Introduction

The retail sector in the United Arab Emirates (UAE), particularly in Dubai, is a vibrant market driven by urbanization, a diverse population, and growing consumer demand for convenience and variety. Supermarkets and hypermarkets account for roughly 85% of grocery retail spending, with a market value of US$40 billion in 2023. The rise of e-commerce, accelerated by the COVID-19 pandemic, has transformed the industry, with online grocery sales in the UAE growing from $170 million in 2018 to $1.1 billion by 2023. Web Scraping Top Supermarkets Data in Dubai and UAE has emerged as a vital tool for retailers, analysts, and businesses to gain insights into market trends, pricing strategies, product availability, and consumer behavior. With the ability to Extract Supermarket Data in Dubai and the UAE at scale and in real-time, companies are better equipped to make informed decisions and optimize their digital presence. Furthermore, Scraping Top Retail Chains in Dubai and UAE supports strategic analysis of promotions, competitor offerings, and stock fluctuations. This report examines web scraping to collect data from top supermarkets in Dubai and the UAE, focusing on key players, data types, and strategic applications through 2025.

The UAE Supermarket Landscape

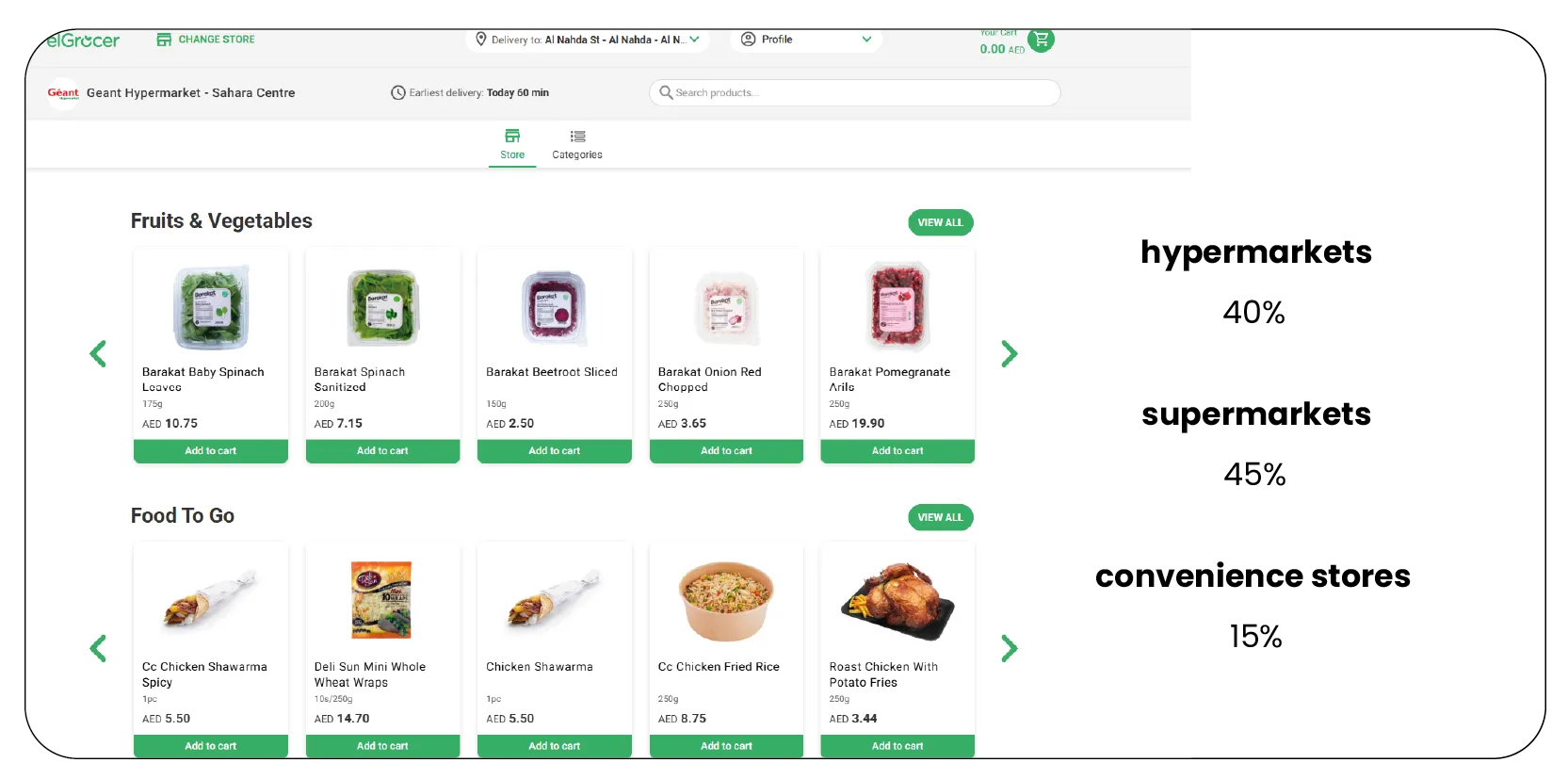

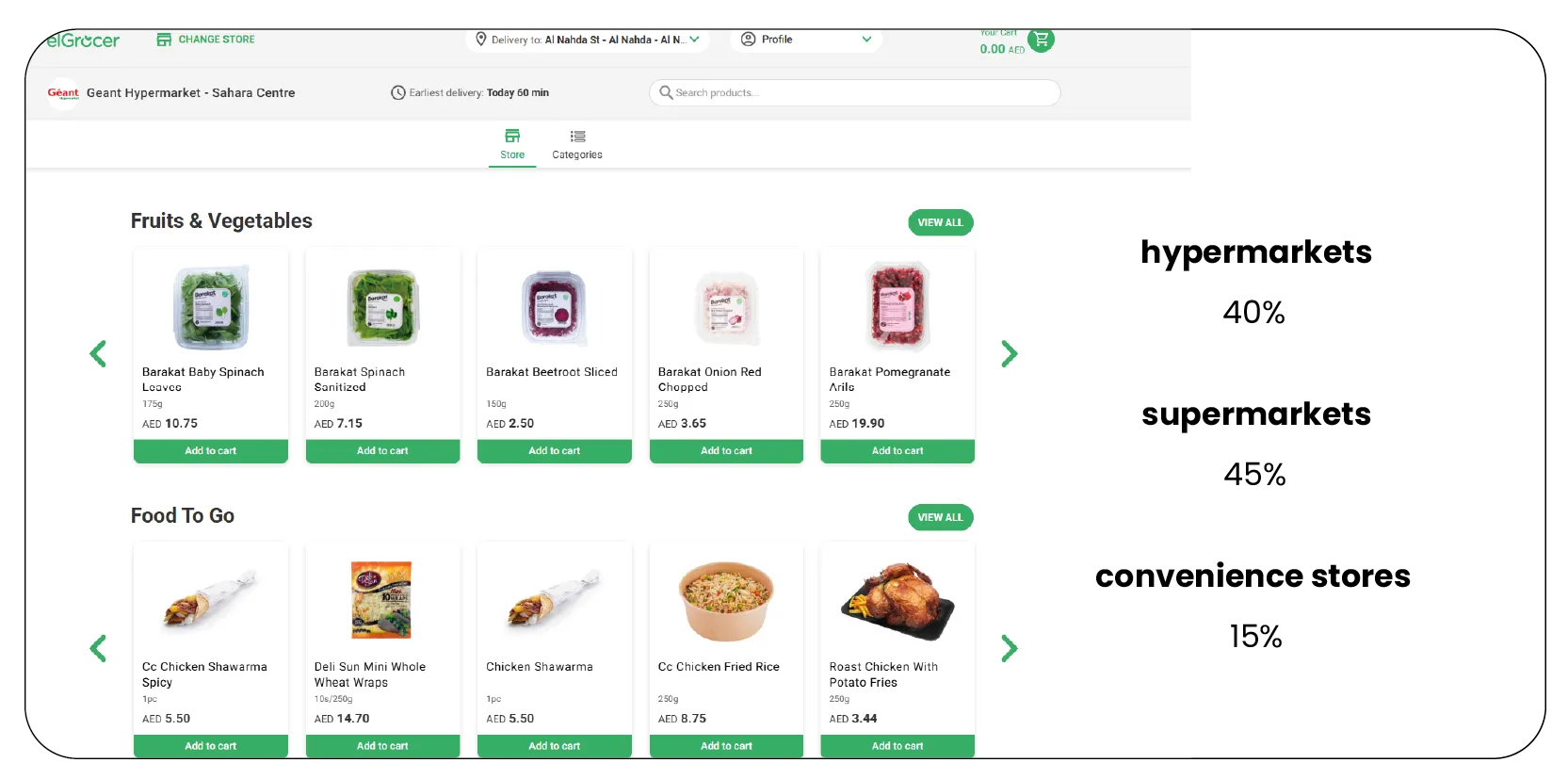

