Introduction

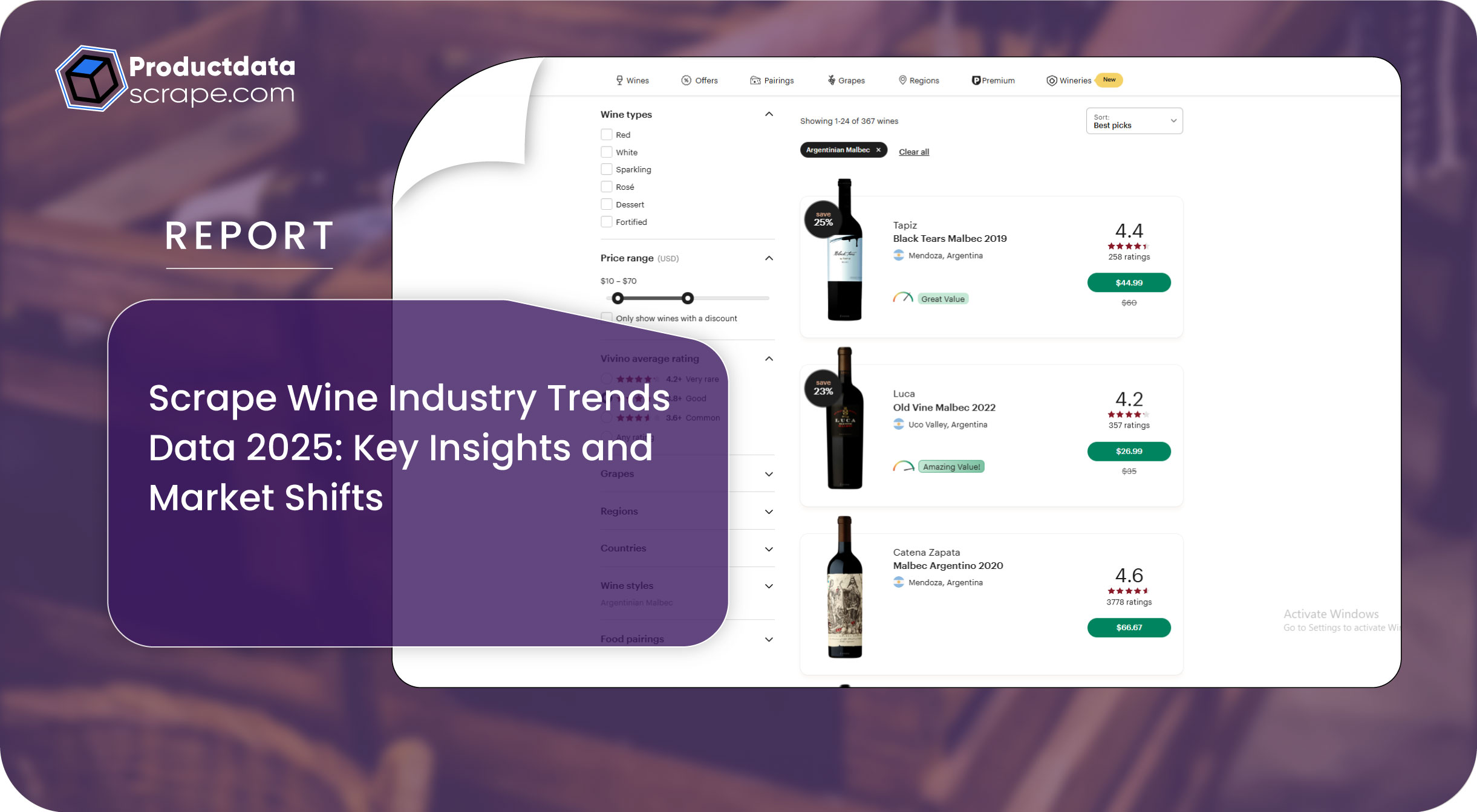

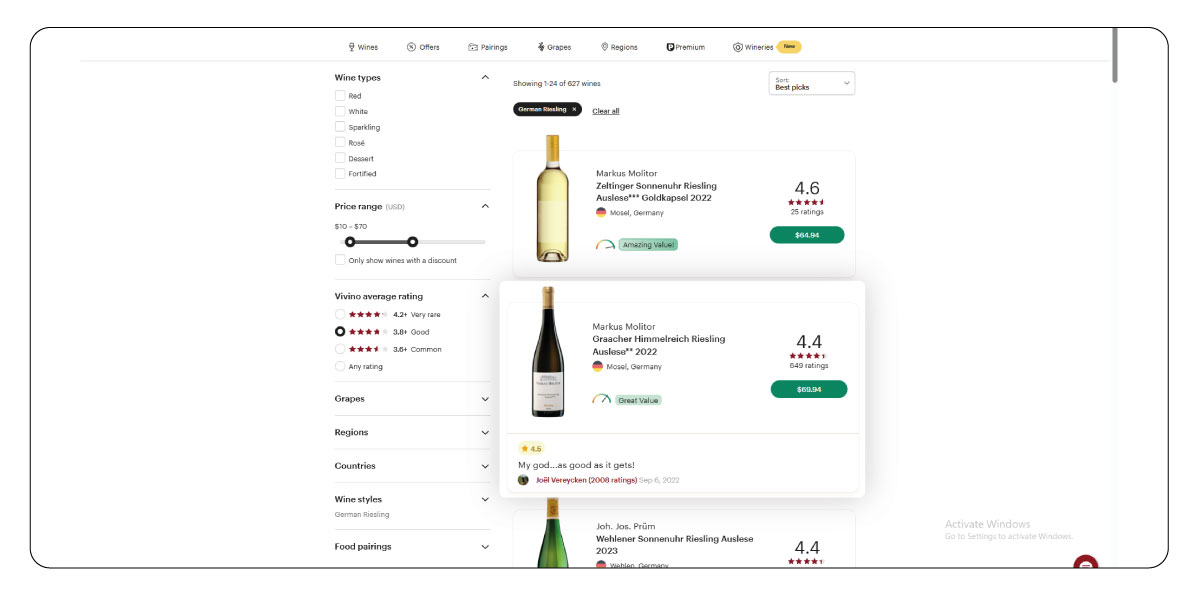

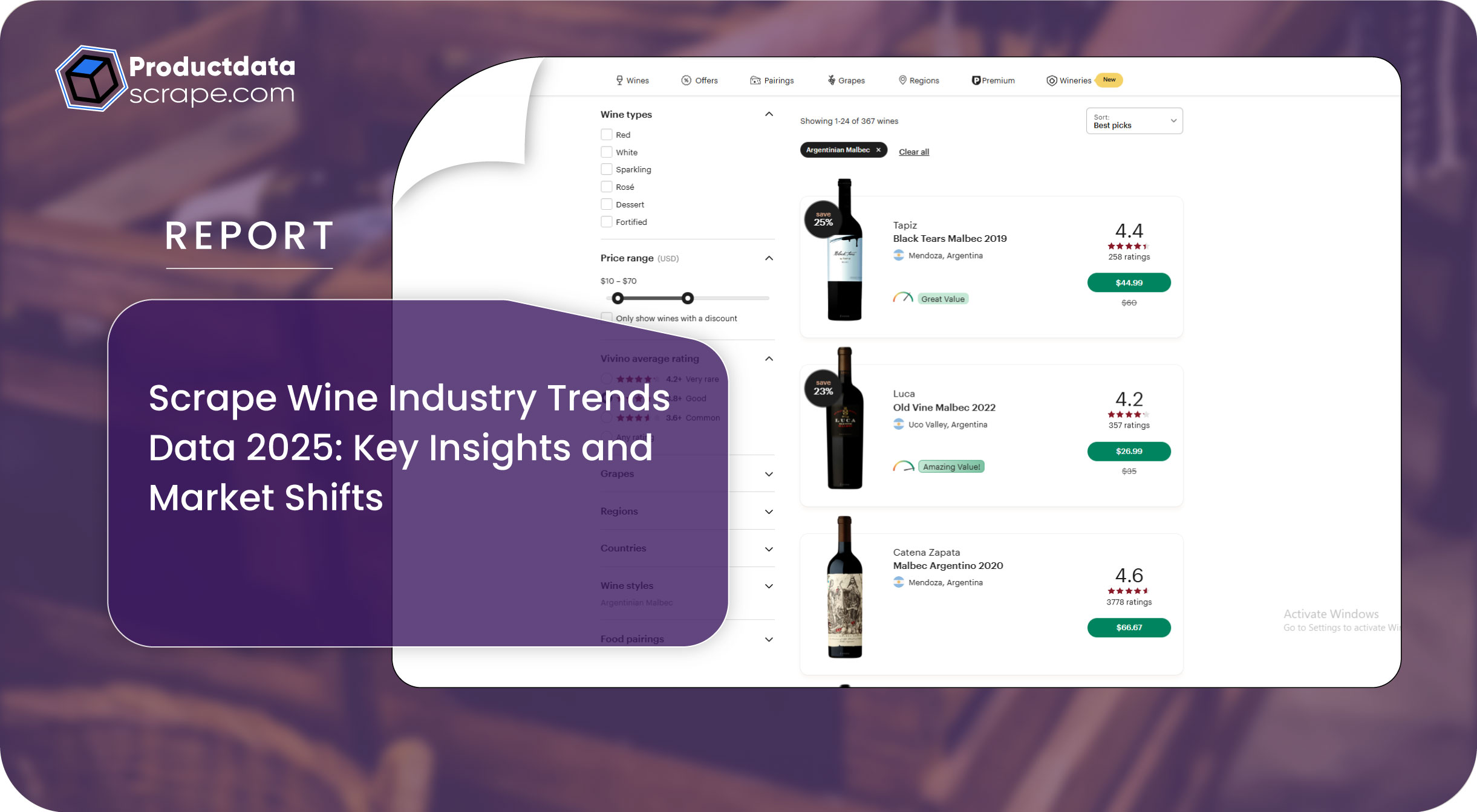

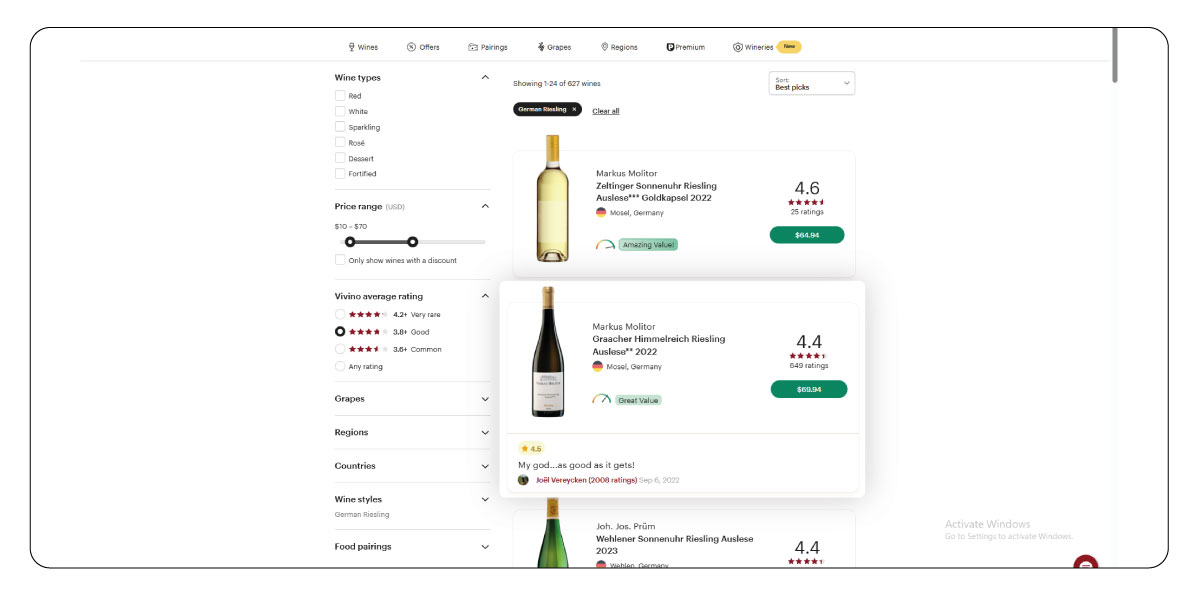

The global wine industry in 2025 is undergoing significant transformation, driven by changing consumer preferences, technological innovation, and environmental challenges. This report provides an in-depth analysis of the key trends shaping the wine market from 2021 to 2025, leveraging industry reports, market analyses, and consumer behavior studies. It explores how sustainability, premiumization, e-commerce, alternative packaging, and the rise of low/no-alcohol wines are reshaping the market. Scrape Wine Industry Trends Data 2025 reveals how these factors influence consumer choices and industry strategies. With a focus on market dynamics, the report also looks at the growing importance of online platforms. Extract Wine Market Insights for 2025 underscores the shift towards digital channels as consumer buying behavior evolves. A detailed methodology explains the approach to Scrape Online Wine Marketplace Data 2025, offering a comprehensive view of the wine industry's trajectory.

