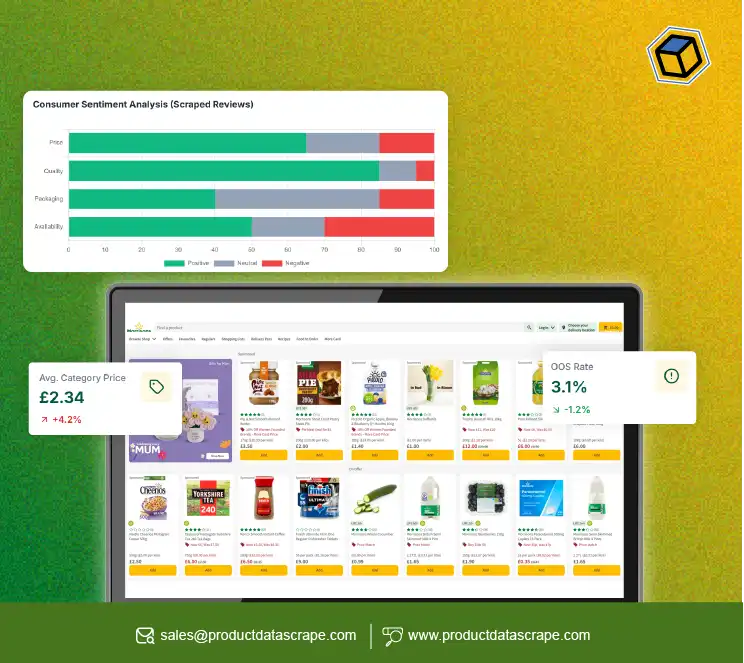

In the rapidly evolving retail landscape, brands are increasingly acknowledging the critical role of tracking and enhancing their digital shelf KPIs. Metrics like Content Quality, Share of Search, and Availability are paramount in enhancing eCommerce sales and securing a larger online market share. To meet brands' escalating demands, top Digital Shelf Analytics providers are enhancing their sophistication. Consequently, adopting digital shelf solutions has become a vital prerequisite for leading brands.

However, as brands and vendors delve deeper into Digital Shelf Analytics, analyzing digital shelf data on mobile apps needs to be more noticed. Solution providers' ability to effectively track and analyze this mobile-specific data is crucial. Mobile app data scraping has emerged as a valuable tool, enabling brands to gather insights into customer behavior, preferences, and trends on mobile platforms. Scrape retail mobile app data to help brands enhance their understanding of the digital shelf landscape and make informed decisions to drive sales and customer engagement.

The Mobile Shopping Revolution: Adapting Retail Strategies for Consumer Behavior Shifts

The emphasis on mobile apps is crucial due to the shift in consumer behavior towards mobile devices. Today, consumers are browsing and making purchases on their mobile devices. A recent Insider Intelligence report highlights that more than 40% of retail eCommerce sales are now made on mobile devices, showcasing the growing importance of mobile platforms in the retail landscape.

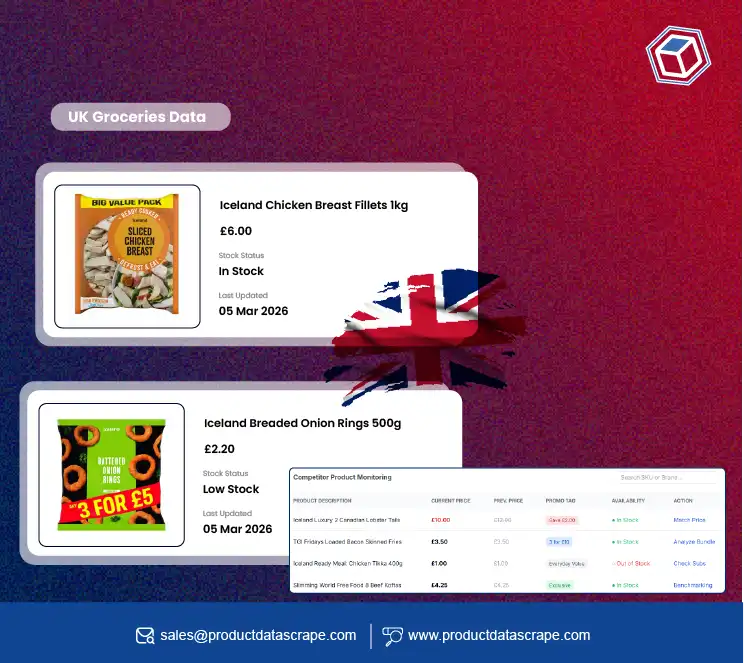

Additionally, the rise of delivery intermediaries such as Instacart, DoorDash, and Uber Eats has further fueled the growth of mobile app shopping. According to eMarketer, US grocery delivery intermediary sales are projected to reach $68.2 billion by 2025, a significant increase from $8.8 billion in 2019.

Understanding and optimizing brands' presence on mobile apps using Retail Data Scraping Service is critical. Our client, a multinational CPG company, revealed that up to 70% of its online sales are generated through mobile apps, highlighting the significance of mobile platforms in driving sales and customer engagement.

In conclusion, the surge in app usage underscores the importance of adapting digital shelf strategies to meet consumers' evolving needs. Leveraging a retail mobile app data scraper can give brands valuable insights into mobile app data, helping them optimize their digital shelf presence and stay ahead in the competitive retail landscape.

The Critical Importance of Mobile App Data in Digital Shelf Analytics

When it comes to digital shelf analytics, brands have traditionally placed a strong emphasis on data collected from desktop websites of online marketplaces. This preference stems from the complexity of gathering data from mobile apps, which requires dedicated effort and advanced technological capabilities. Systems designed for grocery data scraping are not readily adaptable to capture data from mobile apps reliably and consistently.

However, the distinction between data from apps and desktop sites is becoming increasingly crucial for brands. This is because several critical digital shelf metrics vary significantly between these two platforms due to differences in user behavior. One such metric that is particularly affected is search discoverability, where even slight changes in search rankings can notably impact a brand's performance on retail mobile apps.

For instance, consider the search results for "running shoes" on the Amazon website compared to the Amazon mobile app. Product listings and the number of sponsored listings often differ, which can significantly impact a brand's Share of Search. Share of Search refers to the share of a brand's products among the top 20 ranked products in a category or subcategory, indicating the brand's visibility on online marketplaces.

To illustrate the potential consequences of overlooking mobile app data, imagine a brand heavily relying on desktop digital shelf data. Based on reports from its analytics partner, the brand believes it has a substantial Share of Search. However, in reality, the brand's Share of Search on mobile may be significantly lower, negatively impacting sales.

We experimented with our data analysis and aggregation platform to better understand these differences. Focusing on Amazon.com and Amazon's mobile app, our e-commerce data scraping services analyzed over 13,000 SKUs across various shopping categories to ensure a robust sample size. Below, we outline the key findings of our experiment to highlight the importance of considering mobile app data in digital shelf analytics.

Comparing Share of Search: App vs. Desktop in Grocery, CPG, and Health & Beauty Categories

Our analysis delved into three prominent consumer categories – Grocery, CPG, and Health & Beauty – to compare the Share of Search between mobile apps and desktop platforms.