The UAE’s supermarket sector features a mix of international chains, regional players, and local brands serving a diverse consumer base. Major supermarkets like Carrefour, Lulu Hypermarket, Spinneys, Union Coop, and Al Maya operate extensive store networks, offering products ranging from fresh produce to electronics. The market is segmented into hypermarkets (40%), supermarkets (45%), and convenience stores (15%). Hypermarkets such as Carrefour and Lulu dominate due to their one-stop shopping appeal. At the same time, supermarkets like Spinneys and Choithrams focus on quality and niche offerings, such as organic and imported goods. The sector is highly competitive, with retailers enhancing digital online ordering and delivery platforms. The grocery delivery market in the UAE reached US$38.58 million in 2024, driven by platforms like InstaShop, elGrocer, and Noon.

Extract Product Listings from UAE Supermarkets to monitor real-time inventory, pricing trends, and product availability. Web scraping enables businesses to Scrape Store Details of Dubai Supermarkets, including operational hours, service coverage, and delivery options, facilitating more targeted service planning. Additionally, efforts to Extract UAE Supermarket Chain Information allow analysts and retailers to map regional reach, identify expansion opportunities, and evaluate store performance. This data offers insights into market dynamics, competitor strategies, and consumer preferences, helping retailers optimize pricing, inventory, and marketing efforts. The following sections explore the top supermarkets, scraped data types, and their strategic value.

