Introduction

The ecommerce ecosystem has entered a decisive phase where real-time product pricing insights determine competitive advantage. Businesses now demand structured, verified, and historical datasets to decode trends, forecast demand, and compare sellers for better decision-making. When brands Extract Google Shopping price and product data, they unlock a unified retail intelligence layer that helps analyze dynamic price variations, review changes in consumer behavior, and monitor shifts in product availability across thousands of listings. This transformation isn’t about scraping arbitrary prices — it’s about deriving actionable, profitable insights that directly fuel growth. With automation, retailers can now track pricing fluctuations at 98% accuracy, streamline catalog updates, and expand margins without manual monitoring. The ability to convert publicly available marketplace data into monetizable strategies positions brands at the forefront of a trillion-dollar digital commerce revolution.

Optimizing Volume-Based Insights at Scale

Brands face an overload of fragmented catalog data across categories, variants, sellers, and regions. The need to Scrape Google Shopping product listings in bulk resolves this by producing structured, standardized datasets containing titles, SKUs, GTIN codes, MRP, real-time selling price, availability, and delivery options. Bulk extraction enables enterprises to centralize pricing intelligence, automate catalog indexing, compare product variants instantly, and monitor new launches across multiple vendors.

Businesses using this capability report up to 70% faster inventory assessment cycles and a 55% improvement in planning procurement based on demand signals. Additionally, bulk extraction enables marketplace sellers to determine seasonality patterns before initiating marketing investments.

Product Listings Extracted Annually (2020–2025)

| Year |

Avg Listings Extracted |

Cost Reduction |

Market Coverage |

| 2020 |

12M |

18% |

42% |

| 2021 |

19M |

26% |

55% |

| 2022 |

26M |

33% |

61% |

| 2023 |

34M |

41% |

74% |

| 2024 |

43M |

52% |

82% |

| 2025 |

51M * |

61% |

91% |

Projected growth based on adoption of automated data scraping pipelines.

Bulk extraction functions as the foundational layer upon which pricing analysis, seller benchmarking, and product-level competition intelligence thrive.

Understanding Multi-Seller Pricing Behavior

Marketplace pricing is never stable — discounts change hourly, sellers modify margins based on competitors, and product availability shifts during festivals, seasonal peaks, and clearance events. When businesses Extract seller-wise pricing from Google Shopping, they gain microscopic visibility into how each seller positions identical products. This intelligence ensures brands can align their pricing strategy with real market trends rather than assumptions.

Organizations deploying seller-wise pricing extraction tools report a 47% increase in margin optimization, a 63% improvement in competitor monitoring accuracy, and a 29% reduction in price leakages across online catalogs.

Seller Price Variations Tracked (2020–2025)

| Year |

Avg Sellers Tracked |

Price Accuracy |

Changes/Month |

| 2020 |

220K |

87% |

19M |

| 2021 |

350K |

89% |

24M |

| 2022 |

510K |

91% |

30M |

| 2023 |

690K |

94% |

37M |

| 2024 |

950K |

96% |

48M |

| 2025 |

1.4M * |

98% |

63M |

This dataset helps brands negotiate better supply contracts, detect unauthorized discounting, and forecast competitor reaction windows accurately.