Methodology

This research uses a mixed-methods approach to gather and analyze data on wine industry trends 2025, with a retrospective review of 2021–2024. Data was sourced from respected industry publications, including reports from IWSR, Silicon Valley Bank (SVB), Grand View Research, and Straits Research, supplemented by insights from trade journals like SevenFifty Daily and The Drinks Business. Wine Market Data Scraping Services 2025 was not used; publicly available reports and articles were manually curated to ensure accuracy and relevance. Quantitative data, such as market size, growth rates, and consumption statistics, were cross-verified across multiple sources to ensure reliability. Qualitative insights, including consumer preferences and technological innovations, were derived from expert interviews and industry forecasts cited in the sources. Trends were identified by analyzing recurring themes and statistically significant shifts in market dynamics over the five years. The analysis prioritizes global and U.S. markets but includes regional insights from Europe and Asia-Pacific where relevant. Extract 2025 Wine Industry Trends Data to highlight key market drivers and emerging trends for the future.

Key Trends in the Wine Industry (2021–2025)

.jpg)

The wine industry has undergone significant changes over the past five years, influenced by economic, environmental, and cultural factors. Below is a detailed examination of the dominant trends, followed by a table summarizing their evolution.

1. Sustainability and Eco-Friendly Practices: Sustainability has transitioned from a niche concern to a core industry requirement. By 2025, wineries are adopting organic, biodynamic, and regenerative farming to address climate change and meet consumer demand for eco-conscious products. Certifications like organic and Fair Trade are increasingly prominent, with the organic wine market projected to reach USD 49.5 billion by 2025 at a CAGR of 9.2%. Climate challenges, such as rising temperatures and unpredictable weather, have pushed producers to share transparent sustainability practices, particularly with younger consumers who prioritize environmental responsibility. Liquor Data Scraping Services can help track these sustainable trends and certifications across wineries.

2. Premiumization and Quality Over Quantity: Consumers are embracing a "less but better" philosophy, favoring premium and super-premium wines over lower-priced options. Global sales of value-tier wines dropped 27% between 2021 and 2023, while premium-and-above tiers are expected to grow through 2027. This shift is driven by younger, higher-spending consumers seeking unique, high-quality wines with compelling stories or sustainable credentials. The trend is powerful in emerging markets like China and India, where rising disposable incomes fuel demand for luxury wines. Alcohol Price Data Scraping Services can provide valuable insights into the pricing trends for premium wines across global markets.

3. E-Commerce and Direct-to-Consumer (DTC) Sales: The pandemic accelerated the shift to online wine sales, a trend that continues to reshape distribution. By 2025, e-commerce and DTC channels will account for a significant share of sales, with 47 U.S. states permitting winery DTC shipping. Digital platforms offer convenience and personalization, with subscription services and curated wine clubs gaining traction. This shift has empowered smaller producers to bypass traditional distributors, fostering direct consumer relationships. Extract Liquor Data from online platforms to identify emerging e-commerce trends and opportunities.

4. Alternative Packaging: Innovations in packaging, such as cans and boxed wines, have gained momentum due to their convenience, sustainability, and appeal to younger demographics. The U.S. canned wine market surged 125% from 2020 to 2021 and continues to grow, with brands like The Uncommon (UK) and Babe (U.S.) leading the charge. These formats reduce waste and align with outdoor and casual drinking occasions, challenging the dominance of traditional glass bottles. Web Scraping Liquor Price Data can help track the cost trends of these alternative packaging formats, offering valuable pricing insights for businesses.

5. Low/No-Alcohol Wines: Health-conscious consumers, particularly Gen Z and Millennials, are driving demand for low- and no-alcohol wines. This segment grew 25% annually from 2015 to 2020 and is expected to expand significantly by 2025. Advances in fermentation technology have improved the taste and complexity of these wines, making them viable alternatives to traditional options. The trend aligns with broader wellness movements and "tempo drinking," where consumers alternate between alcoholic and non-alcoholic beverages. Web Scraping Alcohol & Liquor Data can assist in identifying growth patterns within this segment.

6. Shifting Consumer Demographics: The wine consumer base is aging and diversifying. While Baby Boomers, historically the core wine-drinking demographic, are reducing consumption, younger generations (Millennials and Gen Z) are not adopting wine at the same rate. In 2021, Millennials accounted for 36% of U.S. wine consumers, but Gen Z's alcohol spending dropped 15% in January 2025. Wineries target consumers aged 30–45 with occasion-based marketing and innovative offerings like sparkling spritzers and rosé blends to capture this elusive demographic. The Alcohol & Liquor Data Prices Dataset can help businesses identify price points and consumer preferences in this shifting market.

