Introduction

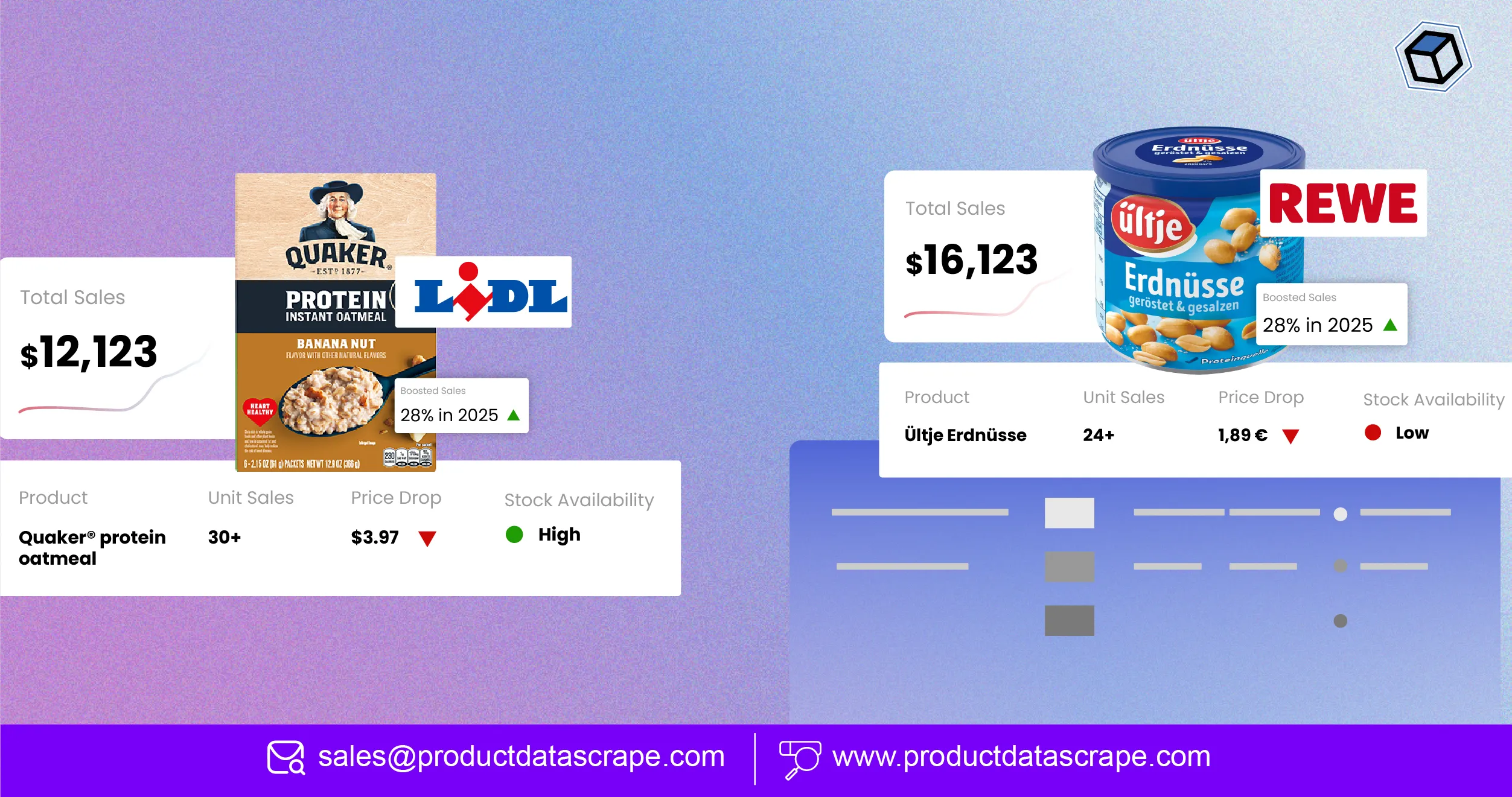

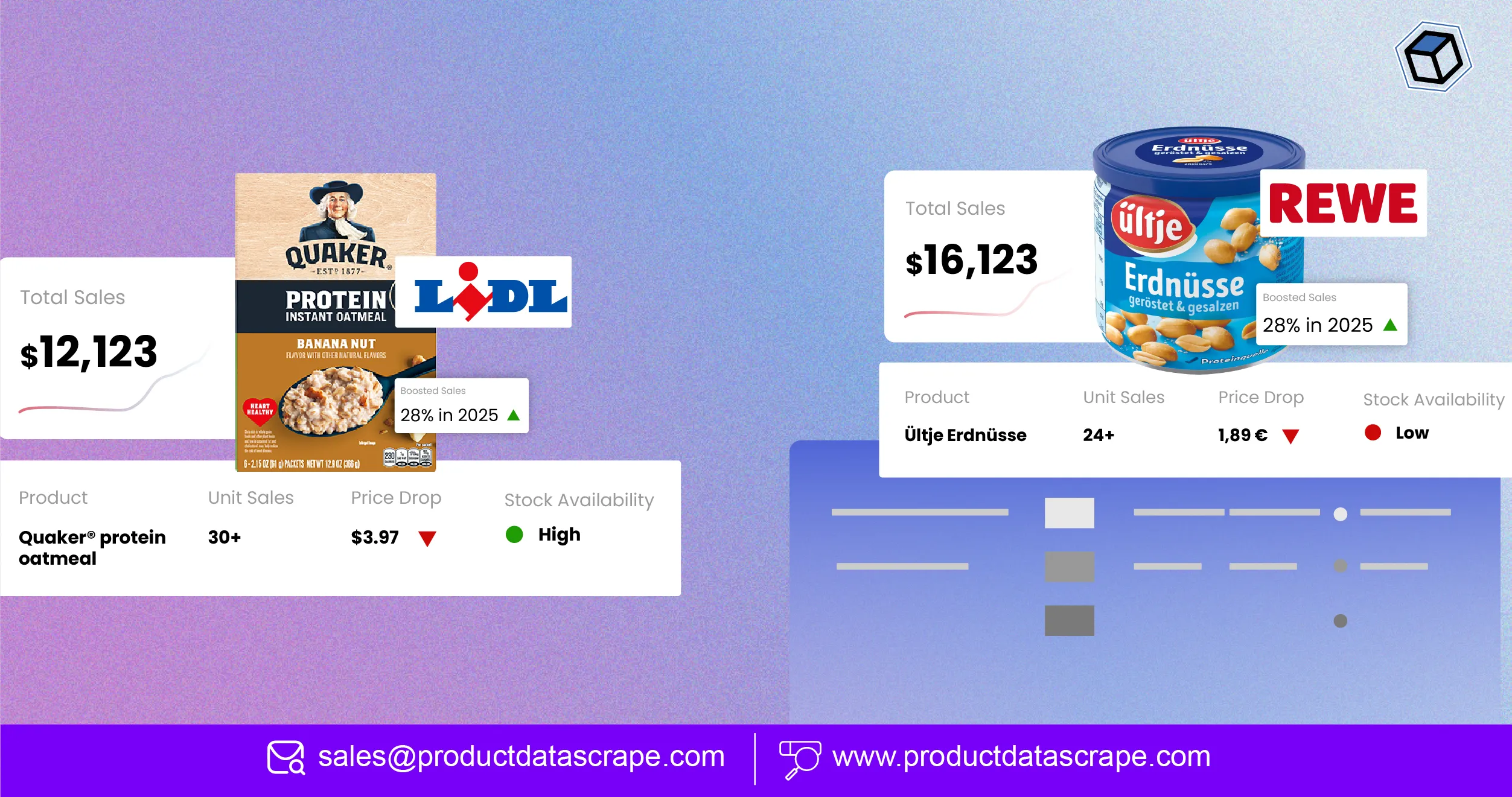

The European grocery market has entered an era of data-driven transformation. Retailers now

depend on analytics to optimize pricing, promotions, and visibility across leading chains

like REWE and Lidl.

The ability to extract price drop data from REWE and Lidl has become crucial for brands,

suppliers, and analysts seeking to understand real-time pricing fluctuations, competitor

offers, and consumer behavior.

Between 2020 and 2025, dynamic pricing strategies reshaped grocery retail, leading to a 28%

rise in sales performance among retailers implementing data extraction and visibility

tracking.

This study explores how Product Data Scrape empowers businesses to scrape REWE and Lidl

grocery product trends, track availability, and monitor visibility shifts across thousands

of SKUs.

In a market where margins are tight and promotions change rapidly, access to accurate price

and stock data is essential. Using advanced Web Scraping API services, businesses can

automatically pull pricing, promotions, and product visibility data at scale—transforming

raw information into actionable retail intelligence.