Key Supermarkets in Dubai and the UAE

Dubai, the UAE’s largest city, hosts 492 supermarkets as of January 2025, a 2.07% increase from 2023. The table below summarizes key details of the top supermarkets in Dubai and the UAE, based on store count, product focus, and digital presence.

| Supermarket |

Store Count (UAE) |

Key Offerings |

Online Platform |

Target Market |

| Carrefour |

175 |

Fresh produce, electronics, groceries |

Yes |

Mass market, budget-conscious |

| Lulu Hypermarket |

150 |

International products, fresh food |

Yes |

Diverse, expatriate-heavy |

| Spinneys |

58 |

Organic, premium, imported products |

Yes |

Affluent, health-conscious |

| Union Coop |

40 |

Groceries, electronics, local produce |

Yes |

Community-focused, mid-range |

| Al Maya |

44 |

Fresh produce, affordable premium goods |

Yes |

Budget-conscious, diverse |

| Choithrams |

39 |

Fresh fruits, vegetables, Tesco brands |

Yes |

Local tastes, mid-to-high-end |

| Viva Supermarket |

20+ |

North African, international ingredients |

Limited |

Niche, international cuisines |

| West Zone |

46 |

Southeast Asian, affordable products |

Yes |

Expatriate communities, budget |

Example Insights from Web Scraping:

- Carrefour: Scraped data shows real-time promotions (e.g., AED 5.99/kg tomatoes with 10% off), helping competitors plan pricing.

