Introduction

In the competitive baby care market, real-time pricing data is a strategic advantage. This case

study highlights how a growing baby brand used Boost Baby Product Sales with Price Scraping

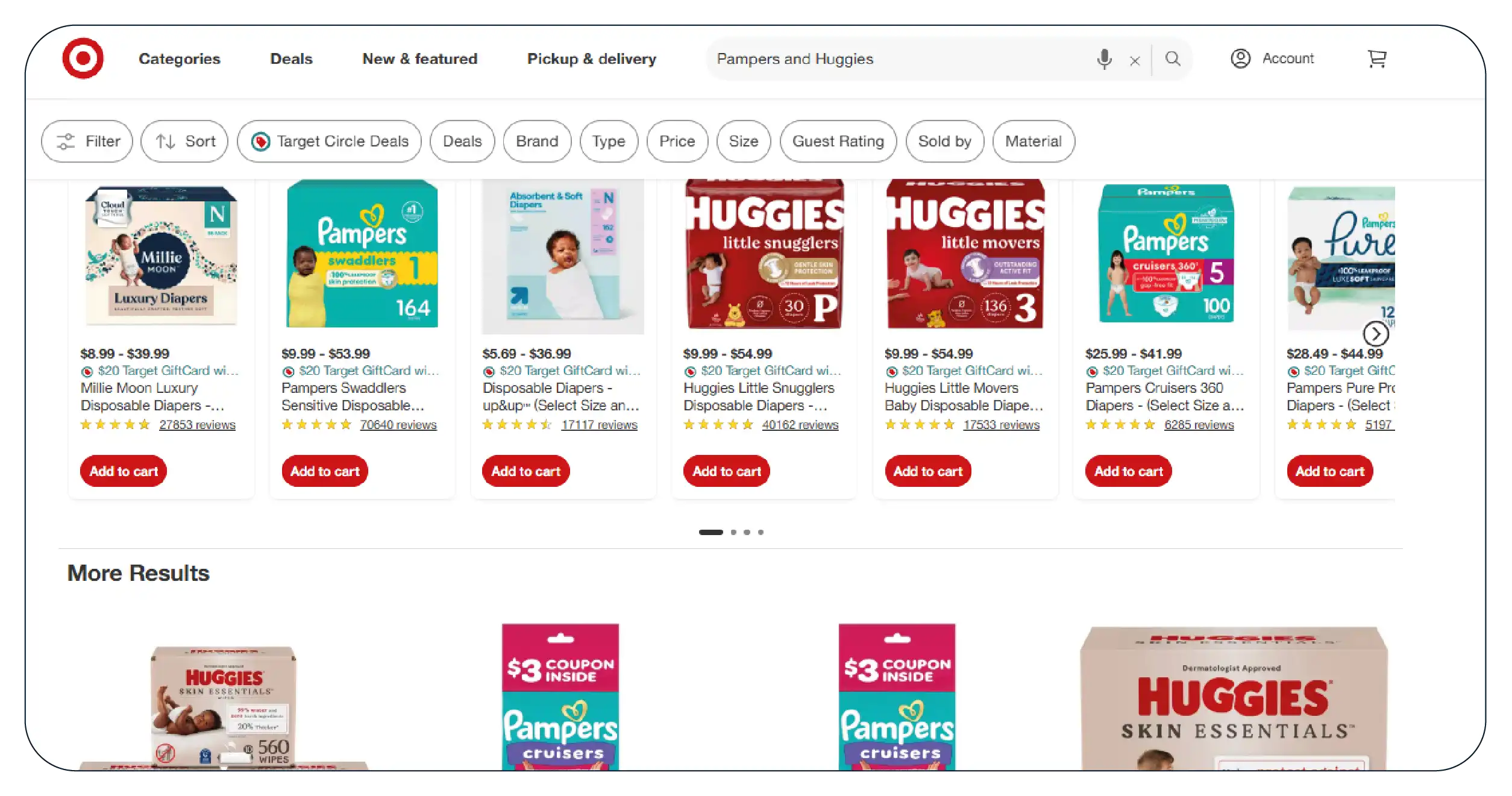

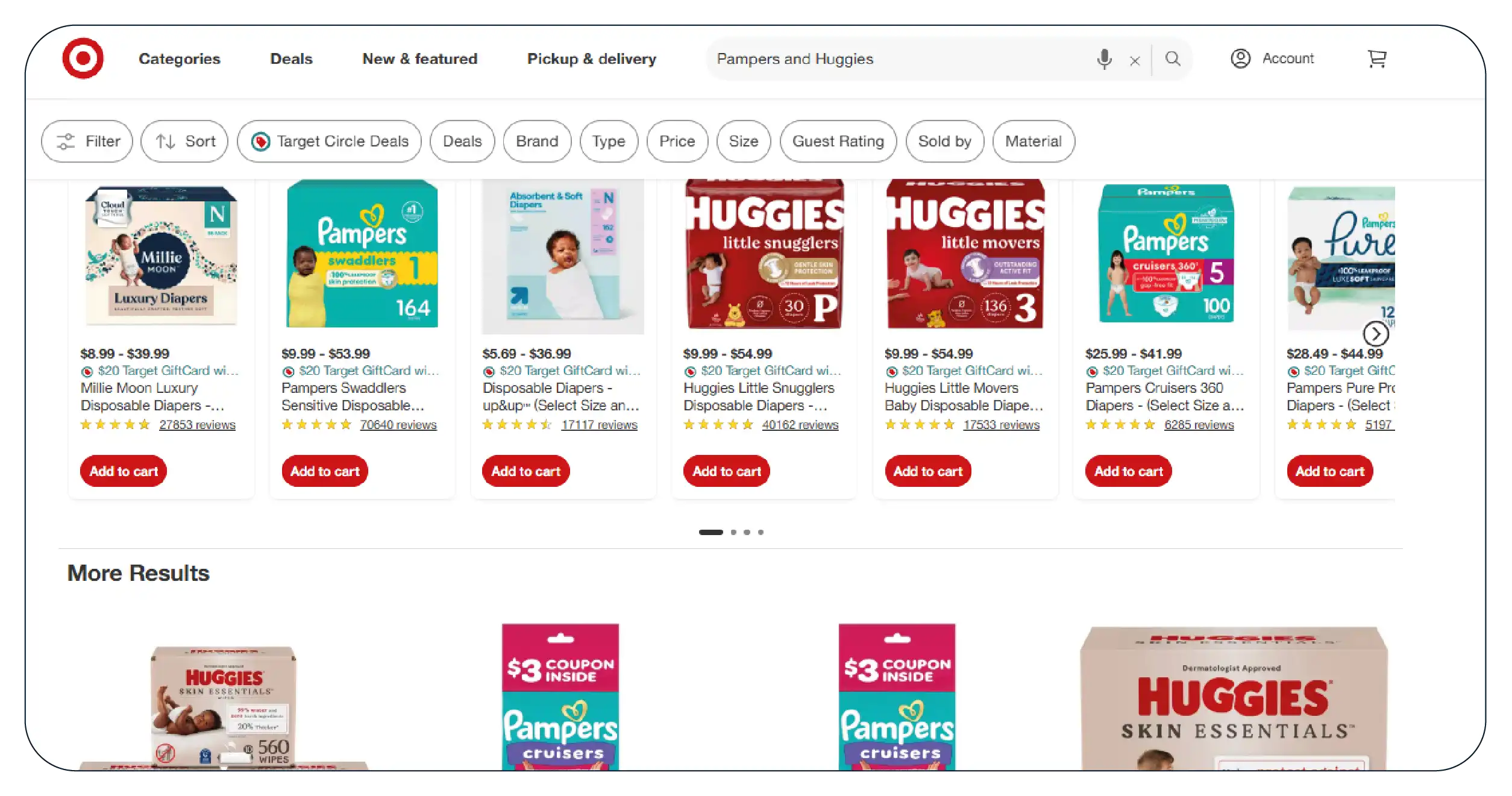

Insights to sharpen its edge. By tracking weekly diaper price changes on major platforms like

Target, the brand fine-tuned pricing and inventory moves across markets.

Their primary focus was the Pampers vs Huggies price comparison dataset, which revealed

actionable pricing trends. Automated tools delivered consistent insights, enabling quicker

decision-making and improved campaign planning. In a crowded category, smart data—not

guesswork—became their key to better margins and growth.

Thanks to Weekly Diaper Pricing Intelligence Using Web Scraping, the brand turned raw pricing

data into a powerful business weapon that consistently improved visibility and sales

performance.

The Client

The client is an emerging baby care company headquartered in India, expanding operations to the

U.S. Known for eco-conscious diapers and gentle infant care products, they wanted to scale

efficiently. Facing fierce pricing wars from global brands, they sought a clear market-view to

react faster and smarter.

While their marketing team was agile, the absence of centralized real-time pricing data created

delays. Their cross-functional teams were working independently, making it difficult to optimize

campaign timing or stock decisions. The brand needed to understand competitors' pricing,

especially for Pampers and Huggies products.

