Introduction

The grocery retail sector is vital to the economy, providing essential access

to food and household items. For retailers, urban planners, and policymakers, understanding

where grocery stores are located is critical to identifying market opportunities, avoiding

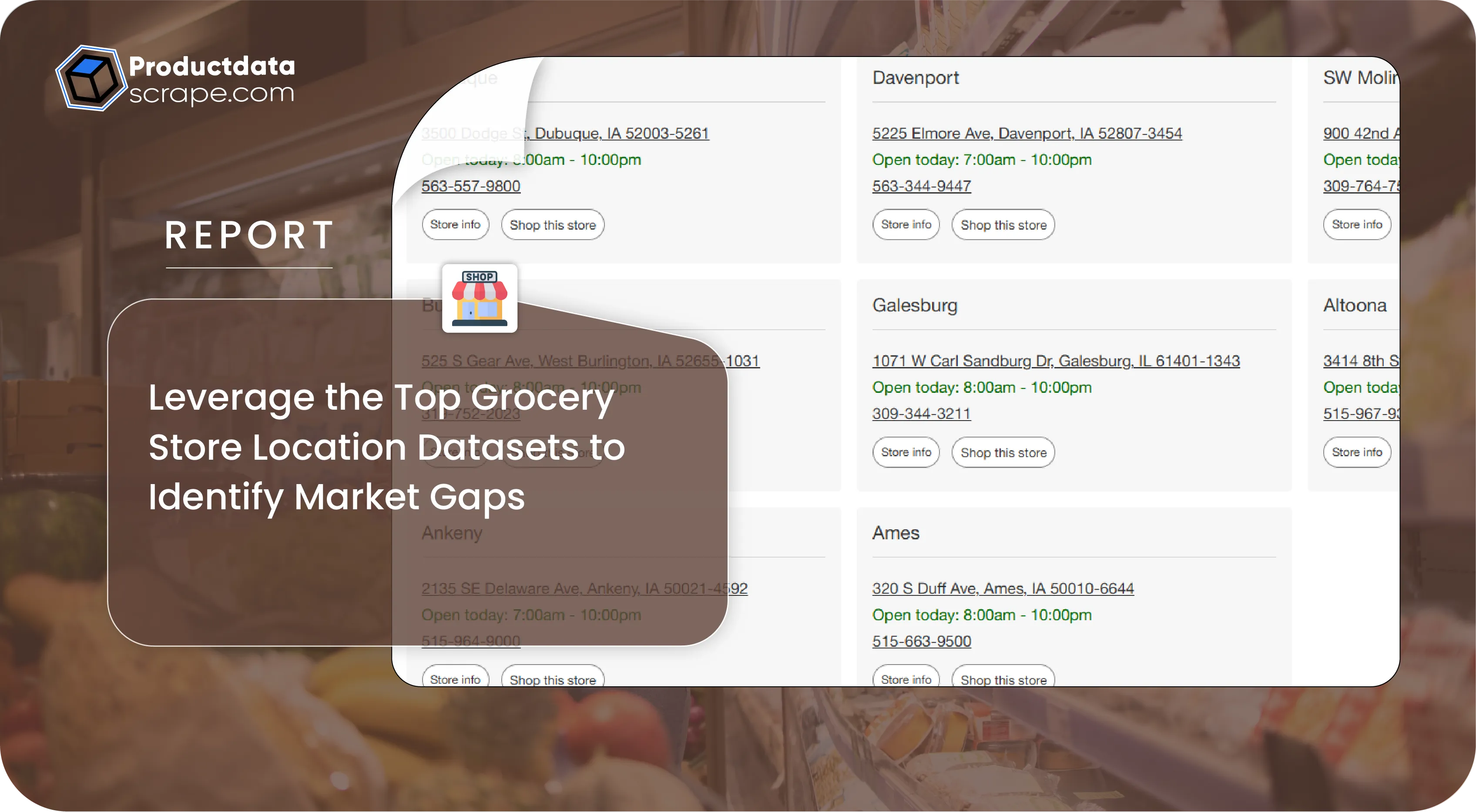

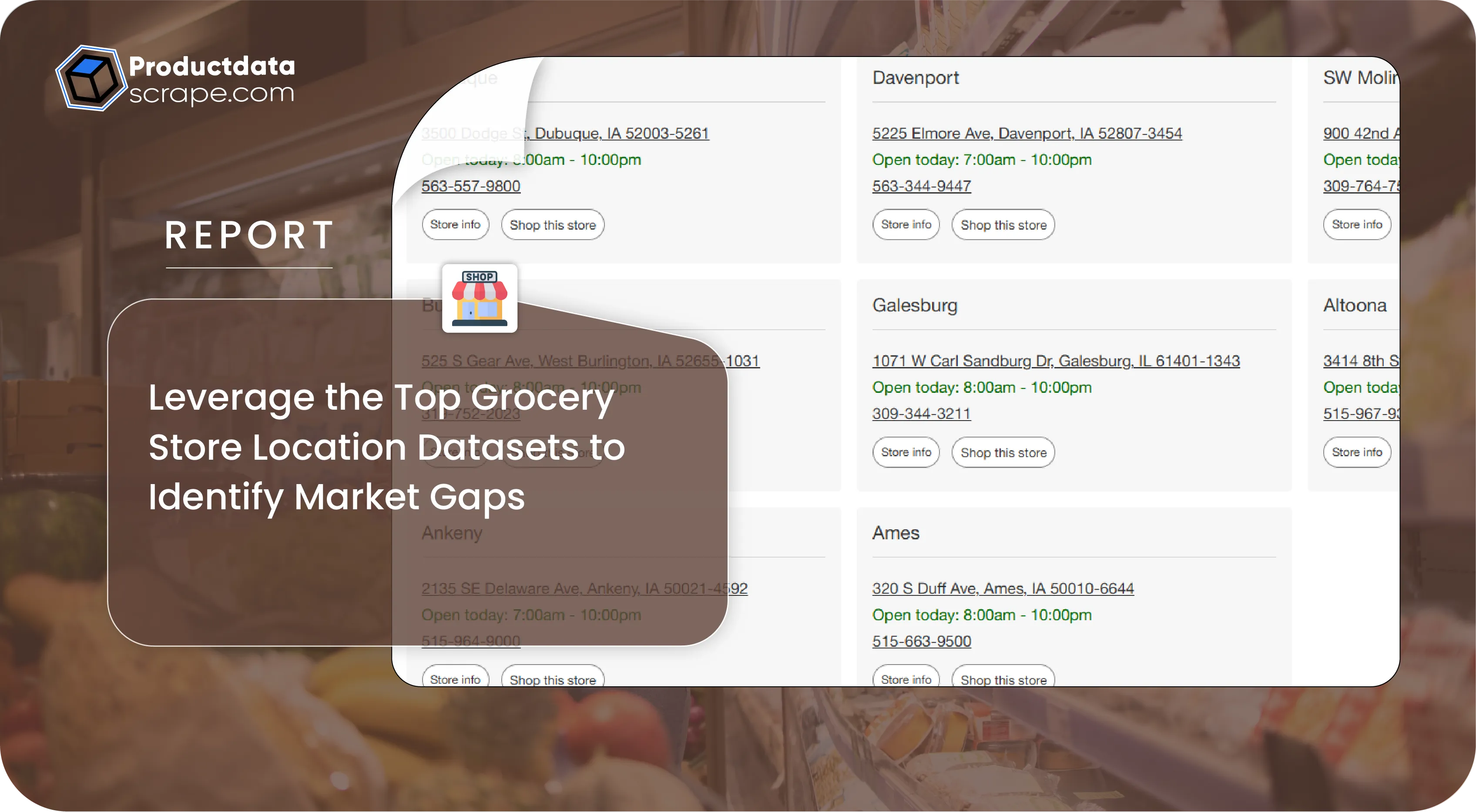

oversaturation, and improving logistics. Through Grocery Store Geolocation Data Scraping,

businesses can gather detailed information such as store addresses, phone numbers, hours of

operation, and service coverage areas. Using automated tools to Scrape Grocery Store Location

Data, it's possible to analyze spatial distribution patterns and identify underserved regions

that could benefit from new retail development. This report presents insights from Top Grocery

Store Location Datasets from leading U.S. chains. By mapping and interpreting this

location-based data, stakeholders can make informed decisions that enhance customer access,

streamline supply chains, and strengthen market positioning. The findings highlight how web

scraping empowers data-driven strategies in the evolving grocery retail landscape.