7. Technological Innovations: Technology is revolutionizing production and consumer engagement. AI-powered vineyard management, blockchain for authentication, and robotic harvesting enhance efficiency and transparency. In 2025, these tools will be mainstream, with wineries using AI to monitor vine health and predict harvests, while blockchain ensures provenance for premium wines. Virtual tasting platforms and augmented reality (AR) experiences also enhance consumer engagement, particularly in emerging markets. Web Scraping Liquor Price Data can help track technological advancements in pricing and product offerings across different platforms.

Trends Summary Table (2021–2025)

| Year |

Key Trends |

Market Impact |

| 2021 |

Post-COVID recovery, surge in e-commerce, rise of rosé and sparkling wines, early sustainability focus |

Global wine exports hit record 111.6M hectoliters; online sales grew as on-premise sales dropped 30% |

| 2022 |

Premiumization gains traction, canned wine market grows, low/no-alcohol wines emerge |

Premium wine sales outpace value-tier; canned wine up 125% in U.S. from 2020 |

| 2023 |

Sustainability becomes mainstream, DTC channels expand, Gen Z shows moderation trends |

Organic wine market grows at 9.2% CAGR; 47 U.S. states allow winery DTC |

| 2024 |

Technology adoption accelerates (AI, blockchain), white wine popularity rises, consumer base diversifies |

AI and robotics streamline production; Chenin Blanc gains traction globally |

| 2025 |

Low/no-alcohol wines surge, alternative packaging dominates, focus on 30–45 age group |

Premium-and-above tiers drive growth; low-ABV wines expand significantly |

How Trends Are Revolutionizing the Wine Industry?

The above trends fundamentally reshape the wine industry by aligning it with modern consumer values and technological capabilities. Sustainability is no longer a differentiator but a baseline expectation, forcing wineries to invest in eco-friendly practices or risk losing market share. This shift has spurred innovation in viticulture, with producers adopting climate-resilient grape varieties and regenerative farming to mitigate environmental challenges. For example, regions like Spain’s Sierra de Gredos and New Zealand’s Otago are gaining prominence for their fresh, balanced wines from cooler terroirs, reflecting a move away from overheated traditional regions.

Premiumization is redefining market dynamics, with consumers prioritizing quality and authenticity. This has elevated smaller, artisanal producers who can offer unique, sustainably produced wines, challenging the dominance of large conglomerates. The focus on premium wines also supports higher margins, enabling wineries to invest in innovation and marketing tailored to younger, adventurous consumers.

E-commerce and DTC sales have democratized access to wine, empowering boutique wineries to reach global audiences without relying on traditional distributors. This shift has fostered direct consumer relationships, enabling personalized marketing and data-driven insights into preferences. For instance, AI-driven recommendations and virtual tastings enhance engagement among tech-savvy Millennials and Gen Z.

Alternative packaging is revolutionizing consumption patterns by making wine more accessible and sustainable. Cans and boxes cater to casual, on-the-go occasions, appealing to younger consumers who view wine as a versatile beverage rather than a formal luxury. This trend is reducing the industry’s environmental footprint and challenging the cultural dominance of glass bottles.

The rise of low/no-alcohol wines reflects a broader wellness movement, positioning wine as a health-conscious choice. Producers are attracting moderation-focused consumers by improving taste profiles without cannibalizing traditional sales. This innovation is critical for engaging Gen Z, prioritizing health and sustainability over traditional drinking culture.

Finally, technological advancements are enhancing efficiency and transparency across the supply chain. AI and robotics optimize production, reducing costs and improving quality, while blockchain ensures authenticity for premium wines. These tools are critical for meeting consumer demands for transparency and traceability, particularly in high-value markets.

Conclusion

The wine industry in 2025 is at a pivotal juncture, with trends from 2021 to 2025 driving a shift toward sustainability, premiumization, and technological integration. E-commerce, alternative packaging, and low/no-alcohol wines are expanding the market’s reach, while a diversifying consumer base challenges producers to innovate. These trends are revolutionizing the industry by aligning it with modern health, convenience, and environmental responsibility values, ensuring its resilience in a competitive landscape. Continued adaptation to these dynamics will be essential for wineries to thrive in the coming decade.

At Product Data Scrape, we strongly emphasize ethical practices across all our services,

including Competitor Price Monitoring and Mobile App Data Scraping. Our commitment to

transparency and integrity is at the heart of everything we do. With a global presence and a

focus on personalized solutions, we aim to exceed client expectations and drive success in data

analytics. Our dedication to ethical principles ensures that our operations are both responsible

and effective.

.jpg)