To modernize operations and compete head-to-head with market leaders, they partnered with

Product Data Scrape. The mission: Boost Baby Product Sales with Price Scraping Insights by

integrating automated price intelligence across marketing and operations for Pampers and Huggies

in both Indian and U.S. retail ecosystems.

Key Challenges

The brand faced several operational hurdles that limited growth. First, they lacked a reliable

method to perform Scrape Pampers vs Huggies price comparison India/US in real-time. Without

automation, price checks were slow, inconsistent, and labor-intensive.

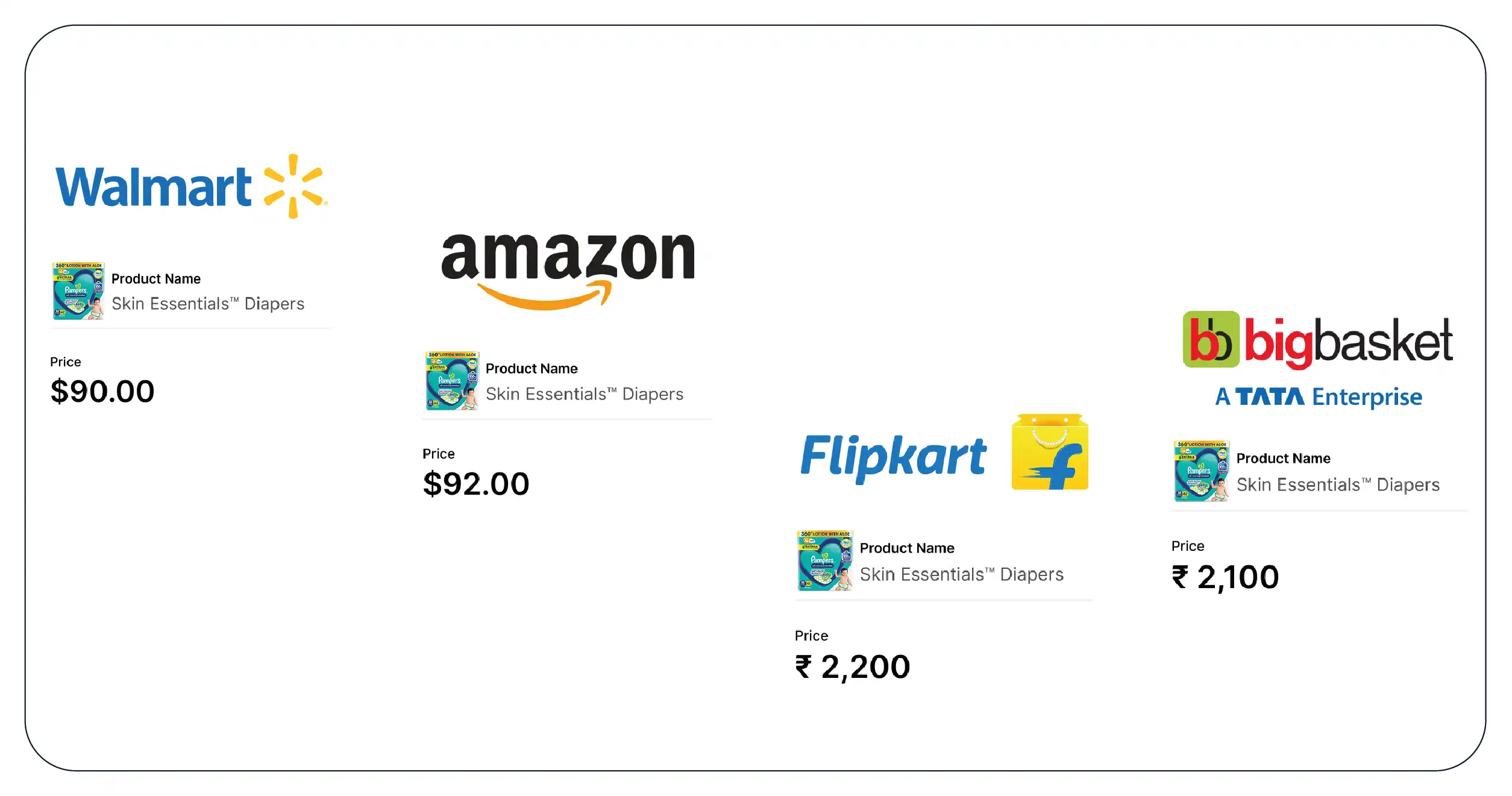

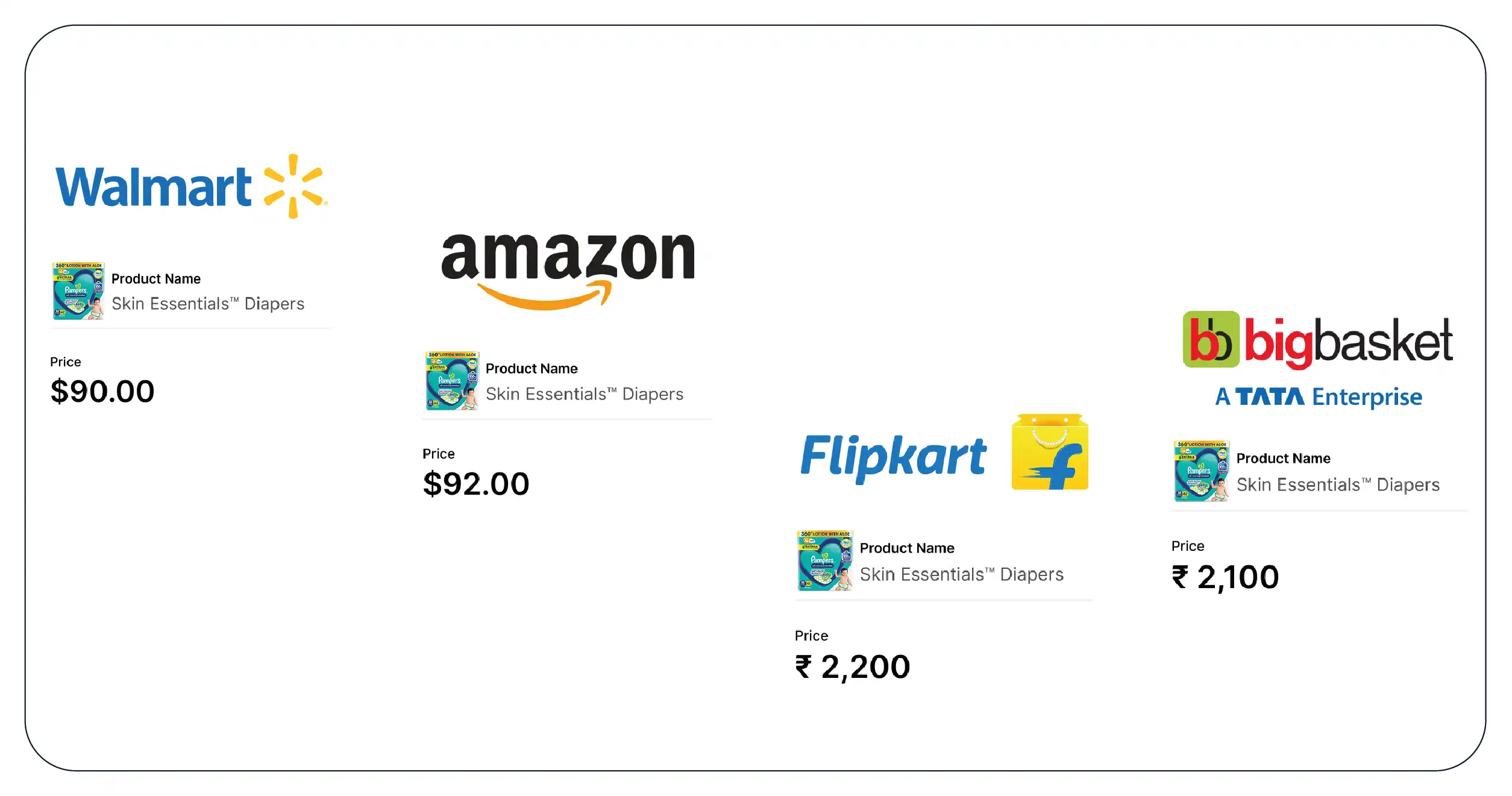

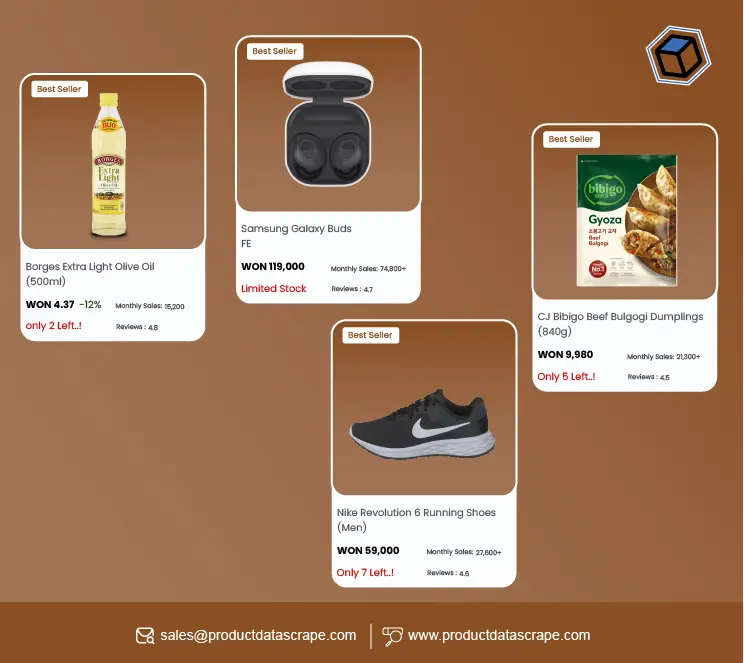

Their next challenge was data fragmentation. Pricing on Walmart, Amazon, Flipkart, and BigBasket

varied widely. The team needed to Scrape diaper prices from Walmart, Amazon, Flipkart, BigBasket

and normalize the results to compare apples to apples.

Frequent promotions also posed issues. Price shifts happened weekly, sometimes daily. Capturing

these required a system for Weekly Diaper Pricing Intelligence Using Web Scraping, which their

team didn’t have.

To understand profitability across SKUs and product lines, they had to gather a Baby Care

Product Pricing Dataset via Scraping that included variations by size, pack, and region.

Another obstacle was departmental isolation. Pricing teams and marketing teams didn’t share live

data, leading to misaligned campaigns.