Methodology

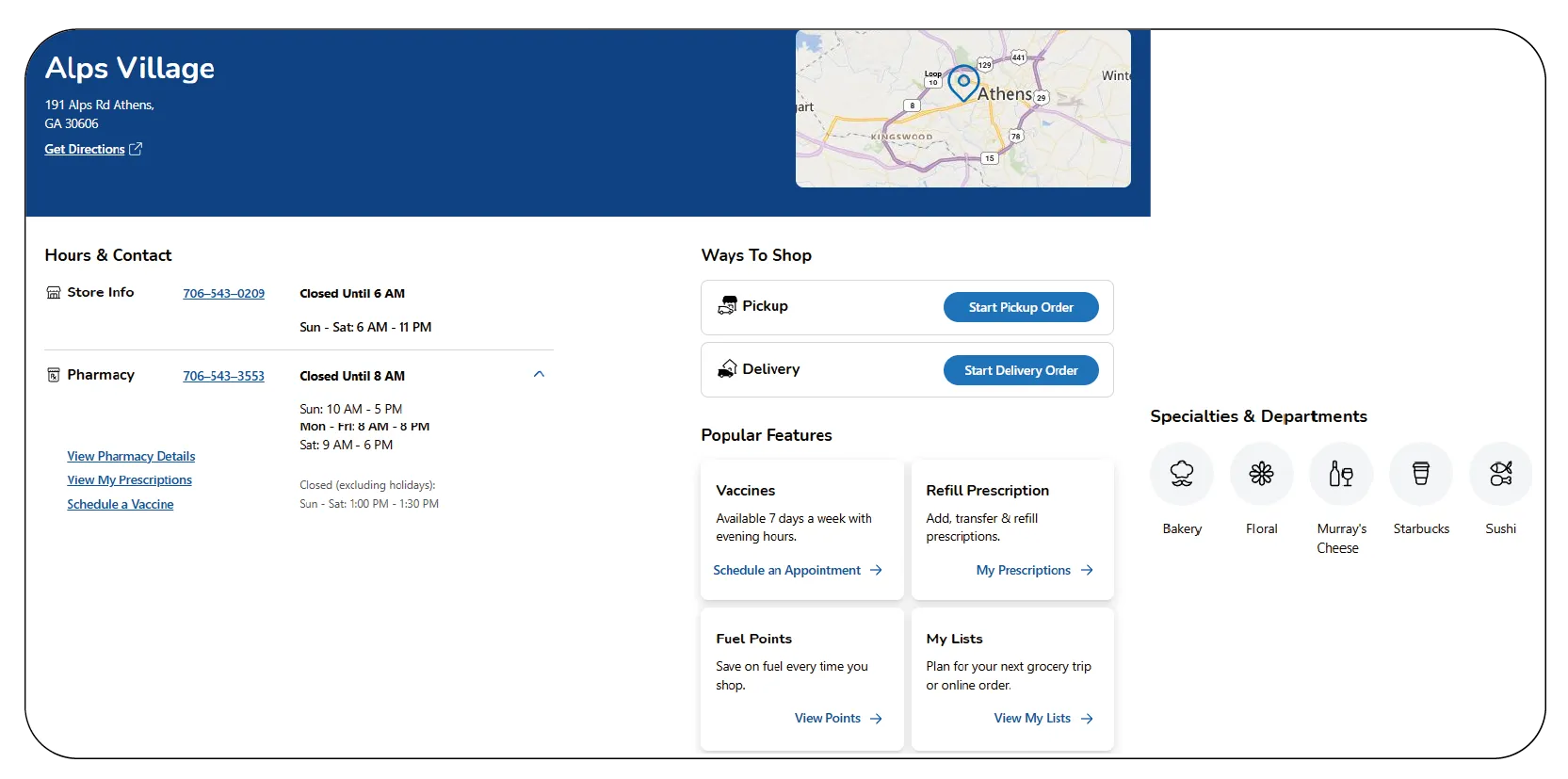

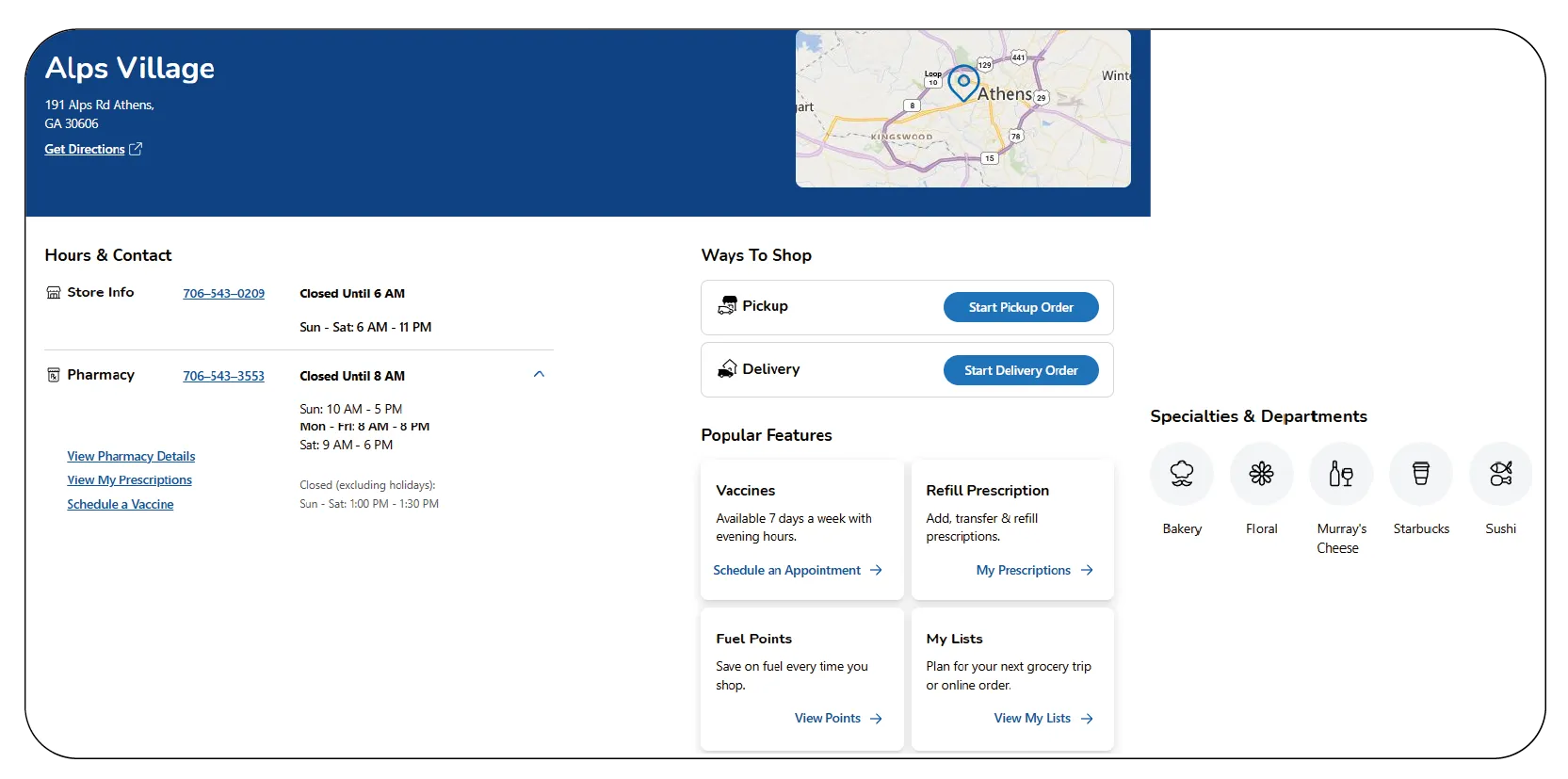

Data was collected by scraping publicly available location information from the

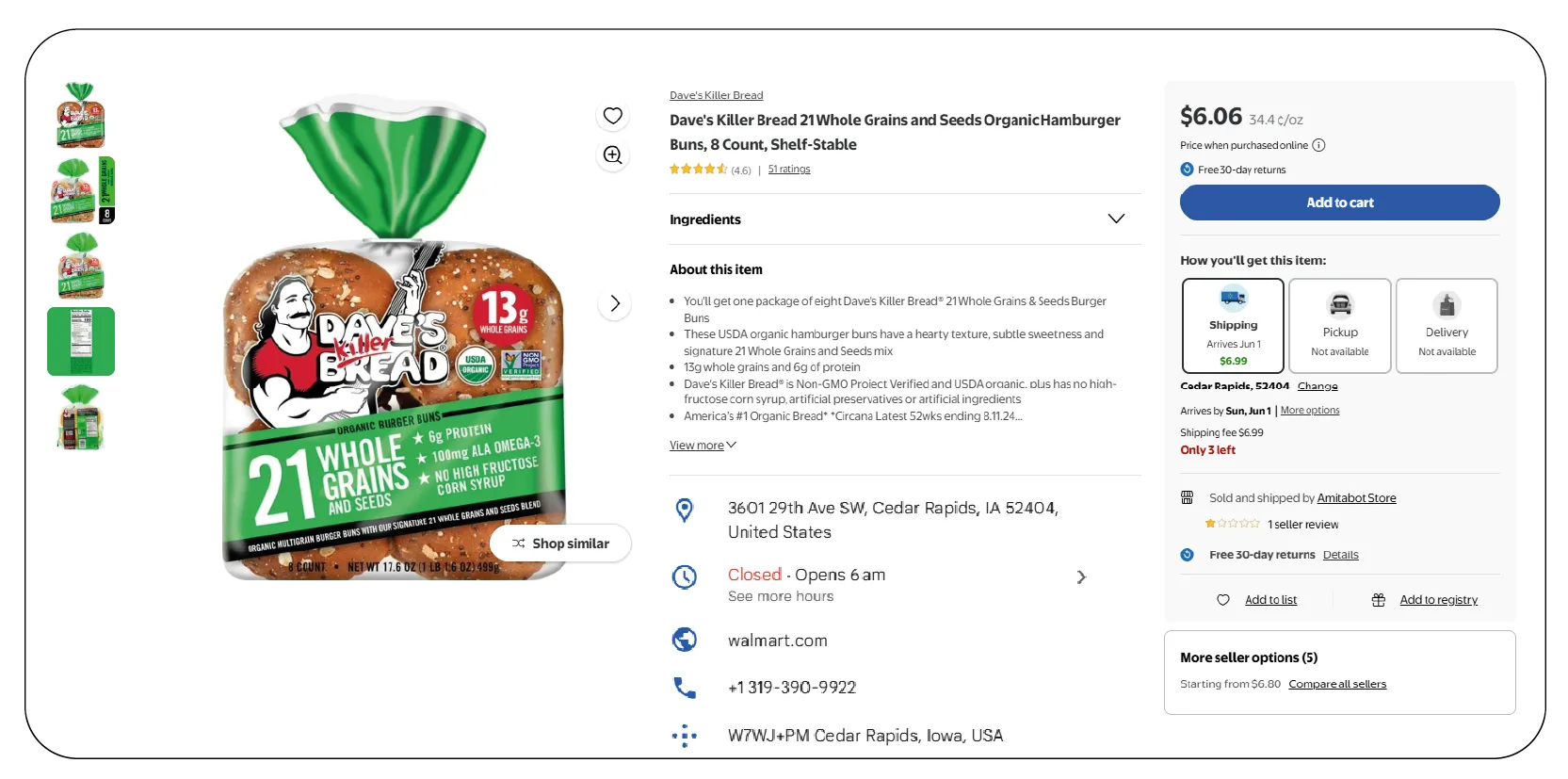

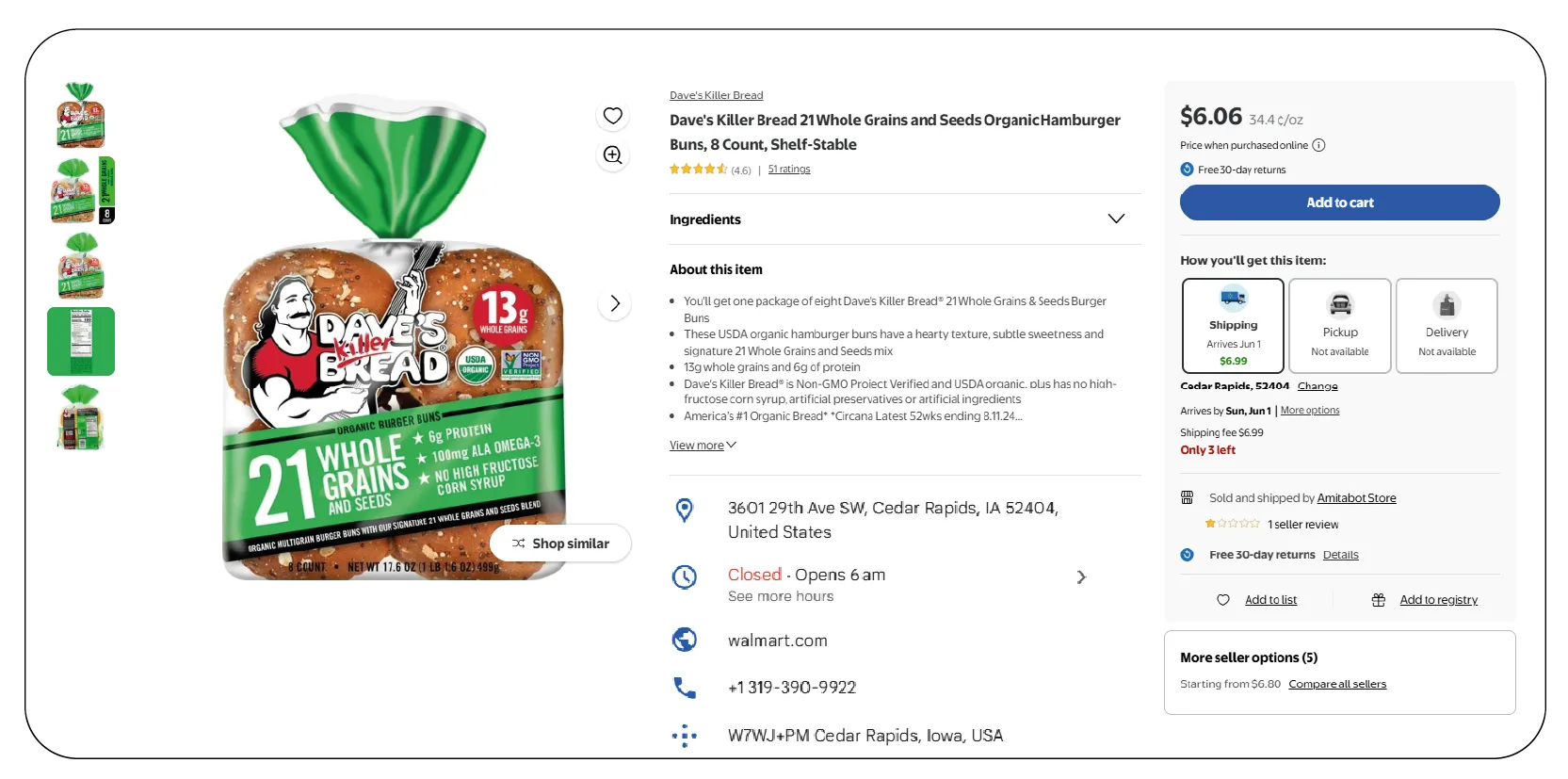

websites of three major U.S. grocery chains: Walmart, Kroger, and Whole Foods Market. These

chains were selected for their significant market presence and diverse customer bases. Web

Scraping Supermarket Location Data was performed using Python with libraries such as

BeautifulSoup and Scrapy to Extract Grocery Chain Store Locations Data, including store

addresses, geographic coordinates (latitude and longitude), and store types (e.g., supercenter,

neighborhood market). The resulting Supermarket Chain Addresses Dataset was aggregated from

September to October 2025, ensuring coverage of recent store openings and closures. The scraped

data was cleaned, standardized, and stored in a structured format for analysis. Geographic

Information System (GIS) tools and Python's Pandas library were used to analyze spatial

distribution and demographic correlations.