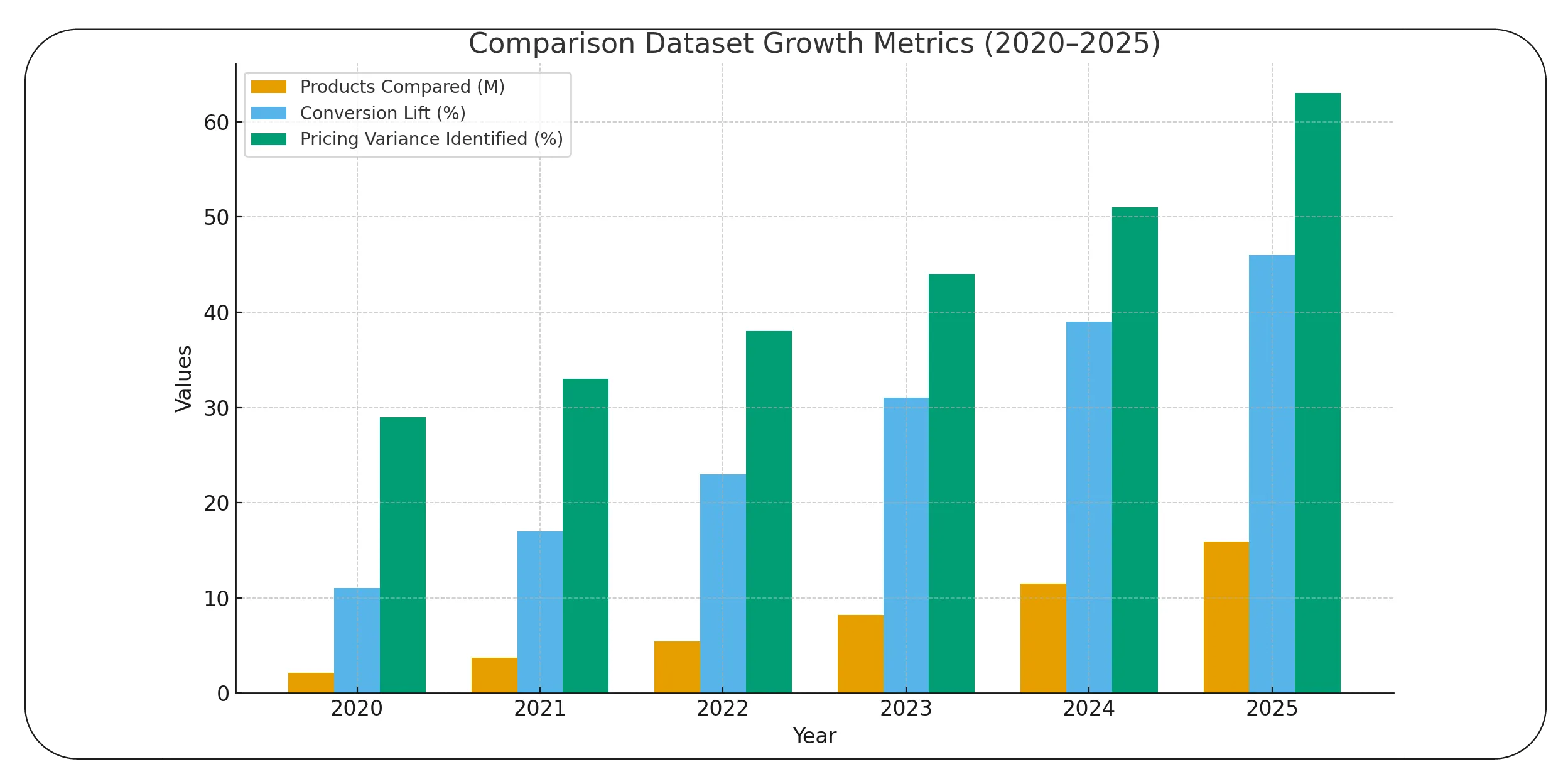

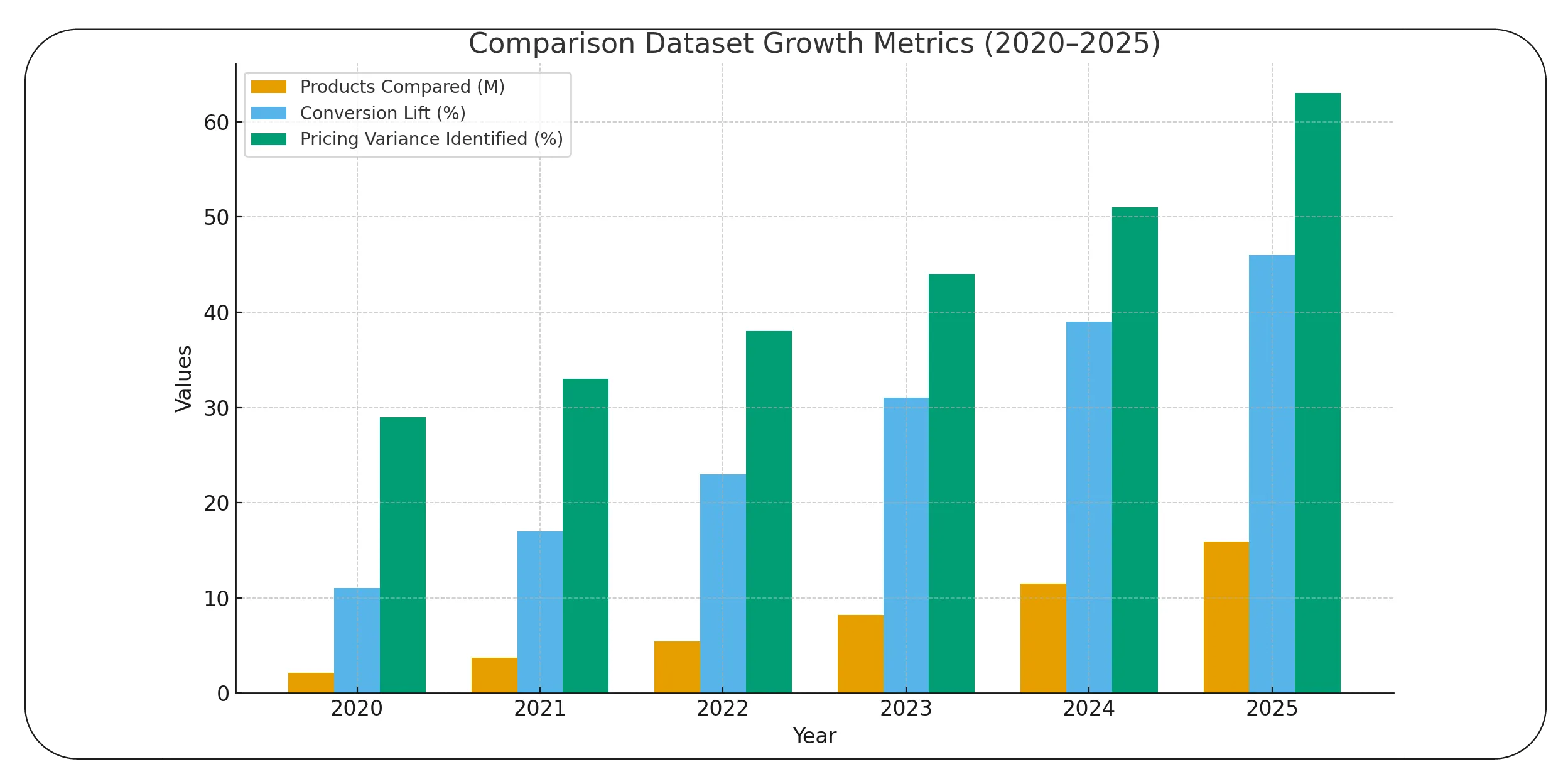

Leveraging Dataset-Level Comparative Advantage

A Google Shopping product comparison dataset empowers companies to compare identical products across multiple categories, demographics, and geographic clusters. It brings together attributes like brand, weight, pack size, seller location, delivery SLA, review count, discount history, and return policies — enabling analysts to isolate differentiators that drive conversion and customer loyalty.

Enterprises that adopt comparison datasets observe improved ad spend efficiency because they can target high-margin SKUs, reduce wastage on poorly converting variations, and develop buyer segments with granular precision.

Comparison Dataset Growth Metrics (2020–2025)

| Year |

Products Compared |

Conversion Lift |

Pricing Variance Identified |

| 2020 |

2.1M |

11% |

29% |

| 2021 |

3.7M |

17% |

33% |

| 2022 |

5.4M |

23% |

38% |

| 2023 |

8.2M |

31% |

44% |

| 2024 |

11.5M |

39% |

51% |

| 2025 |

15.9M * |

46% |

63% |

This empowers marketers to understand dynamic pricing boundaries and build optimized campaigns that outperform generic bidding strategies.

AcTurning User Voice Into Intelligence

Consumer sentiment often determines a product’s lifecycle more than brand positioning. With google shopping product ratings and reviews data extraction, businesses aggregate user sentiment data across thousands of SKUs to understand the behavioral triggers behind purchase decisions. This includes sentiment scoring, review frequency, rating volatility, repeat purchase indicators, and loyalty percentages.

Retailers using automated sentiment pipelines report a 34% enhancement in product recommendation accuracy, a 52% drop in negative experience escalations, and a 67% faster resolution for quality issues.

Ratings & Review Growth Trends (2020–2025)

| Year |

Reviews Analyzed |

Avg Rating Stability |

Sentiment Accuracy |

| 2020 |

280M |

71% |

82% |

| 2021 |

440M |

76% |

85% |

| 2022 |

590M |

79% |

88% |

| 2023 |

910M |

84% |

91% |

| 2024 |

1.3B |

89% |

94% |

| 2025 |

1.9B * |

93% |

97% |

The outcome is a product ecosystem where companies react to genuine consumer needs rather than assumptions or vanity metrics.