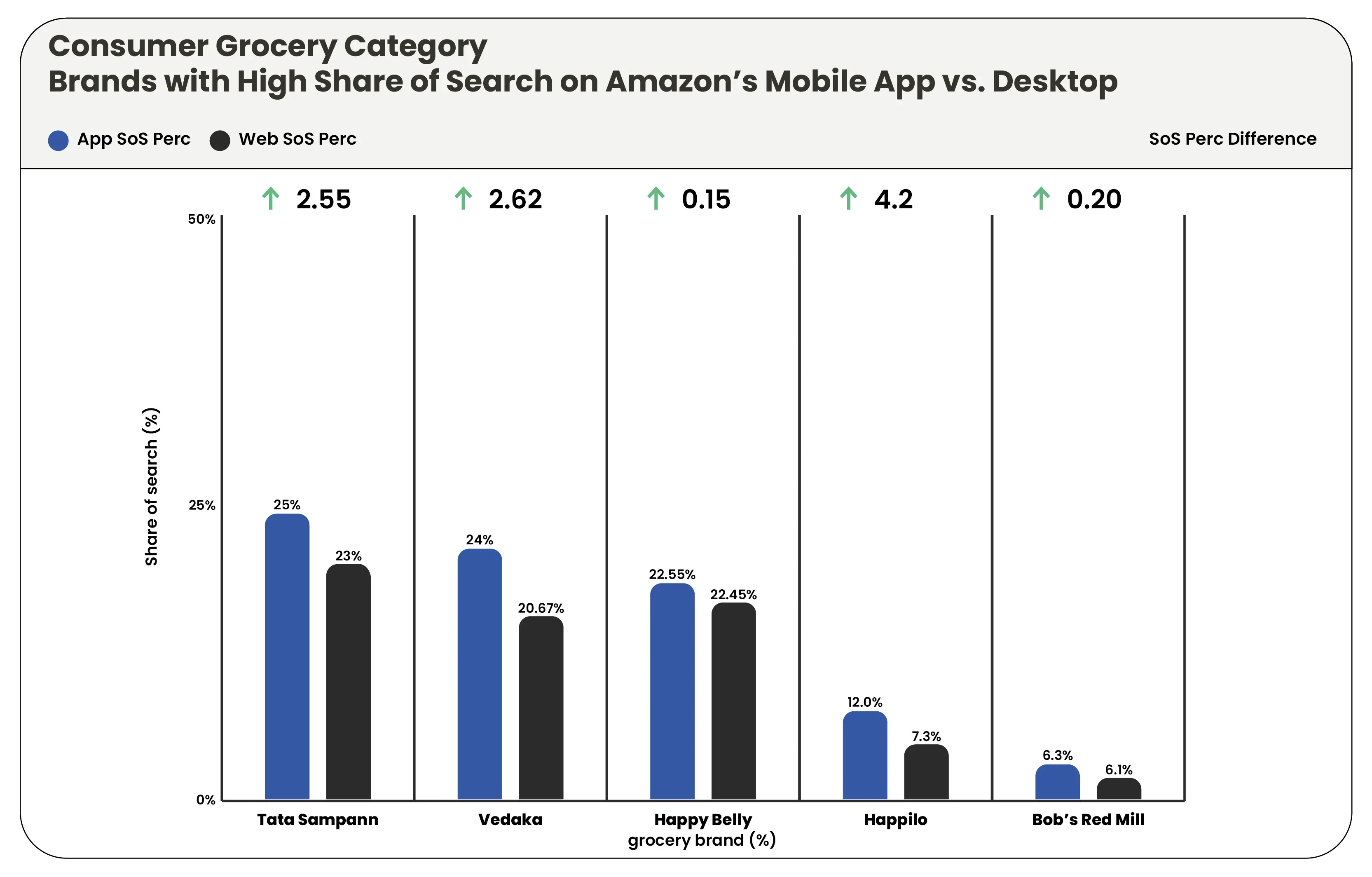

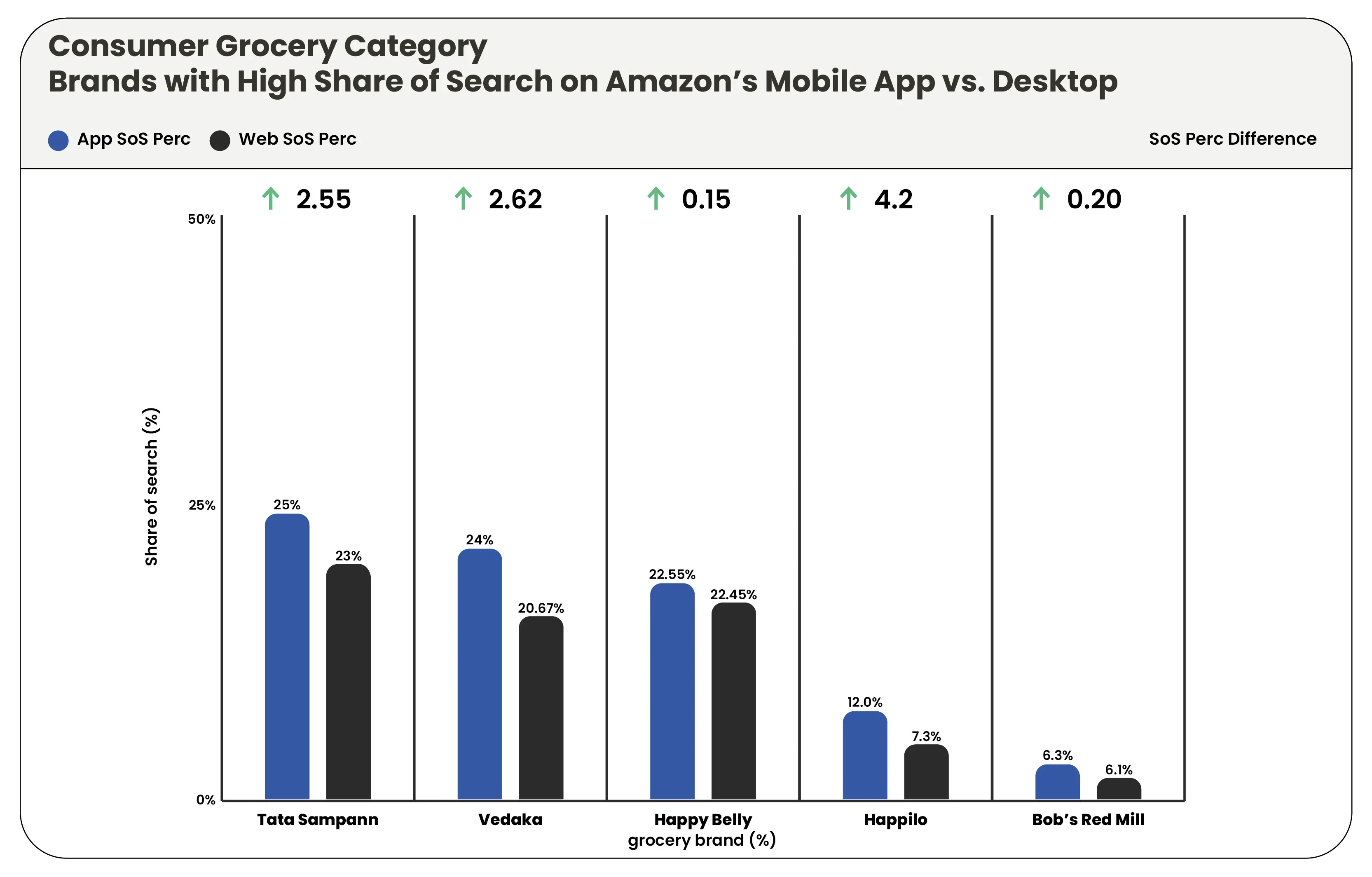

In the grocery category, renowned brands such as Tata Sampann, Vedaka, Happy Belly, Happilo, Bob’s Red Mill which offer a range of grocery Dried Fruits, Rice, Flour & Pulses and more, demonstrated a higher Share of Search on the Amazon mobile app compared to the desktop site. This trend underscores the importance of mobile optimization for brands in this category, as consumers are more inclined to search for grocery items on mobile devices.