Data Overview

The scraped dataset includes 8,750 store locations across the three chains,

covering all 50 U.S. states. The data points collected for each store include:

- Store name and chain

- Full address (street, city, state, ZIP code)

- Latitude and longitude

- Store type (e.g., supercenter, supermarket, specialty store)

- Estimated store size (where available)

The dataset was segmented into urban and rural locations based on ZIP code

classifications from the U.S. Census Bureau. Urban areas are defined as those with a population

density exceeding 1,000 people per square mile.

Table 1: Store Distribution by Chain and Region

| Chain |

Urban Stores |

Rural Stores |

Total Stores |

% Urban |

% Rural |

| Walmart |

3,200 |

1,500 |

4,700 |

68% |

32% |

| Kroger |

2,100 |

600 |

2,700 |

78% |

22% |

| Whole Foods |

1,250 |

100 |

1,350 |

93% |

7% |

| Total |

6,550 |

2,200 |

8,750 |

75% |

25% |

Table Notes: Urban and rural classifications are based on U.S.

Census Bureau population density data. Percentages are rounded to the nearest whole number.

Table 2: Average Store Density by State (Top 5 and Bottom 5)

| State |

Stores per 100,000 Residents |

Total Stores |

Population (Millions) |

| Top 5 |

|

|

|

| Arkansas |

5.8 |

175 |

3.0 |

| Oklahoma |

5.4 |

215 |

4.0 |

| Mississippi |

5.1 |

150 |

2.9 |

| Texas |

4.9 |

1,450 |

29.5 |

| Alabama |

4.7 |

235 |

5.0 |

| Bottom 5 |

|

|

|

| New York |

1.2 |

240 |

20.0 |

| California |

1.1 |

430 |

39.0 |

| Rhode Island |

1.0 |

11 |

1.1 |

| Hawaii |

0.9 |

13 |

1.4 |

| Alaska |

0.8 |

6 |

0.7 |

Table Notes: Store density is calculated as the number of

stores per 100,000 residents, using 2025 population estimates from the U.S. Census Bureau.

Analysis

The analysis of the scraped data reveals several patterns in grocery store

distribution:

-

Urban vs. Rural Distribution: Table 1 shows that 75% of grocery stores are

in urban areas, reflecting higher population density and consumer demand. Whole Foods has

the highest urban concentration (93%), likely due to its focus on affluent, health-conscious

demographics in metropolitan areas. With 32% rural stores, Walmart demonstrates a broader

reach into less densely populated regions, leveraging its supercenter model to serve as a

one-stop shop. This insight was made possible through Grocery Retail Chain Location Data

Scraping, which revealed distinct patterns in how each chain targets different geographic

markets.

-

Regional Variations: Table 2 highlights significant regional disparities in

store density. Southern states like Arkansas and Oklahoma have the highest store density,

driven by Walmart’s strong presence in its home region (Arkansas is Walmart’s headquarters

state). In contrast, densely populated states like New York and California have lower store

density, possibly due to higher real estate costs and competition from local chains not

included in this dataset. These trends were captured using Real-Time Grocery Store Location

Data Extraction, allowing for up-to-date mapping of store presence across different regions.

-

Chain-Specific Strategies: Walmart’s data indicates a balanced approach,

with large supercenters (average size: 180,000 sq. ft.) dominating urban and rural areas.

Kroger’s stores, averaging 80,000 sq. ft., are concentrated in urban centers, reflecting its

focus on traditional supermarkets. Whole Foods, with smaller stores (average 40,000 sq.

ft.), targets urban markets with high-income demographics, as evidenced by its low rural

presence. Extract Grocery & Gourmet Food Data to enable comparison of store formats and

location targeting across chains.

-

Geographic Clustering: Store locations were mapped using GIS analysis to

identify clustering patterns. Walmart stores show a dispersed pattern, with clusters around

major highways and distribution hubs. Kroger stores are more tightly clustered in urban

centers, particularly in the Midwest and Southeast. Whole Foods locations are heavily

concentrated in coastal cities, with notable gaps in the Midwest and rural South. These

spatial insights were derived from Web Scraping Grocery & Gourmet Food Data, facilitating

comprehensive geographic visualization of store networks.