- Lulu Hypermarket: Data reveals a focus on same-day delivery and high demand for international items.

- Spinneys: High ratings and customer reviews emphasize organic product demand, helping other retailers shape health-focused campaigns.

- Al Maya & Union Coop: Analysis of delivery options and promotional patterns informs service optimization and marketing strategy.

- Carrefour: Carrefour, operated by Majid Al Futtaim, leads with 100 stores in Dubai and 175 across the UAE. It offers a wide range of products at competitive prices. Its online platform, carrefouruae.com, generated $369 million in net sales in 2024, ranking second in UAE e-commerce. Web scraping Carrefour’s website provides data on promotions, product categories, and pricing trends, enabling competitors to benchmark strategies.

- Lulu Hypermarket: With 150 outlets, Lulu Hypermarket is popular among expatriates for its international product range. Its online platform supports same-day delivery, aligning with the UAE’s 12% e-commerce penetration rate in 2024. Scraped data from Lulu’s website reveals seasonal promotions, inventory levels, and preferences for imported goods.

- Spinneys: Spinneys operates 58 stores, focusing on high-quality organic and imported products for affluent consumers. Its stores, such as those in Motor City and Jumeirah Beach Road, cater to health-conscious shoppers. Web scraping Spinneys’ platform yields pricing for premium products, stock availability, and customer reviews, which are critical for niche market insights.

- Union Coop and Al Maya: Union Coop, with over 40 stores, emphasizes community engagement and affordable quality. Al Maya, with 44 stores, pioneered free delivery in Dubai and supports international orders via social media. Scraped data from their websites highlights local produce pricing, promotional campaigns, and delivery logistics.

- Other Notable Players: Choithrams (39 stores) is known for fresh produce and Tesco-branded products, while Viva Supermarket (20+ stores) specializes in North African and international ingredients. West Zone (46 stores) targets Southeast Asian expatriates with affordable offerings. Scraping data from these chains provides insights into niche markets and regional preferences.

Types of Data Scraped

Web scraping targets various data points from supermarket websites and apps, including:

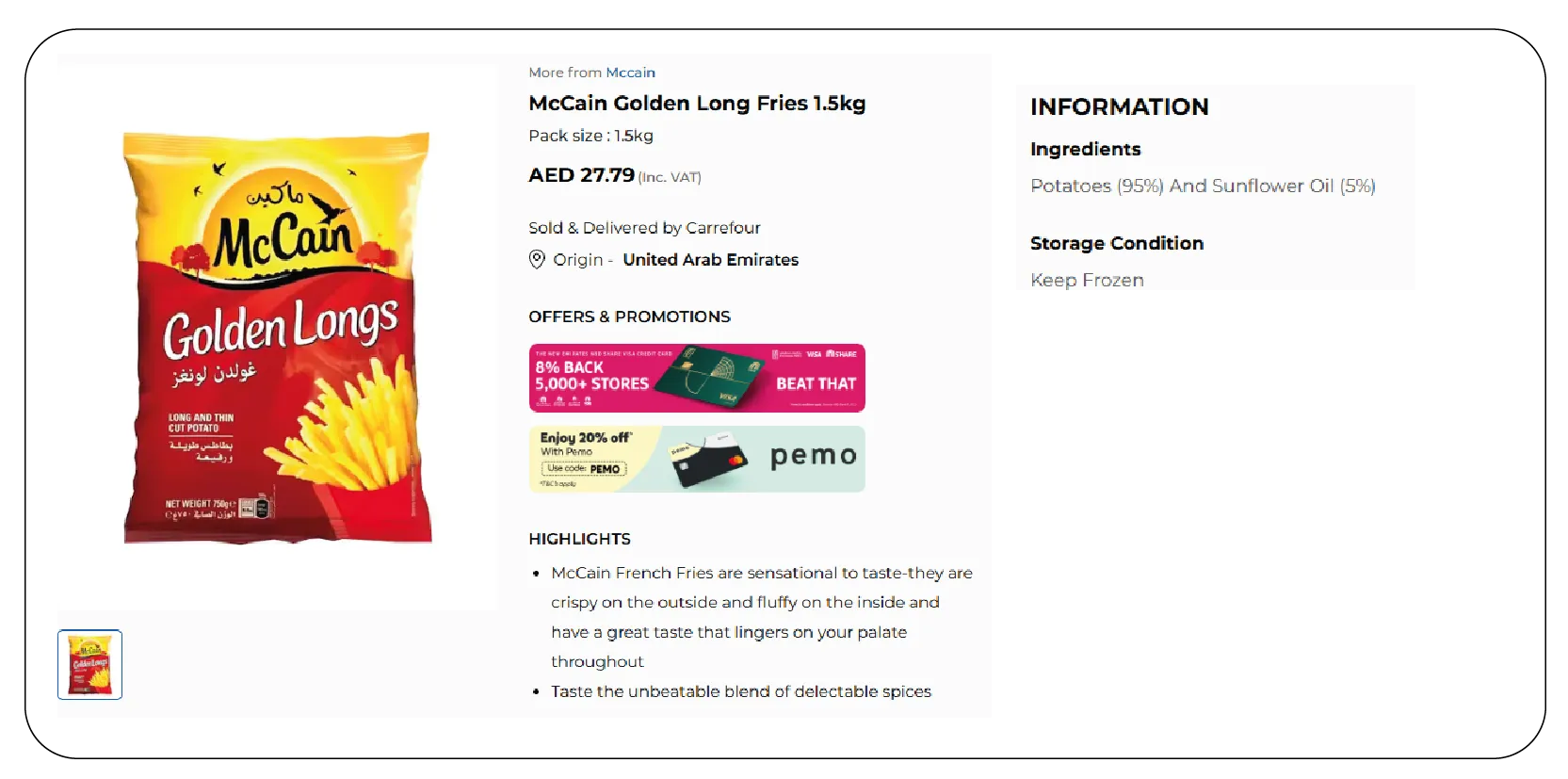

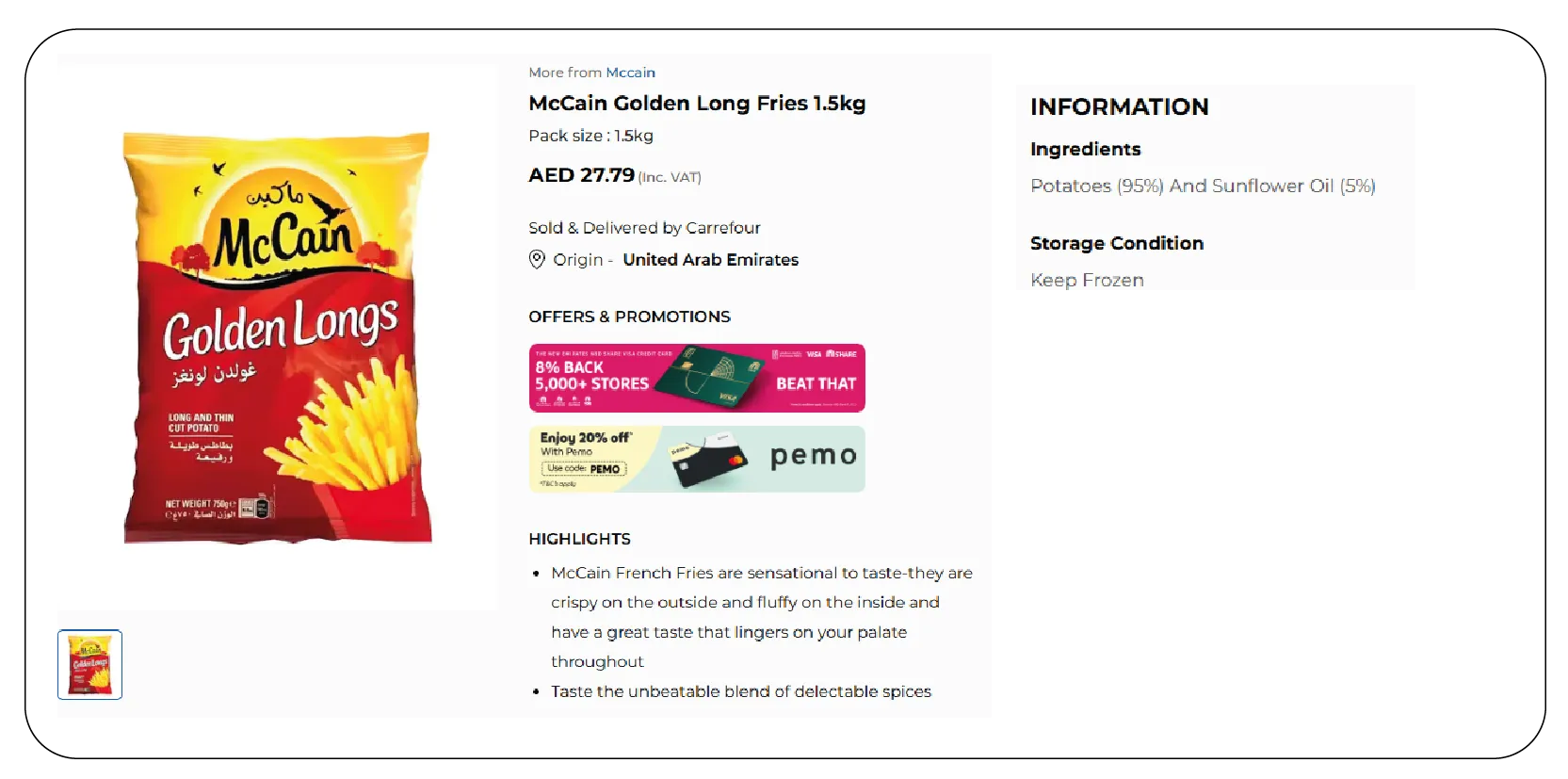

- Product Details: Names, categories, descriptions, and nutritional information.

- Pricing and Promotions: Regular prices, discounts, and limited-time offers.

- Inventory Levels: Stock availability across physical and online stores.

- Customer Reviews: Ratings, feedback, and sentiment analysis.

- Delivery and Logistics: Delivery times, fees, and service areas.

- Store Information: Locations, operating hours, and contact details.

These data points are extracted in structured formats (e.g., JSON, CSV) for analysis, enabling retailers to track competitors and optimize operations. For example, scraping Carrefour’s website might show a 1kg pack of tomatoes priced at AED 5.99 with a 10% discount, while Lulu offers it at AED 6.50 without promotion, informing pricing strategies.

Sample Price Comparison for Common Grocery Items (as of 2025)

| Product |

Carrefour (AED) |

Lulu Hypermarket (AED) |

Spinneys (AED) |

Union Coop (AED) |

| Fresh Milk (1L) |

5.75 |

5.50 |

6.25 |

5.40 |

| White Bread (loaf) |

4.00 |

4.25 |

5.00 |

4.00 |

| Tomatoes (1kg) |

4.95 |

4.65 |

6.10 |

4.50 |

| Basmati Rice (5kg) |

35.00 |

33.50 |

38.00 |

32.75 |

| Chicken (whole, 1kg) |

15.25 |

14.90 |

16.50 |

14.80 |

| Eggs (12 pack) |

10.50 |

10.25 |

11.50 |

10.00 |

| Cooking Oil (1.8L) |

18.00 |

17.50 |

19.00 |

17.20 |

By leveraging Grocery & Supermarket Data Scraping Services , UAE retailers can stay competitive, align with digital trends, and meet evolving customer expectations. Looking forward to 2025, web scraping will remain integral to gaining a data-driven edge in one of the Middle East’s most advanced retail landscapes.