Understanding these differences in Share of Search between app and desktop platforms is crucial for brands looking to maximize their visibility and engagement with consumers. By optimizing their presence on both platforms, brands can capture consumer interest and drive sales in these competitive markets.

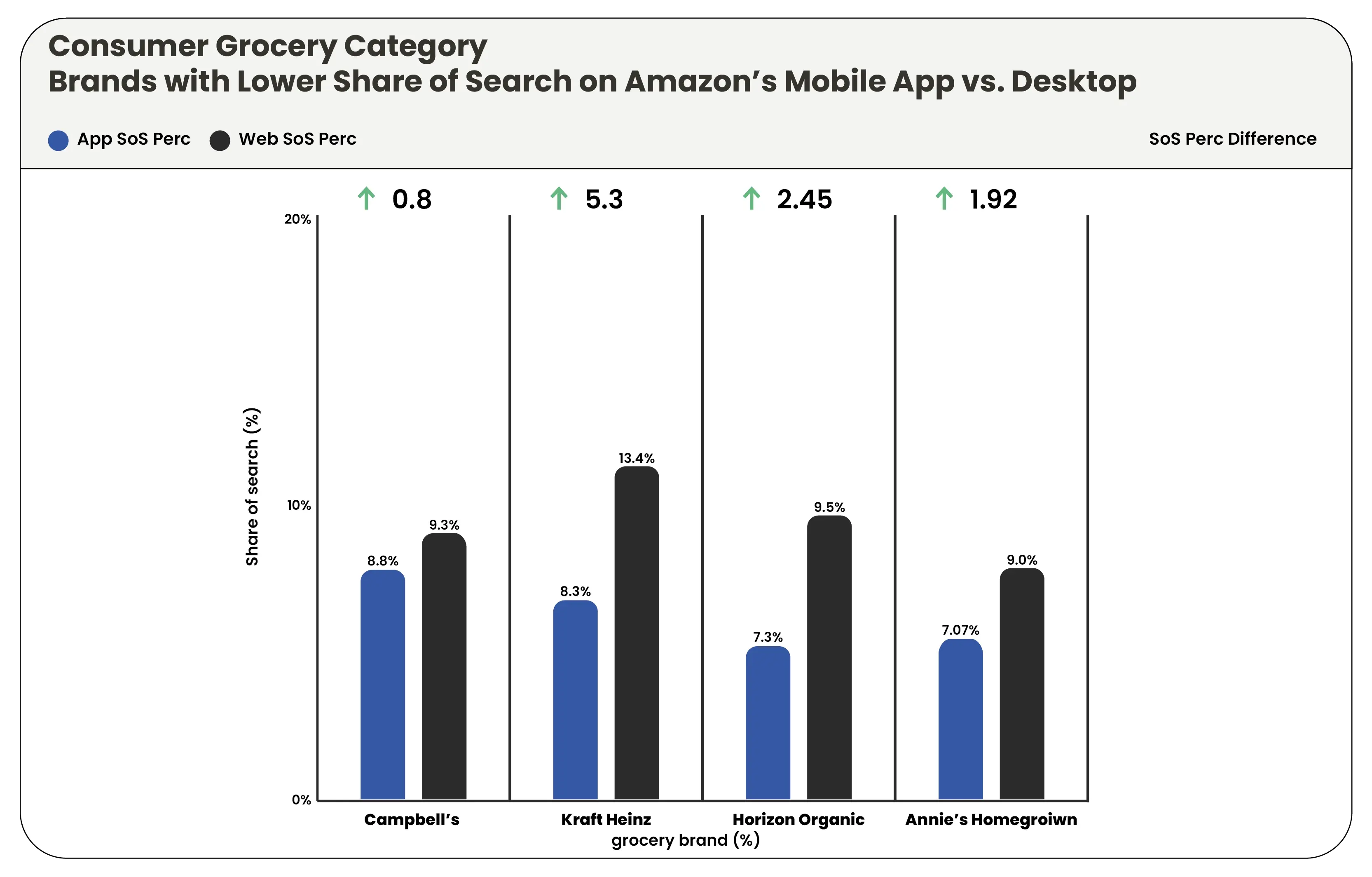

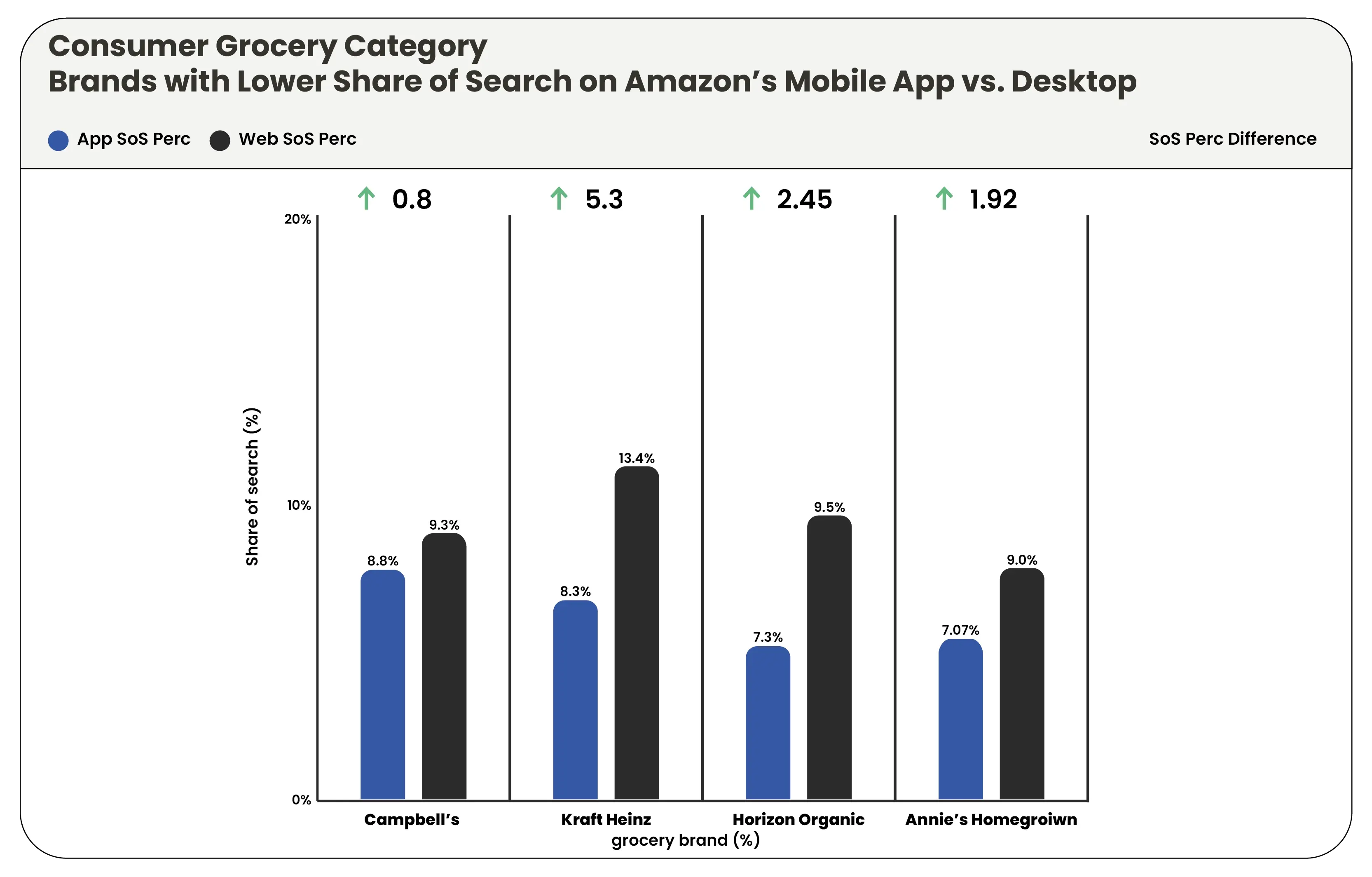

In contrast, Campbell’s, Kraft Heinz, Horizon Organic and other leading brands like Google exhibit a higher Share of Search on the desktop site than on the app. This highlights a critical scenario for brands to consider. A lower Share of Search on mobile apps could indicate missed opportunities for corrective action, as they may need more data from their provider. Understanding these discrepancies between app and desktop Share of Search is vital for brands to allocate resources effectively and optimize their digital shelf strategies across platforms.