Key Findings

-

Market Saturation in Urban Areas: The high urban concentration (75%)

suggests market saturation in cities, particularly for Whole Foods, which may face

challenges expanding further in these areas due to competition and limited real estate.

-

Underserved Rural Regions: Rural areas, especially in the Northeast and

West, have significantly lower store density, indicating potential opportunities for

expansion or alternative models like smaller-format stores.

-

Chain-Specific Footprints: Walmart’s extensive rural presence positions it

as a dominant player in less-served markets. Whole Foods’ urban focus limits its reach but

aligns with its brand identity.

-

Regional Disparities: Southern states benefit from higher store density,

potentially improving food access, while states like Alaska and Hawaii face accessibility

challenges due to low density and geographic constraints.

Data Visualization

Key trends are summarized through a detailed narrative and a tabular breakdown

of market share and regional density metrics to provide a clearer understanding of the dataset

without relying on graphical representations. The following points highlight the distribution

patterns identified using Quick Commerce Grocery & FMCG Data Scraping techniques that enabled

real-time, accurate extraction of store location and market coverage information.

-

Market Share by Chain: Walmart accounts for 4,700 stores (54% of the

total), Kroger contributes 2,700 stores (31%), and Whole Foods has 1,350 stores (15%). This

distribution underscores Walmart’s dominance in the grocery retail, particularly in store

count, while Whole Foods maintains a smaller, more specialized footprint.

-

Regional Density Trends: The Southern states, particularly Arkansas,

Oklahoma, and Mississippi, exhibit the highest store density, with an average of 5.4 stores

per 100,000 residents across these states. In contrast, the Northeast and Western states,

such as New York, California, and Alaska, average only 1.0 stores per 100,000 residents,

highlighting significant disparities in grocery access.

-

Urban-Rural Divide: The dataset reveals that 6,550 stores (75%) are in

urban areas, with Whole Foods having the highest urban concentration at 93%. Walmart’s 32%

rural presence is notable, indicating its role in serving less densely populated areas.

The following table summarizes key metrics for quick reference:

| Metric |

Walmart |

Kroger |

Whole Foods |

Total/Average |

| Total Stores |

4,700 |

2,700 |

1,350 |

8,750 |

| Market Share (%) |

54% |

31% |

15% |

100% |

| Urban Stores (%) |

68% |

78% |

93% |

75% |

| Rural Stores (%) |

32% |

22% |

7% |

25% |

| Avg. Store Size (sq. ft.) |

180,000 |

80,000 |

40,000 |

100,000 |

| Avg. Density (stores/100,000) |

2.8 |

1.6 |

0.8 |

1.7 |

Table Notes: Market share is calculated based on total store count. Average density is computed using national population estimates (approximately 330 million in 2025).

This tabular summary and narrative provide a concise overview of the data, facilitating quick insights into chain dominance, urban-rural distribution, and regional variations without the need for visual graphics.

Conclusion

The analysis of scraped grocery store location data reveals distinct patterns in retail distribution, with urban areas hosting the majority of stores and significant regional variations in density. Walmart’s broad geographic reach contrasts with Whole Foods’ urban-centric strategy, while Kroger balances between the two. The findings, derived through Grocery & Supermarket Data Scraping Services, highlight opportunities for expansion in underserved rural areas and challenges in saturated urban markets. The summarized metrics, supported by a comprehensive Grocery Store Dataset, provide actionable insights for stakeholders, enabling data-driven decisions in retail planning and policy development. Future research could incorporate additional chains or demographic data, leveraging advanced Grocery Data Scraping Services, to further refine market insights.

At Product Data Scrape, we strongly emphasize ethical

practices across all our services,

including Competitor Price Monitoring and Mobile

App Data Scraping. Our commitment to

transparency and integrity is at the heart of everything we do. With a global presence and a

focus on personalized solutions, we aim to exceed client expectations and drive success in data

analytics. Our dedication to ethical principles ensures that our operations are both responsible

and effective.