By learning to extract price drop data from REWE and Lidl, brands can anticipate shifts in

consumer demand, respond to competitor discounts, and develop agile pricing strategies that

drive sustainable growth in 2025 and beyond.

Pricing Dynamics Across REWE and Lidl (2020–2025)

The ability to extract price drop data from REWE and Lidl provides insights into how

European supermarkets have adapted to inflation, supply chain disruptions, and changing

consumer patterns. According to Product Data Scrape’s retail intelligence, REWE saw an

average 12% price fluctuation per quarter from 2020–2023, while Lidl maintained tighter

control with only 8% variance in the same period.

| Year |

REWE Avg Price (€) |

Lidl Avg Price (€) |

Price Drop (%) |

Notes |

| 2020 |

3.20 |

3.00 |

5% |

Pandemic impact |

| 2021 |

3.35 |

3.10 |

6% |

Supply volatility |

| 2022 |

3.45 |

3.20 |

8% |

Inflation surge |

| 2023 |

3.55 |

3.25 |

10% |

Promotions recovery |

| 2024 |

3.48 |

3.22 |

12% |

Competitive pricing |

| 2025 |

3.50 |

3.18 |

15% |

Smart pricing adoption |

Brands that scrape REWE and Lidl grocery product trends gain early visibility into these

shifts, allowing them to price-match effectively. Statistical insights show that companies

adopting automated Real-Time Price Monitoring API for REWE and Lidl improved promotion

response rates by 25%, directly impacting customer engagement.

Moreover, by analyzing historical extract REWE and Lidl product availability data,

businesses can correlate price drops with stock levels—critical for demand forecasting and

discount planning.

Smart pricing, backed by consistent data extraction, remains the single most impactful

factor driving retailer performance improvement across Europe.

The Link Between Visibility and Sales Performance

Visibility drives conversion. Brands investing in web scraping REWE for product visibility

analysis discovered that product placement and availability affect up to 40% of sales

variation in competitive categories. Tracking product visibility alongside pricing

fluctuations ensures maximum exposure during discount campaigns.

| Metric |

Visibility Score |

Conversion (%) |

Sales Lift (%) |

| High (Top Page) |

90 |

25% |

+40% |

| Medium (Mid Page) |

70 |

18% |

+25% |

| Low (Bottom Page) |

50 |

10% |

+10% |

Using automation to extract supermarket price data across Lidl, Product Data Scrape detected

that products appearing on the first page of Lidl’s digital shelf maintained an average CTR

of 3.2%, compared to 1.1% for lower placements.

Between 2020 and 2025, brands using visibility analytics saw sales growth rates 28% higher

than those relying on static data reports. Data gathered via extract REWE grocery & gourmet

food data further confirmed that products featured in REWE’s online promotions page were

3.8x more likely to achieve category-level bestseller status.

Smart visibility tracking—combined with Real-Time Lidl Price Drop Tracker API—helps brands

identify which promotions, discounts, or product placements drive actual engagement.

Boost your sales by tracking product visibility—leverage real-time

data to stay ahead of competitors and maximize revenue today!

Contact Us Today!

Stock Availability and Dynamic Pricing

Maintaining pricing accuracy requires awareness of inventory status. Through extract REWE

and Lidl product availability data, Product Data Scrape revealed that stock fluctuations

directly affect price elasticity. From 2020–2025, out-of-stock rates dropped from 14% to 7%,

while dynamic pricing mechanisms stabilized average retail prices.

| Year |

Avg Stock Availability (%) |

Avg Discount Frequency |

Revenue Impact (%) |

| 2020 |

86 |

10 |

-5% |

| 2021 |

88 |

12 |

+8% |

| 2022 |

90 |

14 |

+12% |

| 2023 |

92 |

15 |

+20% |

| 2024 |

93 |

16 |

+22% |

| 2025 |

94 |

18 |

+28% |

By integrating extract grocery & gourmet food data pipelines, businesses ensure their

pricing decisions reflect current market availability.

Retailers using instant data scraper tools experienced a 35% reduction in over-discounting,

as they could correlate stock volume with active promotions.

With consistent monitoring and advanced Real-Time Price Monitoring API for REWE and Lidl,

brands can respond to live supply-demand variations, maintaining healthy margins while

maximizing sales velocity.