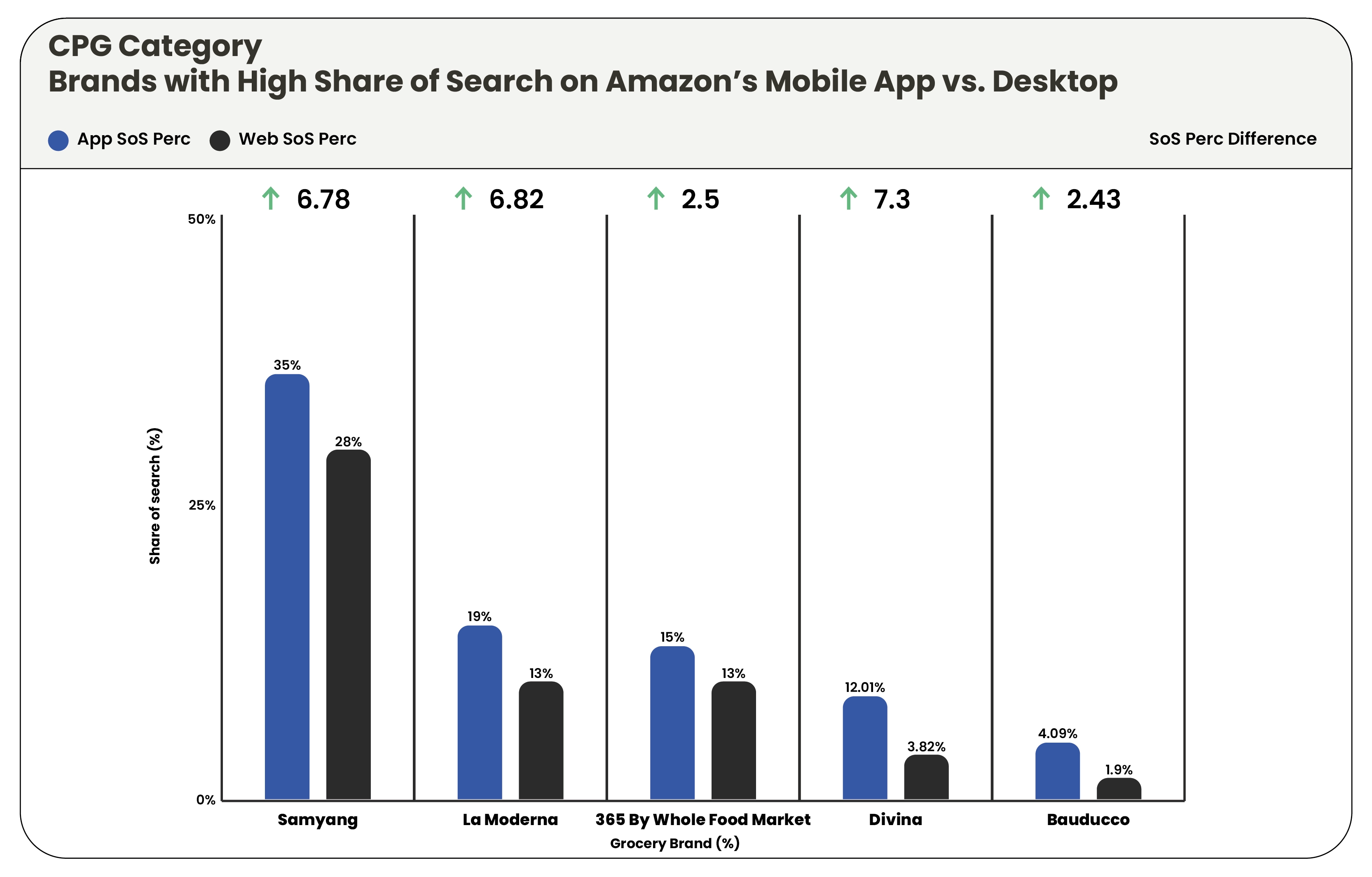

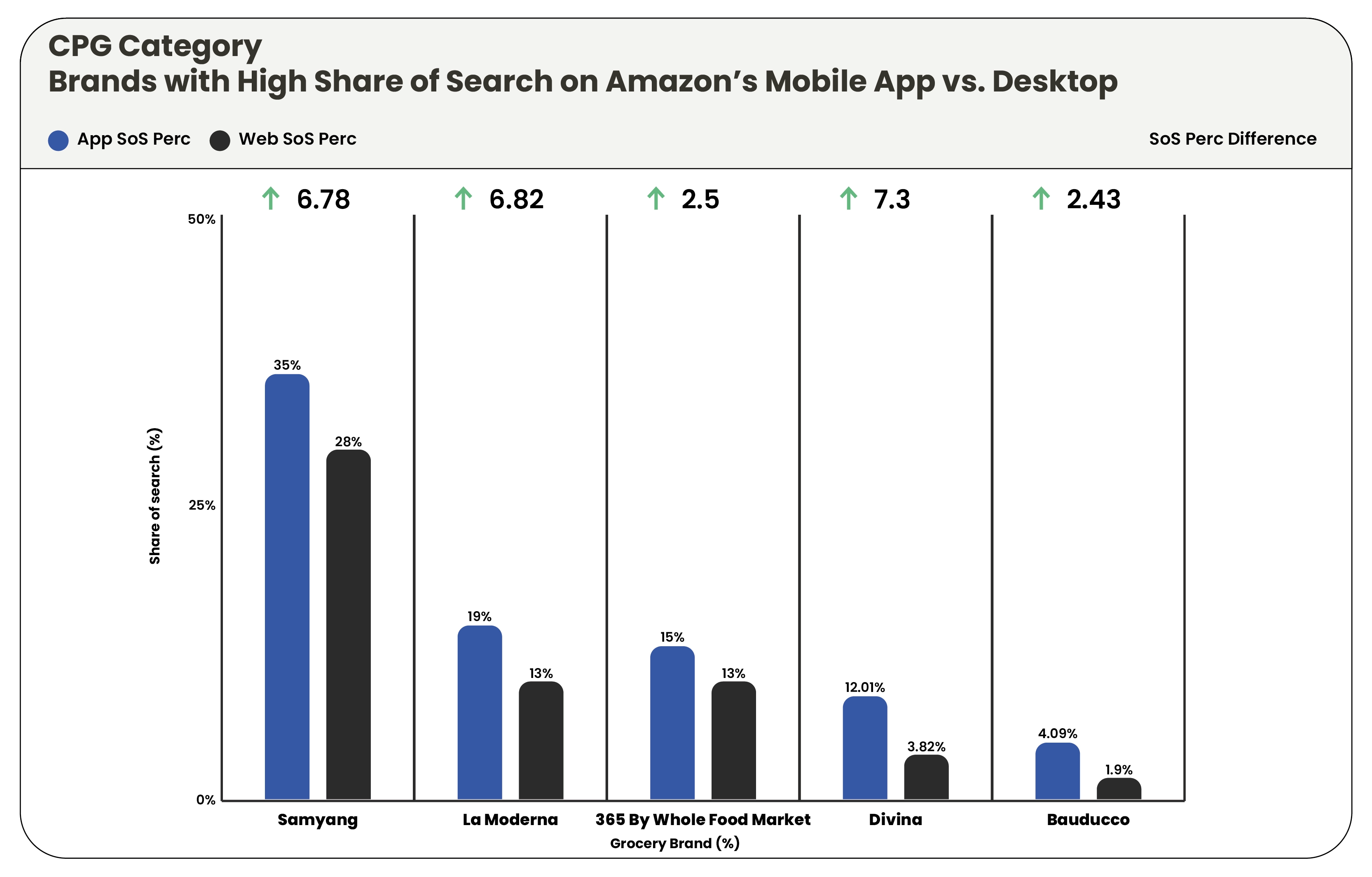

In the CPG category, the Ramen brand Samyang, known for its popularity on TikTok and Instagram, demonstrates a higher Share of Search on Amazon's mobile app. Similarly, specialty brands like 365 By Whole Foods & pasta and Italian food brands Divinia, La Moderna, and Bauducco also exhibit a significantly higher Share of Search on the app. These findings underscore the importance of CPG brands prioritizing their mobile app presence as consumer search behavior and preferences increasingly shift towards mobile platforms. Brands that effectively leverage this trend can capitalize on higher visibility and engagement with their target audience.