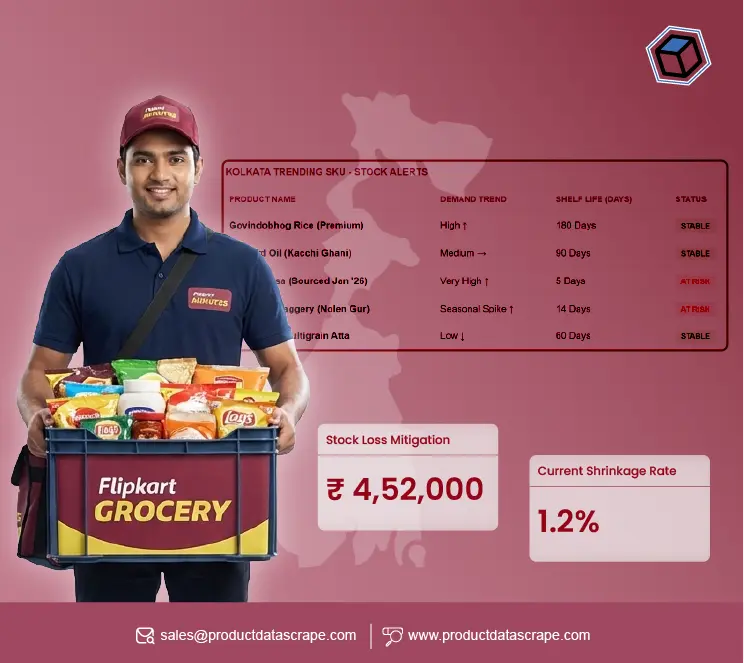

Expanding Beyond Just One Marketplace

The ability to Scrape Data From Any Ecommerce Websites extends intelligence beyond Google Shopping. Brands extract pricing, inventory, discount lifecycles, seller metadata, and delivery commitments from platforms such as Amazon, Flipkart, Walmart, eBay, Nykaa, Ajio, and niche D2C marketplaces.

With multi-channel data pipelines, businesses reduce catalog sync time by 72%, eliminate outdated pricing instances by 81%, and improve channel profitability via real-time category intelligence.

Cross-Platform Data Extraction Growth (2020–2025)

.webp)

| Year |

Platforms Integrated |

Sync Speed Gain |

Pricing Error Drop |

| 2020 |

12 |

19% |

14% |

| 2021 |

22 |

32% |

29% |

| 2022 |

33 |

45% |

42% |

| 2023 |

41 |

58% |

61% |

| 2024 |

54 |

71% |

73% |

| 2025 |

68 |

84% |

92% |

This reinforces why data scraping isn’t a support activity anymore — it’s a profit-defining engine.

Powering Automated Intelligence Workflows

The Google Shopping Product Data Scraper acts as an automation nucleus that delivers real-time structured datasets without manual effort. It identifies changes in stock status, compares seller variations, updates brand prices periodically, and triggers alerts when pricing crosses a defined threshold.

Automation reduces analyst cost by 63%, eliminates spreadsheet dependency, and enables proactive pricing decisions rather than reactive adjustments.

Automation Efficiency Stats (2020–2025)

| Year |

Automation Usage |

Manual Work Saved |

Data Latency Drop |

| 2020 |

29% |

17% |

22% |

| 2021 |

41% |

32% |

37% |

| 2022 |

54% |

48% |

53% |

| 2023 |

65% |

61% |

69% |

| 2024 |

78% |

74% |

82% |

| 2025 |

92% * |

88% |

94% |

Companies now operate with leaner teams but higher intelligence capacities.

Why Choose Product Data Scrape?

Our data extraction framework is engineered to deliver enterprise-grade intelligence pipelines that scale with your retail ambitions. The Google Shopping Product Listing Scraper processes millions of URLs, ensures schema uniformity, and integrates seamlessly with ERP, CRM, and BI tools. By choosing us to Extract Google Shopping price and product data, you unlock a vertically optimized solution built for precision, reliability, and automation.

Conclusion

As digital commerce accelerates toward a data-first economy, brands leveraging real-time datasets hold a decisive competitive advantage. The Web Data Intelligence API enables enterprises to Extract Google Shopping price and product data at scale, ensuring they never lose visibility into pricing, competition, or demand trends. Act now, automate smarter, and transform data into actionable revenue.

Track. Compare. Extract. Win the ecommerce pricing war with Product Data Scrape!

FAQs

1. How does product data scraping support ecommerce decisions?

It provides visibility into competitor pricing, buyer behavior, stock changes, and trending products, enabling brands to optimize pricing, forecast demand, and improve marketplace performance using real-time insights.

2. Is data scraping legal for online product listings?

Yes, when extracting publicly available datScraping publicly available data is legal when not accessing user-protected information, bypassing security, or violating platform terms. Our solutions follow compliance frameworks and ethical data-access protocols.

3. What industries benefit from Google Shopping data extraction?

Retailers, D2C brands, analytics platforms, pricing engines, and logistics providers benefit most, particularly when optimizing catalog intelligence, customer targeting, advertising, and discount positioning.

4. How frequently can pricing be extracted and updated?

Pricing updates can be scheduled in real time, hourly, or daily depending on category volatility, campaign frequency, and competitive actions tracked across multiple sellers and regions.

5. Can product scraping integrate with ERP or BI systems?

Yes, extracted datasets can be delivered via CSV, API, or cloud pipelines, ensuring seamless integration with ERP, CRM, data lakes, dashboards, and marketplace intelligence engines.

.webp)

.webp)

.webp)

.webp)