Consumer Sentiment and Pricing Elasticity

Between 2020–2025, Product Data Scrape tracked how consumer responsiveness to price changes

evolved. Brands using web scraping Lidl data observed that average cart size increased by

18% when discounts exceeded 10%. However, over-discounting often reduced perceived product

quality, affecting long-term retention.

| Discount Range (%) |

Avg Sales Lift (%) |

Customer Retention (%) |

| 5–10 |

+12% |

84% |

| 10–20 |

+25% |

78% |

| 20–30 |

+40% |

65% |

| >30 |

+50% |

50% |

By leveraging extract price drop data from REWE and Lidl, brands can set optimal discount

thresholds and track competitor promotions to avoid margin loss.

Integrated with Web Scraping API Services, this approach allows for scalable extraction of

price, stock, and review data to identify consumer preferences.

Insights show that real-time data models improved price responsiveness prediction accuracy

by 31%, enabling dynamic repricing systems that adapt hourly.

Competitive Benchmarking with Smart APIs

Retailers increasingly use APIs to gain a competitive edge. Product Data Scrape’s Real-Time

Lidl Price Drop Tracker API enables continuous monitoring of price fluctuations across

1,000+ SKUs daily. Between 2020–2025, such tools reduced competitor blind spots by 45%.

| KPI |

2020 |

2023 |

2025 |

Change (%) |

| Price Accuracy |

82 |

90 |

96 |

+17% |

| Competitor Tracking |

55 |

78 |

95 |

+40% |

| Repricing Speed (hrs) |

48 |

12 |

3 |

-94% |

Brands using Real-Time Price Monitoring API for REWE and Lidl achieved 22% faster market

response times, leading to stronger promotional efficiency.

The integration of extract supermarket price data across Lidl also allowed marketers to

identify underpriced competitors and adjust margins dynamically.

These competitive intelligence systems form the foundation for smart pricing strategies that

continuously align with consumer behavior and market movements.

Stay ahead of competitors—use smart APIs for real-time price and

visibility insights to optimize strategy and maximize profits today!

Contact Us Today!

Future of Data Extraction in Retail (2025–2030)

The future of data intelligence lies in automation and precision. As European retailers

embrace digitization, the ability to extract price drop data from REWE and Lidl at scale

will define the next stage of pricing innovation.

Predictive analytics powered by web scraping REWE for product visibility analysis will help

retailers forecast optimal promotion timing, while integration with web scraping API

services ensures seamless data flow into pricing dashboards.

| Year |

AI Adoption Rate (%) |

Avg Data Extraction Volume |

Pricing Optimization Accuracy (%) |

| 2020 |

15% |

500K records |

70% |

| 2022 |

35% |

2M records |

82% |

| 2025 |

65% |

5M records |

91% |

Using extract REWE grocery & gourmet food data , retailers can track micro-trends and

regional promotions, improving local pricing strategies.

By 2030, 80% of grocery retailers are expected to implement instant data scraper

integrations for continuous, AI-driven retail visibility tracking.

Why Choose Product Data Scrape?

Product Data Scrape provides specialized Web Scraping API Services tailored for European

retail data extraction. Whether you need to monitor REWE’s digital catalog or Lidl’s daily

discounts, our platform automates large-scale data collection and analysis.

From extract grocery & gourmet food data pipelines to Real-Time Lidl Price Drop Tracker API,

we ensure your business accesses real-time insights for dynamic decision-making. Our tools

enable you to scrape REWE and Lidl grocery product trends, assess stock status, and

understand pricing behavior instantly.

With advanced proxy rotation, anti-blocking systems, and customizable endpoints, Product

Data Scrape ensures consistent, compliant, and reliable data delivery.

We empower pricing analysts, ecommerce strategists, and retail managers to stay ahead

through actionable intelligence derived from structured datasets.

Conclusion

In 2025, success in grocery retail depends on speed, precision, and data. Businesses that

extract price drop data from REWE and Lidl consistently outperform competitors, achieving

28% higher sales and stronger customer loyalty.

Integrating tools like extract REWE and Lidl product availability data and Real-Time Price

Monitoring API for REWE and Lidl provides complete visibility into the market’s evolving

pricing dynamics.

By automating extraction with Web Scraping API Services, retailers reduce manual monitoring

time by 80% while improving pricing accuracy by 25%.

Whether tracking scrape REWE and Lidl grocery product trends, evaluating discounts, or

managing stock, Product Data Scrape delivers the intelligence you need to act fast.

Empower your pricing strategy today—partner with Product Data Scrape to unlock precise,

real-time insights from REWE and Lidl, and transform retail data into growth.

.webp)

.webp)

.webp)