Lastly, they missed many opportunities due to untimely or irrelevant discounts. Without Web

Scraping Diaper Offers for Sales Growth, they couldn’t accurately benchmark deals against

competition.

Key Solutions

We developed a bespoke scraping infrastructure built to meet the client’s real-time pricing

intelligence goals. Our first move was weekly SKU-level price monitoring using the

Pampers Baby

Product Data Scraping API and

Huggies Baby Product Data Scraper. These tools collected

structured data from Target and regional e-commerce sites.

For multi-market optimization, we introduced a comparative dashboard with insights from Scrape

Pampers vs Huggies price comparison India/US, segmented by country, retailer, and pack size. The

client now knew where to lead or match pricing.

Next, we tackled platform fragmentation. The scraping engine aggregated and cleaned diaper

prices across Amazon, Walmart, Flipkart, and BigBasket—automating the need to Scrape diaper

prices from Walmart, Amazon, Flipkart, BigBasket manually. This gave them unified visibility in

one place.

We launched weekly reports under Weekly Diaper Pricing Intelligence Using Web Scraping. These

insights informed discount strategy, helping them time campaigns for maximum lift.

To track stock and product listing changes, we deployed Web

Scraping Baby Products Websites .

Combining this with tools to Scrape Baby Product Catalogs with Pricing and Availability, the

team stayed updated on what was in or out of stock at each channel.

Finally, we transformed raw data into actionable dashboards using a curated Ecommerce Product

Price & Review Dataset , enriching insights with user ratings and seller data. This data

lake was

shared across teams in marketing, logistics, and leadership.

These initiatives helped them Boost Baby Product Sales with Price Scraping Insights, enabling

better forecasting, promotion planning, and timely campaign launches.

Client’s Testimonial

“Working with the Product Data Scrape team has been transformative. Their scraping solution

gave us weekly visibility into Target’s Pampers and Huggies pricing. We aligned our

strategies in both India and the U.S. and saw a 22% uplift in campaign performance within

just three months.”

— Head of Growth

Conclusion

This case study proves that brands don’t need to be giants to outcompete industry leaders. With

the right tools, insights, and data partnerships, even emerging companies can leverage smart

scraping to shift outcomes in their favor.

By applying Boost Baby Product Sales with Price Scraping Insights through the use of structured

pricing data, the client gained full visibility over market dynamics. From using the Pampers vs

Huggies price comparison dataset to identifying promotional timing via Web Scraping Diaper

Offers for Sales Growth, their transformation was both strategic and scalable.

Looking to scale in the diaper and baby care category? Adopt intelligent scraping workflows that

align marketing with pricing and stock realities.

Partner with Product Data Scrape and turn your pricing data into your

most powerful growth

driver!

.webp)