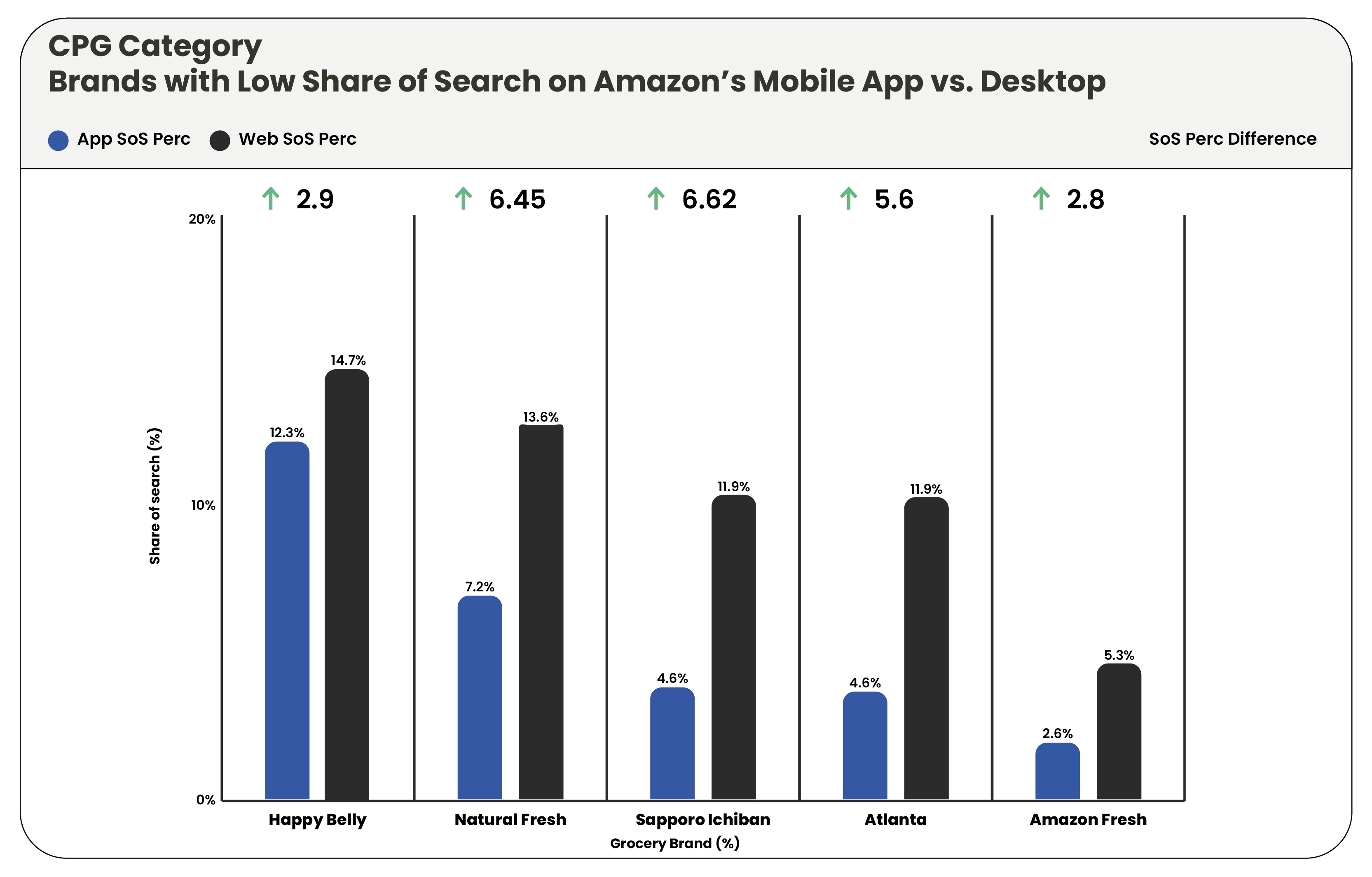

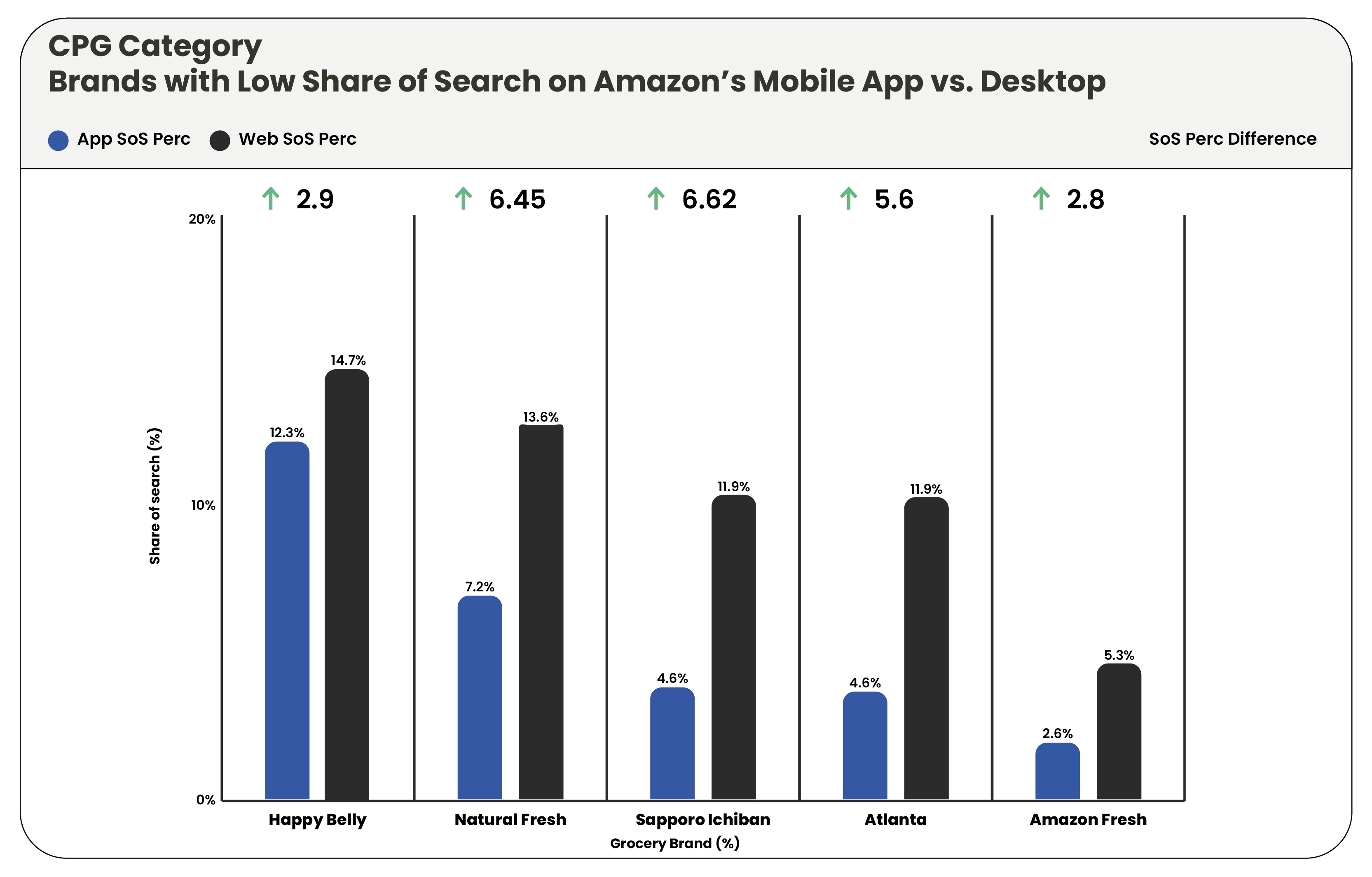

Cheese and dessert brands such as Happy Belly and Atlanta Cheesecake Company, among others, have a lower Share of Search on the mobile app. Similarly, the Ramen brand Sapporo is more easily discovered on Amazon's desktop site. These findings reveal more than a 5% difference in the Share of Search for some brands, which is likely to impact their mobile eCommerce sales and overall performance significantly. It emphasizes the importance of these brands analyzing and optimizing their digital shelf strategies for mobile platforms, ensuring they effectively reach and engage with consumers where they are most active.