Strategic Applications of Scraped Data

Strategic applications of scraped data empower retailers with actionable insights into pricing trends, stock levels, and customer preferences. By leveraging Grocery & Supermarket Data Scraping Services, businesses can enhance decision-making, streamline operations, and create targeted marketing campaigns. These services support competitive analysis and demand forecasting, enabling companies to stay agile and responsive in the dynamic UAE grocery retail landscape.

- Competitive Analysis: Scraped data helps retailers monitor competitors’ pricing, product ranges, and promotions. For instance, analyzing Spinneys’ premium product prices allows Carrefour to consider similar offerings at lower prices, enhancing market positioning.

- Market Trend Identification: Aggregating data across supermarkets reveals trends like growing demand for organic products or same-day delivery. The grocery delivery market’s growth to $1.1 billion by 2023 highlights the need for real-time data to adapt to consumer preferences.

- Inventory and Supply Chain Optimization: Scraping inventory data aids in managing stock levels. If Al Maya’s website shows low stock for a popular dairy product, competitors can prioritize restocking to capture market share, which is crucial in Dubai’s fast-paced retail environment.

- Consumer Behavior Insights: Customer reviews scraped from platforms like InstaShop or Spinneys’ websites reveal preferences. Sentiment analysis might show consumers prioritize fast delivery, prompting retailers to invest in logistics.

- E-commerce Optimization: With e-commerce penetration doubling from 2019 to 2023, scraped data from platforms like carrefouruae.com informs digital strategies. Retailers analyze user interfaces and checkout processes to enhance online experiences, boosting sales.

Future Outlook Through 2025

The UAE supermarket sector will continue growing through 2025, driven by technological advancements and online shopping trends. The grocery delivery market is projected to serve 3 million users by 2025, with innovations like AI-driven insights shaping the industry. Scrape Grocery Store Locations in Dubai for delivery logistics optimization and regional market analysis. Web scraping will remain essential, providing real-time data to navigate competition. Businesses that Extract Grocery & Gourmet Food Data can better understand product trends, specialty preferences, and consumer demand shifts. Leveragingaa

Web Scraping Grocery & Gourmet Food Data enables retailers to implement advanced analytics and personalized marketing strategies. This gives them a competitive edge while aligning with the UAE’s data-driven economic goals.

Conclusion

Web scraping data from top supermarkets in Dubai and the UAE provides a strategic advantage in a competitive retail market. Extracting data on pricing, inventory, promotions, and consumer behavior from players like Carrefour, Lulu Hypermarket, and Spinneys enables businesses to optimize operations and enhance customer experiences. Quick Commerce Grocery & FMCG Data Scraping is critical in tracking fast-moving products and delivery trends, especially as rapid delivery platforms gain traction. The sector’s growth, fueled by e-commerce and urbanization, emphasizes the importance of data-driven strategies. A well-structured Grocery Store Dataset allows businesses to monitor changing product lines and localize offerings based on real-time demand. By leveraging Grocery Data Scraping Services , retailers can stay ahead of trends and meet diverse consumer demands, ensuring success in this dynamic market through 2025.

At Product Data Scrape, we strongly emphasize ethical practices across all our services,

including Competitor Price Monitoring and Mobile App Data Scraping. Our commitment to

transparency and integrity is at the heart of everything we do. With a global presence and a

focus on personalized solutions, we aim to exceed client expectations and drive success in data

analytics. Our dedication to ethical principles ensures that our operations are both responsible

and effective.