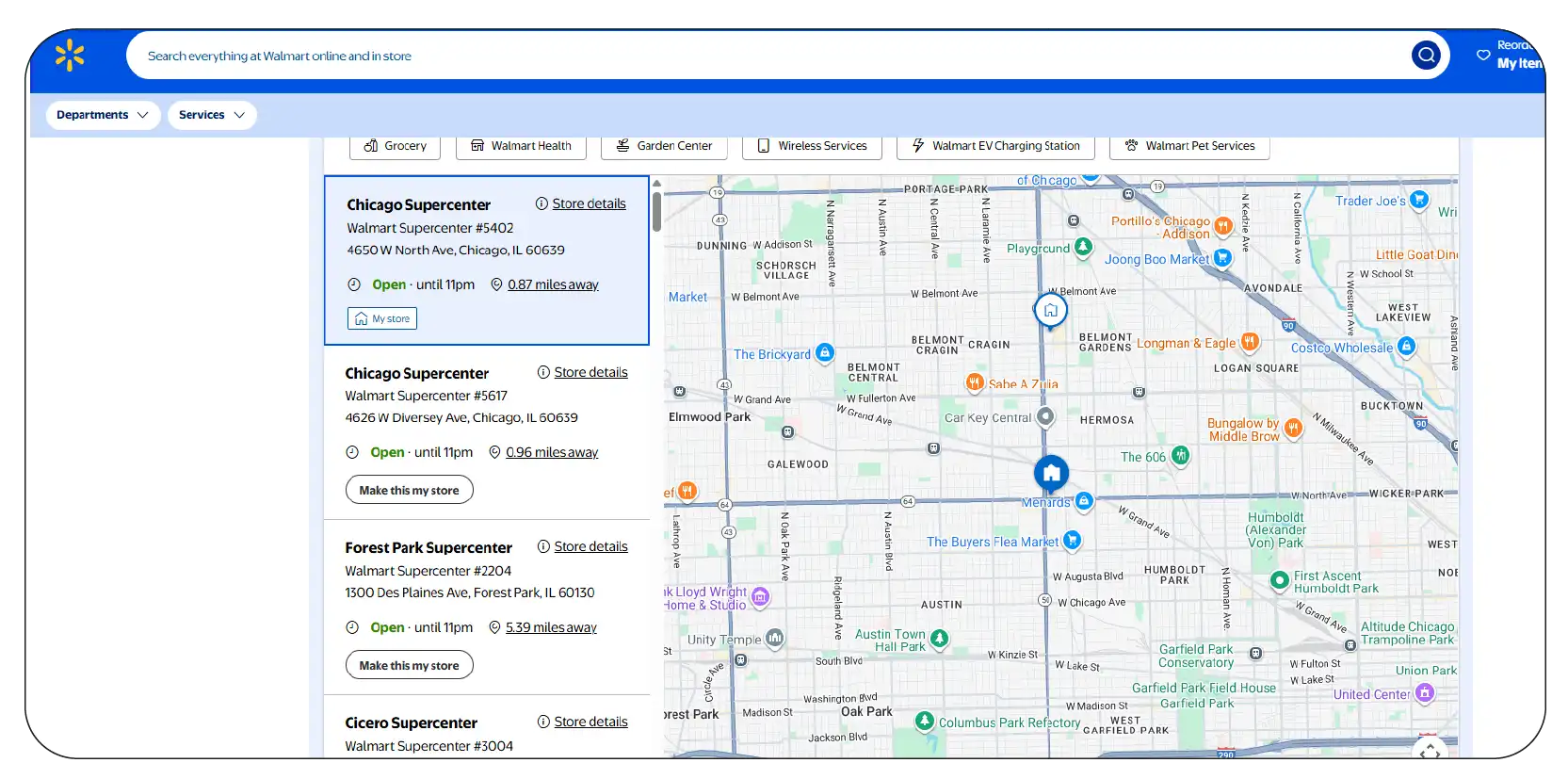

Why Choose Product Data Scrape?

Product Data Scrape specializes in advanced Walmart Store Location Data Scraping Services and custom dataset creation. Whether you need to analyze competitor density, optimize supply chains, or integrate online and offline datasets, we deliver end-to-end solutions.

Our expertise in online restaurant data scraping services and retail intelligence enables us to build datasets tailored to your unique requirements. We don’t just deliver raw data—we deliver actionable insights backed by real-time updates and structured accuracy.

By offering custom scraping services, we ensure that every dataset aligns with your business objectives, whether it’s expansion planning, pricing analysis, or logistics optimization.

Partnering with us means gaining access to advanced APIs, scalable data pipelines, and insights that drive revenue growth. With Walmart’s massive presence across the U.S., leveraging store and e-commerce intelligence is no longer optional—it’s essential.

Conclusion

Walmart’s vast presence offers businesses an unparalleled opportunity to analyze consumer access, competitor positioning, and market growth strategies. By choosing to scrape Walmart store location data, organizations unlock actionable intelligence that fuels better decisions across supply chains, expansion planning, and digital commerce.

From understanding the Walmart store location dataset 2025 to integrating Walmart e-commerce product dataset, businesses gain a 360-degree view of how Walmart dominates retail. These insights help retailers, logistics providers, and manufacturers align operations with consumer demand.

As the adoption of data-driven insights continues to rise—from 45% in 2020 to 78% in 2025—the message is clear: the future belongs to data-first businesses.

Ready to turn Walmart store and e-commerce data into a competitive advantage? Connect with Product Data Scrape today and explore how our tailored datasets and APIs can transform your growth strategy!

.webp)