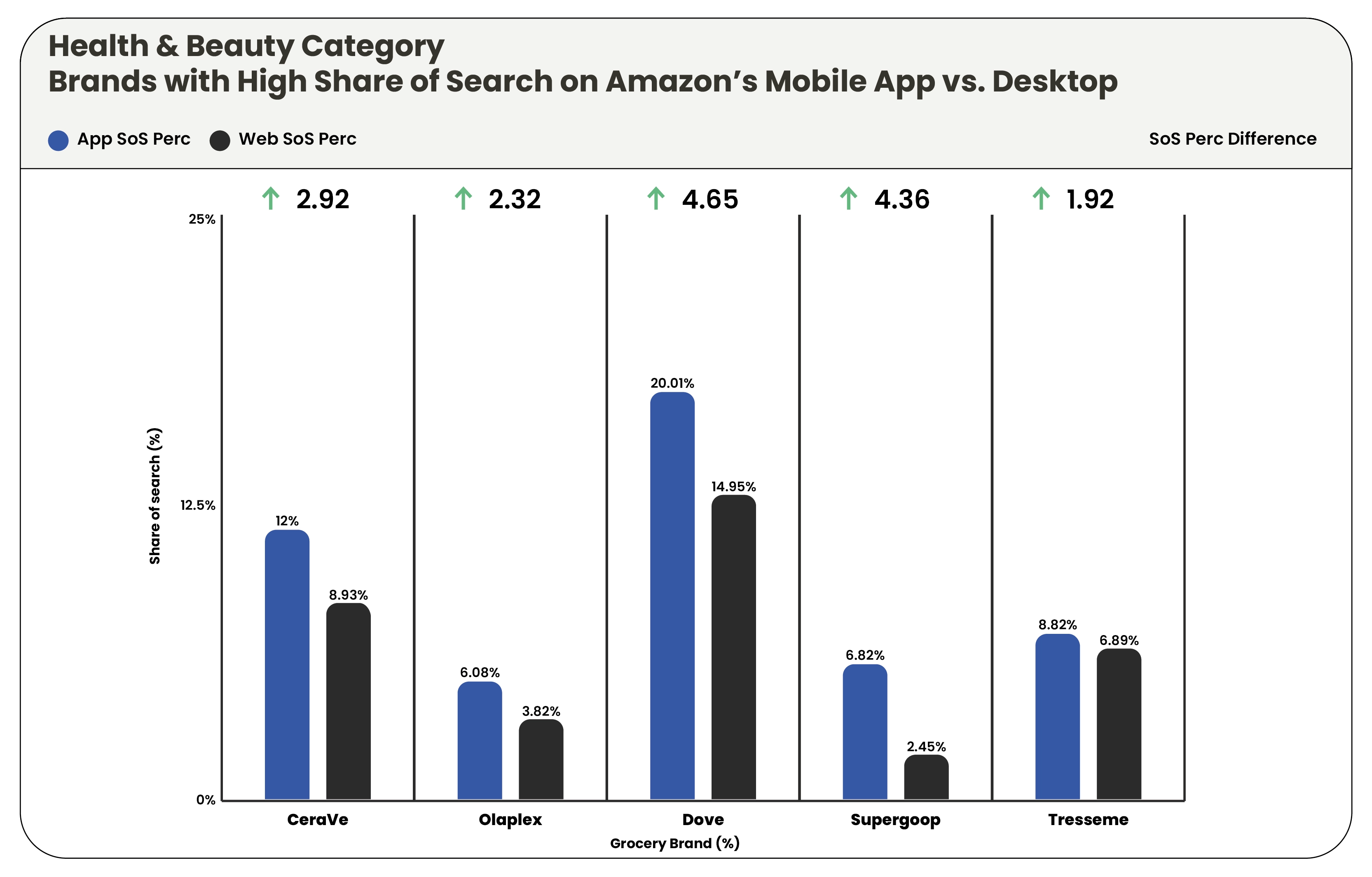

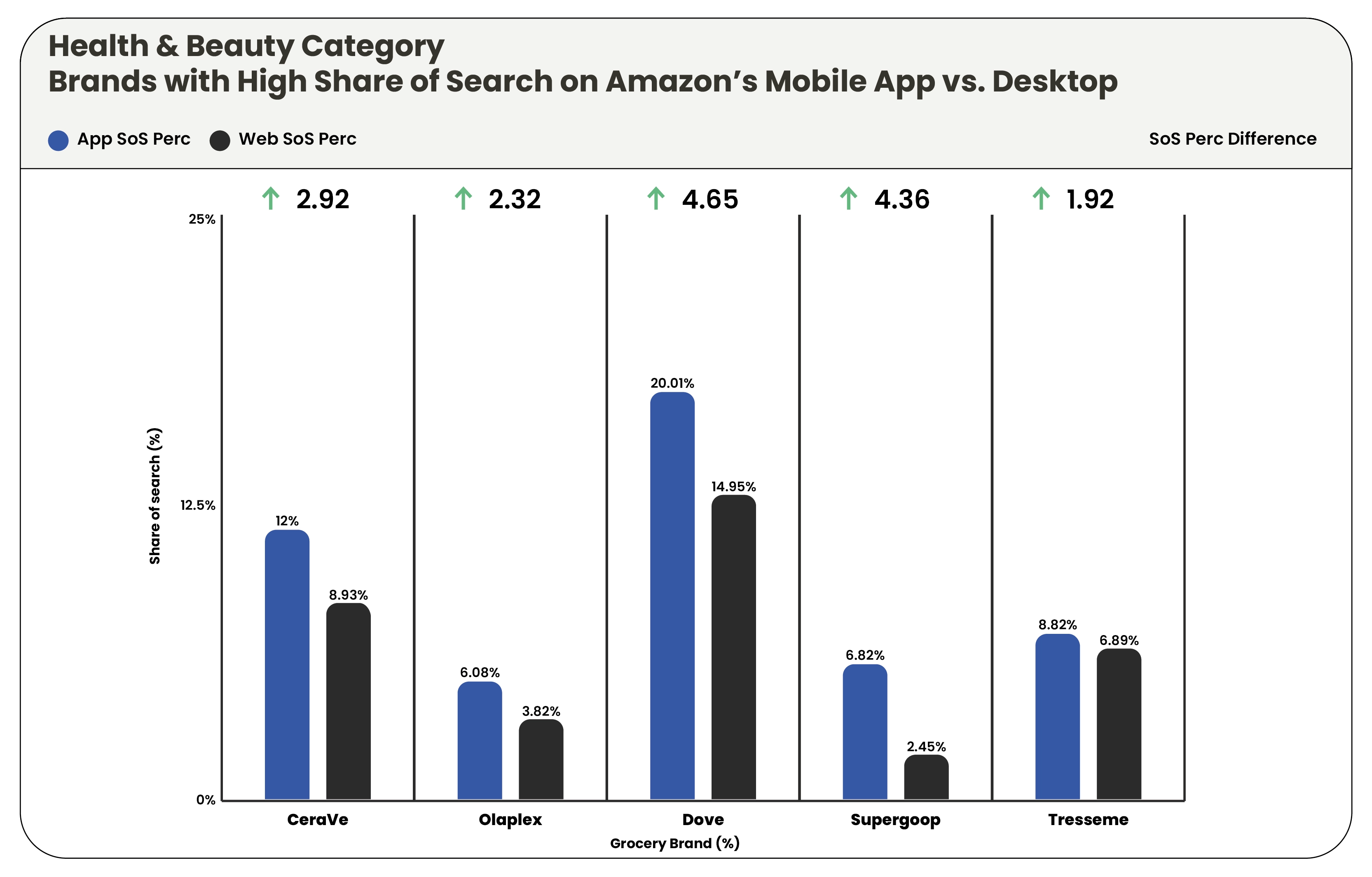

Finally, in the Health & Beauty category, shampoos and hair care brands like Dove, Olaplex, and Tresemme showed a higher Share of Search on the mobile app than on the desktop site. This trend highlights the importance of brands in this category focusing on their mobile app presence, as consumers are increasingly using mobile devices to search for health and beauty products. By optimizing their digital shelf strategies for mobile, these brands can enhance their visibility and engagement with consumers, ultimately driving sales and market share in the competitive health and beauty market.

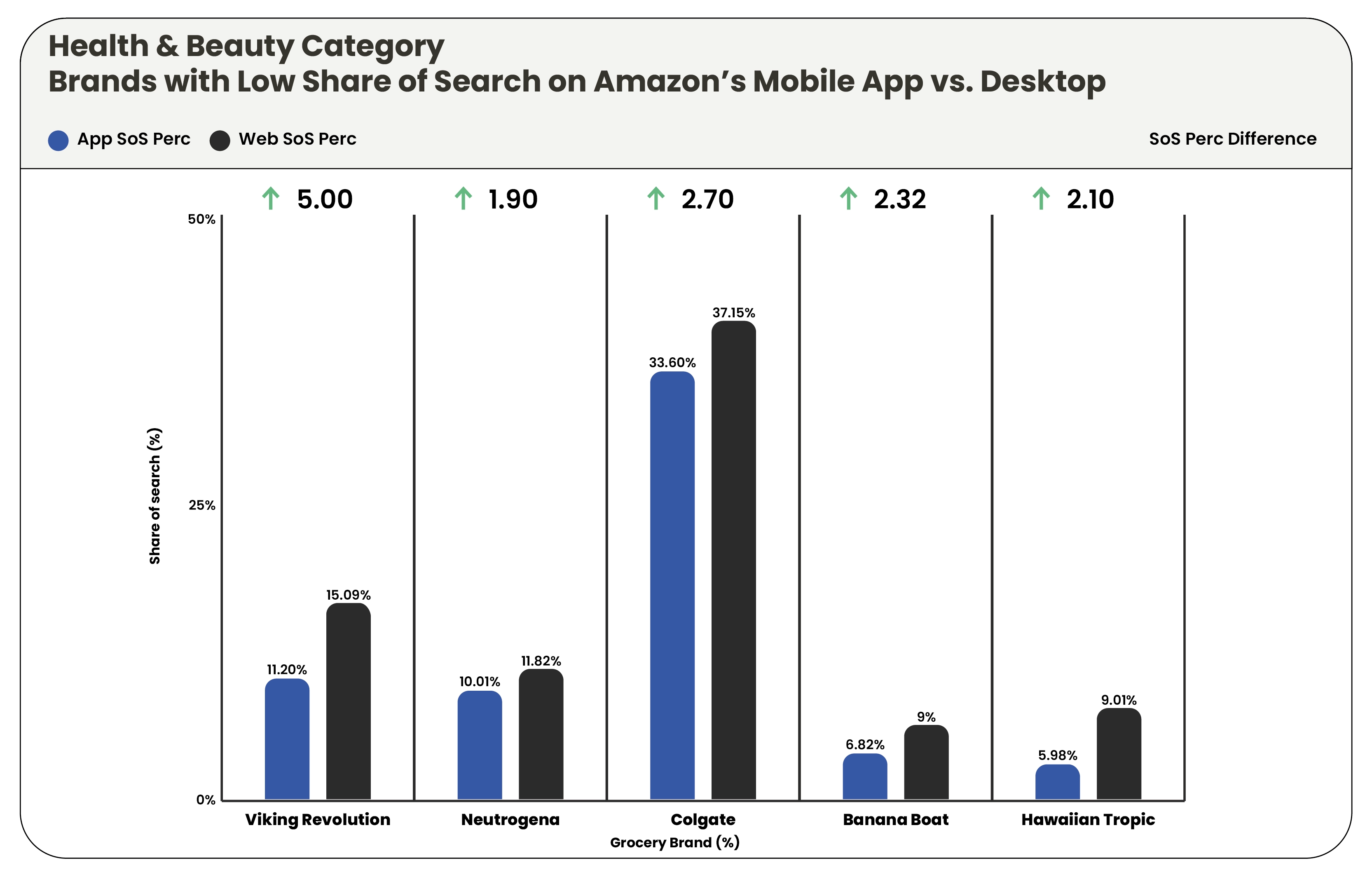

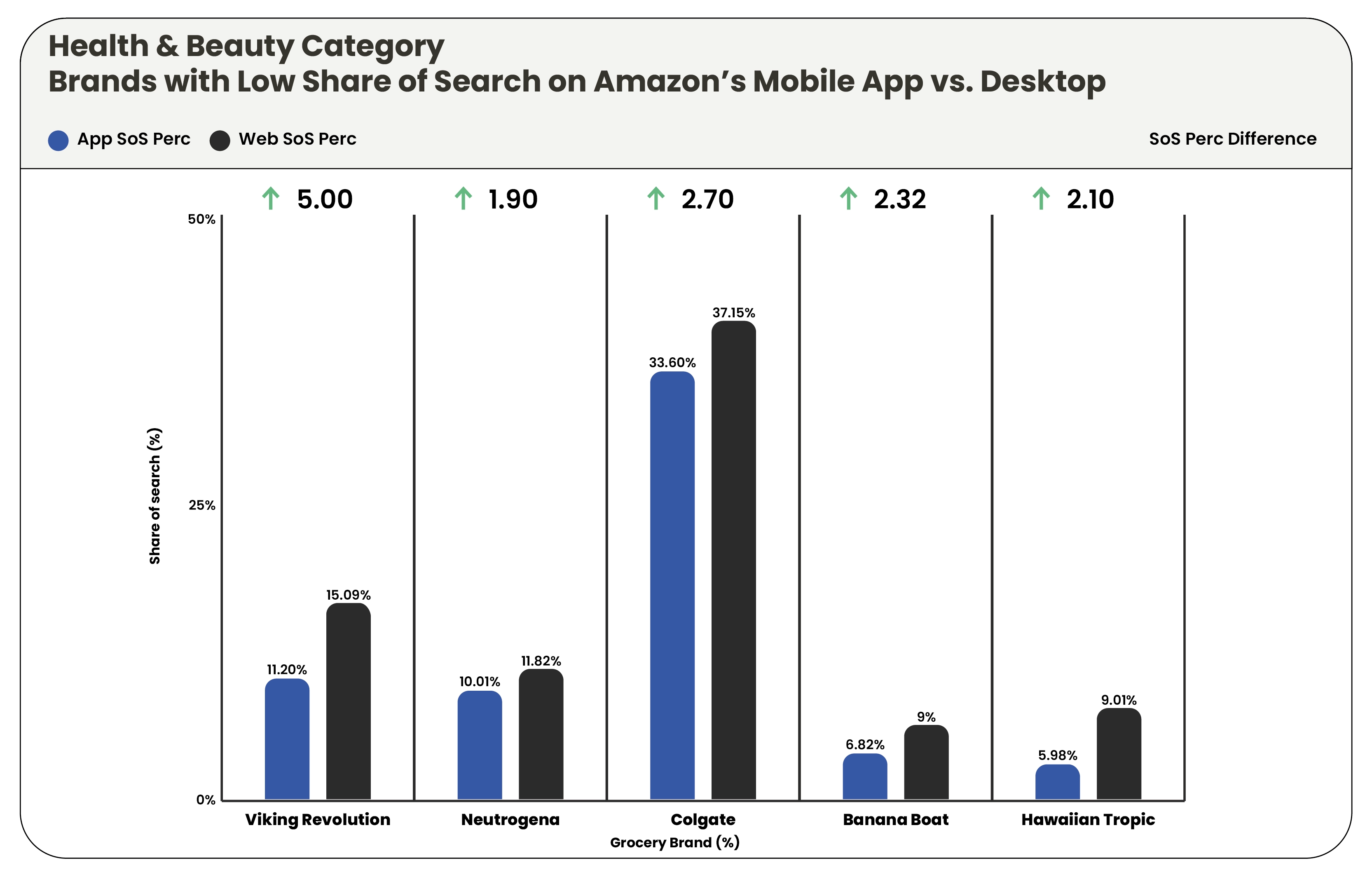

Conversely, body care brands such as Neutrogena, Hawaiian Tropic, and the beard care brand Viking Revolution exhibited a higher Share of Search on Amazon's desktop site. This suggests that these brands may need to reassess their digital shelf strategies to better target and engage with consumers on mobile platforms, where a growing number of shoppers are conducting product searches and making purchases. By optimizing their presence on both desktop and mobile platforms, these brands can maximize their visibility and competitiveness in the Health and beauty category.

Based on our data analysis, numerous brands perform significantly better on either Amazon's desktop site or mobile app. The disparity in performance between the two platforms is often quite pronounced.

Our findings underscore the necessity for brands to adopt a more nuanced approach to digital shelf analytics, recognizing the distinct dynamics between mobile apps and desktop sites. The significant disparities in the Share of Search between these platforms highlight the need for more reliance on desktop data for digital shelf optimization.

For brands lagging on the mobile digital shelf, there are strategic measures they can take to enhance their performance:

Shift Retail Spend to Mobile: Brands can allocate more of their retail spending to mobile to compensate for a lower Share of Search. This targeted investment can help mitigate short-term visibility challenges and optimize budget allocation for improved Return on Ad Spend (ROAS).

Optimize Content for Mobile: It is crucial to ensure that content is optimized for mobile. It includes using images that are easily viewable on smaller screens, crafting product titles that are concise yet impactful, and highlighting key product attributes. This optimization can increase clicks from mobile shoppers and boost organic Share of Search on mobile platforms.

Focus on Delivery Intermediary Apps: Optimizing the digital shelf for delivery intermediary apps is paramount for CPG brands. With the surge in popularity of delivery services like DoorDash, Uber Eats, and Swiggy, brands must adapt their strategies to these platforms. It involves leveraging Digital Shelf Analytics to enhance visibility and conversions on delivery apps, which requires careful analysis and strategic implementation.

Conclusion: Before implementing these strategies, brands must collaborate with a Digital Shelf Analytics partner capable of capturing and analyzing mobile app data. This partnership is essential for developing tailored optimization approaches across all eCommerce platforms, ensuring brands remain competitive and adaptable in the evolving digital landscape.

At Product Data Scrape, ethical principles are central to our operations. Whether it's Competitor Price Monitoring Services or Mobile App Data Scraping, transparency and integrity define our approach. With offices spanning multiple locations, we offer customized solutions, striving to surpass client expectations and foster success in data analytics.

.webp)